So much gloom out there, yet the S&P 500 is up 12%. Sell-side "chasing stocks" higher but even after 9 target changes, only 5 Strategists see upside into YE. Softer inflation strengthens case for "dovish" June hike.

________________________________________________

Today’s note will include a short video update. Please click below to view:

So much gloom out there, yet the S&P 500 is up 12%

It is not an exaggeration to say investors just seem so gloomy. I don’t have to look far. My twitter feed is full of doom and “don’t chase stocks due to a looming recession.” And it seems like every conversation I have with an average person believes the Fed is driving the US into a recession. The only cohort that is not bearish, in my view, are CEOs. In conversation after conversation, I find CEOs noting demand is holding up better than expected, but they are reluctant to see this as true for the overall economy.

- What is the implication? For me it’s obvious. This really strengthens the case to buy the dip and expect stocks to continue to rise — that is, if the national and consensus view is caution, then that means most are underinvested. Can consensus really be right if we have a trifecta of bearishness of: (i) sell-side Strategists; (ii) institutional investors and (iii) retail?

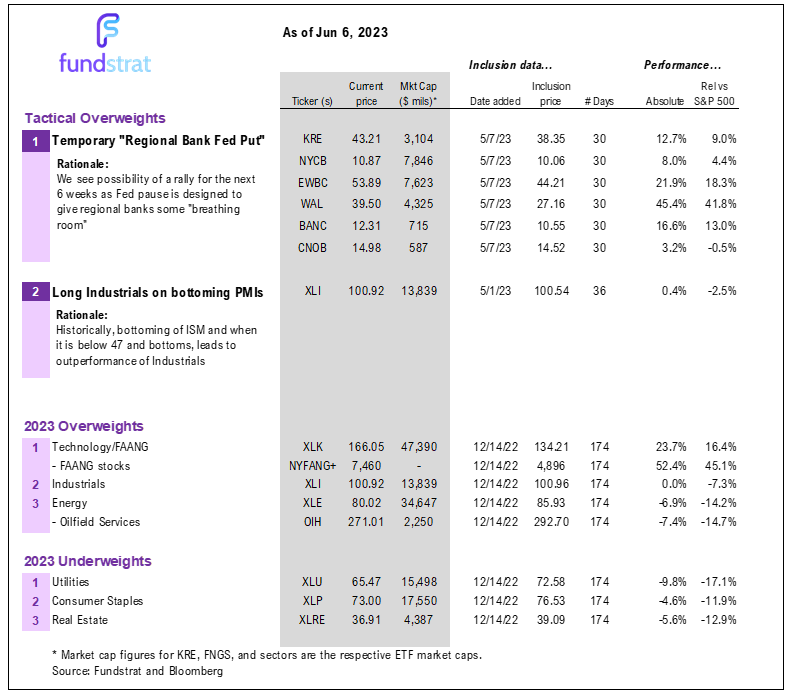

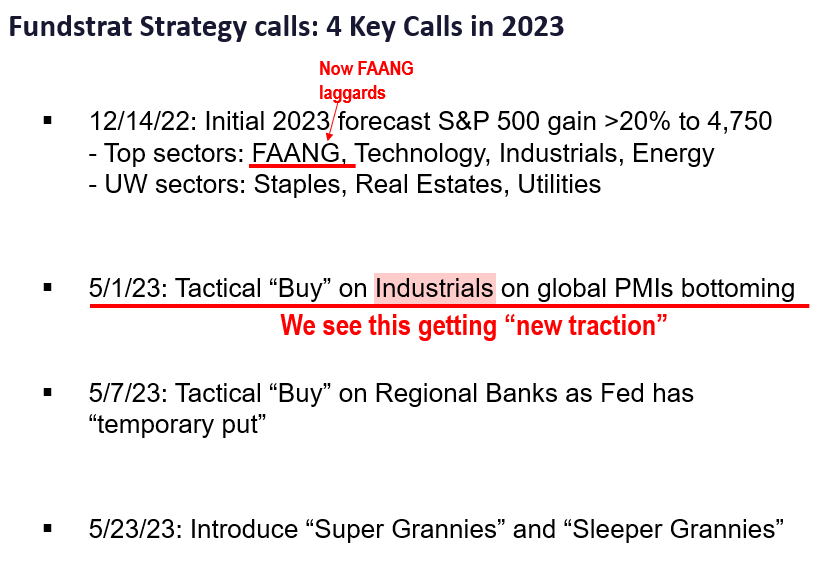

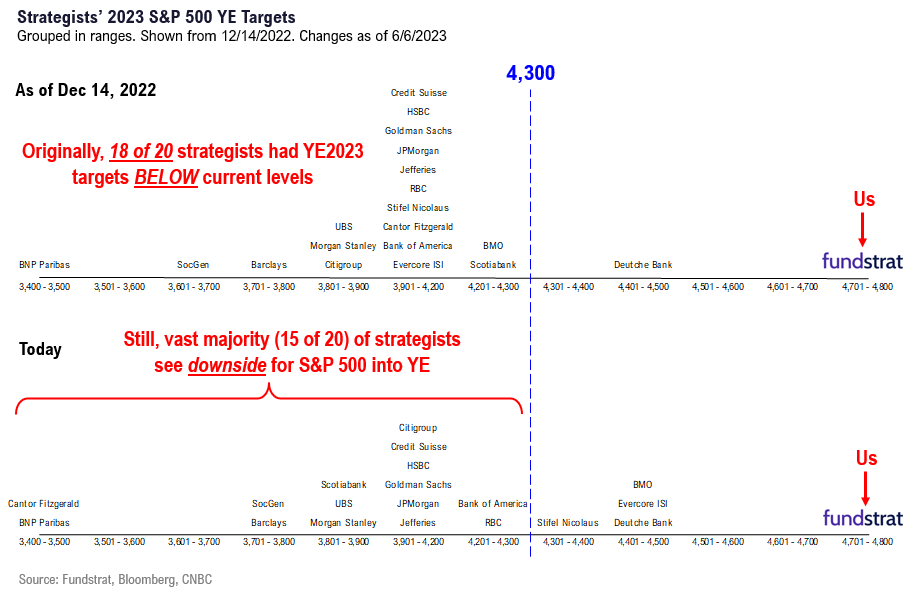

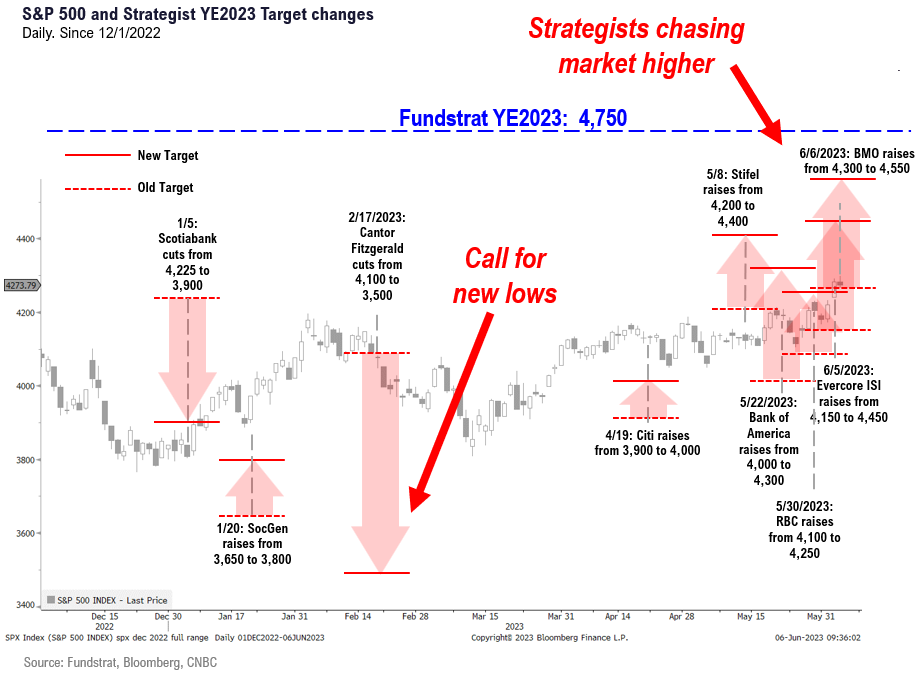

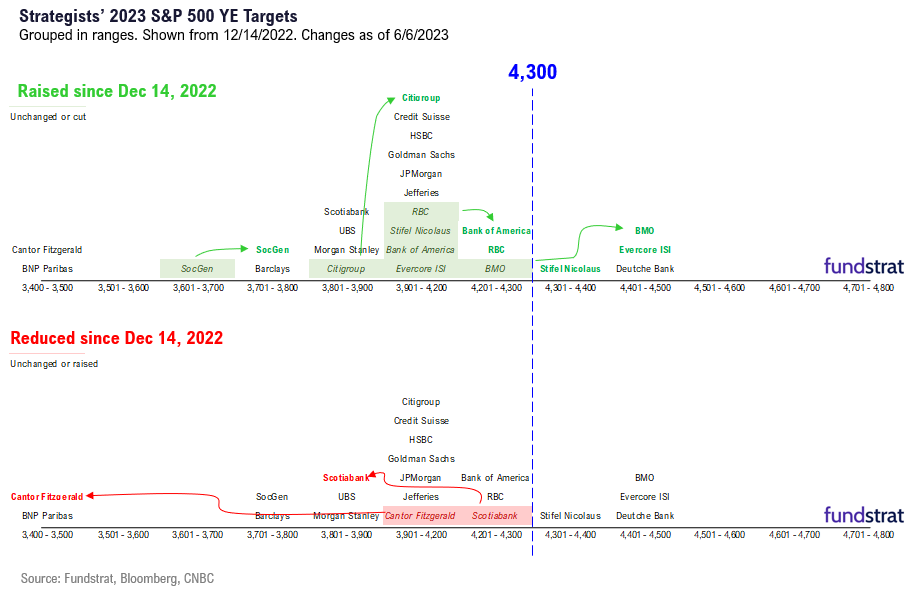

- The sell-side bearishness might be the most extreme I have seen in 30 years. Consider that at the end of 2022, only 2 Strategists saw S&P 500 exceeding 4,300 in 2023:

– Deutsche Bank 4,300

– Fundstrat 4,750 - And even after 5 months of gains, and 9 price target changes, only 5 strategists see the S&P 500 closing above 4,300 before YE2023. Think about that, even as Strategists chase equities higher, 15 of 20 still call for markets to finish the year lower. While I am not trying to malign sell-side strategists, keep in mind consensus conclusions of the sell-side are largely priced in. If they are collectively bearish, the factors they cite are largely baked into price.

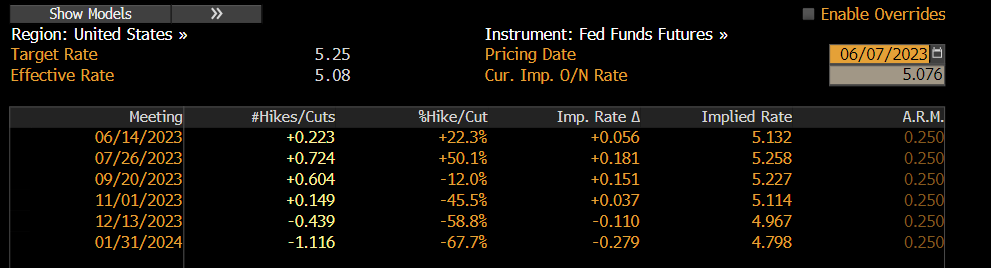

- The key event in the next 4 weeks remains the Fed’s June FOMC decision and whether this is a “dovish” pause. Fed futures are betting its a “hawkish” pause as markets see a 22% chance of a June hike but a 75% cumulative probability of a July hike (50% for July). But there has been some recent incoming data in the past week to push for a “dovish hike.”

- Three incoming data points, in our view, support the Fed to lean towards a “dovish” hike:

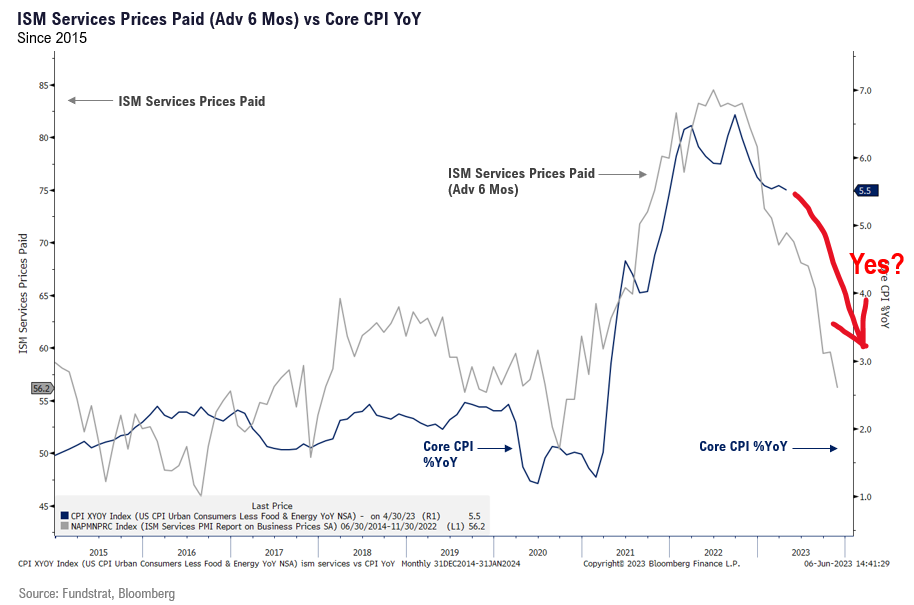

– first, ISM May Services prices paid at 56, lowest in 24 months and leads CPI by 6M

– suggesting CPI could fall to 3%-ish before YE

– second, NY Fed paper shows “persistent inflation” is down to 3.6% (Apr) vs 4.5% (Mar)

– Fed funds at 5% is very tight against this

– third, Minneapolis Fed comments suggest Fed might change inflation target in 2025

– a band of 1.5% to 2.5% makes more sense and if that is direction, why hawk now?

BOTTOM LINE: Evidence market is broadening

There are signs that equity markets are broadening, which we view as constructive:

- FAANG did heavy lifting YTD

- We like the “laggards of FAANG” currently, which is AMZN 1.34% META 3.02% NFLX 3.04% TSLA 1.97%

- Russell 2000 has surged (3% today, 6% for the month) IWM 1.19%

- Regional banks surged in past week KRE 0.83% , supporting our tactical upgrade from 5/7/2023

- Industrials are strengthening (4% for the month) XLI 1.01% consistent with a bottoming of PMIs

So you can see, the market breadth is showing signs of expanding. Even Mark Newton, Head of Technical Strategy, notes that advance/decline line shows signs of an upside breakout as well.

SELL-SIDE: At start of 2023, 18 of 20 Strategist YE targets BELOW 4,300… now still 15 of 20

One doesn’t have to look far to find bearish/cautious Strategists. For instance, look below as this strategist says he would not be “chasing this rally” — again, this is the consensus view.

As highlighted in the table below, on Dec 2022, only 2 strategists expected S&P 500 to be above 4,300 before YE 2023:

- Deutsche Bank 4,500

- Fundstrat 4,750

- The other 18 saw S&P 500 3,400 to 4,000 and a smattering above that

Even after S&P 500 has surged to 4,300 from 3,800 at the start of the year, only 3 additional strategists have raised their target to above 4,300. In our view, this speaks to the level of bearishness. After all, in my 30 years of research, I don’t think I have ever seen the sell-side this bearish.

- The consensus of the sell-side has a terrible track record. When they are all bearish, please BUY stocks aggressively.

As this time series below highlights, the sellside has been “chasing” equities in both directions:

- when S&P 500 fell in early 2023, two strategists slashed their YE price targets

- now as S&P 500 has made multi-month highs, Strategists have been busily raising targets

But to me, what is curious, is literally only 5 see any semblance of upside into YE.

- our YE target of 4,750 is the most aggressive, but arguably the market is tracking towards this

- I also think it is sort of shocking to see 2 strategists with YE targets below 3,500 (see below)

JUNE FOMC: June 14th still the most important date — Fed futures sees 22% chance of a June hike

In the next month, the most important event is the Fed’s June FOMC rate decision. The idea of a “pause” is widely telegraphed:

- The key question is whether this pause is “dovish” or “hawkish”

- Fed futures sees a 22% chance of a June hike and then 50% for July, meaning really a 75% chance of a hike by July

- This essentially says the Fed Funds Futures is betting on a “hawkish” hike — a pause in June but then a hike one month later

For the reasons we have explained for the past 8 months, we think inflationary pressures are falling faster than expected, thus, we expect June to ultimately be “dovish” but the key is whether the Fed pursues this path.

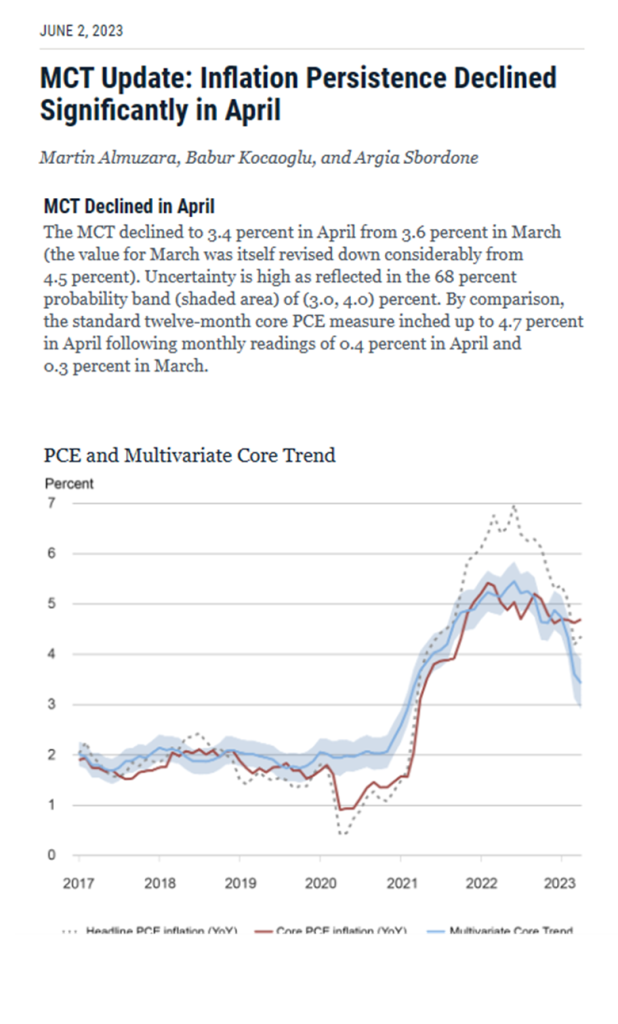

This week, we saw multiple data points that suggest the Fed should be leaning more towards “dovish.” For instance, look at this research paper by the NY Fed which highlights:

- The MCT (Multivariate Core Trend) of inflation per NY Fed has fallen to 3.6% in March, dropping from 4.5% just a month ago.

- This is a huge drop in the persistent trend of inflation, and as their graph below highlights, shows inflation is set to fall sharply in coming months.

- With the Fed at 5%, this would imply monetary policy conditions are actually VERY TIGHT now

Additionally, the May ISM prices paid component fell to 56, which is the lowest in 2 years (May 2020). As shown below:

- this is a collapse in pricing on services

- and leads Core CPI by roughly 6 months

- pointing to Core CPI falling towards 3% before YE 2023

This is consistent with our base case and again, another reason for the Fed to make a dovish pause.

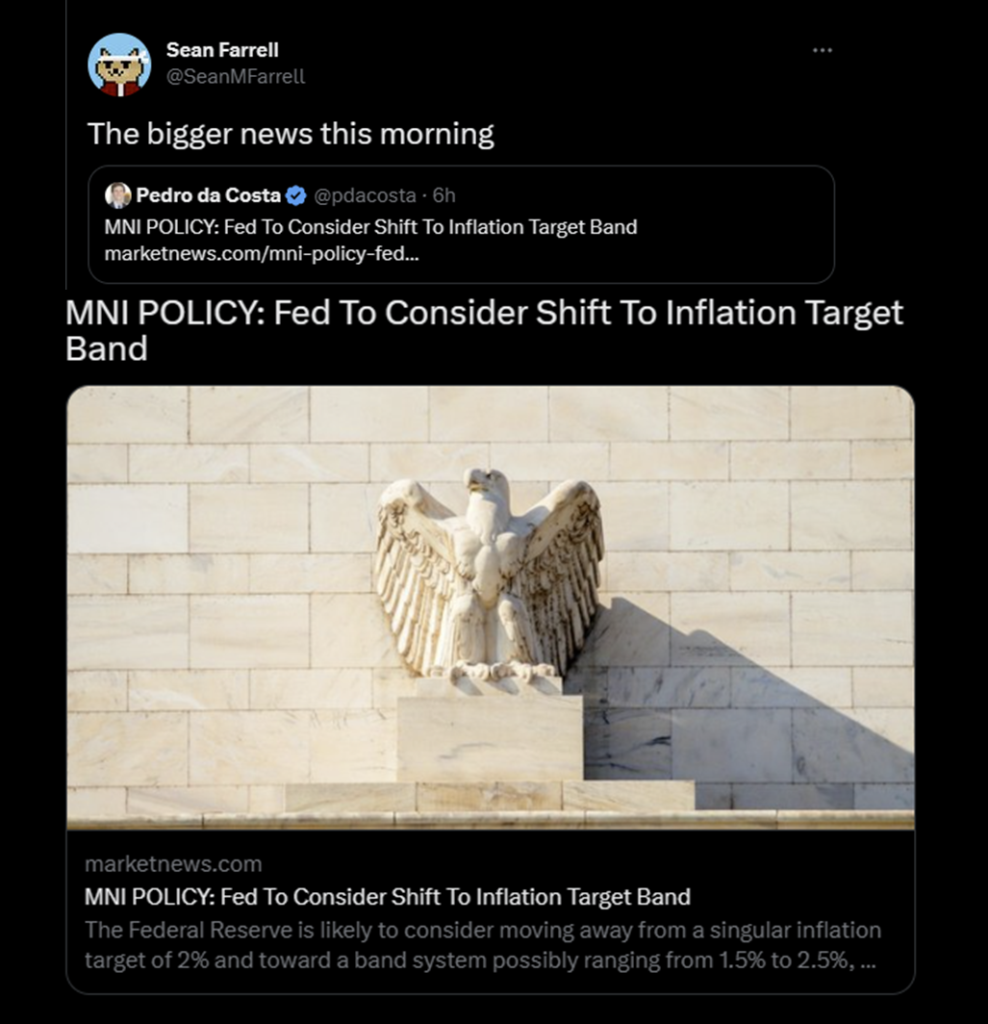

Lastly, there is some talk that the Fed might consider changing the inflation target, from a 2% level towards a range target. This was flagged by @SeanMFarrell of Fundstrat below.

- this is what makes sense to us

- the Fed relenting on 2% is also a Fed avoiding unleashing a possible deep recession on the US economy.

ECONOMIC CALENDAR: FOMC keyin June

Key incoming data June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame- 6/5 10am ET May ISM Services

- 6/7 Manheim Used Vehicle Value Index May

- 6/9 Atlanta Fed Wage Tracker April

- 6/13 8:30am ET May CPI

- 6/14 8:30am ET May PPI

- 6/14 2pm ET April FOMC rates decision

- 6/16 10am ET U. Mich. May prelim 1-yr inflation

- 6/27 Conference Board Consumer Confidence

- 6/30 8:30am ET May PCE

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

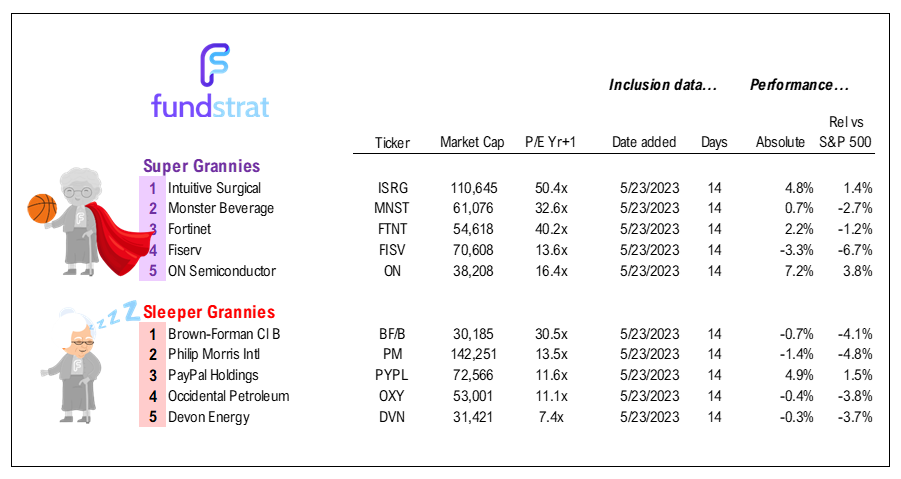

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday