Crypto Research Guide

A guide to our Crypto publications, including reports and videos.

FS Insight’s crypto research empowers you to develop your own investing thesis and take ownership over your future by using digital assets to build generational wealth. After all, ownership is one of the core tenets of crypto.

Our crypto research experts were early adopters and are well-versed in navigating the crypto ecosystem. They fuse scarce insights from this emerging asset class with a diverse range of legacy market experience to create a powerful set of tools and actionable recommendations for both novices and experienced investors. Access to our research enables you to think like a digital assets expert and master the crypto market like a professional.

Sean Farrell AC

Head of Crypto Strategy

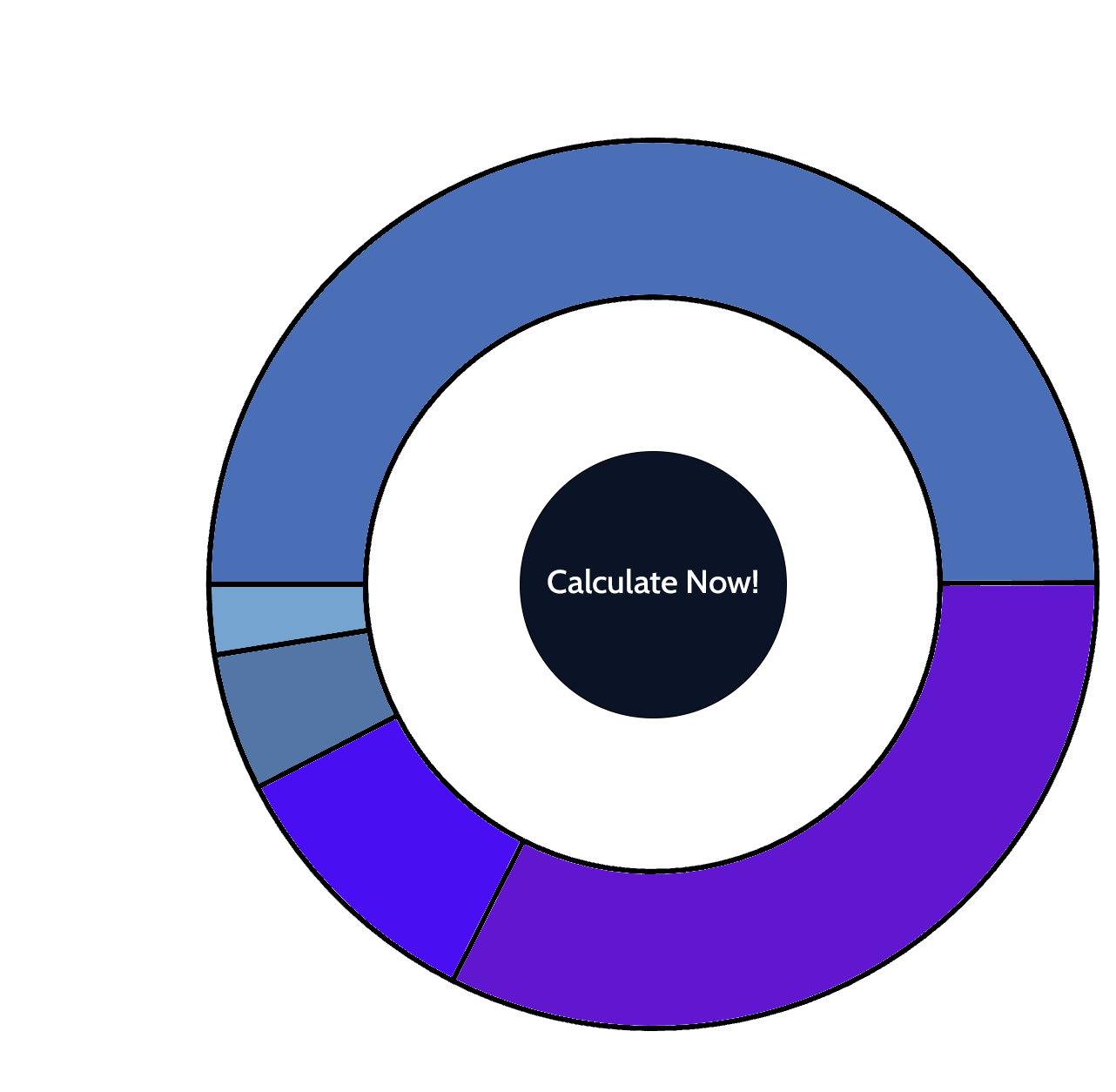

A powerful tool designed to help crypto investors build a crypto portfolio that outperforms the industry’s king – bitcoin – regardless of market conditions. The FSI Crypto team leverages their crypto expertise and ongoing analysis of macro, on-chain, and market data to craft an allocation strategy that can help investors manage the crypto portion of their investment portfolios.

How to Use the Crypto Core Strategy

- The strategy incorporates stablecoins, bitcoin, and select altcoins that have been selected from the largest by circulating market cap and then carefully assessed by the crypto team.

- The Crypto Core Strategy also helps investors better understand the team’s views on risk in the markets: A higher allocation of stablecoins in the strategy indicates that the team is feeling risk averse, while a lower allocation indicates that the team believes the time is right to seek out beta.

- The alt-coin allocation in this strategy can also be used as an assessment of the team’s views on this segment of the crypto ecosystem. Watch this allocation to gauge whether the team believes “alt season” is approaching or not.

Tom Couture AC

Vice President of Crypto Strategy

A recurring research note focused on delivering unique insights into high-risk investment opportunities within the crypto ecosystem, primarily centered on early-stage or small-cap tokens.

What to expect from Liquid Ventures

- The service aims to unearth promising crypto projects poised for significant growth, with a typical standard time horizon of 12 months or more, though some of these might be adaptable to certain shorter-term situations.

- The team constantly assesses the thousands of early-stage token to identify those with the most potential, laying out their reasoning to help investors learn what to look for.

- These long-only ideas will be presented by the Crypto team on a periodic basis depending on the current opportunities in the market, but members should expect biweekly or monthly ideas.

Tom Couture AC

Vice President of Crypto Strategy

Often, the best way to understand where the industry is heading is to follow the money. Funding Friday aims to bring you up to speed on the latest deals in the crypto industry. Get up to speed on the latest in crypto capital markets and discover emerging projects before they reach the mainstream.

What to expect from Funding Fridays

- We collect and analyze deal data from countless sources to bring our clients the latest venture deals, token sales, M&A, and capital-markets deals for crypto projects and companies.

- The crypto team provides a breakdown of the most active subsectors (NFTs, DeFi, Metaverse, etc.) in the space and the most active investors for the preceding week. It features a “Deal of the Week,’ which is a nod to the transaction we find to be the most integral to the industry for the week.

FS Insight Team

We periodically provide in-depth research on the leading protocols, companies, and funds shaping the crypto ecosystem.

What to expect from Deep Research

- The digital assets team provides granular breakdowns on the leading platforms based on technology, market positioning, value propositions, and risks.

- The team also releases reports on emerging crypto funds, providing clients with insight into unique investment strategies and emerging investment opportunities.

Sean Farrell AC

Head of Crypto Strategy

Find out what’s driving the market in these quick-hitting videos discussing the latest market developments and what to look for in the near term.

What to expect from Comments

- Explanations of the latest market events, discussion of relevant macro and on-chain data, and potential catalysts or risks that may determine short-term market direction.