Arguably, this coming week most critical to our positive equity 2023 thesis. April ISM might be inflection = tactically favor Industrials $XLI this week. Plus, May FOMC might be last hike of cycle = thesis changing.

This is the most hated 7-month, 20% rally ever.

This coming week is arguably the most critical to our positive equity thesis in 2023. The S&P 500 is up 9% YTD and has been in a solid uptrend since the Oct 12, 2022 lows (S&P 500 3,491), posting gains 5 of the last 7 months and up two consecutive quarters. This means there is “good news” priced into equities. But we think this coming week could represent the “make or break” moment for our view and for those bearish/cautious on markets:

- I concede there is a lot of uncertainty with a wide range of possible outcomes for the regional bank crisis, inflation and economic outcomes and even debt ceiling and Russia-Ukraine war. How these play out leads to a wide range of outcomes, and this is the reason investor expectations are so divergent.

- The two key events this week, in my opinion, are the ISM Manufacturing April (5/1 at 10am ET) and the May FOMC rate decision (5/3 at 2pm). The supporting cast is March JOLTS (job openings, 5/2 10am ET) which impacts the Fed’s May rate decision. There are others (see below) but these are the two critical to markets.

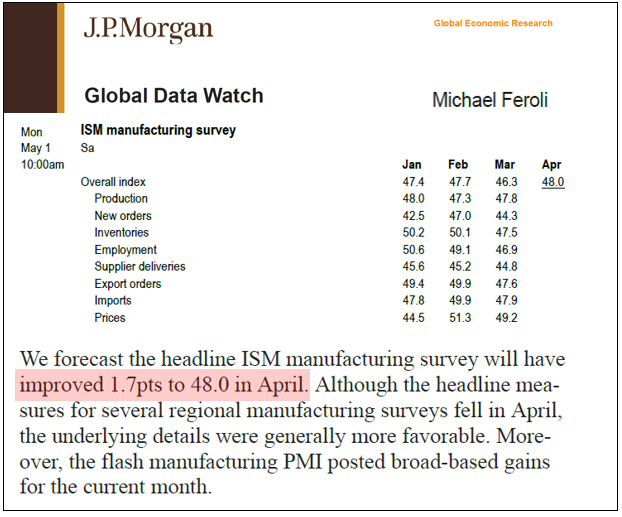

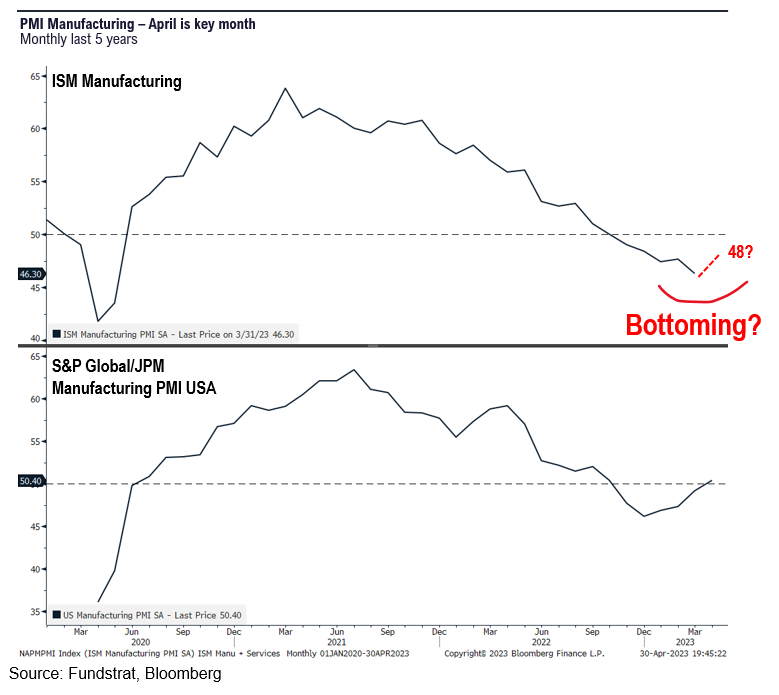

- On ISM, the ISM manufacturing PMI has been in a freefall since March 2021 (peaking at 63.8) and fell below 50 in Oct 2022. We believe the ISM manu. might finally be bottoming with April. JPMorgan Economists forecast 48.0 and even Street consensus sees a modest uptick to 46.8 from 46.3 in March. The regional surveys have been mixed, but we lean to a beat, as the S&P Global US PMIs already show US at over 50. So we see a convergence.

- The May Fed FOMC decision is thesis-changing as well. Given the softish inflation readings over the past two months (see our ongoing commentaries), we expect Fed FOMC will make a “dovish” +25bp May hike. That is, this will likely be the last hike of the cycle. This is thesis changing.

- For those in the “higher for longer” camp, seemingly the plurality of investors, the Fed is expected to continue hiking for much of 2023. Taking their cues from the March 2023 SEP (summary economic projections), they see a “terminal rate” in 2023 of 5.1% to 5.6% (central tendency) or most see 5.50% to 5.75%, or at least 2-3 further hikes. A “pause” would likely have many question their “higher for longer” thesis.

- So it is pretty obvious why this week’s data will be critical. Over the weekend, rescue/resolution efforts are underway for First Republic (FRC) and the outcome is tragic on many levels. The bank had an enviable franchise and customer relationship truly differentiated. And the loss to shareholders and employees is devastating. Wider spillover to broader markets, however, seems limited.

- As for our positive thesis for 2023, we remain constructive and this week will be critical. Our positive view on stocks stands in stark contrast to consensus, which is overall quite negative. The primary difference, in my view, is that we see this as an inflation-driven Fed cycle and bear market (2022), consistent with the experience of the 3 precedent inflation bear markets. Conversely, consensus sees a classic business cycle, coming recession, Fed breaks economy cycle.

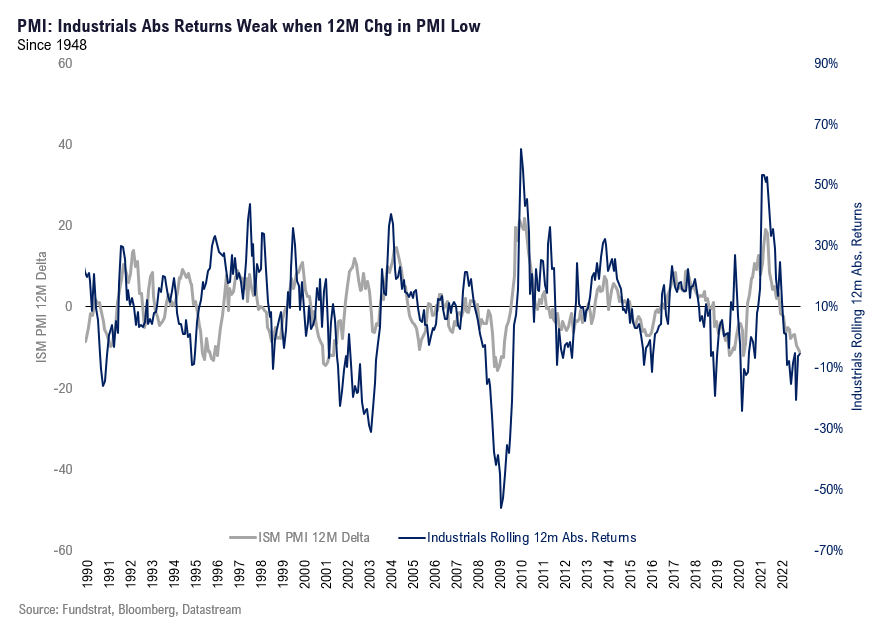

- The bottoming of PMIs is a big deal for S&P 500 EPS, which closely follows PMIs and even more so for Industrial stocks XLI 0.66% , which literally track PMIs. Thus, bottoming on PMIs (Monday) means we expect a fairly strong rally in Industrials in coming weeks (see below).

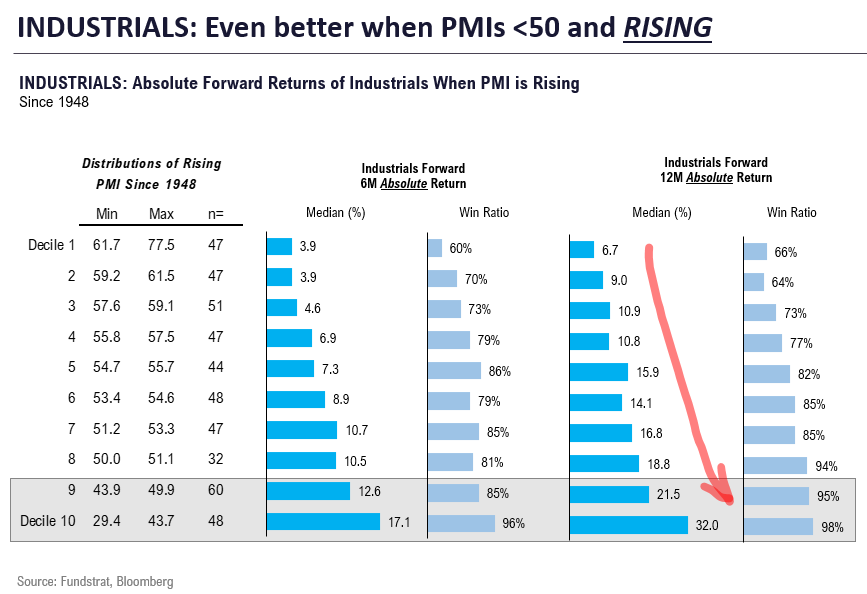

- The best way to leverage this week, arguably, will be via Industrials (XLI 0.66% ). As we have highlighted in the past, Industrials are very sensitive to manufacturing PMIs inflecting higher. We highlight this in a series of charts below. Since 1948, when PMIs are <50 and are rising (n=60), Industrials see positive forward 6M and 12M gains of 85%/95% of the time with median gains of +12.6%/21.5%, respectively. Those are very favorable risk/reward and high absolute return opportunities.

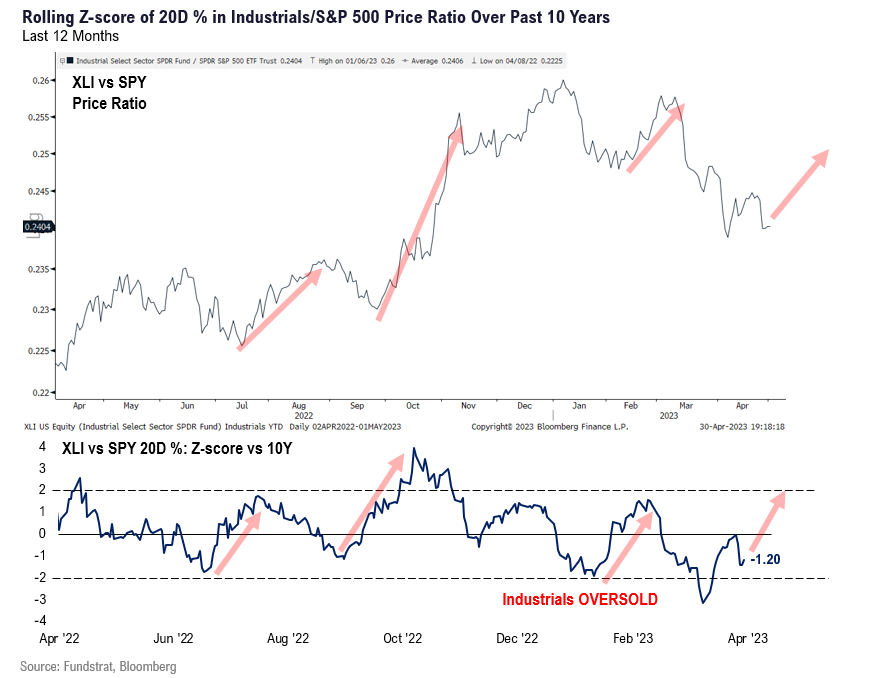

- Moreover, Industrials are oversold vs S&P 500 on 20D %-change, with a z-score of -1.2. The most recent 4 times this was seen, Industrials staged strong rallies vs the broader market. This is not that different than the signal we highlighted two weeks ago regarding FAANG/Technology. And we know that FAANG powered higher in the past two weeks.

BOTTOM LINE: Industrials likely bounce. We see ISM and FOMC as key to our thesis

This is the most hated 7-month, 20% rally ever. We had ~1,000 of our clients tune into our “Perspectives on bottom” webinar last week and among the hundreds of questions, the vast majority were negative and bearish. We only managed to answer about 10 or so for our webinar, but you would be surprised at the level of skepticism regarding stocks.

- is this high level of skepticism bullish or bearish?

- we think it depends on the cadence of data in the coming weeks

- April was generally dovish data and thus, the skeptics had to course correct

- interestingly, because the S&P 500 is up 9% YTD, the level of bearishness is higher

- the logic is: I hated S&P 500 at 3,800. I hate it even more at 4,170

We still remain constructive and see S&P 500 reaching 4,750 by YE. Our top sectors remains FAANG/Tech and Industrials and Energy. QQQ 1.54% FNGS 1.64% XLI 0.66% XLE 0.22% META 2.05% AMZN -0.58% AAPL 1.18% NFLX -0.11% NVDA 3.79% TSLA -1.93% GOOG 0.92% .

- and if you are interested in single stock ideas, refer to our “Granny Shots” (see below).

S&P 500: 7 months of gains and two consecutive quarter of gains NEVER happened in a bear market

The bear market is over, if one cares for statistics.

LEADERSHIP: We see Industrials as positively levered to ISM this week

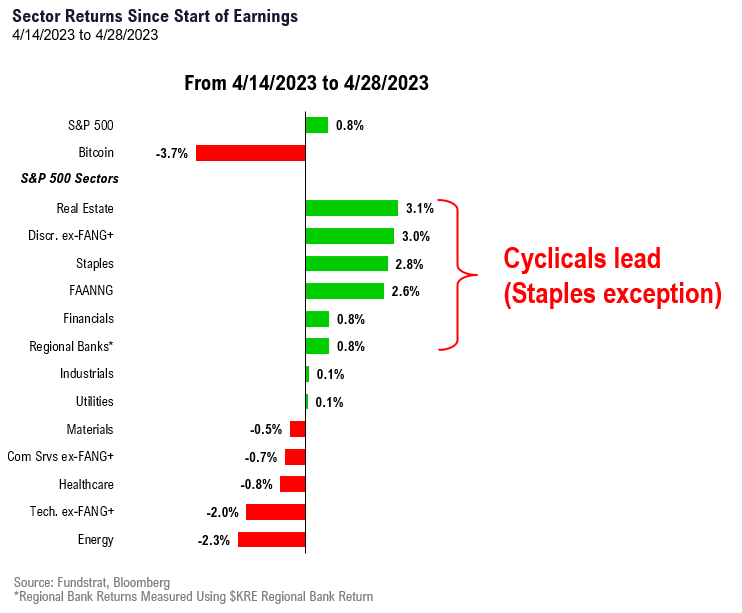

Two weeks ago, ahead of 1Q23 EPS, we highlighted FAANG and cyclicals as likely beneficiaries of a “better than feared” earnings season. As shown below, this has been largely the case.

INDUSTRIALS: A good week to make a tactical positive bet

The April ISM is released Monday 5/1 at 10am ET.

- Consensus sees slight uptick to 46.8 from 46.3 last month

- JPMorgan sees 48, a larger beat

- The regional surveys have been mixed, but we lean to a beat, as the S&P Global US PMIs already show US at over 50. So we see a convergence.

Whenever PMIs bottom (see below), Industrials tend to bottom. This first chart shows rolling change for US PMIs and US Industrials returns.

This distribution table puts this in a clearer light. When PMIs are rising and from low levels, Industrials see strong gains.

- Since 1948, when PMIs are <50 and are rising (n=60), Industrials see positive forward 6M and 12M gains of 85%/95% of the time with median gains of +12.6%/21.5%, respectively.

- Those are very favorable risk/reward and high absolute return opportunities.

Industrials are oversold vs S&P 500 on 20D %-change, with a z-score of -1.2.

- The top chart is the relative price ratio of Industrials vs S&P 500

- The bottom is the z-score of the 20D % change.

- The most recent 4 times this was seen, Industrials staged strong rallies vs the broader market.

- This is not that different than the signal we highlighted two weeks ago regarding FAANG/Technology. And we know that FAANG powered higher in the past two weeks

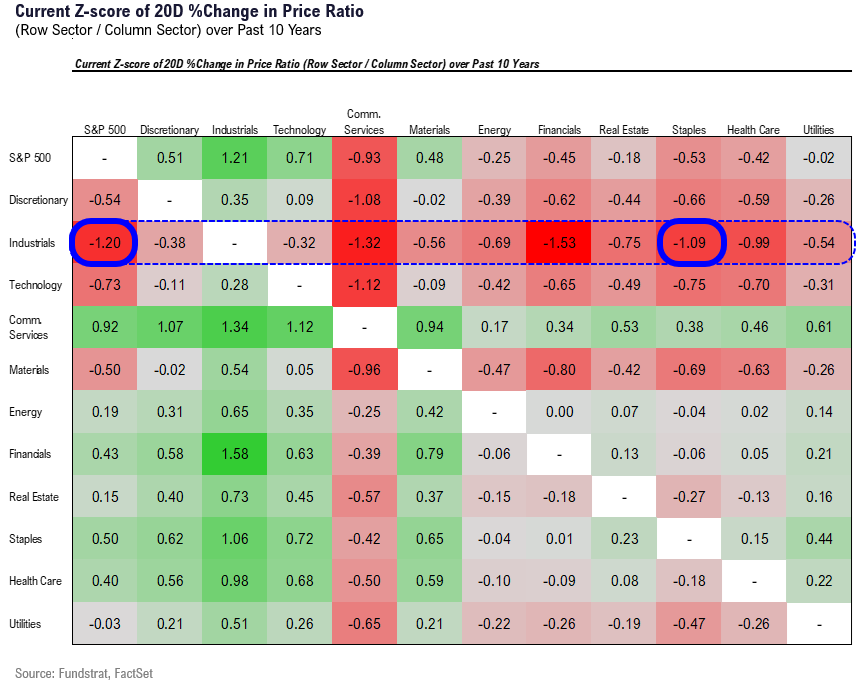

And Industrials are the most oversold vs other sectors, particularly against Staples.

ECONOMIC CALENDAR: Key May data is inflation and ISM, and April was overall “tame”

Key incoming data May

- 5/1 10am ET April ISM Manufacturing (PMIs turn up)

- 5/2 10am ET Mar JOLTS

- 5/3 10am ET April ISM Services

- 5/3 2pm Fed May FOMC rates decision

- 5/5 8:30am ET April Jobs report

Key incoming data April

4/3 10am ISM Manufacturing Employment/Prices Paid MarchTame4/4 10am ET JOLTS Job Openings (Feb)Tame4/7 8:30am ET March employment reportTame4/12 8:30am ET CPI MarchTame4/12 2pm ET March FOMC MinutesTame4/13 8:30am ET PPI March Tame- 4/14 7am ET 1Q 2023 Earnings Season Begins Better than feared

4/14 Atlanta Fed Wage Tracker MarchSemi-strong4/14 10am ET U. Mich. March prelim 1-yr inflationHawkish4/19 2:30pm ET Fed releases Beige BookTame4/28 8:30am 1Q23 Employment Cost IndexSemi-strong4/28 8:30am ET PCE MarchTame4/28 10am ET UMich April final 1-yr inflationHawkish

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 76aa41-d66d9c-5d0554-a60bc0-fd1866

Already have an account? Sign In 76aa41-d66d9c-5d0554-a60bc0-fd1866