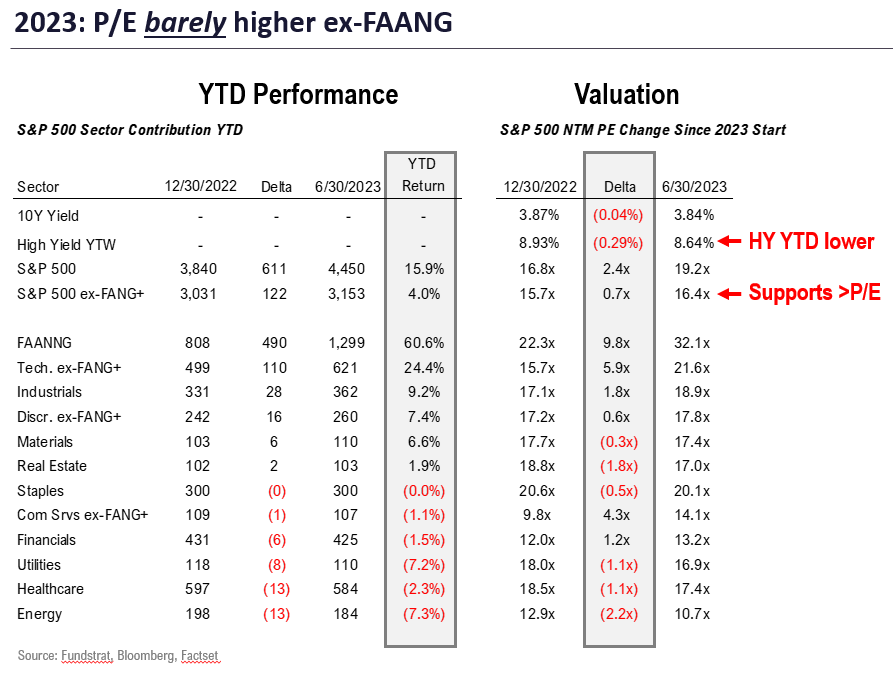

2023 Mid-Year: Raising S&P 500 YE Target to 4,825 from 4,750, implies at least +8% in 2H (maybe more). P/E ex-FAANG is only 0.7X higher to 16.4X, hardly demanding.

NEW: Section (above) added identifying Key Recommendations and Super Grannies

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– SKIP WEDNESDAY <– July 4th Holiday

– SKIP THURSDAY

– Friday

________________________________________________

Today’s note will include a short video update. Please click to view. We discussed why we raise our YE target from 4,750 to 4,825 (implied +8% in 2H). The rise in stock prices over the past 9 months is the start of a new bull market. This new bull market will be driven by AI advancements and the Fed’s successful efforts in curbing inflation. (Duration: 6:47).

NOTE: Click HERE to view our 2023 mid-year outlook presentation.

The S&P 500 is up +16% by mid-year and the Nasdaq posted its best ever first half gaining +38%. In our view, the stock market bottomed October 12, 2022 and the rise over the past 9 months is the start of a new bull market. I know this sounds counterintuitive since we had no “recession” nor “Fed cutting rates.” But we have had a huge decline in inflation, and as we argued for most of 2022, the inflation war is the war the Fed is waging and seemingly winning.

- We are raising our year-end target for S&P 500 to 4,825, from 4,750. The prior all-time high for S&P 500 was 4,821, so we are expecting equity markets to exceed those highs.

- This is an aggressive view, we realize, but our roadmap is as follows:

– headline inflation downshifts in 2H23 falling towards 3%

– Fed can point to real progress and Street consensus will shift dovish

– S&P 500 EPS growth (ex-Energy) inflects positive 2Q23

– investors begin to allocate back towards equities out of the $5.5T cash pile - The equity market has been a “game of inches” all year, with a lot of blocking and tackling. And then periods of market progress. I think this will still be the case in the second half. So be prepared for volatility. But as we highlighted a few months ago, we have entered a “buy the dip” regime, so 2% pullbacks are generally buyable. We saw this on display last week.

- Inflation, not high inflation, is generally good for equities via growing EPS. One just needs to look at the Nikkei 225 reaching all-time highs (breaking 40-year records) on a rise in inflation to appreciate this.

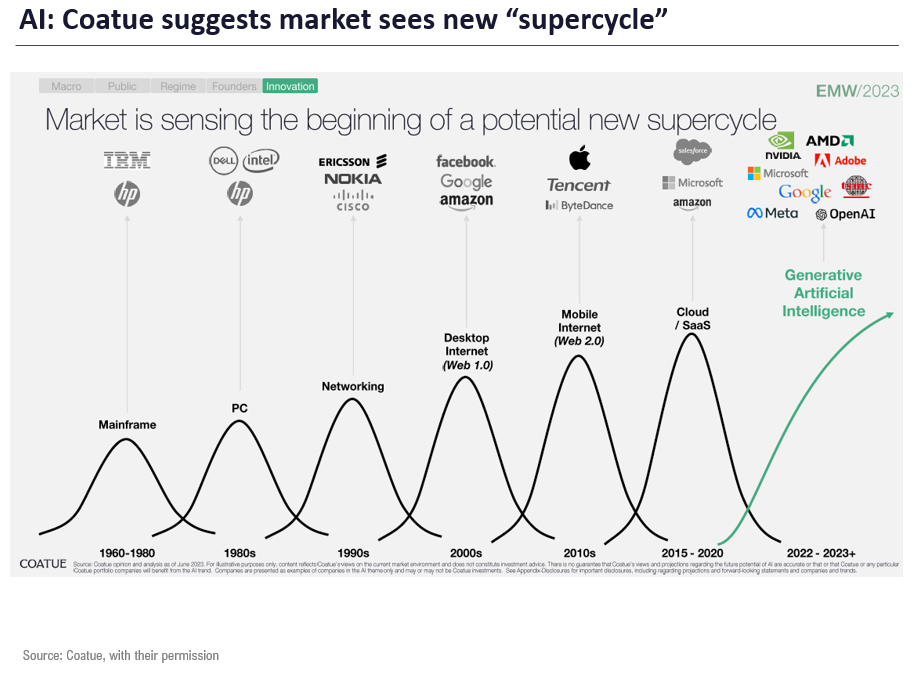

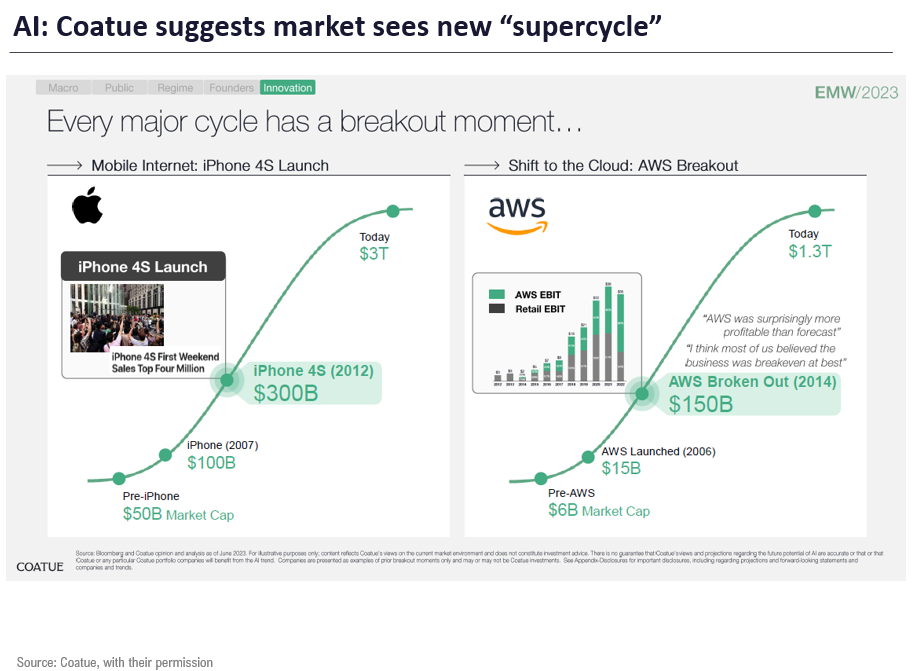

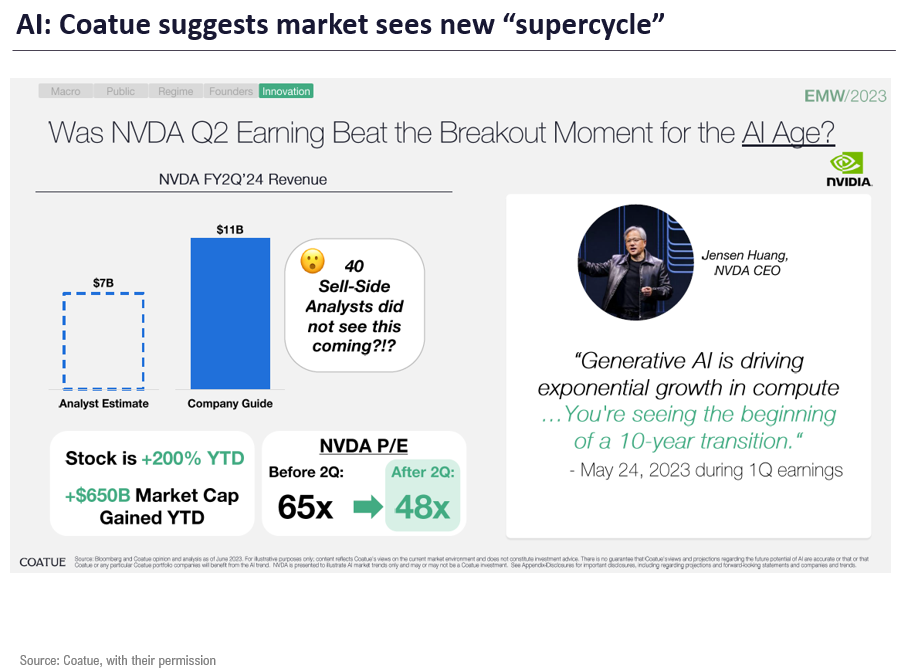

- The ascendance of AI in 2023 is a driver for the equity story. Coatue Capital had some useful slides from their 2023 offsite, which I have shared 3 below, with their permission. Their point is that AI could be the start of a supercycle, similar to internet, cloud and mobile internet. And NVDA 3.79% 1Q results were the “aha moment.” The timing makes sense. AI also solves the inflation problem. By the way, doesn’t this justify the surge in FAANG? Not as a bubble but as the sign of the emergence of this cycle.

- The forward P/E of S&P 500 ex-FAANG was 15.7X at start of the year and now stands at 16.4X, a mere +0.7X increase. We believe P/E should expand as companies are viewed as resilient (“nutty professor” effect) and we are at the start of a new EPS cycle (“slipping into expansion”). But the key is the above happening, a combination of easing inflation and improving growth outlook.

- By the way, +8% in 2H23 is the low end of what can be expected. Of the 9 times (since 1950) when S&P 500 saw >10% gains in first half AND was negative prior year, the median gain is +12%. A +12% gain would imply 5,000 for S&P 500.

- As for consensus, at the start of the year, sentiment was outright bearish, seeing (i) echos of 2008 bubbles, coupled with (ii) a Fed raising rates at the fastest ever pace and (iii) a belief that a hard landing was the primary outcome. To this group, the rise in stocks is only amplifying their skepticism. So, one should expect a lot of pushback from consensus on further market gains.

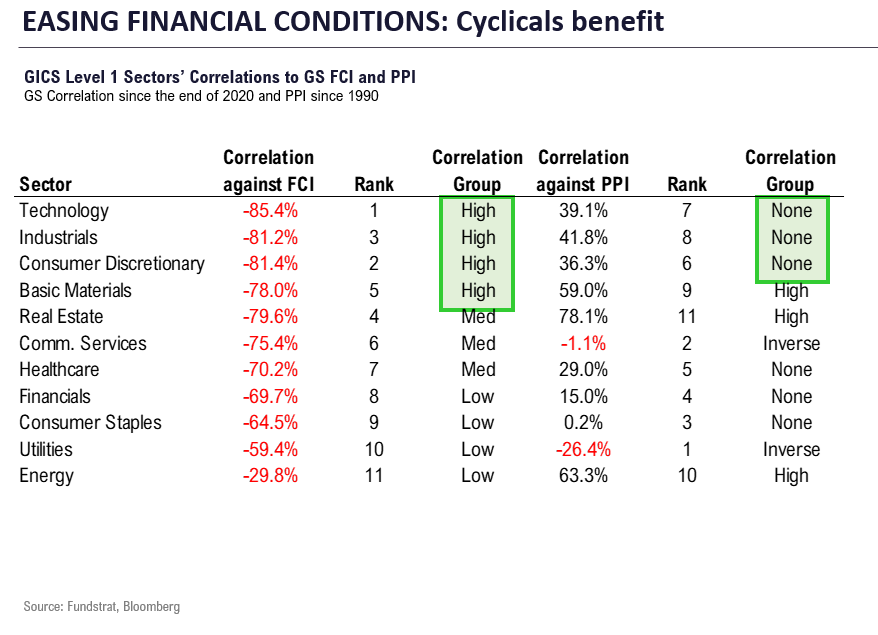

BOTTOM LINE: Cyclicals should lead if financial conditions are easing

We expect consensus to remain skeptical of markets in the second half of this year, so we are prepared to be dealing with lots of pushback. Part of this is that many investors still believe a “hard landing” is ahead for the economy. The future is uncertain, and they could be proven correct. But when CEOs like James Gorman of Morgan Stanley say their “gut tells them things have bottomed” — it is evidence that consensus of economists are not necessarily lining up with consensus of CEOs.

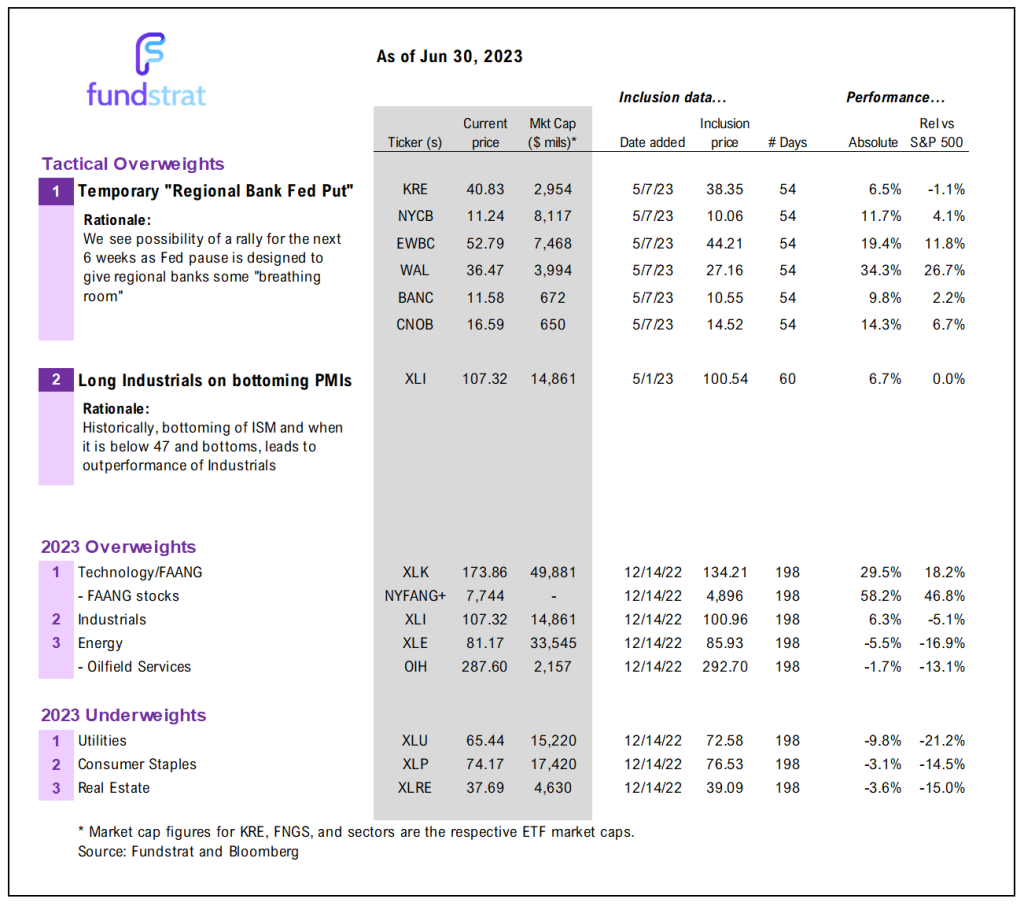

- if financial conditions (FCI) ease, our analysis shows the most positively correlated to easing FCIs:

– Technology

– Industrials

– Discretionary

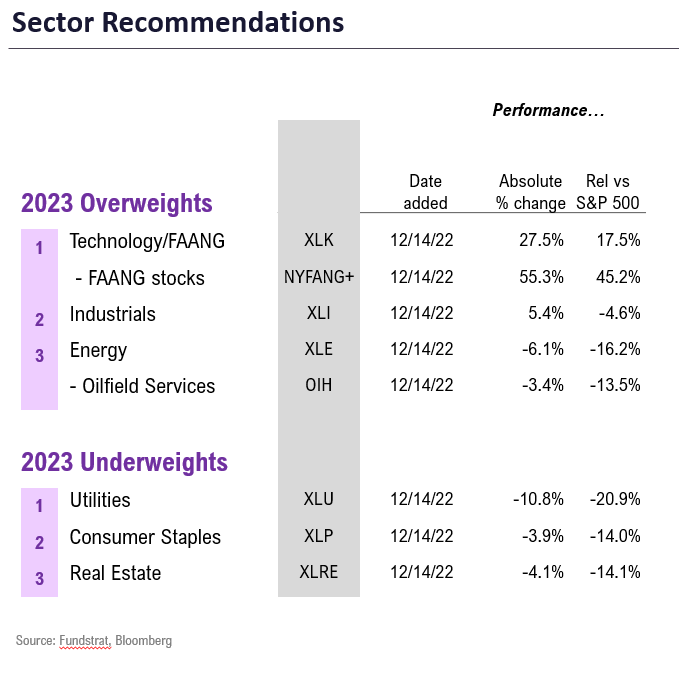

– Materials - we see this as the primary story in second half and thus stick with our recommendations:

– FAANG/Technology

– Industrials

– Energy <– laggard, but not hopeless - And we still stick with our tactical OW of regional banks. While it has been a rough few weeks, we still see upside on this group.

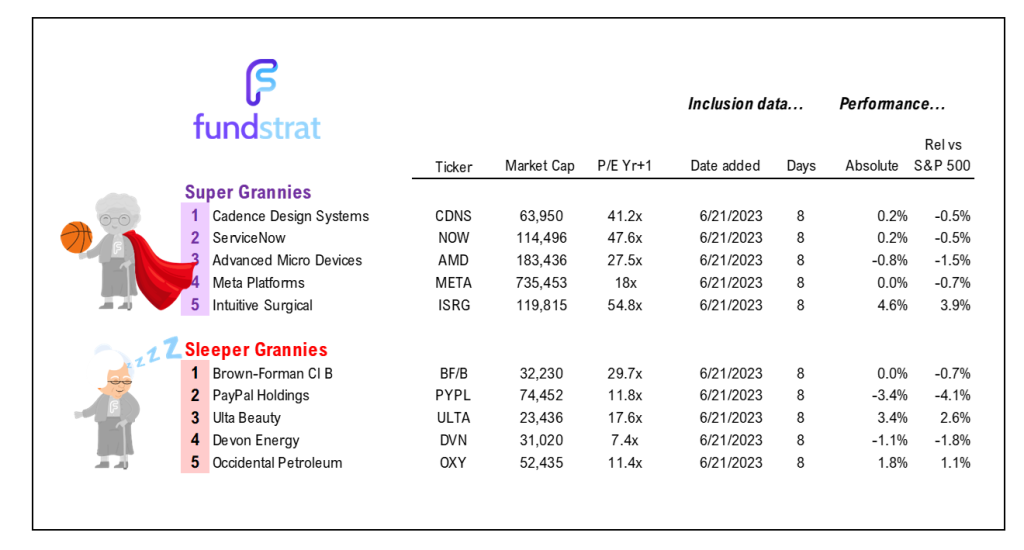

- Lastly, we still favor our Granny Shots, the 34 stock list of core holdings. See below for the list.

Have a great 4th of July!!!

ECONOMIC CALENDAR: FOMC keyin July

Key incoming data July

- 7/3 10am ET June ISM Manufacturing

- 7/6 10am ET June ISM Services

- 7/6 10 am ET May JOLTS

- 7/7 8:30am ET June Jobs report

- 7/10 Manheim Used Vehicle Value Index June Final

- 7/12 8:30am ET June CPI

- 7/13 8:30am ET June PPI

- 7/14 Atlanta Fed Wage Tracker June

- 7/14 10am ET U. Mich. June prelim 1-yr inflation

- 7/15 Manheim Mid-Month Used Vehicle Value Index July

- 7/25 9am ET May S&P CoreLogic CS home price

- 7/25 10am ET July Conference Board Consumer Confidence

- 7/26 2pm ET July FOMC rates decision

- 7/28 8:30am ET June PCE

- 7/28 10am ET July Final U Mich 1-yr inflation

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 10add3-7bb59a-630e93-f688c4-529815

Already have an account? Sign In 10add3-7bb59a-630e93-f688c4-529815