A daily market update from FS Insight — what you need to know ahead of opening bell

“Russia is never as strong as she looks; Russia is never as weak as she looks.” — Winston Churchill

Overnight

White House releases long-awaited P3 program funding opportunity

Raymond James hires 10 former Citi public finance employees

Chicago Bears announce plans for new Chicago stadium development

Liquid Death, the canned water company, raises $67 million at a $1.4 billion valuation

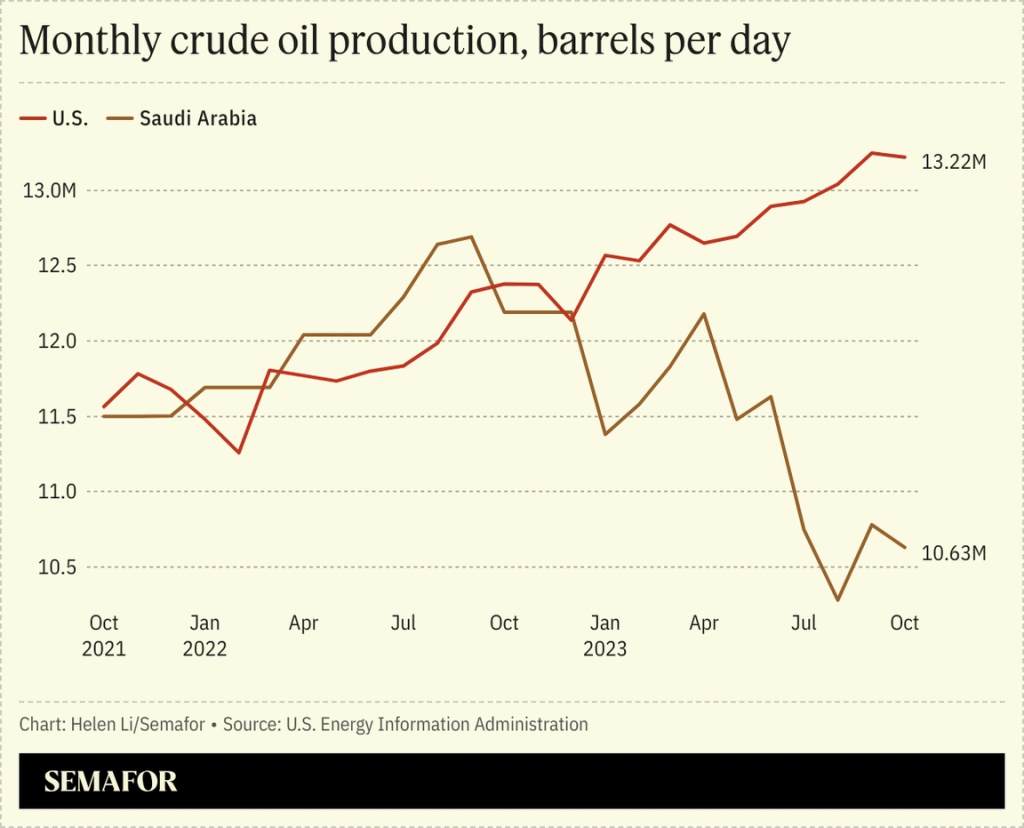

The U.S. is currently pumping more oil than any country in history

First news

- Russia to allow investors to trade their Western securities for cash

- Messaging app Telegram, founded and run by Pavel Durov, the exiled “Mark Zuckerberg of Russia”, nears profitability as a possible IPO hovers on the horizon

- Two months later, Microsoft has still not eliminated a breach by hackers affiliated with SVR, Russia’s CIA.

Charts of the Day

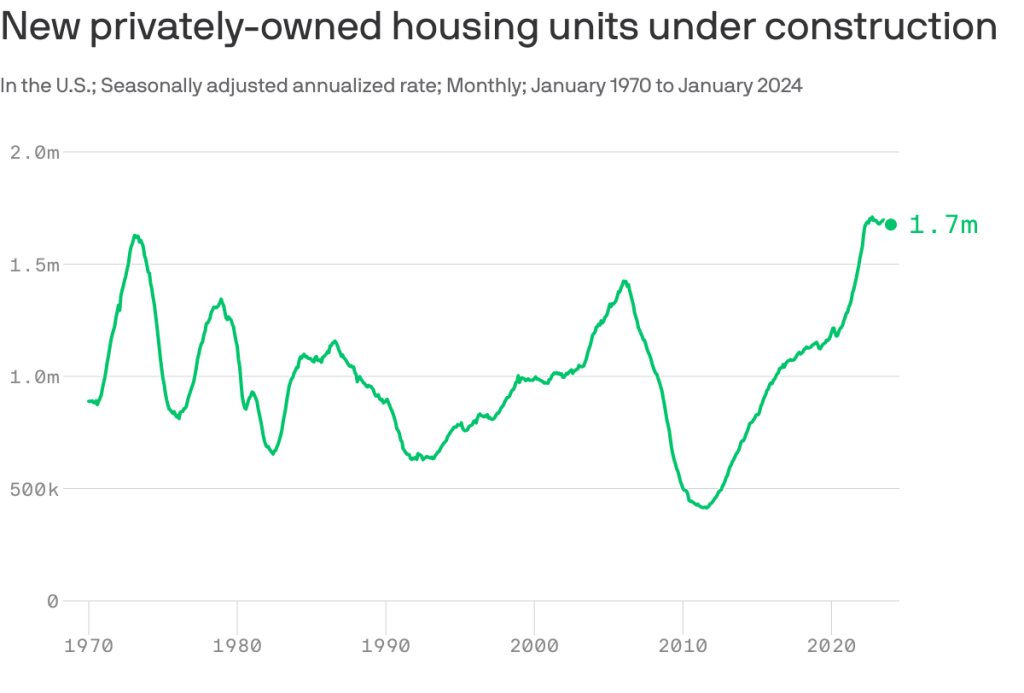

Data: U.S. Census Bureau via FRED; Chart: Axios Visuals

MARKET LEVELS

| Overnight |

| S&P Futures +12

point(s) (+0.2%

) overnight range: +6 to +23 point(s) |

| APAC |

| Nikkei -0.06%

Topix -0.36% China SHCOMP -0.41% Hang Seng +3.05% Korea +0.83% Singapore +0.1% Australia +0.11% India +0.08% Taiwan +0.96% |

| Europe |

| Stoxx 50 +0.28%

Stoxx 600 +0.39% FTSE 100 +0.87% DAX +0.35% CAC 40 +0.18% Italy +0.33% IBEX +0.6% |

| FX |

| Dollar Index (DXY) -0.01%

to 102.86 EUR/USD +0.05% to 1.0931 GBP/USD -0.2% to 1.2788 USD/JPY +0.27% to 147.35 USD/CNY -0.12% to 7.173 USD/CNH -0.05% to 7.1764 USD/CHF -0.17% to 0.8759 USD/CAD -0.08% to 1.3472 AUD/USD +0.08% to 0.6619 |

| Crypto |

| BTC -0.11%

to 72036.77 ETH -0.53% to 4011.6 XRP -3.68% to 0.6966 Cardano -3.49% to 0.7462 Solana +2.1% to 152.03 Avalanche -3.13% to 47.56 Dogecoin -2.45% to 0.1709 Chainlink -3.54% to 20.5 |

| Commodities and Others |

| VIX -0.53%

to 15.14 WTI Crude +0.59% to 78.39 Brent Crude +0.64% to 82.74 Nat Gas +0.06% to 1.76 RBOB Gas +0.36% to 2.59 Heating Oil +0.82% to 2.674 Gold -0.22% to 2177.96 Silver -0.04% to 24.46 Copper +0.09% to 3.926 |

| US Treasuries |

| 1M -6.5bps

to 5.3048% 3M -6.0bps to 5.3318% 6M -1.9bps to 5.297% 12M -3.3bps to 4.9213% 2Y -0.6bps to 4.5296% 5Y -0.5bps to 4.083% 7Y -0.5bps to 4.0911% 10Y -0.8bps to 4.0904% 20Y -0.8bps to 4.351% 30Y -0.8bps to 4.2526% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.9bps to -89.1

bps 10Y-2 Y Spread narrowed 0.3bps to -44.3 bps 30Y-10 Y Spread widened 0.0bps to 16.1 bps |

| Yesterday's Recap |

| SPX -0.11%

SPX Eq Wt +0.13% NASDAQ 100 -0.37% NASDAQ Comp -0.41% Russell Midcap -0.11% R2k -0.81% R1k Value +0.28% R1k Growth -0.47% R2k Value -0.52% R2k Growth -1.09% FANG+ -1.01% Semis -1.78% Software +0.27% Biotech -2.14% Regional Banks -0.5% SPX GICS1 Sorted: Materials +1.13% Energy +1.0% Cons Staples +0.58% Utes +0.51% Fin +0.19% Healthcare -0.05% SPX -0.11% Comm Srvcs -0.23% Tech -0.38% REITs -0.49% Cons Disc -0.49% Indu -0.53% |

| USD HY OaS |

| All Sectors -1.3bp

to 365bp All Sectors ex-Energy -1.6bp to 351bp Cons Disc -1.0bp to 307bp Indu -1.0bp to 276bp Tech -4.7bp to 454bp Comm Srvcs -0.5bp to 564bp Materials -1.5bp to 336bp Energy -0.5bp to 300bp Fin Snr -1.7bp to 338bp Fin Sub -1.8bp to 255bp Cons Staples +0.2bp to 313bp Healthcare -3.5bp to 443bp Utes -0.6bp to 229bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 3/12 | 6AM | Feb Small Biz Optimisum | 90.5 | 89.9 |

| 3/12 | 8:30AM | Feb CPI m/m | 0.4 | 0.3 |

| 3/12 | 8:30AM | Feb Core CPI m/m | 0.3 | 0.4 |

| 3/12 | 8:30AM | Feb CPI y/y | 3.1 | 3.1 |

| 3/12 | 8:30AM | Feb Core CPI y/y | 3.7 | 3.9 |

| 3/14 | 8:30AM | Feb PPI m/m | 0.3 | 0.3 |

| 3/14 | 8:30AM | Feb Core PPI m/m | 0.2 | 0.5 |

| 3/14 | 8:30AM | Feb Retail Sales m/m | 0.8 | -0.8 |

| 3/15 | 8:30AM | Feb Import Price m/m | 0.3 | 0.8 |

| 3/15 | 10AM | Mar P UMich 1yr Inf Exp | 3.1 | 3.0 |

| 3/15 | 10AM | Mar P UMich Sentiment | 77.2 | 76.9 |

| 3/18 | 10AM | Mar Homebuilder Sentiment | 48.0 | 48.0 |

MORNING INSIGHT

Good morning!

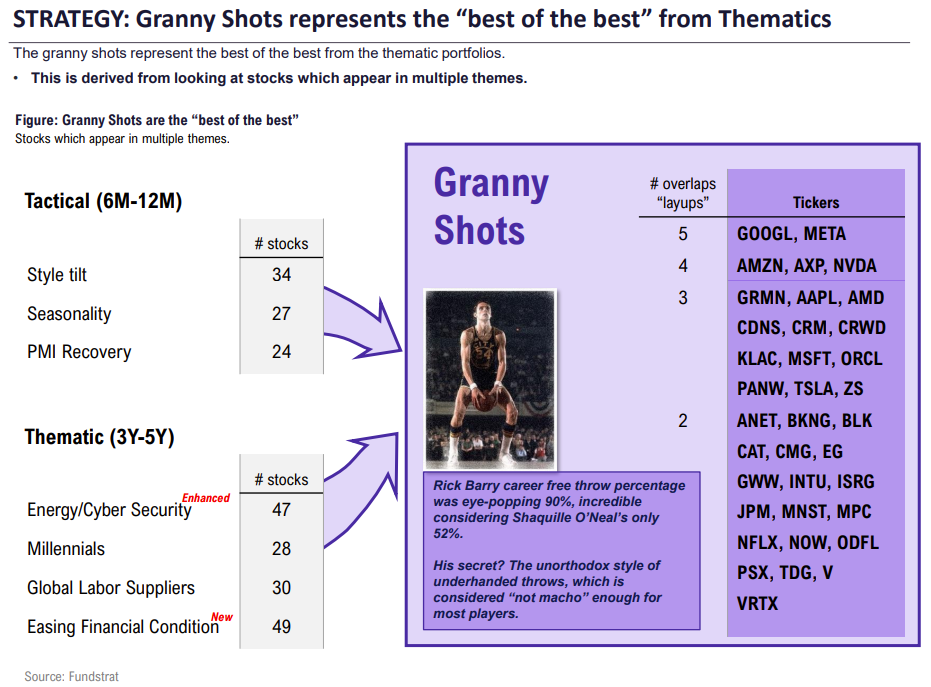

An updated list of 36 Granny shots appears below. The list is sorted from most attractive (most frequently cited) to least. To be a “Granny shot” the stock needs to appear in at least two portfolios.

- There are 5 stocks appearing in at least 4 of 7 themes: GOOGL 10.17% , META 0.27% , AMZN 3.36% , AXP -0.62% , NVDA 6.25% .

Consider that these the stocks that are the most commonly seen as “grannies”, and thus the higher-quality ideas. To be a Granny, a stock must be in at least 2 of 7 themes.

Communication Services:GOOGL 10.17% , META 0.27% , NFLX -0.63%

Consumer Discretionary: AMZN 3.36% , BKNG 0.53% , CMG 2.41% , GRMN 0.29% , TSLA -1.10%

Consumer Staples: MNST 0.41%

Energy:MPC -0.56% , PSX -3.71%

Financials:AXP -0.62% , BLK 0.69% , EG -0.29% , JPM 0.06% , V -0.46%

Healthcare:ISRG 0.59% , VRTX -0.06%

Industrials: CAT 0.59% , GWW -1.96% , ODFL -6.95% , TDG 0.20%

Information Technology:AAPL -0.41% , AMD 2.41% , ANET -0.02% , CDNS 1.92% , CRM 0.42% , CRWD 2.26% , INTU 1.62% , KLAC 4.95% , MSFT 1.80% , NOW 0.73% , NVDA 6.25% , ORCL 2.01% , PANW 0.77% , ZS 1.28% .

TECHNICAL

We continue to see the U.S. stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time. While momentum gauges such as RSI have gotten technically overbought, those are not great metrics through which to view the market. Despite the churning in parts of Large-cap Technology in recent weeks, other sectors have rallied to pick up the slack. It remains to be seen whether last week’s poor jobs report signaled the start of a slowdown in economic data or whether CPI comes in “hot” for a second month in a row. Technically speaking, there is alignment with Tom Lee: any volatility should lead to buying opportunities back to new high territory, and it’s still expected that further gains above 5200 are likely in SPX for the next couple weeks, which might reach 5250-5300 ahead of a possible period of consolidation.

Click HERE for more.

CRYPTO

- MicroStrategy completed an offering of 0.625% convertible senior notes due in 2030, raising an aggregate principal amount of $800 million. This total includes an additional $100 million of notes issued following the full exercise of an option by initial purchasers. The offering featured notes convertible into cash, MicroStrategy’s class A common stock, or a combination thereof, under specific conditions. The initial conversion rate is 0.6677 shares per $1,000 principal amount, implying a premium over the stock price as of the closing date. The proceeds were used to acquire an additional 12,000 BTC for $821.7 million, utilizing both the proceeds from the convertible notes and excess cash, at an average price of $68,477 per bitcoin. MicroStrategy now holds 205,000 BTC, acquired for $6.91 billion at an average price of $33,706 per bitcoin. The offering, initially set at $600 million, closed at $800 million, indicating significant investor interest in potentially securing MSTR stock, a proxy for BTC, at a discount upon conversion.

- The Ethereum network is set for a significant upgrade this week with the deployment of the Dencun upgrade on Wednesday. This upgrade is designed to address key areas of scalability, efficiency, and security, with a particular focus on EIP-4844, also known as proto-danksharding. Proto-danksharding introduces the concept of temporary data blobs in transactions, which is expected to substantially reduce gas fees for rollups like OP and ARB and enhance the network’s scalability by increasing throughput and lowering transaction costs. By improving the user experience (UX), Dencun aims to promote broader adoption of layer-two rollups. These rollups process transactions on the L2 to boost efficiency and reduce costs, while still relying on the Ethereum mainchain for security assurances.

- Jito Labs, a developer of an alternative SOL client, has decided to discontinue its mempool functionality, which was a crucial component of its technology but facilitated expensive front-running, or sandwich attacks, on crypto traders. Although Solana’s core system doesn’t include a mempool, Jito’s client did, through its Block Engine aimed at optimizing MEV on-chain. This move comes after a six-week struggle to curb exploitative trading strategies that preyed on transactions waiting in the Jito mempool. Despite efforts to mitigate these negative MEV effects through various means, the persistent issue led Jito Labs to ultimately remove the mempool. Jito Labs remains committed to enhancing Solana’s performance for all users while seeking other revenue avenues for validators and stakers.

FIRST NEWS

Fire Sale of Frozen Assets. In desperate need of cash to fund the brutal war it is prosecuting in Ukraine, Russia announced yesterday that it will allow domestic investors to sell shares in 3,500 Western companies, and has named a broker for a swap of the frozen assets with foreign investors caught up in international sanctions imposed after Russia invaded Ukraine.

The submission deadline for offers is May 8 for residents and July 5 for non-residents. Acceptance of offers and swaps with foreign owners of so-called C accounts may take place in late July. Investitsionnaya Palata LLC, a Voronezh-based brokerage founded in 1993, whose name translates from Russian as Investment Chamber and which is somehow not subject to sanctions, will gather bids from Russian investors wishing to exchange shares they hold abroad for cash that non-residents hold in C accounts in Russia, according to statements from the Finance Ministry and Investment Chamber.

Classes of securities included in the swap are shares of foreign (non-Russian) issuers, depositary receipts for the shares of foreign issuers, investment shares (as in mutual funds), and ETFs registered outside of Russia but (once) available for purchase in Russia. Ineligible securities include Eurobonds, shares and receipts of issuers whose primary business is in Russia, structured notes, and non-qualifying foreign financial instruments.

The initial price of every security will be calculated based on prices as of market close on March 22, in rubles, convertible per the Russian Central Bank’s exchange rate. The final selling price will be “determined after receipt of requests for share sales from non-residents, and will depend on actual demand” per the website of Investment Chamber, which also promises that no personal data will find its way to purchasers or regulators from abroad, i.e. from “unfriendly countries”. A limit of 100 000 rubles (~$1100) per investor is to be placed on the initial cumulative value of each investor’s securities to be sold. It is not clear how much cash could be cumulatively raised as a result of this swap.

Yesterday also brought news that Russia, which will hold presidential elections on March 15-17, was weighing post-election hikes to both personal and corporate taxes by as much as 4 trillion rubles ($44 billion) – again, in an effort to raise money for war. Bloomberg, Intellinews, Bloomberg; Investment Chamber, The Kremlin (in Russian)

How to Make a Small Fortune in Russia? Start with a Large One. As another proof point that the only way to legally make money in the Russia of recent years is to physically abstract oneself and one’s money from it, Telegram, the seemingly ubiquitous secretive messaging app created by Pavel Durov, the “Mark Zuckerberg of Russia”,* is bringing in ‘hundreds of millions of dollars’ from advertising, has 900 million users** (up from 500 million at the beginning of 2021) and is nearing profitability*** as Durov mulls a U.S.-based IPO – all while based in Dubai.

Durov founded Telegram in 2013 with his brother, but fled Russia a year later after refusing to share data on certain Ukrainian users of VK with Russia’s security agency. Durov said he sold his shares in VK to Kremlin-friendly oligarchs for $300 million under duress. He says today that the main reason he introduced monetization was to remain independent and “to democratize access to Telegram’s value”, even as the company has been “offered $30 billion-plus valuations” from potential investors, including global late-stage tech funds.

Telegram has raised $2 billion-plus in debt financing, from $1 billion and $750 million bond offerings in 2021, followed by a $270 million one in 2023, with bondholders able to convert the senior unsecured debt into equity at a 10-20% discount to the price of Telegram’s IPO if the latter takes place before the end of March 2026; this gives the company an incentive to list before that date, but also a generous runway.

Durov said there’s been interest in a smaller equity raise. “That remains a possibility if we wanted to raise funds, for example, to fuel our [artificial intelligence] related ambitions,” he said, adding that the company was exploring introducing an AI-powered chatbot.

Telegram said it would consider selling an allocation of stock to loyal users, following Reddit ‘s rewardful example. This month, the company will also introduce revenue sharing with the creators running its channels, promising them a 50% cut of marketing dollars. In addition, it is also introducing business accounts and a social-discovery feature to help users meet or date people near them.

Once home mainly to the anything-goes, early-days cryptocurrency community, the company, which only has about 50 full-time employees, has surged in popularity over the past few years, becoming an essential communication tool for governments and officials and a lifeline for citizens in conflict zones.

Researchers warn that the lightly moderated platform remains a hotbed for criminal activity, as well as extremist or terrorist content and misinformation. Critics have suggested that the Kremlin may have links to or leverage over Telegram, a claim that Durov dismissed as “inaccurate”.

Telegram’s bid for advertising dollars is at odds with its reputation as a renegade platform with a hands-off approach to moderation, which recently drew scrutiny for allowing Hamas-related content to remain on the platform. Elon Musk’s X has similarly aimed to walk the tightrope woven in varying degrees of free-speech absolutism and the personal preferences of its owner while trying to have at least a few advertisers supporting its platform. FT

* After co-founding VKontakte (VK), the country’s most popular social-media network in 2007.

** Meta-owned rival WhatsApp has 1.8 billion monthly active users, while encrypted communications app Signal has 30 million as of February 2024, according to analysis by Sensor Tower, although this data only covers mobile app use.

*** Annual expenses stand at less than 70 cents per monthly user.

Slow-walk Security, Fast-track Trouble. In late-July, the SEC instituted a rule to the effect that public companies have to report cybersecurity breaches within four days if there is a chance that the company’s finances could be affected. Over the weekend, Microsoft admitted that a practically two-month-old hack by Russian state actors has still not been contained. Six weeks ago, we wrote about this attack, which also affected HP, in That Tipping Point (The Spy Who Underwhelmed Me). Apparently, a group known as Midnight Blizzard aka Cozy Bear, associated with Russia’s SVR, an analogue of the CIA, gained purchase in Microsoft’s cloud stack by compromising credentials on a legacy test account some time ago.

Microsoft says that it has yet to determine whether the incident will materially impact its finances. It did say that the stubbornness of the intrusion “reflects what has become more broadly an unprecedented global threat landscape, especially in terms of sophisticated nation-state attacks”. Given Redmond’s software monoculture, and the fact that one billion customers and 20 million businesses are theoretically linked through its global cloud network, the national security consequences are potentially dire, even if implications for the company’s finances are somehow not so. Hackers working for the elite non-allied foreign alphabet agency may now be able to leverage supply-chain attacks against Microsoft’s customers. Fortune

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 063072-d753dc-ad2004-bfd1a4-1472d3

Already have an account? Sign In 063072-d753dc-ad2004-bfd1a4-1472d3