Financial Markets Panicked This Week, On The Double Whammy of Omicron + Powell Taper

The first two USA Omicron cases have been “mild” –> yet, 20 nations have closed borders…does it matter now?

Policymakers panicked a week ago, in response to the identification of the new Omicron COVID-19 variant. And this resulted in swift action taken by > 20 nations, quickly closing their borders to incoming travelers from Africa. That was a week ago.

- in the past 7 days, Omicron cases have appeared in nearly all > 20 nations that locked down their borders

- in the past 7 days, US has already identified 2 Omicron cases

- it is early days, but so far, nearly all Omicron cases identified are described as “mild”

In other words, Omicron is truly an anagram (hint, moronic). We will discuss the catastrophic impact on financial markets later in this note, but as we know, financial markets often:

- fire, ready, aim

- and in the past, these presented opportunities for investors to leverage “panic selling” days

Omicron has been in the US since before mid-November…

Of the first 5 US identified cases of Omicron, nearly all are characterized as mild cases. Ironically:

- the person who caught Omicron in NY was infected between 11/19 to 11/21

- US closed borders to incoming flights on 11/25

- this is at least 4-6 days after the first cases arrived in the US

So, I am puzzled why the US and 20 other nations closed borders.

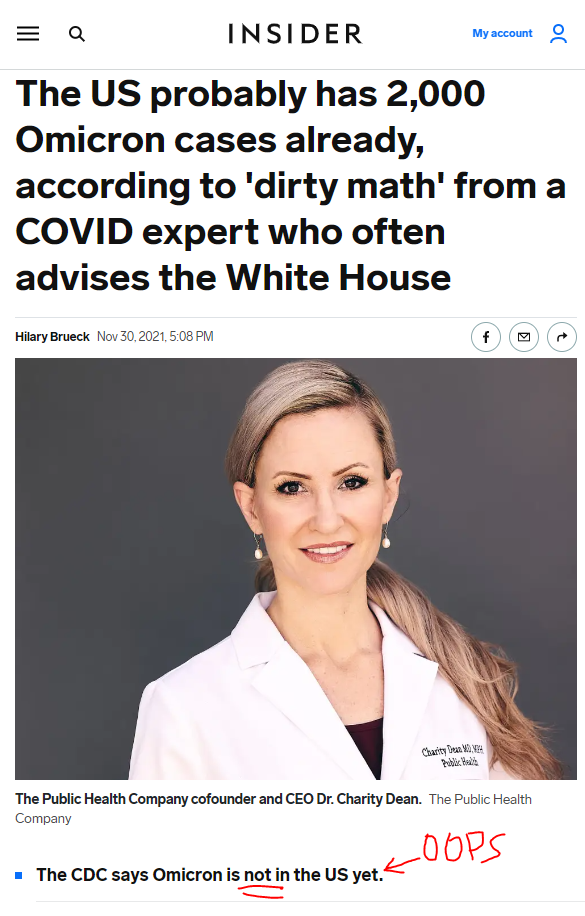

And policy experts to the White House made the same assertions. This article below is from 11/30/2021, and this advisor estimated that the US already had > 2,000 cases.

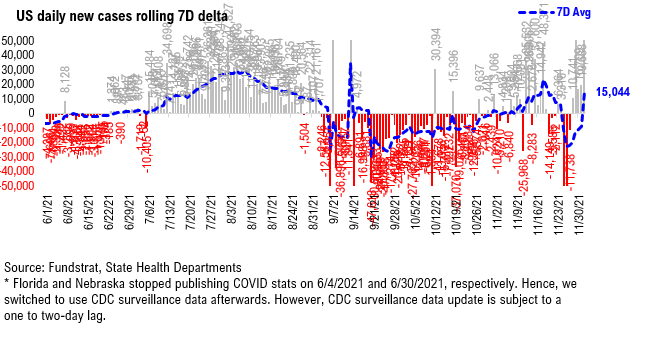

…USA COVID-19 case trends are polluted by Thanksgiving distortions… so underlying trends are not clear

US COVID-19 cases are curling upwards, as shown below. And part of this is seasonal as the northern states experience cooler weather. But it is difficult to see actual underlying trends as a bigger factor, in our view, is the distortions from Thanksgiving. We wrote about this earlier in the week and this reflects the closures of offices and the subsequent jump in cases later in the week:

- 7D average of cases is still sub-100,000

- but with the seasonal uptick, USA cases could reach > 100,000 next week

The chart below looks at 7D delta, or change versus 7D ago. And as shown, this is showing a swing in case trends. We think underlying cases are rising, but the magnitude of this rise is distorted by Thanksgiving impacts.

STRATEGY: A lot of bad news got baked in by financial markets panic this week, on the double whammy of Omicron + Powell taper

Financial markets were in full blown liquidation since the Friday post-Thanksgiving, reflecting panic around:

- Omicron variant

- “hawkish” Fed as timeline for accelerating end of bond purchases + removal of “transitory” rattled markets.

And this lead to 3 of the last 5 days seeing 90% down days — where 90% of the volume was down. And as we highlighted in prior analyses, the prevalence of two or more 90% down days is associated with market bottoms.

- yet, even as we saw this selling as signs of a bottom

- investment confidence collapsed

The above GIF is from one of my favorite movies, of all time, Animal House (1978), a comedy based loosely on the college experiences of the writers (Harold Ramis, Douglas Kenney and Chris Miller). Towards the end of the movie, this is Omega pledge and ROTC cadet, Chip Diller (Kevin Bacon) is trying to bring order to a panicked crowd:

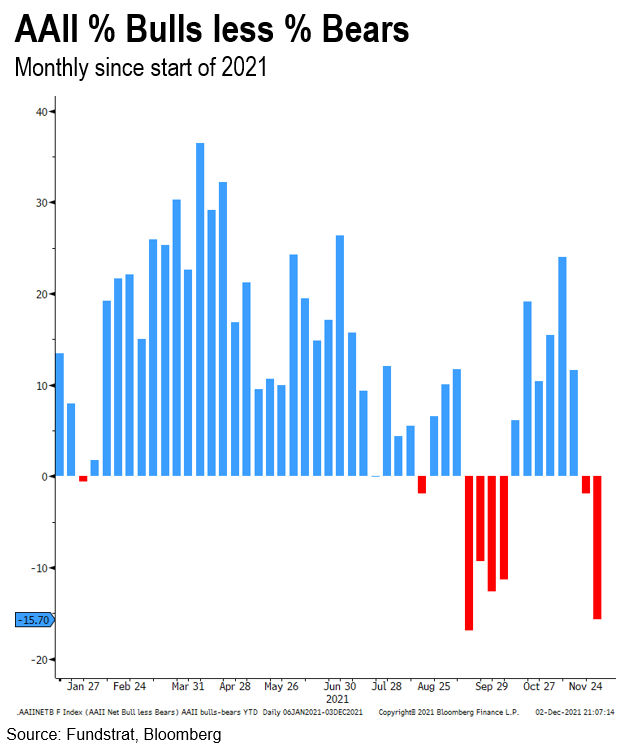

- AAII % bulls less % bears fell to -8.6%

- this is among the lowest readings in all of 2021

- does it make sense that investors were more bearish yesterday than anytime in 2021?

…Shouting at the market doesn’t work and one will get run over

But this week is also a lesson in realizing financial markets will march to their own tune. And whether a sell-off is justified is secondary to the fact that price is the short-term metric that matters.

…S&P 500 is now 5% from its recent all-time high, within the window of a healthy correction

There has been quite a lot of technical damage to the financial markets in the past week. And this technical damage means sentiment has obviously weakened, meaning investors might be more inclined to sell strength, rather than buy dips. But:

- the 5% down means a lot of bad news has been baked in

- this means that bad news is priced in –> bad news = good news

- and to the extent the cadence of incoming data surprises to the upside

- stocks could react positively –> good news = good news

So, in a way, the magnitude of the decline, coupled with the collapse in sentiment, means a lot of bad news is baked in. We get quite a lot of incoming data in the next few weeks.

- Friday is the payrolls report

- and supply chain glitches, the source of much inflationary pressures, could begin to ease

- and as such, reduces the execution risk of the economy

- incoming data on Omicron could also positively impact markets

…Unlike 2018, 10-year yields are falling post-Powell hawkish pivot = sell-off in bond markets seems more reflective of Omicron, more than “liftoff”

I am still confused by the bond market’s reaction to Fed Chair Powell’s comments earlier this week. He made two statements to Congress that seemed to rattle markets. The first is the pace of tapering bond purchases could be accelerated and secondly, that inflationary pressures are no longer termed transitory.

In other words, this was seen as a hawkish pivot by the Fed. But compare the bond market reaction to the Fed pivot in 2018

- in 2018. as Fed funds and interest rates moved higher

- long-term yields, the 10-yr specifically, moved higher as well

This move in the long-end reflected markets pricing in a strengthening economic outlook and a more deliberate need to raise rates by the Fed.

- This rise in the 10-year did not stop until late 2018

- That is when financial markets finally reached a break point, where Fed actions were far ahead of market belief on where rates should be.

But look at the move in the rates markets in the past week. With this “hawkish pivot”:

- short term rates (1-yr Tbills) surged to 25bp from 10bp

- long-term yields, however, collapsed, falling from 1.7% to 1.45% in a few days

In other words, the reaction from the rates market is very different than what was seen in 2018. And this suggests to me that the reaction in financial markets was not solely Fed commentary:

- if it was only the Fed, presumably long-term rates would have been rising in expectations of a tightening cycle

- the drop in long-term rates is a “risk off” flavor

- investors seeking protection

- which could be reflective of the uncertainty around the new Omicron COVID-19 variant

In any case, our takeaway is that financial markets over-reacted in the past week. There has been a lot of technical damage. But given the fundamental trajectory of the US economy remains healthy (look at US jobless claims) coupled with negative sentiment. And the risk/reward remains positive. We realize it has been a challenging week for markets, but our central view remains at YE rally in December.

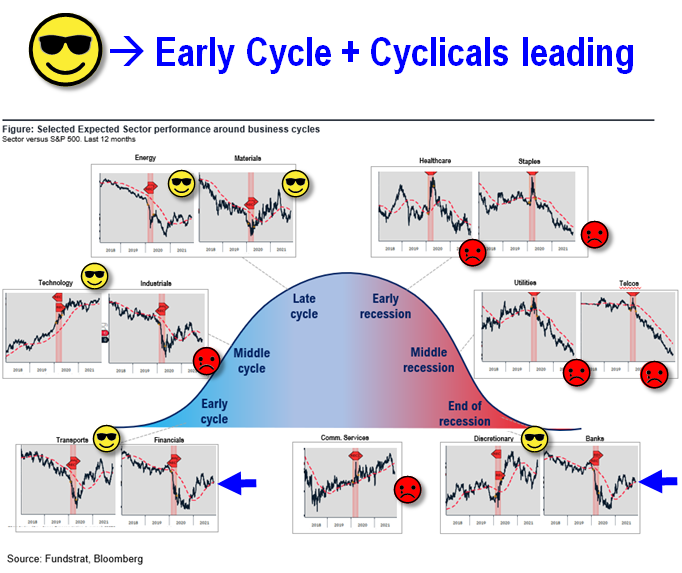

SECTORS: Leadership still Cyclicals/Early-cycle aka Epicenter

Relative sector performance is shown below and as we can see, 5 sectors are showing positive relative trend:

- Energy

- Basic Materials

- Technology

- Transports

- Discretionary

- sort of Financials/Banks

These are all cyclical groups. And also have general positive exposure to reflationary trends. Inflation, incidentally, in isolation is not a bad word. The real risk to markets is:

- too much inflation hurting consumer confidence

- or unanchored inflation expectations, fear of uncontained inflation

This is not necessarily what markets seem to be pricing. If markets were worried about either of the above, Defensive stocks or Growth stocks would be leading. Instead, we are seeing Cyclicals lead.

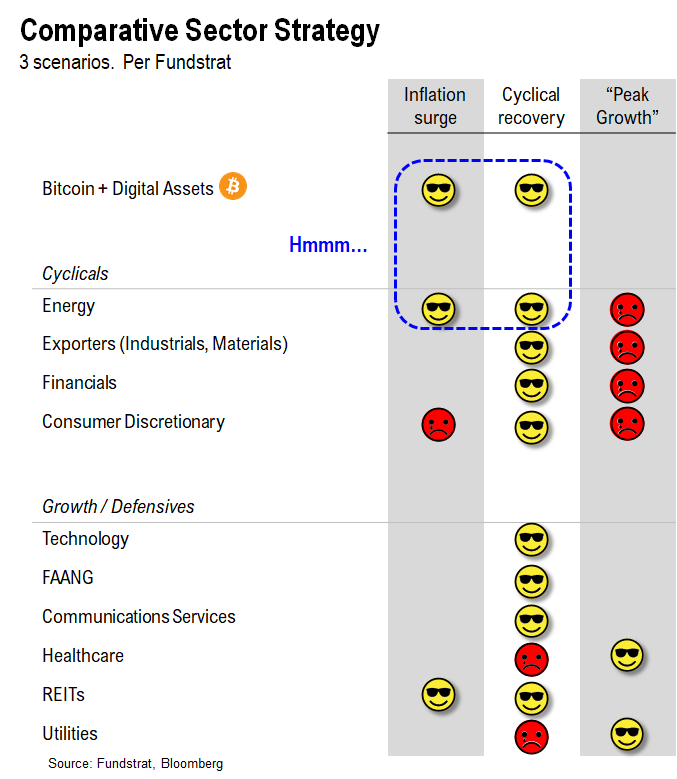

Into YE, our recommended strategies are:

- Energy

- Homebuilders (Golden 6 months) XHB

- Small-caps IWM 0.05%

- Epicenter XLI 0.11% XLF 0.60% XLB 0.85% RCD

- Crypto equities BITO 2.64% GBTC 2.72% BITW 3.20%

Into 2022…

- Industrials

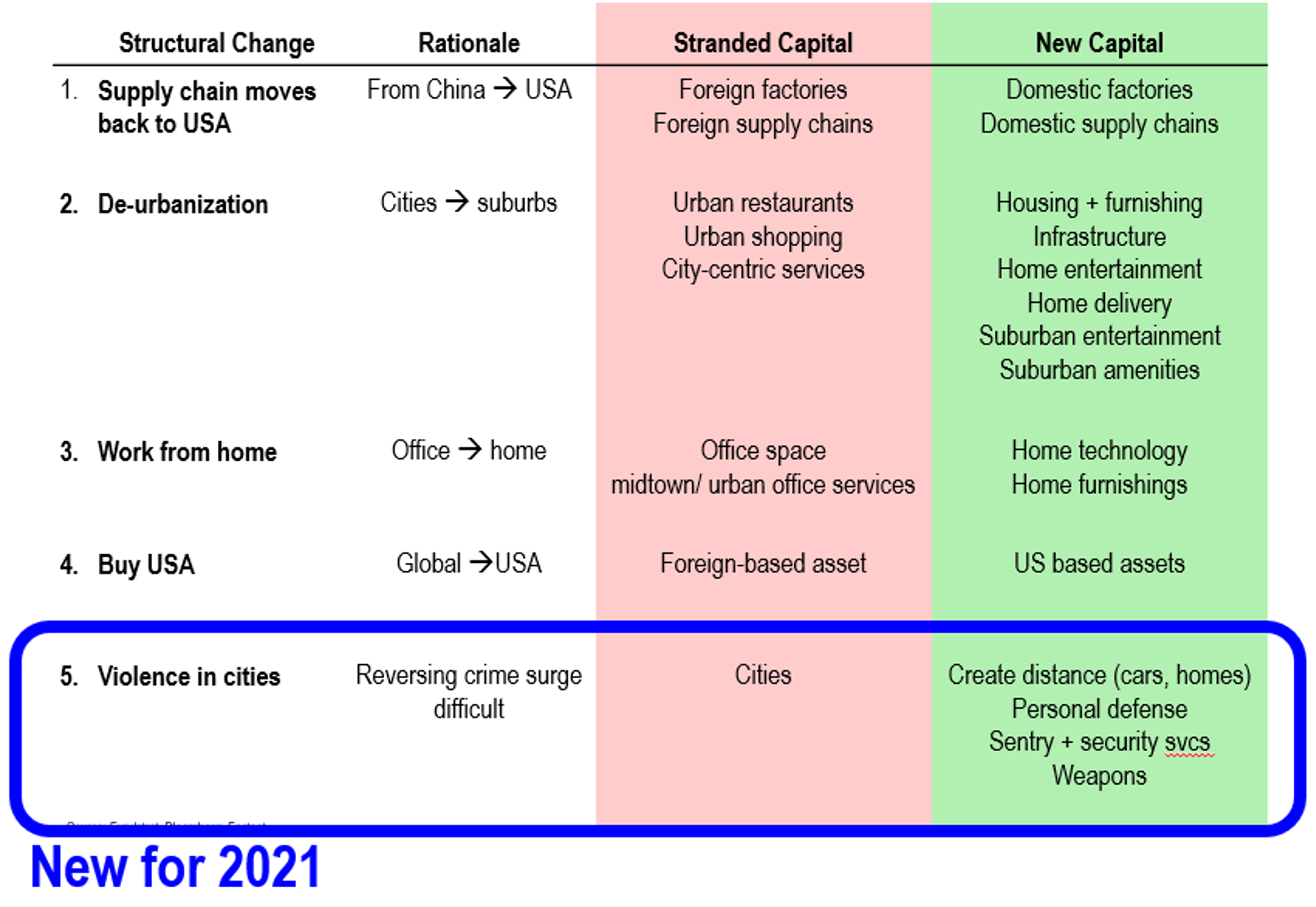

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

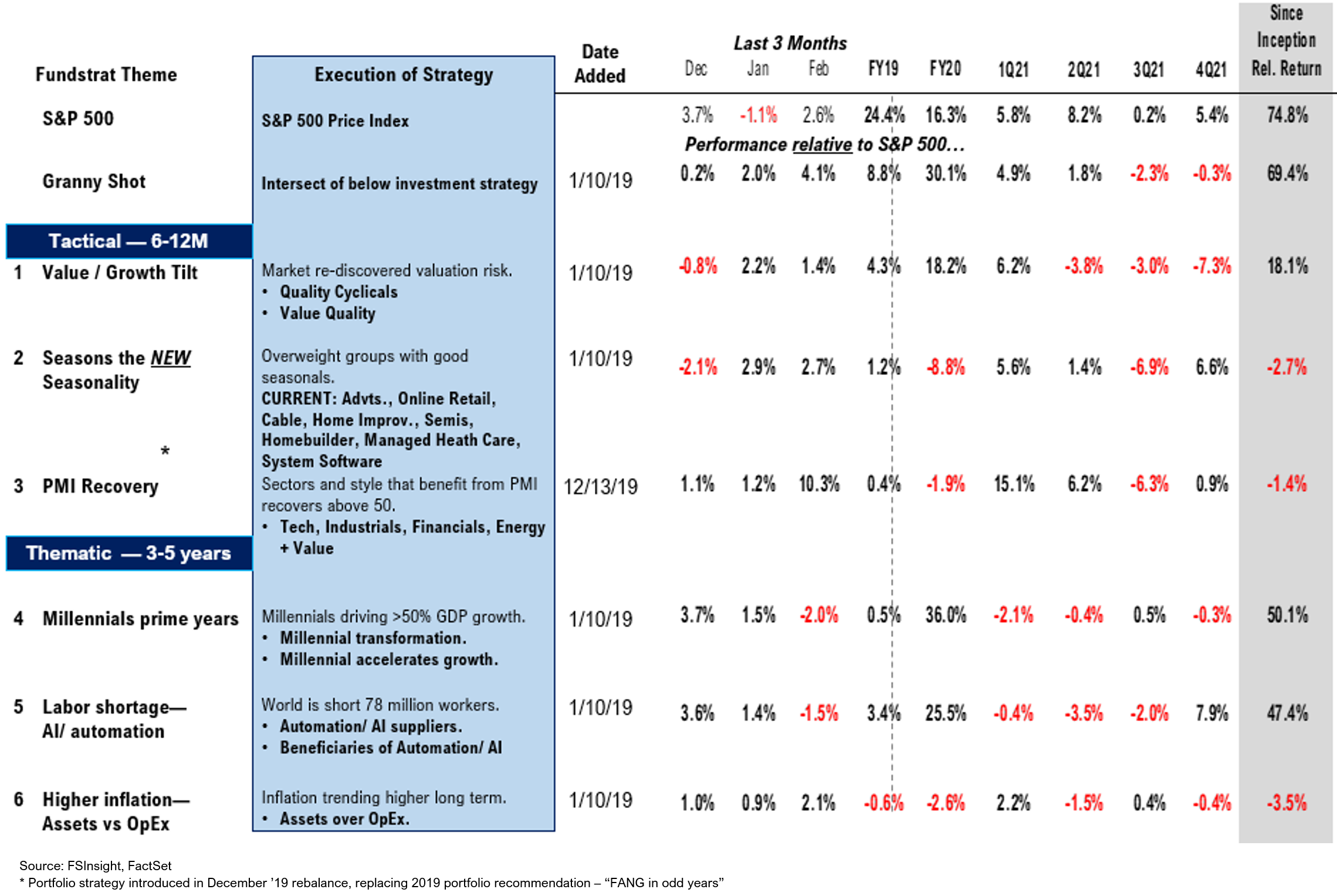

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 2381b6-cbd648-b7a4b9-27cdfd-02bc73

Already have an account? Sign In 2381b6-cbd648-b7a4b9-27cdfd-02bc73