Technical Writeups of Super Granny-shot picks

- ANET -0.39% , CRM 0.53% , META -2.46% , NVDA 0.25% , CDNS 0.03% represent the 5 Super Granny-shot selections

- ANET and CRM are carryovers, while META, NVDA and CDNS are ranked highly

Summary: I continue to see the US stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time. While price action has been a bit more subdued in recent weeks following momentum gauges having gotten overbought, there remain precious little other evidence with regards to frothy speculation to excessive valuation measures that would warrant a major selloff. Rallies up to SPX-5300 look possible ahead of a possible late March pullback into April. Both Treasury yields and US Dollar could be prone to trend reversal following this week’s FOMC meeting.

SUPER GRANNY-SHOT stocks

Arista Networks (ANET -0.39% - $304.60)

Arista Networks continues to be a super granny. For the month of March, we’ve shown the ability to escalate in a parabolic fashion. In the last few days, ANET has broken out of an ascending triangle pattern which started back in the month of February.

This is a very bullish technical development, and likely leads it up to $300, with further resistance targets up at $325, and then $340 as resistance. In the short run, any pullback should be seen as a chance to buy dips, and only a move under $272 would postpone the rally.

Bottom line, barring any evidence of technical deterioration. Arista Networks remains quite bullish technically, and I continue to endorse this name.

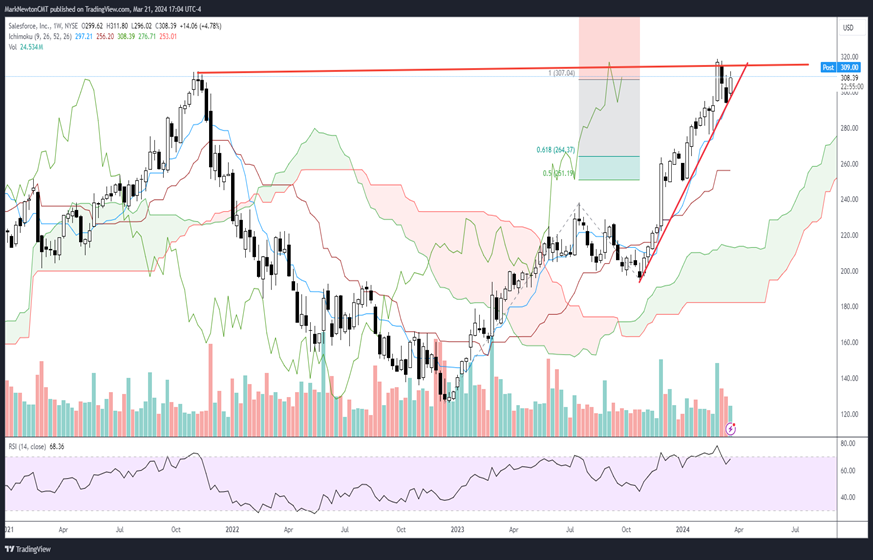

Salesforce Inc. (CRM 0.53% – $308.39)

Salesforce Inc. has been a standout, maintaining its position as a formidable force in the market. Despite a recent stall near its all-time highs from November 2021, there is no indication of a downturn.

The uptrend, consistent since late 2022, signals strength and potential for surpassing previous peaks. The three-week consolidation phase appears to be concluding, setting the stage for an anticipated rise beyond its February peak of 318.71, aiming for a target of 376, aligned with Fibonacci resistance levels.

Support lies at $276 and until/unless this is breached, it’s right to expect CRM can continue to trend higher.

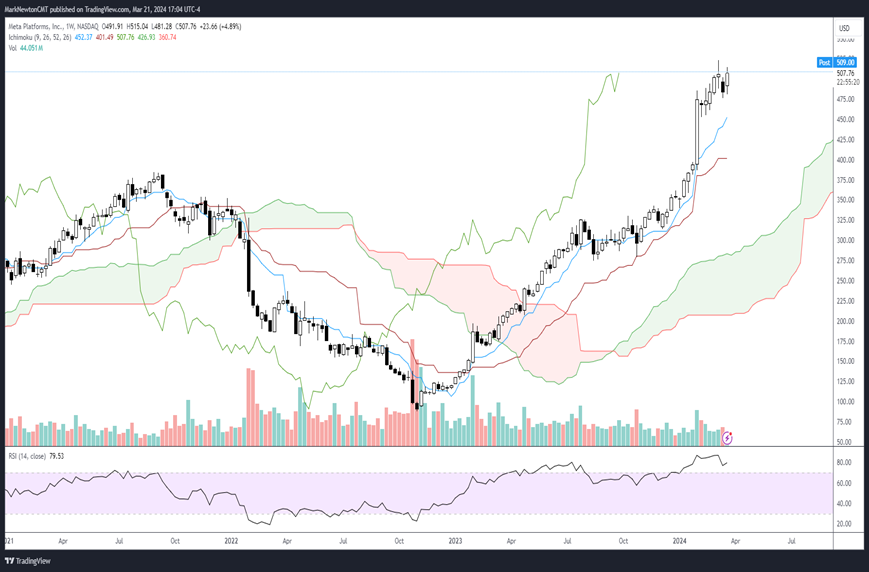

Meta Platforms (META -2.46% – $507.76)

Meta Platforms has seen a remarkable trajectory, especially after surpassing its August 2021 highs.

While many felt that pullbacks might happen following a minor stallout in recent weeks, this week’s ability to turn back to new all-time weekly highs on a closing basis should keep this uptrend ongoing.

The swift ascent to over $500, coupled with sustained momentum, suggests further gains are still likely and makes it difficult to expect an immediate consolidation.

With recent consolidations being short-lived, Meta is poised to set new records, possibly reaching between 560 to 600, before encountering a consolidation phase anticipated in mid-spring.

Nvidia (NVDA 0.25% - $914.35)

Nvidia remains a focal point for investors, thanks to its consistent outperformance.

With no signs of technical weakness, the stock briefly rocketed up to near $1000 before some minor short-term consolidation in recent days.

However, the recent consolidation did not demonstrate any technical deterioration, and Thursday’s (3/21) push back up above $904 should help this escalate back to new all-time highs. This pattern had formed a minor triangle formation over the last week which now looks to have been successfully resolved with Thursday’s gains.

The near-term forecast includes testing new highs around 974, pushing towards 1,000, and possibly extending gains towards 1,200.

Cadence Design Systems (CDNS 0.03% – $322.80)

Cadence Design Systems has emerged from a brief consolidation, now targeting new highs, with its stock demonstrating strong technical resilience.

Its uptrend turned more parabolic in late December 2023, and this continues to show excellent near-term structure with a pattern of escalating higher highs and higher lows.

Support levels near February lows of 284.79 are important to hold on any weakness. Barring a close under this level, it’s right to expect further upward trajectory towards 360, which is the first significant resistance.