COVID-19 UPDATE: Michigan COVID-19 hospitalizations could surge to new highs in coming weeks. S&P 500 gains YTD explained by +6.4% revisions to 2021 EPS by Street

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

- Monday

- Tuesday

- Wednesday

- SKIP THURSDAY

- Friday

STRATEGY: S&P 500 gains YTD explained by +6.4% revisions to 2021 EPS by Street

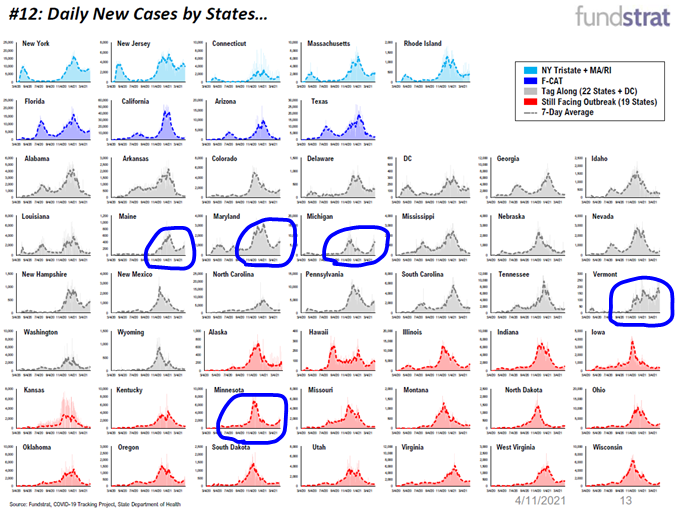

For the most part, US COVID-19 trends have been stable. Below is the 7D delta chart and while it has been choppy, the trend in cases is not necessarily accelerating to the upside. But the overall US state figures are masking the bifurcating trends in the US. The rise in cases is really attributable to 5 states:

– MI

– ME

– MD

– MN

– VT

Source: Fundstrat and US state healthcare websites

Take a look for yourself at the 50 states here (slide from our chartbook) and you can see the rise in these 5 states versus their own timeline. There are other states seeing increases, but hardly of this magnitude.

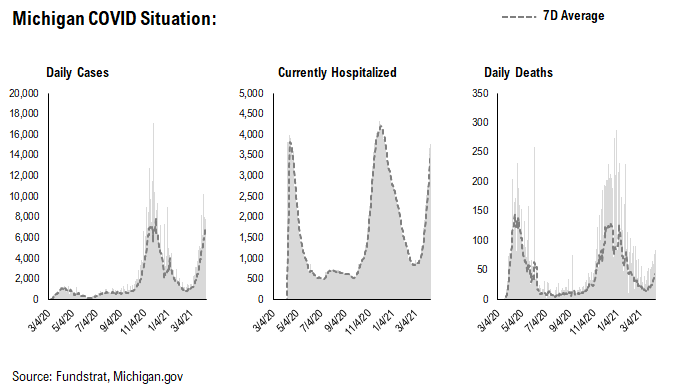

Is there a common thread to explain this? I am not entirely clear. And of these states, MI seems to be experiencing the worst of the surges. Gov Whitmer has attempted multiple explanations for this from “mutations” to “vulnerability of population” due to low prior exposure. But the reasons are not entirely clear to me:

– the state’s daily cases could make a new all-time high and the 7D avg seems to be there

– currently hospitalizations certainly look to be making new highs

– perhaps there is some solace that daily deaths are muted

And Dr Scott Gottlieb weighed in on Michigan, noting that the Biden administration may need to allocate new resources to the state. While MI Gov Whitmer would like additional vaccine allocations, the Biden administration is targeting other measures.

Source: https://thehill.com/homenews/sunday-talk-shows/547594-gottlieb-biden-administration-needs-to-think-about-surging

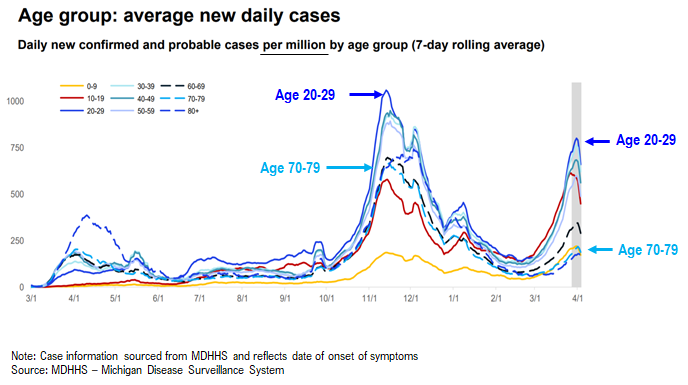

And if there is some “half-full” view of the situation in Michigan. It appears that the older adults are accounting for a smaller rise in cases. The surge in daily cases stems from age 20-29 and by contrast, age 70-79, while higher, is considerably more muted. Thus, one might believe this could reflect the benefit of vaccinations.

STRATEGY: 1Q2021 Earning seasons starts soon… S&P 500 2021 EPS revised +6.4% so far, Energy +80%…

Earning season is starting in the next few weeks, and 1Q2021 will differ from the last 4 earnings season for a few reasons:

– top-line growth is expected to be solidly up YoY (due to March 2020 being “easy comps”)

– company visibility should be considerably stronger for 2021, compared to three months ago

– economy should be largely open by mid-June, so companies are going to see roadmap to normalcy finally

– Cyclicals are leading the upwards earnings revisions

…S&P 500 2021 EPS forecasts are up 6.4% since start of year while Energy is up +80%

Earnings revisions have solidly for 2021 and in fact, have largely explained the YTD gains in equities.

– S&P 500 2021 EPS is +6.4% to $174.33

– S&P 500 is up ~10% YTD

– Most of the gains YTD are due to EPS revisions to 2021 EPS

Source: Fundstrat and Bloomberg

…Energy 2021 EPS is +80% in 2021 and yet the stocks are only up +27%…hmmmm

The positive revisions to the Energy sector have been even stronger:

– Energy has seen 2021 EPS revised +80% since the start of the year.

– Energy stocks are up +27% YTD

So Energy EPS is up +80%, only 3 months in 2021. And yet, investors think this sector is not attractive? To me, this is old-fashioned “beat and raise” for Energy.

Source: Fundstrat and Bloomberg

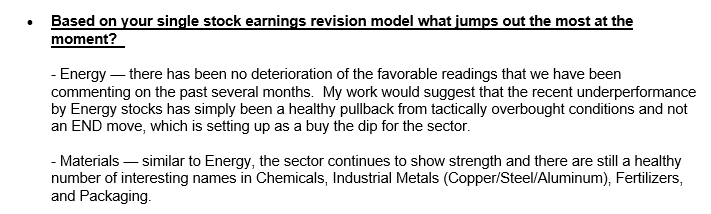

Our Head of Global Portfolio Strategy, Brian Rauscher, made a similar comment in his latest “Wall Street Whispers” report which was published late last week. He notes there has been no deterioration in the favorable readings for Energy stocks. Hence, he think this is simply profit taking hitting the stocks.

Source: Fundstrat

…Epicenter leading positive revisions only 3 months in 2021, suggesting these stocks lead during earnings season

I am going to state something potentially obvious:

– Epicenter stocks have been driving the positive 2021 EPS revisions YTD

– Visibility is improving as US should be fully opened by mid-June

– We are only 3 months into 2021, thus, positive revisions should continue

To me, this seems like a formula for Epicenter stocks to continue to lead.

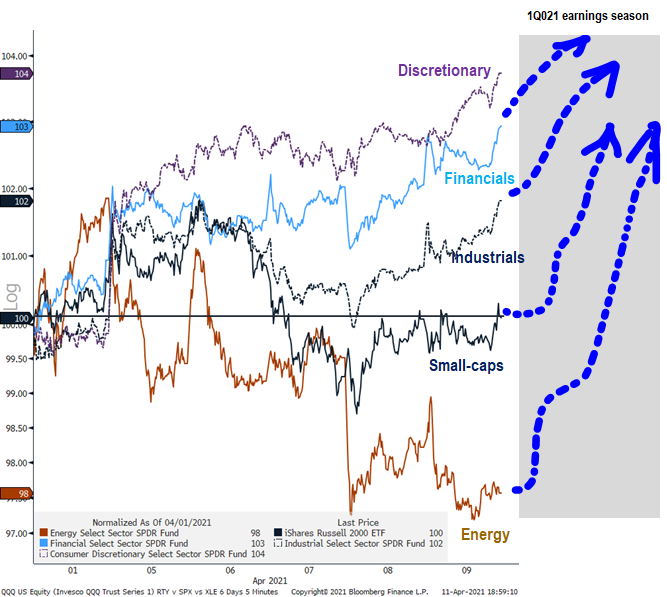

And as shown below, since the start of April, Epicenter stocks have been performing well, except for Energy, which is down since the start of the month. In our view, Energy is way oversold and given the potential for positive EPS surprise, we expect Energy stocks to recover over the coming weeks.

Source: Fundstrat and Bloomberg

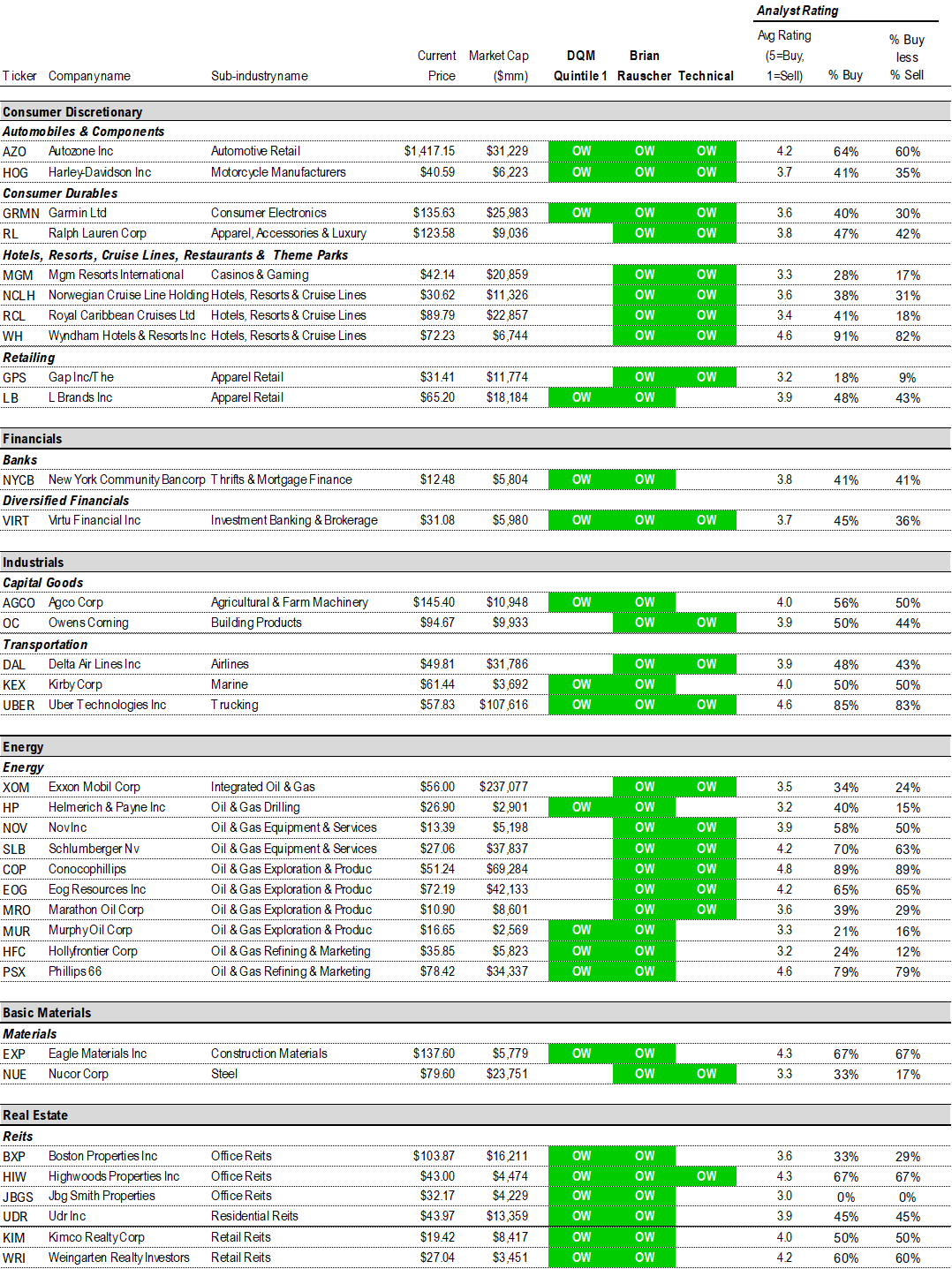

STRATEGY: Updating our Power Trifecta, adding net 10 stocks, now Power Trifecta 35 (*)

We are updating our Power Trifecta list. In this rebalance, 3 stocks are deleted and 13 stocks are added. Thus, the total number of stocks has risen by 10 to 35. This makes sense given the recent pullback in the Epicenter names (more stocks are attractive).

3 Deletions:

PBCT, NVT 1.68% , VNO

13 Additions:

AZO 0.02% , HOG 4.30% , GRMN 0.29% , MGM -2.44% , WH -2.08% , GPS 5.39% , LB, VIRT -1.70% , AGCO -0.90% , OC 2.10% , UBER -0.38% . EXP 1.09% , NUE -0.26%

35 “Power Trifecta” Stocks Ideas:

Consumer Discretionary:

AZO 0.02% , HOG 4.30% , GRMN 0.29% , RL -0.27% , MGM -2.44% , NCLH -1.76% , RCL 2.26% , WH -2.08% , GPS 5.39% , LB

Financials:

NYCB -3.26% , VIRT -1.70%

Industrials:

AGCO -0.90% , OC 2.10% , DAL 0.08% , KEX -0.14% , UBER -0.38%

Energy:

XOM, HP -0.12% , NOV -0.42% , SLB -0.49% , COP 0.10% , EOG 0.25% , MRO 0.11% , MUR 0.02% , HFC, PSX -3.71%

Materials:

EXP 1.09% , NUE -0.26%

Real Estate:

BXP -0.71% , HIW 0.31% , JBGS 0.27% , UDR -0.16% , KIM -0.22% , WRI

Source: Fundstrat, Bloomberg

(*) the 35 “Power Epicenter Trifecta” stock ideas are the subset of the original 108 “Epicenter Trifecta” stock list. For the full list of our original “Epicenter Trifecta” stock list, please click the link below. Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

For the full list of the 108 “Epicenter Trifecta” stock ideas, please click here

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Technicals

– Violence in USA –> companies that are involved in some aspect of home or personal security. We are not “recommending” these stocks, but rather, bringing these stocks to your attention.

Granny Shots:

Full stock list here –> Click here

Tickers: AAPL, CSCO, INTC, MXIM, NVDA, EBAY, KLAC, GRMN, GOOG, MNST, MSFT, AMZN, QCOM, TSLA, PYPL, AXP, BF/B, PM, XLNX, TGT, PG, XOM, VLO, GL, RF, ATVI, BBY, GE, AMAT, LRCX, MU, HPQ

Trifecta Epicenter (*):

Full stock list here –> Click here

Tickers: AAP, AN, AZO, F, GM, HOG, BBY, GRMN, GPC, LEG, TPX, PHM, NWL, MAT, PII, RL, MGM, HLT, MAR, NCLH, RCL, WH, TNL, SIX, FL, GPS, KSS, LB, VFC, WTFC, ASB, FNB, PB, TFC, WBS, PACW, NYCB, MTG, EVR, IBKR, VIRT, BK, STT, BHF, AGCO, OC, ACM, WAB, GNRC, CSL, GE, GGG, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, EAF, ITT, ALK, DAL, JBLU, LUV, MIC, KEX, JBHT, R, UBER, UHAL, MAN, XOM, HP, BKR, HAL, NOV, SLB, COP, EOG, FANG, HES, MRO, MUR, PXD, XEC, HFC, MPC, PSX, EXP, CF, NEU, NUE, RS, SON, IP, ARE, BXP, HIW, JBGS, ESS, UDR, KIM, NNN, O, WRI, PSA

Violence in USA:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

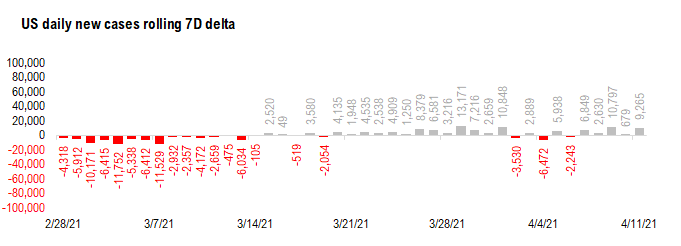

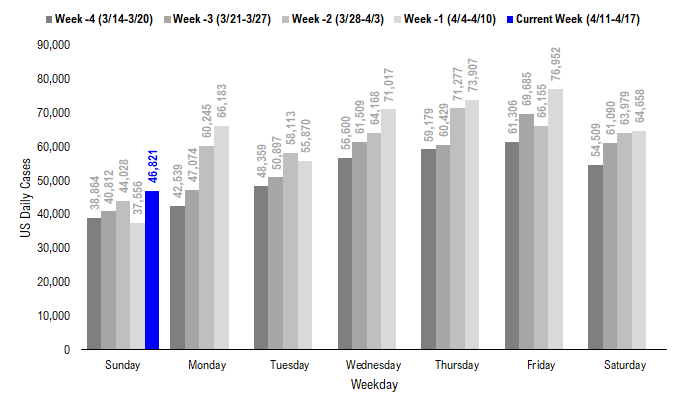

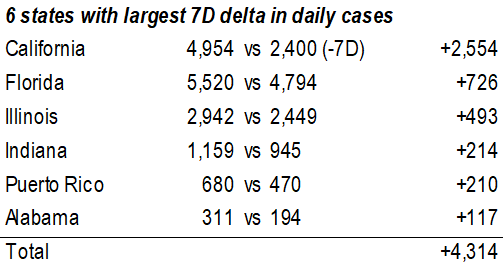

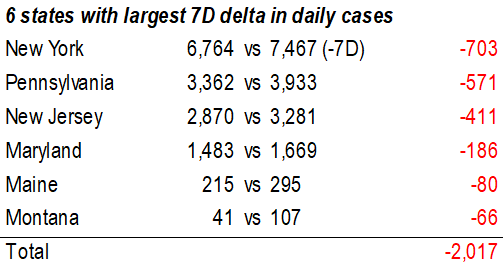

POINT 1: Daily COVID-19 cases 46,821, +9,265 vs 7D ago…Easter is throwing off the 7D delta…case trends still stable

_____________________________

Current Trends — COVID-19 cases:

– Daily cases 46,821 vs 37,556 7D ago, up +9,265

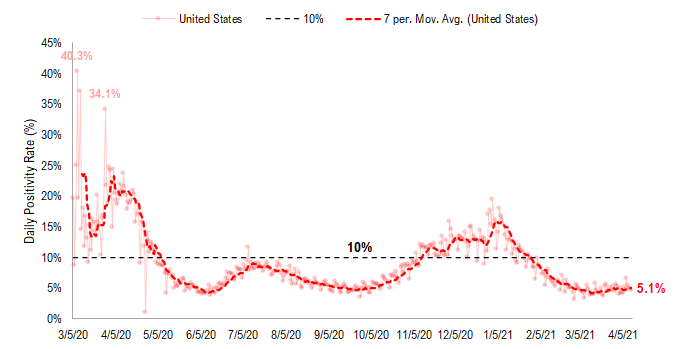

– 7D positivity rate 5.1% vs 4.8% 7D ago

– Hospitalized patients 39,171 up +6.4% vs 7D ago

– Daily deaths 716, down -8.9% vs 7D ago

_____________________________

– The latest COVID-19 daily cases came in at 46,821, up +9,265 vs 7D ago.

– 7D delta in daily cases surged last Friday and today. This was primarily due to the underreport 7D ago (in observance of the holidays). That said, the overall case trend is still stable. The positivity rate has been flat-lined, at ~5%, since the start of March. The number of currently hospitalized people has been up slightly, while the number of daily deaths continues to trend downward.

– At this stage of pandemic, vaccinations might matter more than daily case trends. As long as vaccinations work, eventually the rollout of the vaccines will lead to a decline in the pervasiveness of the COVID pandemic.

Source: Fundstrat and state health departments

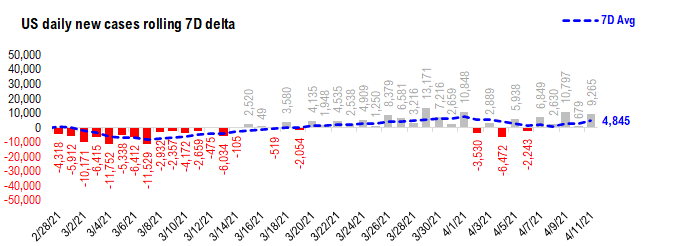

7D delta in daily cases surged last Friday and today – primarily due to the data distortion last week…

7D delta in daily cases surged last Friday and today. This was primarily due to the underreport 7D ago (in observance of the holidays). That said, the overall case trend is still stable. The positivity rate has been flat-lined, at ~5%, since the start of March. The number of currently hospitalized people has been up slightly, while the number of daily deaths continues to trend downward.

Source: Fundstrat and state health departments

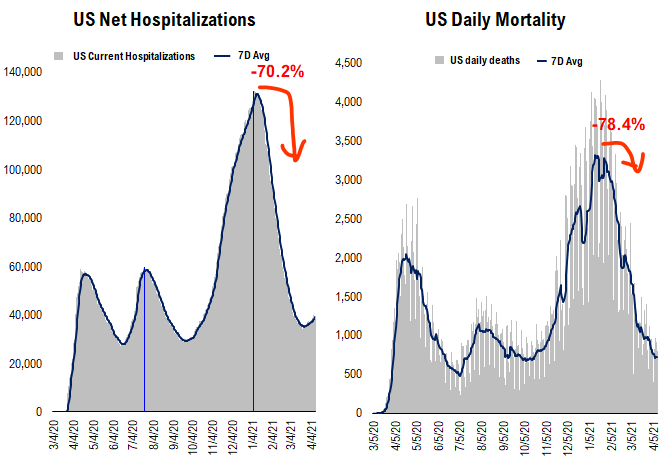

US hospitalization still rolling over … and even US deaths seem to be rolling over…

Below we show the aggregate patients who are currently hospitalized due to COVID. It has fallen significantly from the wave 3 peak.

Source: Fundstrat and state health departments

Source: Fundstrat and state health departments

Source: Fundstrat and state health departments

Source: Fundstrat and state health departments

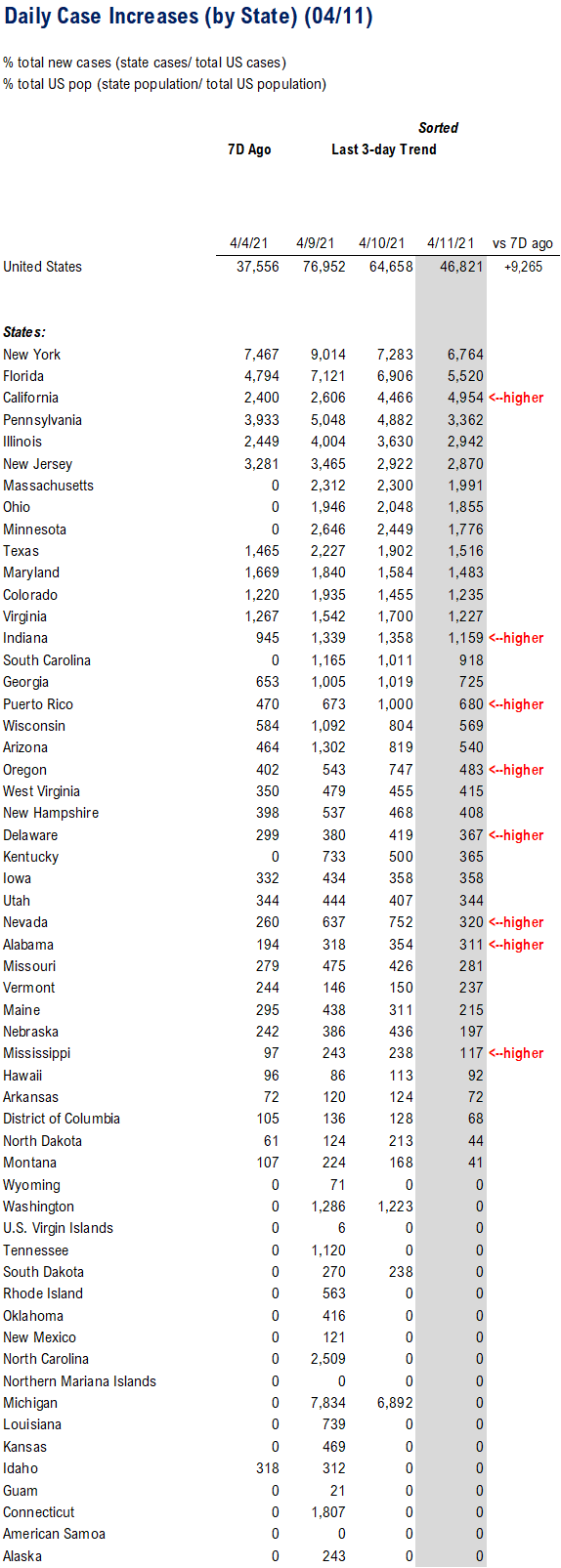

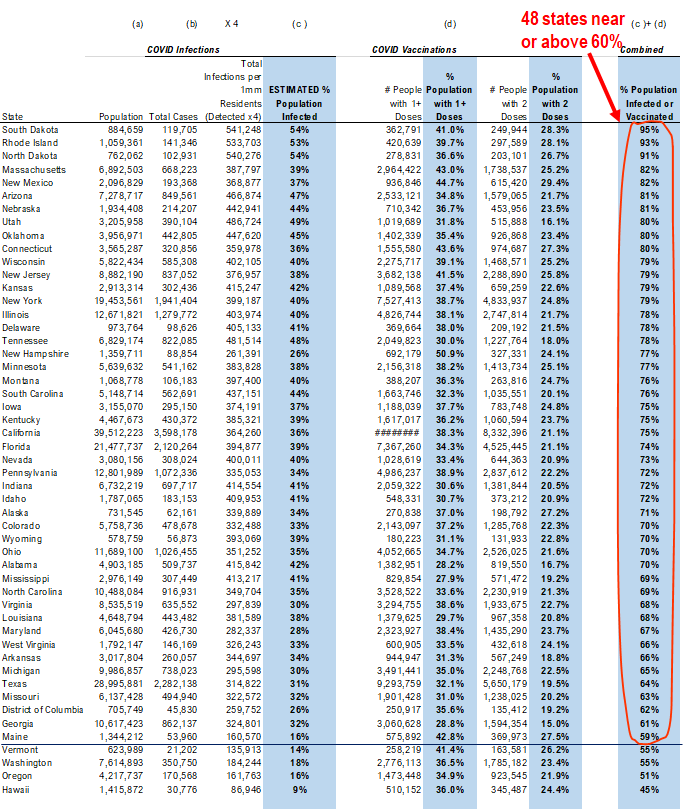

POINT 2: VACCINE: 48 states (+2 from last Thursday) near ~60% infected + vaccinated…

_____________________________

Current Trends — Vaccinations:

Vaccinations ramping steadily

– avg 3.1 million this past week vs 3.1million last week

– overall, 21.7% fully vaccinated, 35.7% 1-dose+ received

_____________________________

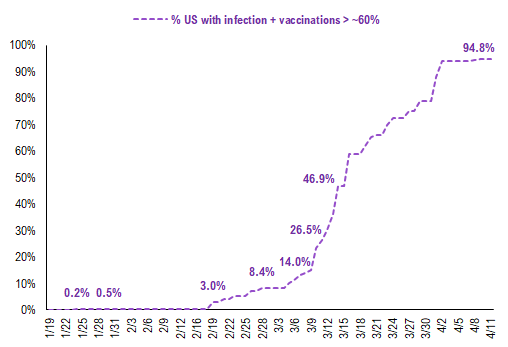

Vaccination frontier update –> 48 states now near or above 60% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). As we commented in the past, the key figure is the combined value >60%, which is presumably near herd immunity. That is, the combined value of infections + vaccinations as % population > 60%.

– Currently, 48 states (see below) are basically all at this level

– SD, ND and RI are now above 90% combined penetration (vaccines + infections)

– So slowly, the US is getting to that threshold of presumable herd immunity

Source: CDC and Fundstrat

Collectively, these 48 states represent about 94.8% of the US population. As the chart below highlights, the US is seeing steady forward progress and this figure continues to rise steadily.

Source: CDC and Fundstrat

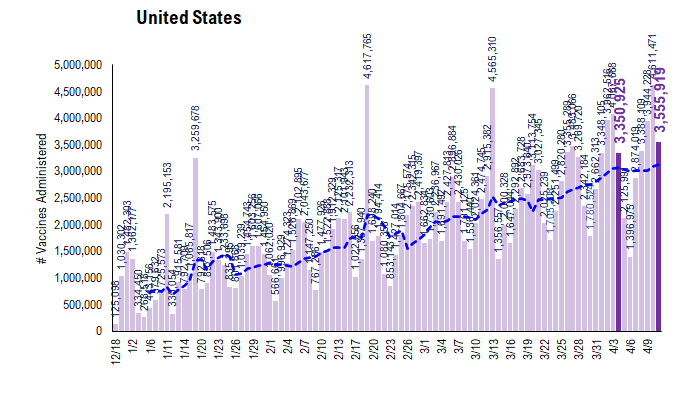

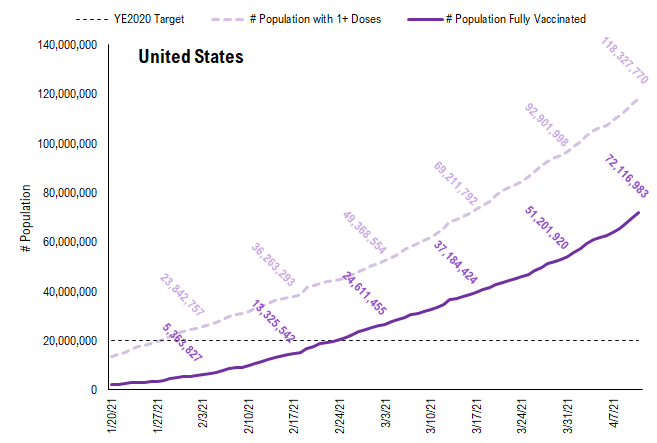

There were a total of 3,555,818 doses administered on Sunday, up 6.1% from 7D ago. Overall, the pace is steadily rising, as evidenced by the 7D moving average (see blue line).

Source: CDC and Fundstrat

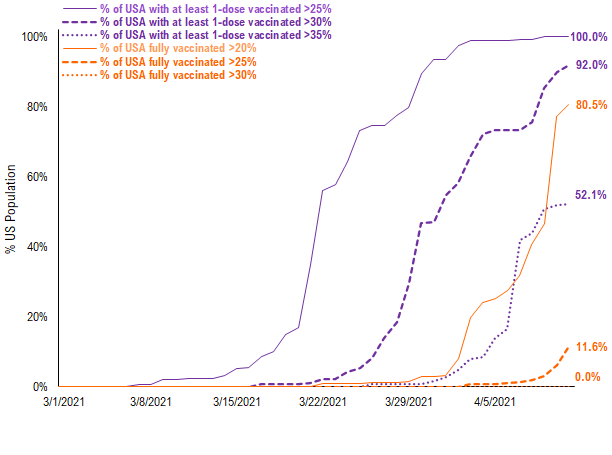

~92.0% of the US has seen 1-dose penetration >30%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 20%/25%/30% of its residents fully vaccinated, displayed as the orange line on the chart. Currently, 80.5% of US states have seen 20% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 25% of its residents fully vaccinated, this figure is 11.6%. And currently no states have seen 30% of its residents fully vaccinated.

– While all US states have seen vaccine penetration >25%, 92.0% of them have seen 1 dose penetration >30% and only 52.1% of them have seen 1 dose penetration > 35%.

– 80.5% of the US has at least 20% of its residents fully vaccinated, However, only 11.6% of US has fully vaccinated >25%

– This is still a small figure but this figure is rising sharply now. This figure could rise even more rapidly after the JNJ’s 1-dose vaccines roll out.

Source: CDC and Fundstrat

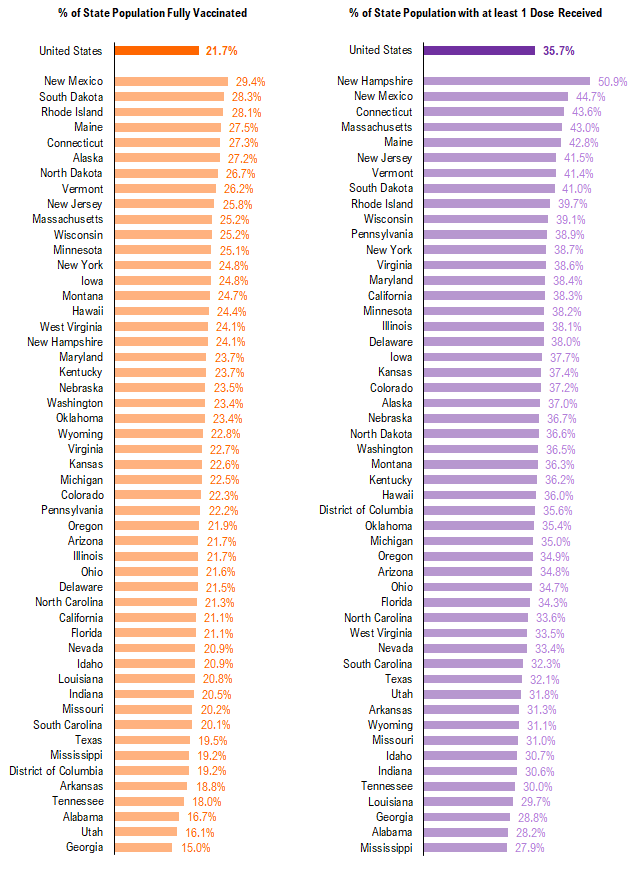

This is the state by state data below, showing information for states with one dose and for those with two doses.

Source: CDC and Fundstrat

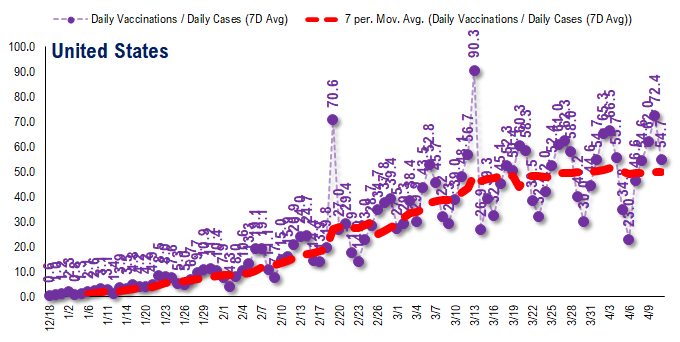

The ratio of vaccinations/ daily confirmed cases is generally trending higher (red line is 7D moving avg) and this is the most encouraging statistic.

– the 7D moving average is about ~50 for the past few days

– this means 50 vaccines dosed for every 1 confirmed case

This figure is rising nicely and likely surges in the coming weeks

Source: CD and Fundstrat

In total, about 118 million Americans have received at least 1 dose of a vaccine. This is a good pace and as we noted previously, implies 50% of the population by May.

Source: CDC and Fundstrat

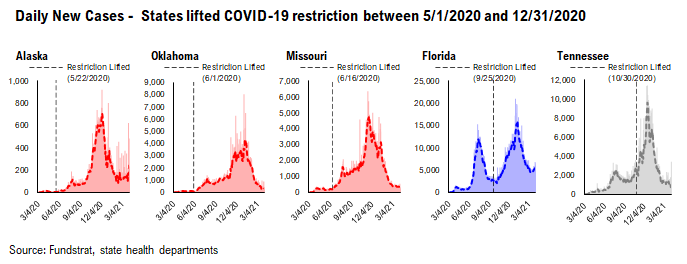

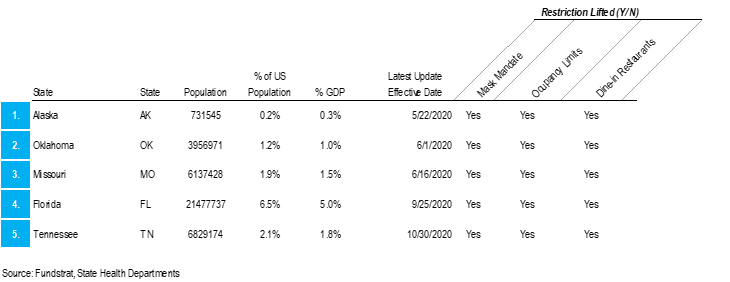

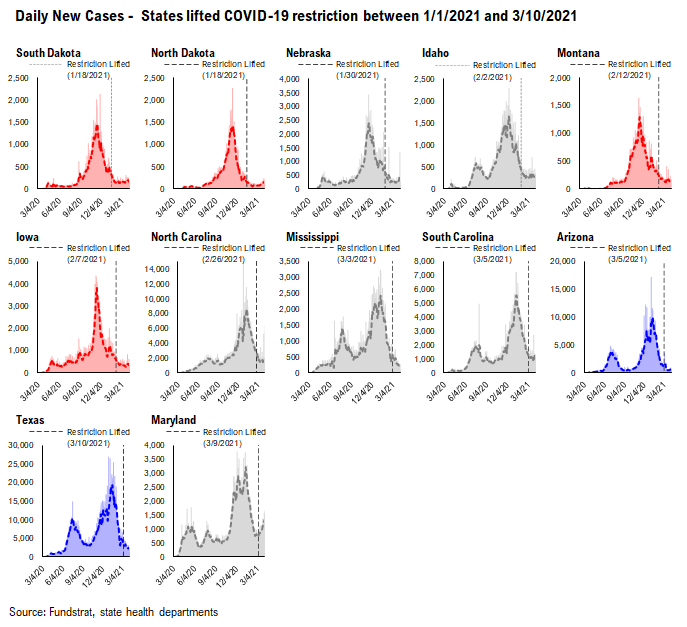

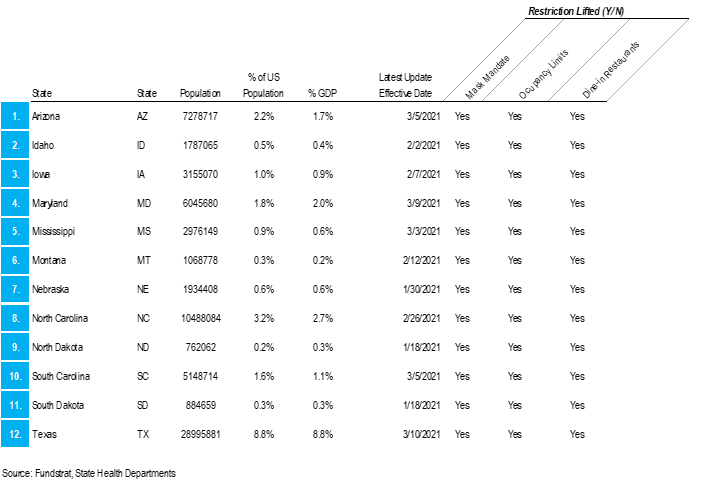

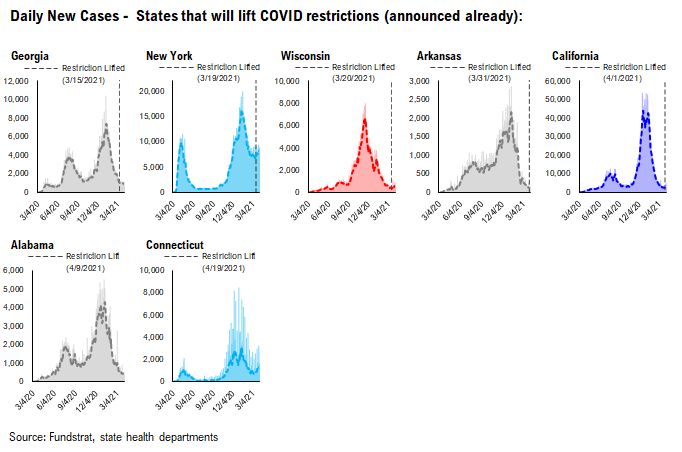

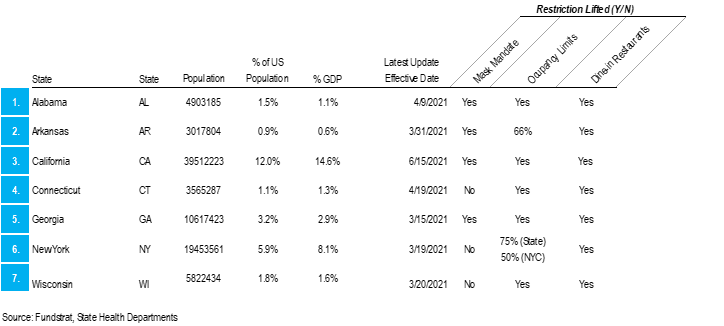

POINT 3:Tracking “un-restricted” and “restriction-lifted” states

We are changing Point #3 to focus primarily on tracking the lifting of restrictions, as states begin to ease various mandates. Keep in mind, easing/lifting restrictions can take multiple forms:

– easing indoor capacity

– opening theaters, gyms, salons, saloons

– eliminating capacity restrictions

– eliminating mask mandates

So there is a spectrum of approaches. Our team is listing 3 tiers of states and these are shown below.

– states that eased in 2020: AK, OK, MO, FL, TN

– states that eased start 2021 to now: SD, ND, NB, ID, MT, IA, NC, MS, SC, AZ, TX, MD

– states that announced future easing dates: GA, NY, WI, AR, CA, AL, CT

GROUP 1: States that eased restrictions in 2020…

The daily case trends in these states is impressive and it is difficult to say that lifting restrictions has actually caused a new wave of cases. Rather, the case trends in these states look like other states.

GROUP 2: States that eased restrictions in 2021 to now…

Similar to the list of states above, the daily case trends in these states are impressive and it is difficult to say that lifting restrictions has actually caused a new wave of cases.

– we have previously written about how ND and SD, in particular, have seen an utter obliteration of COVID-19 cases in those states

– that seems to be a function of vaccine penetration + infection penetration, leading to something akin to “herd immunity”

GROUP 3: States that announced plans ease restrictions in 2021…

These states have upcoming dates to ease restrictions. The dates are indicated on each chart. The cases trends in these states have been mostly positive, with perhaps the exception of NY state:

– NY state case levels seem awfully stubborn at these high levels

– weather is improving in NY area, so if weather has any effect on virus transmission, it should slow cases