Inflation less of a "blackhole of pain" and Fed sees that = why risk assets YE rally could exceed June +23 days/+16% meaningfully.

Inflation is becoming less of a “blackhole of pain” and Fed sees that

In the past week, risk assets staged one of the best gains in 2022. Over that same time frame, there was little “hard” economic data and 3Q2022 earnings season has been largely uneventful (74% beating). But there was far meaningful change in Fed commentary and a far more favorable set-up for risk assets upon investor positioning. It is for these reasons we see risk-assets having the potential to gain more than many skeptics expect.

We realize the majority of investors see this as just another “bear market rally” petering out in a week or two. But consider the following:

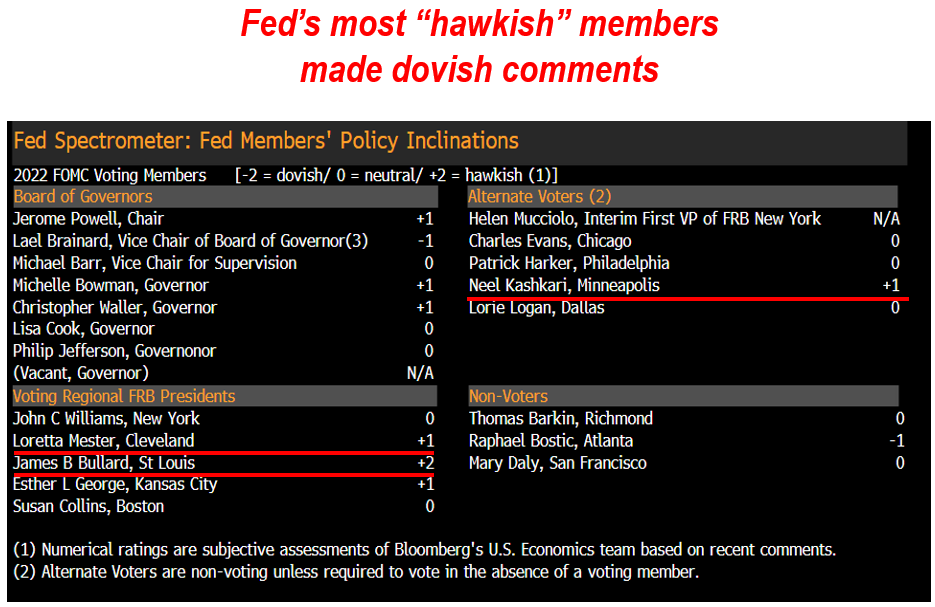

- Multiple Fed speakers, including three of the most hawkish, Mester, Bullard and Kashkari, spoke of a Fed “pause” after Dec 2022.

- While skeptics say this is because something is “gonna break,” commentary by Fed members show it is arguably more due to acknowledging that monetary policy takes time.

- That point concurring with what many economists have made from Wharton Professor Jeremy Seigel, to Ian Shepherson of Pantheon, to Ed Hyman of ISI (and of course, Fundstrat data science team, led by tireless Ken)

- Moreover, another shift in Fed speak has been multiple Fed members (Bostic and Kashkari) pointing to inflation’s source as supply chains and commodities, and not labor markets

- Thus, banging out +75bp hikes and slowing economy was to “buy time” for supply chains to normalize.

- That is now well underway by multiple measures as we have highlighted so many times in the past month or so

- A more nuanced dialogue is taking place regarding CPI as well. Fed conditioned markets to only focus on “hard” data (CPI, PCE) as leading indicators seemed to have lost their relationship to actual delivered CPI

- Many investors are starting to see the fallacy of looking at lagged CPI versus leading. CPI Housing is now well acknowledged to be far behind the current state of housing and the rental market.

- A similar realization is taking place with Medical Insurance, which added meaningfully to services CPI in 2022 (see below) and this could entirely reverse in 2023

- Ultimately, the labor market does need to cool and there are already multiple signs of this.

- This means, this weeks ECI, or employment cost index, might be the single most important data point for the week.

- This was flagged to us by HA, one of most well regarded macro PMs, and is known by many on the Street as one of the best at tracking macroeconomic data.

- If the ECI comes in below 1% for 3Q2022, this implies 4% annualized labor costs and typically 1.5%-2.0% is subtracted for productivity. This is not a wage-price spiral and thus, further supporting “peaking inflation” thesis.

Ingredients for a rally that should exceed the “June pivot” rally in duration and amplitude

All of this, in our view, are reasons that any equity rally should exceed that seen in July, which was the “false dawn of a Fed pivot”:

- that rally was 23 trading days and gained +16%

- at that time, only headline CPI peaked and many investors expected core CPI to keep strengthening

- labor markets were extremely tight in July with JOLTS/workers ~2.0

- that ratio is 1.67 today and falling

- more economists now forecast substantial declines in core CPI ahead and we highlight JPMorgan’s report below

- today, multiple Fed members are openly discussing some type of “pause and look around” which is a dovish turn

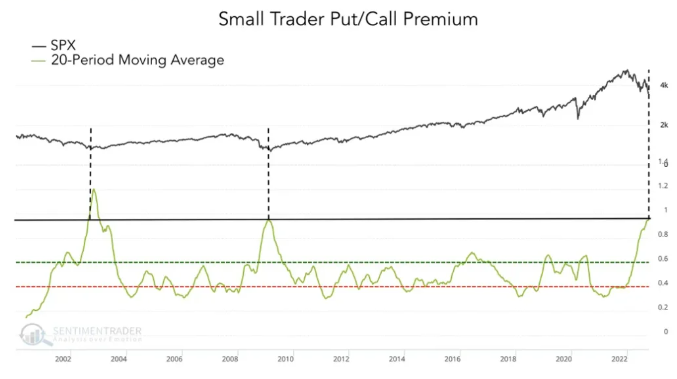

- investor positioning is far more bearish now than anytime in 2022 (see below)

Taken together:

- doesn’t it make sense a rally should exceed the “false dawn pivot”?

- consider a possible 30-50 day rally and 20-25%?

- 2022 mid-terms will be in the coming weeks, and Fundstrat’s Policy Strategist, Tom Block, believes Republicans will take the House and even possibly the Senate

- This would be considered disinflationary as well (reign spending) driving possibly lower rates

- And voters likely see less risk of “higher inflation” (with Republicans) and thus, reduce the risk of a wage-price spiral

- The fly in the ointment, however, is the continued surge in 10-yr yields

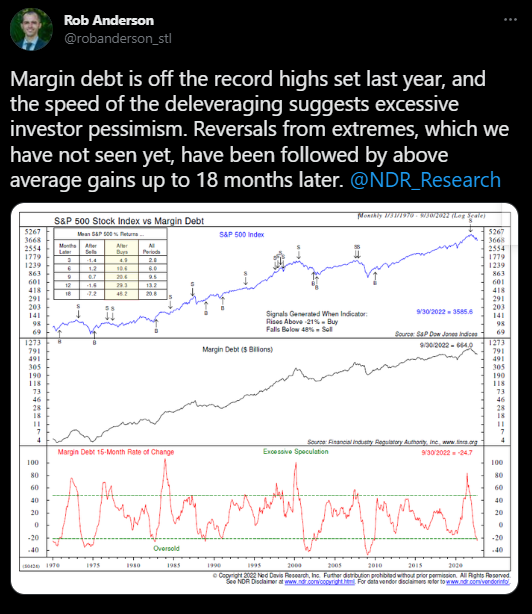

POSITIONING: Whether margin debt, sentiment, gamma, it’s GFC/Dot.com/COVID-19 extreme

Adding to the discussion above, positioning is far more extreme today in terms of risk-off and short positioning. There are too many examples to cite and we have flagged many over the past few weeks. But we are adding some new ones below.

Margin debt, as analyzed by Ned Davis Research has fallen >20% in the past 15 months, matching extremes seen at the lows of:

- 1974

- 1990

- 2003

- 2009

Pretty strong bullish signal (contrarian)

And Sentiment Trader notes Put/Call premium (20D avg) is now at levels seen at:

- 2003 lows

- 2009 lows

Again, extreme bullish signal (contrarian) and not seen at anytime in 2022.

Retail sentiment has posted its longest ever negative streak as flagged by @MichaelAArouet.

- this measures consecutive weeks

- AAII % bears exceed % bulls

- this is the longest ever streak

- second longest was through March 2020

Again, a very strong bullish signal (contrarian)

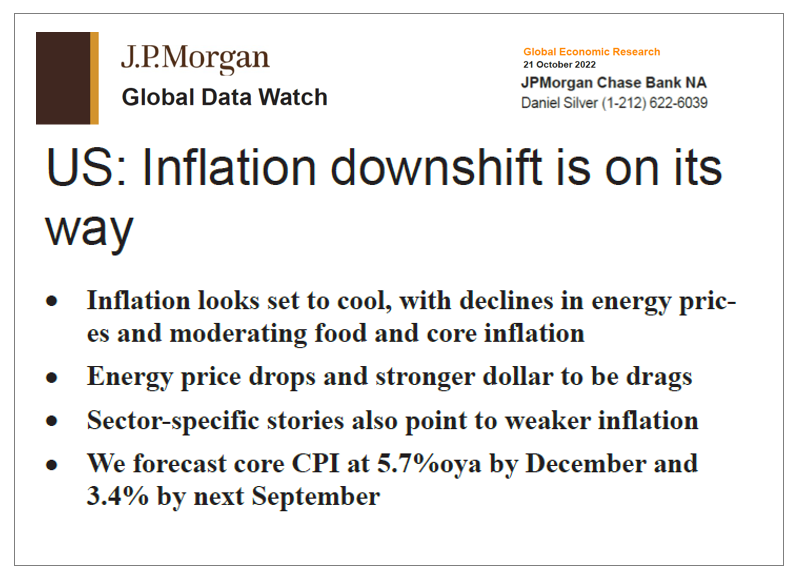

INFLATION: More economists mapping path for lower core CPI into YE

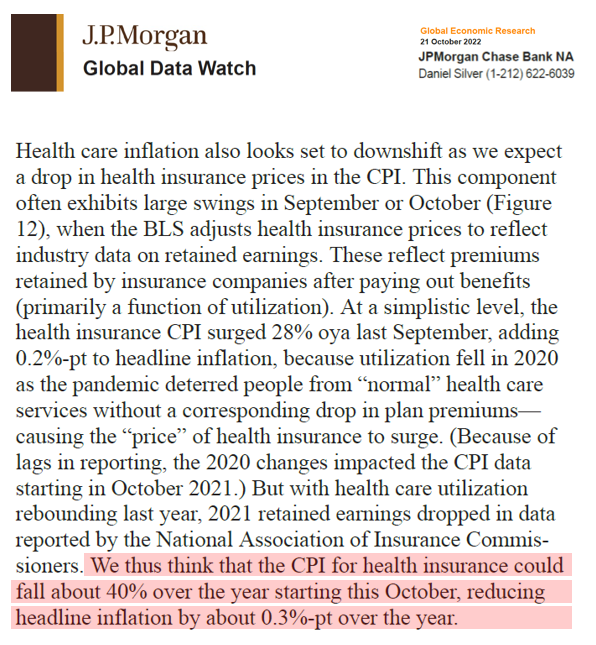

JPMorgan’s economist, Daniel Silver, published a widely circulated report this past Friday.

- the title “US: Inflation downshift is on its way” speaks for itself

- the Fed is more focused on seeing declines in Core and Core Services CPI

- Silver lays out several arguments why statistical factors and others will drive lower services CPI

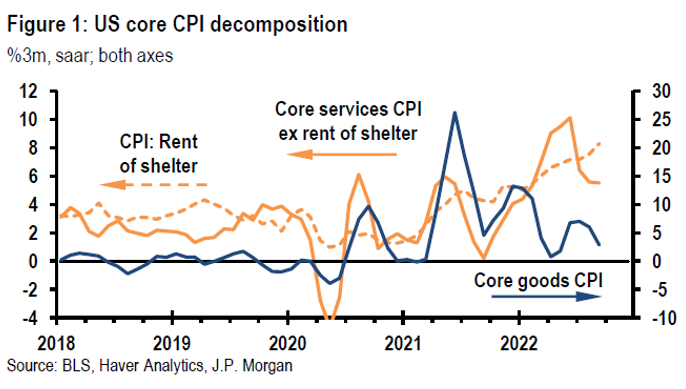

This chart from JPMorgan shows their forecast for “core services CPI ex-shelter”:

- ex-shelter is a cleaner look at services components

- they forecast an abrupt drop from 10% annualized in Sept

- down to 6% in October and into YE

Among many factors cited, they point to an expected abrupt decline in Healthcare services inflation. We have included the CPI report on Healthcare service below:

- the standout is the 28% YoY rise in Health Insurance (+2% monthly)

- this accounts for the majority of the excess surge in Healthcare services CPI

As Silver (of JPMorgan) notes, there is a statistical quirk at work. Healthcare Insurance CPI is impacted by how much Healthcare is used. And this is then reflected in CPI with a 1-year lag:

- in 2020, few people used healthcare (low utilization)

- so in CPI Sep 2021 to now, this caused a rise in cost of insurance (since it was not used) and +28% in CPI costs

- Healthcare usage is greater now, so this will show us as a decline in Healthcare CPI (more used, so unit cost drops)

- Silver estimates this will be a -40% decline in CPI YoY

- That is a massive swing from +28% to negative -40%

- The CPI impact is +0.2% in 2022 to -0.3% in 2023, or +0.5% swing in CPI

- That is massive

MIDTERMS: Republicans gaining House and possibly Senate could also alter inflation expectations

2022 Midterms elections are in November. Tom Block, Fundstrat’s Policy Strategist, see Republicans taking the House and potentially the Senate.

- as NYPost shows, voters see Republicans as better able to handle inflation

- thus, inflation “fears” should ease if Republicans take seats

- this further supports risk asset rallies, as this would reduce the risk of a wage-price spiral

And oddly, Republicans perceive higher inflation in many polls, as shown below. Thus, Republican voters perception of inflation likely improves as well.

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In bc5bcb-564814-751f32-a0536e-747114

Already have an account? Sign In bc5bcb-564814-751f32-a0536e-747114