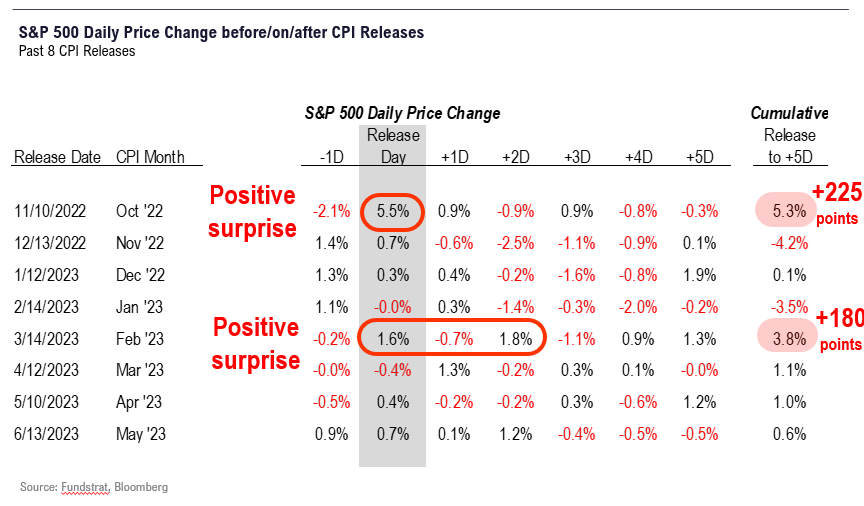

The last two "meaningful" CPI positive surprises (Oct 2022 and Feb 2023) saw +4%-5% 5D rally = 180 to 225 points today. Thus, 100 point gain could be "low end" of a potential rally.

Click here to register for our live Roundtable (7/12) @ 2 PM ET

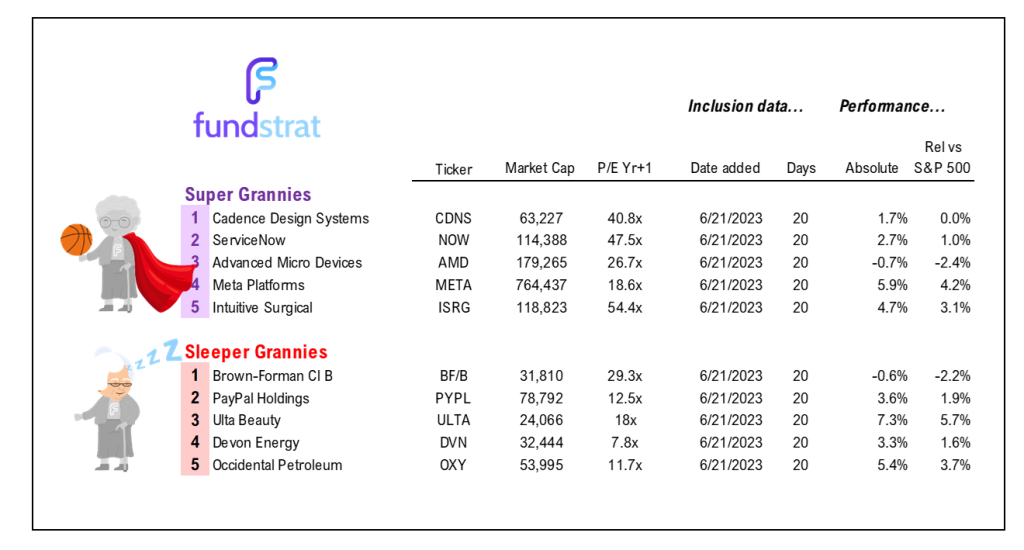

NEW: Section (above) added identifying Key Recommendations and Super Grannies

________________________________________________

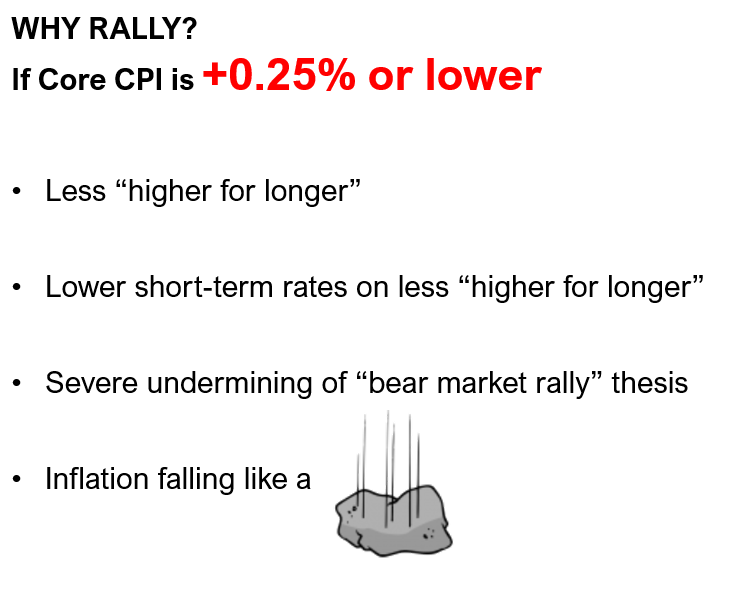

Today’s note will include a short video update. We discuss that of the last 8 CPI reports, markets had a positive reaction 6 of 8 times. The two “surprises” saw 4%-5% rallies, or +180-225 points. Thus, our 100 points rally tactical call might be on the low side. Is the Fed funds of 5.5% “higher for longer” if Core CPI is 3% by Dec 2024? We don’t think so. Please click to view yesterday’s macro minute. (Duration 4:10 ).

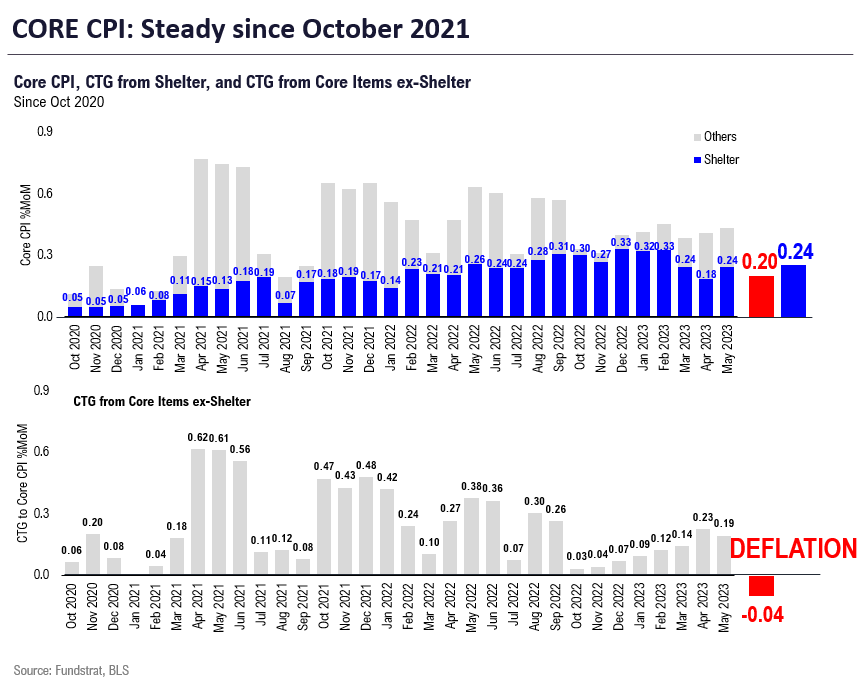

The main event for this week, and arguably the main event for this month is the June CPI report. We even issued a “tactical Buy call” (100 points on S&P 500 by Friday this week) as we expect a material downside read on Core CPI of 0.25% or better MoM, compared to Consensus of +0.30%.

- Of the last 8 CPI reports, the S&P 500 has risen and in two of them, rallied strongly:

– Oct CPI (11/10) +5.3% 5D rally

– Feb CPI (3/14) +3.8% 5D rally

– So, +4%-5% rally is 180 to 225 S&P 500 points

– Thus, 100 points could be a “low end” on a CPI beat - This is by no means a “done deal” but the probabilities are high that we will see a soft Core CPI reading. The simple drivers are Used Cars (1/3 of Core CPI rise) and the seasonal factors (benefitting June and July).

- But you might wonder how a “beat” would be so consequential. As we outlined in our comments and daily Macro Minute videos over the last two days, the driver is a downside read would materially impact how markets and the Fed view the trajectory of inflation.

- If this CPI print is +0.20% or so, the odds are very high that we will see +0.20% Core CPI prints for each of July and August CPI. That would make 3 consecutive months where Core inflation is running at 2.0%-2.5% and would make markets entirely rethink that path of future inflation.

- Core CPI of +0.20% or less would be the lowest since August 2021, and a complete break below the range that has been in place since the start of 2022. There has not been a Core CPI MoM print this low during that time.

- Used cars is an easy repeatable factor, as it added +0.14% to Core CPI for the last two months and could flip to a drag. And as Goldman Sachs’ Economics team exhaustively noted, the distorted seasonal adjustments due to pandemic and bullwhip supply chains mean Core CPI seasonal adjustments will push down CPI for the next few months. On top of that, housing will start to roll over.

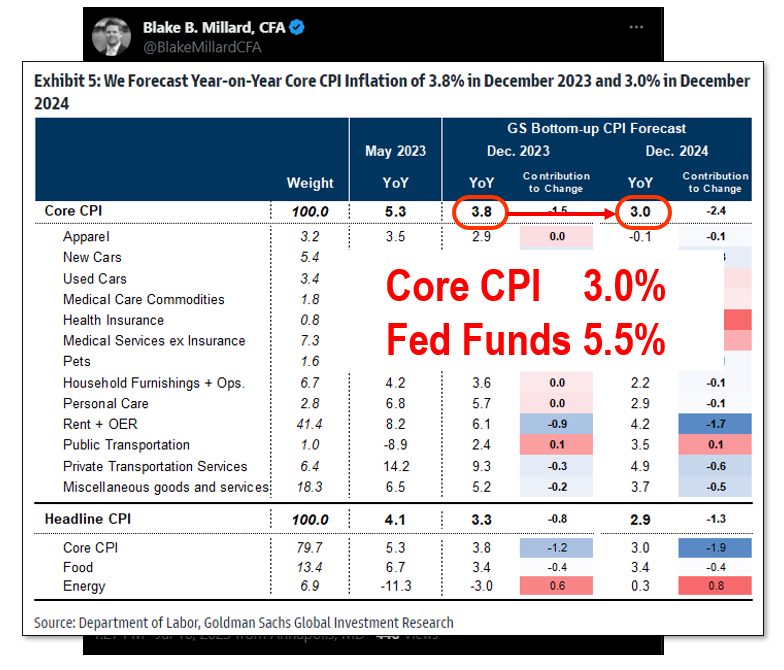

- But think beyond this week, and where Core CPI might end up by Dec 2024. Goldman’s latest forecast is Core CPI falling to 3.0%. The June Core CPI YoY is probably 4.9%-5.0% YoY. So, core could drop 200pp in the next year.

- And the Fed funds is set to be 5.5% by the end of 2023. Does a 5.5% Fed funds make sense if Core CPI is 3.0%? See what I mean? It really raises the question whether “higher for longer” makes sense.

BOTTOM LINE: A June Core CPI positive print (+0.20% or less) would strengthen the case for stocks in second half

We still believe the highest probability is a large rally this week. And as we noted above, on the Oct 2022 and Feb 2023 CPI prints, the S&P 500 rallied the equivalent of 180 to 225 points.

- So 100 points this week could be a low end

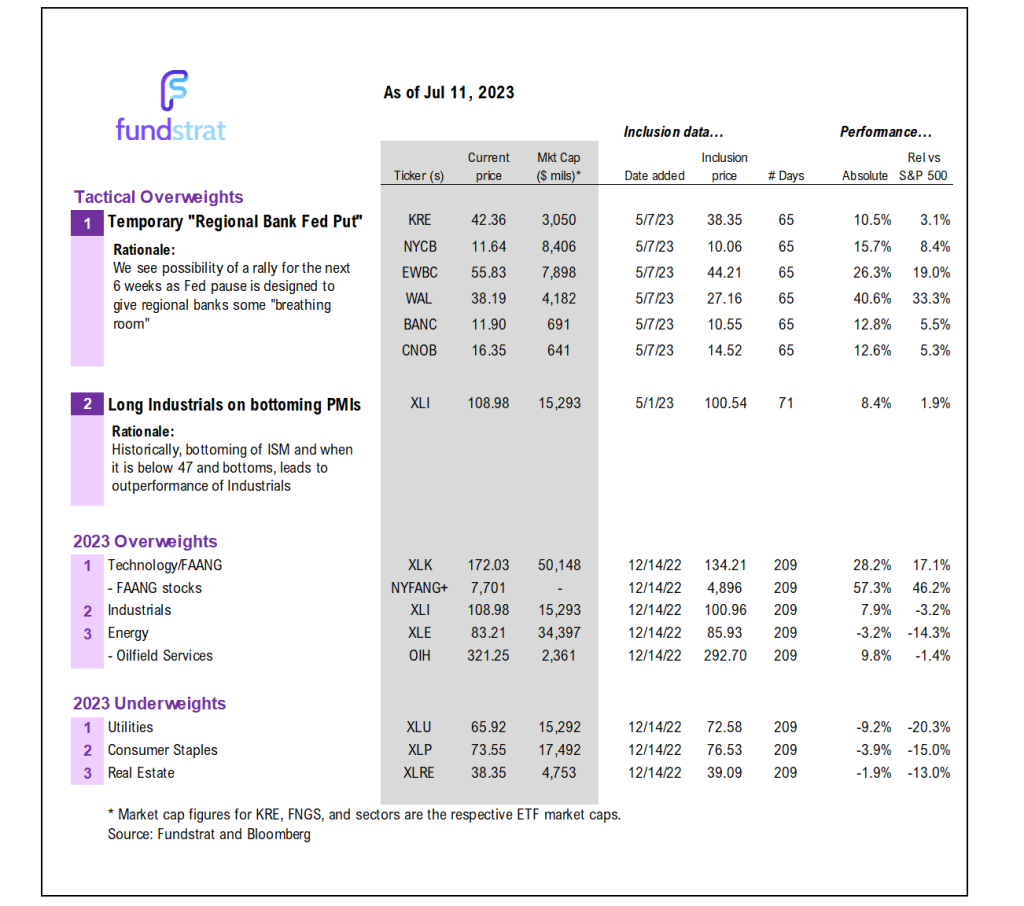

- What would we be buying? Financial conditions are easing.

- So we would be buyers of Technology/FAANG (QQQ 1.55% ) and Industrials XLI 0.16%

- But we believe Cyclical growth would improve, favoring Energy XLE -0.92% and Regional Banks KRE -0.66%

- And small-caps IWM 1.04% likely get a bid, since this is the easiest way for many active managers to “catch up”

Recall, as we noted in our comments Monday evening, a Core CPI of +0.20% implies ex-shelter, a negative -0.04% — DEFLATION.

ECONOMIC CALENDAR: FOMC keyin July

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame- 7/12 8:30am ET June CPI

- 7/13 8:30am ET June PPI

- 7/14 Atlanta Fed Wage Tracker June

- 7/14 10am ET U. Mich. June prelim 1-yr inflation

- 7/15 Manheim Mid-Month Used Vehicle Value Index July

- 7/25 9am ET May S&P CoreLogic CS home price

- 7/25 10am ET July Conference Board Consumer Confidence

- 7/26 2pm ET July FOMC rates decision

- 7/28 8:30am ET June PCE

- 7/28 10am ET July Final U Mich 1-yr inflation

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 4c6260-0bc8b8-b0867e-d556bc-49a75b

Already have an account? Sign In 4c6260-0bc8b8-b0867e-d556bc-49a75b