"Soft landing" scenario strengthening. 1980s inflation broken when "goods" inflation peaked. Consumer discounts ahead. Target confirms. Manheim Index shows Luxury + Full-sized tanking.

The Fed doesn’t want every stock to fall, but they want to tighten financial conditions

Investors tell us they don’t want to “fight the Fed” and as long as the Fed is tight, they will not touch equities. This is intuitively sound, but here are some issues with this thinking:

- The Fed is fighting inflation, and probably has White House consent to drive a recession, if this is needed

- Inflation, however, could cool faster than Fed and markets anticipate = dovish turn

- The Fed is trying to tighten financial conditions broadly — stocks, housing, cost of money, etc.

- The Fed is not targeting specific stocks — ie, FAANG doesn’t need to keep getting pummeled

- Why doesn’t Fed just short oil futures and tank commodity speculators if they were being specific

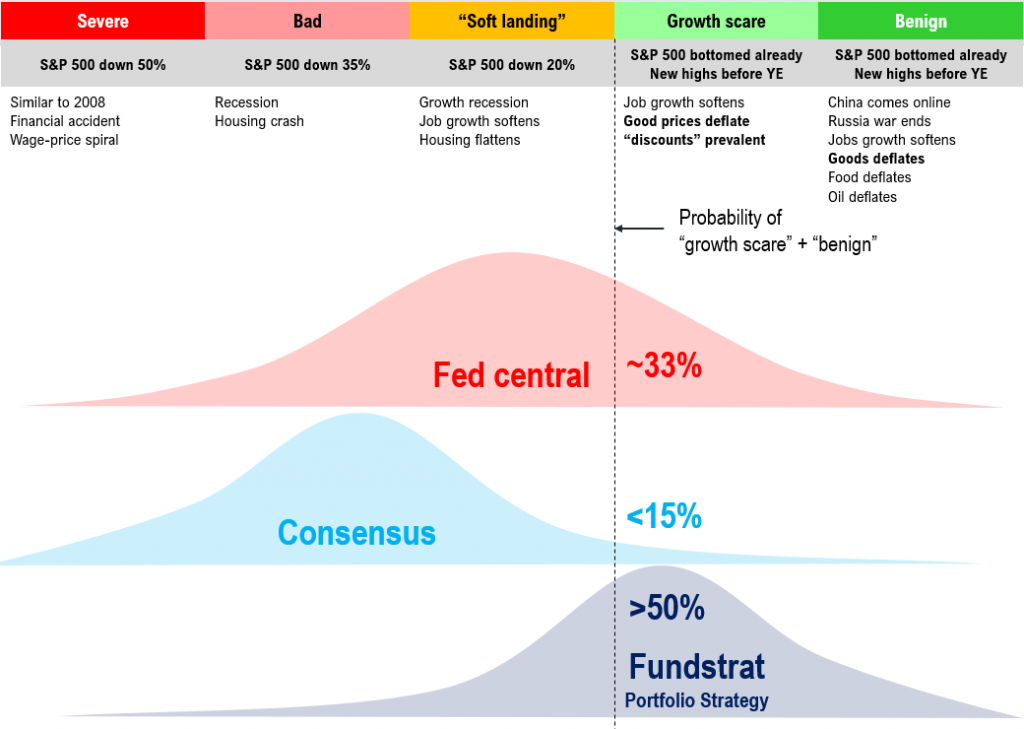

In other words, this current Fed policy stance doesn’t means stocks have to keep falling. There is simply no way for the Fed to titrate and create equilibrium in stock prices this way. In fact, looking at scenarios below:

- In our view, markets are focused on the “left tail” risks of Hard landing, recession

- Our base case is that US is facing a “growth scare” and means 20% decline fully discounted this

- FAANG valuations are attractive and we favor OW FAANG/Tech here

INFLATION: Breaks when “goods” deflate, not when “services” deflate

There is a misconception, in our view, how US inflation historically breaks.

- many clients tell us “services are inflating”

- inflation can’t break until “services” cool or deflate

- history shows this is not the case

- inflation episodes in the US break when “goods” deflates not “services”

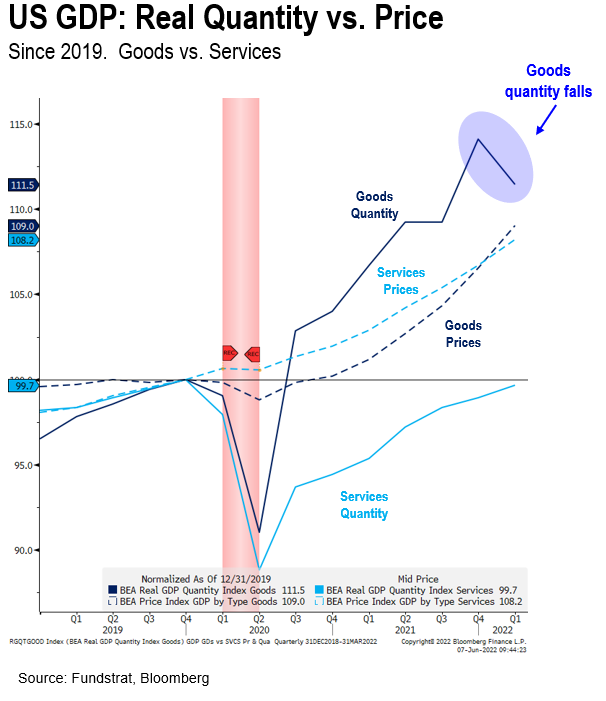

In 1Q2022 GDP report, the quantity of US goods (durables, apparel, car, furniture, etc) fell. This is a pretty big break in pattern. As shown below:

- goods quantity has soared since pandemic lows

- quantity is the “units” side of GDP and multiplied by “price” gets to GDP

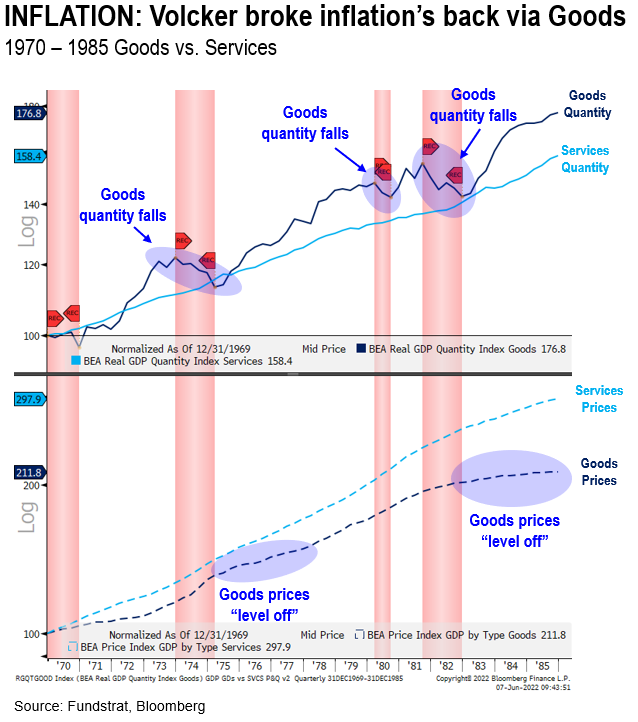

Volcker broke 1980s inflation via Goods not Services

Take a look at the composition of goods versus services in the 1970-1980s period. This is the last major US inflation episode and when Fed chair Paul Volcker ultimately broke the back of inflation:

- The double-digit recession of 1982 is the key period to focus on

- “goods” quantities imploded during that time

- “goods” prices leveled off

- this is what set the glide path for falling inflation rates

- prices flattening is ending “inflation”

- “services” quantities kept rising steadily

- “services” pricing continued to rise

In other words, it is breaking the back of “goods inflation” that killed inflation of 1980s.

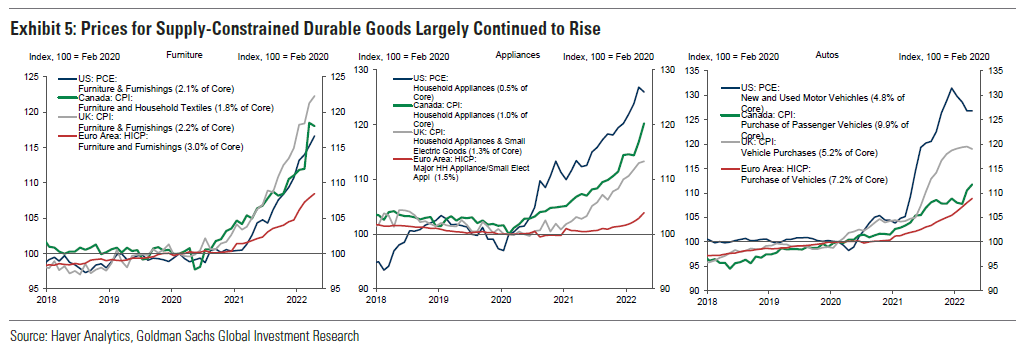

INFLATION: Prices for “goods” is behind surges globally

The chart from Goldman Sachs is helpful in seeing the surge of inflation globally. It is goods prices that are soaring:

- surge in prices is due to limited availability

- supply chains are gummed up

- China opening is easing access, which we believe fuels further disinflation

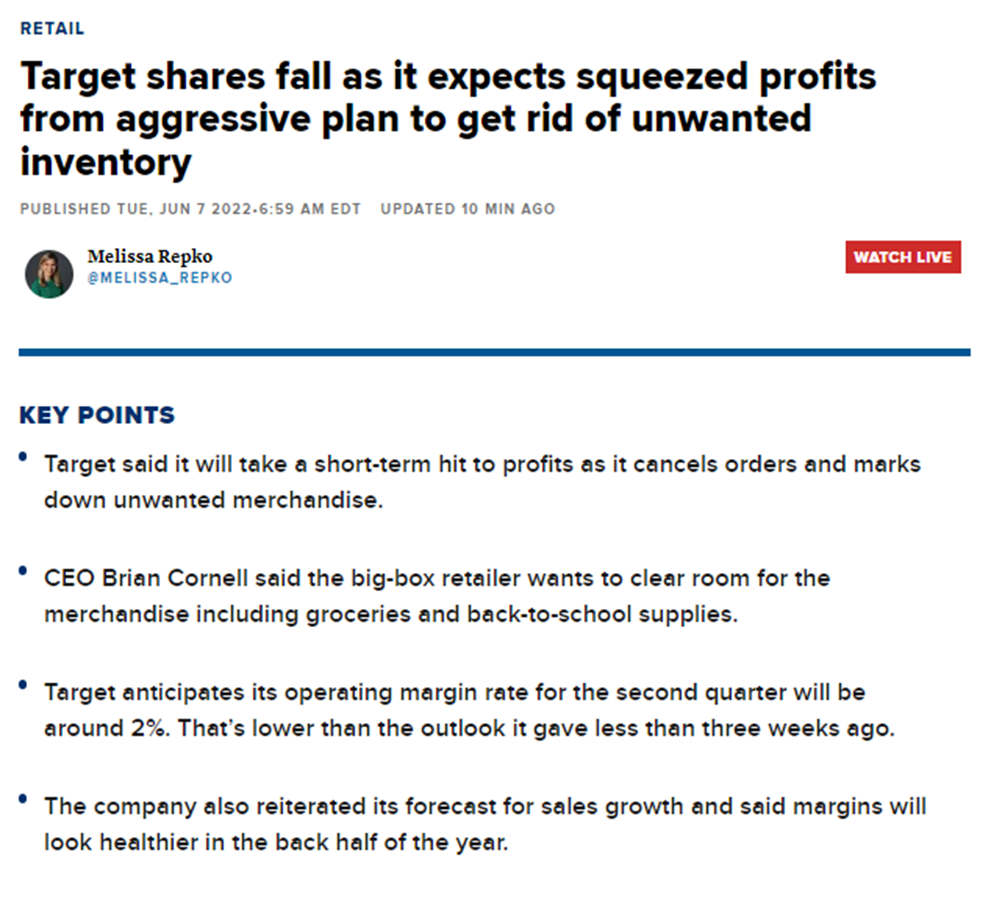

Target purging inventory = discounts coming for retail

On Tuesday before the market open, Target (TGT) CEO Brian Cornell spoke to CNBC and siad that they want to clear piling up inventories. And achieve this by discounting, which in turn hurts margins.

- while this is negative for Target and other retailers

- this is actually positive from an inflation perspective

- consumers seeing discounts for merchandise is a break from the inflationary environment of past 2 years

- retail merchandise are at record levels, so it is not just TGT who needs to clear inventory

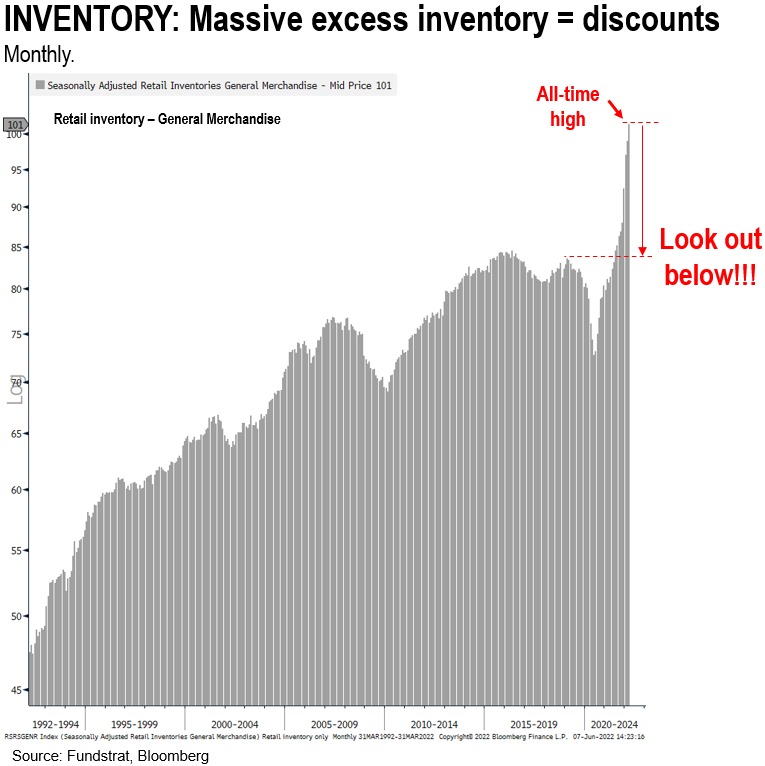

Massive retail inventory = discounts on the way = job cuts coming

It is not just Target with piles of inventory. Take a look at the BEA retail inventory (this is monthly thru May).

- see the pile of inventory?

- all-time high by a huge margin

- think about it, if there is massive inventory

- no company is raising prices

- they are clearing inventory by cutting prices

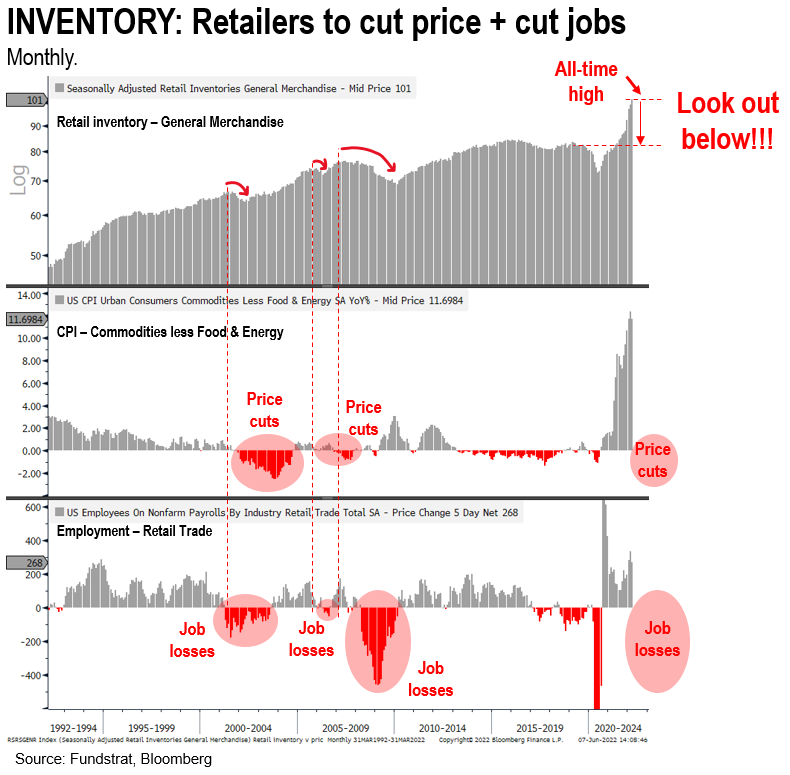

Precedent inventory corrections show retailers cut prices + cut jobs

Looking at the 3 precedent inventory corrections (reduce inventory), we can see the impact of high inventories on pricing and on employment in retail:

- 3 precedent episodes since 1990 — 1999, 2004 and 2006

- retailers cut prices (middle section) leading to negative YoY CPI

- retailers massively shed jobs (bottom segment)

- isn’t the setup in 2022 exactly the same?

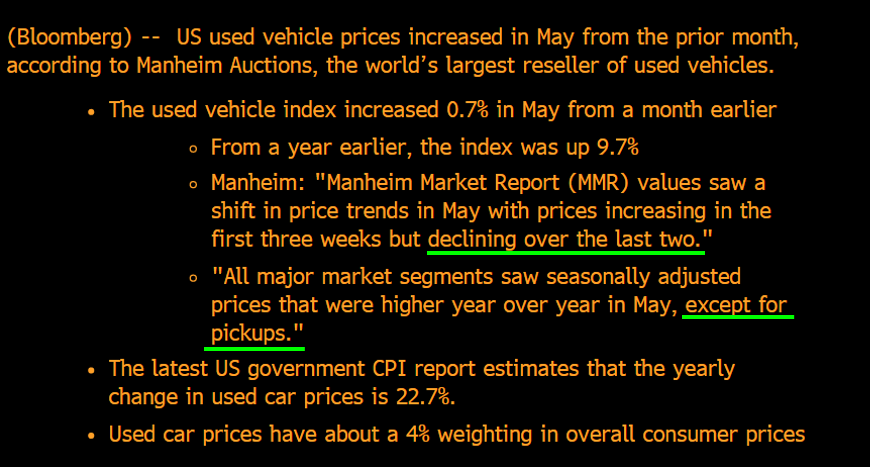

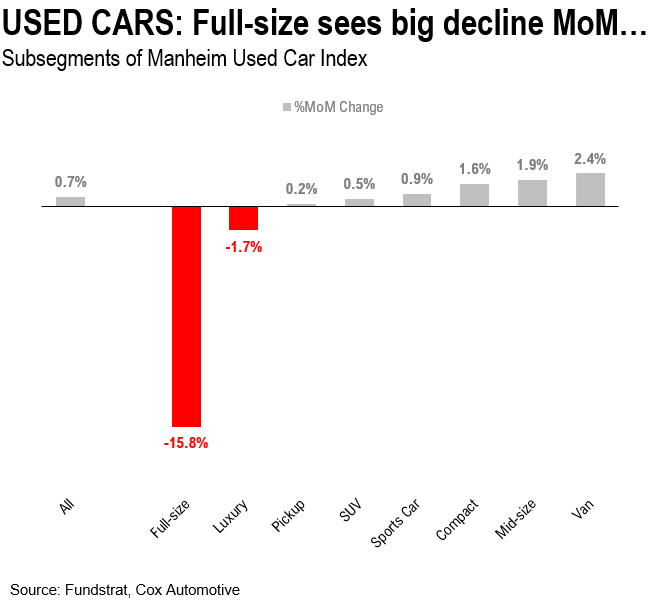

USED CARS: Latest Manheim Index shows car prices cooling, some segments collapsing

Used and new car prices accounted for half of the rise in CPI in 2021. And while many economists have modelled auto prices cooling in 2022 (thus, slowing CPI impact), few are modelling outright “deflation” of car prices.

- The latest Manheim overall shows prices are down now from the Jan 2022 peak

- pick-up trucks are down YoY

- luxury and full-size car prices tanked in May

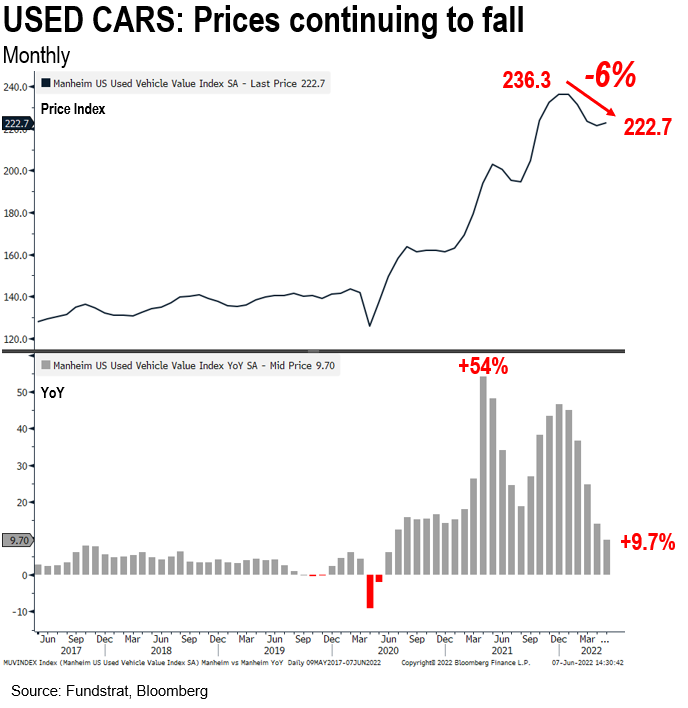

Used car prices are 6% off their peak and the YoY is slowing

Those in the “half empty” view might be alarmed that used car prices rose sequentially April to May. But this belies a few facts:

- Used car prices are 6% off their peak and YoY is decelerating sharply

- specific segments like luxury and full-sized cars are seeing prices tank

Full-sized and luxury car prices fall sharply month over month = foreshadow other segments

Look at the segment data from Manheim, showing month to month changes in price.

- Full-sized prices down 16%, whoa

- Luxury down 2%, whoa

Luxury and full-sized, in our view, shows there is demand destruction taking place. What does it mean?

- luxury demand possibly speaks to “wealth effect” kicking in

- European imports tend to be luxury and easing supply chains might impact price

- arguably, this spills over into other categories

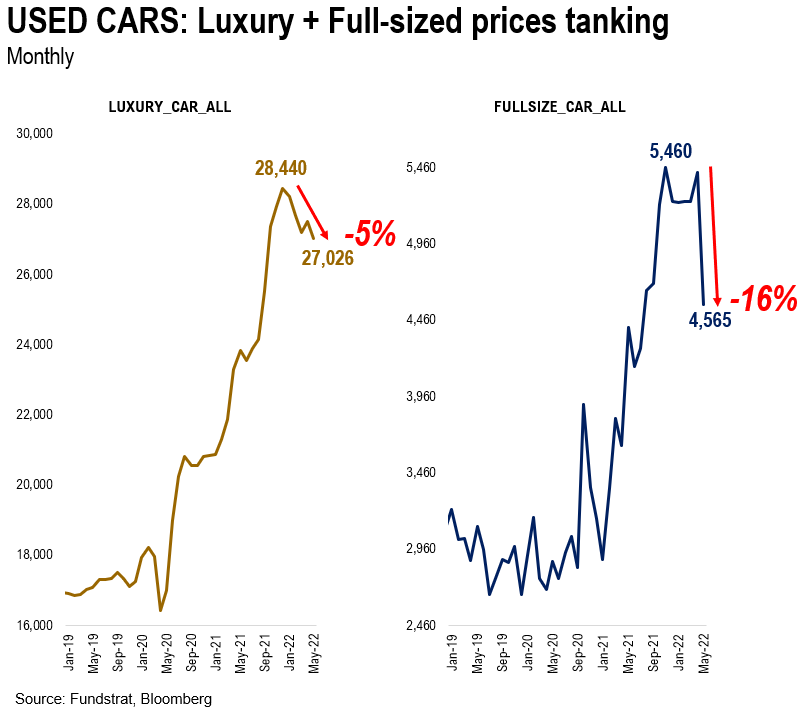

LEADING INDICATOR: declines in Luxury and Full-sized have been in place for 5 months

The downturn in prices for these segments has been in place for some time. Take a look below:

- the declines are not one-month anomolies

- the downturn in prices has been in place for some time

- we think used cars will deflate before YE 2022

- this is subtracting from CPI

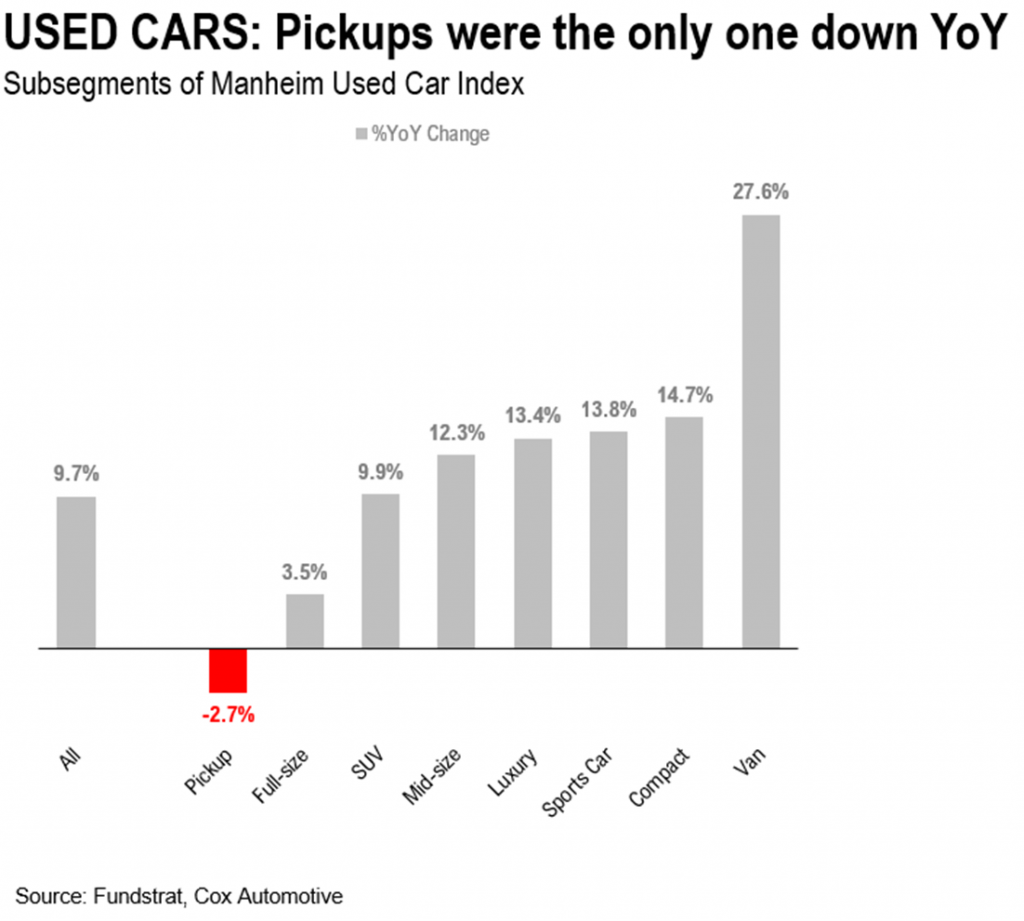

DEFLATION: Pickup truck prices are deflating now

Remember those stories of massive rises in pick-up truck prices? Take a look below.

- YoY, pickup truck prices are down

- this is surprising

- but then again, construction activity is turning down

- so fewer people buying pickups

- plus this speaks to the disinflationary impact of supply chains easing

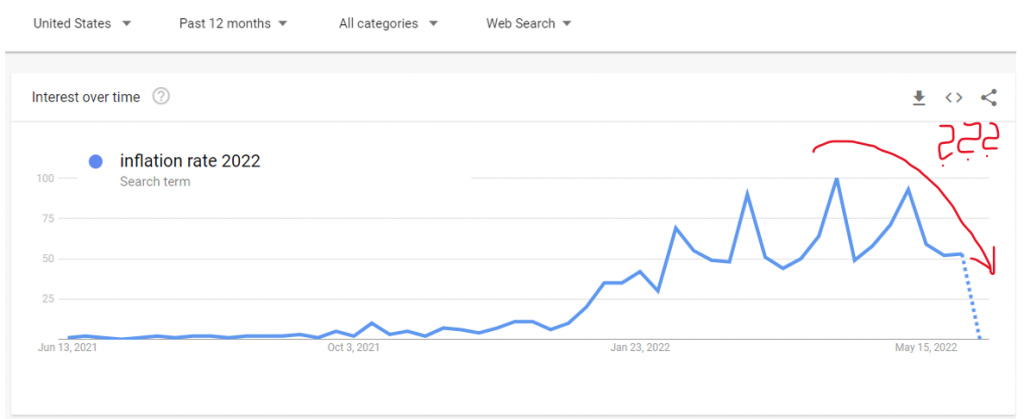

CONSUMER: Inflation searches tanking too… Signal?

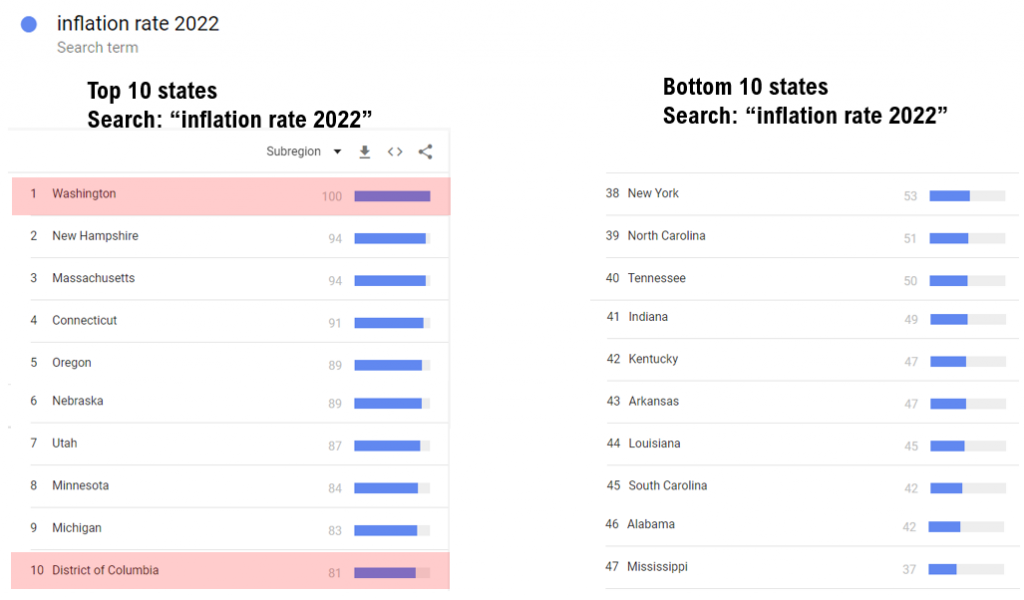

I am not sure if this is signal, but look at the search trends (Google) for “inflation rate 2022”:

- searches have tanked

- and the peak was mid-April

…regionally, inflation is most searched in Washington/DC area, but NY and Southeast less so

Take a look at the regional breakdown of searches. I think this is interesting:

- Washington DC and the Northeast are the most popular places for “inflation rate 2022”

- but New York and the Southeast are the places where this is least searched

- Is inflation a political issue?

- just kidding, but it seems like media and Washington are very focused on this

- of course, inflation is an issue, so don’t call me a doubter

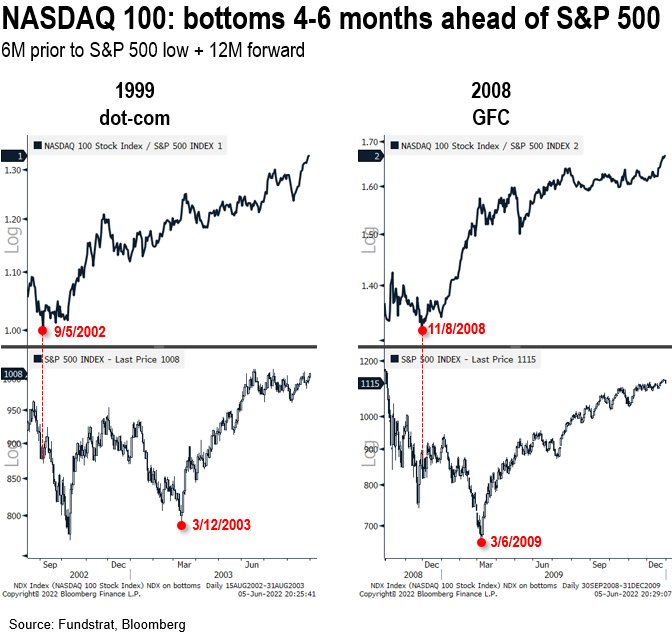

STRATEGY: Fed is not targeting FAANG and these lead off prior bottoms

To reiterate a point we made earlier in the week, Nasdaq 100 (QQQ 1.55% ) and FAANG (FB AMZN 3.36% AAPL -0.41% NFLX -0.63% NVDA 6.25% GOOG 9.90% GOOGL 10.17% ) historically lead off the market bottoms:

- if this is a “growth scare” equities have bottomed

- while many say Tech is “dead” this is not supported by history

- post dot-com and post-GFC, Technology lead

- Tech bottomed 4-6 months before overall equities

- case for Tech is rising due to labor shortage

STRATEGY: We lean relatively “bullish” into 2H2022 (but also 2Q22), but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

Stocks have continued to be treacherous in 2022. Investors are on a hair trigger.

– this is in context to a challenging 1H2022

– so jagged next 3 months

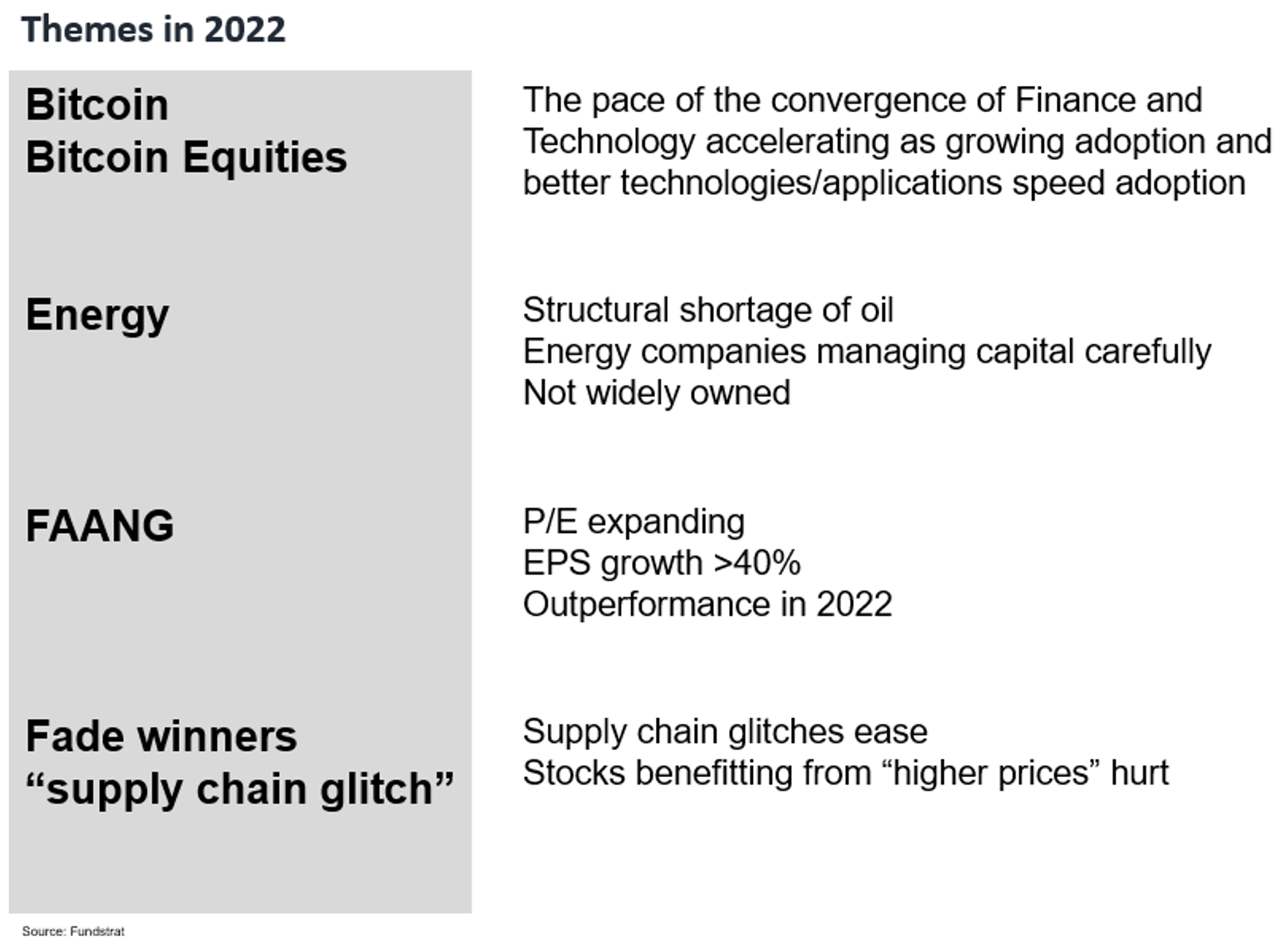

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO -1.45% GBTC -1.49% BITW -0.74%

– Energy

– FAANG FNGS 2.50% QQQ 1.55%

Combined, it can be shortened to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL -0.41% AMZN 3.36% NFLX -0.63% GOOG 9.90%

All in all, one wants to be Overweight BEEF

_____________________________

31 Granny Shot Ideas: We performed our quarterly rebalance on 4/5. Full stock list here –> Click here

_____________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In a9c80b-cb370e-6ad261-7114ed-a02316

Already have an account? Sign In a9c80b-cb370e-6ad261-7114ed-a02316