Nov FOMC minutes reveal "stale" view of inflation risks = room for Fed to move dovish Dec.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday (no evening Macro Minute Video)

– SKIP THURSDAY

– SKIP Friday <– Thanksgiving

We discuss: The Nov FOMC minutes showed that views around upside risks to inflation seem stale. By the time we get to Dec FOMC, there will be 2 additional CPI reports in hand. Oct (good) and Nov (potentially good). Thus, possibility Fed could shift dovishly.

Please click below to view our Macro Minute Video (Duration: 3:29).

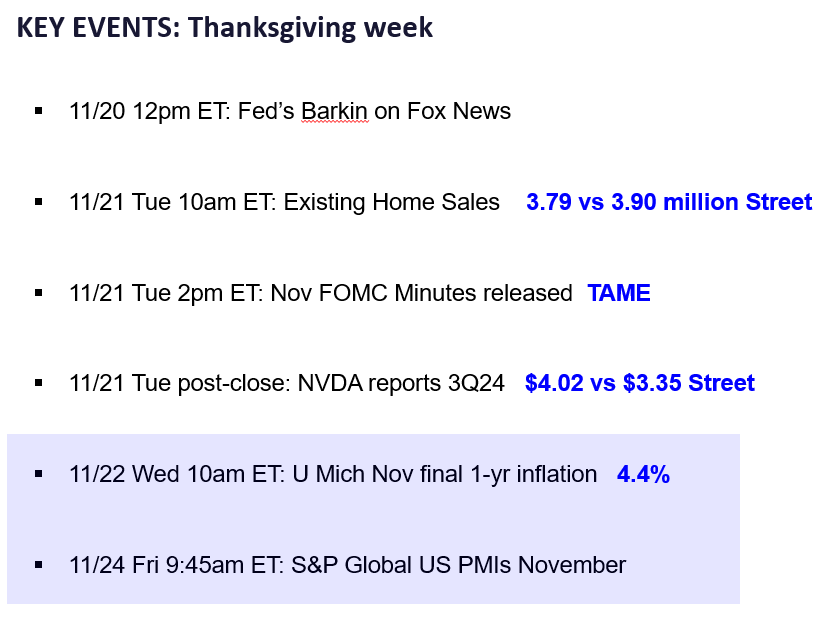

This remains a shortened holiday trading week, with fewer market participants around. Today, equities traded essentially flat ahead of Nvidia’s 3Q23 results (reported after the close). NVDA -1.98% posted strong 3Q23 results with data center revenues of $14.5b vs $12.8b Street (tripling vs year ago) but the stock is slightly down after hours.

- Incoming economic data today was overall soft. Existing home sales came in at 3.79 million vs 3.90 million Street and regional surveys too Chicago Fed -0.49 vs Street 0.00. But to me, the Nov. FOMC minutes stood out.

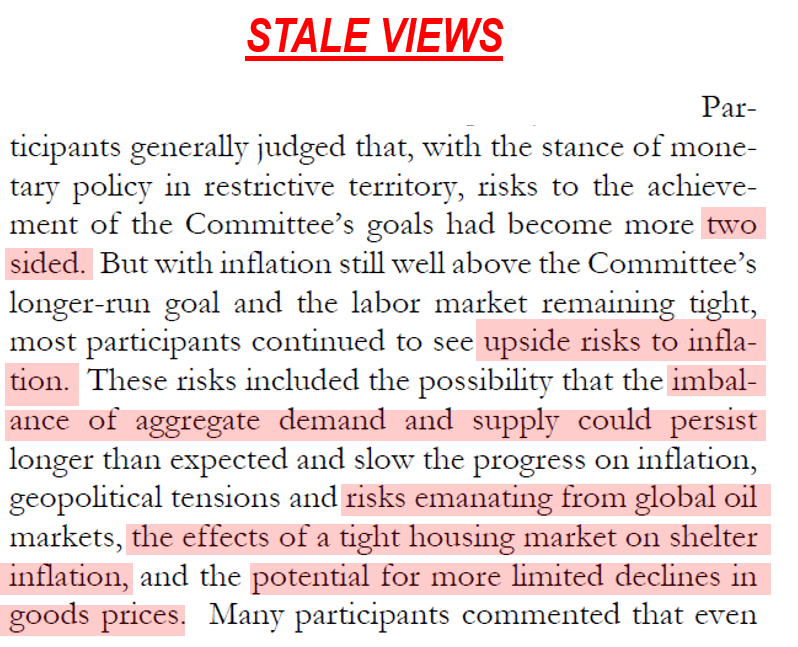

- While the overall tone was more dovish than past minutes, I was surprised to see how Fed discussed the two-sided risks for inflation. Specifically:

– participants see “upside risks to inflation”

– imbalances of “demand and supply could persist longer”

– potential for more “limited declines in goods prices”

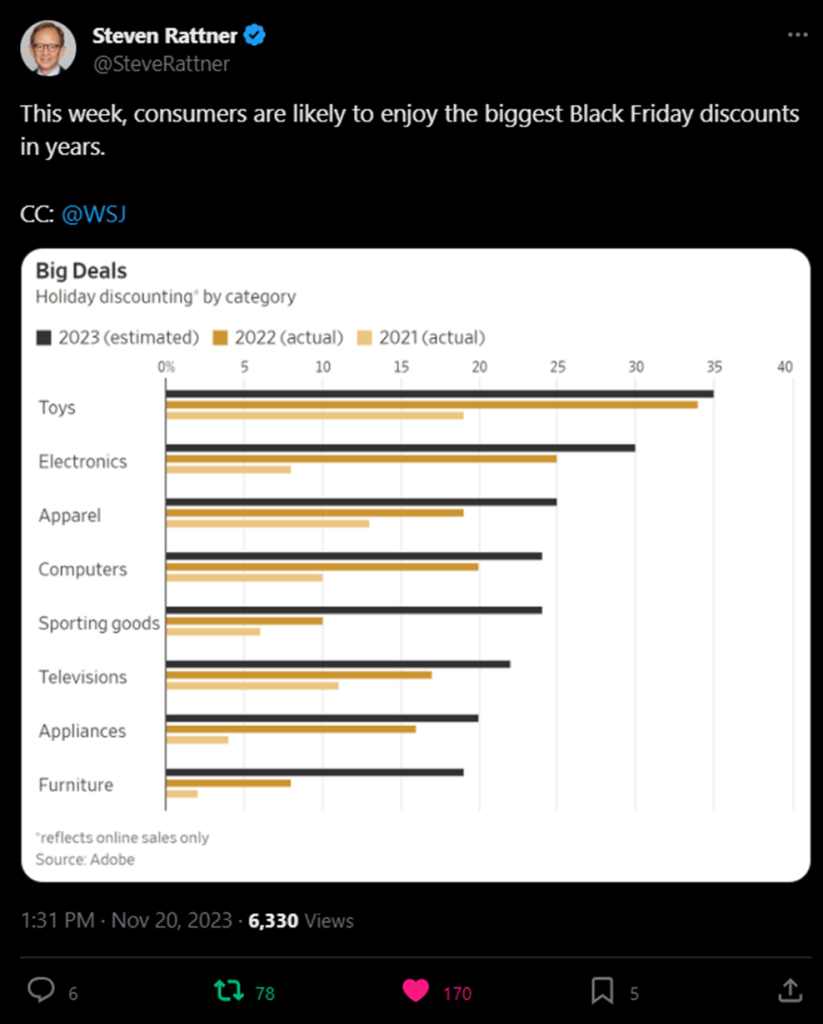

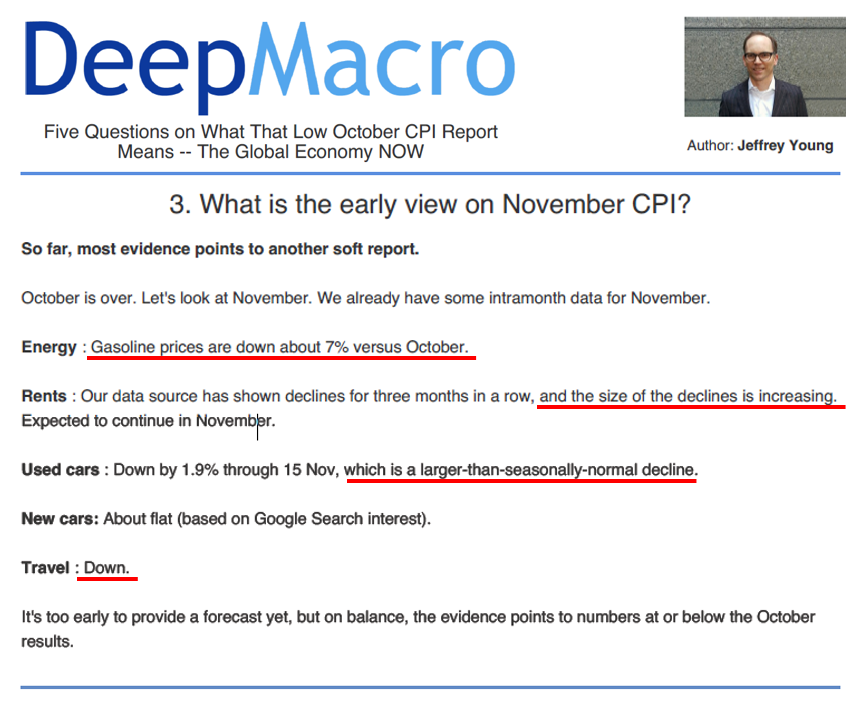

– effects of a “tight housing market on shelter inflation” - To me, these seem like stale views on inflation. This FOMC meeting was 10/31-11/1 before the October CPI report released (mid-Nov). And many of the above concerns were shown to be less pertinent. And as Deep Macro’s Jeff Young has noted, the upcoming November CPI report likely shows even more downside pressure on inflation.

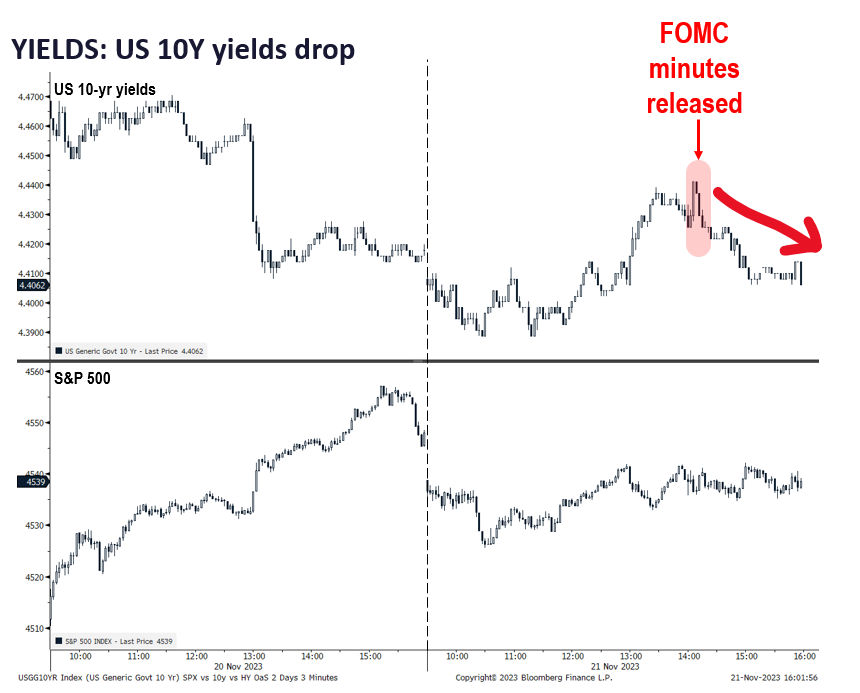

- The 10-year yields sort of agree with our take. When the minutes were released at 2pm today, yields rose into that, but after some time, reversed course and fell by the afternoon. In other words, markets could be seeing the above FOMC views as stale.

- And this matters because, this means the FOMC members have room to move dovishly in this December FOMC meeting (12/13). And there will be the November CPI release on 12/12. So this would be 2 additional CPI reports that FOMC member have in hand — Oct CPI (good) and Nov CPI (expected to be good).

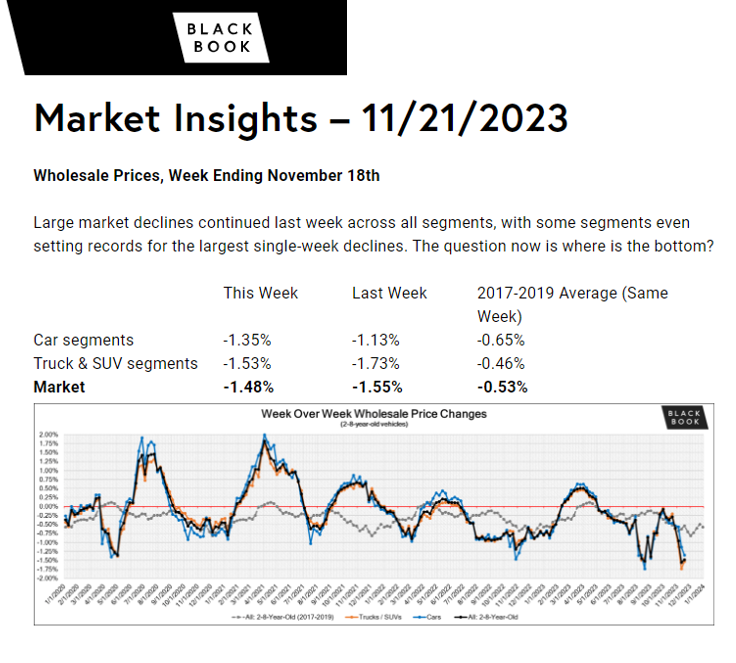

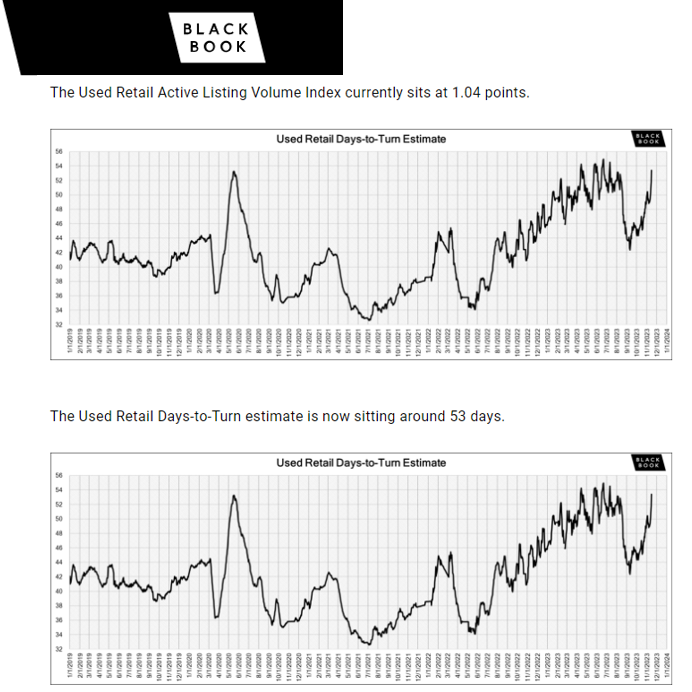

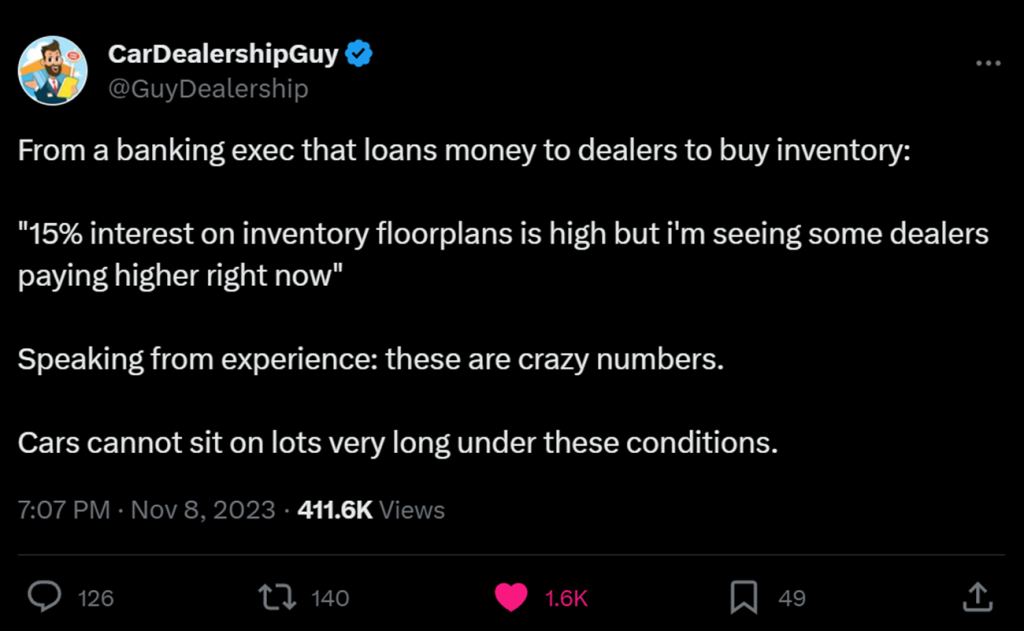

- Blackbook used car data shows that used car prices softened during the week -1.5% and seasonally worse than average. And their inventory data shows a major jump in inventory to near 2023 highs. The economics of used cars is worsening due to high floorplan costs and costs to buyers. These are anecdotes but do support the view Nov FOMC views are stale.

Bottom line: Our base case remains for a YE rally, and upcoming Nov CPI and Dec FOMC likely catalysts

The bottom line is the Nov FOMC minutes seem stale relative to the reality of incoming inflation data and upcoming Nov CPI (12/12) likely reinforces this. And thus, Dec FOMC meeting could see Fed members make a dovish move.

- By Dec FOMC meeting the Fed will have potentially 2 good CPI reports — Oct and Nov.

- Raising probabilities that they could marginally move away from “higher for longer”

- We still see a rally into YE and next week and upcoming Nov CPI (as well as the Dec FOMC) might be the catalyst

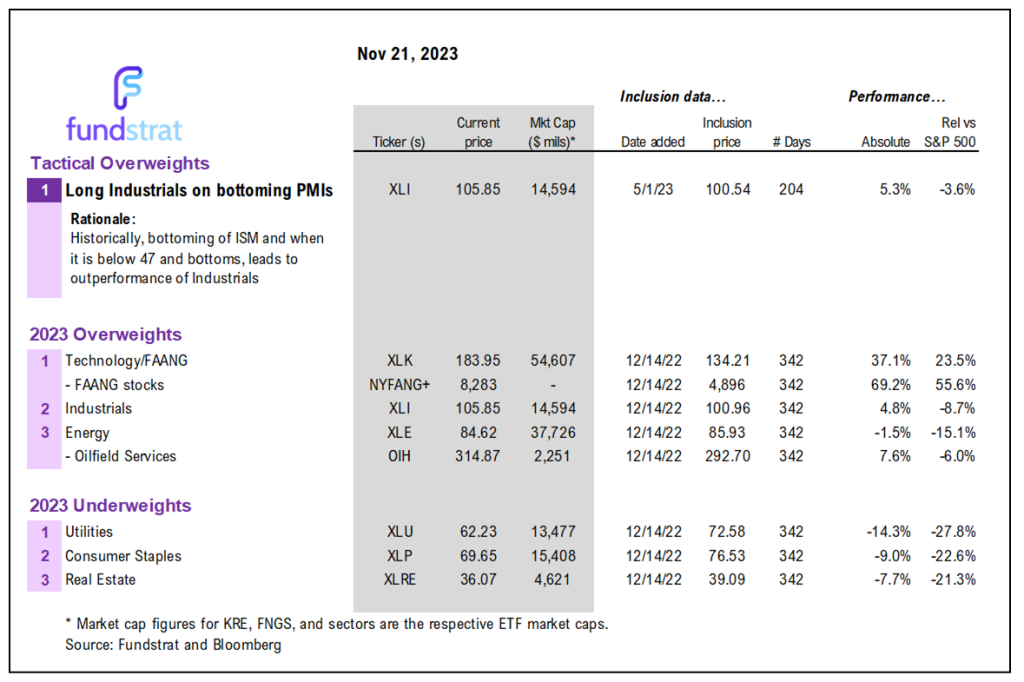

- We favor Technology/FAANG QQQ -0.07% XLK -0.25%

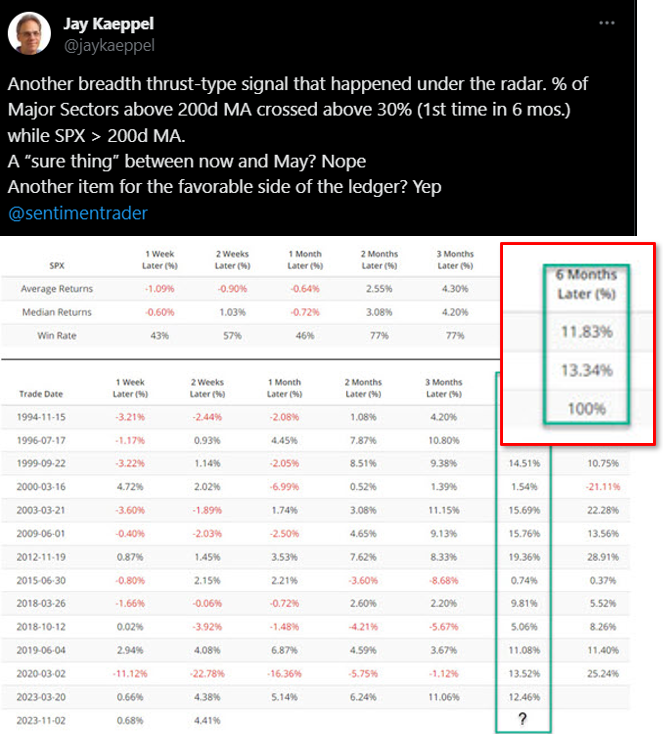

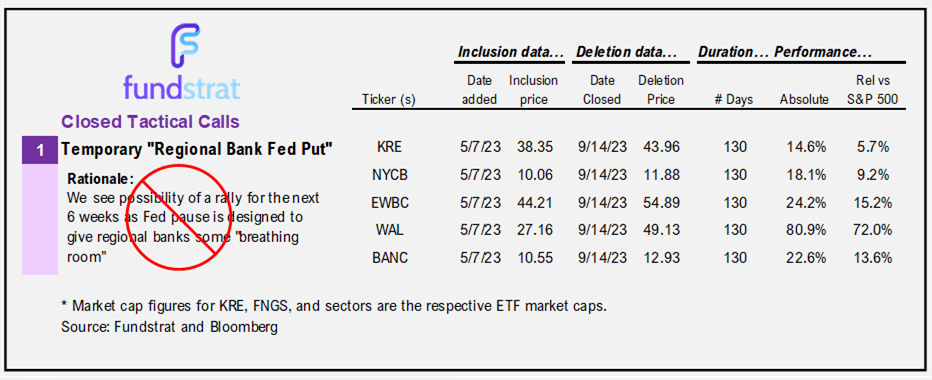

- And small-caps IWM 0.05% and Financials XLF 0.60%

Happy Thanksgiving!! We thank you for being our clients and wish you a wonderful holiday.

Key incoming data November

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame- 11/22 10am ET: U. Mich. November final Sentiment and Inflation Expectation

- 11/24 9:45am ET S&P Global PMI November Prelim

- 11/27 10:30am ET Dallas Fed November Manufacturing Activity Survey

- 11/28 9am ET November S&P CoreLogic CS home price

- 11/28 10am ET November Conference Board Consumer Confidence

- 11/29 8:30am ET 3QS 2023 GDP

- 11/29 2pm ET Fed Releases Beige Book

- 11/30 8:30am ET October PCE

Key incoming data October

-

10/2 10am ET September ISM ManufacturingTame -

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decisionMarket saw Hawkish-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

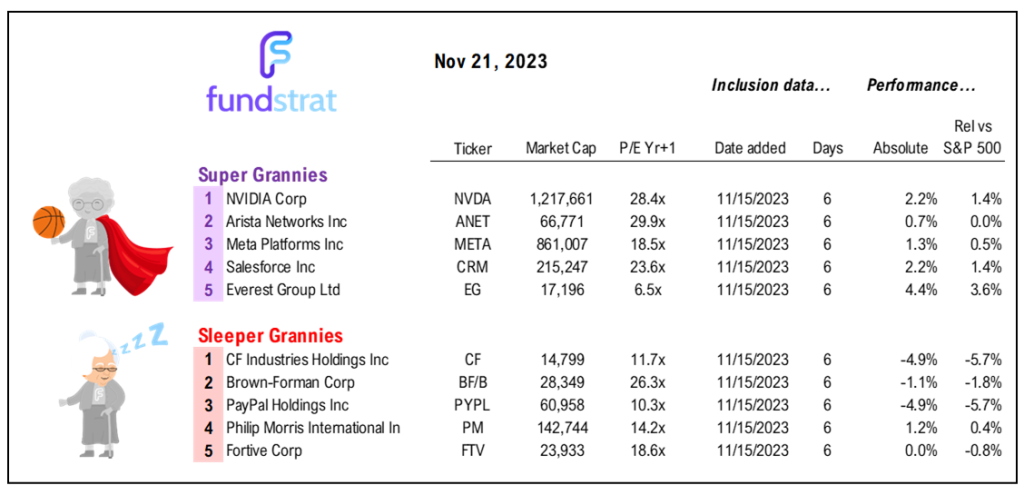

36 Granny Shot Ideas: We performed our quarterly rebalance on 10/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In f3c1d3-2ed7c0-0c17d5-0f3c5a-cd57d6

Already have an account? Sign In f3c1d3-2ed7c0-0c17d5-0f3c5a-cd57d6