Best Discretionary stocks to favor technically for bounce into 2024

- SPX lies just below 2022 peaks which should be important this week

- Equal-weighted Consumer Discretionary has reached the highest levels since last Spring

- Stocks like ETSY, UA, EXPE, RCL, CCL, NKE, and RL have appeal within Discretionary of the Non-Builder names

Technically the broad-based participation higher in multiple sectors in the last month is certainly a positive heading into 2024. While near-term risk/reward doesn’t seem favorable for those with timeframes less than two to three months, the recent overbought readings have not signaled any evidence of giving way. I’ll be watching for evidence of any hint of trend reversal in the days ahead. If this fails to materialize until January, then a larger than normal correction likely would occur into February of 2024.

As discussed in recent days, the US Equity and Treasury market rallies have gotten extended, and now the Equity rally is nearing an important level with regards to QQQ, SPX as well as IWM. Despite some slowdown in the last week with regards to several of the highest percentage SPX names like AAPL, markets have shown no evidence of any deterioration of any kind.

Weekly SPX chart shows prices now within four points of a record weekly high close (as of midday Tuesday 12/19), while price remains roughly 50 points shy of its all-time intra- week peak of 4818.62. While I expect that this level should hold this week, there hasn’t been much to comment on regarding pullbacks of any sort in recent days.

Tuesday brought about above-average strength in the Materials sector, along with Discretionary, Healthcare and REITS in what proved to be a broad-based rally for the market. The more actionable movement seemed to happen within the Pharmaceutical space on Tuesday along with the Discretionary stocks (the latter which will be discussed later in the report).

S&P 500

Consumer Discretionary sector is set to make new highs for the year as of Tuesday’s rally.

On an Equal-weighted basis, Consumer Discretionary ETF from Invesco (RSPD 0.92% ) exceeded the prior peak from July 2023, which represents the highest levels since Spring 2022. This is a bullish development in the short run for Discretionary and should result in another 1-2 weeks of upside follow-through before this likely finds resistance.

It’s important to relay that not all Discretionary stocks have shown above-average performance for this year. When screening the top-performing stocks over the last 3 months within Discretionary, 4 of the 15 are associated with Homebuilding and Housing construction.

However, the appeal lies in identifying potential attractive names from the stocks which lie greater than 20% off 52-week highs but have demonstrated superior strength in recent months.

My analysis shows that some of the recent bullish momentum in names like GPS -0.47% , EXPE 0.71% , ETSY 2.15% , UA, NKE 0.03% , and RL 0.33% not to mention RCL 1.61% and CCL 0.13% , likely can continue into 2024.

While many of those seem short term overbought, they’re likely to still outperform and could show absolute price gains into year-end.

RSPD 0.92%

Discretionary relative to SPX should still have another 2-3 weeks of outperformance before facing meaningful resistance.

Relatively speaking, when looking at ratios of Equal-weighted Consumer Discretionary ETF (RSPD 0.92% ) vs. Equal-weighted SPX (RSP 0.70% ), the Discretionary sector has not yet surpassed July 2023 peaks in relative terms to the RSP.

Thus, on a relative basis, Discretionary is a bit weaker than what’s been seen on an absolute basis. However, the next few weeks might still allow for some outperformance, given the lack of any weekly DeMark based exhaustion on weekly charts along with the strong level of near-term momentum.

I favor RSPD 0.92% to be able to push higher to test this larger downtrend vs S&P into next year before a stalling out and likely consolidation. If/when July highs are exceeded sometime next year on a relative basis, this would point to a good likelihood of further outperformance.

The key takeaway with just a couple weeks remaining in the year is that this sector should still offer near-term outperformance into year-end, despite many of the names having gotten overbought.

RSPD 0.92% /RSP 0.70%

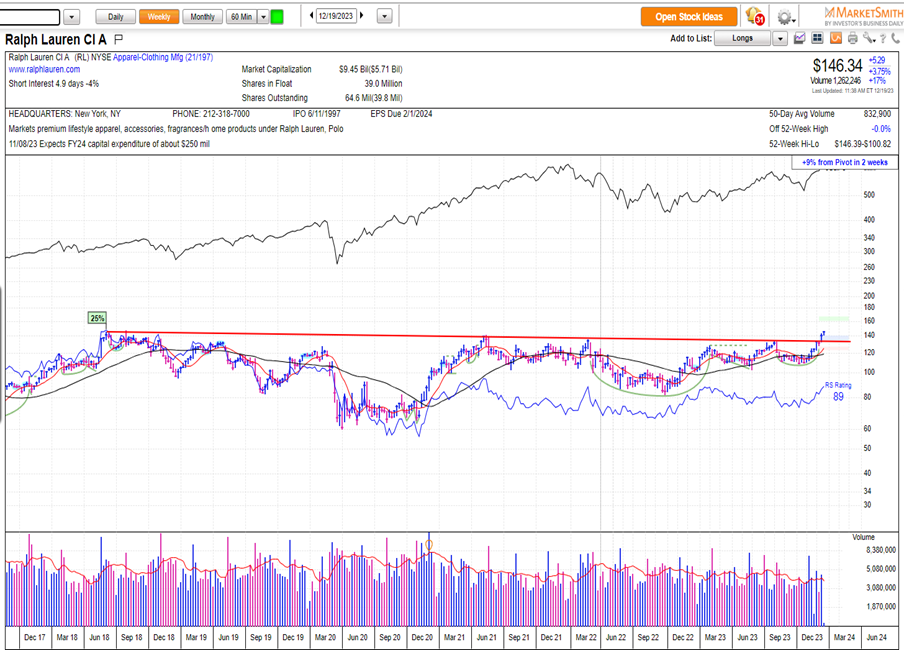

Ralph Lauren (RL 0.33% ) has particular appeal technically following its multi-month base breakout

The weekly RL chart below shows a large sideways technical base which has been formed since 2018 which is now being exceeded. This week’s breakout gives this particular appeal towards likely helping this breakout extend into 2024.

Given the extent of the sideways motion, momentum is not too overbought, and pullbacks (if they happen) would offer a very appealing risk/reward opportunity at $136-$138 for a push higher to over $180.

The area of resistance which looks most prominent starts at $187 and extends up to $192. This is thought to be an ultimate target for RL sometime in 2024.

Overall, I find this technically appealing at current levels despite the short-term overbought levels specifically given the degree of weekly structural progress and feel this is a promising technical candidate into 2024.

RL 0.33%