We See Multiple Reasons For A September Rally, But The Key Is “Bad News Is Good News”

Probably better to expect an “expiration date” for many of the COVID-19 extraordinary measures

In our conversations with clients this week, one of the questions that has come up is how many of the pandemic-driven changes wrought in our World are permanent or only extraordinary. Among the key questions:

– work from home

– COVID-19 prevalence

– education

– vaccinations

– government support

– Fed and central banks

– etc

It is an obvious and long list. This is not the world’s first pandemic, but it is the first that brought a full global economic shutdown. And it is the first that forced governments to impose lockdowns. So, the question of how many of these policies remain in place versus have a natural expiration date is a key question.

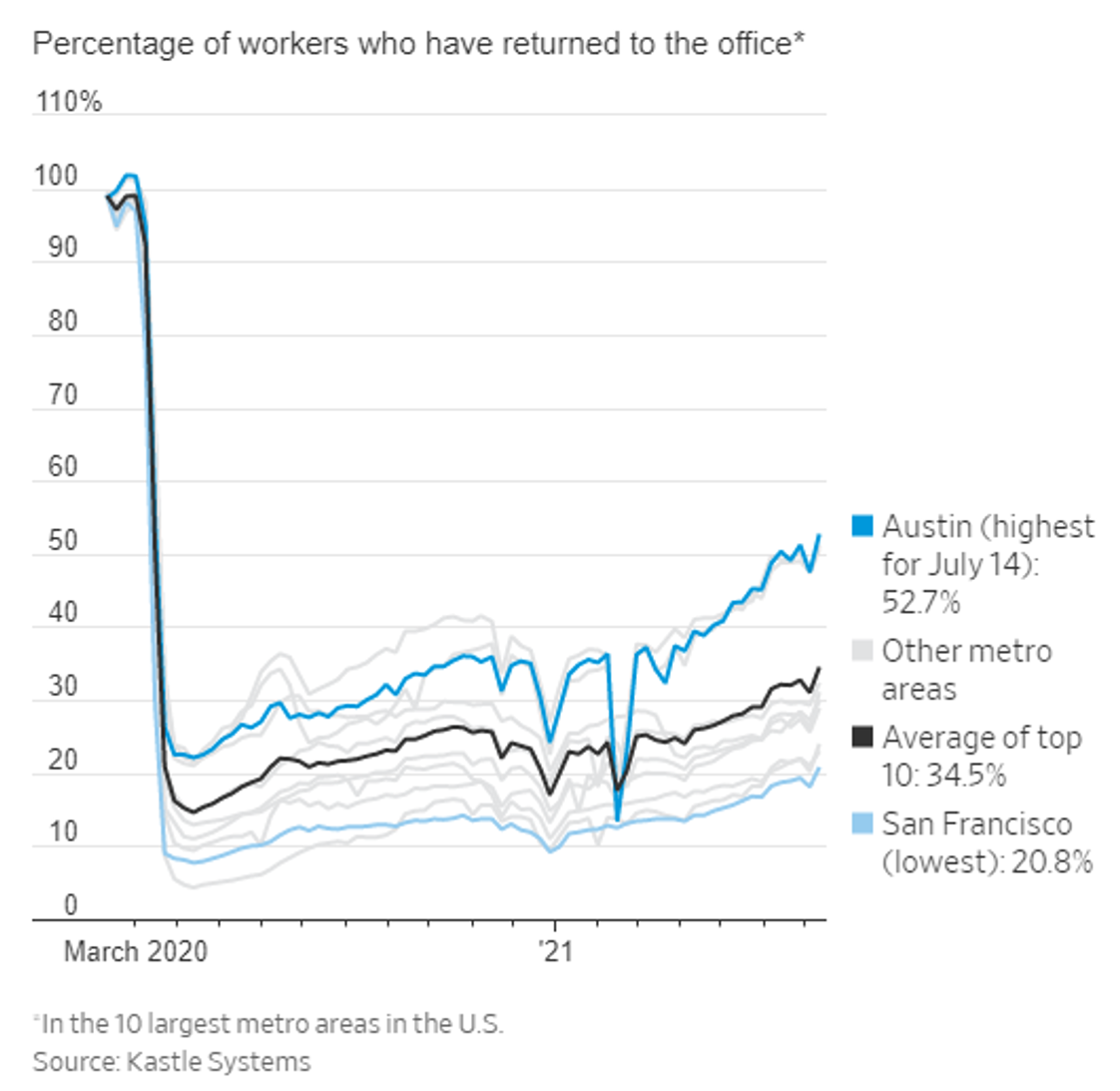

…Return to work remains unknown, but major corporations are pushing for return to office

Not surprisingly, businesses are pushing for a return to the office. There are multiple reasons for this stemming from work flow, culture, reduce job turnover (easier to switch jobs in a remote setting) and there are generational differences as older Americans are more interested in a return to the office. That said, the progress to date has been slow as shown on the chart from the WSJ.

T-cell rapid test could improve vaccine development and also better direct therapeutics

This news story did not get much coverage in the West, but we think it is one of the more important COVID-19 developments in the past week. Scientists in Singapore have developed a rapid test to measure the level of T-cell reactivity to COVID-19. This is positive for several reasons:

– T-cell immunity, which is from white blood cells, are considered the “long term memory” of the immune system

– T-cell immunity might be the durable immunity and is currently not measured by current antibody tests

– Much of the focus on protection from COVID-19 has focused on antibody levels, rather than T-cell immunity

– Previously, tests for T-cells required culturing white blood cells and took some time

– this might help vaccine makers as well as therapeutics, for multiple logical reasons

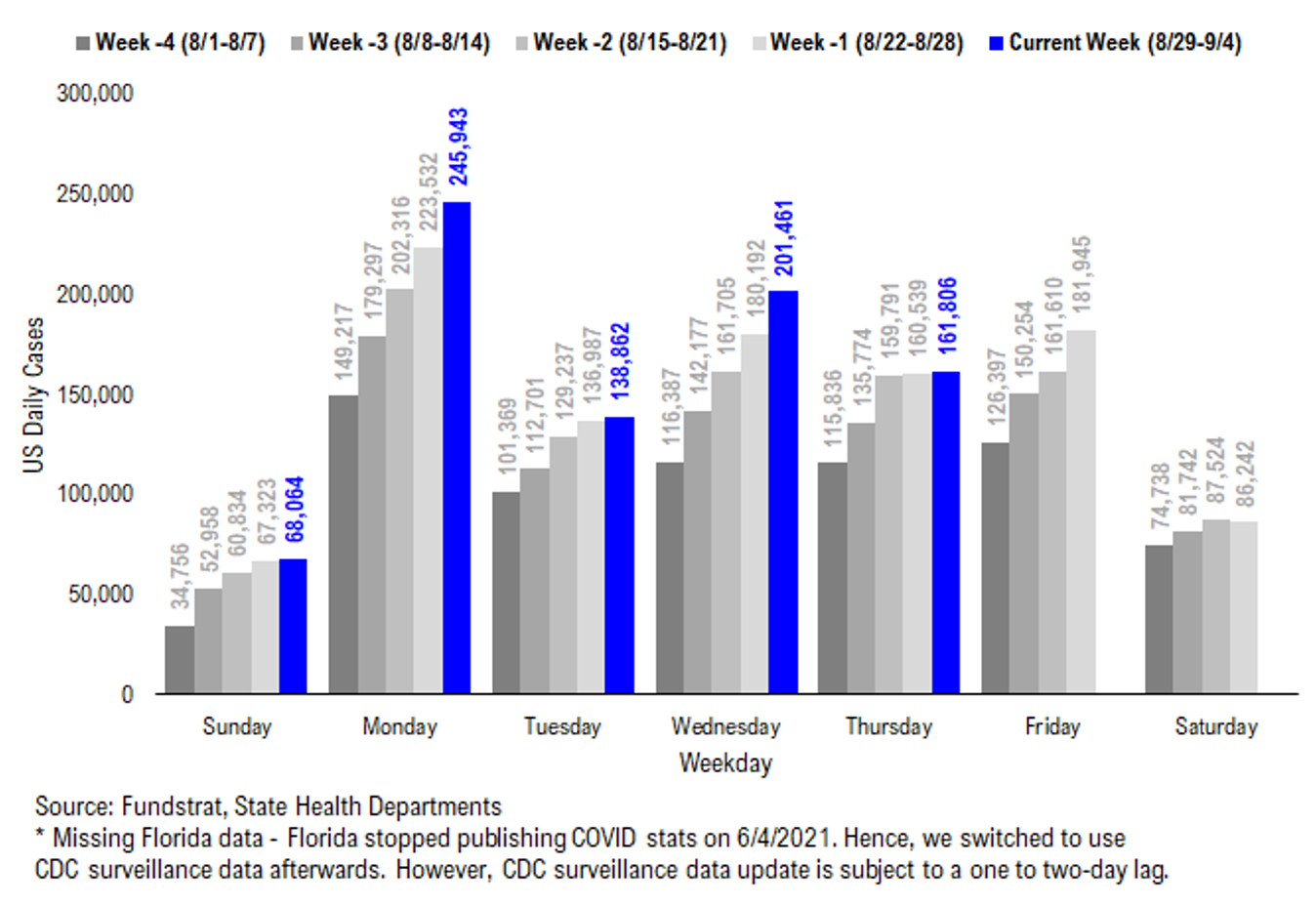

Daily cases are still “flat” vs 7D ago… so not rolling over, but a good sign

Daily cases are essentially bumping up against a ceiling, running flat vs a week ago. And the seasonal pattern is evident below. You can see that daily cases are not really rising any longer, but they are not really rolling over either.

– this reflects a mix shift as multiple states are seeing cases rollover

– but others are still seeing case increases, see below

– and back to school season makes this a bit less clear whether cases will rollover

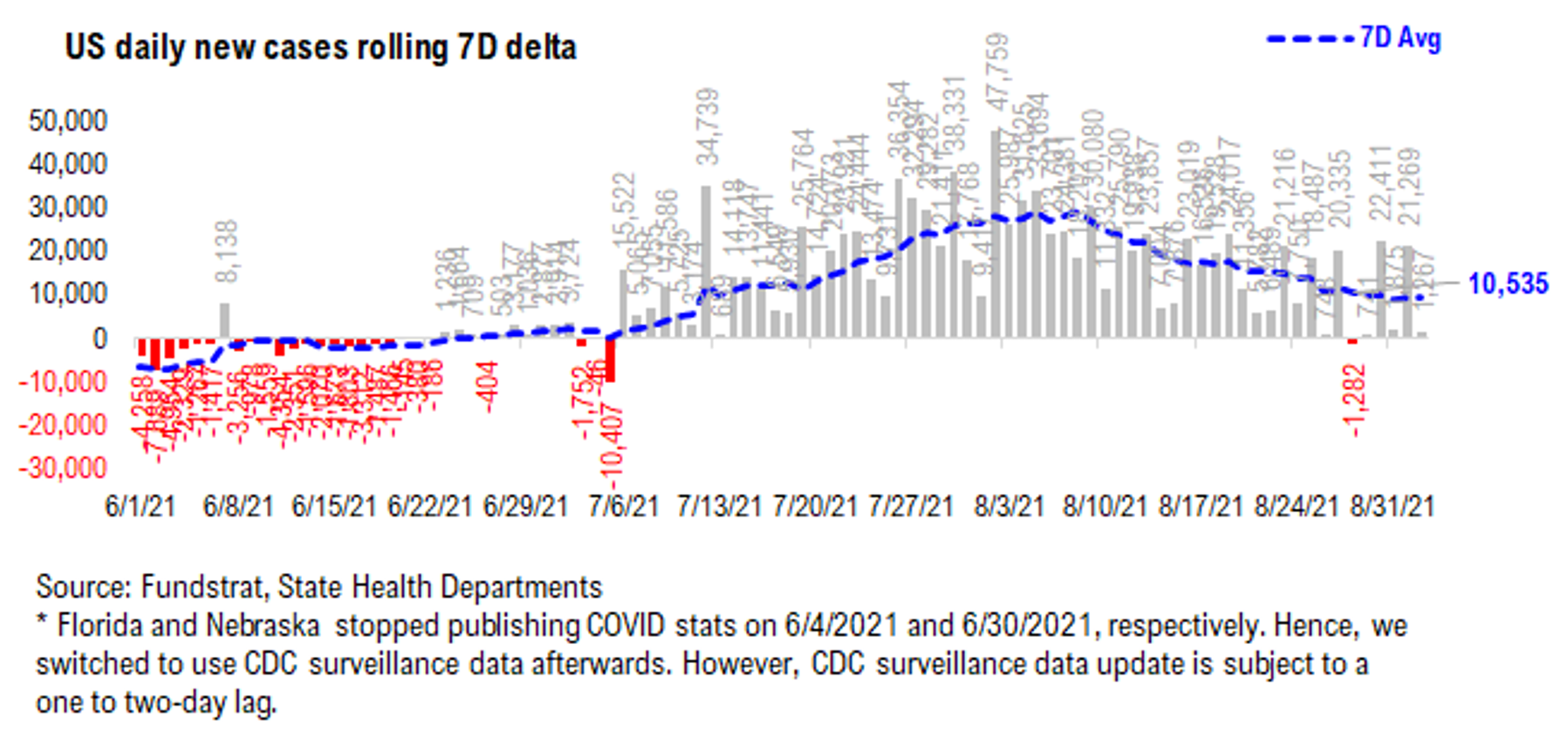

And even 7D delta is showing this tension. It has flattened to about 10,000 vs 7D ago. The good news is that it is lower than the 30,000 7D delta seen in August. So the first derivative is improving.

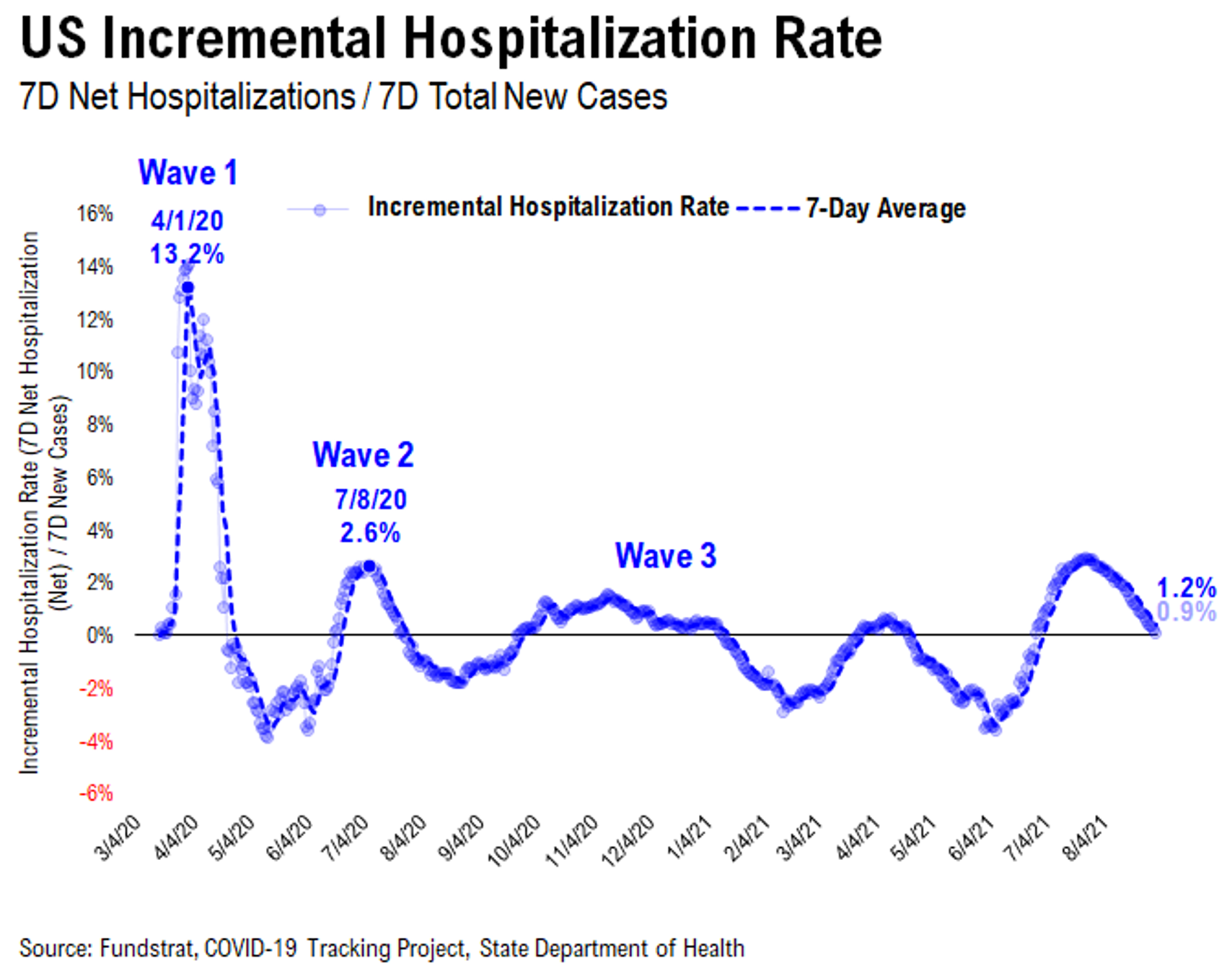

…Another sign Delta-variant surge MIGHT be peaking, hospitalization rates + hospitalizations flattening (not negative)

Hospitalizations tends to be a lagging factor in COVID-19, in the sense that an infected person becomes hospitalized only when symptoms progress 7-10 days after infection. Thus, positive case results generally peak prior to hospitalizations. And in the current wave, we are seeing hospitalizations slow.

– the 7D change in level of hospitalized is not negative yet

– and there is a regional mix issue as the Southeast is probably apexing while the rest of the USA is not

– still, the incremental hospitalization rate (hospitalized per 100 case positives) is slowing to near zero

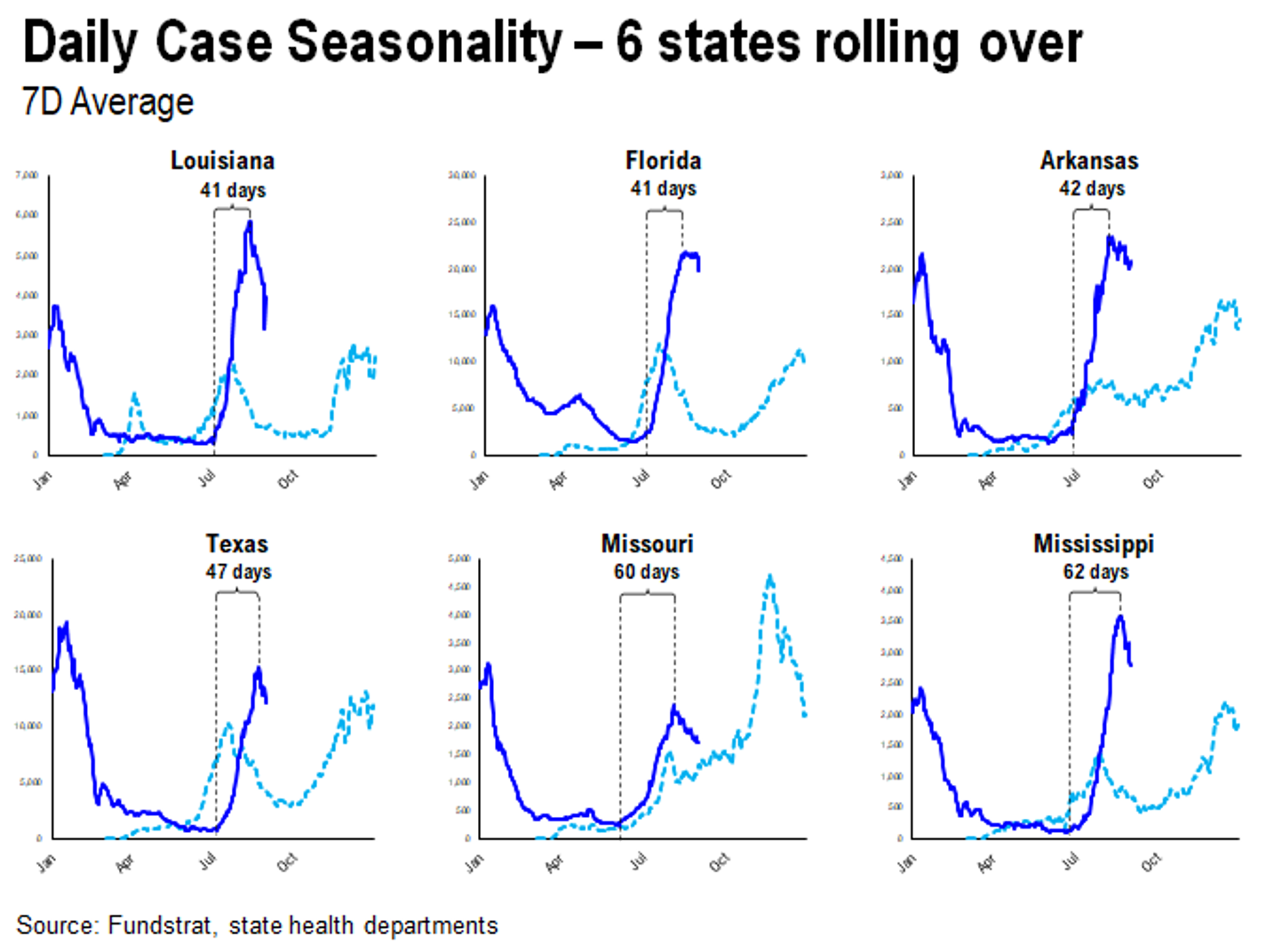

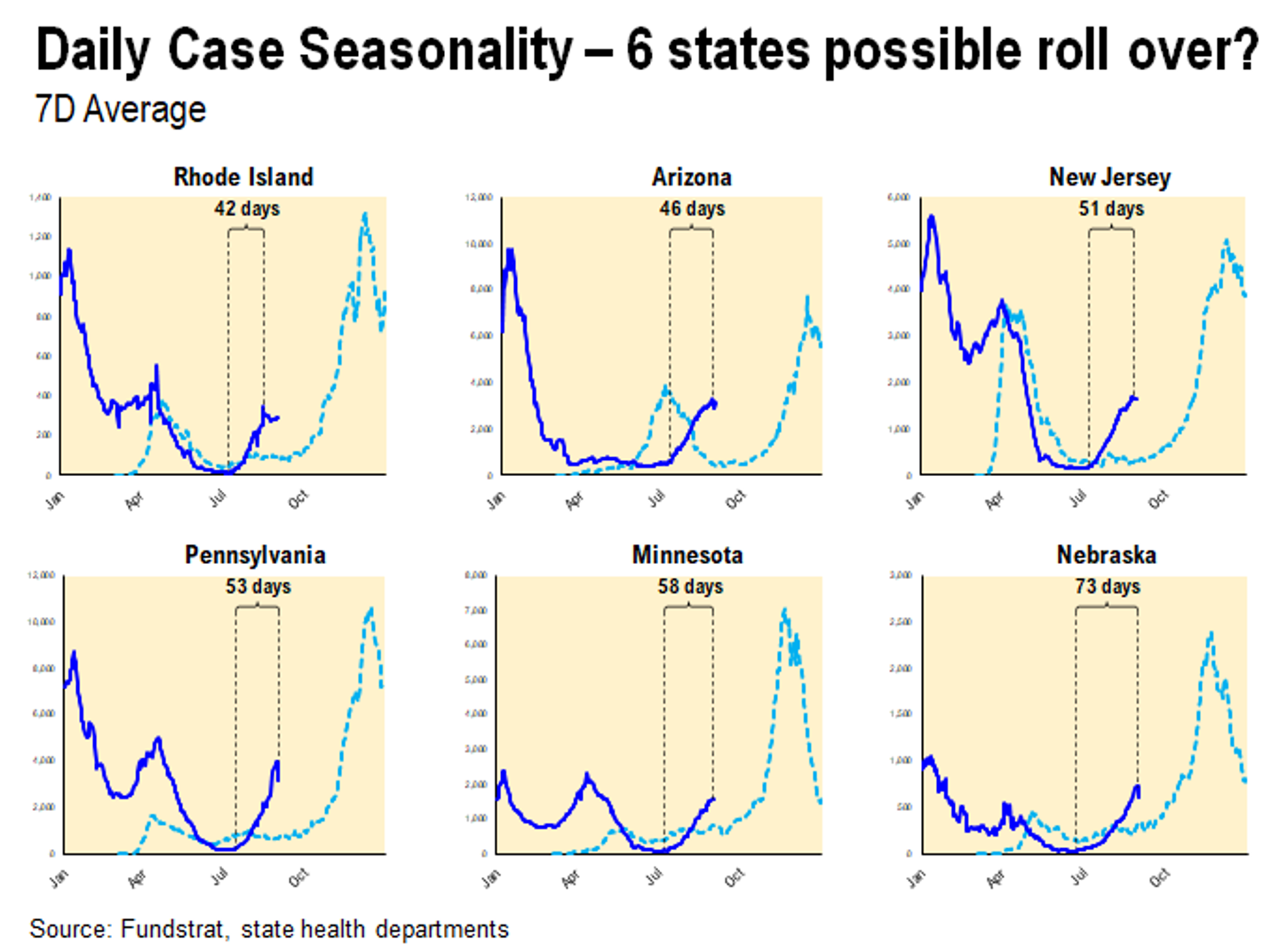

…the number of states with clear cases rolling over remains about 6

The number of US states where the trend in Delta-variant surge is ending remains somewhat small. As shown below, there are only really 6 states where this trend is clearly rolling over.

– But this is still a good sign.

– There is an expiration date for Delta

– But it will take time for more states to show this rollover trend

STRATEGY: September rally –> “bad news is good news” –> Fed dovish

The August jobs report came in very soft, almost 600,000 below the consensus estimate. Nonetheless, as we predicted, the market took this in stride, partially probably because there were some bullish undertones in the data but primarily because of the effect this soft data has on the timeline of ending ultra-accommodative Federal Reserve policy.

As our clients are aware, we believe stocks will post a rally in September, contrary to consensus which generally believes stocks are due for a sell-off. In the broader picture, our base case is for the S&P 500 to rise 23-25% in 2021, meaning stocks will build upon the 21% gains YTD.

So far, the S&P 500 is up in the month of September (it is only 2 days) and it might be helpful if we explain our rationale for an an “everything rally”:

– Delta variant surge likely peaking, short term –> risk-on

– Interest rates creeping higher modestly –> risk-on

– Pent-up demand remains strong –> delayed risk-on

– Soft “economic data” –> dovish Fed –> risk-on

– Washington to pass fiscal stimulus –> risk-on

– Consumer confidence collapsed –> bad news priced in –> risk-on

– Retail investors raised cash 3 weeks in a row in August –> counter trade –> risk-on

– VIX spiked and posted rare inversion –> counter-trade –> risk-on

– Oil has re-attained $70 after falling nearly 20% –> risk-on

– Yield curve steepening –> risk-on

– Cyclicals drove much of the points gain in late August –> risk-on

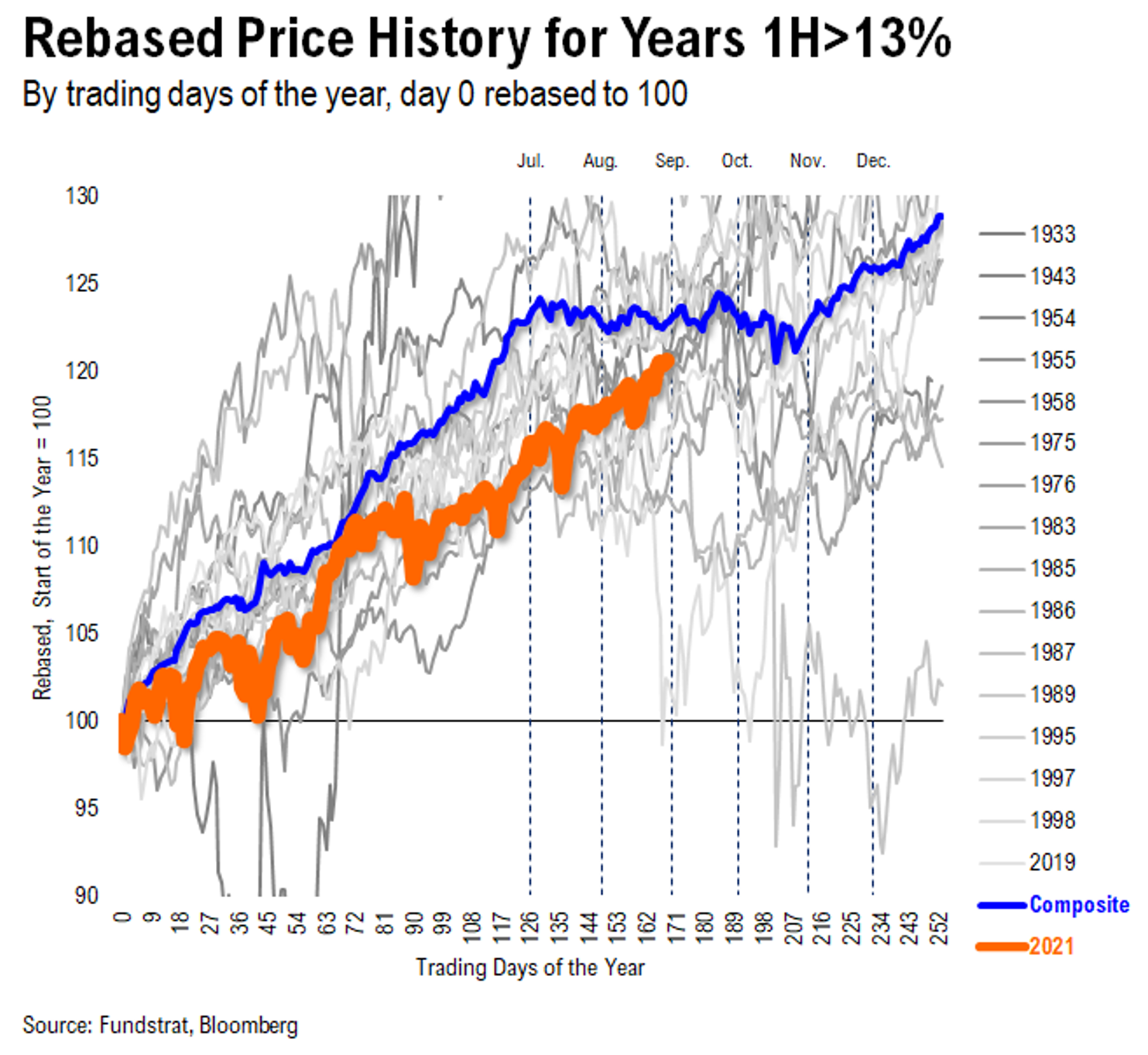

– History shows when 1H >13% YTD, Sept unusually strong –> risk-on

– Pundits are cautious on Sept –> counter trade –> risk-on

So it’s an exhaustive list. And in a way, this is one of the stronger set ups since early March. Over the past 8 weeks, the level of skepticism of the direction of the US and global economy dramatically worsened. And it is this nadir in consensus views that is creating a risk-on set-up.

But we think the window for the rally might get challenged towards end of September…

Now, as much as we see an “everything rally”, we think there is a tactical consideration. We think October could have some headwinds. We discussed these in the past but the 3 biggies are:

– Delta-variant risk from “back to school” and flu season

– Fed might announce possible taper

– Evictions and moratorium expiration plus expiration of extended unemployment might lead to softness

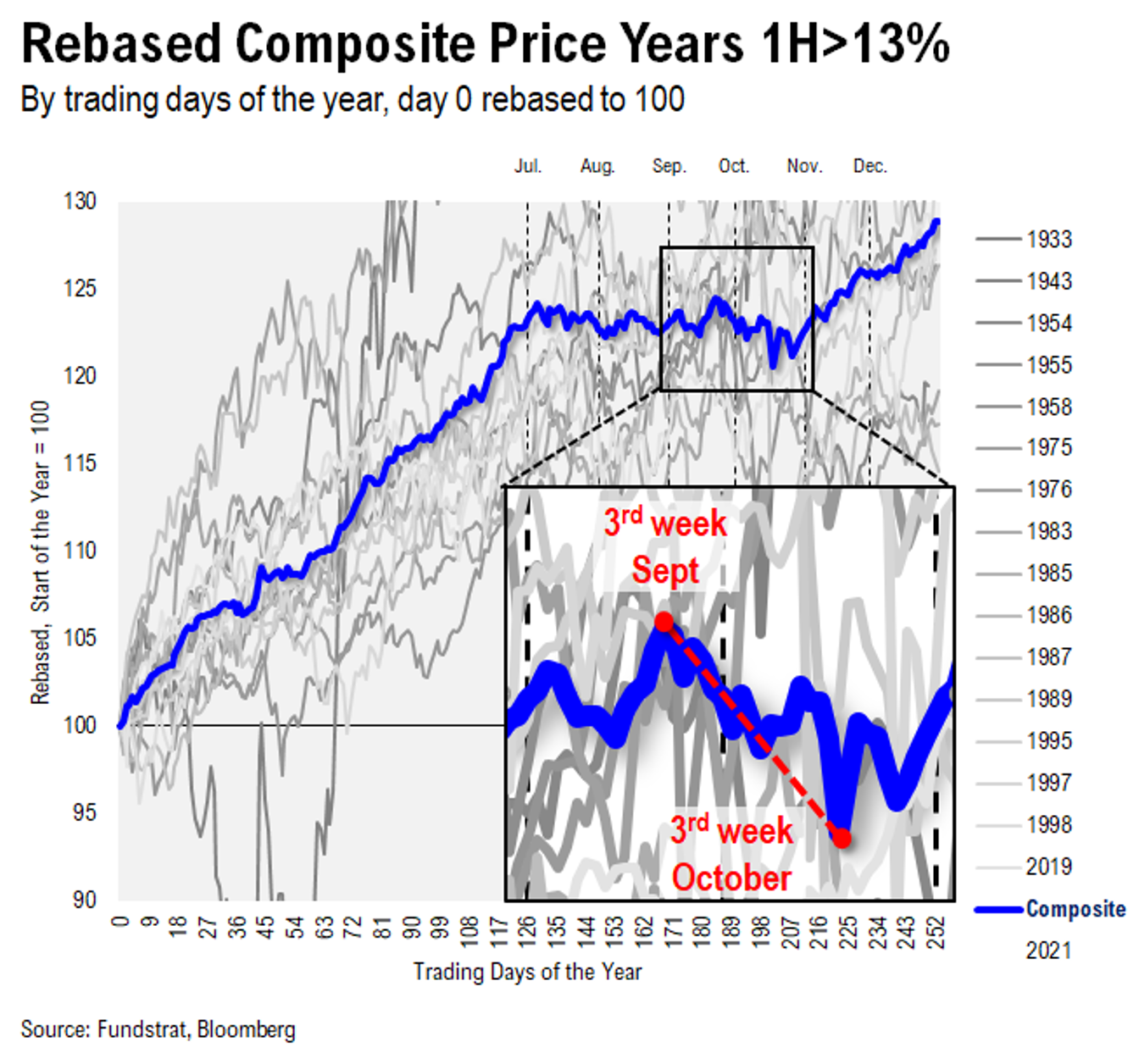

And there is a possible additional risk. A composite of the 13 years when 1H >13% shows that stocks see turbulence into October. As shown below:

– 3rd week of September is when stocks soften historically

– Of those 13 years, October win-ratio is a mere 33%

– This is far worse than “all years” at 59%

So we think there is a heightened risk, in 2021, of an October sell-off.

And comparing 2021 to the composite shows that equities have been fairly steadfast. FYI, there is no requirement for stocks to “correct” in 2021. I am not sure there is a time-based requirement for a sell-off.

– but we have been consistent with the following

– we have said the next “window” for a sell-off is likely October

– and that is the extent of our view

I am just saying the risks of turbulence are higher in October. Not a prediction of a sell-off.

STRATEGY: In an everything rally, we like Epicenter, particularly Energy

Our top 3 favorite sectors into YE are:

– Energy XLE -0.65% OIH 0.60% –> catch-up to oil

– FAANG FNGS 0.51% –> catch-up trade to S&P 500 +25%

– Basic Materials XLB 0.14% –> reflation beneficiaries

…Oil has rallied +14% and now >$70 per share –> just a matter of time before Energy stocks catch up

WTI has managed to rally sharply as shown below +14% in just last 10 days and is now back >$70. Recall the glum views that developed between July and August and many skeptics thought the entire global expansion was at risk. But the steady recovery in oil, in our view:

– remains more consistent with a resilient economy

– and one where markets “panicked” to the downside

Now we see a recovery.

And even Goldman Sachs Jeff Currie, Head of Commodities Research, reiterated his positive view on oil. We have alluded to this multiple times in recent weeks — so we won’t belabor the point. But oil has an upside bias from here.

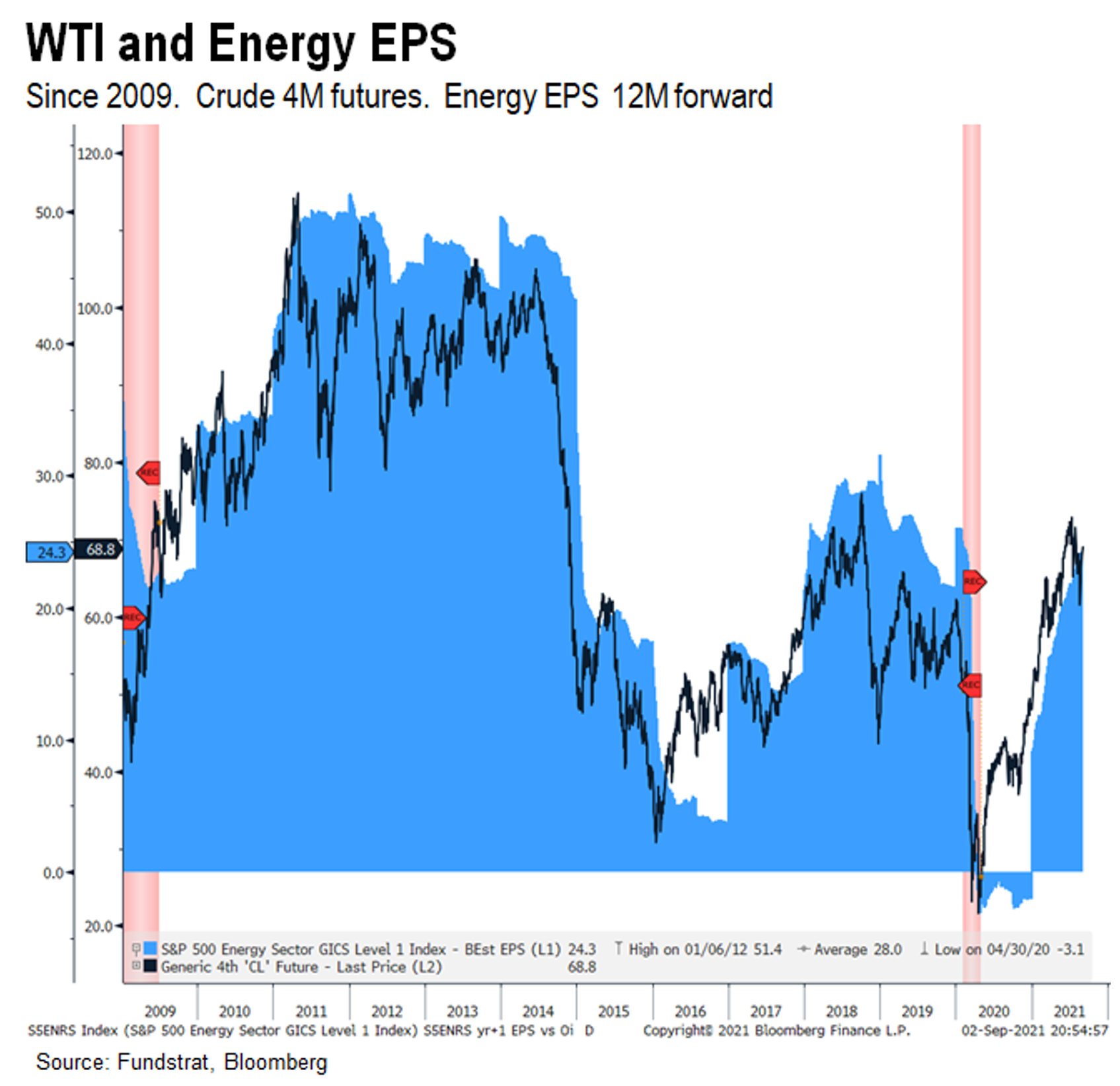

…Energy EPS tracks Oil price = rising oil = Energy EPS upside

And this takes us back to Energy equities. Take a look at the relationship between Energy equities EPS (12M forward) and WTI oil (4M futures). Oil is the leading indicator for EPS.

– rising oil

– rising EPS forward

– rising EPS means higher equity prices

– unless P/E contracts

So, there is a natural linkage. This is the reason investors should not get too bearish on Energy equities. If Oil returns to pre-pandemic levels:

– $80 WTI is where oil was in the 2010s and in 2019 for period

– Energy EPS upside is +100% upside from here

Thus, we get to this simple question below.

– Does it make sense Energy stocks have trailed oil by such a wide margin?

– This is why we are constructive on Energy into YE

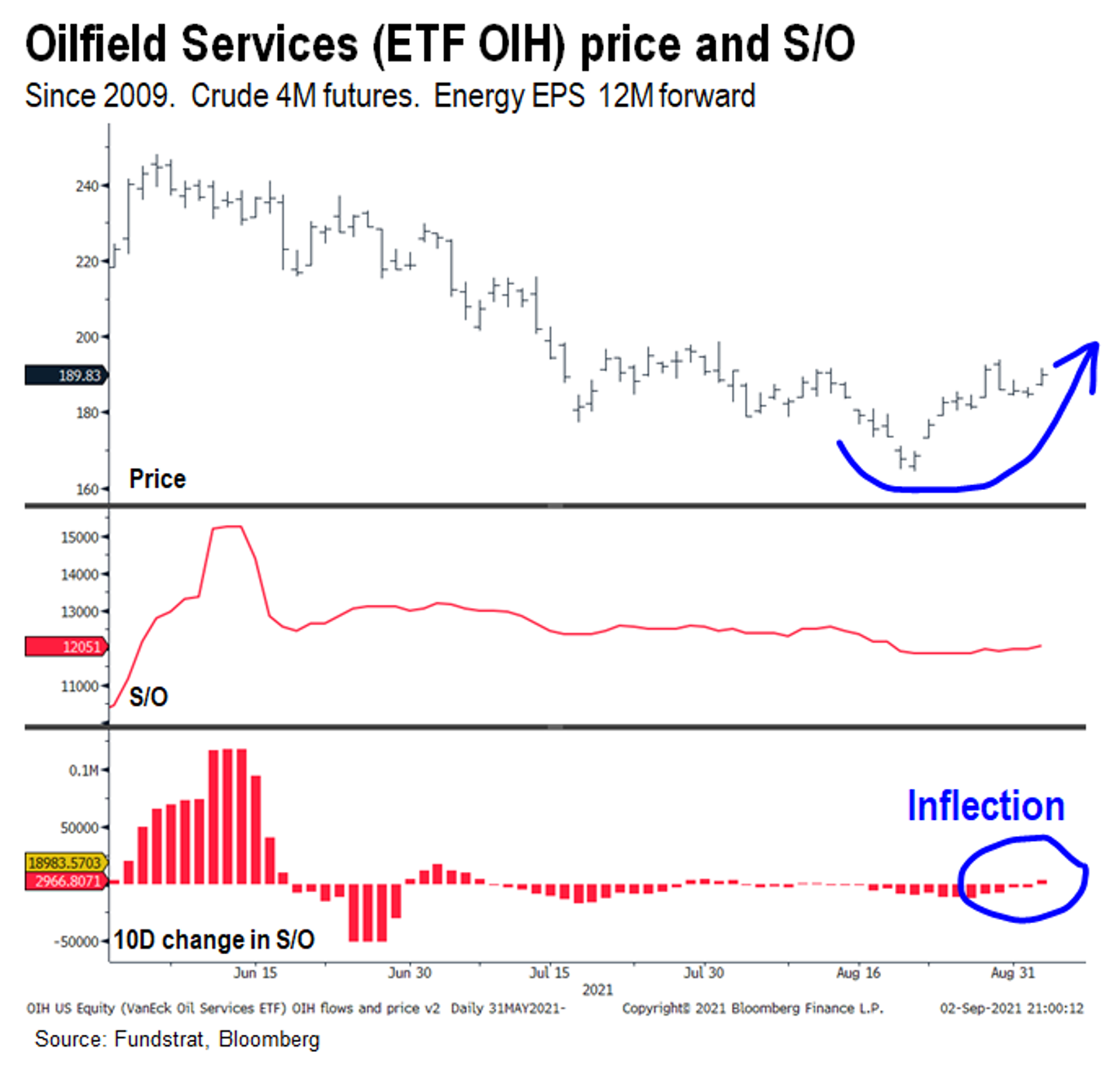

…OIH S/O inflecting positive = good sign

Lastly, another good data point is that OIH 0.60% shares outstanding are finally inflecting higher. Last week, we highlighted how OIH share price rose even as investors were liquidating the ETF.

– But this has reversed

– OIH share count is rising again

– Investors are buying the ETF

– this is further positive inflection and supports our view Energy will rally into YE

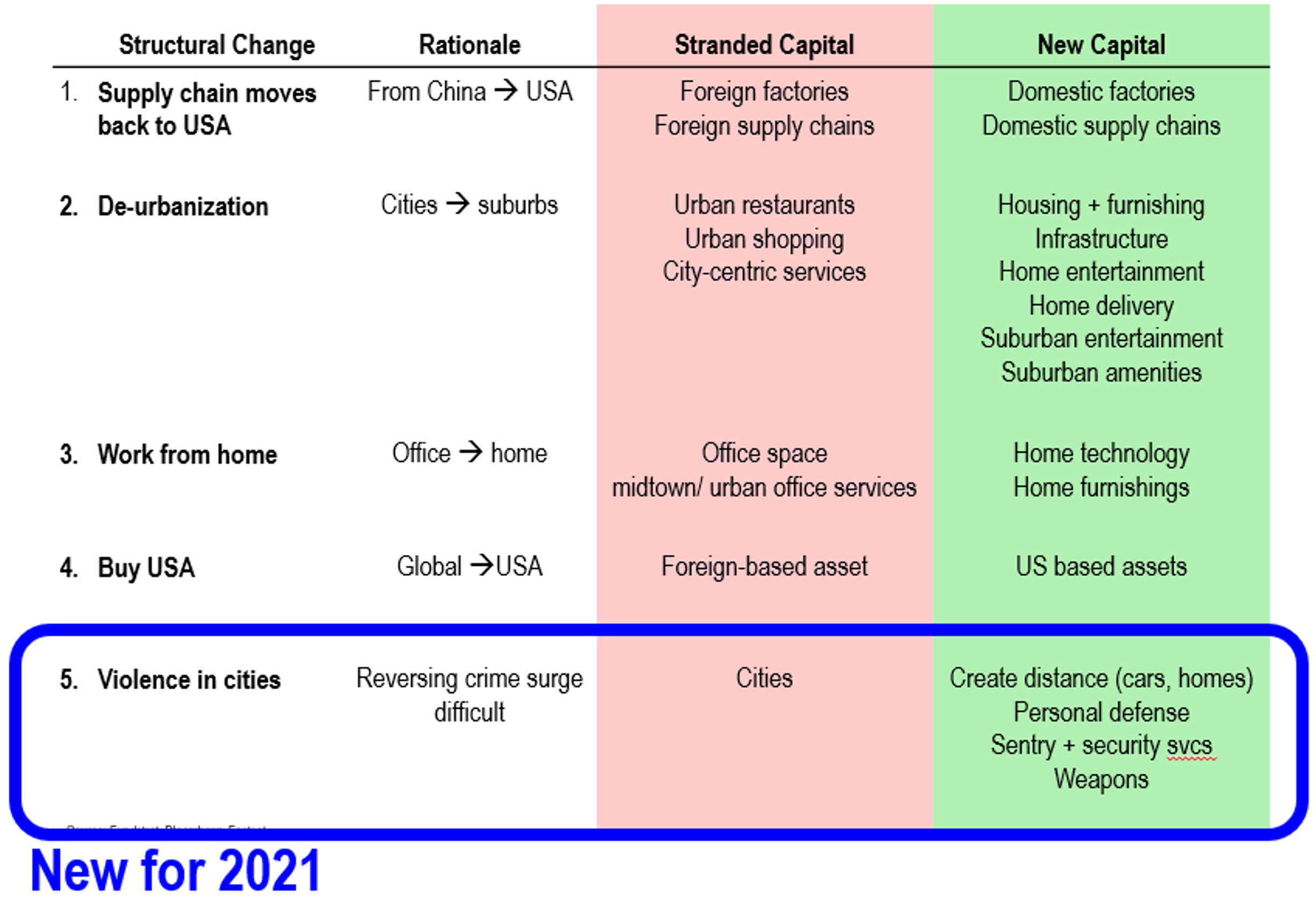

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

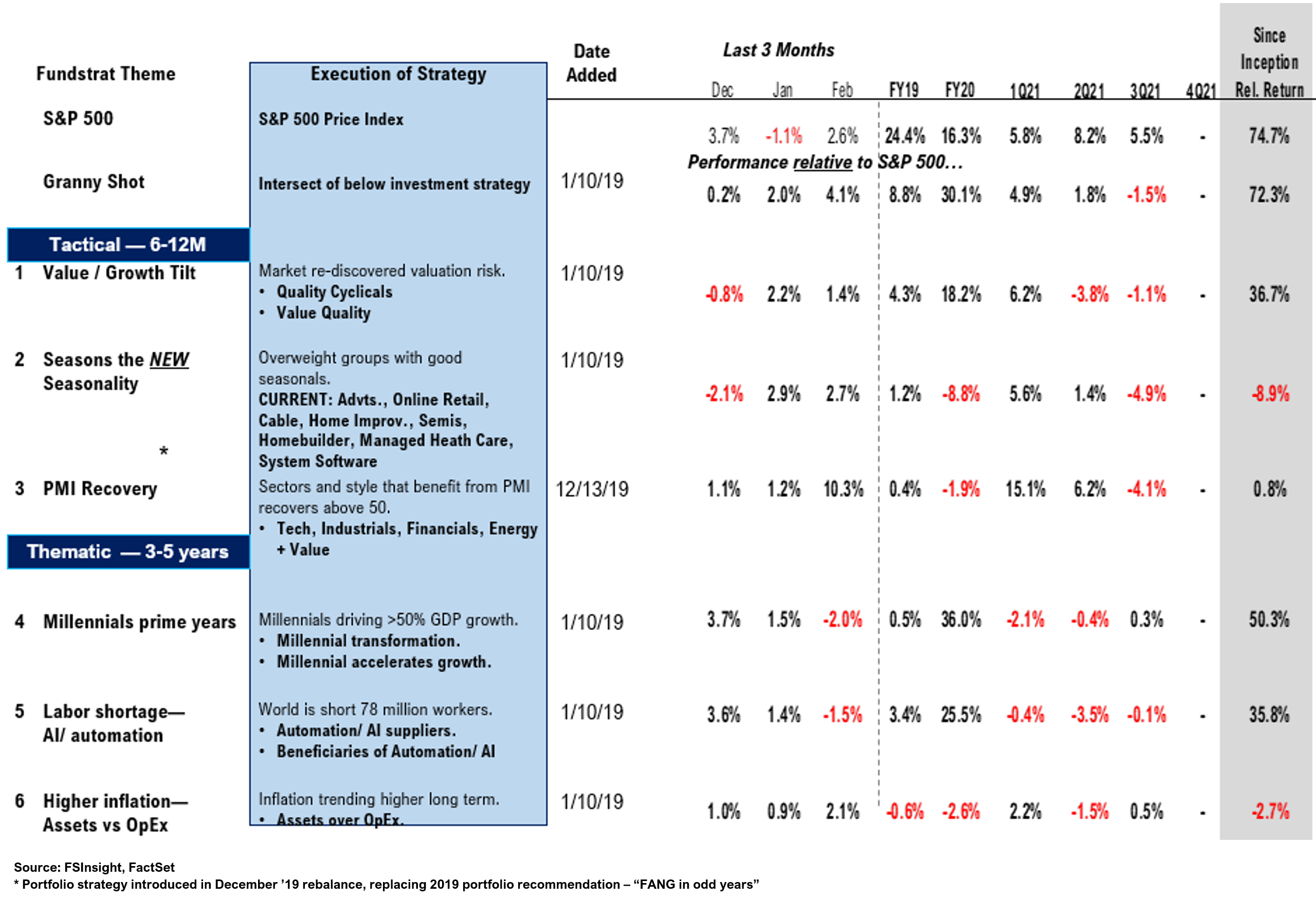

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 13b712-72dab5-adbeee-a13567-8ef5a7

Already have an account? Sign In 13b712-72dab5-adbeee-a13567-8ef5a7