Delta variant likely gives market "transitory panic" in July. S&P 500 rally +100 to 4,400 then end month at 4,300

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

- Monday

- Tuesday

- Wednesday

- SKIP THURSDAY

- Friday

STRATEGY: Delta variant likely gives market “transitory panic” in July. S&P 500 rally +100 to 4,400 then end month flat?

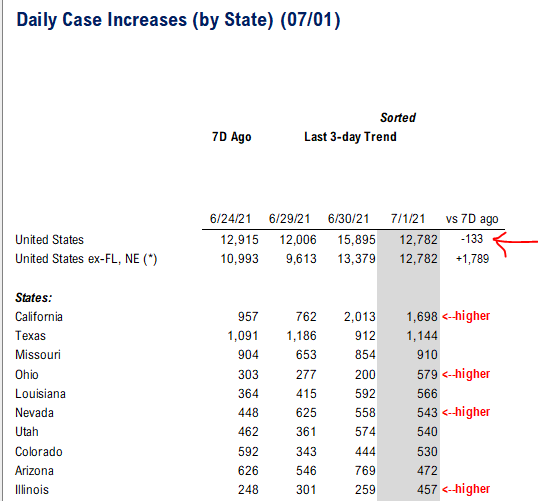

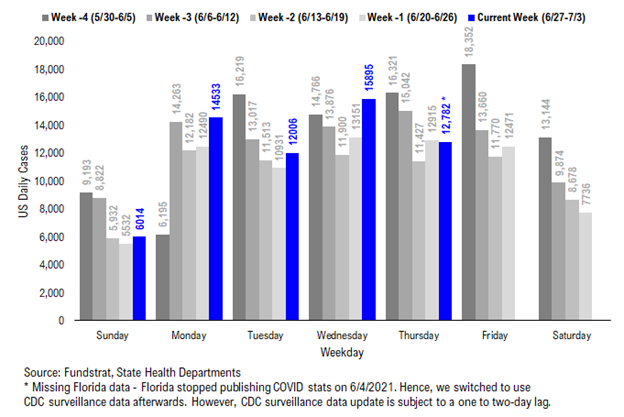

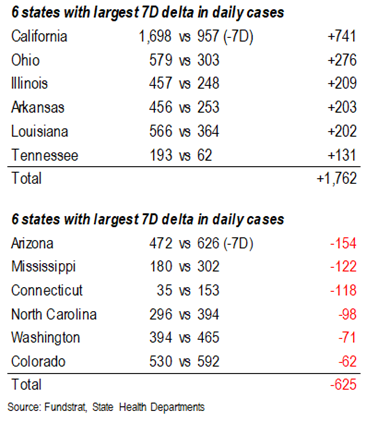

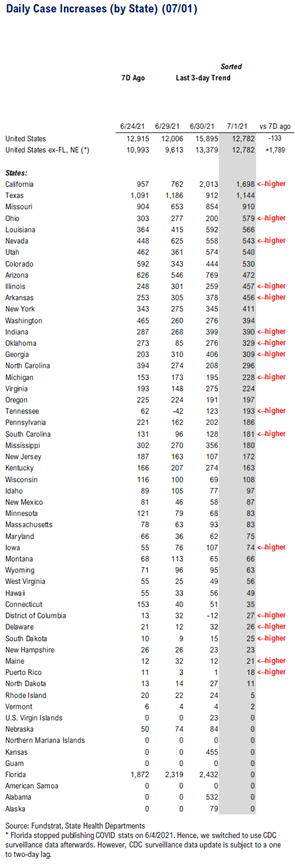

So far, US COVID-19 cases are not following the parabolic surge seen in the UK. Case trends are rising and evidenced by simply looking at the table below. Many states are seeing a rise in cases. The mRNA vaccines are shown to be effective against the Delta variant, so low vaccination rates/ unvaccinated Americans will be the ones vulnerable:

– our central case is that 10-15 states might seen a parabolic rise in cases in new few weeks

– this would mirror the linear rise in UK, then a sudden parabolic rise

– but we do not expect this to lead to lockdowns

– this will be likely result in a renewed surge in vaccinations

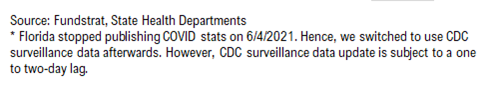

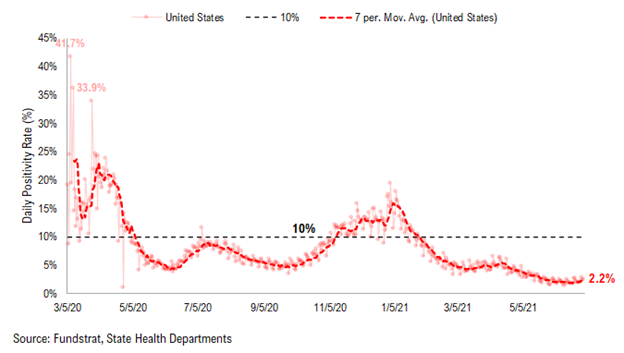

The positivity rate is now 2.2% and rising. It had fallen to sub-2% for many weeks and is now curling upwards. This is surely a sign that Delta variant, or the virus itself, is finding new individuals to infect. But again, we are not panicking here. The vaccination rates are higher in the US than many places in the world. And the penetration of the mRNA vaccines are particularly high.

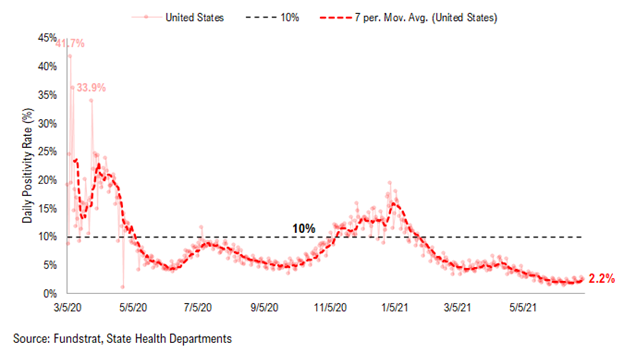

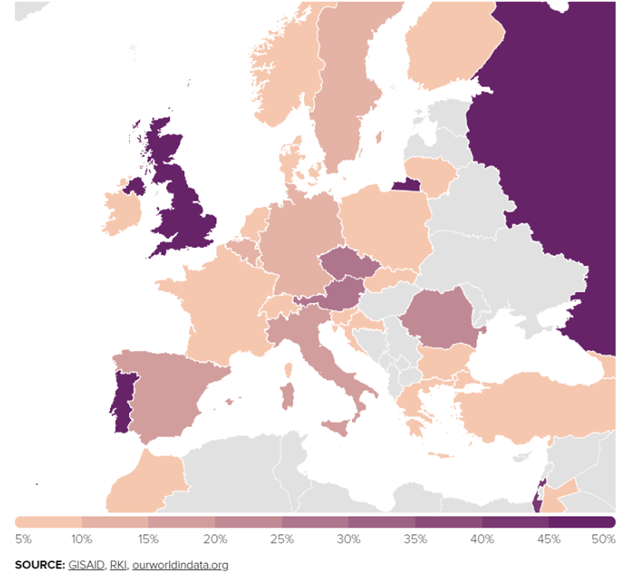

…Curiously, UK is the only European nation with a surge

I am not sure why the delta variant is spreading so rapidly in the UK, but not throughout Europe. This could be a matter of timing. That is, Germany, France, etc are soon going to see a surge in cases associated with the delta variant. But this is something we are watching.

And tireless Ken found this chart. The darker the color, the greater the share of the Delta variant. And as you can see, the delta variant is in Europe, but the share is small.

– my guess?

– Delta variant likely causes a surge in nations with low vaccination rates

– or nations with low mRNA penetration

STRATEGY: Our central case is “transitory panic” of Delta cause July to be “flat”

In July, there is a strong possibility that the narrative around stocks becomes somewhat complicated. That is, there are both positive and negative influences, and as a result, our central case remains that July will be a month of “chop” and probably a decline. Our stylized view is shown below:

– S&P 500 rally to +100 points to 4,400 by mid-July

– then decline of possible 300 points

– recovery to end the month at 4,300

The conflicting factors are:

– stabilizing interest rates = stock go UP

– institutional cash off sidelines = stocks go UP

– VIX finding stablity at 15-ish = stocks go UP

– infrastructure bill moving along = stocks go UP

– 2Q2021 gonna be strong = stocks go UP

But…

– Delta variant could become “parabolic” in 10-15 states in July = headline RISK

– Europe could face a Delta variant surge = headline RISK

– Equity markets extended = downside RISK

– July historically tougher month if S&P: 500 >13% 1H2021 = downside RISK

– Consensus is a July rally = countertrade RISK

…Delta variant likely gives market “transitory panic” in July

So, on the surface, one could argue the central case should be “July rip higher in stocks” given the confluence of positive factors. While the path of equities always make sense in hindsight, the risk of a rise in the delta variant likely impacts markets in a “transitory manner”:

– CEOs on 2Q2021 earnings calls might “dial back” confidence due to Delta variant

– OPEC decisions likely impacted by Delta variant as risk to economic recovery unknown

– good news Fed likely to be “dovishly” tilted due to Delta variant

STRATEGY: FAANG likely strengthens in July, but Epicenter still solid. Energy remains favorite sector

As we look into 2H2021 and July 2021, we remain favorable towards Epicenter stocks. I realize these got hit hard in mid-June and have since slowly recovered. In a way, this is reminiscent of the beating FAANG took early in 2021. After stabilizing, FAANG recovered its footing.

We thought it would be helpful to summarize our views on our Overweight sectors:

FAANG…

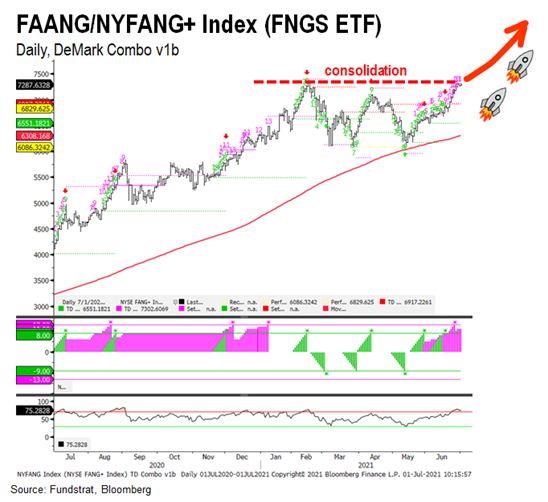

– FAANG (FNGS 2.50% MAFANG FNGU 8.35% ) –> ready for breakout. “Delta transitory panic” = good

– Communications Services (XLC 2.76% ) –> “Delta transitory panic” +good recovery in media, theme parks = good

Epicenter…

– Energy (XLE -0.92% OIH -0.06% ) –> still favorite sector –> massive FCF generation + Capex shortfall = price support

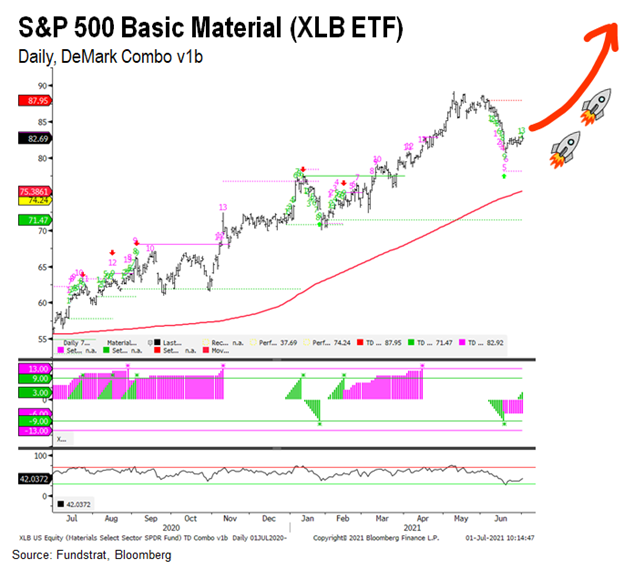

– Materials (XLB 0.62% ) –> great FCF generation = good

– Industrials (XLI 0.16% ) –> demand surprise = good

– Discretionary (RCD XLY 0.90% ) –> revenge spending = good

In other words, there are still positive factors supporting our Overweight sectors. We see the equity markets in July broadening, so there should be wide participation on the way to S&P 500 4,400.

…FAANG looks strong and a long consolidation

The fundamental for FAANG remain among the strongest in the S&P 500, both in topline growth and in profit margins. But the headwinds seen in stocks in early 2021 were a function of:

– rising interest rates

– FAANG over-owned

– other sectors seeing better growth

But as interest rates have cooled, and as FAANG valuations have come in, these stocks look to be strong risk/reward in our view. After all:

– if S&P 500 is +25% in 2021

– AAPL -0.41% is only +3.5% YTD, +22% in 2H2021? Maybe

– AMZN 3.36% is only +5.4% YTD, +20% in 2H2021? Maybe

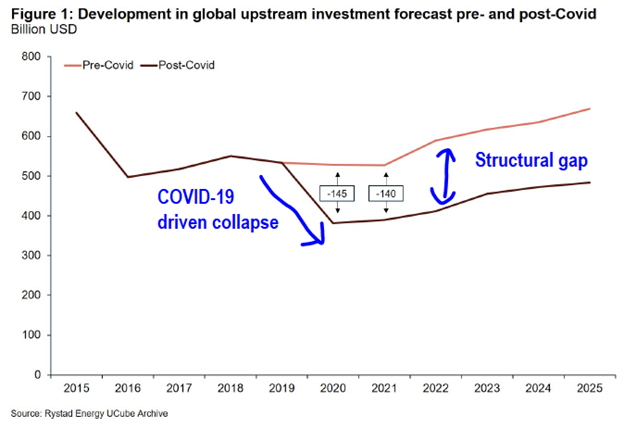

…Energy top sector idea because massive FCF + structural deficit capex = support for prices

Energy remains our favorite sector because of the best alignment of supply/demand fundamentals seen for oil, perhaps the best in more than a decade. Take a look at the Rystad capex analysis below (we published this previously, see our prior notes) and you can see the ~$300 billion capex shortfall.

– this structural gap means future oil production will fall

– Delta variant impacting OPEC willingness to expand quotas

– Demand surprise as US consumers recover and business resume meetings

Oil market outlook healthy.

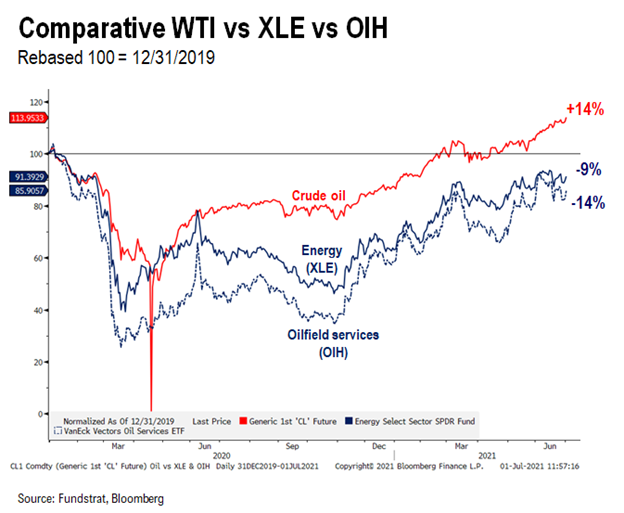

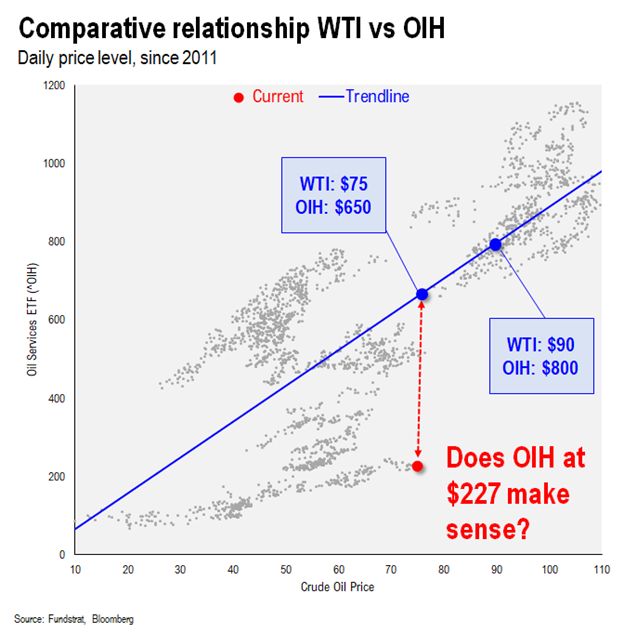

…$75 oil not reflected in XLE or OIH

And as shown below, WTI has alreaday recovered to +14% above pre-pandemic levels. This means Energy stocks should be above pre-pandemic levels. But this is not the case.

– this is surprising considering the near record FCF generation by the industry

– fundamentals are justifying a return to these stocks

– Energy is 12%/11% of 2021/2022 S&P 500 EPS growth, and only 2.5% of sector weight

We see the greatest upside in OIH. As shown below, at $75 oil, OIH should be $650 versus $228 on Monday. Prior to 2020, OIH never traded below $400 when WTI was $75

– means upside is large

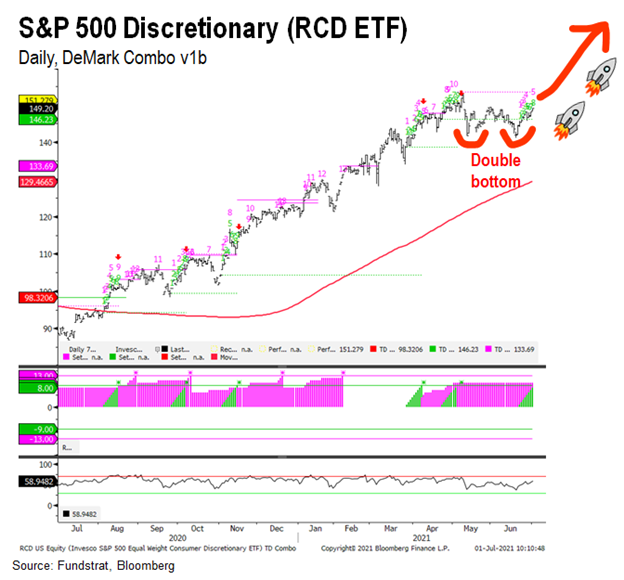

…Discretionary looks very strong –> likely double bottom = moon

Discretionary suffered mightily for the past 8 weeks but we think we see the signs of a double bottom forming. The pent-up consumer demand along with infrastructure spending are powerful tailwinds. So we think Discretionary will be strong in 2H2021.

– revenge consumer spending

– strong operating leverage

– benefit from fiscal programs including infrastructure spend

…Industrials showing strong gains in recent weeks

Industrials similarly are showing nice relative strength in recent weeks. Like Basic Materials, Industrials saw a deep pullback. While “delta transitory panic” might be a headline issue, we think investors will use that weakness to add further exposure.

– benefit of global re-opening

– strong operating leverage

– positive leverage to fiscal stimulus/infrastructure

– “revenge capex” coming = topline upside

…Basic Materials is climbing its way back after a deep pullback

Basic Materials suffered a steep pullback in June but has since found footing. Given the group was so oversold, we see upside in July.

BOTTOM LINE: Strong markets stay strong but July might be choppy

Going forward, we see strong 2H gains. We think leadership from this rally is both Epicenter and FAANG:

– Energy remains our favorite sector, given the positive supply/demand dynamics in oil

– FAANG benefits from the “undershoot” of interest rates, relative to consensus

– we also like Epicenter stocks broadly, and the incoming data this week should be supportive

– But July has complex and conflicting headwinds

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Technicals

– Violence in USA –> companies that are involved in some aspect of home or personal security. We are not “recommending” these stocks, but rather, bringing these stocks to your attention.

Granny Shots:

Full stock list here –> Click here

Trifecta Epicenter (*):

Full stock list here –> Click here

Power Epicenter Trifecta 35 (*):

Full stock list here –> Click here

Violence in USA:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

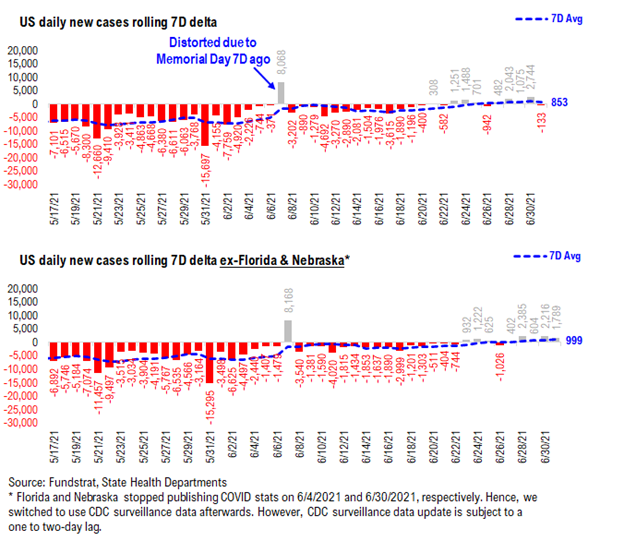

POINT 1: Daily COVID-19 cases 12,782, up +1,789 (ex-FL&NE) vs 7D ago…7D delta has been positive in 8 of the last 9 days…

_____________________________

Current Trends — COVID-19 cases:

– Daily cases 12,782 vs 12,915 7D ago, FL and NE data are not available

– Daily cases ex-FL&NE 12,782 vs 10,993 7D ago, up +1,789

– 7D positivity rate 2.2% vs 2.1% 7D ago

– Hospitalized patients 14,092, up +2.4% vs 7D ago

– Daily deaths 253, down -17% vs 7D ago

_____________________________

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, as CDC surveillance data is subject to a one to two-day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

The latest COVID-19 daily cases came in at 12,782 up +1,789 (ex-FL&NE) vs 7D ago. The number of daily new cases has been creeping up recently. 7D delta has been positive in 8 of the past 9 days. Although the speed of the case increase is still linear (not parabolic like UK), the Delta variant is proving to be an obstacle in eliminating COVID-19 from the US.

As we noted previously, the vaccination penetration appears to have some causal relationship with the case trend as the case figures are rising most in the states with relatively lower vaccination rates. Hence, if the case figure truly starts to surge rapidly, we expect policymakers to make a renewed push for vaccination rather than to reintroduce lockdowns.

But the future is uncertain, and COVID (and its variant) remains mysterious. We will be closely watching the relevant data and provide our clients with the latest COVID development.

7D delta in daily cases (ex-FL&NE) has been positive in 8 of the past 9 days…

The 7D delta has been positive in 8 of the last 9 days. Although the 7D delta has not exploded to the upside, the positive 7D delta indicates the case figure starts to rise. The COVID data in the next one or two weeks are crucial – they could show us whether states with higher vaccine penetration will have proportionally lower cases and COVID-associated deaths. And it could also provide policymaker with insight on how to respond to the possible case surge.

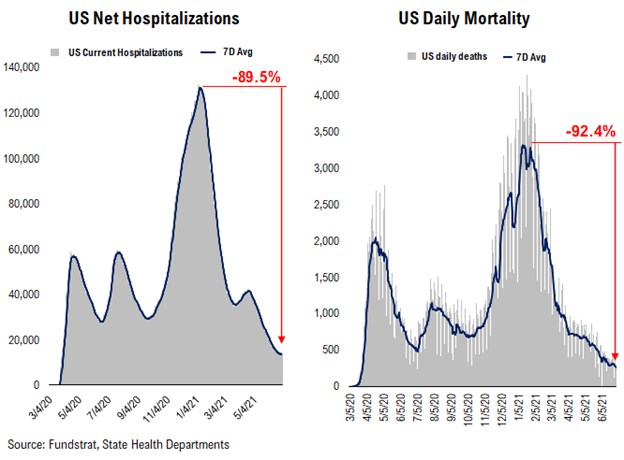

Current hospitalization, daily deaths and positivity rate are at all time low, but the declines have stalled…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID. As you can see, all three metrics are at their all-time lows since the start of the pandemic. However, the declines in these three metrics have recently stalled. In fact, the positivity rate has edged up slightly.

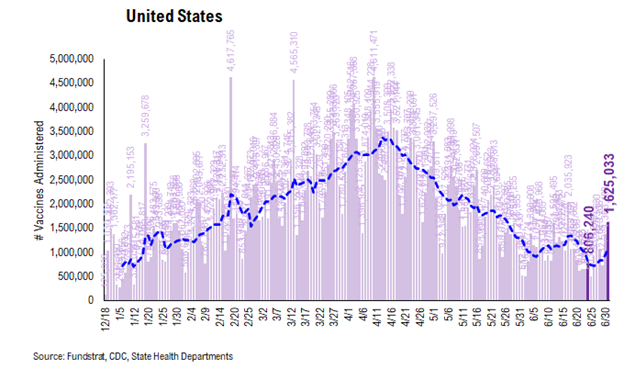

POINT 2: VACCINE: Vaccination pace has improved and the number of doses administered per day has accelerated to the upside. Do people start to worry about the Delta variant?

_____________________________

Current Trends — Vaccinations:

– avg 1.1 million this past week vs 0.8 million last week

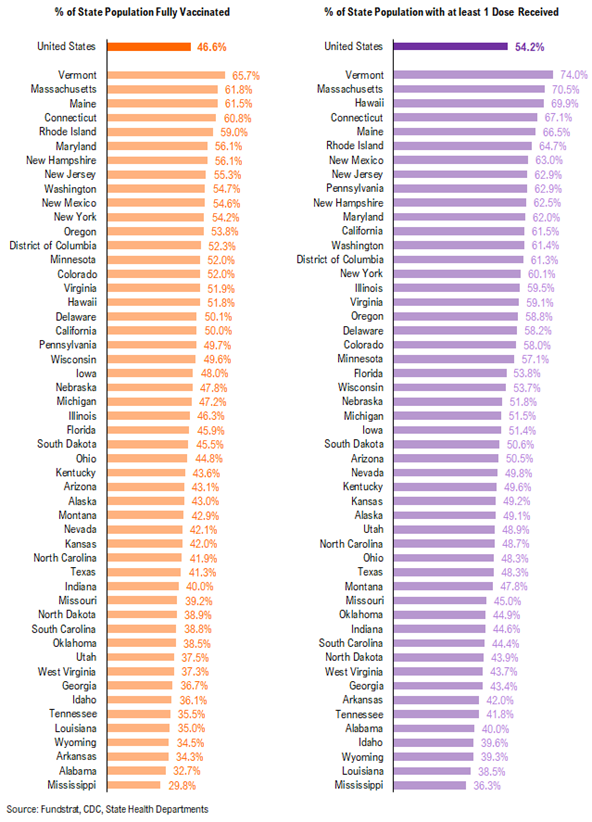

– overall, 46.6% fully vaccinated, 54.2% 1-dose+ received

_____________________________

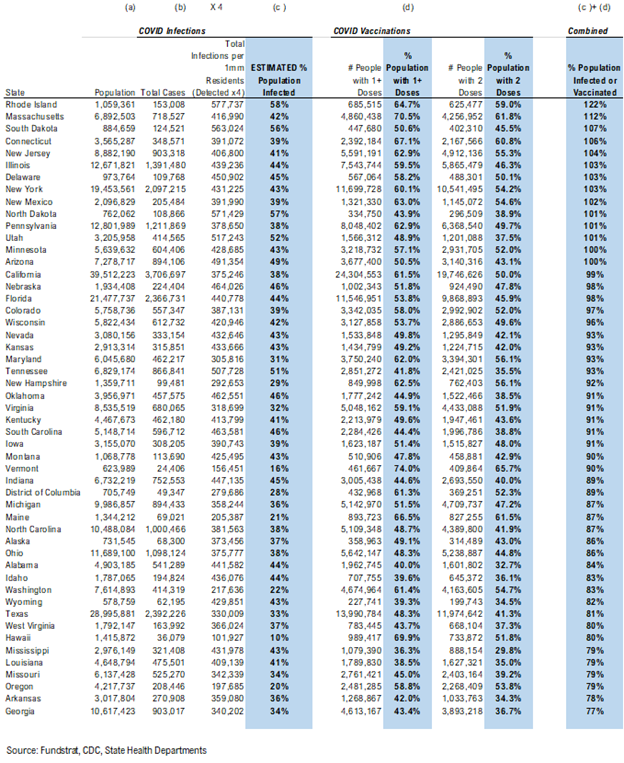

Vaccination frontier update –> all states now near or above 70% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). As we commented in the past, the key figure is the combined value >60%, which is presumably near herd immunity. We have overlaid our case progress with that of Israel several times to demonstrate what should happen to cases once immunity reaches a certain critical level in the population. That is, the combined value of infections + vaccinations as % population > 60%. The persistent and rapid decline in cases suggest that the US is following a similar path to Israel (see our prior notes) while nations with less penetration continue to struggle more.

– Currently, all states are near or above 70% combined penetration

– RI, SD, MA, ND, CT, NJ, DE, NY, IL, UT, MN, NM, NE, AZ, PA are now above 90% combined penetration (vaccines + infections)

– So gradually, the US is getting to that threshold of presumable herd immunity. So long as a vaccine resistant variant doesn’t spread widely, the continued retreat of cases should continue.

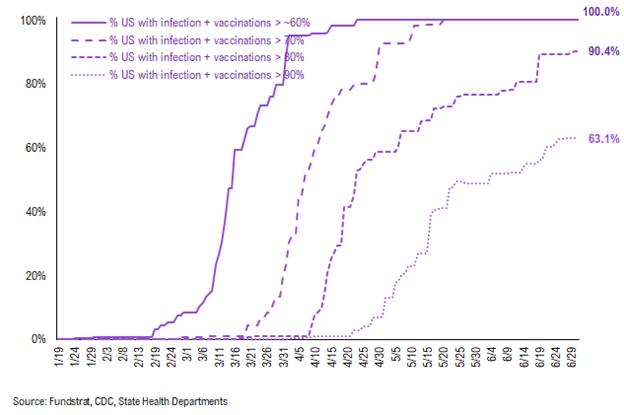

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration >60%/70%/80%/90%. As you can see, all states have reached 60% and 70% combined vaccination + infection. 90.4% of US states (based on state population) have seen combined infection & vaccination >80% and 63.1% of US states have seen combined infection & vaccination >90%.

There were a total of 1,625,033 doses administered reported on Thursday. Over the past 7 days, 1,059,256 doses were administered per day on average, up 31% from 7D ago. The vaccination trend has improved and the number of doses aminidersted per day is accelerating to the upside recently. As we wrote previously, the spread of Delta variant across the country could incent more people to seek getting vaccinated. And the recent data seems to suggest that.

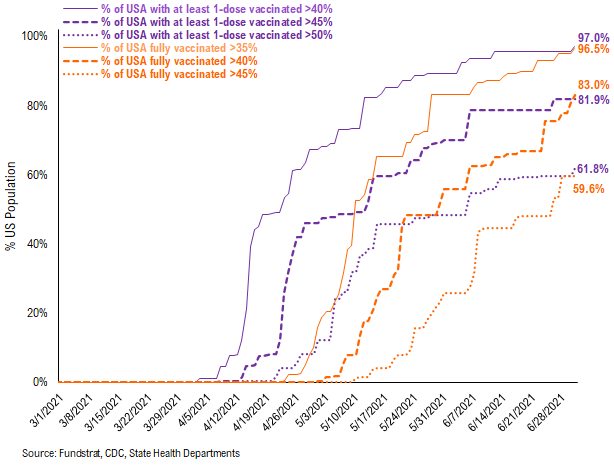

97.0% of the US has seen 1-dose penetration >40%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 35%/40%/45% of its residents fully vaccinated, displayed as the orange line on the chart. Currently, 96.5% of US states have seen 35% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 40% of its residents fully vaccinated, this figure is 83.0%. And only 59.6% of US (by state population) have seen 45% of its residents fully vaccinated.

– While 97.0% of US states have seen vaccine penetration >40%, 81.9% of them have seen 1 dose penetration >45% and 61.8% of them have seen 1 dose penetration > 50%.

– 96.5% of the US has at least 35% of its residents fully vaccinated, However, only 83.0% of US has fully vaccinated >40% and 59.6% of US has fully vaccinated >45%.

This is the state by state data below, showing information for individuals with one dose and two doses.

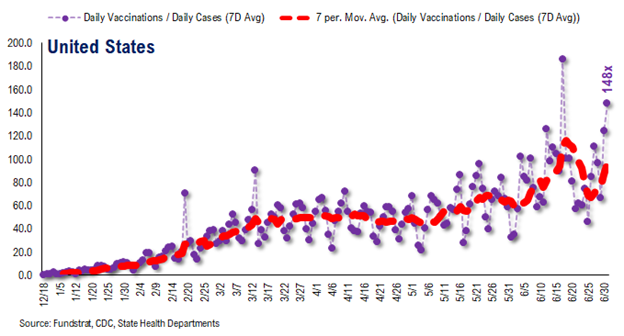

The ratio of vaccinations/ daily confirmed cases is generally trending higher (red line is 7D moving avg), but it has fallen over the past few days due to the stalled vaccination rate.

– the 7D moving average is about ~60 for the past few days

– this means 60 vaccines dosed for every 1 confirmed case

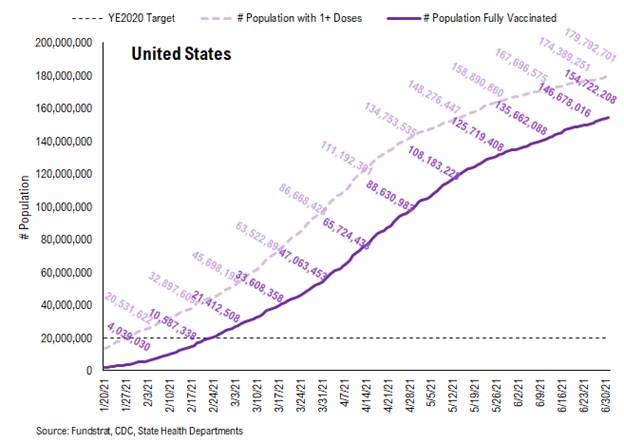

In total, 323 million vaccine doses have been administered across the country. Specifically, 180 million Americans (54% of US population) have received at least 1 dose of the vaccine. And 155 million Americans (47% of US population) are fully vaccinated.

POINT 3: Tracking restrictions lifting and subsequent effects in individual states

Point #3 focuses primarily on tracking the lifting of restrictions, as states have eased the majority of mandates. Keep in mind, easing/lifting restrictions are contingent upon state of emergency ordinances being renewed.

– States in groups 1 and 2 represent states that let their emergency ordinances expire, or that never had one in the first place

– Note: IL and HI are not listed. This is because restrictions lifting is determined at the county / island level, and no statewide policy will be established to lift restrictions until a full reopening

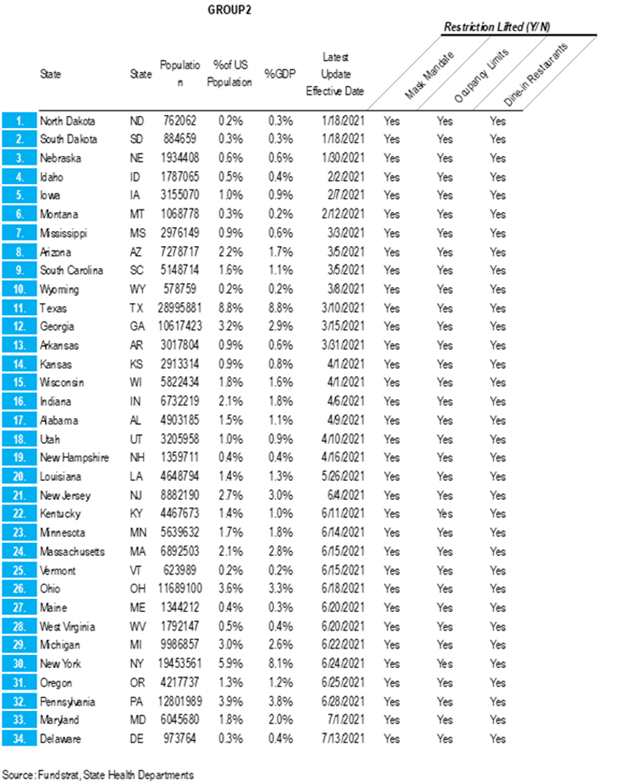

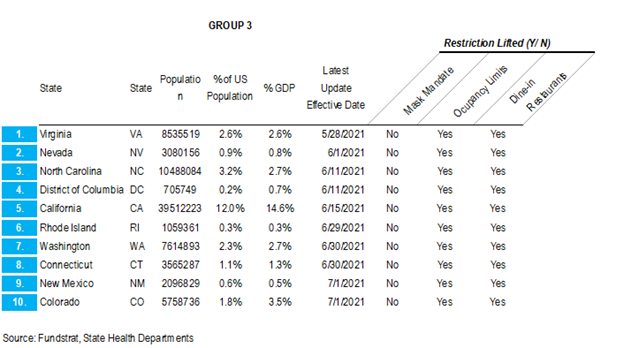

So there is a spectrum of approaches. Our team is listing 3 tiers of states and these are shown below.

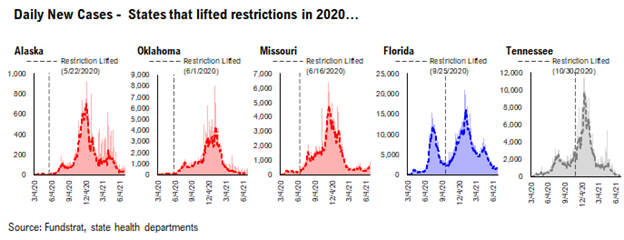

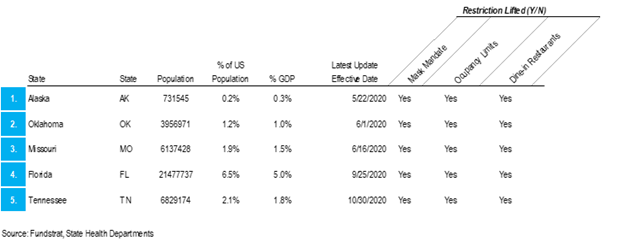

– states that eased all restrictions in 2020: AK, OK, MO, FL, TN

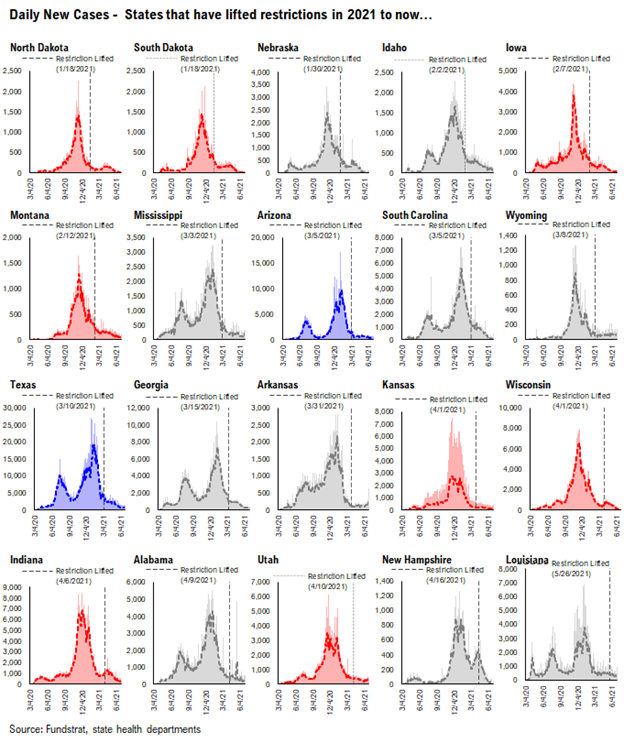

– states that have eased all restrictions in 2021 to now: ND, SD, NE, ID, IA, MT, MS, AZ, SC, WY, TX, GA, AR, KS, WI, IN, AL, UT, NH, LA, NJ, KY, MN, MA, VT, OH, WV, ME, MI, NY, OR, PA, MD, DE

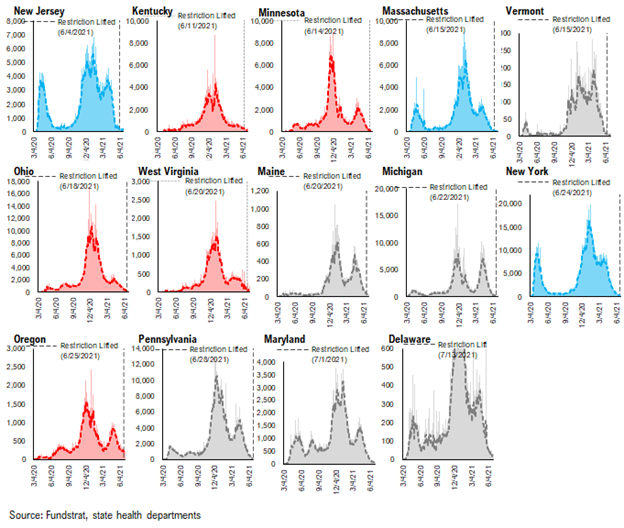

– states that are still easing restrictions in 2021: WA, NC, CA, NM, CO, NV, CT, VA, RI, DC

GROUP 1: States that lifted restrictions in 2020…

The daily case trends in these states are impressive and it is difficult to say that lifting restrictions has actually caused a new wave of cases because the case trends in these states look like other states.

GROUP 2: States that have lifted restrictions in 2021 to now…

Similar to the list of states above, the daily case trends in these states are impressive and it seems that lifting restrictions hasn’t caused an increase in cases.

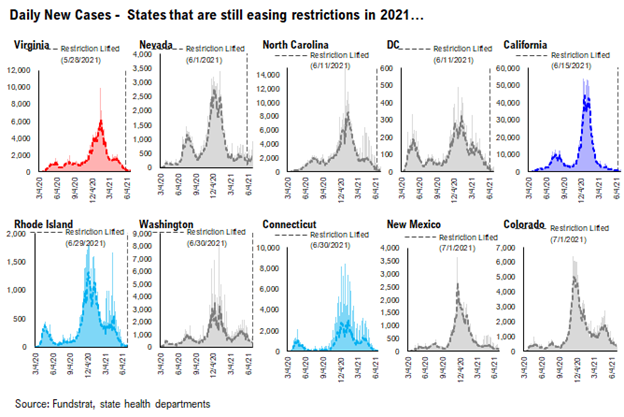

GROUP 3: States that are still easing restrictions in 2021…

These states have begun to lift restrictions but have yet to ease all restrictions. The date of each state’s most recent restrictions lifting is indicated on each chart. The case trends in these states have been mostly positive.

– Easing restrictions appears to have contributed to an increase in cases in several of these states, most drastically in OR, ME, WA, and MN