Even as banking crisis still expanding, FAANG/Tech nearly recovered entire 2022 losses

The scope of the banking crisis continues to edge wider, with additional regional banks seeing pressure by investors (bonds well under par) and over the weekend, a Bloomberg article noted US authorities discuss expanding emergency lending facilities to stave this off. Over the weekend, in multiple casual conversations with friends and acquaintances, so many told us they believe this is the GFC all over again. So the public is clearly rattled by the high profile bank failures and the dramatic market reactions since.

At the same time, there is a problem with this doomsayer narrative. The bank crisis started with the collapse of SVB Financial (SIVB) on 3/10 and while bank stocks have since crumbled, this has not been the case for the broader market. As we enter the final week of March, month to date (MTD), the S&P 500 is flat and YTD +3.42%.

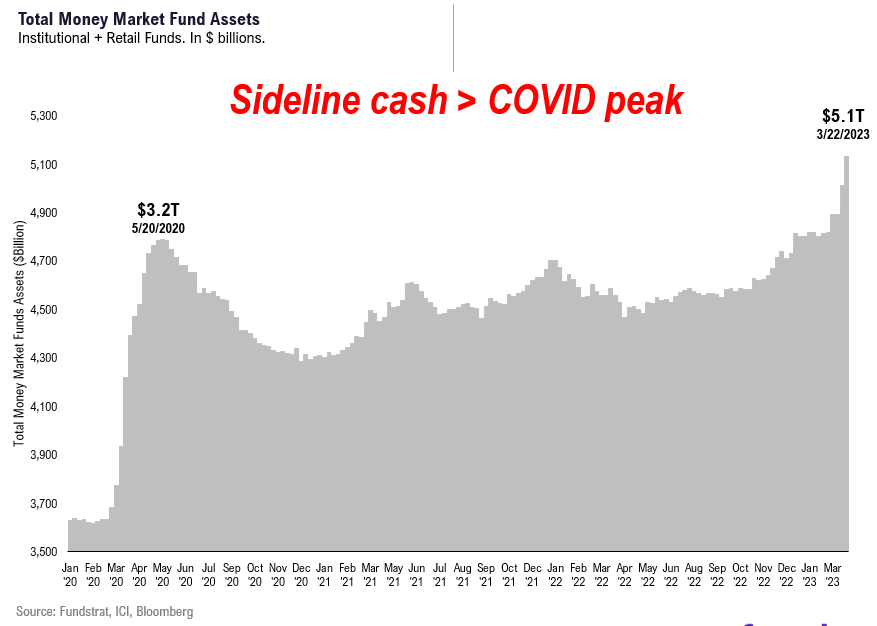

- Our clients and many pundits say this is a bearish setup for risk assets. The relative stability of equities merely means that stocks have not fully appreciated, and therefore not discounted, the coming economic and EPS decline stemming from the bank crisis. And in their minds, the “dumb” money is holding onto stocks as the “smart” money piles into money market funds, which have now soared to $5.1 trillion, exceeding COVID peak of $3.2T. But to us, this is a linear argument. That stocks only discount a crisis as it unfolds and essentially equities had not yet discounted all the mounting stresses in the financial system.

- At the risk of oversimplification, there are essentially two paths this banking crisis will track:

– bearish fork: crisis spreads, becomes full blown crisis and “harder landing”

– bullish fork: banking crisis is contained, while slower lending kills inflation. - The bullish fork is positive for equities as the Fed has already pivoted. And if inflation legs lower, the “higher for longer” is off the table and thus, the financial crisis slows the economy but doesn’t mean hard landing. And given the plurality of investor positioning is tilted to the bearish fork, there is a positioning tailwind that follows.

- It is our view that this crisis will track towards the bullish fork. But this is not a certainty. A financial crisis requires policymakers and the Fed to react swiftly to restore confidence for bank customers and financial markets. Full confidence has not yet been restored.

- But there are signs that the crisis is not set to morph into a broader crisis:

– deposit outflows appear to have slowed and FHLB issuance also slowed

– Fed/Treasury are aware of the need to communicate protection for uninsured deposits

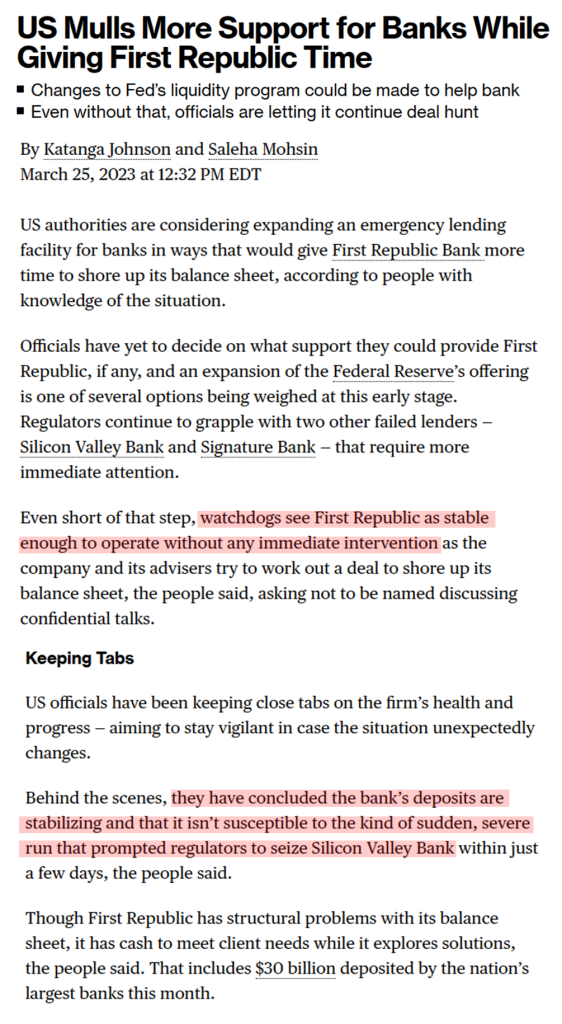

– First Republic (FRC) still in crisis but officials see as stabilizing (Bloomberg link) and

– FRC senior bank debt has leveled out last few days, though at low 51 (% par)

– First Citizens (FCNCA -2.55% ) looks set to be buyer of SVB, bringing that saga closer to an end - A fuller blown financial crisis is not inevitable. But the regional bank crisis is going to create larger problems for commercial real estate (CRE), which has been widely discussed in public. This is where investors need to watch for contagion spread and for a larger problem to emerge.

- As for our investment stance, this remains overall positive. In our 2023 Outlook, published early December, we identified FAANG and Technology as our 2023 top sector pick and argued FAANG could rise 40% or more in 2023. The banking crisis has not altered this view. But, with the realization that downside risks are significant, but not a thesis killer. In 2022, our top sector pick was Energy. Energy has fallen to #3 for us (XLE -0.92% ). Industrials #2 (XLI 0.16% ).

- There is economic data this week (see calendar lower in report) but this is just not as important

BOTTOM LINE: While it might feel like GFC Redux is unfolding, the heavy cash positions mean many positioned already for that

While it might feel like another Great Financial Crisis is underway (and it could be), it is important to appreciate that investors are largely positioned for the downside (high cash positions, negative sentiment).

- Moreover, at the heart of this issue is the higher interest rates and the associated damage to bank balance sheets

- Lower rates goes a long way to fixing this

- Look at the context of $5.1T of cash on sidelines. This dwarfs the COVID peak of $3.2T.

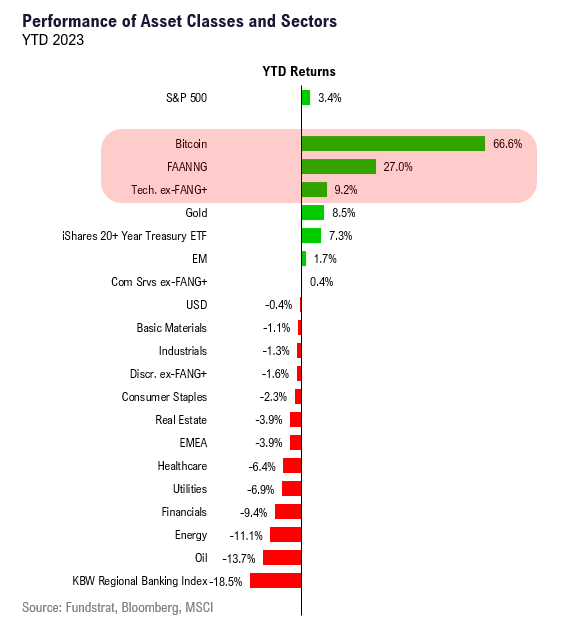

BTC/FAANG/TECH LEAD: There is meaningful positive gains YTD

Take a look below. The case for Technology/FAANG/Bitcoin has multiple factors as we outlined in our 2023 outlook including lower rates, solving inflation problems and we can now add “safety from financial crisis.”

- YTD, this is two markets

- Tech/FAANG/Bitcoin

- Everything else

- But with Tech/FAANG 40% of S&P 500, this is a reason the overall market has lift as well

In fact, the entire 2022 underperformance of both groups has been essentially erased:

- recall all those skeptics who said “Tech was done”

- “FAANG over”

- Nope

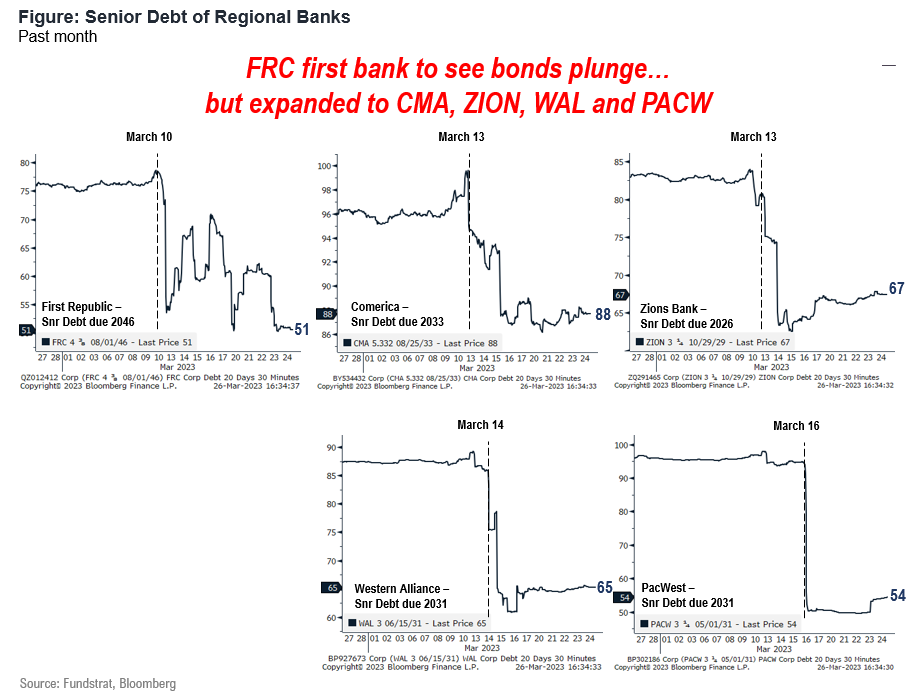

BANKING CRISIS: Multiple regional banks seen bank bonds selling well off highs

The crisis is edging to other banks, beyond FRC (First Republic) and as shown below, in the past week or two, has engulfed other regionals including CMA -0.15% ZION WAL and PACW

And the US regulators are mindful of need to expand efforts to stem this. We see this as positive on the margin, as the opposite is far worse — regulators not acting.

- this article caught my eye as it made reference to officials seeing FRC as stabilizing

- arguably, that is a marginal positive as a worsening situation there could fuel panic

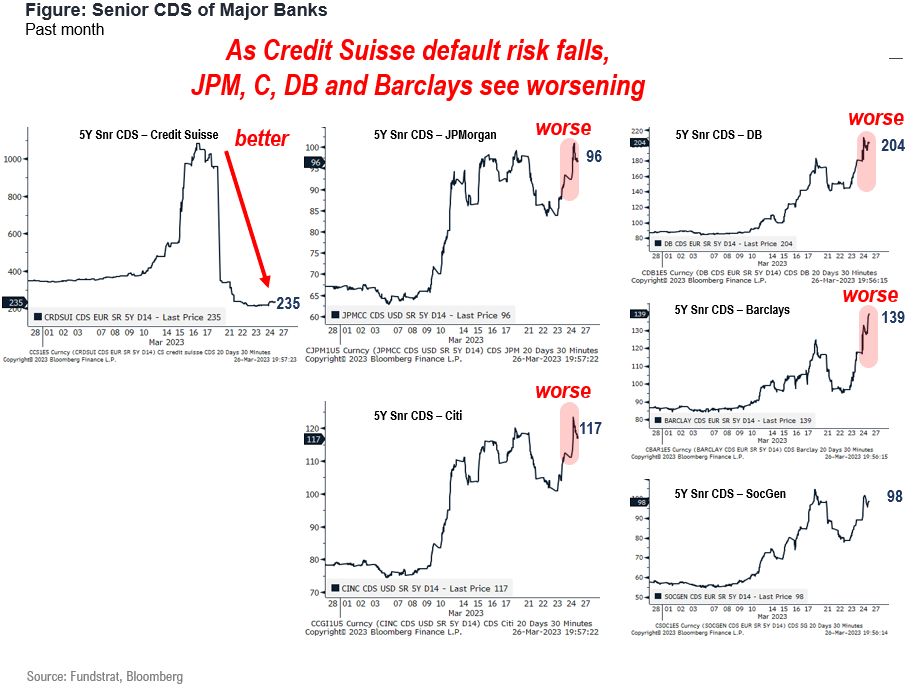

And while larger banks have been stable, their credit default swaps, aka CDS, have widened to new highs in the past few days for the major G-SIB (systematically important) banks:

- this includes JPM 0.06% C 1.29% DB -5.08% and Barclays among others

- this needs watching as CS CDS spread widening to >1,000 led to its collapse

- none of the banks below is near those levels with DB -5.08% worst but at 204 is lower than CS, post-UBS merger

ECONOMIC CALENDAR: U Mich next week most important in our view

There are some key inflation data points next week:

- most notably PCE deflation for Feb (its late)

- U Mich 1-yr inflation March final (more important)

CALENDAR: Key incoming data starting March 19

The big event this week is FOMC. That is the only real macro data point:

3/7 10 am ET Powell testifies SenateHawkish3/8 10am ET Powell testifies HouseNeutral3/8 10am ET JOLTS Job Openings (Jan)Semi-strong3/8 2pm ET Fed releases Beige BookSoft3/10 8:30am ET Feb employment reportSoft3/13 Feb NY Fed survey inflation exp.Soft3/14 6am ET NFIB Feb small biz surveySoft

3/14 8:30am ET CPI FebTame3/15 8:30am ET PPI FebTame3/17 10am ET U. Mich. March prelim 1-yr inflationBIG DROP3/22 2pm ET March FOMC rate decisionDOVISH- 3/31 8:30am ET Core PCE deflator Feb

- 3/31 10am ET U Mich. March final 1-yr inflation

Watch these 4 signs to see first signs the crisis ebbing

As we have mentioned recently, we get the sense that investors are being patient. They want to see how markets react to these multiple actions and how the Fed responds to the market turmoil. This means stocks are buffetted by these aftershocks.

The natural question is what are the signs this crisis might be ebbing?

– MOVE Index (bond volatility) below 150 (151 now) and hopefully settles below 125

– VIX Index falls below 20

– First Republic (FRC) comes to a resolution

– Regional bank deposits stabilize (Tables 9 and 10 of Fed’s H8).

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 1/30. Full stock list here –> Click here

______________________________