Technology rally can help QQQ start to outperform SPY

- US Equities rally on the heels of Technology but more needed from broader market

- AAPL’s breakout looks helpful for Technology and broader market given its weighting

- QQQ vs SPY relative ratio looks to be turning back higher

In the very short-term, insufficient strength has occurred based on Thursday’s rally to suggest an imminent move back to new highs is upon us. US Dollar and Yields remain trending higher and the Equal-weighted S&P 500 needs to achieve the same degree of success which has happened with the NDX. However, AAPL’s strong breakout move happened on schedule, and gives a sharp nod of confidence that the broader market could be close to turning back higher following the last couple weeks of consolidation. I feel that it’s important that both Financials and Healthcare show some evidence of stabilization given their combined weighting of roughly 25% within SPX.

Simply stated, Thursday’s lift in Technology was helpful for US stock indices. However, the broader market move was far less robust. Equal-weighted S&P 500 ETF from Invesco (RSP 0.70% ) finished negative on the day and requires more strength to argue that lows of this recent consolidation are officially in place.

That being said, it looks to be close to a time when the broader market should turn back up to new highs and this could be driven by Technology. However, movement out of Financials and Healthcare are equally important, as they account for roughly 25% of SPX and have been underperforming over the last week.

Overall, the most important catalyst from a technical perspective to watch for in the weeks ahead concerns a turn back lower in the US Dollar and Treasury yields. Despite the correlation between Treasuries and SPX having dissipated somewhat in the last month, the breakout in Yields looked to be a clear negative catalyst for Stock indices to turn lower. Moreover, it’s thought that when cycles start to project lower for Yields between late April and August, that Stock indices should respond positively.

For now, there remain a handful of things investors who are price focused need to be honing in on:

- AAPL bounce- Encouraging for market given AAPL’s size within QQQ, SPX.

- Treasury Yields and US Dollar. Does this trend extend, or stall and retreat?

- Equal-weighted US index progress- Can this break out to join the NASDAQ 100?

- Healthcare and Financials trying to bottom out. Important for those concentrating on a broad-based snapback in US stock indices.

I’m inclined to think this recent US Equity index consolidation is nearly complete, and part of my thinking comes from analyzing the Equal-weighted RSP 0.70% having pulled back to levels just above important Ichimoku support.

Technically speaking, I do not expect RSP to fall under $162 right away. (See daily Trading View chart of RSP below). However, it’s important that RSP climb back above $168 on a closing basis. Unfortunately, insufficient progress happened Thursday to have real conviction on the market having bottomed. Bottom line, technical downside should prove minimal into next week, but more progress is needed to claim victory for “the Bulls”.

S&P 500 Equal Weight ETF

As said in recent days, the level on the upside which SPX needs to exceed to have more confidence lies near 5224. Downside support lies from 5091-5125 with key closing levels near 5110.

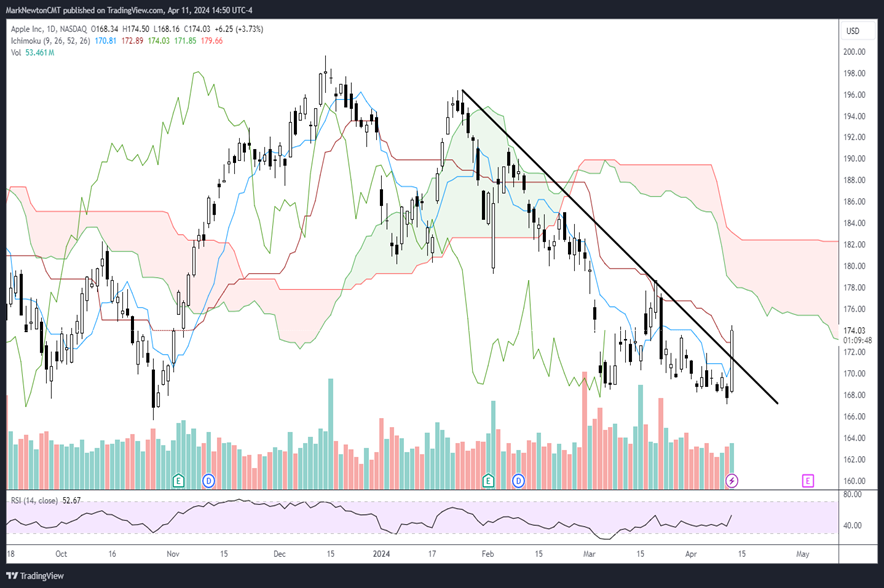

AAPL breakout has occurred on schedule and should be helpful to US stock indices in the weeks ahead

As mentioned early on Thursday in FlashInsights, Apple made the biggest move in 11 months today, rallying to the highest levels since mid-March. I discussed this in Tuesday’s report (4/9) for Technical reasons why this stock might be close to bottoming.

My hypothesis was based on the following reasons:

- Structural support near former lows made this an excellent risk/reward

- Elliott-wave structure looked to show AAPL having carved out five waves lower into this week.

- DeMark indicators showed confluence of exhaustion on a daily and weekly basis

- Some minor positive momentum divergence is now present on daily charts

- My Cycle composite on AAPL shows a possible bottom at hand, and a possibility for this to move higher

- AAPL has pulled back to just above weekly trendline support and despite its lengthy consolidation, remained within 20% of its all-time highs after having risen more than 100% off its lows from last Spring (Intermediate-term, this made AAPL appealing based on bullish technical structure)

Today AAPL broke back above a very significant trendline which had been trending down since January. My first real resistance zone for AAPL 2.52% lies at 177-179 and then 183.50. Volume is expanding to the highest levels since last month, adding credibility to this rally. Upon the ability of AAPL to reclaim $183.50, one can make a more intermediate-term bullish call on AAPL’s possible progress.

Apple Inc. Equity

NDX success in holding its consolidation has now given way to an upside breakout

NASDAQ 100 index looks to have arguably broken above the upper area of resistance of its consolidation from the last few weeks.

AAPL’s gains look significant in this regard in having helped NDX’s progress. However, other names like TEAM, AVGO -0.41% , MU -0.55% , and NVDA 0.25% were all up higher than 4% on the day.

Overall, a rally up to 18,800-19k looks underway for NASDAQ 100. In the event that Thursday’s rally is given back for whatever reason, I find strong technical support to lie at $17875 for NASDAQ 100

NASDAQ 100 Index

Equal-weighted QQQ looks to have bottomed vs. Equal-weighted S&P 500

An interesting development happened on Thursday given the sharp rebound in AAPL among other Tech stocks. QQQ on an Equal-weighted basis (QQEW 0.49% ) has begun to show credible signs of bottoming vs the Equal-weighted S&P 500 ETF (RSP 0.70% )

Technically, this ratio of QQEW vs. RSP had reached former support from late last Fall and begun to stabilize over the last couple weeks.

Thursday’s gains (4/11) showed QQEW turning up to multi-day highs vs. RSP. Overall, this is a bullish development and coinciding with AAPL’s bottoming, should drive QQQ higher vs the broader market in the weeks to come.

However, given the extent of the weakness since late March, one needs to see a rally move straight back to highs sooner than later. Any half-hearted attempt at rallying which then turns back lower and breaks April lows would prove problematic for the weeks ahead. At present, I expect the QQEW to show better relative strength than RSP, and feel that a rolling over in interest rates might help Small-caps to also begin demonstrating better participation.

QQQ Equal-Weight ETF / S&P 500 Equal-Weight ETF