July CPI should be a positive surprise, with core CPI well below Street consensus of +0.22% MoM. This should reverse the path of higher rates.

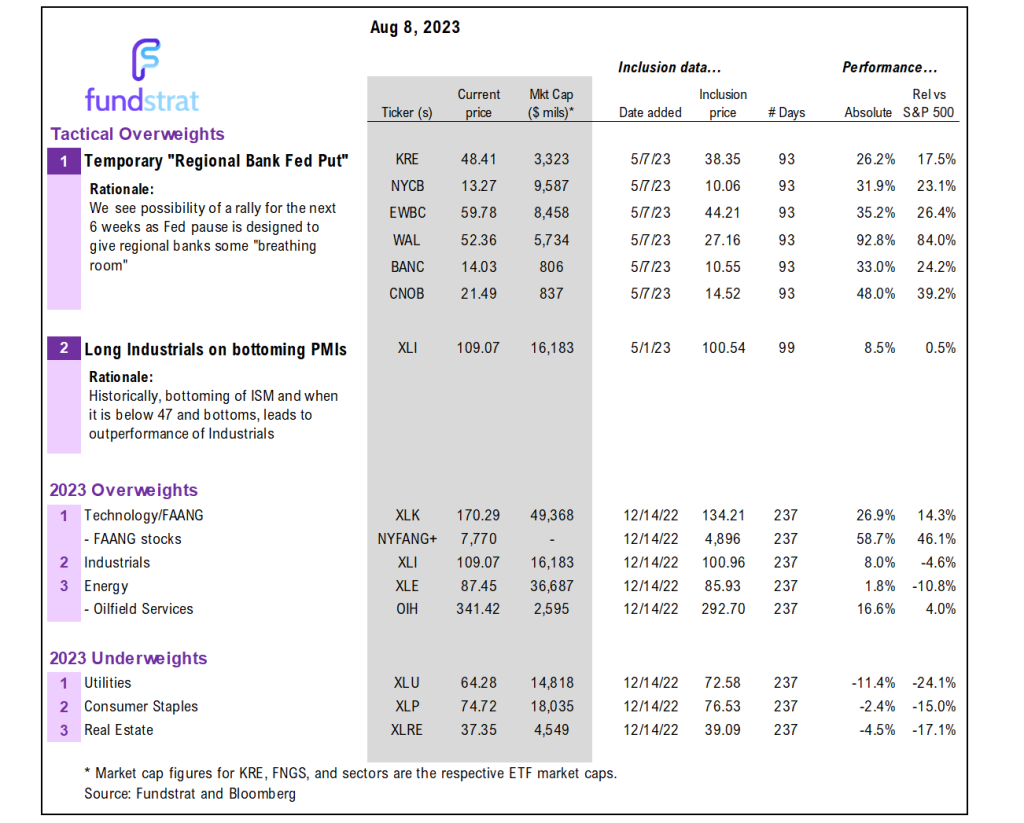

Today’s note will include a short video update. We discuss the tape bombs that hit stocks Tuesday including China exports and Moody’s regional bank downgrade. But, the main event is July CPI set to be released Thu and we expect this to be similarly soft like the June CPI. This likely triggers a sustained rally in stocks, as future Fed hikes diminish and this has the potential to push interest rates lower. Duration (5:11).

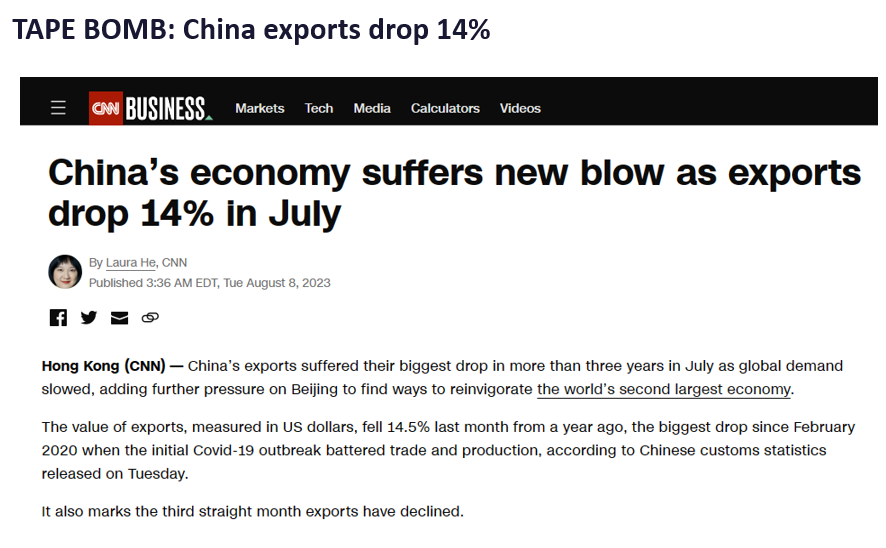

Equities came under pressure during the futures session Monday evening as China reported a 14% drop in exports. And before the open Tuesday, Moody’s downgraded regional banks on concerns of a recession. These two “tape bombs” caused stocks to open down >1% early in Tuesday trading but equities managed to climb to a loss of -0.4% by the close. Investors remain wary about equities in August and the surge in VIX, yields, stronger dollar and these “tape bombs” are adding to these concerns.

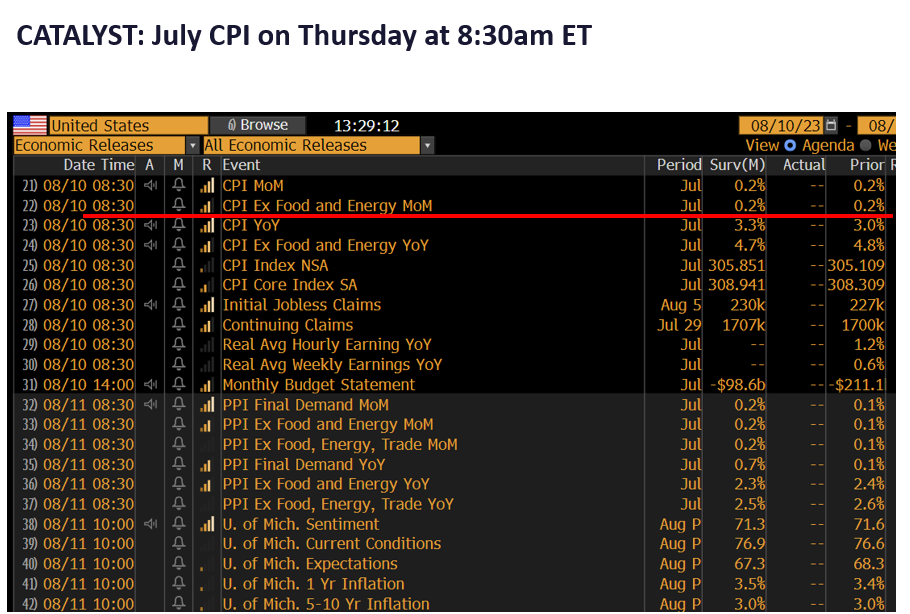

But investors are overlooking the primary and arguably the only fundamental data point in August — July CPI, which is set to be released on Thursday at 8:30am ET:

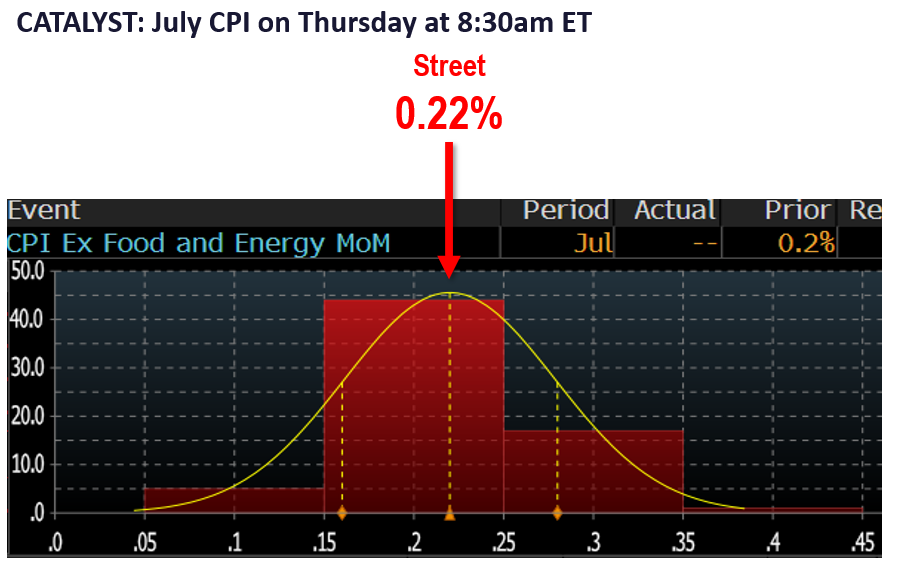

- The Bloomberg consensus (67 economists) is for July core CPI to come in at +0.22% MoM. The distribution skews higher:

– 18 economists see July core CPI at +0.30% or higher

– 1 economist sees +0.40% for core CPI MoM - As our clients know, we believe the disinflationary pressures of falling used car prices and cooling home prices are powerful.

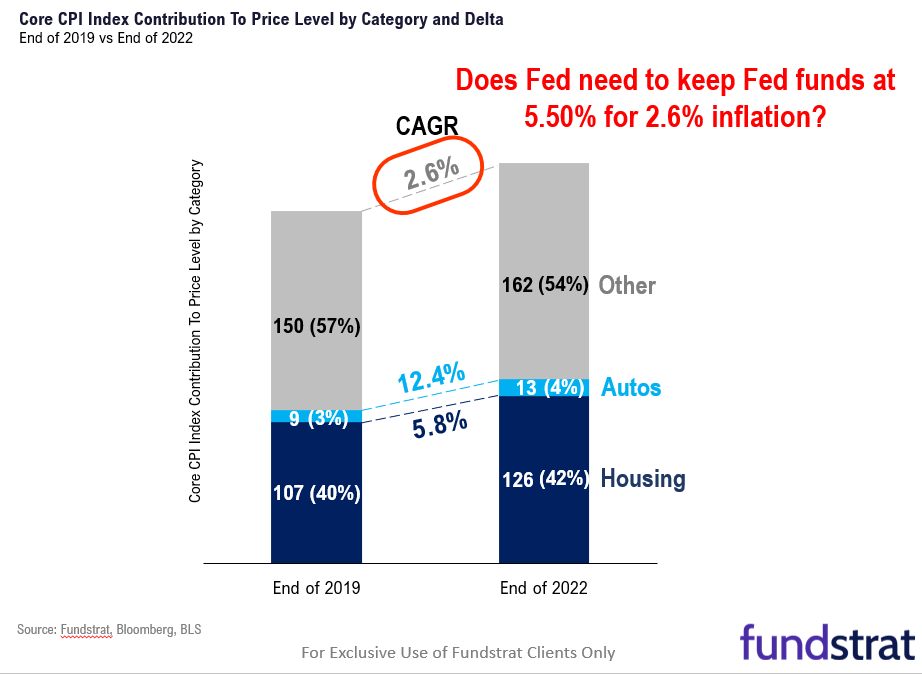

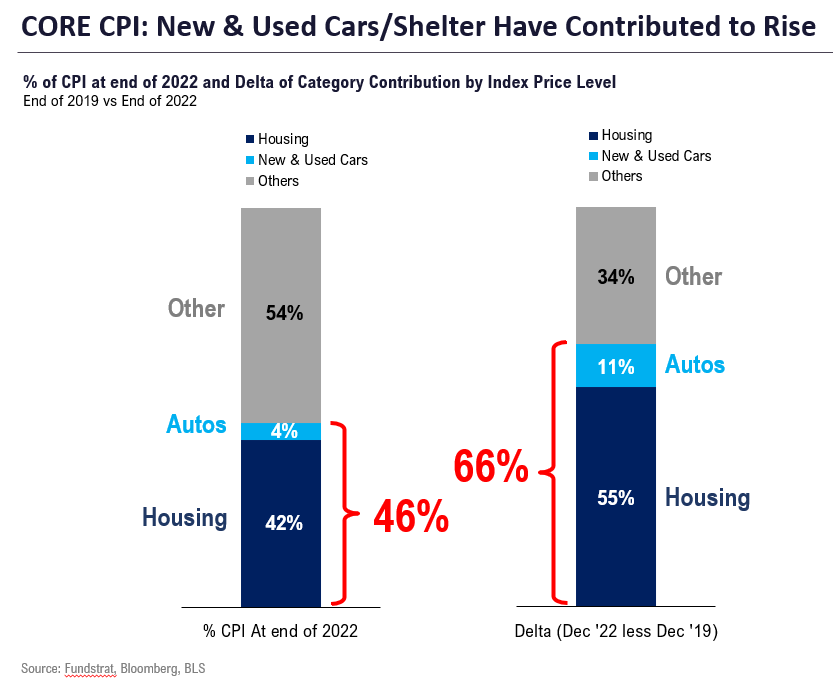

– Since the end of 2019

– autos + shelter accounted for 66% of core price increases

– autos + shelter accounted for 42% of core basket

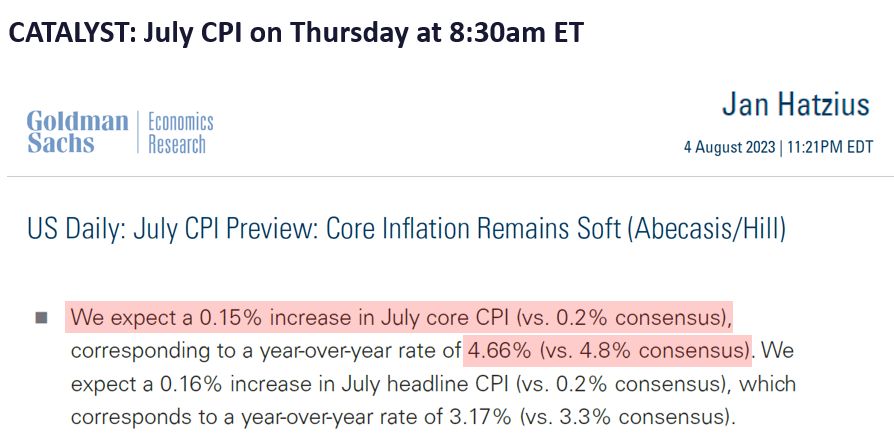

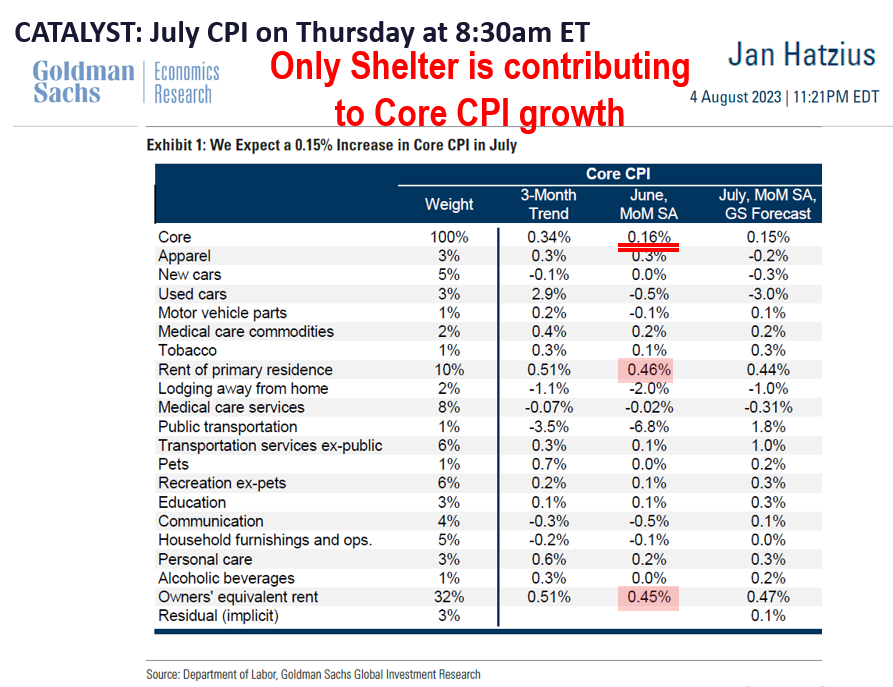

– other components have CAGR’d at 2.6% since end of 2019, hardly “structurally high” - Our data science team expects Core CPI to come in at +0.15% or better MoM. This is below consensus estimates of +0.22%. JPMorgan and Goldman Sachs economists see this figure at +0.15% or so, so our data science team estimate is consistent with these estimates. The primary driver remains the drag in CPI coming from the fall in used car prices.

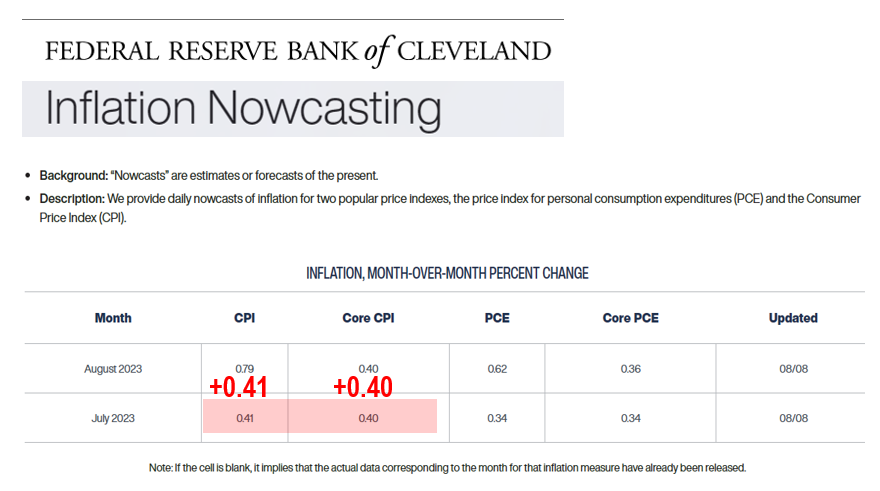

- We believe +0.15% would be a positive surprise versus consensus. After all, the Cleveland Fed inflationNow is +0.40% MoM. And many investors rely on the Cleveland Fed forecast. The problem with the Cleveland Fed forecast model is it is a relatively simple 9 variable model that uses gasoline plus the prior month’s CPI forecast to forecast July. Whereas, more accurate forecasts model used cars and shelter and other components specifically.

- In our view, this positive surprise would be more than enough to offset the “tape bombs” that rattled markets on Tuesday. And we also think it is enough of a surprise for stocks to recover their losses from Tuesday and even possibly from earlier in August.

- Many investors fret that inflation is set to pick up again. I hear this time and again. But investors overlook that used cars and housing are such outsized contributors to inflation. And as these components cool, the remaining components will not necessarily lead to a renewed surge in overall core inflation.

- The weakness in China’s exports is arguably a result of the cumulative headwinds as global central banks tighten monetary policy. In other words, the Fed hike cycle is breaking the China economy.

BOTTOM LINE: We think the fundamental catalyst of CPI likely triggers a sizable recovery in stocks

Is this a replay of June CPI which took place in early July? Possibly. The selling since the start of August has pushed equities down 2.5% or more.

- If core CPI is +0.2% or less, this should lead to more investors falling into the July is last hike camp

- And this should reverse the rise in longer term interest rates

- The rise in rates has made investors nervous, though this could stem from the BoJ yield control tweaks

- investors seem to have already become far more wary and that is a good thing from a sentiment perspective

- equities seem oversold as well

- so, we think the probability for stocks to rally strongly after CPI is very high

The overnight tape bomb was China reporting a 14% drop in exports. And imports were down as well. As we know, the Fed breaks something with every hiking cycle. Instead of breaking the US economy, the fractures are in China and Europe.

The second is Moody’s downgrade of regional banks. Is this revelatory and shocking? Nope. But it is hurting stocks short term.

Consensus is looking for Core CPI to come in at +0.2%.

And the key is core CPI inflation has been mainly driven by used cars and shelter.

- as shown below, ex-autos and ex-housing, inflation CAGR’d at 2.6%

- the 2.6% doesn’t feel like Fed needs to keep rates at 5.5%

Goldman Sachs Economists see July core CPI coming in at +0.15%.

And their component analysis shows only high inflation for shelter. That is about it.

Which is why Cleveland Fed inflationNow forecast seems just plain wrong. Yet, many use this.

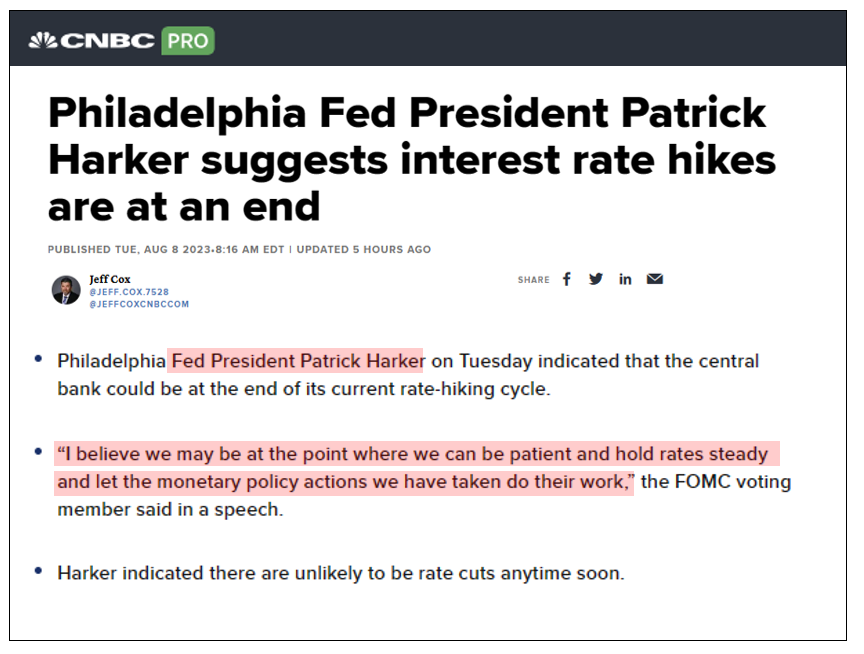

And if July core CPI is low, the calls for Fed to halt will rise.

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame- 8/10 8:30am ET July CPI

- 8/11 8:30am ET July PPI

- 8/11 10am ET U. Mich. July prelim 1-yr inflation

- 8/11 Atlanta Fed Wage Tracker July

- 8/15 8:30am ET Aug Empire Manufacturing Survey

- 8/15 10am ET Aug NAHB Housing Market Index

- 8/16 8:30am ET Aug New York Fed Business Activity Survey

- 8/16 2pm ET FOMC Minutes

- 8/17 8:30am ET Aug Philly Fed Business Outlook Survey

- 8/17 Manheim Aug Mid-Month Used Vehicle Value Index

- 8/23 9:45am ET S&P Global PMI Aug Prelim

- 8/25 10am ET Aug Final U Mich 1-yr inflation

- 8/28 10:30am ET Dallas Fed Aug Manufacturing Activity Survey

- 8/29 9am ET June S&P CoreLogic CS home price

- 8/29 10am ET Aug Conference Board Consumer Confidence

- 8/29 10 am ET Jul JOLTS

- 8/31 8:30am ET July PCE

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

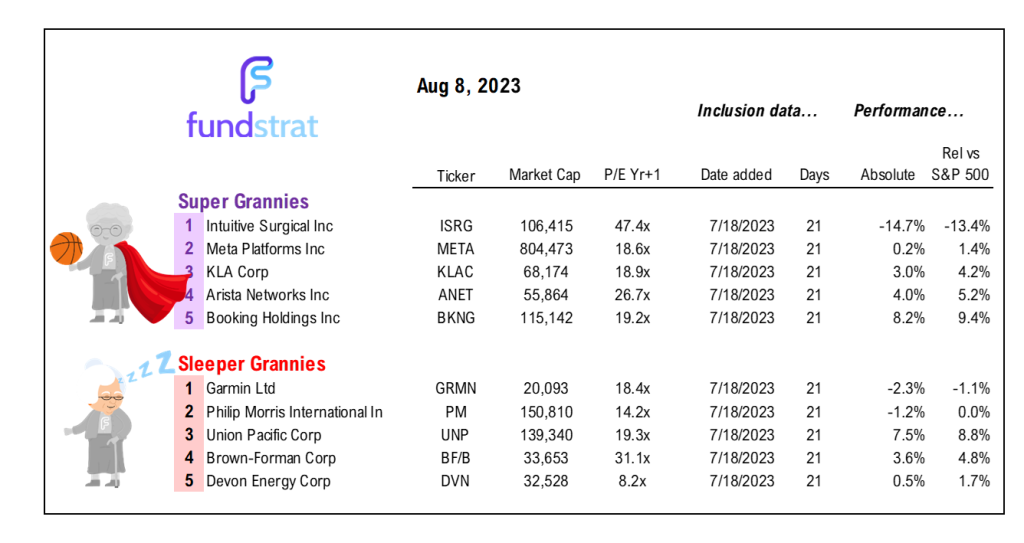

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.