Updating "Granny Shots" adding 7 names, deleting 9 -- seasonals favor inflection in "Pure Growth" + further upside in "Quality Defensive"

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

STRATEGY: Updating “Granny Shots” adding 7 names, deleting 9 — seasonals favor inflection in “Pure Growth” + further upside in “Quality Defensive”

Market shows resilience given macro headwinds. S&P 500 > 200D = good

We are 3 trading days into April, and S&P 500 is up modestly (+0.3%) and narrowed YTD losses to -4.3%. This shows resilience in equites given the macro headwinds and increased Fed hawkishness:

– Fed cumulative hikes for December 2020 is now 8.84 hikes (each hike = 25bp)

– this is up from 8 hikes at end of March

1Q2022 earnings season starts next week and stocks are biding their time at the moment. We think it is a good sign that the S&P 500 is managing to hold above the 200D, in the face of bad news.

– when a stock/ index is > 200D, that is considered being in an uptrend

– this can change, of course

– hence, hopefully, stocks can hold gains in the face of bad news

– and if there is “good news” (not a lot lately), then equities can further build upon gains

…hedge funds likely primary “buying power” in the next 3-6 months

JPMorgan’s prime brokerage team (JPM PB) March monthly report is pretty revealing, as it shows March was a month of intense de-risking by JPM PB clients, which are primarily hedge funds.

– the z-score of net activity is the blue line

– and reached > 3 std deviations in March

– this mirrors the major de-risking seen in 4Q18 and 1Q20

– both previous points were major turning points for equities

In other words, in the prior episodes, stocks had bottomed at that time. The implication being that HF selling pressure pushes markets down (naturally) and at the height of this de-risking, measured by z-score, is when stocks see the peak of selling pressure.

– this helps establish a bottom

The JPM PB report then shows that HF tend to re-risk from those nadirs. This is shown below and the peak is marked with green circles:

– the JPM PB team’s implication is that HF might be turning into net buyers for stocks

– this buying provides a natural bid to equities

– this could explain why stocks are drifting higher

– and VIX stable at low 20s is also aiding the risk-increase

– the prior episodes of 4Q18 and 1Q20 took several months

– before HF were “re-risked”

Thus, if 2022 plays out in a similar way, this would support our view that stocks might have made their low for 2022. Based on the recovery of the 200D (see note from last week), we think this probability could be greater than 88%.

STRATEGY: Rebalancing Granny Shots, including style rebalance to favor “Pure Growth” and “Quality Defensives”

We have completed our quarterly rebalance of Granny Shots. As a brief reminder, our Granny Shots are comprised of stocks which are most commonly found across our 6 thematic/ quantitative strategies. The major rebalance this quarter is the style rebalance, along with a change in the composition of the Granny Shots portfolio:

– top 2 styles recommended for the next 6 months

– Pure Growth and Quality Defensive

– while the two sectors sound contrary to one another, the common rationale

– is a market that is gradually becoming “risk-on”

– as such, large-cap steady growers (above GDP), with lower P/E multiples could outperform

– this is both large-cap Tech (“pure growth” proxy) and defensive stocks like Healthcare/ Staples

– the Granny Shots rebalance

…Two best style tilts are Pure Growth and Quality Defensives

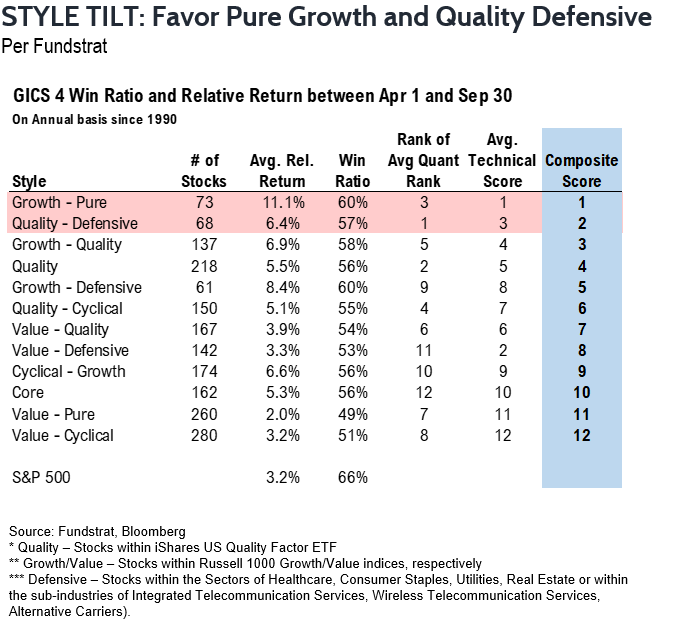

The win-ratio and expected 12M return (relative to S&P 500). The 12 styles and their seasonal expected return is below:

– of the 12, the two best are Pure Growth and Quality Defensive

– average 12 month relative return is +11.1% and +6.4%, respectively

– win ratio is 60% and 57%, respectively

This is derived both on quantitative and technical factors, and takes into account seasonal factors.

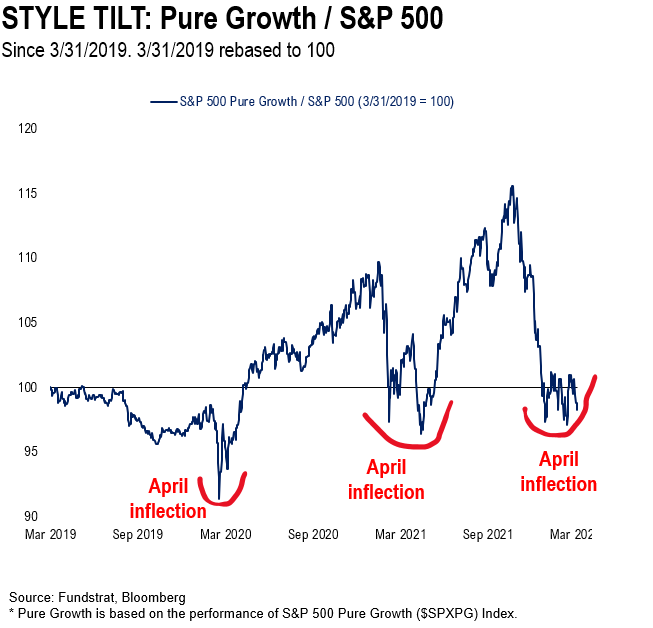

…Pure Growth looks like end of March is seasonal inflection

Seasonally, it looks like a good time to be shifting to a “Pure Growth” tilt. Take a look below, and you can see the positive inflection with Pure Growth at the end of March:

– end of March 2020, 2021 saw a positive inflection of outperformance

– in 2022, given the steep massive under performance since Oct 2021

– it looks like this inflection might be in the early stages again

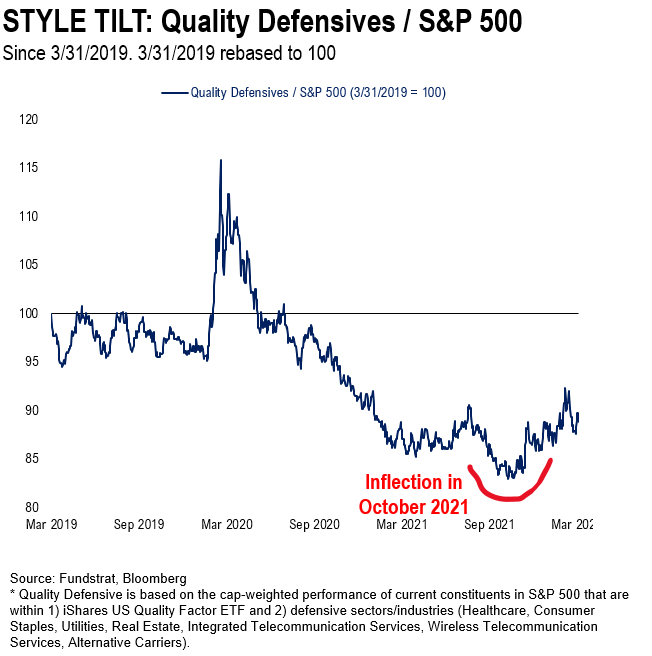

…Quality Defensives have been quietly outperforming since October 2021, and possibly hitting stride next 3-6M

As for Quality Defensives, take a look below. The relative performance of Quality Defensives have been bottoming for some time. This bottoming looks like a process underway for some time:

– Quality Defensives started bottoming in Oct 2021

– recently turned upwards

– lots of relative performance ahead if this is happening

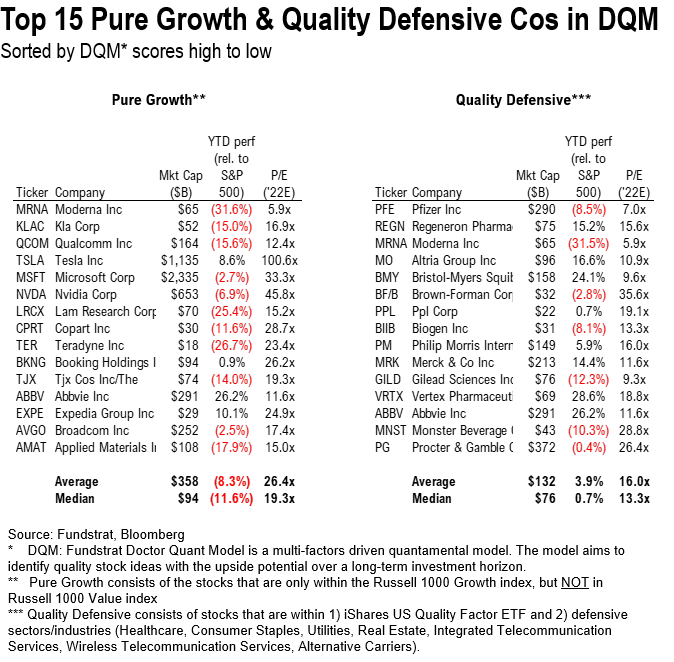

Representative list of top 15 stocks (based on DQM Quant) in Pure Growth and Quality Defensive

If one is wondering what type of stocks make up the Pure Growth and Quality Defensive lists. Take a look below.

– these are the top 15 stocks within the S&P 500 “Pure Growth” and “Quality Defensive” indices

– these top 15 are based on their quantitative score based upon DQM Quant model.

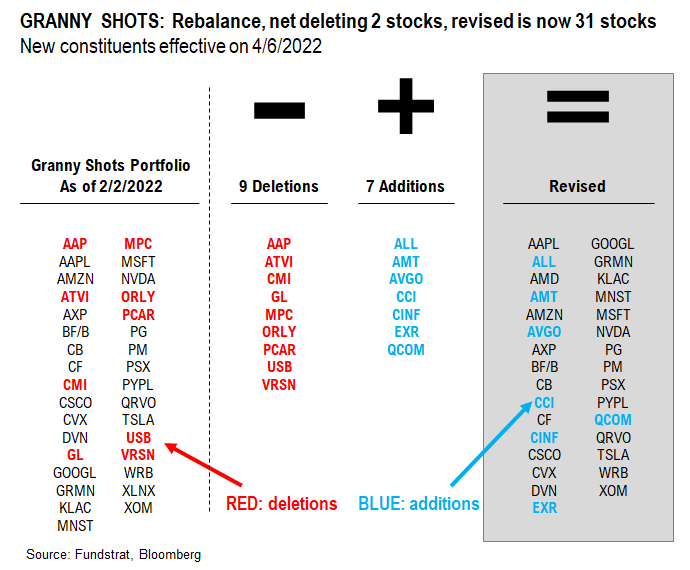

STRATEGY: Granny Shot rebalance, add +7, delete -9, net -2. 2022 YTD relative performance +275bp

The Granny Shots is going through the standard quarterly rebalance. And this involves updating each of the 6 thematic/quantitative portfolios.

– the latest list is now 31 stocks

– this fell by -2, driven by +7 additions and -9 deletions

7 Additions: AVGO -1.19% , QCOM 0.31% , ALL 0.25% , CINF 1.30% , AMT -0.22% , CCI -1.09% , EXR 0.36%

9 Deletions: VRSN, ATVI, AAP 0.81% , ORLY 0.40% , CMI -0.80% , PCAR 0.07% , MPC 2.81% , GL 2.54% , USB

The rebalanced list of 31 stocks is below:

Consumer Discretionary: AMZN 0.48% , GRMN 0.56% , TSLA 1.50%

Communication Services: GOOGL 1.14%

Information Technology: AAPL 0.04% , AMD 1.03% , AVGO -1.19% , CSCO -0.33% , KLAC -0.24% , MSFT -0.23% , NVDA -1.98% , PYPL 0.58% , QCOM 0.31% , QRVO -1.09%

Basic Materials: CF -1.42%

Financials: ALL 0.25% , AXP 0.62% , CB 3.55% , CINF 1.30% , WRB

Energy: CVX 0.98% , DVN 0.85% , PSX 0.85% , XOM

Consumer Staples: BF/B, MNST 0.04% , PG -0.33% , PM -0.82%

Real Estate: AMT -0.22% , CCI -1.09% , EXR 0.36%

The rundown of stocks with the most overlap are listed below:

– appearing in 5 of 6 thematic/quant portfolios are AAPL 0.04% and MSFT -0.23%

Granny Shots outperforming by 275bp YTD…

Granny Shots is outperforming the S&P 500 by 275bp YTD. The monthly relative performance is shown below:

– 2022 YTD relative performance is +275bp

– Jan and Feb were strong relative performance

– March was down slightly

– April is similar

– 2021 relative outperformance was +392bp

– 2020 relative outperformance was +3,015bp

STRATEGY: We lean “bullish” into 2Q2022, but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

– this is in context to a challenging 1H2022

– so jagged next 3 months

– but > 88% probability that bottom for 2022 is in

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO 2.64% GBTC 2.72% BITW 3.20%

– Energy

– FAANG FNGS -0.09% QQQ -0.07%

Combined, it can be shorted to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL 0.04% AMZN 0.48% NFLX 1.71% GOOG 1.06%

All in all, one wants to be Overweight BEEF

31 Granny Shot Ideas:We performed our quarterly rebalance on 04/05.

See above for more details, the Granny Shots page will be updated shortly.

DATA ON RUSSIA-UKRAINE WAR: Tracking Russia-Ukraine war statistics — 3,657 Ukrainian civilian casualties so far

Our data science team, led by tireless Ken, is scraping data from several sources to track some high level data around the Russia-Ukraine war.

– Ukrainian civilian casualties

– Ukraine population movements

– Ukrainian military losses, except personnel

– Russian estimated losses of personnel and material

Ukraine has lost an estimated 91% of its tanks and 95% of its aircraft

Our data science team, led by tireless Ken, has been tracking the casualties and losses associated with the Russia-Ukraine war. And while Ukraine has staged an impressive resistance, the reported losses of equipment show that Ukraine has lost a substantial share of its equipment:

– by our team’s analysis, using reported data

– Ukraine has lost 1,969 tanks or 91% of its equipment

– Ukraine has lost 125 aircraft, or 95% of its fleet

By these measures, the armament of that army is rapidly depleting. I am not sure if this is a well known fact. But this also highlights why the nation is seeking to replenish its equipment.

With each passing day, Ukraine is experiencing further losses of critical equipment.

When we hear Russia has deployed 150,000 soldiers in Ukraine, this is not 150,000. As many military people know, for every front-line soldier, there are 4 support soldiers:

– 1 frontline soldier

– 4 support, fuel, ammo, logistics, supply lines, etc, cooks

Thus, if there are 150,000 Russian soldiers in Ukraine, about 30,000 are doing the actual fighting.

– Using data from Ukraine’s Ministry of Defense, estimates of Russian casualties are about 18,500

– Presumably these are front-line soldiers

– Unless Ukraine soldiers are “attacking from behind” and hitting supply lines

This implies over 50% of the frontline soldiers are casualties.

The number of casualties is 130 on 4/4, and a total of 3,657 have been reported to the UN.

The flow of migrations out of Ukraine had been steady at about 100,000 to 200,000 per day, but continues to gradually decline and is now around 30,000 per day. And a total of 4.2 million have fled so far.

– 53% are entering into Poland

– curiously, 8% or 350k or so, have entered Russia

If one is wondering about reported losses of equipment, we are citing statistics provided by the opposing ministry officials.

– est. 125 Ukraine planes lost

– est. 1,969 tanks lost

– this seems like a lot of equipment

Russian losses are higher

– est. 18,500 Russian soldiers killed

– est. 676 tanks

– est. 150 aircraft

– est. 1,858 armored vehicles

Our team says this data is scraped and can be updated daily. So, we will post these figures for now. And that way, we can get a sense for the intensity of the hostilities.

Thomas Hu, of Kyber Capital, also shared this website which is a crowd sourced view of reported activities. There is a lot to the website, and I encourage you to check it out. The website URL is https://maphub.net/Cen4infoRes/russian-ukraine-monitor

For instance, if you click on one of the icons, a verified post is shown. There is geolocation and other data attached.

POINT 1: Daily COVID-19 cases

This data will be updated every Thursday.

POINT 2: Vaccination Progress

This data will be updated every Thursday.

POINT 3: Tracking the seasonality of COVID-19

This data will be updated every Thursday.