Given first half 2023 gains >10%, history suggests second half gains ~12% = S&P 500 >4,700 by YE. This may be due to the "Nutty Professor" effect and evident in FAANG stocks.

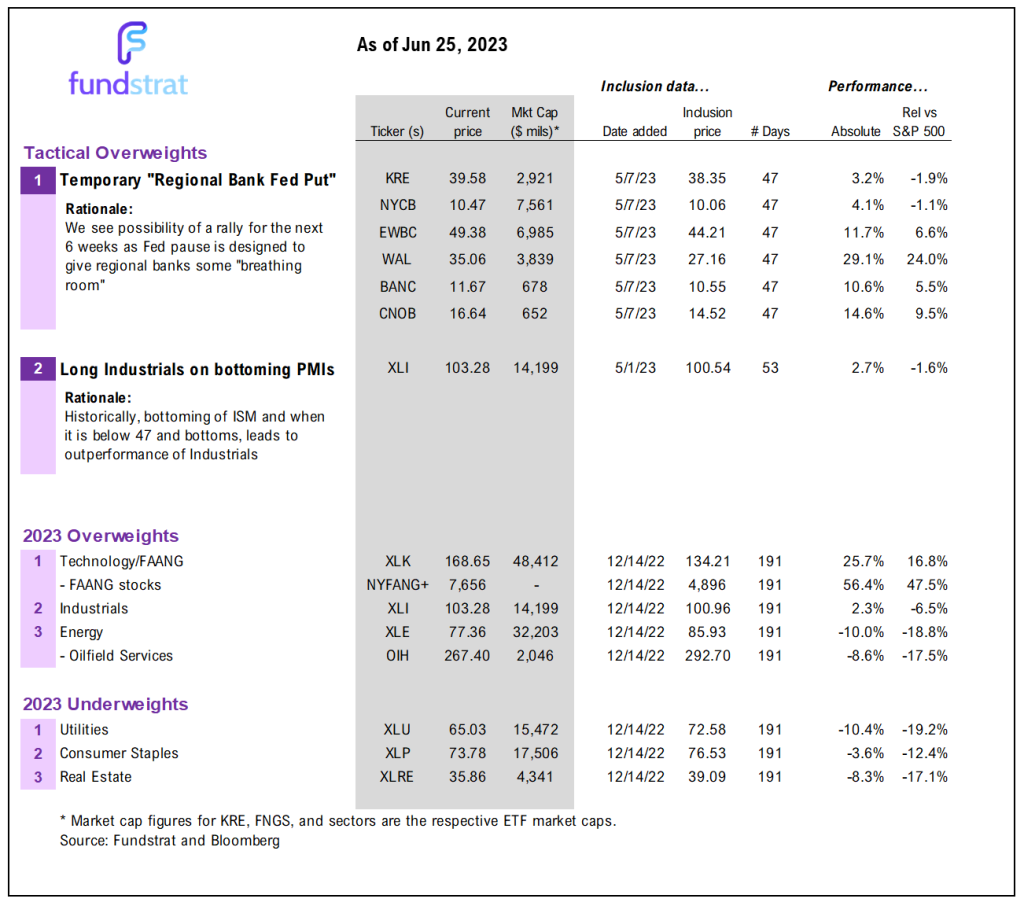

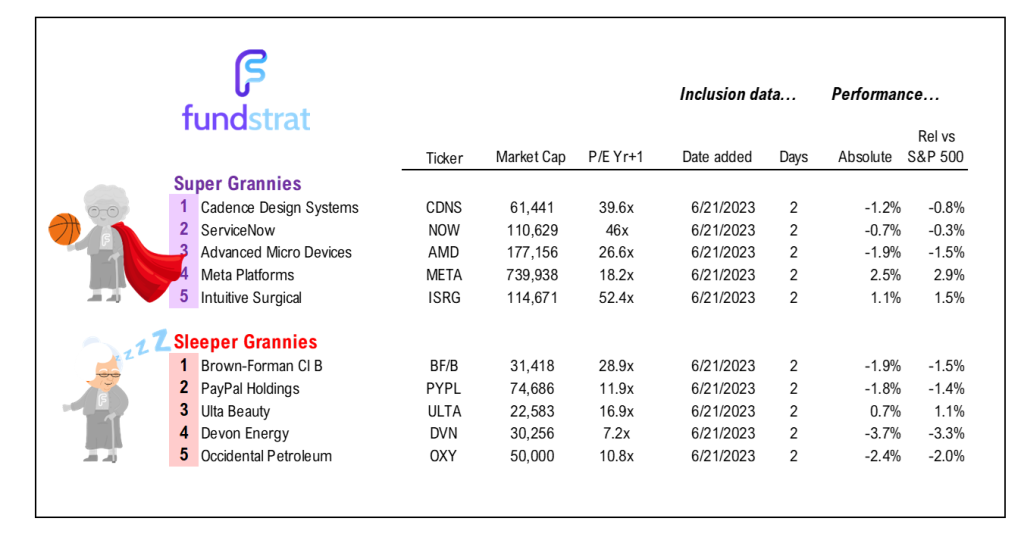

NEW: Section (above) added identifying Key Recommendations and Super Grannies

________________________________________________

Please click below to view yesterday’s Macro Minute (duration 4:18):

WORD OF NOTE: I am visiting clients in Japan this week, and updates less complete given schedule

The first half of 2023 is coming to close at the end of this coming week. Barring a large sell-off, the S&P 500 is up ~13% YTD and should be up double digits by week’s end.

- This strong performance has surprised the majority of investors, because consensus was cautiously positioned at the start of the year. Recall, many pundits claimed that S&P 500 would revisit and even fall lower than the October 12, 2022 low of 3,491 as the “hard landing” was imminent, and a Fed determined to fight stubborn inflation.

- But instead of a falling off a cliff, equities were strong out of the gate. In fact, by day 5, we invoked the “rule of 1st 5 days” which noted that gains >1.4% (and negative the prior year) saw follow through into YE gains ~20%.

- Many of those same cautious/bearish-tilted are unconvinced by market gains YTD and simply deem this a “bear market rally” that will end for one of several reasons:

– inflation will be far stickier = Fed kills rally

– economy will still have “hard landing” = stocks fall

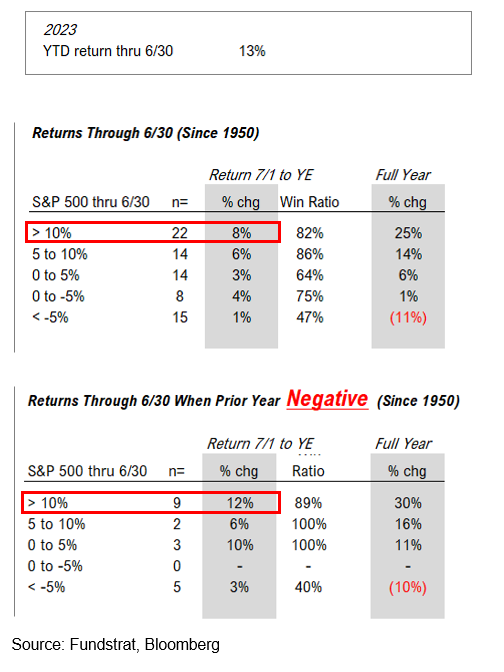

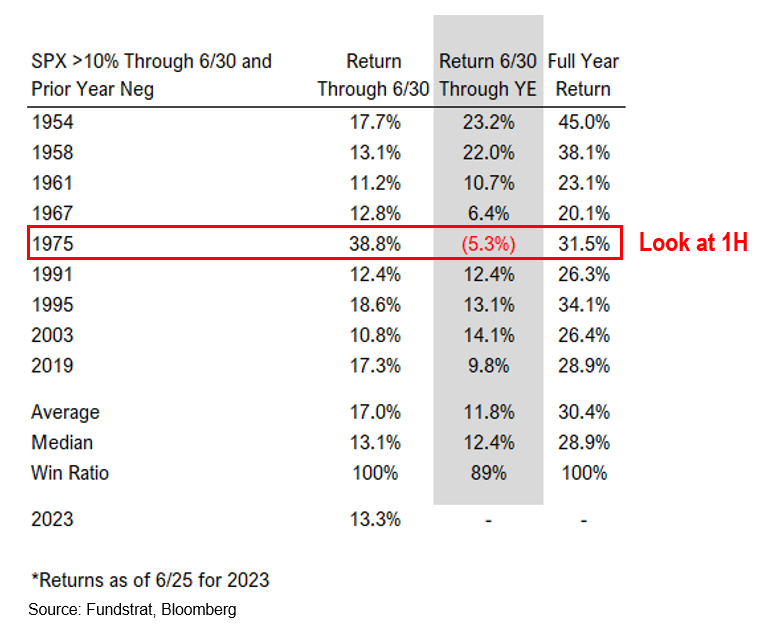

– this is a bubble = valuations too high = stocks fall - History argues the exact opposite. Since 1950, 22 instances when S&P 500 up >10% by mid-year:

– median second half return is 8%, 82% win-ratio

– implies S&P 500 4,700 by YE (inline with our target) - If we look at instance when S&P 500 negative prior year (ala 2022), this is 9 instances:

– median second half return 12% (higher), 89% win-ratio

– implies S&P 500 4,900 by YE

– only exception 1975, but SPY 0.98% up 38% in the first half of 1975 - Get the message? The base case is S&P 500 is set to rise 25% this year. Yup. That is what we argued at the start of this year. And likely makes all time highs.

- But the key question is how is this conceivable? Isn’t the Fed killing the economy? We have had two alternative frameworks that supported why stocks could sustain a rally. And as we get into mid-year, these seem to be holding up.

- First, inflationary pressures are set to fall faster than consensus expects, and thus, Fed will allow financial conditions to ease. This has been evident in 2023, and forward looking measures on housing and autos suggest this will gain momentum. We wrote about this numerous times, so we will not belabor this point.

- Second, is the “nutty professor” (1963 Jerry Lewis movie) effect. Companies survived a gauntlet of headwinds since 2019:

– global lockdowns

– bullwhip/supply chain inflation surge

– fastest Fed hike in history

– yet, 2Q2023 EPS is set to rise YoY (ex-Energy) for the first time in 5 quarters.

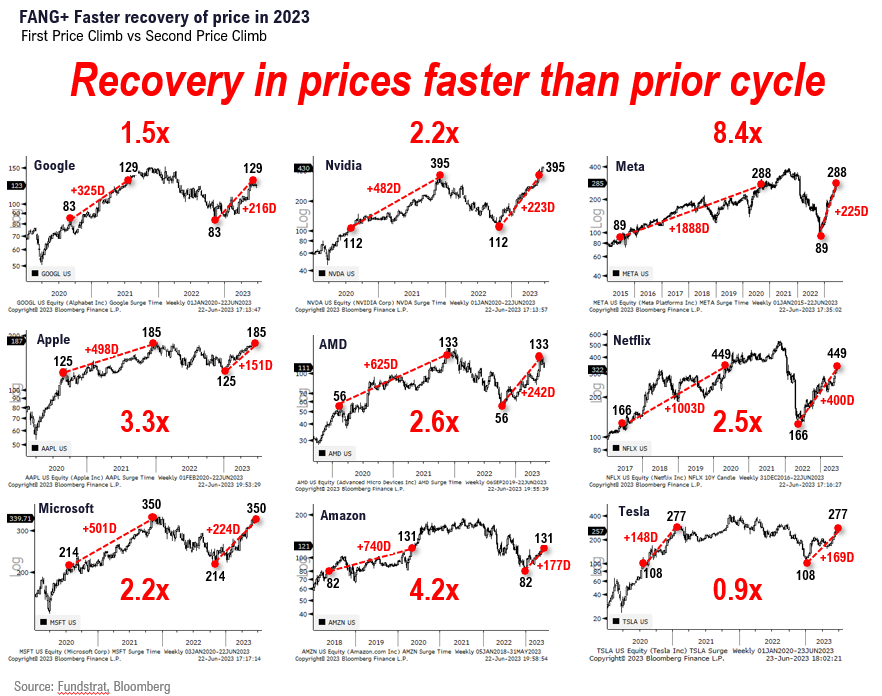

– the concoction did not kill the professor, but he emerged stronger - The recovery in FAANG stock prices is evident of this. That is, how much more quickly these stocks are recovering key price levels. An example:

– 2022-2023: META 0.27% recovered from $88 to $288 in 225 days 2022-2023

– 2015-2020: META 0.27% took 1,888 days to rise from $88 to $288

– this recovery is 8.4X faster - This is true of FAANG stocks broadly (see below) which recovered key price levels 2.0X faster.

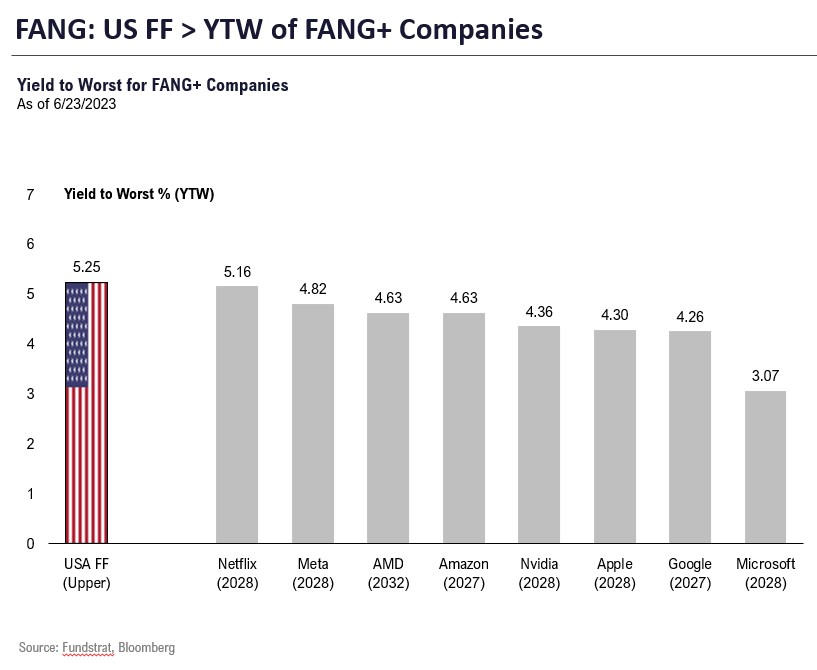

- Moreover, FAANG stocks cost of 10-year debt ranges from 3% (MSFT 1.80% ) to 5.16% (NFLX -0.63% ). Every single one of these stocks is borrowing money at 10-years below the current Fed funds rate of 5.25%. Isn’t this a reason to argue for P/E expansion?

- By the way, this is true for many companies in the S&P 500. But FAANG and Technology are leading markets, so we think it is worth considering these stocks are setting the template for how the rest of the S&P 500 will follow.

BOTTOM LINE: We see strong gains in second half of 2023, and expect a broadening of the market

There is some key economic data this week including home prices (Case Shiller 6/27) and May PCE deflator (6/30) and U Mich Consumer 1-yr inflation exp June F (6/30), so these will have short-term impacts on the market. But given our above statement, we believe any dip will be bought.

- Recall there is a mountain of cash on the sidelines totalling $5.4T currently vs $4.7T at the start of the year.

- We believe the broadening will encompass other cyclical sectors with Industrials XLI 0.16% being our favorite incremental sector at the moment. We also believe regional banks will recover from their recent bout of selling once we move past quarter end KRE -0.66% .

- But our favorite sector remains Technology QQQ 1.55% XLK 1.09% and FAANG as well. And our Granny shots as well.

THE NUTTY PROFESSOR: Story of stock market since 2019

If you don’t know the story of the Jerry Lewis movie, its a comedic take on Jeckyll and Hyde. He is a bumbling professor named Julius F. Kelp but after creating a formula, he turns into Buddy Love. It’s old movie but when I was a kid, this was hysterical.

Take a look below, this is the story of the stock market since 2019.

STRONG 1H = STRONG 2H: Since 1950, 1H >10% = 2H >12% (if negative the prior year)

This is the reason we remain optimistic on stocks. But history also supports this. We noted above that since 1950, if S&P 500 is up >10% in 1H and negative the prior year, the S&P 500 gains 12% in 2H.

Since 1950, 22 instances when S&P 500 up >10% by mid-year:

- median second half return is 8%, 82% win-ratio

- implies S&P 500 4,700 by YE (inline with our target)

If we look at instances when S&P 500 negative prior year (ala 2022), this is 9 instances:

- median second half return 12% (higher), 89% win-ratio

- implies S&P 500 4,900 by YE

- only exception 1975, but SPY 0.98% up 38% in first half of 1975

ACCELERATING RECOVERY: Prices recover faster this cycle

The recovery in FAANG stock prices is evident of this “nutty professor” effect. That is, how much more quickly these stocks are recovering key price levels. An example:

- 2022-2023: META 0.27% recovered from $88 to $288 in 225 days 2022-2023

- 2015-2020: META 0.27% took 1,888 days to rise from $88 to $288

- this recovery is 8.4X faster

- This is true of FAANG stocks broadly (see below) which recovered key price levels 2.0X faster

Moreover, FAANG stocks cost of 10-year debt ranges from 3% (MSFT 1.80% ) to 5.16% (NFLX -0.63% ). Every single one of these stocks is borrowing money at 10-years below the current Fed funds rate of 5.25%. Isn’t this a reason to argue for P/E expansion?

ECONOMIC CALENDAR: FOMC keyin June

Key incoming data June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame- 6/27 9am ET April S&P CoreLogic CS home price

- 6/27 10am ET June Conference Board Consumer Confidence

- 6/30 8:30am ET May PCE

- 6/30 10am ET June Final U Mich 1-yr inflation

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 4d14ec-7efd2d-54273c-6d4aa2-1490a4

Already have an account? Sign In 4d14ec-7efd2d-54273c-6d4aa2-1490a4