Latest Case-Shiller + Rent point to future lower CPI = plz Fed, look forward. WFH + cruise + builders + Bitcoin show FAANG isn't the only group breaking Consensus "rules." 11 Industrial stock ideas.

________________________________________________

Please click below to view yesterday’s Macro Minute (duration 4:18):

WORD OF NOTE: I am visiting clients in Japan this week, and updates less complete given schedule

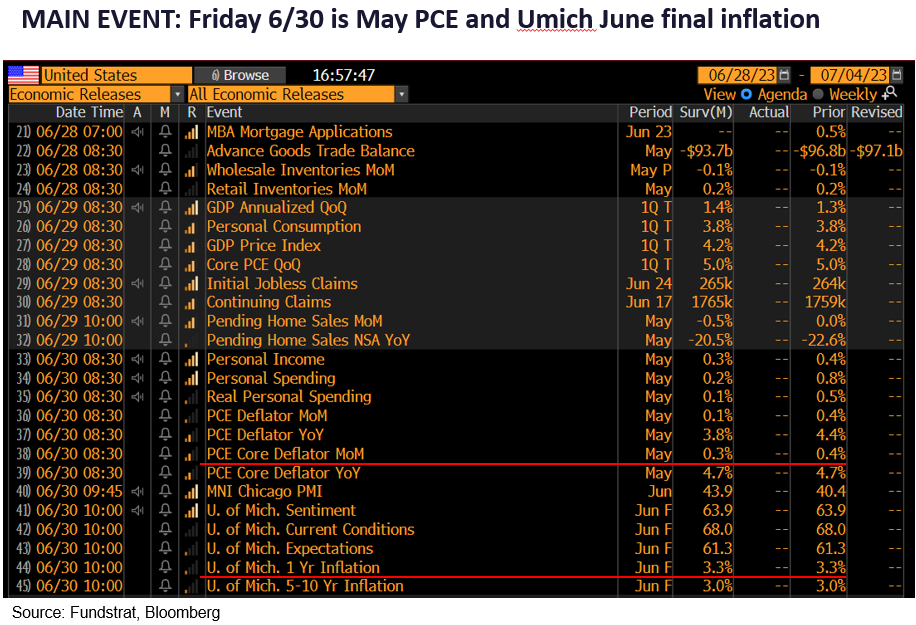

The main event this week is Friday June 30th, when we get the crucial May PCE deflator and the U Mich Consumer June final 1-year inflation. Why? Because we think the primary story in markets today is inflation. Our constructive view on stocks is based on the idea that many forward looking indicators of inflation point to inflation undershooting consensus = Fed having to do less.

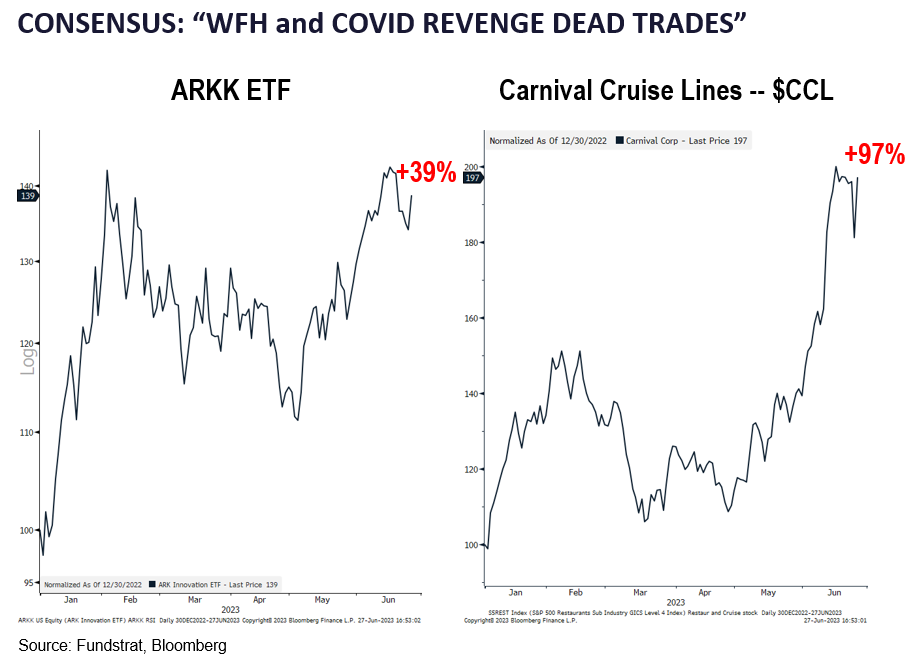

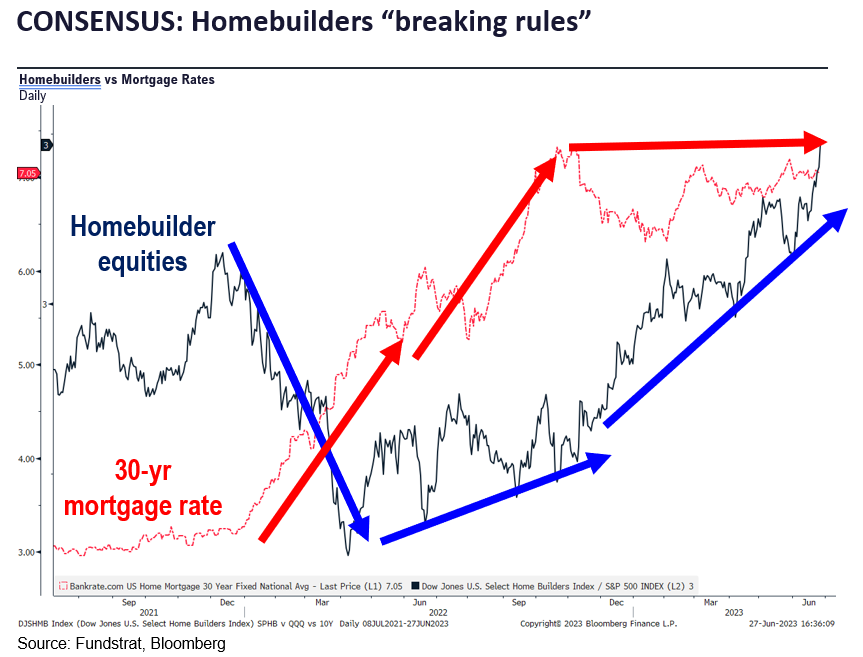

- Skeptics of the rise in equity markets this year centrally argue the stock gains are “narrow.” While it is true that FAANG/Tech are massive leaders (and remains our top sector pick), solace, pointing to what they argue is an extremely narrow market. That is a mischaracterization:

– ARKK ETF, +39% YTD: the “work from home” proxy

– Carnival Cruise Lines CCL -0.72% , +97% YTD: “revenge travel” (3rd best SPY 0.98% )

– Homebuilders ITB 1.19% +40% YTD: homebuilders defy higher rates - In other words, there are plenty of themes, stock ideas and cyclical stocks working. All of this is consistent with the picture that US corporates survived a massive gauntlet of challenges and are emerging stronger — the “nutty professor effect” and the US economy is generally rolling into an expansion.

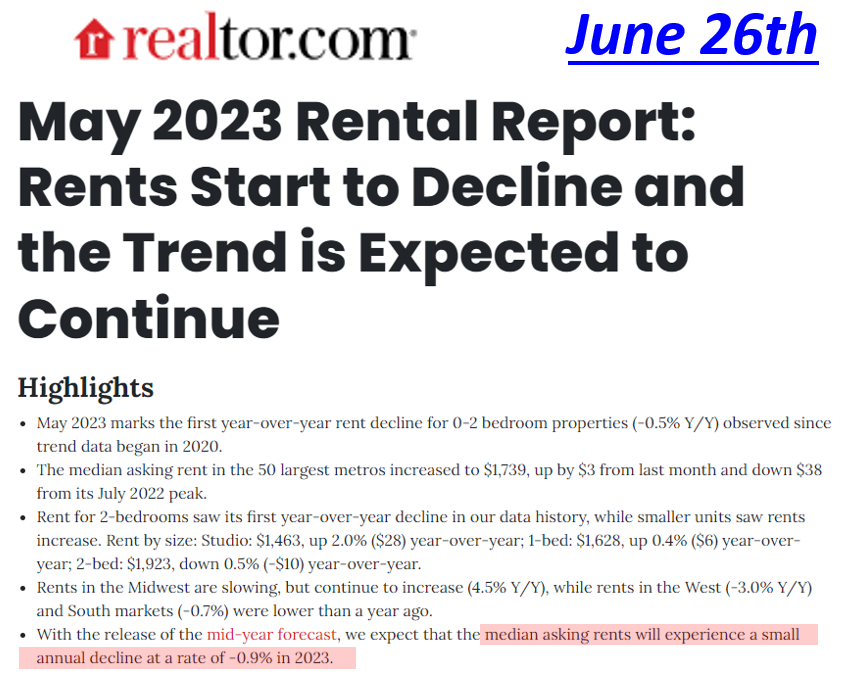

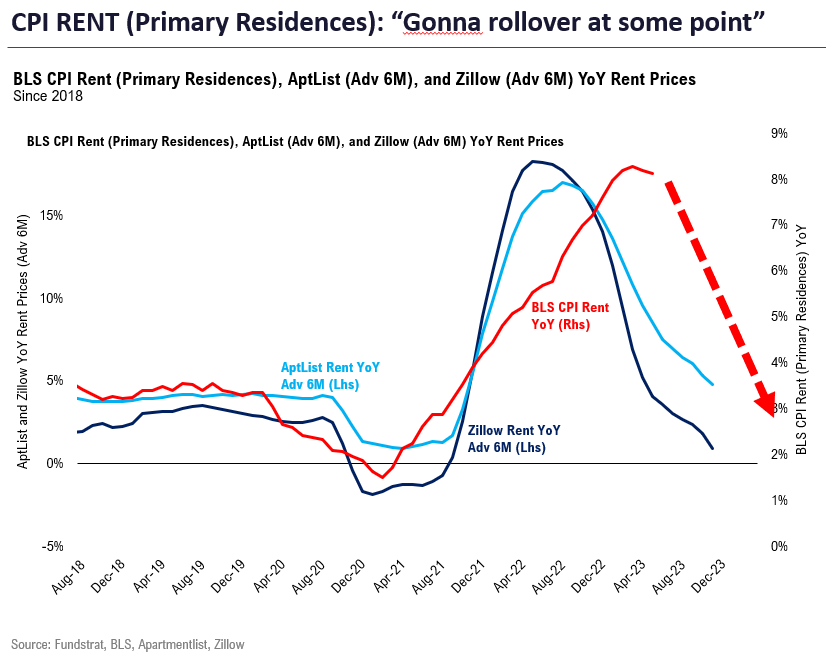

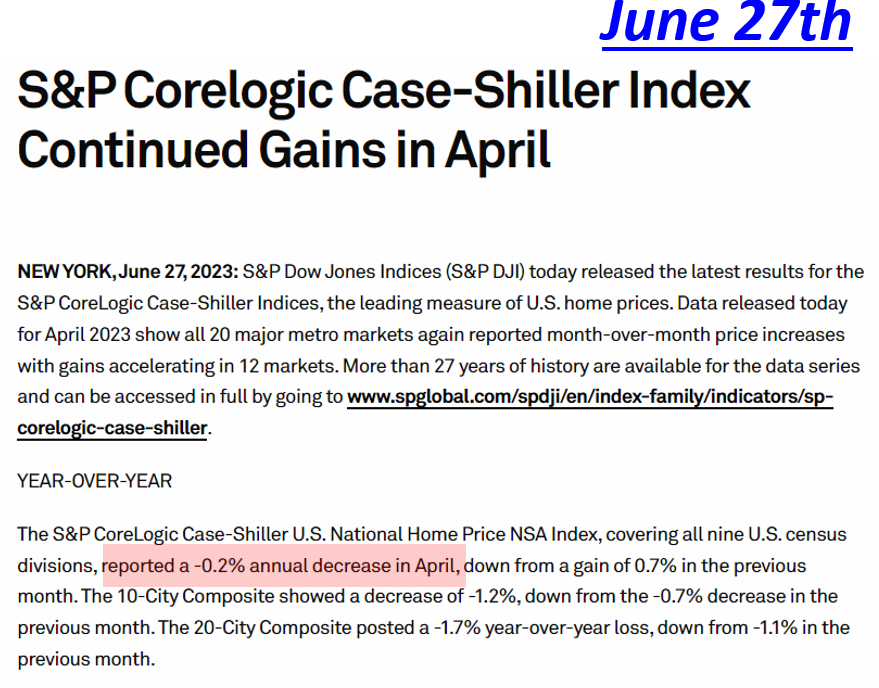

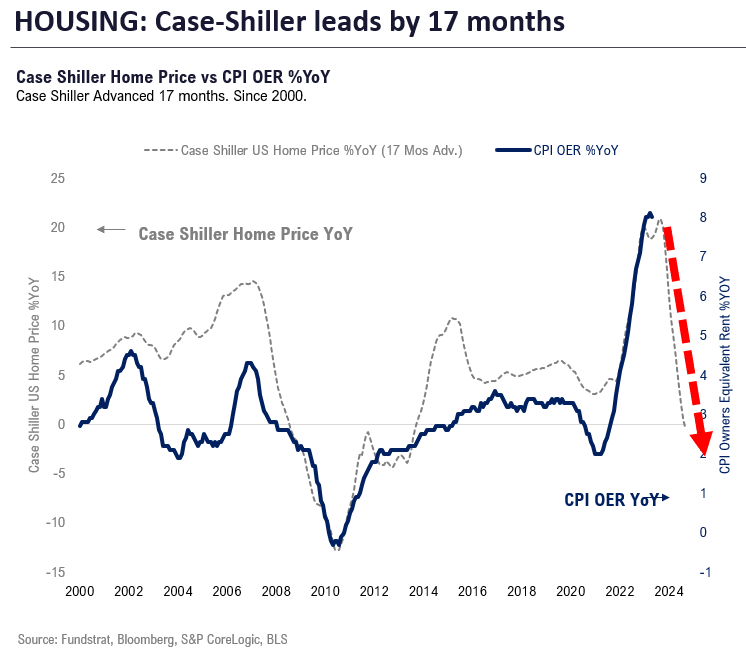

- We also got some very good news on housing/rent inflation this week with the Realtor.com (6/26) rent report and Tuesday’s S&P Corelogic Case-Shiller home price index. Both show that rents/home prices are now declining, or set to decline YoY. That is outright deflation, not “slowing inflation.” These real-time measures often get out of synch with actual CPI data. This is a well known fact as CPI is designed to smooth volatility, but naturally lags. This also means that real-time trends point to a different picture than what “lagging CPI” says.

- And this is known to the Fed. But the Fed has a tough job because they are fighting inflation and fighting to maintain credibility with the public. If the public doesn’t believe forward looking measures, skepticism today, and they only care about CPI. Guess what? The Fed has to focus on CPI. Shelter is a biggie. It is growing in CPI and is 42% of Core CPI and 17% of Core PCE.

- As for lags, according to our data science team, led by “tireless Ken,” the lead of real-time measures is as follows:

– Market rents lead CPI Rent by 6 months, on YoY data

– Market-based housing (CS) lead OER (owners equivalent rent) by 17 months on YoY

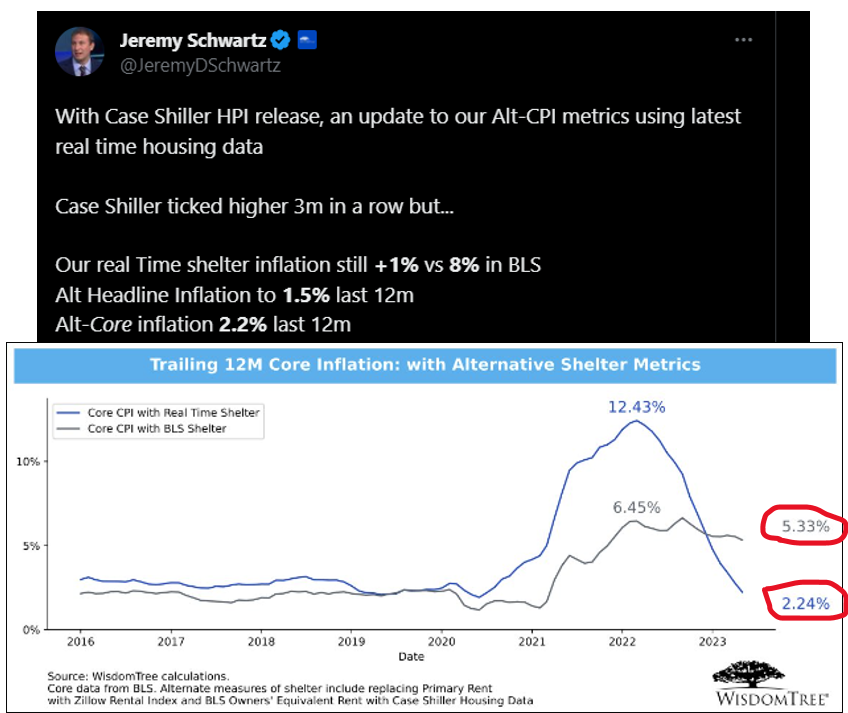

– this means lots of future CPI rent and OER is set to take a fall - Jeremy Schwartz of Wisdom Tree points out some great adjusted “real-time CPI” and according to his model, the following is the trend:

– CPI shelter: +1% vs +8% reported

– Core CPI: 2.2% vs 5.3% reported

– huge differences

BOTTOM LINE: We think investors should expect +12%-or higher second half 2023

We have spoken recently about how S&P 500 posting >10% gains in first half, leads to >12% gains in second half. And we see these favorable conditions in place for second half, led by a Fed that could “relent” on inflation:

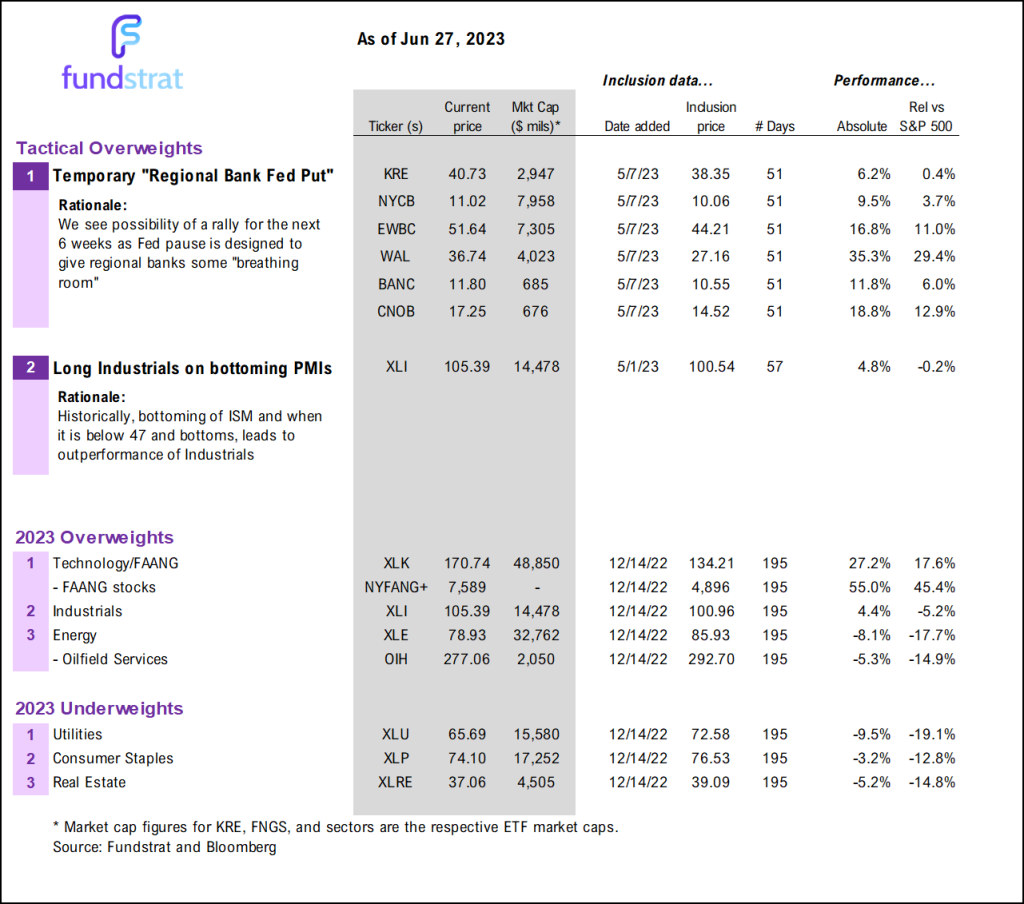

- We stick with our sector calls of:

– OW FAANG/Tech (like the laggards)

– OW Industrials on easing financial conditions/bottoming PMIs

– OW Energy, a laggard on tanking oil - We see Industrials as particularly timely, and Mark Newton, our Head of Technical Strategy, also notes that he believes the tactical timing is improving.

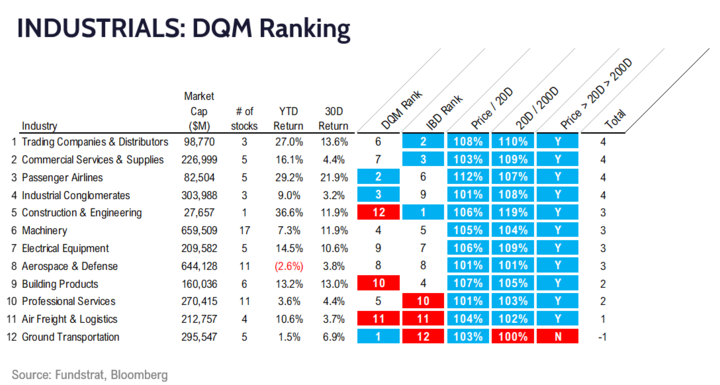

- Below is our latest ranking of the Industrial sub-groups, using the DQM model run by “tireless Ken” and these are the most timely, per this data science model:

– Trading Companies (3 stocks)

– Commercial Services & Supplies (5 stocks)

– Passenger Airlines (5 stocks)

– Industrials Conglomerates (3 stocks) - We discussed Airlines last week, so we want to give the names from the other 3 groups above.

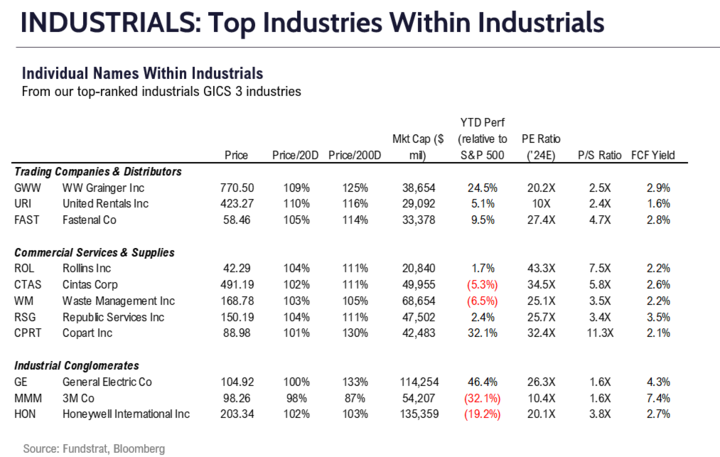

- Trading Companies & Distributors

GWW -1.96% WW Grainger Inc

URI United Rentals Inc

FAST 0.04% Fastenal Co - Commercial Services & Supplies

ROL 1.42% Rollins Inc

CTAS 0.15% Cintas Corp

WM Waste Management Inc

RSG -0.85% Republic Services Inc

CPRT 0.92% Copart Inc - Industrial Conglomerates

GE 0.68% General Electric Co

MMM 0.24% 3M Co

HON 0.22% Honeywell International Inc

Source: Twitter.com

ECONOMIC CALENDAR: FOMC keyin June

Key incoming data June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame- 6/30 8:30am ET May PCE

- 6/30 10am ET June Final U Mich 1-yr inflation

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

1982: 3 months after the low, consensus saying stocks cannot rally if earnings set to fall

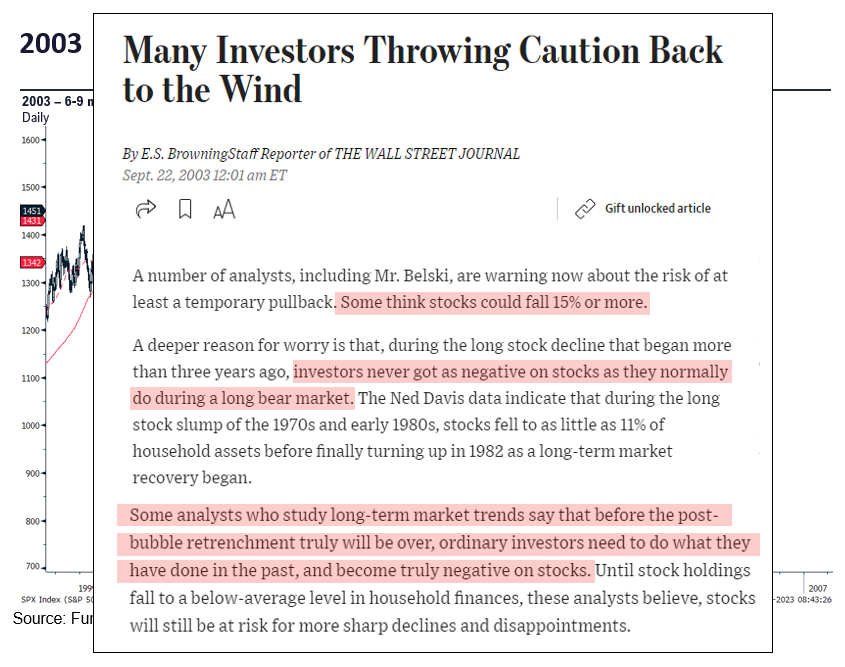

2003: 6-9 months after the low, consensus saying sentiment didn’t get “bearish enough”

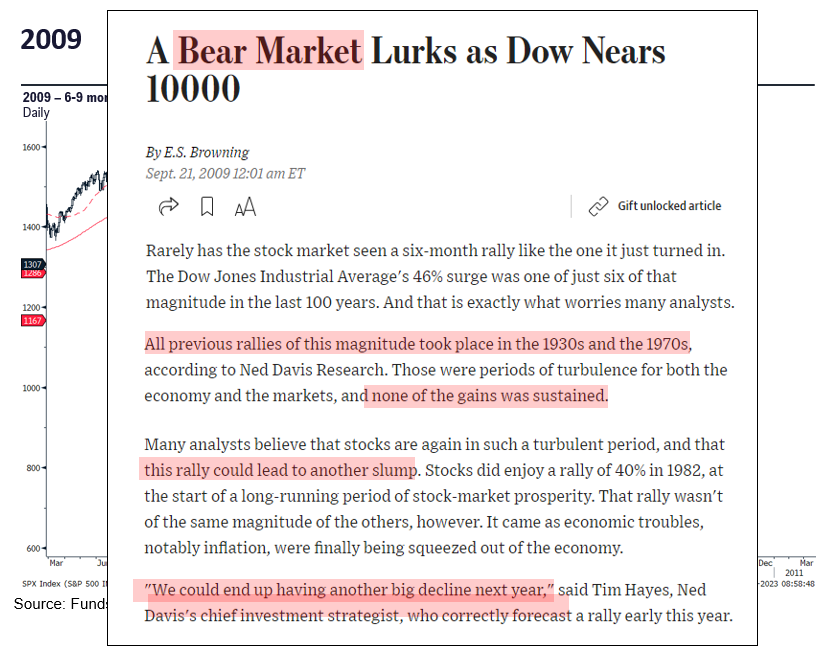

2009: 6-9 months after the low, consensus still predicting a “failed bear market rally”

_____________________________

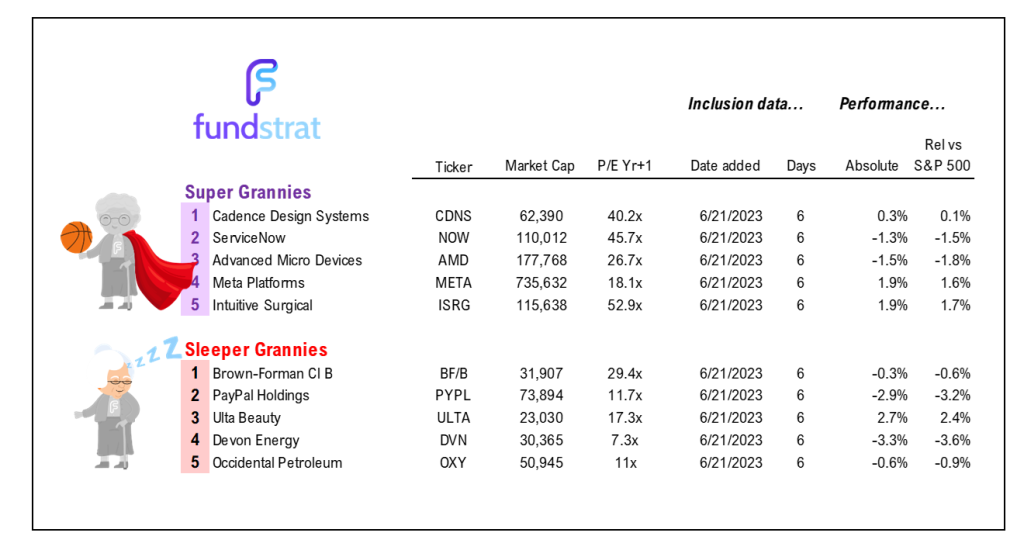

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday