Continued Positive Trends In US, Earnings Strength Continues

In the past week, incoming news in the US was overall very positive. COVID-19 cases are legging down, apparently due to higher vaccine penetration. And the US economy is on track for a strong revival and full reopening by mid-2021. Earnings seasons is so far affirming this trajectory. Good news has continued to proliferate on the case front, the vaccination front, and the re-opening front. Perhaps the most salient example this week is NY Governor Cuomo’s announcement that NYC is likely to see full re-opening by July 1st.

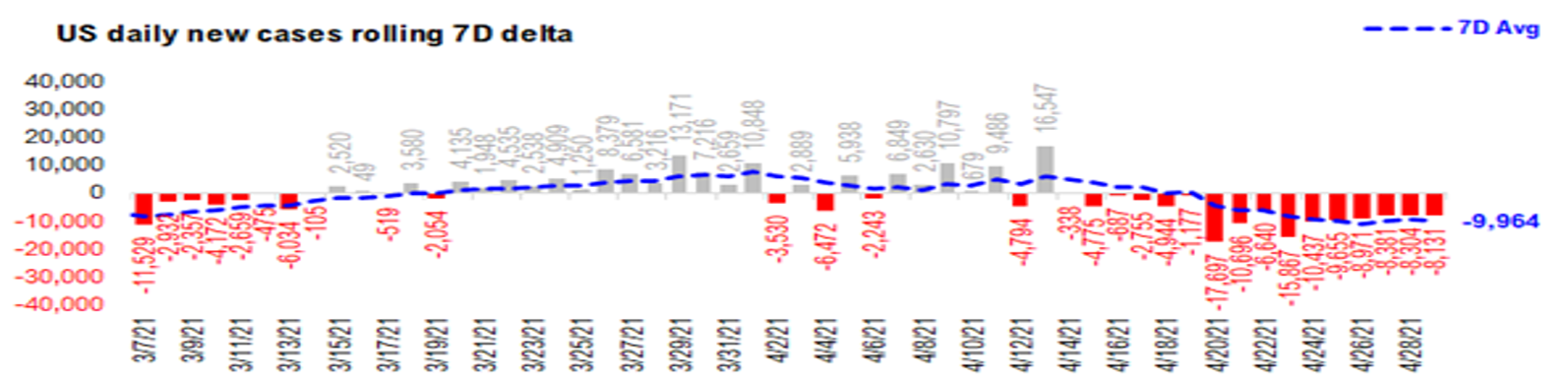

The best evidence for the progress in the US is the continuing substantial “leg down” in daily cases. The &D delta has been negative in the past 16 days! In the past few days, the decline has been at a stable -8k to -10k per day. If this decline persists, we could see the daily cases drop sub-20k by mid-May. But this is positive progress in the US has been achieved largely by vaccine penetration, more so than behavior modification. This is something that healthcare experts like Dr. Gottlieb also spoke about.

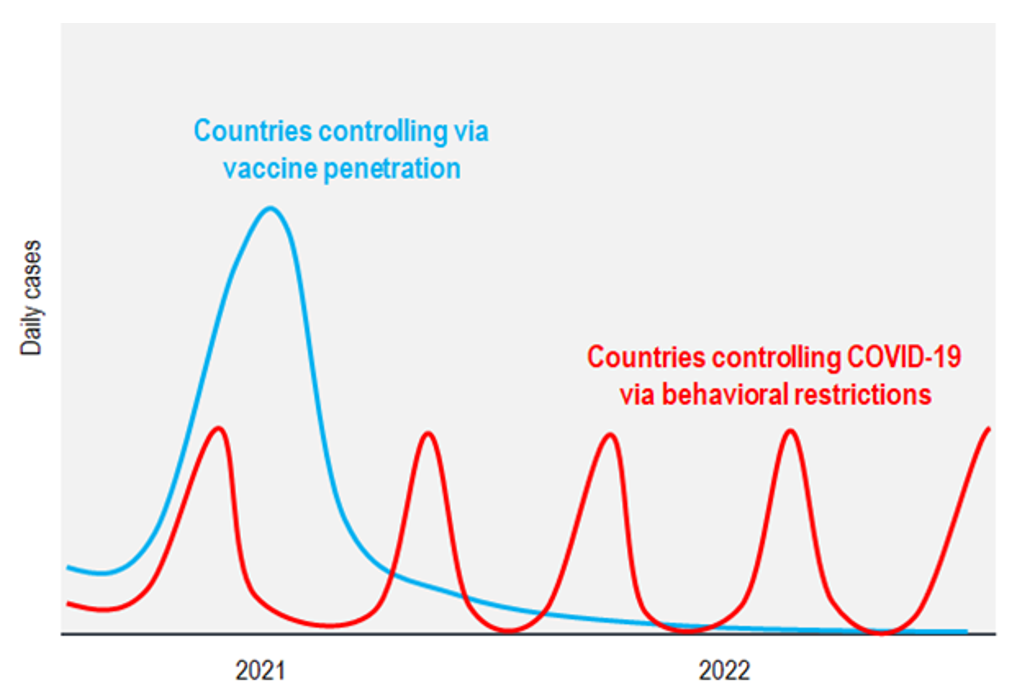

This achievement is quite rare globally though. There are only 18 countries with more than 20% vaccine penetration. The US ranks #11 with Gibraltar and Israel on top. Thus, few nations are in the same position as the US and this should have direct economic impacts. As you can see, the difference between trying to control COVID-19 with restrictions instead of vaccinations will likely have radically different outcome. This is a key point. Only a handful of countries will emerge from COVID-19 like the US. Some countries like China, Australia and Japan have been more successful than many others with lockdowns but nonetheless lag on vaccination progress.

We believe these nations risk recurrent waves of cases that could possibly lead to more lockdowns while the US and these other 17 nations head toward a semblance of normalcy. My takeaway is that the US and these countries will have a stronger economic rebound and the resulting local equity markets should outperform. In other words, I would rather own US equities, and instead of EM, I would stick with US small-caps or US multinationals instead!

STRATEGY: 1Q2021 Earnings Driving a +900bp jump in projected 2021 EPS growth +32% (vs. +23% in Jan)

We are in the midst of earnings season. Over the next few weeks, Technology takes a back seat and the Epicenter/Cyclical companies will report. The strong beats in the first quarter are already causing EPS estimates to rise significantly, as we’ve been forecasting. EPS forecasts have been significantly rising for every quarter except 4Q2021, which is generally a ‘plug.’ 2Q2021 EPS is now +59% cs. +46% in January. The other quarters are up in the high single digits. So the trends are higher and point to sustained improvements.

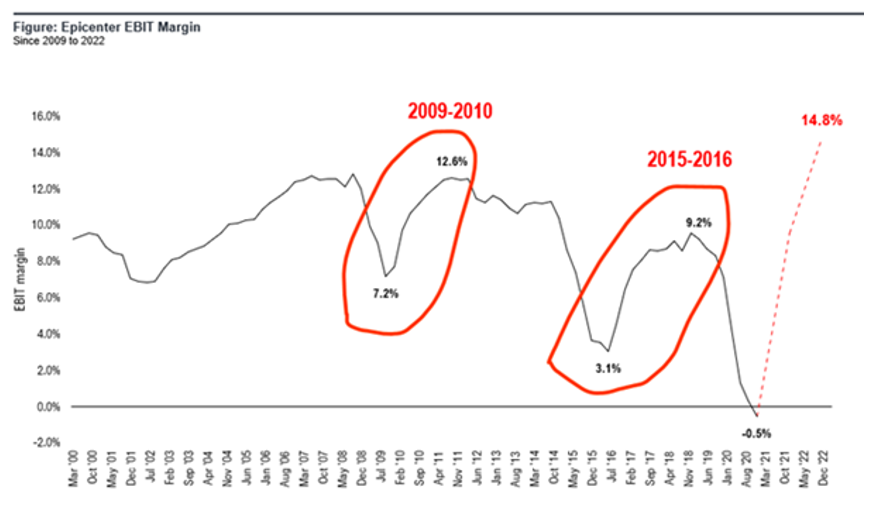

Furthermore, we believe the margin story will really dominate over the next few weeks. Below is the EBIT margin of the Epicenter sectors and they have been absolutely destroyed in 2020 due to the pandemic. The recoveries in margins were lighting fast post-2008 and post-2015. We think it’s reasonable to expect an even stronger margin recovery given the massive cost-cutting by US corporates, and do-or-die nature of business model revamps and efficiencies. Hence, we think there’s a lot more upside in Epicenter stocks.

It also appears that oil has broken out of the “India shutdown” slump which means we think the March highs of $67.98 should be taken out pretty soon. If WTI exceeds those levels, then the next key level is $79, which are the October 2018 highs and would be consistent with Goldman’s forecast.

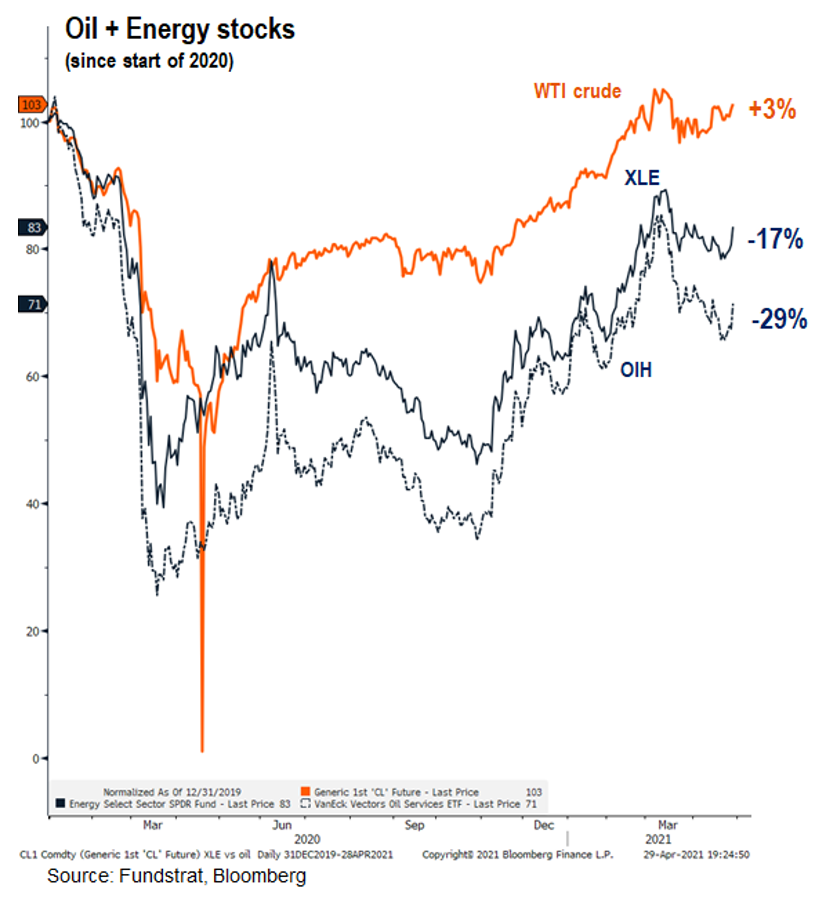

So, if commodities are rising, the associate equities should be similarly gaining. That is, unless the economic relationship/value-capture model has changed. Of the sectors, this is the key question for Energy stocks. Oil is 3% above its 2020 start prices and Energy stocks, XLE and OIH are down -17% and -29% respectively.

More importantly, we know most institutional investors are underweight energy. The entire sector’s weight is less than AAPL. If oil rises to levels that are implied ($79/$80) and takes out 2 year highs, then we don’t think institutional investors will be able to ignore that surge and will pile in quickly and earnestly to ensure they aren’t missing one of the market’s main sources of risk/adjusted return. The result will likely be institutional FOMO that results in significant price appreciation .

It also looks like the threat of lockdowns in India, which markets have been consternating over, is reduced. Our favorite COVID-19 data source predicted India’s COVID infections peaked on 4/26 which means the worst is hopefully over. We see this as potentially being a major catalyst for Epicenter stocks. Likely that Mumbai/Delhi start to improve followed by a gradual realization that the crisis is past the worst point. This should result in a new ‘leg up’ for the Epicenter trade (Energy, Industrials, Financial, and Small-caps). XLE 1.37% , OIH 0.67% , XLI 0.11% , XLF 0.60% and IWM 0.05%

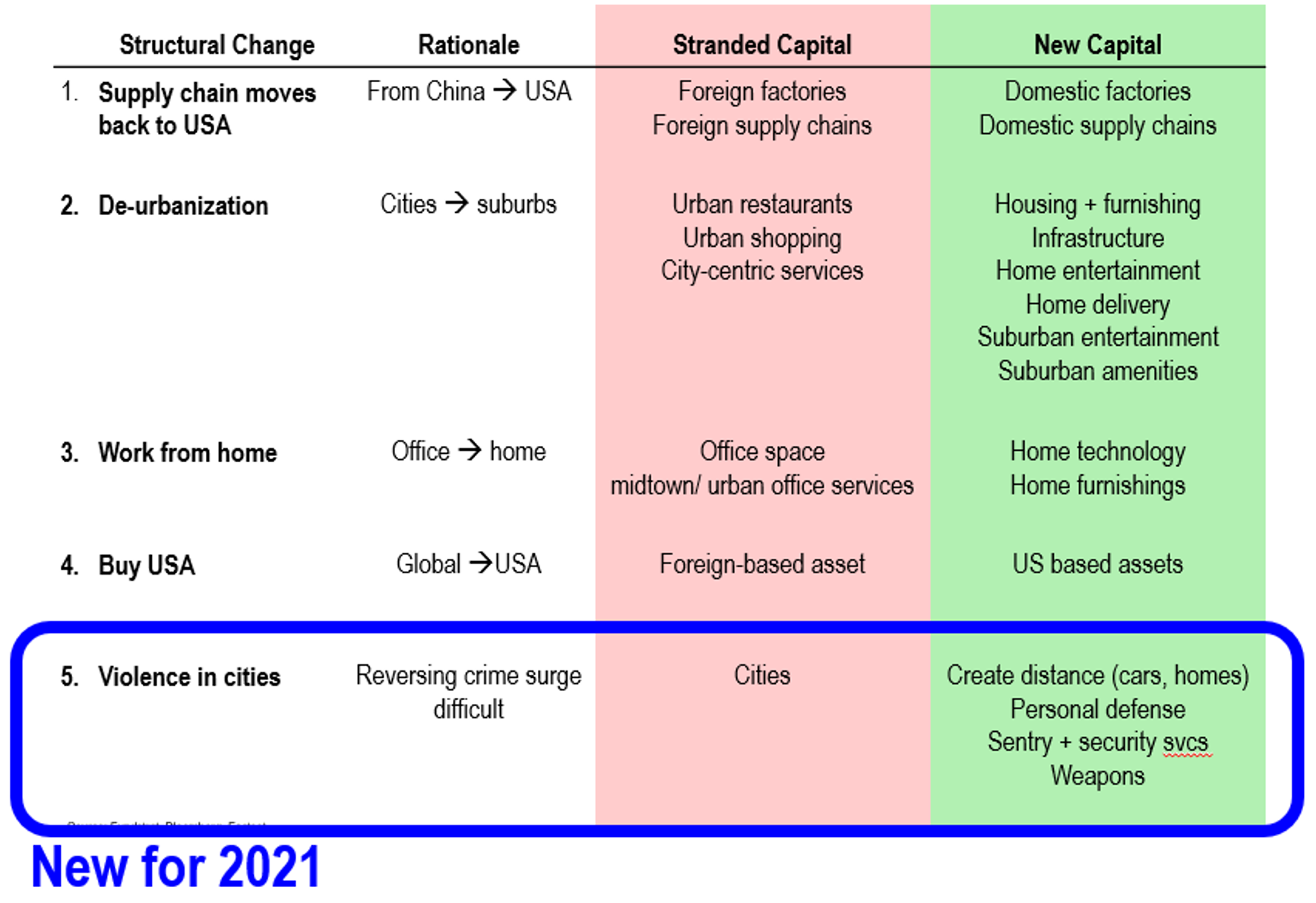

Figure: Way forward ➜ What changes after COVID-19

Per Fundstrat

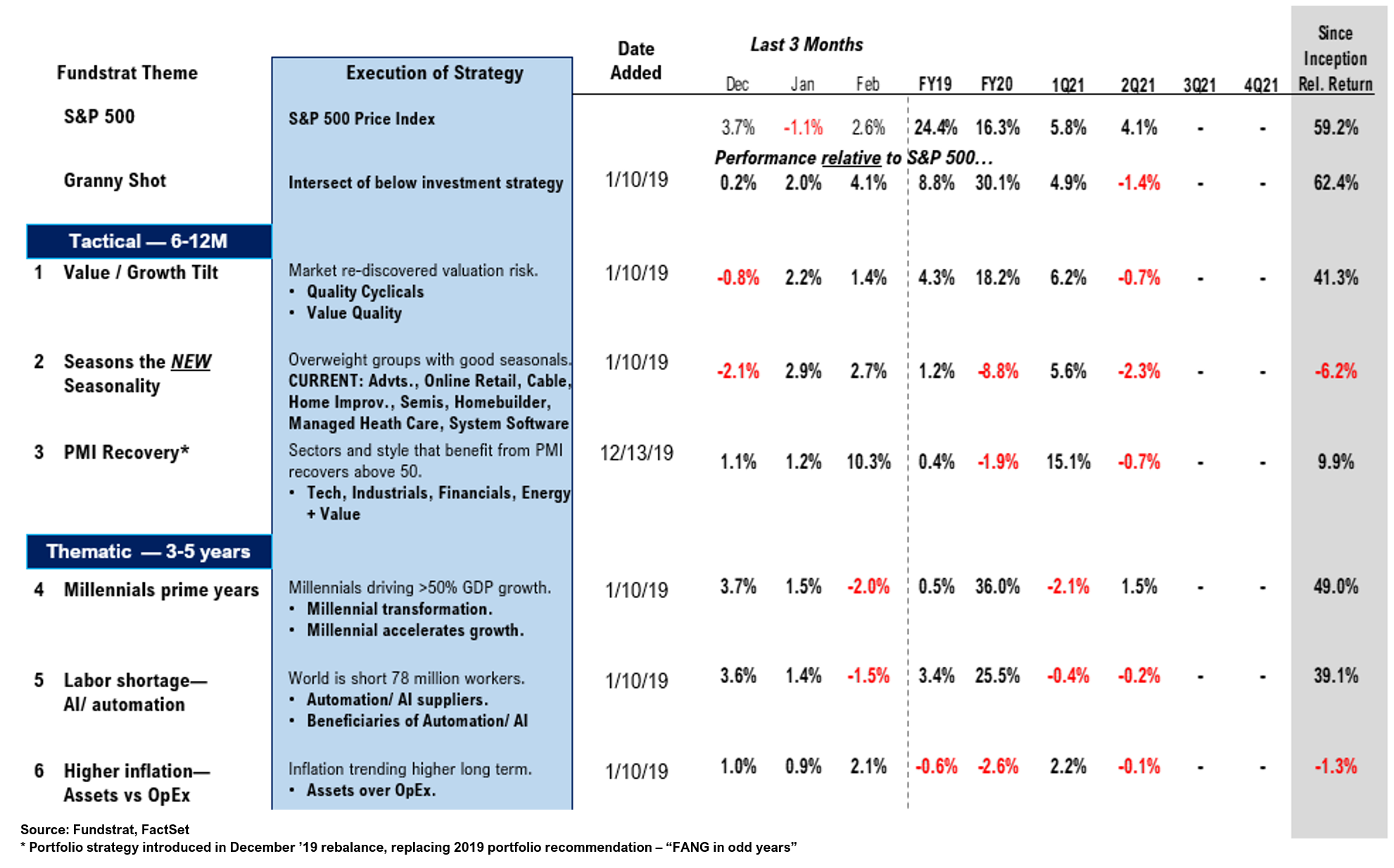

Figure: Fundstrat Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019