Aerospace & Defense along with Energy showing strength

Key Takeaways

- Monday’s churning still leaves markets in bottoming process as the month of February comes to a close. While near-term price action remains choppy, rallies are expected

- Energy has shown some change of character as Equities have begun to stabilize with Exploration and Production stocks starting to outperform. XOP should be favored.

- Aerospace & Defense followed through sharply Monday with many in the group like GD, RTX, NOC, LMT making new all-time high closes on monthly charts.

US Equities closed out the month of February down a bit more than 8% for SPX in the months of January and February combined, but have shown increasing levels of stabilization that suggest that a larger snapback rally for the month of March should be slowly getting underway. Despite ongoing downtrends for SPX on a three-week and a two-month basis, gradual stabilization in groups like Technology and Industrials is encouraging. Near-term, SPX 120-minute charts show the sharp rally from early this month finding initial resistance near its downtrend, found at 4385. Above would argue for a push up to 4460, or a 50% retracement of the Jan-Feb decline. Overall, this remains a two-step forward one step back process, but prices are expected to rally.

Performance shows Materials, Industrials trying to claw higher, but overall, a defensive bias remains over a three-month basis

Energy outperformed all other SPX GICS Level 1 sectors by a wide margin yet again and after a 26.99% gain in the last three months, it still looks early to fade this group.

Last week shows some evidence of Communication Services along with Technology, Healthcare and Industrials snapping back. While these groups all remain lower on a YTD performance basis, their near-term strength is encouraging for a further bounce in March.

Energy, Utilities and Consumer Staples are the only three SPX Sector SPDR ETF’s which have positive performance on a three-month basis, as the Defensive trade remains pervasive.

Energy looks to be shifting back into high gear as Exploration and Production starts to outperform

Don’t look now, but Energy has just made the highest monthly close in at least two years as February comes to a close. XLE, OIH and XOP all finished at new highs for 2022, and XOP, XLE finished at the highest monthly closes since at least Spring 2019.

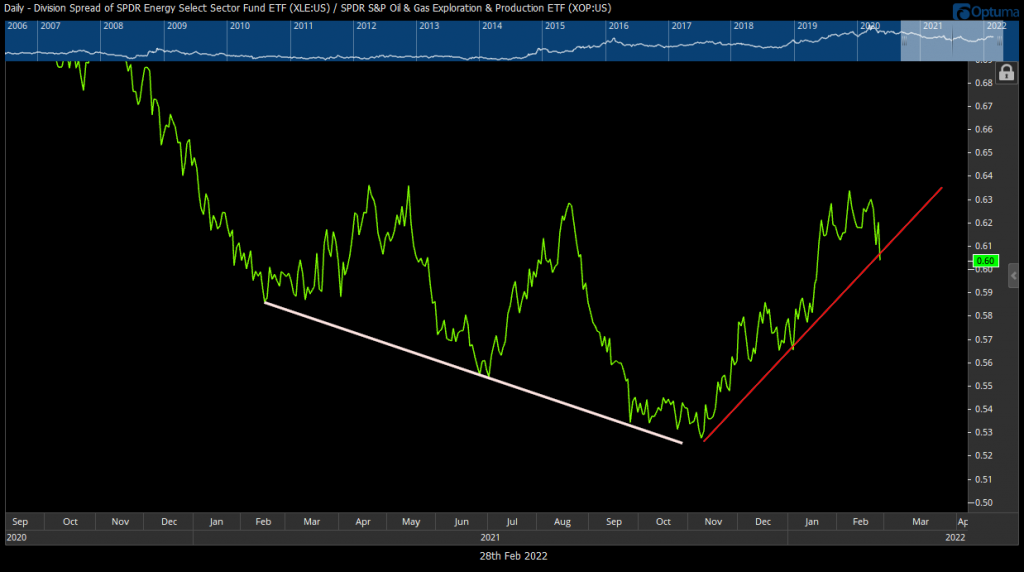

XOP should be favored as signs of stabilization begin for US Equities. After XLE showed better relative strength during recent times of volatility for US Energy, the recent geopolitical tension has brought Exploration and Production stocks (E&P) back to “front and center”.

XOP broke out Monday above the entire multi-week consolidation that had been in place, and should be overweighted above either XLE, or OIH in the month of March.

Daily ratio charts of XLE to XOP (SPDR Select Energy ETF vs SPDR S&P Oil and Gas Exploration and Production) show the breakdown in this uptrend of XLE to XOP which should lead to an above-average pullback in Integrated names vs the E&P’s in the short run. This ratio is peaking at nearly an exact level where this topped out twice before in August of 2021 along with Spring 2021, adding to its importance as a key resistance zone. (Thus, XLE falling vs XOP bodes well for XOP to outperform, with E&Ps showing better relative strength)

Overall, I expect March to be led by some of the higher beta names like DVN, APA, EOG, FANG, and these likely perform better than the Large-cap XLE dominant names like XOM and CHV.

Finally, General Dynamics, GD 1.11% , below, exemplifies exactly the kind of name that looks right to own given current geopolitical tension. I discussed ITA 1.09% last week as being an area of focus, and GD has just achieved a new all-time high close with 2/28/22’s finish above $222.48. Overall, a push up to $250 looks likely, and other peers like RTX 0.98% , NOC 0.90% , LMT 0.96% also look appealing within this Aerospace and Defense group. One should look to own these names tactically into late March, utilizing pullbacks to buy dips with stops at 5-8% for trading purposes, for those that utilize these.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 29c0f2-43960a-ac2d75-d66e27-81639c

Already have an account? Sign In 29c0f2-43960a-ac2d75-d66e27-81639c