-

AMZN

-

$228.88

-

-0.60%

-

$229.83

-

$231.09

-

$227.63

Ticker Appearances

Live Technical Stock Analysis

LIVE Technical Stock Analysis December 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

⚡ FlashInsights

First Word

"Iffy" October behind us. But election uncertainty likely weighs on much of November.

VIDEO: It is clear that the winner of the 2024 Presidential election will not be decided on 11/5 evening, but could be a drawn out...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

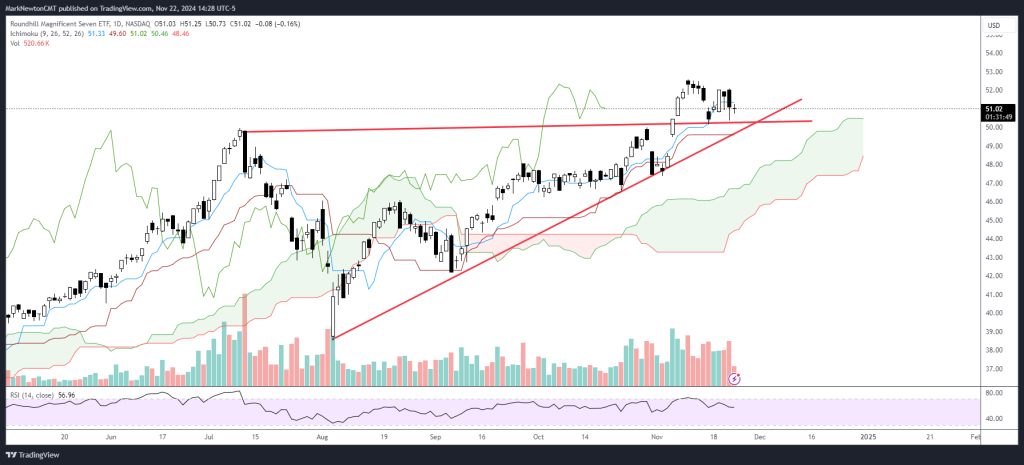

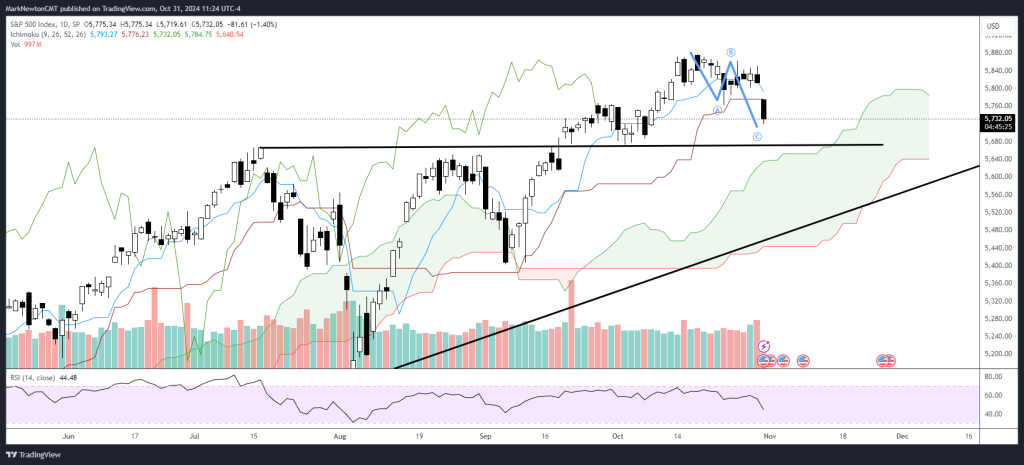

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

⚡ FlashInsights

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Live Technical Stock Analysis

LIVE Technical Stock Analysis December 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

First Word

"Iffy" October behind us. But election uncertainty likely weighs on much of November.

VIDEO: It is clear that the winner of the 2024 Presidential election will not be decided on 11/5 evening, but could be a drawn out...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Consumer Discretionary breakout vs. Consumer Staples is seen as positive

SHORT-TERM US EQUITY TRENDS HAVE STILL GRINDED LARGELY SIDEWAYS IN RECENT WEEKS FOLLOWING THE BULLISH BREAKOUT BACK TO NEW ALL-TIME HIGHS FOR SPX AND DJIA. ...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08

Daily Technical Strategy

Breakouts in Materials, Discretionary are bullish; Healthcare is being lowered to Neutral, technically

SHORT-TERM US EQUITY TRENDS ARE BULLISH AND LIKELY BEGIN TO ACCELERATE HIGHER INTO MID-OCTOBER BEFORE FINDING MUCH RESISTANCE. DESPITE THE BEARISH SEASONALITY TRENDS, IT’S HARD...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 7584e7-ae0e4f-6a2286-e059cf-305f08

Visitor: 7584e7-ae0e4f-6a2286-e059cf-305f08