Technical Strategy

Research

Technical Strategy

Research

Technical Analysis

Mark Newton, CMT

Why is Technical Strategy Important?

Overall, utilizing technical analysis in one's process might be beneficial for the following reasons:

The following concepts can help you navigate the markets:

- First, they allow one to understand what the current trend is of the asset (stock, ETF, crypto, etc ) in question over various time frames. It's useful to know whether a stock is trending higher, lower, or sideways, and attempt to buy/own stocks with both technicals and fundamentals simultaneously improving.

- Second, technicals can be used for risk management purposes, and many investors make use of technicals to help right-size their positions, (overweighting stocks which have the best technical setup or offer attractive risk/reward profiles, particularly if this lines up with the fundamental backdrop). Moreover, others consider using technicals to hedge or sell their positions if/when a stock starts to deviate meaningfully from its trend or potentially reaches levels out of line with fundamentals.

- Third, technical analysis is often used for stock selection, in seeking out stocks which appear like attractive risk/reward candidates and which might offer above-average return possibilities. Based on one's risk tolerance or preference for investment, some might consider buying stocks which are breaking out to new 52-week high territory, or have been demonstrating superb relative strength versus their peers. Others might choose to buy short-term weakness within a current uptrend at levels which technicals suggest make sense.

When looking at technical analysis the following concepts are tied to the discipline and can help one navigate the markets:

- Momentum

- Relative Strength

- Volume

- Breadth

- Sentiment Shifts

- Cycles

- Seasonality

- Trend Analysis (Trend Following, and Counter-Trend)

- Sector Rotation

- Time Analysis

- Elliott-Wave Theory

Mark Newton’s Methodology

Important Indicators Used

Trend Identification

daily, weekly, monthly basis

Structural Analysis

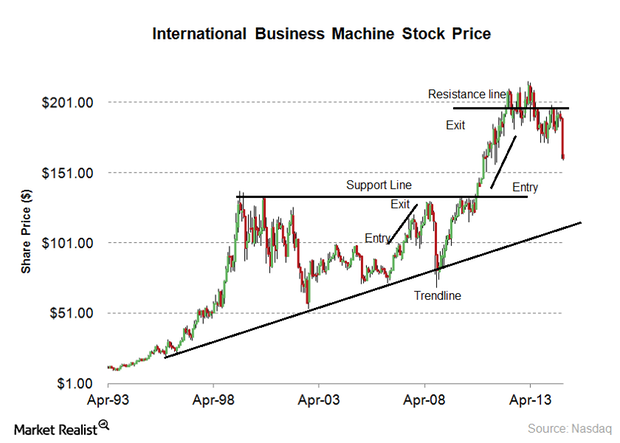

Utilizing former highs and lows as potentially being important for resistance and/or support for trading over multiple timeframes

Trendline Utilization

Drawing trendlines extending from the lowest lows to the low preceding the highest highs

Fibonacci Analysis

Using the concept of Fibonacci for retracements in both time and price terms for identifying possible areas of exhaustion

Momentum Analysis

Seeking stocks exhibiting positive momentum for long investments on multiple timeframes

Momentum Divergence Analysis

Keeping track of when momentum starts to positively or negatively diverge from current price trends for purposes of early warnings

Volume Analysis

Keeping track of heavy volume during price gains or lack thereof for help in deciphering the possible duration of a certain trend

Breadth

his is more useful for broader indices when studying the underlying health of a market, but remains quite useful

Ratio Charts

Comparing a stock to its industry and/or to underlying index such as SPX

Relative Strength

Seeking out stocks which exhibit stellar strength and are trading at or within striking distance of 52-week highs (for Long stock selection)

Counter-Trend Analysis

Utilization of Tom DeMark's indicators like TD Sequential and/or TD Combo to identify strong trends which might be on the verge of reversing course, either from downside to upside, or vice-versa

Cycles

Utilizing cycle composites to gain an understanding of the most commonly seen cycles which dictate patterns of low-to-low, or high-to-high for help in identifying potential highs and lows in price

Elliott-Wave

Elliott-Wave projections for the purposes of forecasting potential price targets and utilizing former highs or lows for various stock rallies and for purposes of identifying whether a rally is a new and impulsive trend, or represents a counter-trend move

Astro-Analysis

Utilizing Sun, moon and planetary cycles for use in pinpointing highs, lows and trends for stocks and indices, both from a transiting to transiting standpoint, or transits to natal charts for analysis

Seasonality Studies

Seasonality Studies to identify times of above–average strength and/or weakness based on historical trends

Sentiment Analysis

Using Equity Put/call ratios for indices or stocks and/or commonly used Sentiment polls for keeping tabs on investor sentiment