Market hypersensitive to inflation data points... but market sees declining forward inflation

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

Market likely pivots on 1 of 4 change in trends

To state the obvious (to those watching macro), Wed’s April CPI print is going to be important. All markets are hyper-reactive to inflation’s trajectory. And given the waterfall decline in stocks since the FOMC meeting, the market most likely to hyper-react are equities.

- I am not sure there is a single item that matters, i.e., “core CPI month over month”

- but given the building data points that inflation might have already peaked

- trends in key items will matter

The market is caught in a “vortex of pain” (thanks AS) as described by one client. While stocks have been struggling for most of 2022, the waterfall collapse since the end of April has been a particularly violent scythe.

We have spent the past few days in Chicago meeting with institutional investors, and the PTSD of the past few weeks is evident. It has been particularly painful because there has been nowhere to hide. And the uncertainty weighing on markets seems insurmountable. In overly simplistic terms, there are four things plaguing visibility, and an improvement in 1 of these 4 would dramatically ease anxiety:

- inflation — key to watch is CPI as signs of apex = relief

- tight labor market — any combo of jobless claims higher, weakening wages or layoffs = relief

- Fed tightening cycle — key is when Fed no longer needs to “shock” markets = see above

- Russia-Ukraine war — de-escalation or end of war = relief

I did not include China and lockdowns. (This is also important but that seems less of a continuing risk, but rather contributing to the constellation of uncertainties.) The above four factors have both an amplitude (how bad does it get) and timing (when will these improve).

…equity market attempting to find equilibrium as VIX and bonds have been relatively calm

While stocks have been gut punched in May, there has been relative calm in credit and in VIX.

- 10-year has held relatively steady at ~3% range and 2-year has been anchored

- VIX has not managed to push to new 2022 highs, but held at ~33-34

The fact that stocks have plunged nearly 10% (since the start of May) while VIX and yields have been flat is unexpected. After all, if markets are fearing rising uncertainty, VIX should be surging and yields moving (safety trade etc). So there are several ways to view this:

- VIX at 33-34 is already elevated, so investors not seeking additional protection = somewhat positive

- market is complacent and VIX set to surge = further downside for stocks = negative

or possibly third explanation:

- fixed income and macro markets on balance see increasing odds of a “dovish” surprise and therefore macro funds are “shorting volatility” = somewhat positive setup

Two developments suggest Fed might have “less wood to chop”

I know, this third explanation seems to be incongruent, but there are two things we want to highlight that possibly support this third explanation. The two factors are:

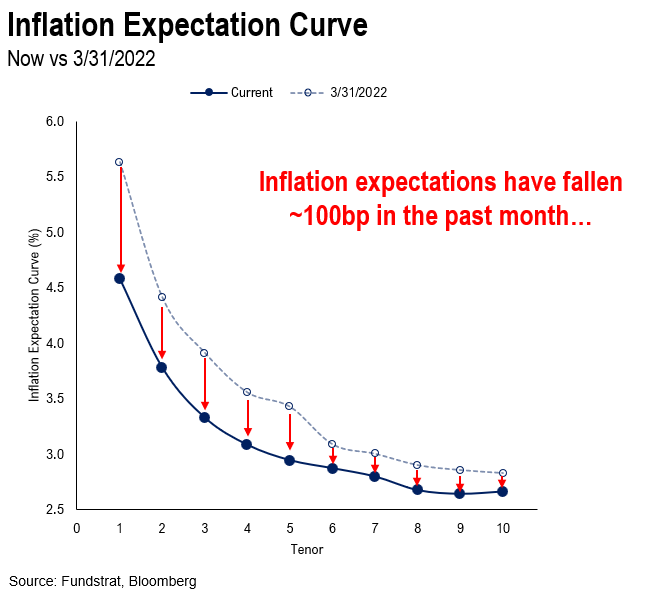

- the market has seen 100bp drop in future inflation expectations across the curve = somewhat positive as Fed has less “wood to chop”

- labor markets are showing cracks, which we discuss below = somewhat positive as Fed has less “wood to chop”

Before going further, you might be asking “if the above is true, why are stocks still tanking?” — that is, why would the bond and VIX market react to something, but the equity market seems to ignore this.

- foremost, this is not the first time the stock market has played a different tune from credit or VIX

- second, equity markets seem more prone to panic in the post-GFC era

As one of my very good friend (and client) states below, a good number of equity investors today have not endured a 20% drawdown. After all, many investors have become involved in stocks post-COVID crash.

- and the equal can be said of the bond market

- unless a bond manager has >50 years of experience, they have never lived through a rising rate environment

- a bond manager would need to be ~80 to have lived through the inflation surge of the 1970s

- so, is it any surprise that bond and equity markets are prone to panic?

Market-based measures of inflation show 100bp reduction in future inflation expectations

You might recall we published this inflation forward curve, created by our data science team led by tireless Ken. This is derived by looking at the differential in yields between nominal treasuries (of constant maturities) versus the yield on TIPS (inflation-protected) as the differential is the embedded inflation expectations.

- across all future maturities

- market-based measures of inflation are lower

- the decline in the 1-3 year range is ~100bp

- meaning, inflation expectations 12-months forward are down meaningfully

- 12M forwards are now 4.5% down from >5.5% at the end of March

- While 4.5% is above the Fed’s target, this 100bp decline is seen after a 50bp hike

…Is the jobs market as structually tight as it appears?

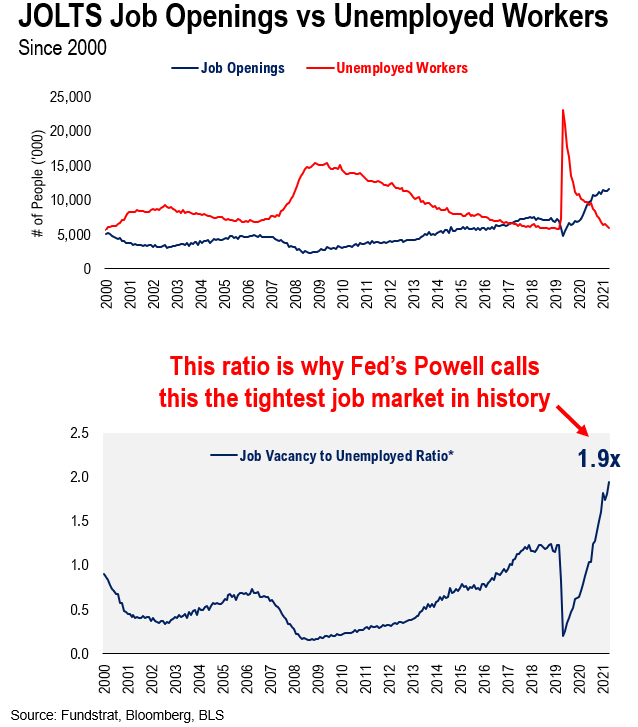

There is no question that labor markets are currently tight. Meaning, companies speak of hiring challenges. And whether visiting a retail store, or speaking to business owners, this is also true.

- hence, the Fed likes to point to this ratio below as evidence of the tightest job market in history

- there are 1.9 job openings for every job seeker

- the series has a 22-year history, so we can’t say this is true pre-2000

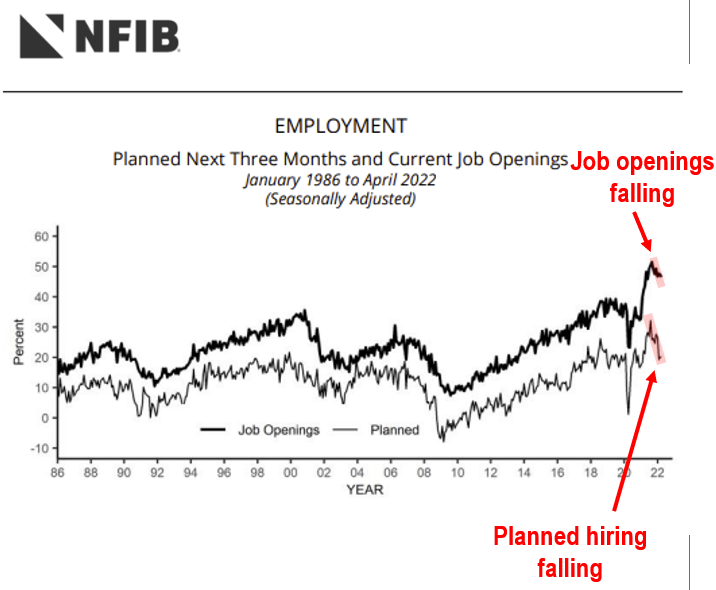

…even NFIB small business survey shows planned hiring is slowing

The latest NFIB small business optimism survey was published Tuesday for April. And among the many dozens of useful exhibits is this one below showing:

- planned next 3 months and current employment plans

- planned hiring is falling steeply to 20% (% net planning to increase)

- current job openings flat at 55% vs last month but down from 62% 5-mos ago (% net planning to increase)

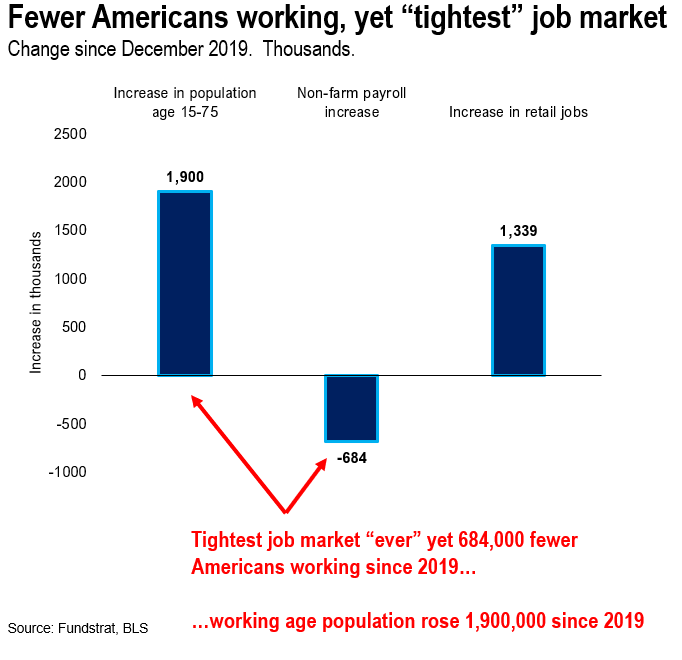

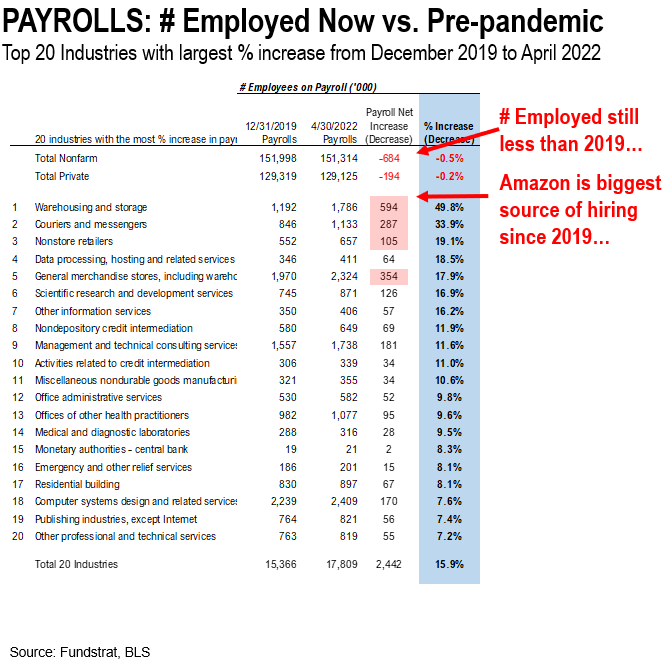

…US non-farm payrolls is still 684,000 less than it was at end of 2019

While the job market is extremely tight, there is something that we don’t fully understand:

- the number of working age Americans has risen 1.9 million since end of 2019

- non-farm payrolls is 684,000 lower versus end of 2019

- the bulk of the hiring has been retail with 1.3 million added workers

Granted, some might say that despite 1.9 million additional Americans 15-75, many took “early retirement” so that is why fewer people are working. This might explain it, but with inflation surging and falling stock prices, we likely hear anecdotes of a rise in the participation rate.

Previously, we highlighted that the bulk of the hiring since 2019 is the 1.34 million hired in retail, in 4 categories:

- warehouses – Amazon, which itself hired ~600,000 since 2019

- couriers and messengers – Uber, doordash, grubhub, etc

- non-store and general retail – despite America seeing a decline in retail stores since 2019

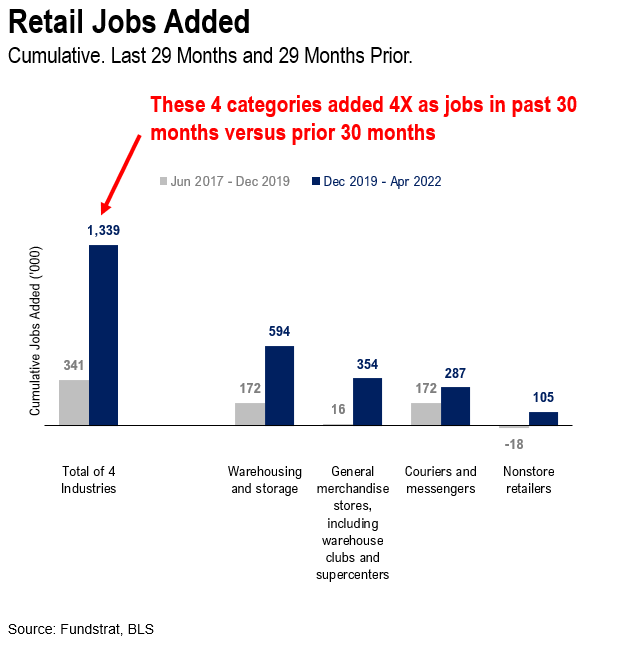

Retail hired 4X as many workers in past 30 months as it did in the prior 30 months

The pace of retail hiring has exploded since the end of 2019 (30 months). And below we compare to the pace in the 30 months from June 2017 to end of 2019:

- Retail added 341,000 jobs June 2017 to end of 2019

- Retail added 1.34 million jobs from end of 2019 to April 2022

- This is 4X the pace of hiring for the most recent 30 months versus the prior 30 months

Question. Did retail grow at such an accelerated pace to justify this 4X surge in retail hiring. I realize COVID-19 did cause growth for “warehouse” (aka Amazon and ecommerce) but the totality of hiring is 4X what it was prior to COVID.

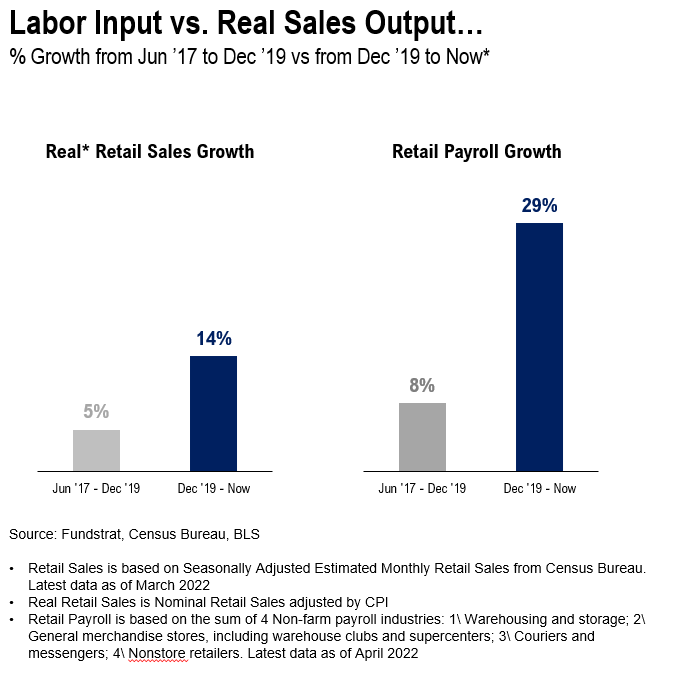

Real retail sales grew 14% (ex-inflation) but hiring grew 29%

Here is perspective. Real retail sales grew a cumulative 14% since end of 2019. We use “real” versus “nominal” since inflation of prices would not justify additional hiring — for instance, if inflation is 8%, sales rise 8% but there is no need to hire more workers for that 8%.

- June 2017 to end of 2019, real retail sales rose 5% and hiring rose 8%

- end of 2019 to April 2022, real retail sales rose 14% and hiring rose 29%

- hiring in most recent 30 months grew far faster than real sales growth

This is what sort of surprises me. There has been a drastic rise in retail hiring far above the pace in real sales growth.

…several possible explanations retail hiring rising faster than real sales growth?

There is not a simple explanation for this and we have heard several possible explanations:

- as workers moved to suburbs and remote areas, these are less dense areas thus, retail sales here are less productive

- retailers are adding extra workers as “insurance” since it is so hard to find new hires, thus, overhiring

- the above seems to be the case for a company like Amazon, where they cannot afford outages from COVID — thus, extra staffing

- venture capital and start-ups are hiring workers and these are not reaching scale of the established players

All of the above could explain this. But this also suggests that there could be excess employment in the retail sector. A simple way to estimate this is:

- real retail sales rose 14%

- retail related hiring should rise 15% or so, versus the actual 29%

- this implies nearly 700,000 of the workers hired in retail in past 30 months are “excess”

STRATEGY: Cost of capital has risen, hurting unprofitable companies, but large-cap tech is oversold

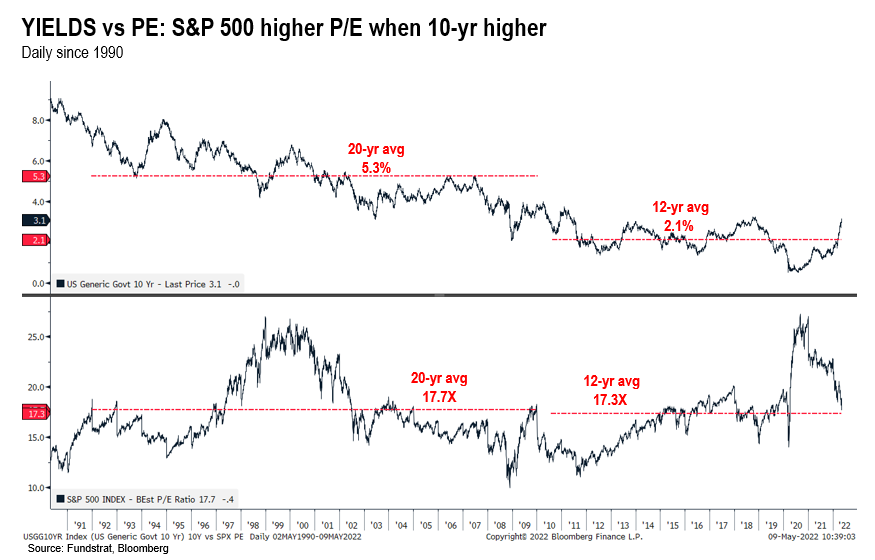

With equities in a tailspin, the natural question is whether stocks need to keep falling given the cost of capital is rising (10-year yields higher). We published the chart below previously and it shows P/E and 10-year yields. And as shown below

- in the 20-years from 1990 to 2019, the 10-year averaged 5.3% and P/E averaged 17.7X

- interest rates averaged 2.1% in the past 12 years, but the P/E averaged 17.3X

- counter to what many believe, the overall market P/E does not have to de-rate

But of course, a rise in interest rates is raising the cost of capital. And companies with low ROIC, or low-return businesses will lose access to capital. Today, that is:

- unprofitable companies

- companies with high P/E that rely on future years for earnings justification

- many start-ups

Collectively, this is where weakness will emerge. FYI, many start-ups are in retail. And with this area losing funding, the 1.34 million hires in the past 30 months could see losses. Earlier this week, we published an estimate that ~4 million Americans are employed by venture-backed companies.

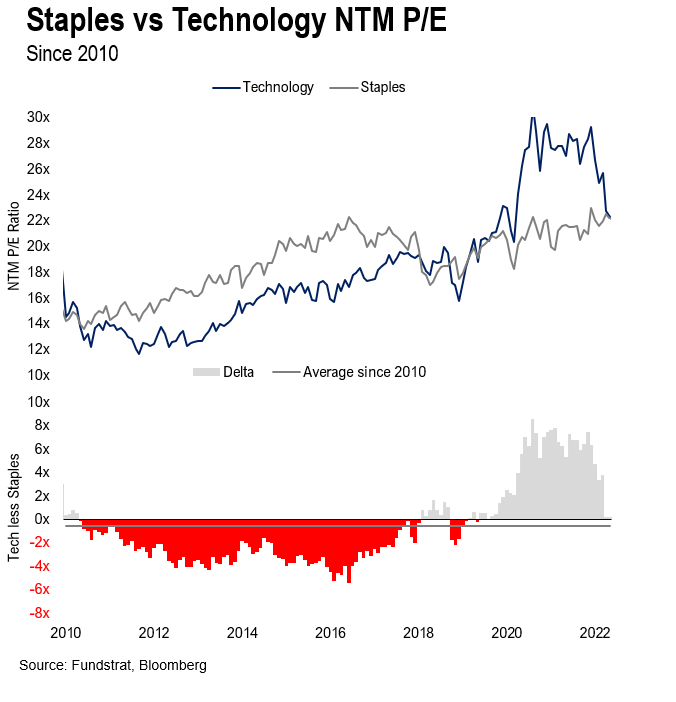

Technology has de-rated and trades at the same multiple as Staples

And as investors have become extremely defensive, we are seeing this in the convergence of the P/E multiples of Technology and Staples as shown below. The question is whether this is fair value.

- if the economy is facing a hard landing, Staples can rerate higher

- if this is a growth scare, Technology will again rerate higher

We are in the camp that this is a growth scare.

STRATEGY: We lean relatively “bullish” into 2H2022 (but also 2Q22), but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

Stocks have continued to be treacherous in 2022. Investors are on a hair trigger.

– this is in context to a challenging 1H2022

– so jagged next 3 months

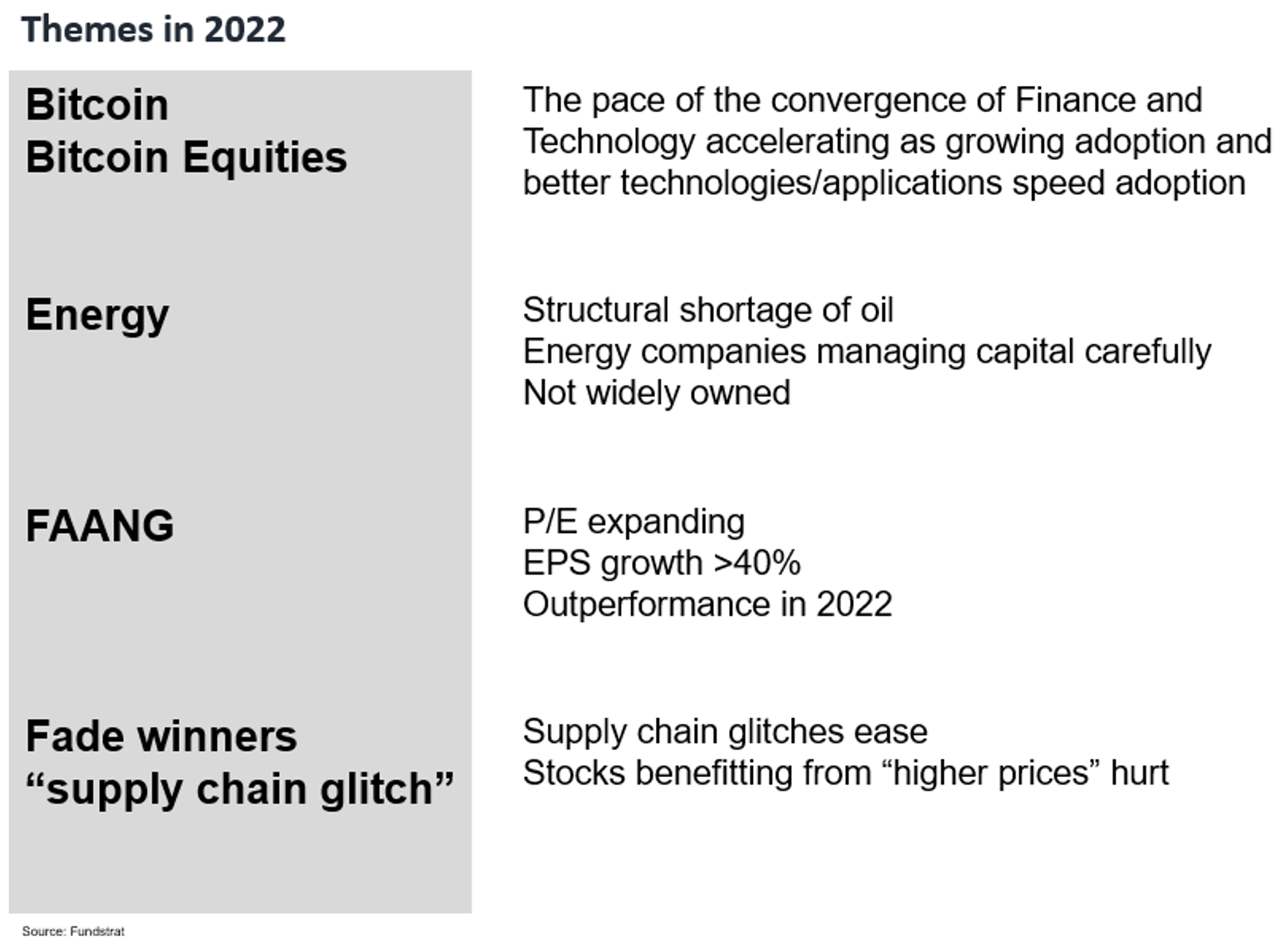

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO1.47% GBTC0.93% BITW1.17%

– Energy

– FAANG FNGS0.77% QQQ0.82%

Combined, it can be shortened to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL0.50% AMZN0.96% NFLX2.31% GOOG10.18%

All in all, one wants to be Overweight BEEF

_____________________________

31 Granny Shot Ideas: We performed our quarterly rebalance on 4/5. Full stock list here –> Click here

_____________________________

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In c12264-620c2b-b6ef53-e4e393-a89cb3

Already have an account? Sign In c12264-620c2b-b6ef53-e4e393-a89cb3