Tech Stocks Hit a Speed Bump; Better Entry Points in Q3 Seen

Tech Technology stocks hit another speed bump this past Thursday following the reversal day that developed on July 13th. That’s two technical shots across the bow to pay attention to, folks. The S&P 500 index Technology sector ETF (XLK) has broken below its 15- and 20-day moving averages for the first time since bottoming in March as did leaders such as AAPL and KLAC.

The steady uptrend from the March lows is showing evidence of changing and investors should be pay close attention to the technical reactions in the market in the coming weeks. If you remember, last week my note contrasted well advanced growth stocks with lagging value and cyclical stocks.

Technology pullbacks testing support

So now what? In the very short-term, many of these leading technology stocks are already bouncing up from trading support near their respective rising 50-day moving averages. This raises the question of whether the correction is over or whether there is more downside risk.

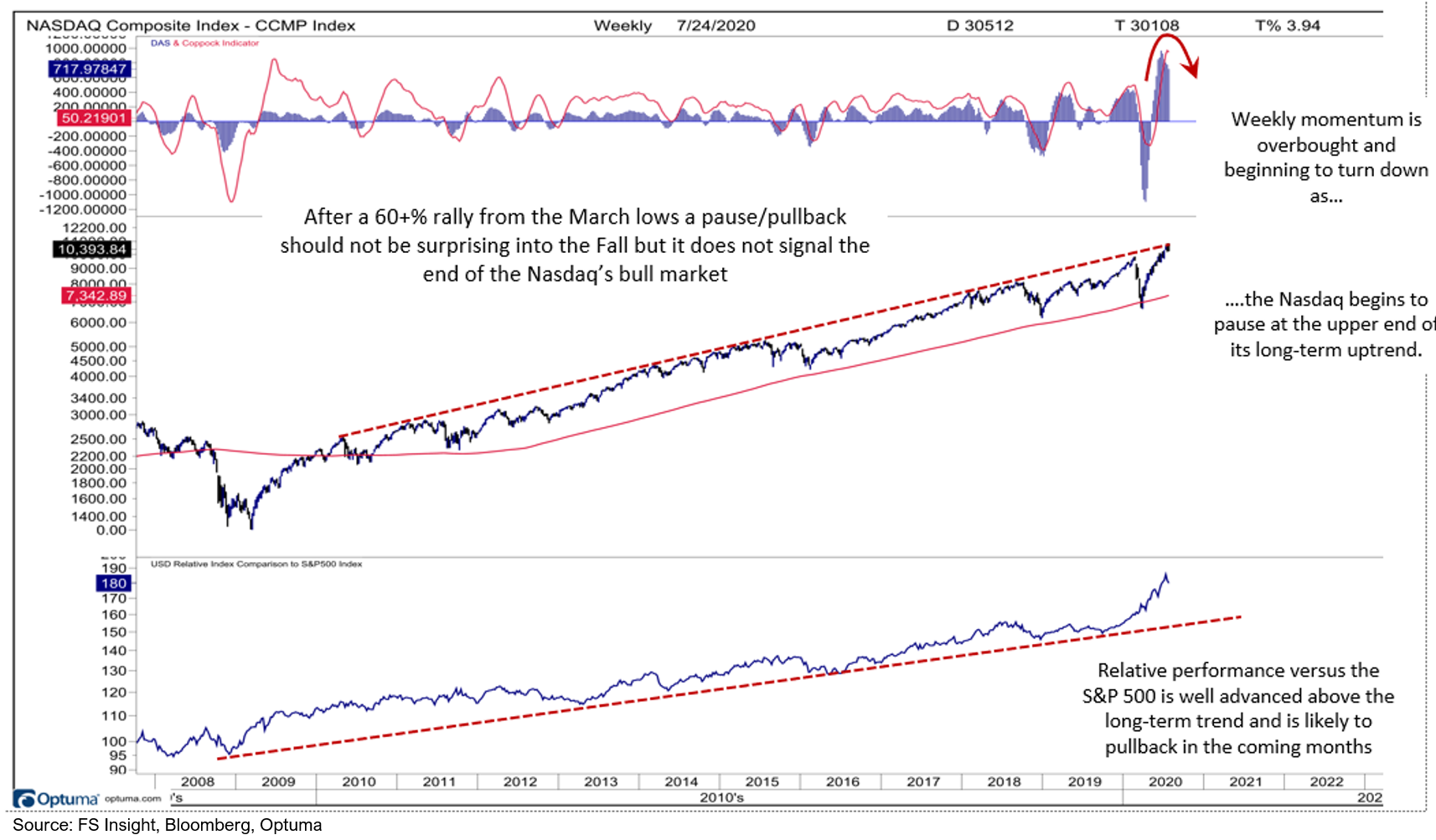

I recommend stepping back from the short-term, daily charts to review the intermediate-term backdrop through weekly charts. I find the weekly charts important for a multi-quarter perspective. The three technical points I view to be important are: First, the Nasdaq’s price and relative performance uptrends remain intact. That may seem like an obvious point, but it is an important reminder that pullbacks should be viewed as corrections in an ongoing longer-term uptrend. It’s premature to conclude the bull market in technology stocks is ending.

Nevertheless, weekly momentum indicators, tracking 1-2 quarter shifts, are overbought and beginning to turn down as the Nasdaq has rallies to the upper end of 10-year trend channel. This data suggests a pause or pullback is likely to develop into the early Fall. (See chart below.) A choppy August and September would not be surprising but don’t lose sight of the bullish longer-term cycle.

Pausing at resistance within a longer term bull market

Bottom Line: After a 60%+ rebound, I’m expecting growth stocks to trade in a broad trading range through August into September that would ideally see the Nasdaq catch up with its rising 200-day moving average in the fall roughly near 9700. Overall a 10-15% correction from the highs or 5-10% from current levels would not be surprising and would set the stage for better entry points on many leading growth stocks later in Q3.

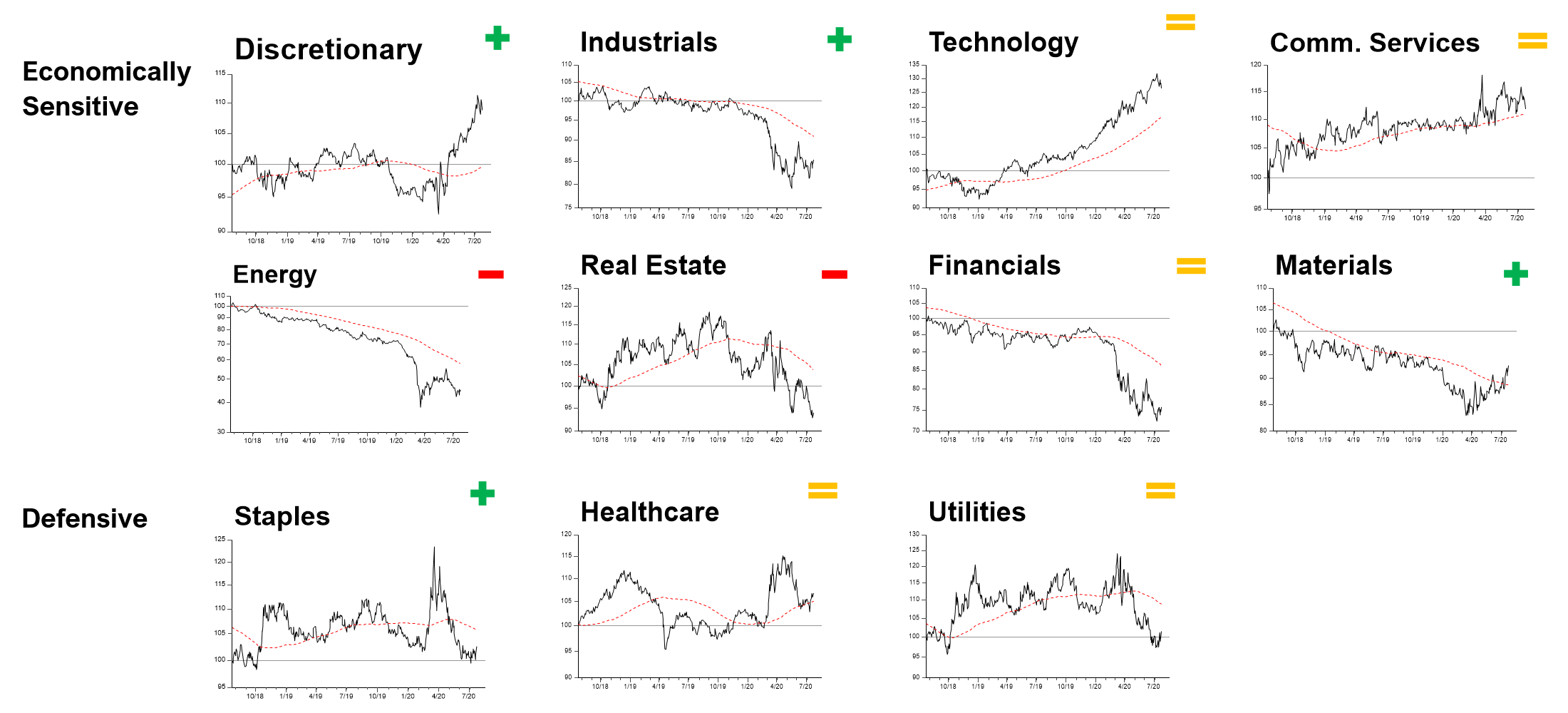

Figure: Weekly Sector Review

Source: FS Insight, FactSet

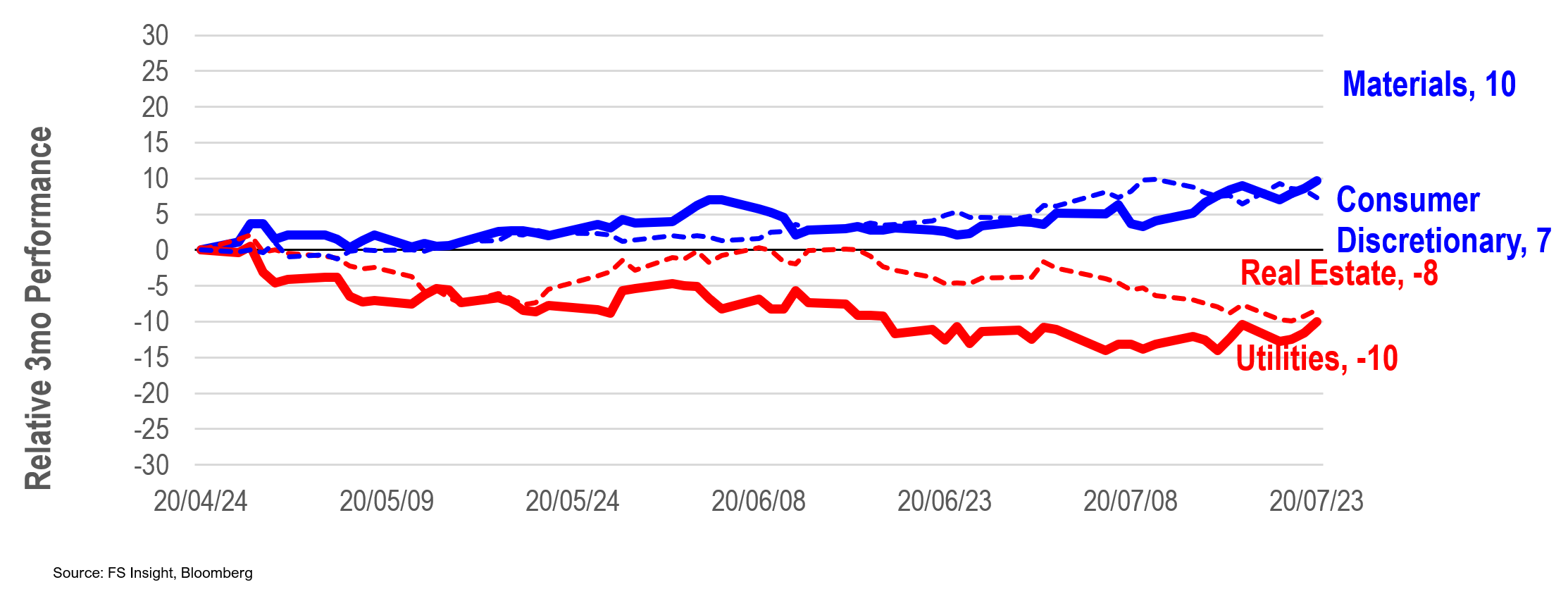

Figure: Best and worst performance sectors over past 3 months

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 7310ae-524517-6ef518-1dc667-2140a6

Already have an account? Sign In 7310ae-524517-6ef518-1dc667-2140a6