What Our Clients Are Talking About Behind The Scenes

FLASH COMMENTS:

Well, last week was on the quieter side as Street attendance was light during the unofficial last week of the summer. Thus, this will be my last shortened commentary and will hope to shift back to a more detailed note going forward. I am going to take today and just think out loud.

Have we entered a new backdrop for the U.S. equity market where good news is bad news and bad news is bad news?

Well, if economic data is neutral-to-strong, then the dovish pivot likely gets pushed out and puts upward pressure on rates (Growth/High Multiple/Tech underperforms). On the other hand, if releases are weak, it is a negative for corporate profits and with Chair Powell and Crew not signaling that they are coming to the rescue until more work has been done on their inflation fight (Cyclicals should underperform). Tough backdrop for the overall equity market, but my work suggests that there should be some relative performance opportunities.

Yes, I guess that soft inflation data could be viewed to fuel some bullish feelings. Well, when looking at this likely macro setup combined with my key indicators, it’s quite challenging to get energized and confident to flip to a more constructive outlook.

If I also include the below, my views are certainly not being favorably impacted:

- Forward earnings still look too high and need to come down!!!

- The U.S dollar is still rising, which will further contribute to negative estimate revisions

- Interest rates are rising & the pace of the QT is about to double

- The domestic economy is decelerating at a moderate pace, but appears poised to weaken much more

- Global growth is quite weak and has many challenges to overcome

- Commodity prices remain elevated, especially Energy/Nat Gas

- Corporate America is dealing with a tricky labor supply environment

With such a powerful combination of bearish key indicators and negative macro factors, I get asked a lot — “Not including your critical metrics clearly flipping to bullish, what would make you feel more constructive?”

You may not like my answer, but here are some things that would entice me into turning contrarian favorable:

- Lower forward profit expectations

- Lower valuation multiples

- Capitulatory selling pressure

- Spike in VIX to over 40

- Lower equity prices

This is not a forecast but having the S&P 500 sell off hard to 3200-3000 before year end as result of hard landing and earnings fears becoming the “hot topic” of the Street would go a long way towards negatively impacting forward expectations and “overly” discounting the bad news, which my historical work suggests likely needs to occur before the decks have been cleared for equity investors.

I reiterate my somber view for the U.S. equity markets and retain my in-house cranky bear position, which might actually be a bit more cantankerous now as I finally tested positive for COVID and had to self-isolate over the entire long weekend of fun (UGH!)

My research still strongly signals that forward earnings expectations remain too high and will be coming down. This process has thus far been a slow bleed lower, and if it stays on this pace it could stretch into 1H23. If it accelerates, it is likely that we can shorten the amount of time needed to start viewing the future as half full. With the dovish FED pivot interpretation now in the rear view mirror, my analysis firmly signals that that earnings cuts WILL MATTER. Stay tuned.

Despite my aggressive tactical tools nearing negative extremes, which historically are contrarian favorable tactical signals, I am still advising selling rallies and NOT buying dips. If one is truly a skilled aggressive trader, you could take a shot for a smallish short duration bump once they flip to favorable, but with HALO falling and suggesting the next 1-3 months have limited upside until it positively inflects from a significant low extreme caution is advised (see discussion below).

For positioning, I am still recommending Growth, both defensive and offensive, relative to Cyclicality even though Tech has been weak over the last seven trading sessions. The opportunity to aggressively pivot towards increasing risk, lowering cash levels, and moving to offense is still in front of us.

SPECIFIC CLIENT QUESTIONS

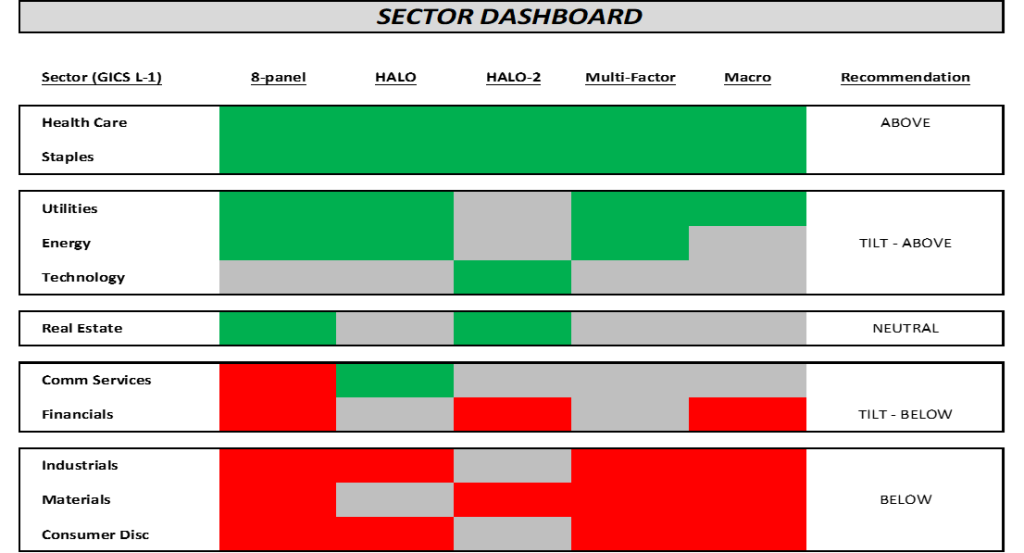

- What were the main conclusions from your monthly sector (GICS L-1) deep dive that you did last week?

- What are your most aggressive tactical indicators saying?

- Has HALO also turned unfavorable?

MY ANSWERS

What were the main conclusions from your monthly sector (GICS L-1) deep dive that you did last week?

The key takeaways continue to be Growth, both defensive and offensive, look relatively more attractive than Cyclicality. Downgraded Industrials and Materials (AGAIN) to Full Below.

When looking through the key indicators that dominate my sector selection methodology, the clear conclusion is that the Cyclical areas of the equity market continue to look at risk. The process of lowering forward earnings and having pessimism overshoot to the downside is still in motion in looks like there is still a fair amount of work to be done on this front. So, my view is to remain cautious and defensive as the aggressive pivot point back to risk and offense is still on the horizon. At times like these, having an objective process that has had a successful long-term forecasting record can prove quite valuable when one’s mind and emotions begin to wobble and question the signals provided by the disciplined process, and hear the siren’s song to follow the crowd to the proverbial cliff. Over our two decades of being on the Street, a hard lesson learned has been to not overly react to sharp unsupported moves in either direction and to stay the course of the objective indicators that have helped navigate challenging market action over the years.

My sector dashboard is quite helpful at presenting my key indicators and visually identifying conclusions, and there has been little, if any. evidence to supporting making any large shifts to my sector views. Thus, my recommendations for the dominant cyclical sectors, CD, Industrials, and Materials are full below benchmark. Furthermore, my work clearly shows that Growth, both defensive (HC and Staples) and offensive (Tech) are looking relatively more attractive. (Please note – our full below benchmark view for CD reflects the broader equal-weighted sector, and not the cap-weighted group that is dominated by AMZN, which our work has a favorable view. So, XLY could outperform solely because of AMZN, but the equal-weighted sector is an underperformer).

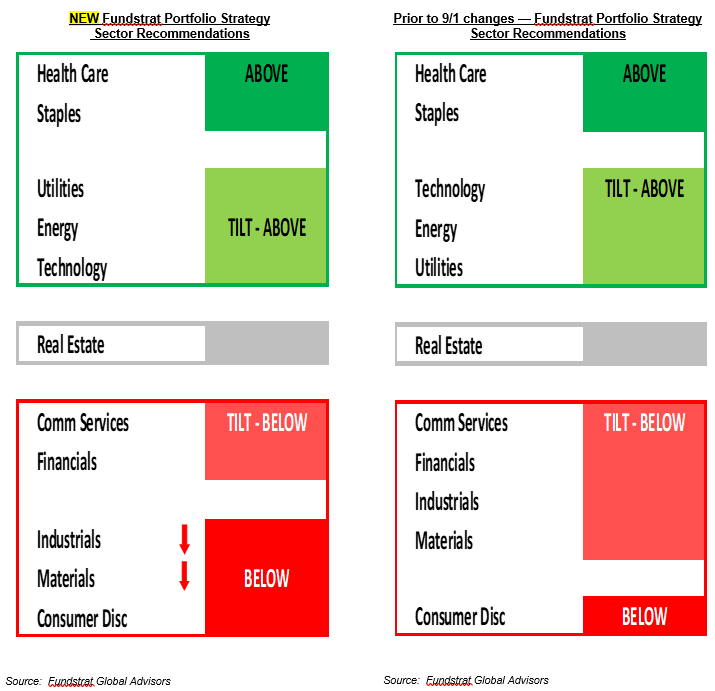

Below please find a comparison of my NEW sectors recommendations versus the OLD.

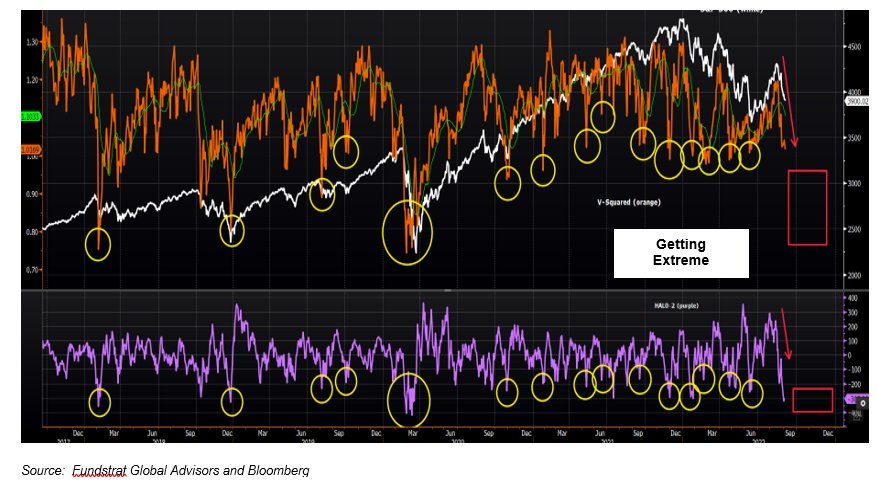

What are your most aggressive tactical indicators saying?

My most aggressive tactical tools are still falling, but they are reaching extreme negative readings. Thus, the clock is ticking for another tactical oversold bounce, which my analysis strongly suggest will also be countertrend and fail.

My highest-frequency and most aggressive tactical tools for looking at the S&P 500 price action — V-squared (orange line top chart) and HALO-2 (purple line bottom chart) – which were helpful in identifying many of the tactical trading reversals since 4Q17, they have both flipped to unfavorable on 8/14 and have been falling ever since. This strongly suggested that the equity market rally that began in June was ending and that a pullback was a high probability.

With HALO also rolling over and the S&P 500’s ASM still falling, my work is signaling that the resumption of the 2022 down trend is back in place, and that rallies should be sold. This once again puts my view at odds with my colleagues and other more constructive forecasters. My research continues to be quite clear that upside potential is limited, at best, and downside risk is considerable and higher probability as my key indicators remain resolutely negative. In addition, with Chair Powell decisively taking the Dovish Pivot scenario off the board for now, my work suggests investors need to be on full alert for negative surprises and weak price action as 3600-3500 remains my next target range and a likelihood that the ultimate bottom is even lower.

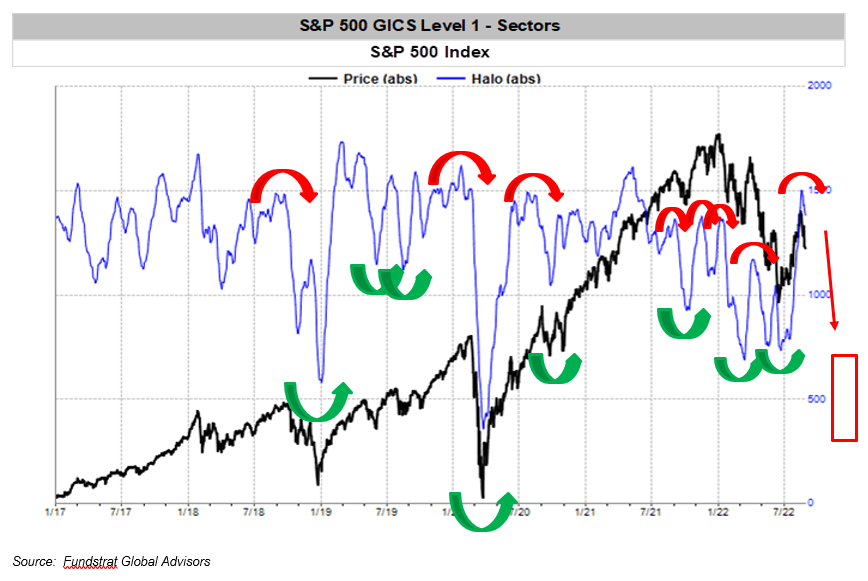

Has HALO also turned unfavorable?

Yes, and it continued to head south last week. The early warning that came from the HALO-2 and V-squared negative inflection has proved to once again have been accurate. Thus, the 1-3 month forecast has a negative bias until HALO can make its new important low.

My preferred tactical indicator (HALO, blue line below) for the index has provided many significant tactical reversal signals since 4Q18, which all ended up rewarding investors. As a result, the model continues to be value-added and remains quite relevant. Beginning in June, HALO had a positive inflection and rose until 8/15 when it finally rolled over. Importantly, with both of my aggressive metrics discussed below also unfavorable, my work is suggesting that rallies should be sold, and that the downside risk is considerable until these tools begin to show signs of negative extremes and bottoming.