5 reasons equities rallying. Expanding breadth affirms 2022 "bottom" is in. P/E can expand with Fed hikes, as long as "shocks" are avoided. 2H rally.

Click HERE to access the FSInsight COVID-19 Chartbook.

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

SKIP WEDNESDAY –> Personal matter this day

SKIP THURSDAY

Friday

We are starting to see strengthening internals for equity markets, including key leadership improvements from Technology (QQQ 1.54% ) and small-caps (IWM 1.03% ) and measures such as advance/decline lines. Thus, from the perspective of our Head of Technical Strategy, Mark Newton, this is the healthiest expansion of participation all year, and a key reason he believes the “bottom” for 2022 is in.

- skepticism of this rally is rampant, not surprisingly

- the plurality of our clients call this a “bear market” rally and doomed to fail

- investors are waiting for 3 things:

- retail to capitulate

- EPS to get downgraded 20% or more

- Fed to capitulate

- In the absence of the 3 above, investors remain skeptical

5 reasons equities rally despite skepticism

The S&P 500 has closed at the highest level since June and is nearing 4,000. This is an important psychological level, as it puts the market closer to its all-time high than the 3,000 downside that many investors are “waiting for.”

But why are equities rallying? We can cite a few factors:

- inflation risks are abating as gasoline tanks, food prices ease (see below)

- 2Q2022 EPS results are better than feared with 70% beating on EPS

- many companies are reporting easing of “supply chains” meaning supply-chain inflationary pressures abating sharply, including semiconductor chip availability

- Strategists capitulated last week with many seeing S&P 500 closing 3,800 or lower by YE

- Institutional investors are arguably near maximum pessimism given BofA gross exposure at 2008 levels

The above, in our view, explains the dramatic improvement in market behavior post the awful and horrific June CPI report.

Supply chains are easing, evidenced by a material improvement in supply chain indices

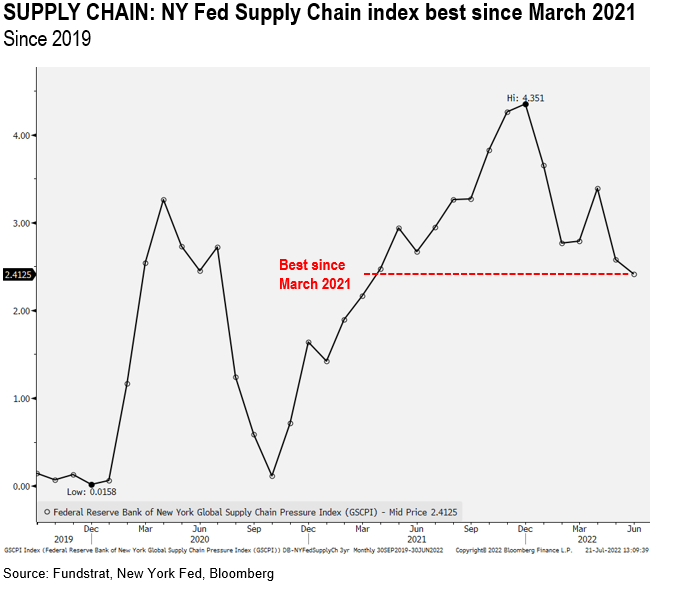

The NY Fed has a supply chain index (Bloomberg: GSCPI) and as this chart below shows:

- the index is at the best level since March 2021

- this index was at its worst in December 2021

- steady improvements since

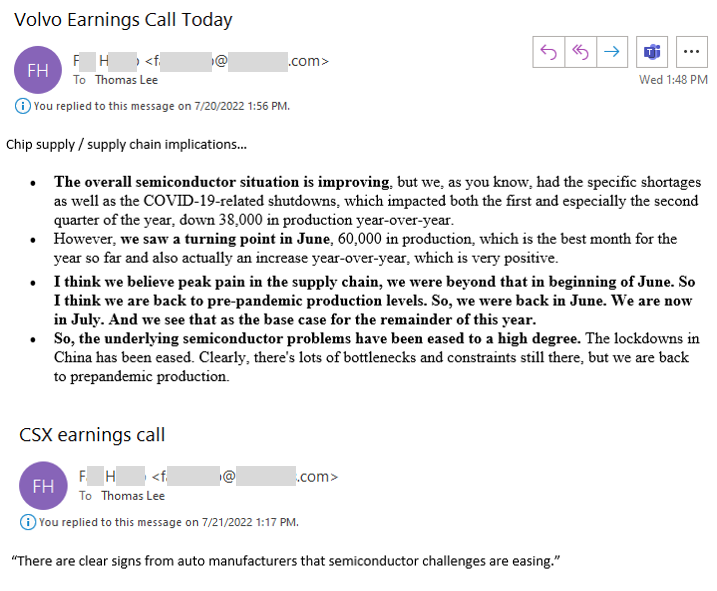

In fact, FH, an institutional client of ours, passed along some of his notes from EPS calls. A few really caught my eye regarding the supply chain:

- Volvo says semi chip access improving and production is at best levels all year

- Volvo sees themselves past peak pain

- CSX -0.27% said “clear signs from auto manufacturers that semiconductor challenges easing”

- this corroborates the vast improvement in the NY Fed supply chain index.

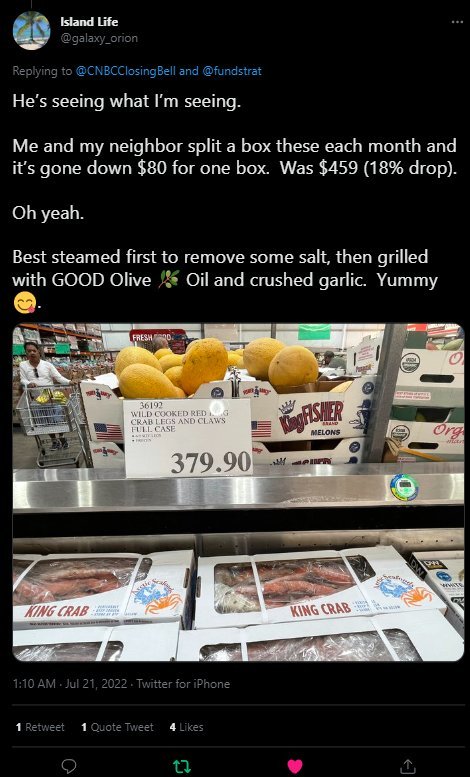

And this tweet from Island Life (@galaxy_orion) is a great example of how easing supply chains are leading to lower retail food prices. We discussed in the past few months, how easing supply chains were going to eventually lead to better inventory levels, which in turn, lower food prices.

- King Crab is down 18% at Costco (COST 1.17% )

- this is a substantial decline

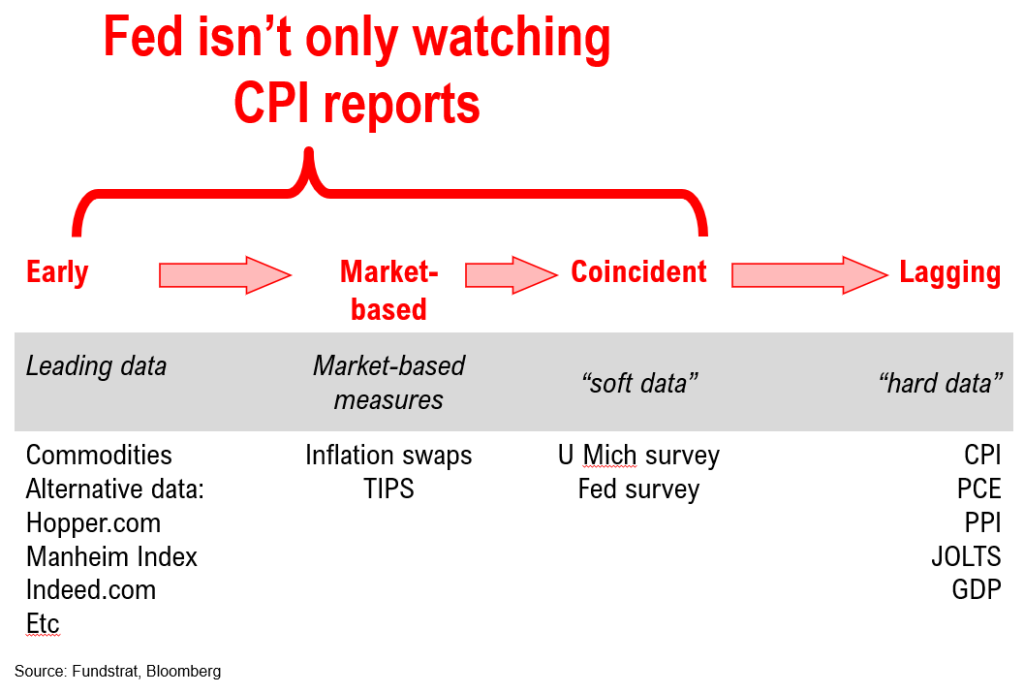

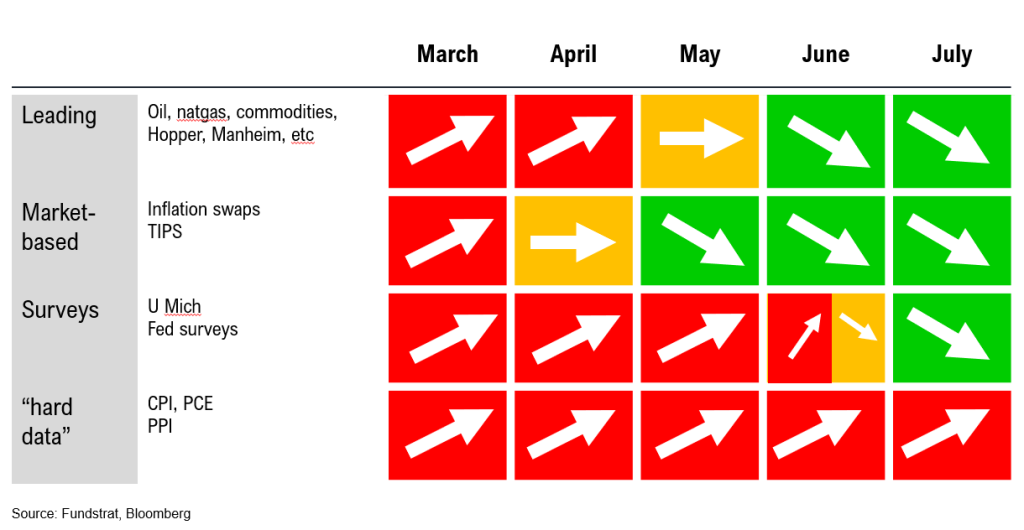

Fed is not only “waiting” for CPI to roll over, but looking for a comprehensive set of data to affirm inflation falling…

One thing that seems to have come up in multiple conversations is the view by clients that the Fed will not ease up on hikes until CPI prints are well on their way to 2%.

- this is mostly correct

- but CPI (PCE) is so lagged, we believe the Fed will be watching many other measures

- thus, the leading indicators and “soft data” will be key to watch

And as we highlight below, the constellation of trends in many of the above has vastly improved in the past 6-8 weeks:

- leading indicators are rolling over

- Market based measures are back to pre-pandemic levels of below 2.5% beyond 5 years.

- All data except for the hard data turned down by July.

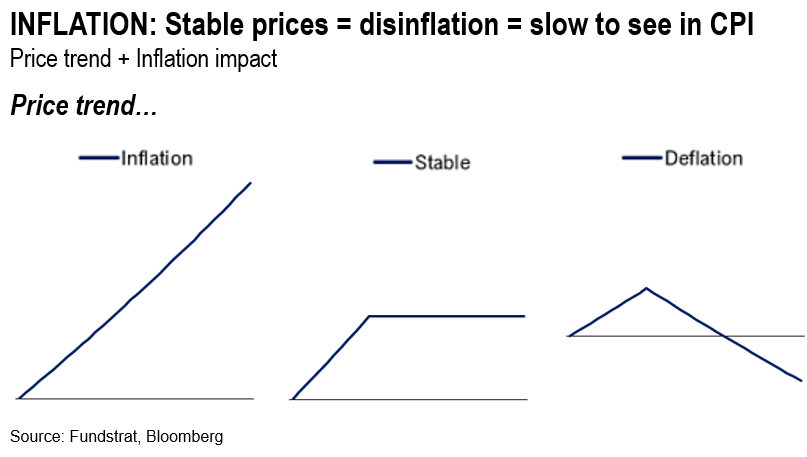

The problem with CPI YoY is that it takes a long time for the change in trend to show up.

As we think about inflation and trends, it is important to keep in mind the difference between inflation, disinflation and deflation. Inflation is the continuous rise in prices. Disinflation is when prices rise and then stabilize.

- As you can see below, when prices stabilize, there is no longer any inflation.

- But it takes some time for the YoY to show that prices are no longer rising.

Gasoline is a good example…

For instance, let’s assume gasoline price go back to $3.62. This is where gasoline was before the Russia/Ukraine invasion.

- Looking at YoY, it would take nearly 7 months before gasoline shows a decline on CPI YoY.

- This is the problem with YoY data.

- Which is why we believe the Fed is not looking only at CPI hard data.

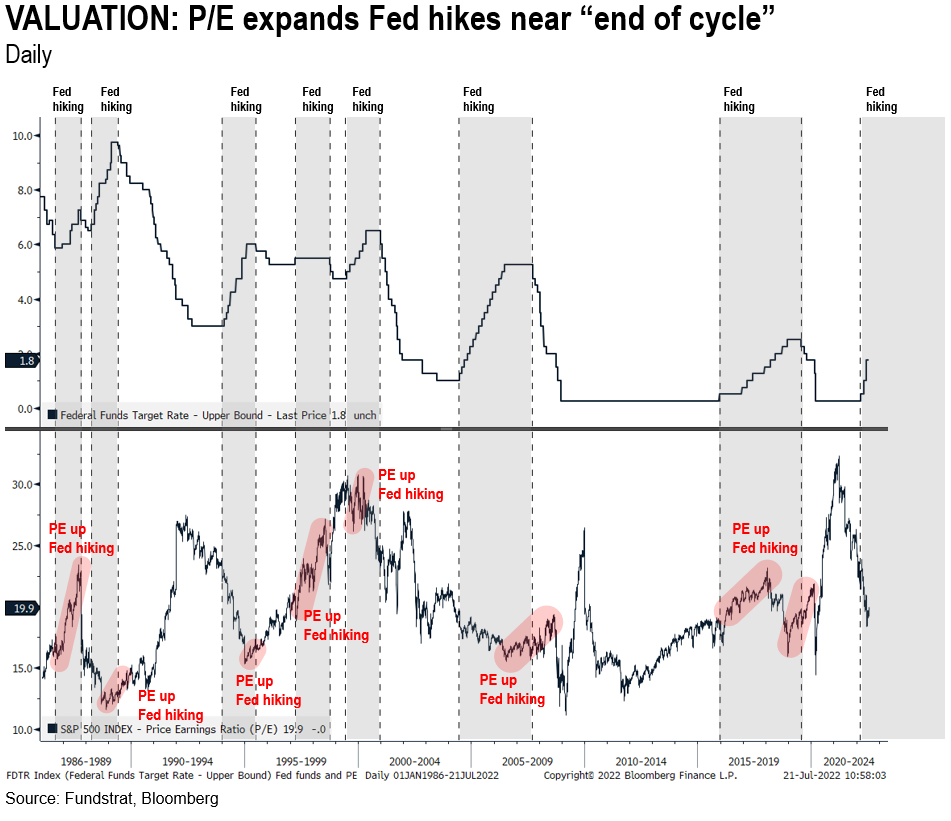

STRATEGY: P/E Expansion is arguably more important “E”

George Boyd, Head of Research at Kidder-Peabody, used to famously say that it takes a whole lot of “E” to offset P/E. What he meant by that, is that valuation expansion and contraction was a more important factor for price than actual earnings trends. And in a downcycle, investors become overly confident that the downtrend will be sustained because they see downside to earnings revisions.

- A central case for the bears, is that stocks will fall because earnings estimates will get cut.

- But the problem with this assumption, is that this assumes the market is not forward looking.

I think one of the things that investors tend to conflate, is that they believe when the Fed is hiking “P/E” has to be falling. History simply says this is not true. Think about it, P/E really only contracts when risk premia is rising:

- Risk premia rises when central banks are shocking markets.

- But raising interest rates doesn’t necessarily raise risk premia, if markets have visibility.

- Take a look at the chart below, in every Fed hiking cycle since 1980, P/E began to expand when the Fed was halfway through its hiking cycle.

- This is the opposite of what most investors are saying.

- Investors are conflating hiking with P/E compression.

- The Fed should be approaching the neutral rate (2.5%) after the July FOMC meeting.

- Therefore, there is less urgency for the Fed to shock markets. If inflationary pressures are abating.

- As we pointed out in our report earlier this week, in 1982, the entire bear market was erased in 4 months.

- That means a 36 month bear market was reversed in one tenth of the time.

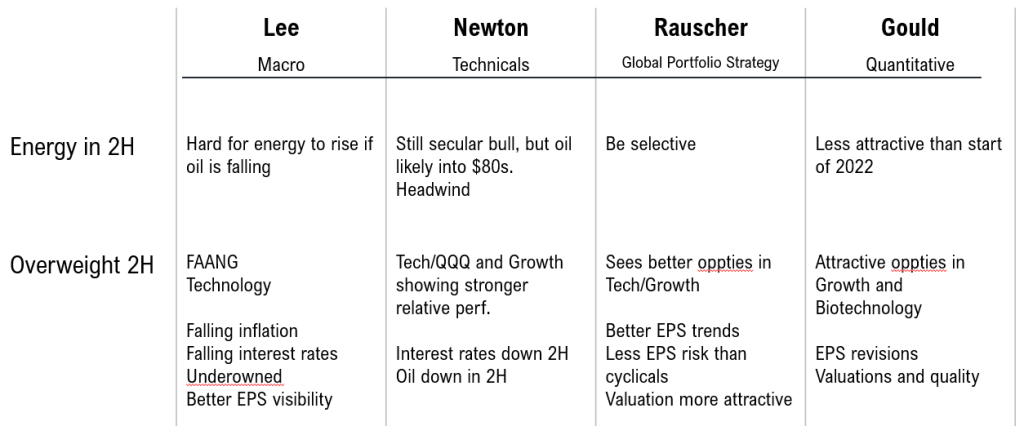

SECTOR: Energy be more selective in 2H

Energy equities led markets in 1H2022 given the triple tailwinds of higher oil, stocks cheap vs oil and energy equities were underowned. But the calculus is different in 2H22:

- Rauscher: Be selective, still above neutral, but focus on better names rather than broad overweighting

- Newton: Oil could be short-term weak, but still in a secular bull

- Lee: Energy stocks can’t rise if oil is falling. So no point in being a hero, but the upside is still there.

SECTOR: Falling oil = OW Technology and Growth Stocks

If oil is not the kingpin sector, what should investors own?

- Rauscher: Growth stocks, both defensive and offensive, are looking more attractive, as secular growth insulates from cyclical EPS risk. Sees valuation compression towards later innings, especially if rates show signs of topping and moderating.

- Newton: Technology and Growth are showing good relative strength and are buyable.

- Gould: Growth stocks valuations have improved considerably. Another potential area to consider is health care (specifically biotech).

- Lee: FAANG should lead in 2H2022. Best EPS visibility. Valuations have come in sharply. Street is less constructive.

Overall, a lot of bad news is priced in. Look at the Russell 2000 Index (IWM 1.03% ) below.

- Russell 2000 has basically roundtripped to 2019 levels,

- erasing entire post-pandemic rally

- EPS is +72% higher, revs +27%

- lots of bad news baked in

WASHINGTON: Midterms. Dems keep Senate. Republicans take House.

Tom Block believes Republicans will take the House.

Democrats may keep Senate with a one seat gain with more Republican seats up for election this year.

As for Fed, listen to Fed officials as July FOMC meeting approaches as under Chair Powell they have been telegraphing policy so as to not surprise markets.

CRYPTO: Beware of bottom 1.0, wait for 2.0

Sean Farrell sees risk/reward very attractive in crypto. For multiple reasons:

- massive deleveraging events are done

- unlike prior cycles, there are real things being done

- crypto remains beta to overall market

- if Fed playbook is changing, tailwind for crypto

- if Tech/growth are leading 2H, crypto is highest beta

- crypto valuations have become reason on multiple metrics

- signs of panic selling/capitulation by retail

- signs of capitulation by miners

- regulatory headwinds diminished

- dollar weakening bullish for crypto

- best ideas are BTC, ETH and SOL

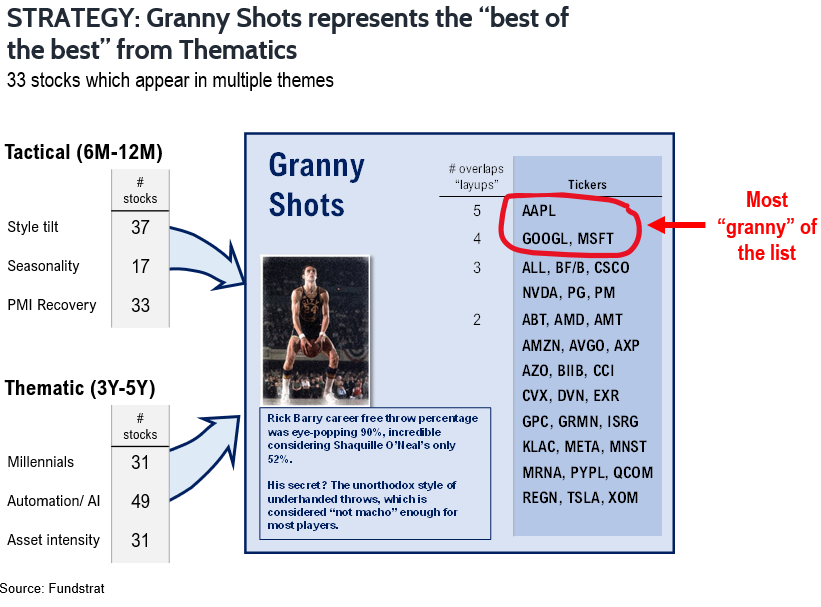

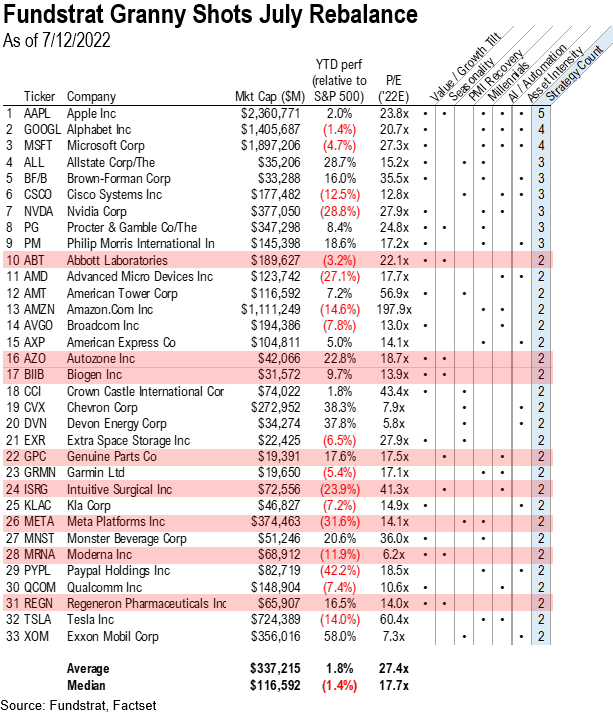

33 GRANNY SHOTS: Updated list is below

The revised 33 Granny shots is shown below. The list on the table below is sorted by the most attractive (most frequently cited) to least. To be a “Granny shot” the stock needs to appear on at least two portfolios:

- AAPL 1.18% in 5 of 6 portfolios

- GOOGL 1.03% MSFT 1.51% in 4 of 6 portfolios

- AMZN -0.58% META 2.05% in at least 2

- This reinforces our favorable view of FANG in 2H2022

33 Granny Shot Ideas:

Consumer Discretionary: AMZN -0.58% , AZO 0.30% , GPC -0.37% , GRMN 0.38% , TSLA -1.93%

Information Technology: AAPL 1.18% , AMD 4.25% , AVGO 4.07% , CSCO 6.05% , KLAC 4.08% , MSFT 1.51% , NVDA 3.79% , PYPL -1.16% , QCOM 2.87%

Communication Services: GOOGL 1.03% , META 2.05%

Energy: CVX -0.34% , DVN -0.24% , XOM

Financials: ALL -1.66% , AXP 0.07%

Real Estate: AMT 2.71% , CCI 2.43% , EXR 2.31%

Health Care: ABT 0.56% , BIIB 3.72% , ISRG 3.96% , MRNA 0.58% , REGN -0.65%

Consumer Staples: BF/B, MNST -0.44% , PG 0.44% , PM 0.86%

_____________________________

33 Granny Shot Ideas: We performed our quarterly rebalance on 7/12. Full stock list here –> Click here

_____________________________

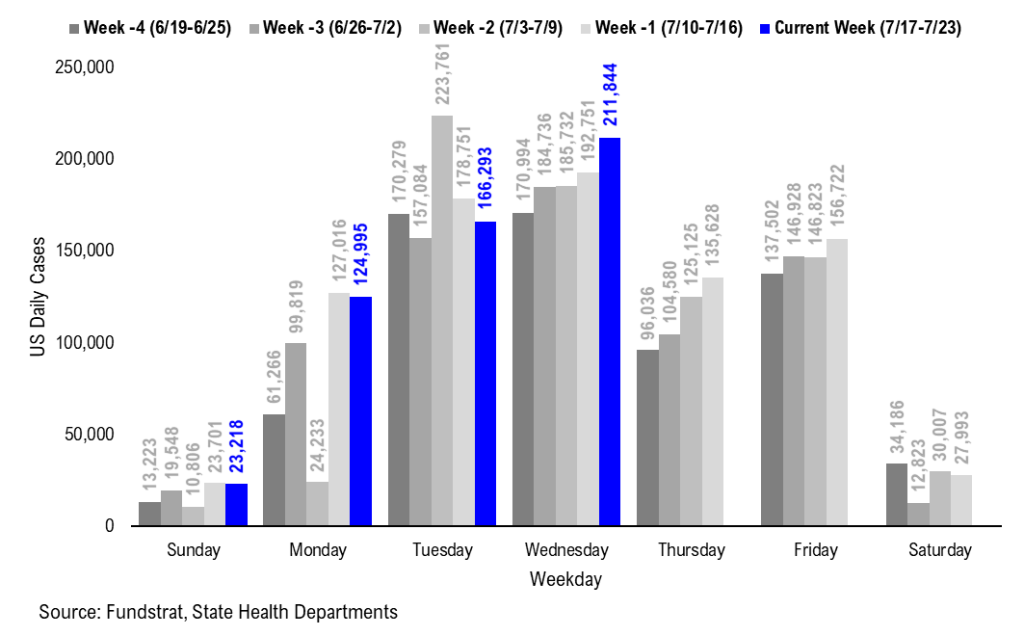

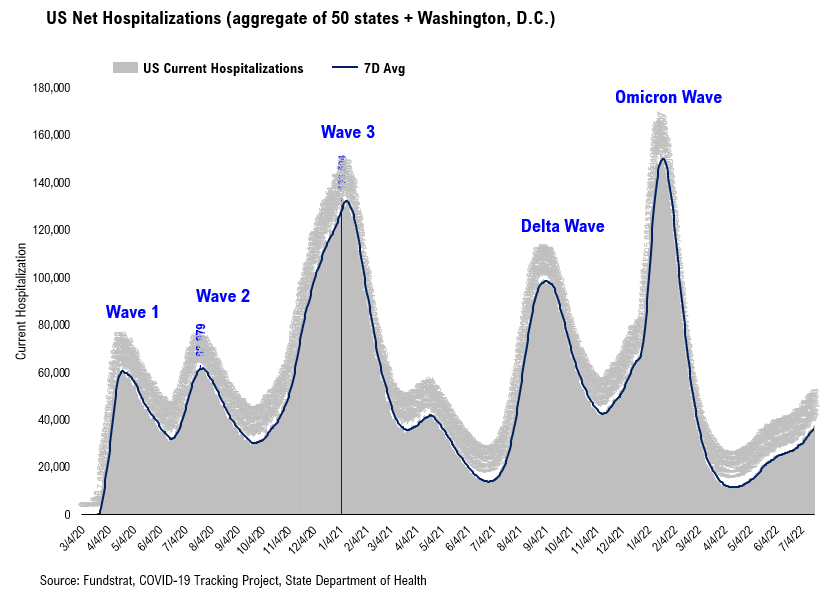

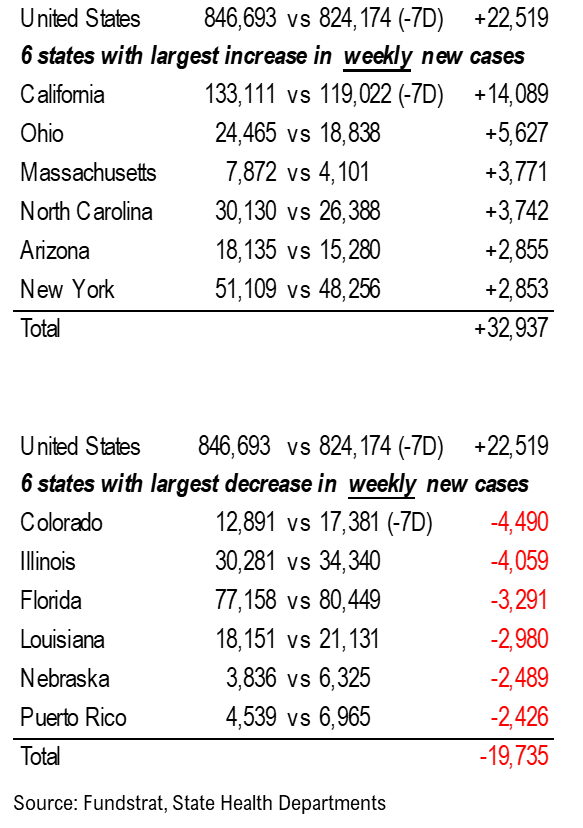

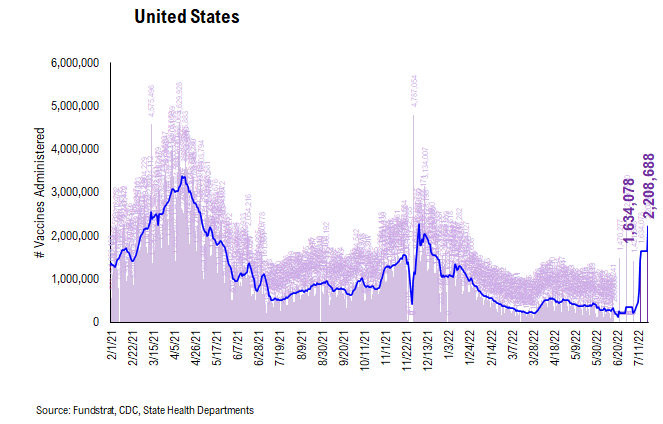

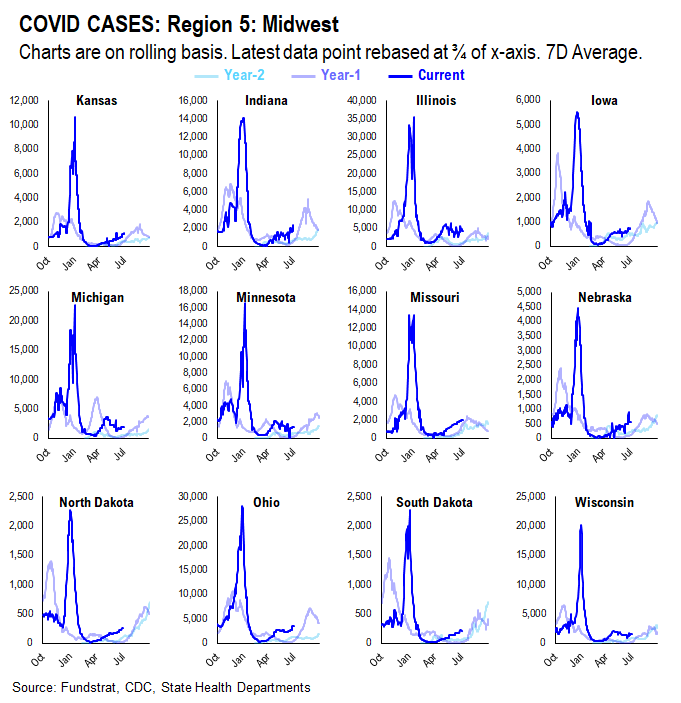

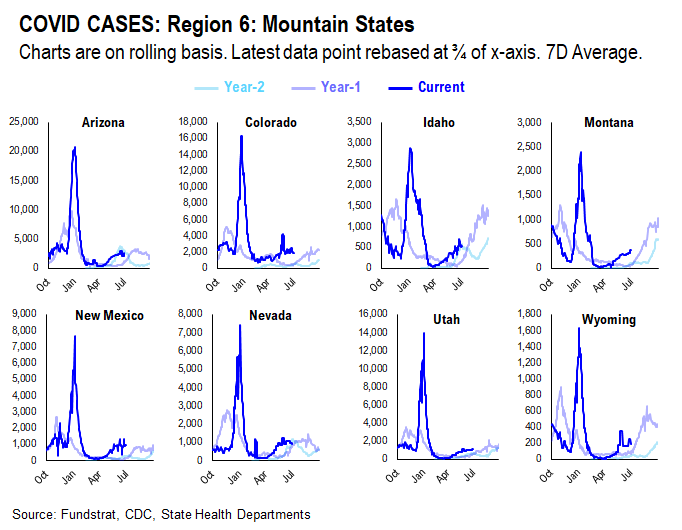

POINT 1: Total COVID-19 cases 846,693 over past 7D (avg 120,956 per day), up +22,519 (+3,217 per day) vs same period 7D ago…

_____________________________

Current Trends — COVID-19 cases (past 7D vs. 7D prior):

– Total new cases 846,693 vs 824,174 7D prior, up +22,519

– Avg daily cases 120,956 vs 117,739 7D prior, up +3,217

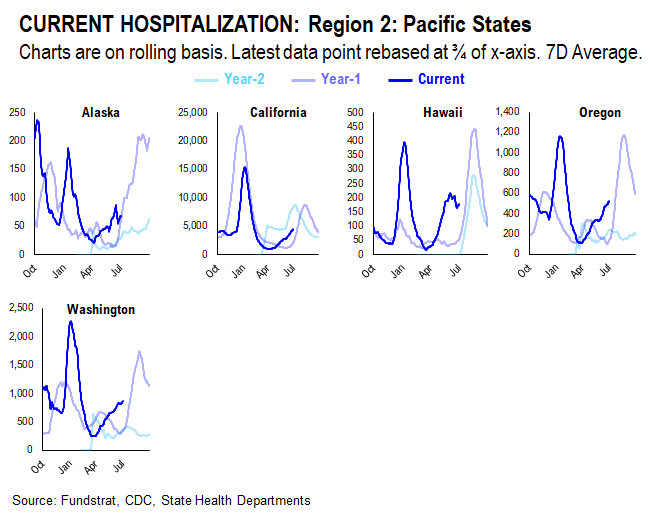

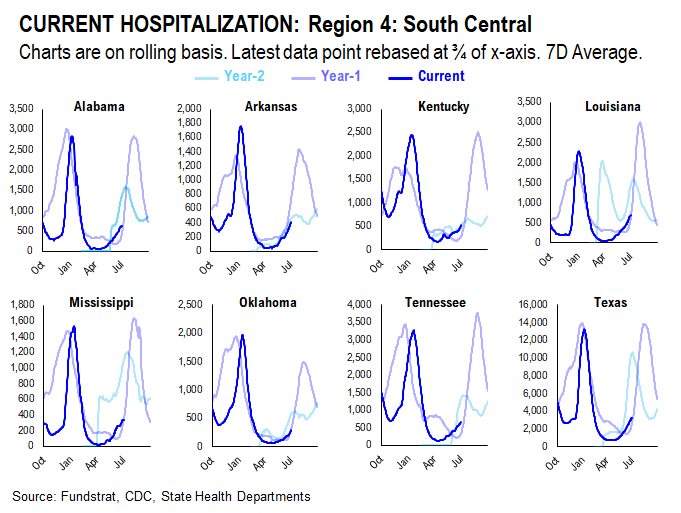

– Hospitalized patients 37,828, up +7.2% vs 7D ago

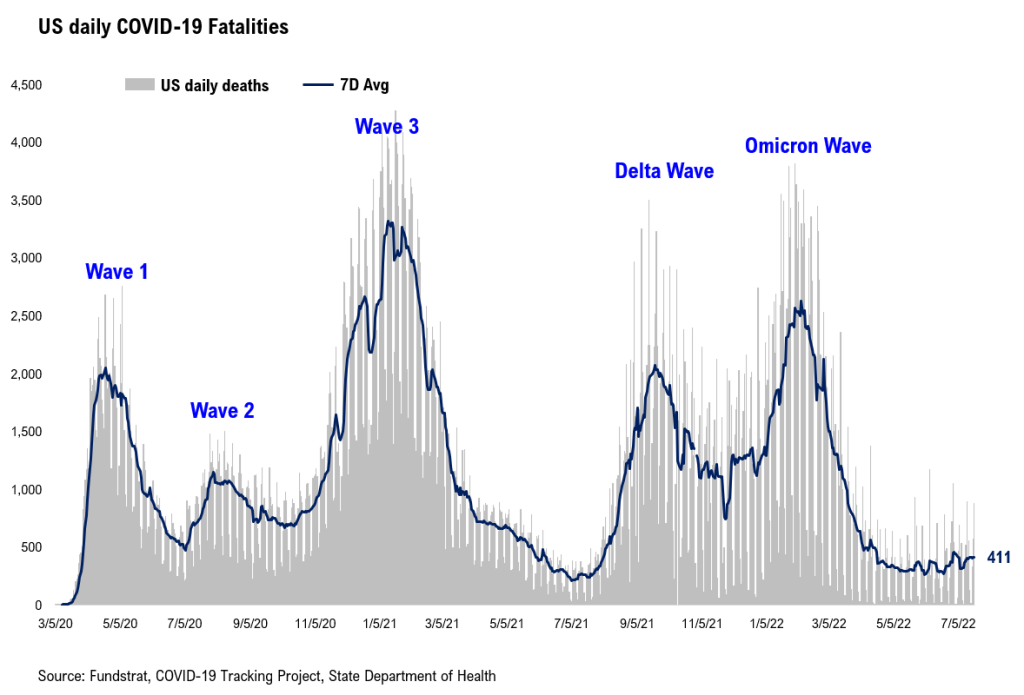

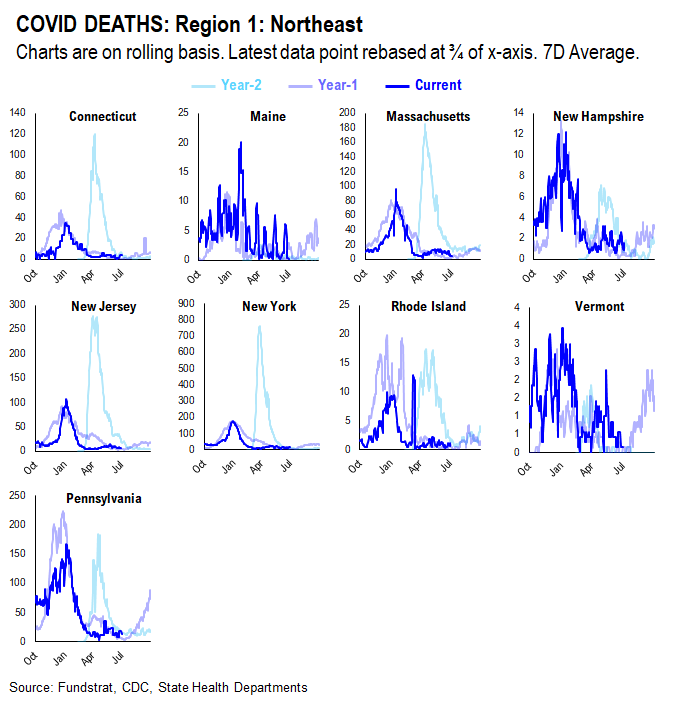

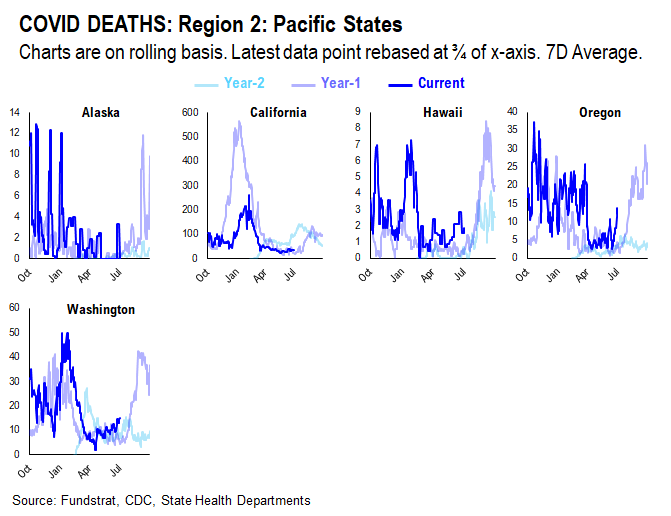

– 7D Avg daily deaths 411, up +1.7% vs 7D ago

_____________________________

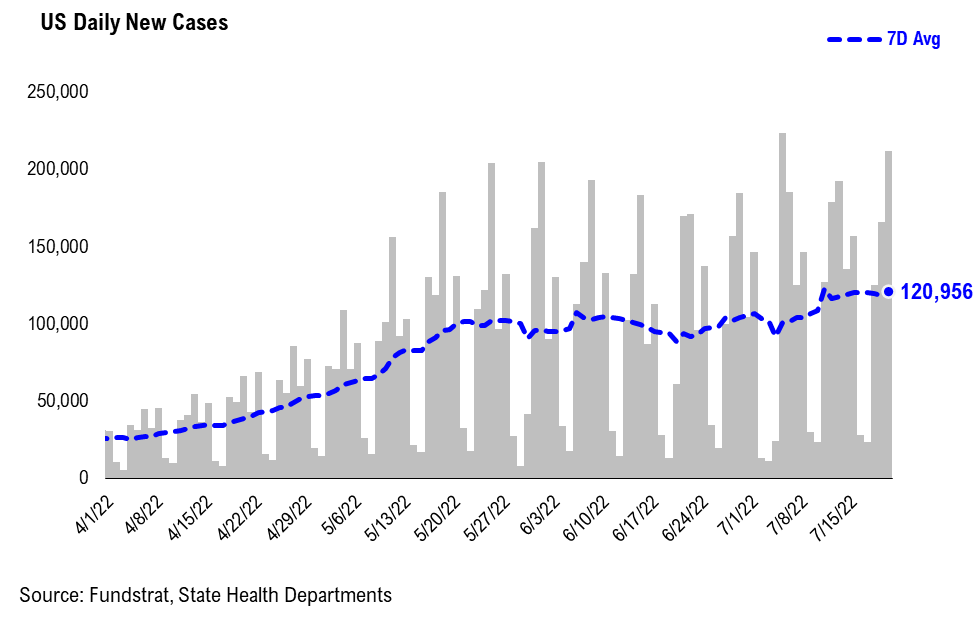

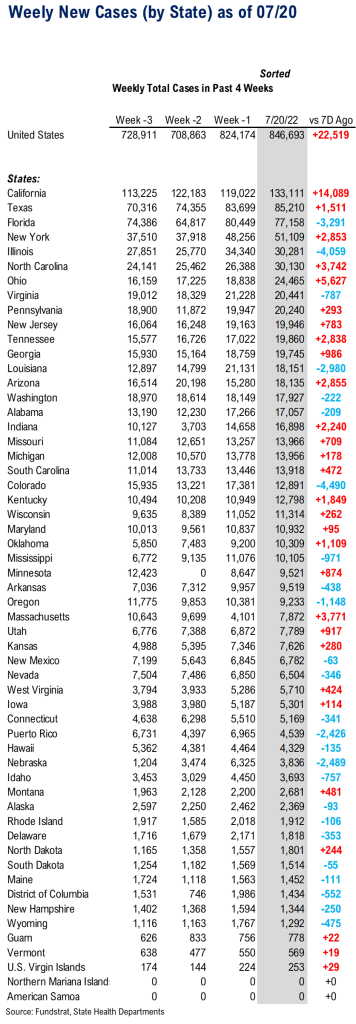

Over the past week, a total of 846,693 (avg 120,956 per day) new cases were reported in the US, up +22,519 (avg +3,217 per day) compared to the same period 7 days prior. The number of daily new COVID cases has been edging up slowly. Average daily cases have been up +2.7% compared to 7D ago.

As we noted previously, the case counts might no longer be the most reliable indicator to reflect the trend, given that self-test kits have been widely deployed and used by average Americans. Hence, to some extent, current hospitalization and the mortality trend are now better indicators compared to case counts.

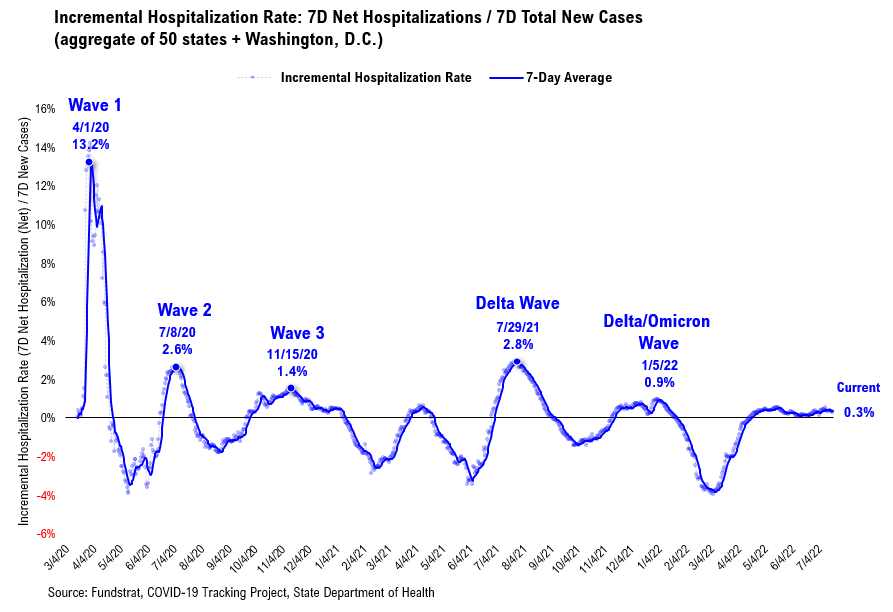

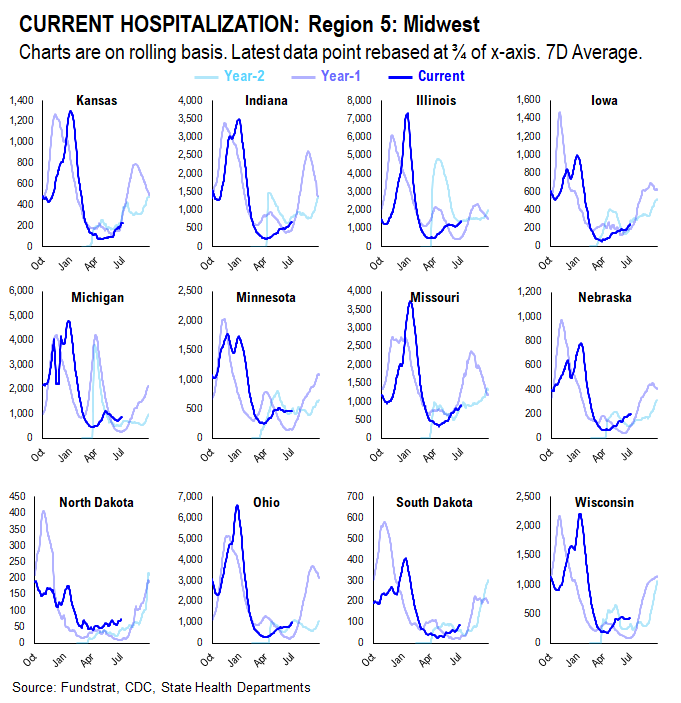

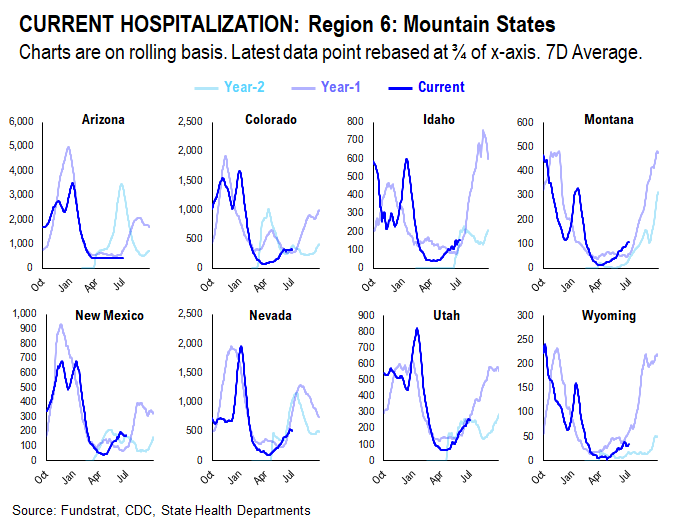

The current COVID hospitalizations have been trending higher since May. But if we look at the incremental hospitalization rate measured by 7D net change in hospitalization divided by 7D total new cases, the hospitalization rate has been flat.

Besides, compared to previous waves, the recent level of incremental hospitalization rate remains relatively low – which means that given the same number of new cases reported, fewer cases require hospitalization. By the way, if the true level of new cases is underestimated (due to the self-test kits), the “actual” incremental hospitalization rate should be even lower.

Despite the spread of “more transmissible” BA.4 and BA.5 variants, the virulence of the two variants appears to be low. Daily deaths have been essentially flat since May.

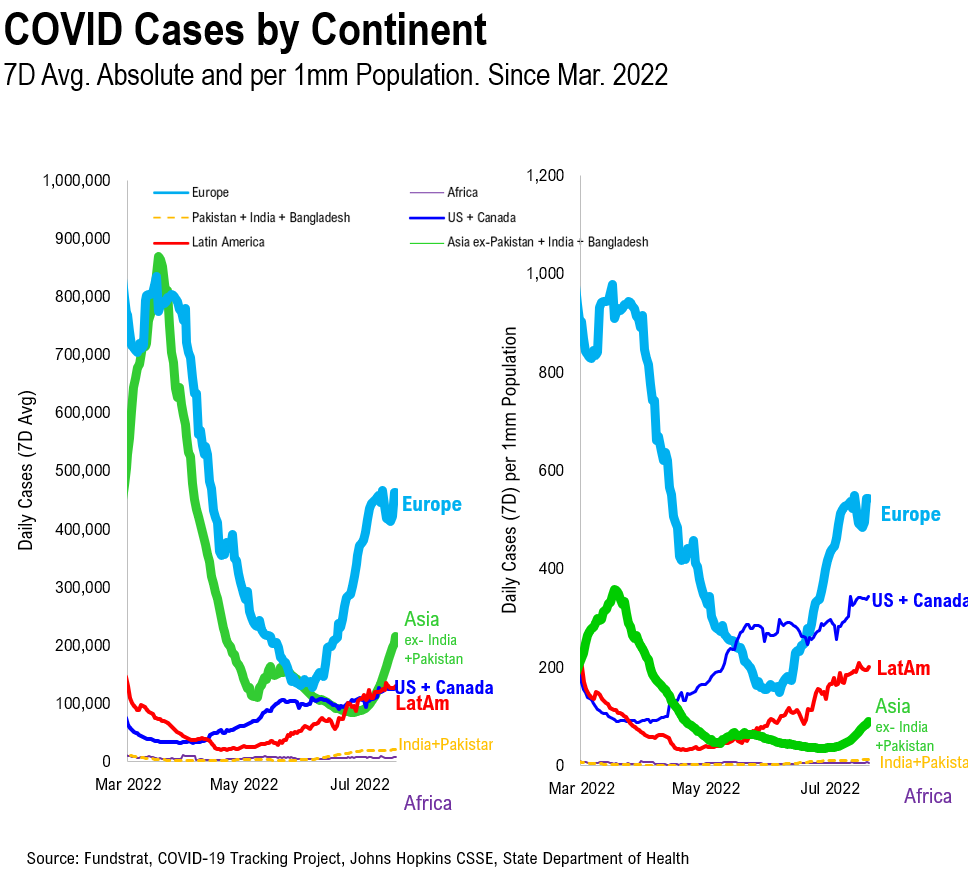

Not only are they gaining dominance in the US, but BA.4 and BA.5 are also causing cases to surge in many countries and regions. Following Europe, LatAm, and North America, Asia recently has seen new cases surging.

The case surge in Asia was primarily due to Japan. Over the past seven days, cases are up 697,649 (68.3% vs the week prior) and show no signs of slowing. But, similar to Germany and France’s trajectory, the daily mortalities in Japan have not elevated at all. Therefore, we have not seen policy makers in Japan implement any restriction in order to cope with the surge. Of course, data lag might be the reason. But we believe more likely the decreased lethality caused people not panic any more.

After facing its bout with Omicron, China is now seeing its COVID cases rise again. Those local outbreaks (likely caused by the new BA.4 or BA.5 variants) have forced many cities, such as Tianjin, and Shanghai to start new rounds of mass testing again. Although the actual number of new cases is negligible compared to the cases counts in the other major countries, any new cases would be a red flag under China’s zero-COVID policy. Therefore, the COVID development in China deserves attention as it has the potential to weigh on the nation’s economic recovery and global economic recovery, and delay the process of supply chain normalization.

Appendix: Weekly cases by US states

POINT 2: VACCINE: CDC Updates Switch From Daily to Weekly

___________________________

Current Trends — Vaccinations:

– avg 0.3 million this past week vs 0.2 million last week

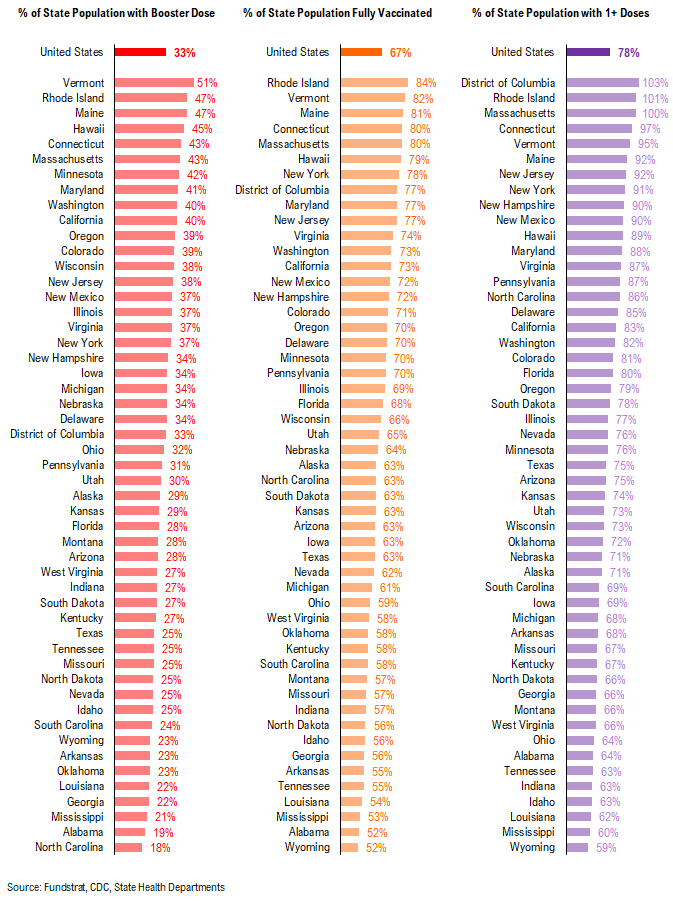

– overall, 33.0% received booster doses, 66.9 fully vaccinated, 78.3% 1-dose+ received

_____________________________

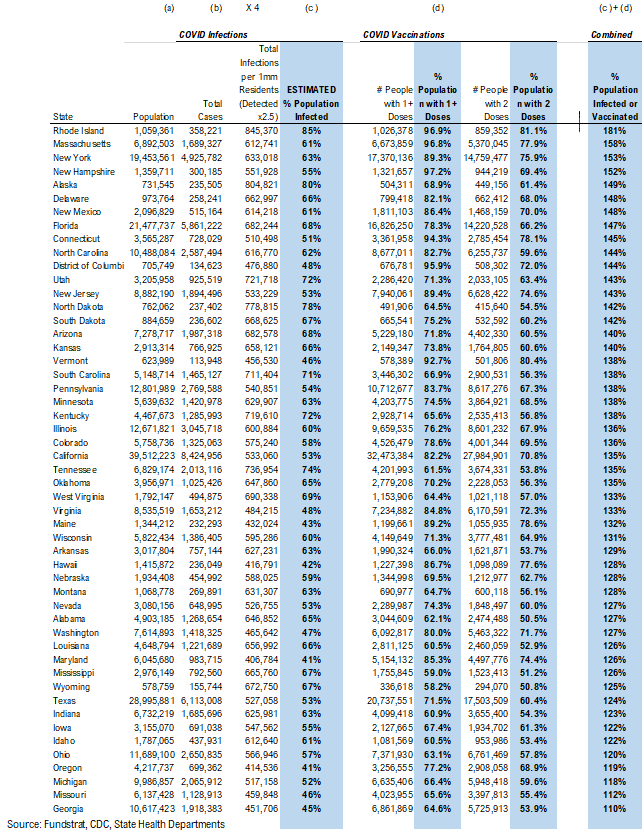

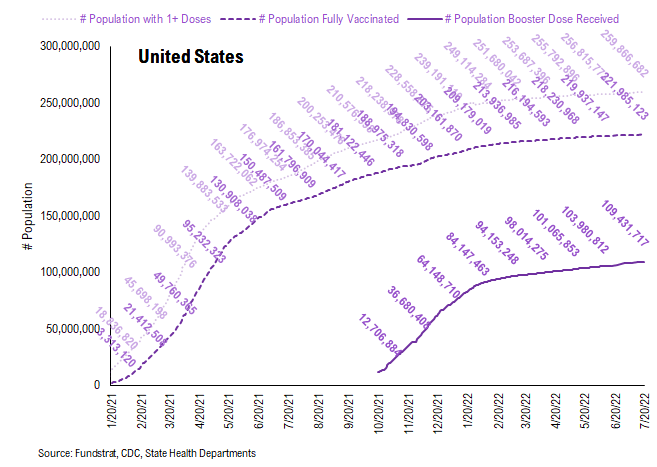

Vaccination frontier update –> all states now above 100% combined penetration (vaccines + infections)

*** We’ve updated the total detected infections multiplier from 4.0x to 2.5x. The CDC changed the estimate multiplier because testing has become much better and more prevalent.

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are above 100% combined penetration

– Again, this metric can be over 100%, as infected people could also be vaccinated, but 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated

The CDC has recently started reported vaccination statistics weekly, rather than daily, which is why the most recent data point shows 2.2 million doses given. Those 2.2 million doses were given over the last 7 days.

This is the state by state data below, showing information for individuals with one dose, two doses, and booster dose.

In total, 591 million vaccine doses have been administered across the country. Specifically, 259 million Americans (76% of US population) have received at least 1 dose of the vaccine. 221 million Americans (66% of US population) are fully vaccinated. And 109 million Americans (31% of US population) received their booster shot.

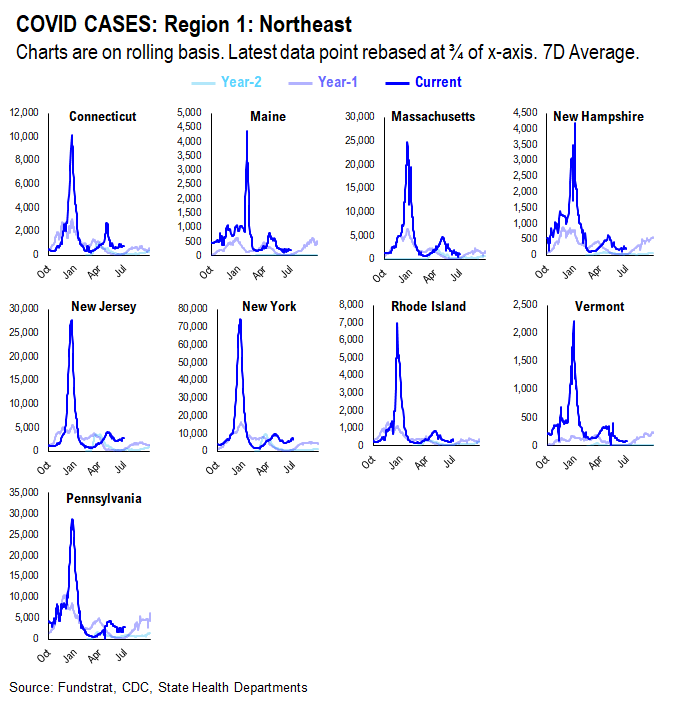

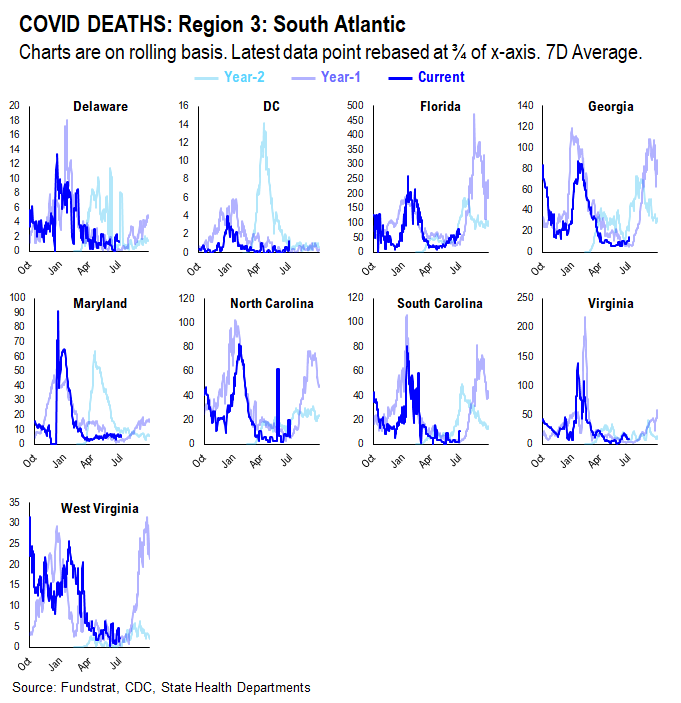

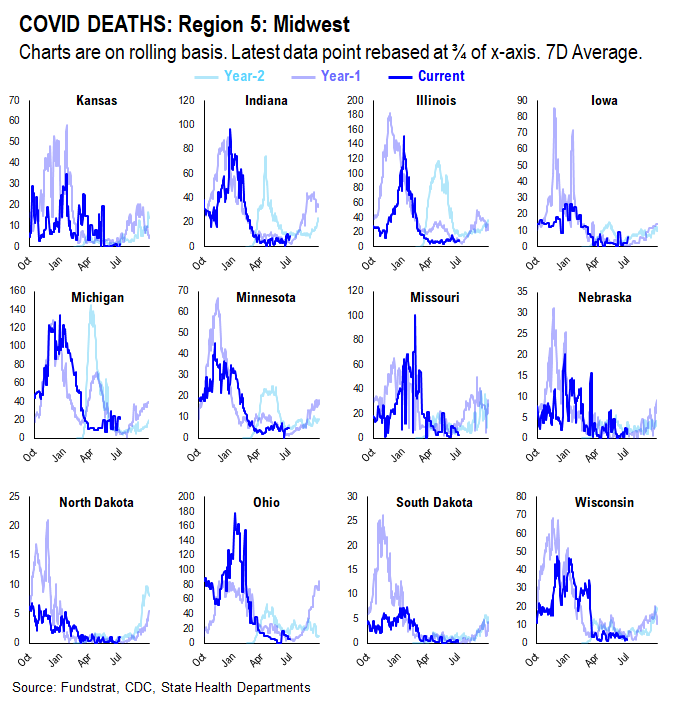

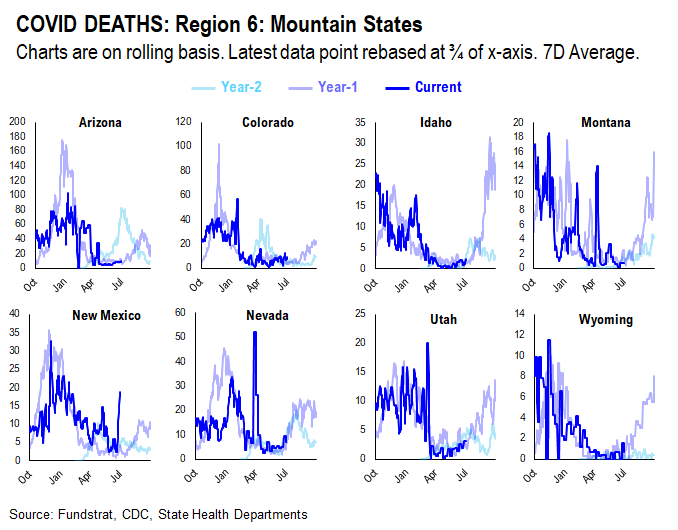

POINT 3: Tracking the seasonality of COVID-19

***We’ve updated the seasonality tracker to show figures from the last 9 months, from this calendar day, in each of the last two years***

As evident by trends in 2020 and 2021, seasonality appears to play an important role in the daily cases, hospitalization, and deaths trends. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus. The possible explanations for the seasonality we observed are:- Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer- “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors- Opposite effects hold true in the winter

During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, southern states are not showing as much of a spike as other states. This could be attributed to spring weather in the south encouraging more outdoor activities.

Point 4: BA.5 Cases Surge Globally

Nearly two months after Japan suspended its COVID-19 State of Emergency, cases are once again on the rise. Over the past seven days, cases are up 697,649 (68.3% vs the week prior) and show no signs of slowing. Some key points on this below:

- Shigeru Omi, President of the Japan Community Health Care Organization said he “has no doubt” that Japan has entered a seventh wave of infection

- This wave is likely fueled by the new BA.5 subvariant Omicron

- Restrictions remain unchanged within Japan, but we are monitoring hospitalizations and deaths (both which lag reported cases by about two weeks)

- Japan seem to be following Germany and France’s trajectory as both nations have experienced increased case volume over the past week

- The question remains: how many countries will follow suit in the recent subvariant surge?

CASES

HOSPITALIZATION

DEATHS

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In cf6013-bada15-8536e6-8ab666-a74fba

Already have an account? Sign In cf6013-bada15-8536e6-8ab666-a74fba