New all-time S&P 500 highs likely in January (if not Friday 12/29). However, 4 reasons we then see a pullback around Feb/March 2024. Small-caps likely lead in 1H24.

We discuss: To us, it is only a matter of days before we make new all-time highs. But then we likely consolidate. Small-caps likely outperform in 1H24. We discuss the multiple reasons we expect large-caps to have a pullback in 1H24.

Please click below to view our Macro Minute (Duration: 4:10).

With 1 trading day left in 2023, the S&P 500 is on track to gain >25%. One might be surprised to learn this is only ranks as the 25th best year (yep) in the past 125 years. Consensus expected a far worse outcome (hard landing and inflation fighting for a decade). So, we are thankful to our clients who supported us through this challenging but ultimately rewarding year.

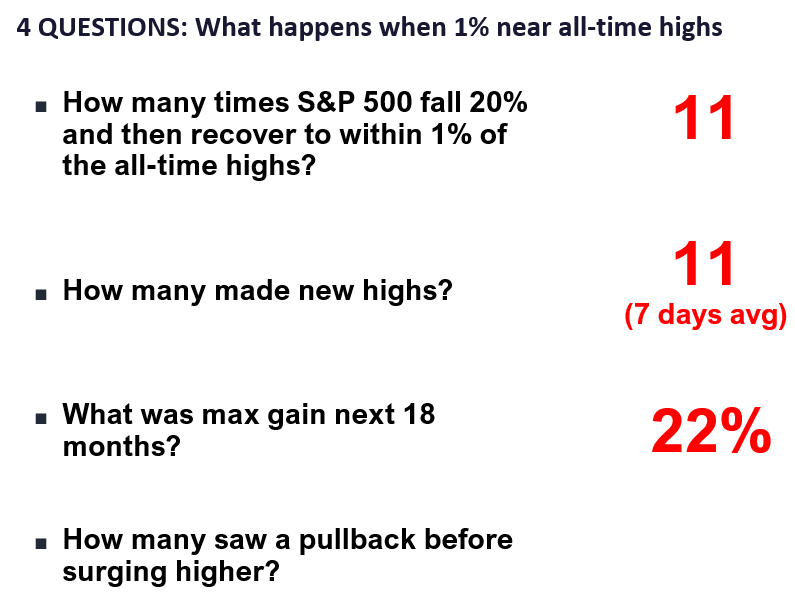

- The S&P 500 is now within 1% of the all-time high of 4.801 but has not yet exceeded this level. Since 1950, there are 11 instances where the S&P 500 fell 20% and then climbed to within 1% of its prior all-time high:

– 11 of 11 times, the S&P 500 quickly made an all-time high

– median time is 7 days and as long as 20 trading days, meaning new highs by Jan 2024

– repeat, the market always soon made an all-time high - Did markets then make further gains? The median max gain over the next 18 months is +22%. So yes, this is a launch point for further gains. There is only 1 instance, May 2007 that the max further gain was nominal (<5%). But the other 10 instances saw significant further gains. This makes sense to me. Reaching an all-time high is a significant market milestone. And stocks do not suddenly reverse from there.

- But there is a wrinkle. 7 of 11 times, markets first consolidated with a drawdown. These are modest with overall declines from this 1% level being 2% to 5%. In the current context, we could see S&P 500 4,400-4,500 once we make all-time highs, or a modest pullback.

- This is consistent with our 2024 Year Ahead Outlook, where our base case is the S&P 500 makes most of its gains in 2H2024. Here are some potential reasons:

– markets get “itchy” waiting for Fed to cut, while Fed itself uncertain

– AI timeline could be pushed out due to a “systematic hack” by malevolent AI

– equity markets need to consolidate the parabolic gains from late 2023

– a drawdown in Feb/March timeframe is consistent with election year seasonal returns - On this last point, take a look at the chart below, and we see a pronounced downturn historically around the Feb/March timeframe. Why this happens is not entirely clear. But as noted above, there are multiple factors that suggest a consolidation/softness could happen in early 2024.

Bottom line: We think small-caps could rally throughout 2024, even if markets soft in 1H24

But a final note, we think small-caps could rally throughout this timeframe. After all, with falling interest rates, a dovish Fed, improving economic momentum, upturn in housing and we see a constellation of reasons for small-caps to rally.

- our favorite sector idea in 2024 is small-caps IWM -0.71% which we believe could rally 50%

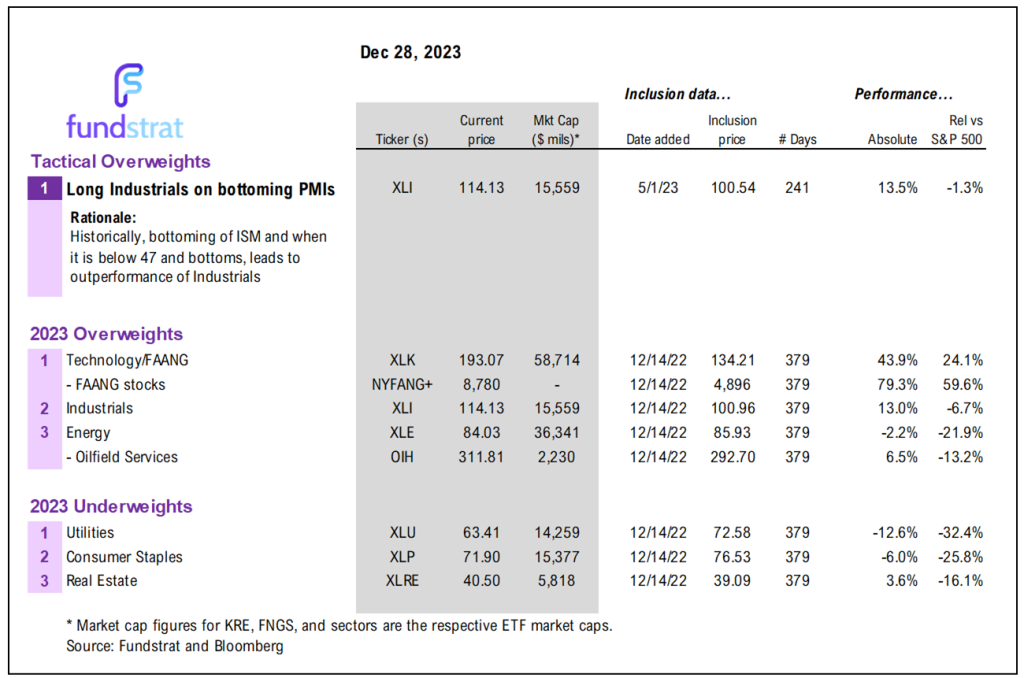

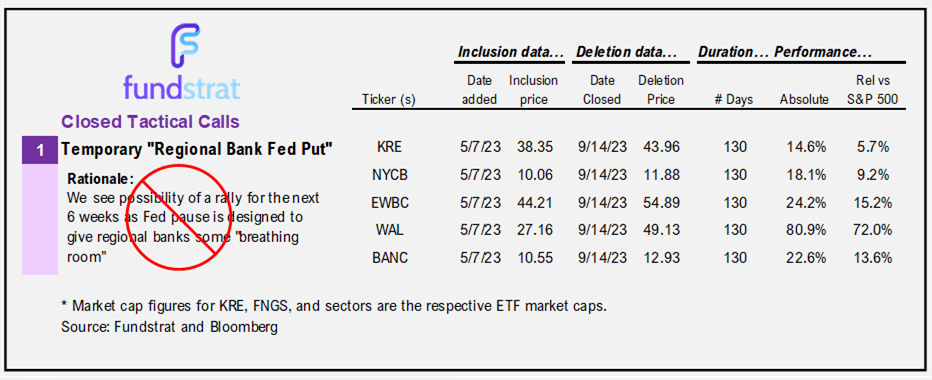

- our favorite large-cap sector is Financials XLF 0.01% and we like regional banks KRE -0.45% for SMID

- we like FAANG/Technology XLK -0.34% QQQ -0.25% because of good earnings visibility but rank this #3

- our #2 sector favorite is Industrials XLI -0.60% which we see benefitting from the bottoming of PMIs and potential recovery in Europe/China.

Key incoming data January:

- 1/02 9:45am ET S&P Global Manufacturing PMI December Final

- 1/03 10am ET December ISM Manufacturing

- 1/03 10am ET JOLTS Job Openings November

- 1/03 2pm ET December FOMC Meeting Minutes

- 1/04 9:45am ET S&P Global Services & Composite PMI December Final

- 1/05 8:30am ET December Jobs Report

- 1/05 10am ET December ISM Services

- 1/08 9am ET Manheim Used Vehicle Index December Final

- 1/11 8:30am ET December CPI

- 1/12 8:30am ET December PPI

- 1/16 8:30am ET January Empire Manufacturing Survey

- 1/17 8:30am ET January New York Fed Business Activity Survey

- 1/17 8:30am ET December Retail Sales Data

- 1/17 9am ET Manheim Used Vehicle Index January Mid-Month

- 1/17 10am EST January NAHB Housing Market Index

- 1/19 8:30am ET January Philly Fed Business Outlook Survey

- 1/19 10am ET U. Mich. Sentiment and Inflation Expectation January Prelim

- 1/24 9:45am ET S&P Global PMI January Prelim

- 1/25 8:30am ET 4QA 2023 GDP

- 1/26 8:30am ET December PCE

- 1/29 9:30am ET Dallas Fed January Manufacturing Activity Survey

- 1/30 9am ET January S&P CoreLogic CS home price

- 1/30 10am ET January Conference Board Consumer Confidence

- 1/30 10am ET JOLTS Job Openings December

- 1/31 2pm ET FOMC Rate Decision

Key incoming data December

12/01 9:45am ET S&P Global Manufacturing PMI November FinalTame12/01 10am ET November ISM ManufacturingStrong12/05 9:45am ET S&P Global Services & Composite PMI November FinalStrong12/05 10am ET JOLTS Job Openings OctoberTame12/05 10am ET November ISM ServicesStrong12/06 8:30am ET 3QF 2023 Nonfarm ProductivityStrong12/07 9am ET Manheim Used Vehicle Index November FinalTame12/08 8:30am ET November Jobs ReportTame12/08 10am ET U. Mich. Sentiment and Inflation Expectation December PrelimTame12/12 8:30am ET November CPITame12/13 8:30am ET November PPITame12/13 2pm ET FOMC Rate DecisionDovish12/14 8:30am ET November Retail Sales DataTame12/15 8:30am ET December Empire Manufacturing SurveyTame12/15 9:45am ET S&P Global PMI December PrelimTame12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame- 12/29 9:45am ET December Chicago PMI

Key incoming data November

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame11/22 10am ET: U. Mich. November final Sentiment and Inflation ExpectationTame11/24 9:45am ET S&P Global PMI November PrelimMixed11/27 10:30am ET Dallas Fed November Manufacturing Activity SurveyTame11/28 9am ET November S&P CoreLogic CS home priceTame11/28 10am ET November Conference Board Consumer ConfidenceTame11/29 8:30am ET 3QS 2023 GDPStrong11/29 2pm ET Fed Releases Beige BookTame11/30 8:30am ET October PCETame

Key incoming data October

-

10/2 10am ET September ISM ManufacturingTame -

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decisionMarket saw Hawkish-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

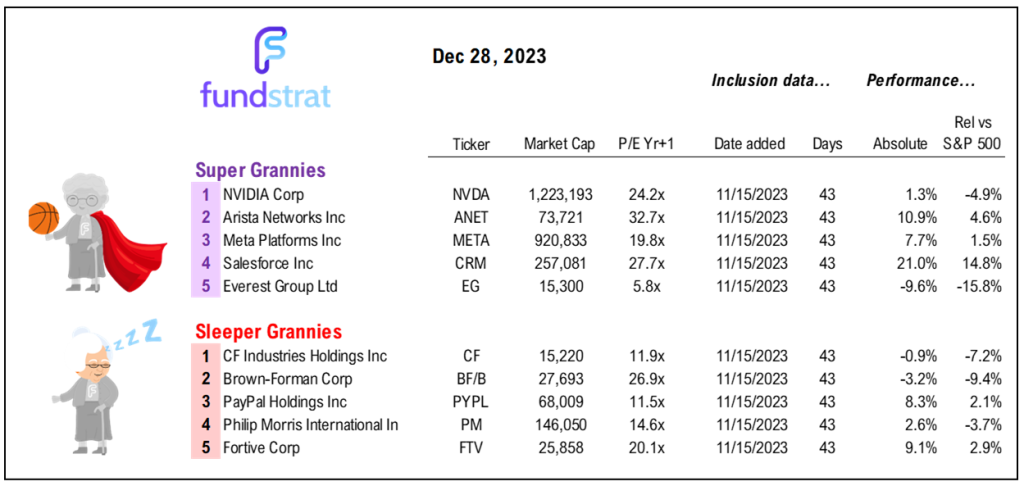

36 Granny Shot Ideas: We performed our quarterly rebalance on 10/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 24f4dc-46a3f6-69be17-7e11c0-9ff4fb

Already have an account? Sign In 24f4dc-46a3f6-69be17-7e11c0-9ff4fb