Key Areas of interest in a very challenging Tape

- Friday’s failed rally attempt warrants patience in the bottoming process .

- Pharmaceutical stocks look to be one of the best defensive areas to favor which should start to accelerate back higher. Favorites included

- Gold pullback offers opportunity as cycles look positive into April

The relentless volatility in US Equities continues to make buying dips difficult in this ongoing downtrend. Several attempts at pushing above SPX 4250 have failed in recent days, and Friday’s about-face resulted in prices taking out Thursday’s lows to close down near the lows of the day and week. SPX has now been lower seven of the last 10 weeks, while momentum is negatively sloped and not oversold on weekly charts. The key level to hold into next week’s FOMC meeting lies at lows from two weeks ago at SPX-4114 but initially 4157 is important. Any breach of 4114 has little until 3950-4000, but this area has multiple targets from a Fibonacci projection standpoint that make dips likely buyable. Unfortunately, it’s going to be difficult to have much confidence in this pullback stabilizing until prices climb back over ongoing two months’ downtrend. At present, diversifying into areas within the commodity space and/or Pharmaceuticals and Defensive groups like Utilities and REITS make sense.

Gold cycles bode well for additional strength into April before any real pullback

Gold and Silver have come alive in a big way given the recent uptick in global geopolitical tension. Gold managed to push back to August 2020 peaks, while Silver has lagged in this regard thus far. My initial target for this rise lies at 2239 up to 2274 before prices settle, and pullbacks into the FOMC meeting this week should represent a good opportunity to add to long positions for further strength in the weeks to come.

Given the uptick in yields this past week, Gold finished near the lows of its weekly range at 1990 after having hit 2077 earlier in the week. That level by the way equates to an exact Fibonacci based 161.8% extension of the initial move up from March 2021 when measured from August 2021. Overall, this move does not look complete by any stretch and pullbacks should offer opportunity.

My cycle composite from Foundation for the Study of Cycles shows further upside progress in Gold into April which has been largely accurate for the last few peaks and troughs using daily cycles over the last few years. Following a runup into April, some minor weakness looks possible into mid-Q2, but offers a good opportunity to buy dips for further upside progress which might reach 2500 and above. Overall, using weakness in the precious metals to buy looks proper, technically speaking and from a cyclical perspective.

Gold cycles bode well for additional strength into April before any real pullback

Gold and Silver have come alive in a big way given the recent uptick in global geopolitical tension. Gold managed to push back to August 2020 peaks, while Silver has lagged in this regard thus far. My initial target for this rise lies at 2239 up to 2274 before prices settle, and pullbacks into the FOMC meeting this week should represent a good opportunity to add to long positions for further strength in the weeks to come.

Given the uptick in yields this past week, Gold finished near the lows of its weekly range at 1990 after having hit 2077 earlier in the week. That level by the way equates to an exact Fibonacci based 161.8% extension of the initial move up from March 2021 when measured from August 2021. Overall, this move does not look complete by any stretch and pullbacks should offer opportunity.

My cycle composite from Foundation for the Study of Cycles shows further upside progress in Gold into April which has been largely accurate for the last few peaks and troughs using daily cycles over the last few years. Following a runup into April, some minor weakness looks possible into mid-Q2, but offers a good opportunity to buy dips for further upside progress which might reach 2500 and above. Overall, using weakness in the precious metals to buy looks proper, technically speaking and from a cyclical perspective.

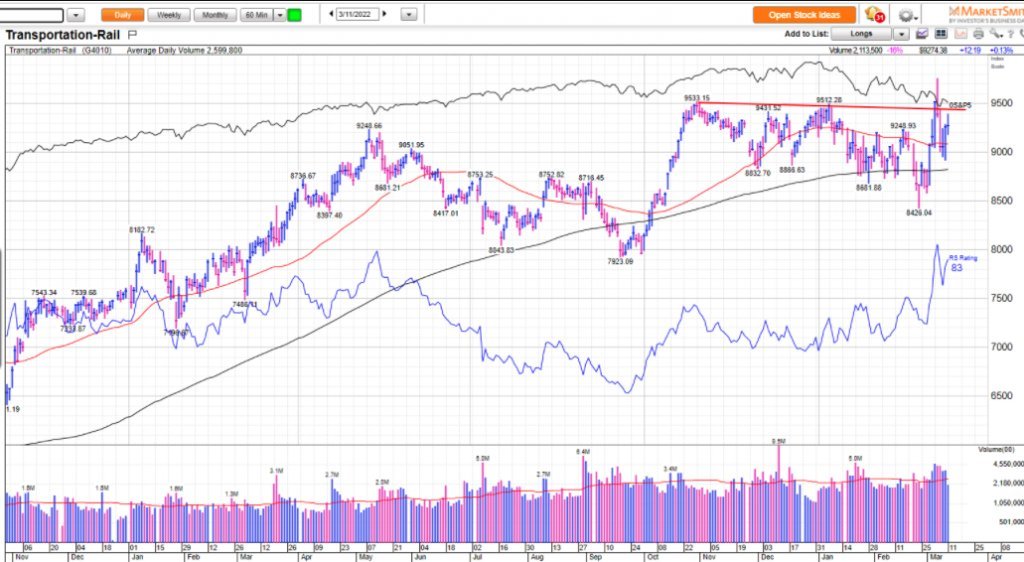

Rails are an appealing part of Transportation to own

Finally, the Rails look attractive within the Transportation group which was mentioned in yesterday’s report. Stocks like UNP, CSX 0.84% and CP 0.66% all have technical appeal and should be overweighted.

The announcement of Ackman’s re-investment into CP this past week was interesting, suggesting the Fundamental picture is also aligning with what my technical analysis suggests is favorable. Recent geopolitical uprising has done little to no damage to this group and this looks attractive technically.

Marketsmith charts of the Rail industry from Investors Business daily show a lengthy consolidation pattern over the last six months, though very little overall damage during this entire US Stock index decline. Thus, this area looks like another group which can offer some relative stability during a time of market volatility, and it’s thought that once the downtrend gives way to a renewed rally higher, this group likely will take the lead and break back out to new all-time highs. Have a nice Weekend !