Netflix -70% is 3rd time Netflix has "faced the end" -- consider risk/reward

Click HERE to access the FSInsight COVID-19 Chartbook.

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

Netflix delivering outsized pain to younger retail investors

In our view, one of the biggest market stories this past week is the collapse of Netflix stock following 1Q2022 earnings results. NFLX 0.94% is considered a blue-chip media/internet stock (hence, its inclusion of the FANG acronym), a leading producer of media content, and a leader in streaming. Thus, the -35% decline speaks not only to market dynamics but raises soul-searching questions about the investment thesis of media/internet stocks broadly. Is it no wonder we are seeing such fierce selling pressure among related media/internet stocks from FB to DIS -0.11% , etc?

- The 1-day decline was -35%, 2nd worst day in its history

- Netflix NFLX 0.94% has fallen a staggering -70% in the past 5 months

- While the market cap of NFLX is 141st in the S&P 500

- NFLX is routinely top 20 holding within Robinhood account HOOD 4.19%

- NFLX is one of the 10 most popular stock options

So, one can imagine that NFLX is delivering outsized pain to retail equity investors. And assuming these accounts use leverage (aka margin), there are numerous margin calls underway and this is amplifying the selling pressure in equities.

…This is the 3rd time Netflix stock collapsed >70% in 5 months

As noted above, Netflix is a bellwether both in the media business and among equity investors. Thus, it is no surprise this is causing a relatively seismic chill among investors.

- But it might surprise investors that NFLX has suffered similar declines in the past 20 years

- Previously, NFLX fell >70% in less than 4 months

- June to October 2004 and July to November 2011

These prior declines are useful to examine, in our view, as a reference point for what to expect of Netflix in the next few quarters.

Third time Netflix falls >70% in 5 months or less

Netflix has been publicly listed since 2002, and in its relatively short 20-year history, there have been 2 precedent declines of >70%.

- June to October 2004 -> NFLX lowers DVD rental price in response to Blockbuster

- July to November 2011 -> NFLX splits DVD biz and raises subscription fees

- Looking at the history of the stock, it is evident that Netflix price history is characterized as long periods of gains, and a sudden collapse.

…NFLX “dead” money for 6-9 months before strongly recovering? Maybe

In the aftermath of the NFLX 0.94% blow-up, many strategists and investors have made bold proclamations, explaining the “earnings miss” and forward implications for Netflix and the media industry:

- streaming is saturated

- NFLX subscription model is broken

- consumer is “tapped out”

One of our key adages is “the future is uncertain” and the same is true for the implications for Netflix. Perhaps the company is indeed at a key juncture. After all, Netflix is no longer a small company and with $100 billion-ish market cap, it is clearly a large company.

When I was an equity research analyst (first at Kidder, Peabody then Smith Barney then JPMorgan, from 1993 to 2007), it was often said one cannot buy a “blowup” for 3 quarters. That is:

- after a stock posts a huge miss

- it takes 2-3 quarters before the bad news is “fully priced” in

- this could be different in the modern context given the faster flow of inflation

…two prior blow-ups show NFLX becomes buyable after 2 quarters

But take a look at the two prior blow-ups of NFLX. The there is a similar pattern:

- Netflix falls >70% in less than 4 months

- Stock is “dead money” for 6-9 months

- Company continues to execute and major stock price recovery ensues

- Post-2004 blow-up: NFLX rises $1.55 to $44, or 28X

- Post-2011 blow-up: NFLX rises $7.76 to $701, or 90X

…Did Netflix use up its “9 lives”?

So, does NFLX 0.94% have more than 3 lives? We do not have specific views on equities and therefore, we are not making any formal recommendation. But here is what history suggests:

- history shows NFLX is “dead money” for next 6-9 months –> Fall 2022

- if company pivots/executes, as it has in its history, stock will make a full recovery

- key question: has NFLX lost its ability to be at the center of media/internet streaming?

Not investment advice, but perspective. And we realize many of our clients own Netflix, or a stock that has seen collateral damage from Netflix. But here is the rough calculus:

- If Netflix is indeed “done” as a stock, it is now trading at the same multiple as Disney

- So it is “dead money” next 5 years, with possibility of a takeout

- If Netflix is doing what it did in 2004 and 2011, face a massive turning point, and coming out

- Stock is up 28X to 90X in the next 5-10 years

Please choose your own adventure.

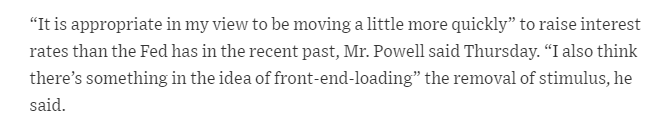

Powell speaking at IMF Forum solidifies expectations for 50bp in May

Fed Chair Powell spoke Thursday at an IMF panel with Christine Lagarde (ECB President) and this is his last appearance before the FOMC policy meeting May 3-4. There will be some incoming data in the next 12-14 days including GDP print, April jobs report and ISM reports. Thus, the Fed will have some additional information between these IMF comments and the FOMC meeting.

- but as highlighted below

- Powell said he believes it is “appropriate” to move more quickly

- And this suggests Fed will likely pursue a 50bp hike in May

This is not necessarily a market surprise, but this is a reminder that the Fed needs to be pursuing “tight” policy as long as inflationary pressures seem to be rising and as long as bond markets worry about inflation.

…Inflationary pressures not necessarily due to demand, but Fed policy can only address demand

Powell, in his IMF session, acknowledged that many inflationary pressures could be due to supply-chain issues, policy (war and also US) and that the Fed’s primary tool to deal with inflation is to use monetary policy to slow demand:

- in other words, the Fed wants to use monetary policy to tighten

- which in turn raises the associated costs of money and other services tied to rates

- which in turn, impact demand

- similarly, the cost of money can rise in anticipation of tighter policy

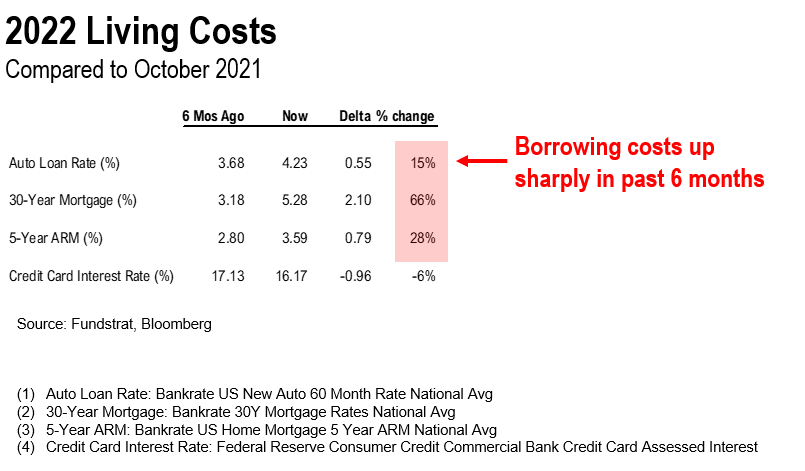

…Already, cost of money is up sharply in past 6 months… market doing Fed’s work

And this is evident by look at the cost of money in the US. Take a look below:

- auto finance rates are up 55bp, or raising cost of financing a car by +15%

- mortgage rates are up +210bp, or 66%, raising cost of borrowing 66%

- The mortgage market has already priced in 4 rate hikes

The Fed needs to be speaking sharply about inflation and managing inflation, as the cost of losing credibility is high. And at the same time, the bond market itself can price in the future path of rates, thus, delivering the tightening the Fed would like to see.

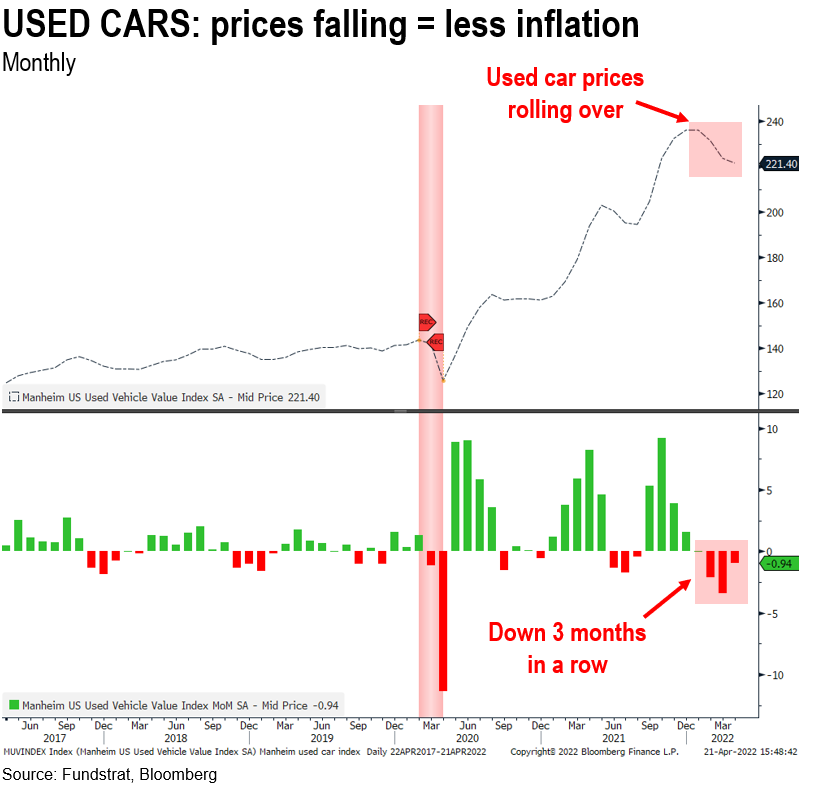

…Already, used car prices down 3 months in a row = reflecting easing inflationary pressures

Used car prices, using the Manheim Used Vehicle Index, are now down 3 months in a row (4 if we consider “flat” the new down). Used car prices soared in the past two years, principally due to the shortages of new vehicles as pandemic-driven supply chain shortages made existing cars more valuable:

- we highlighted earlier this week that new car sales are well below 2019 levels by about 2 million

- yet the auto prices have seen significant inflation

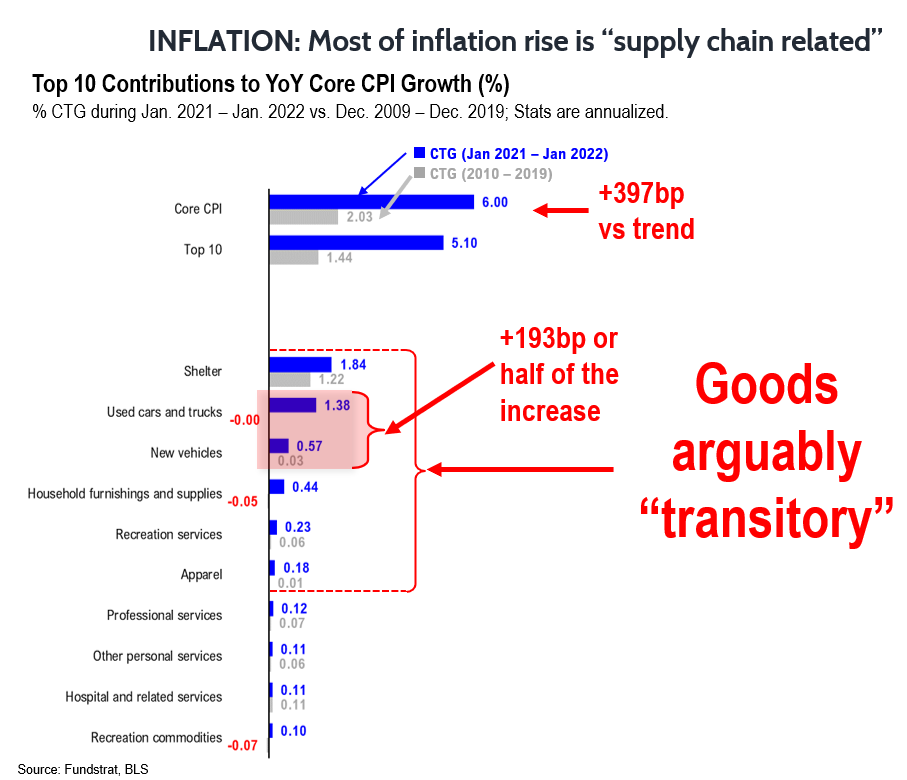

…Auto prices represented 193bp of the 397bp, or half of the increase in inflation in the past 12 months

The rollover in used car prices is a big deal. What many do not appreciate is that used and new cars represented about 193bp, or half of the rise in inflation in the past 12 months.

- thus, if used cars prices stay FLAT, CPI impact drops to 0% in 2H2022

- this is a 193bp reduction in inflation rate in 2H2022

- if used car prices fall 10% in 2H2022

- this would be a +193bp + a further 100bp reduction in inflation in 2H2022

- meaning, auto prices would subtract nearly -300bp from inflation in 2H2022

This would be a big deflation in inflation.

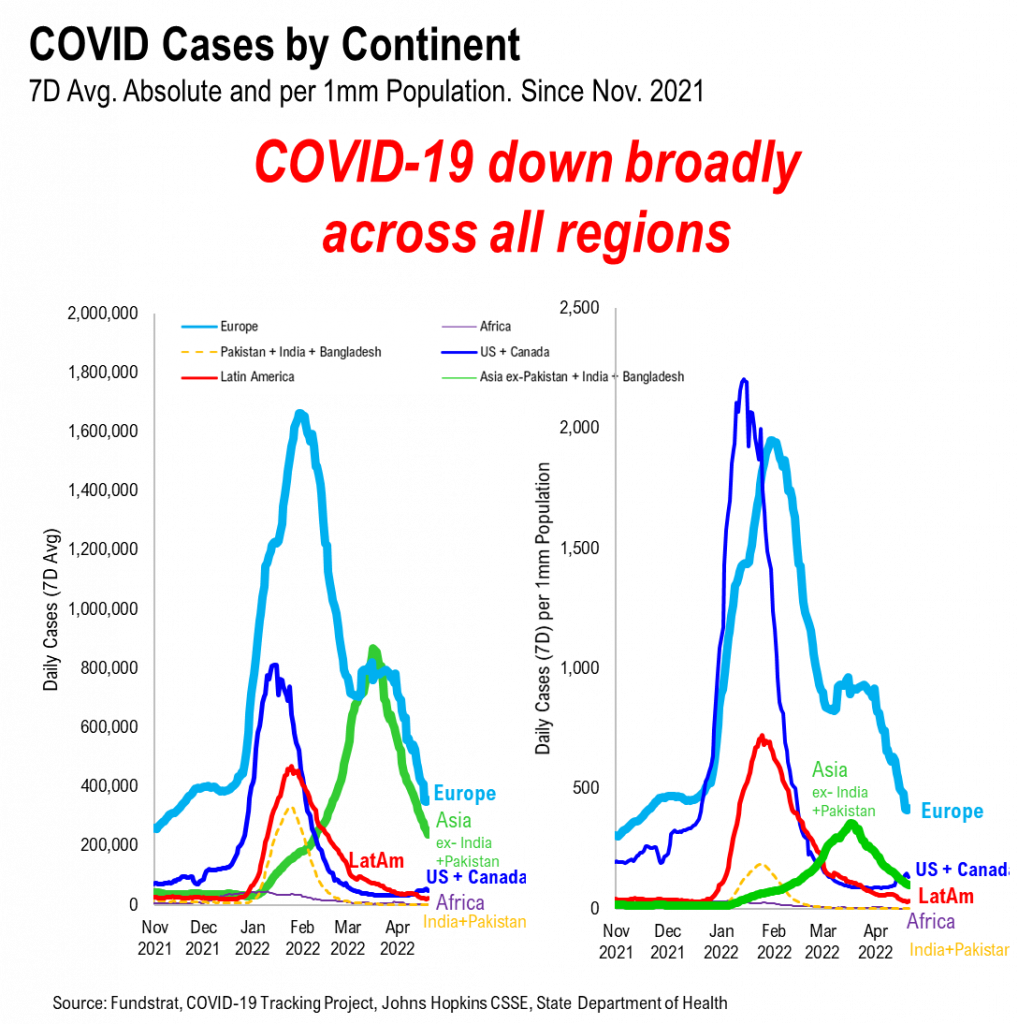

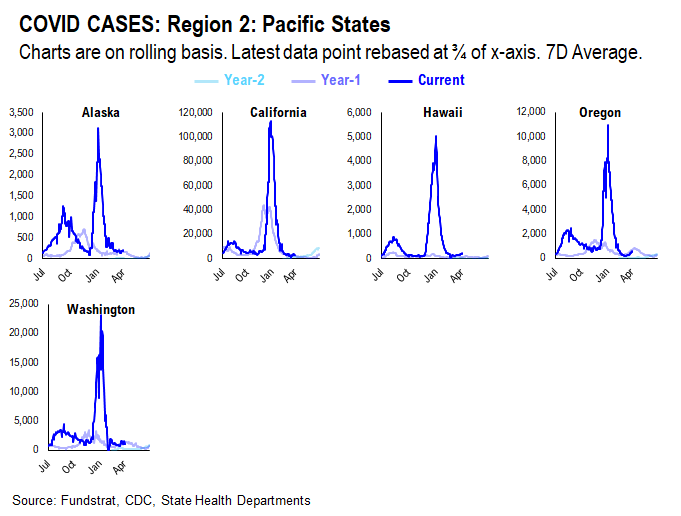

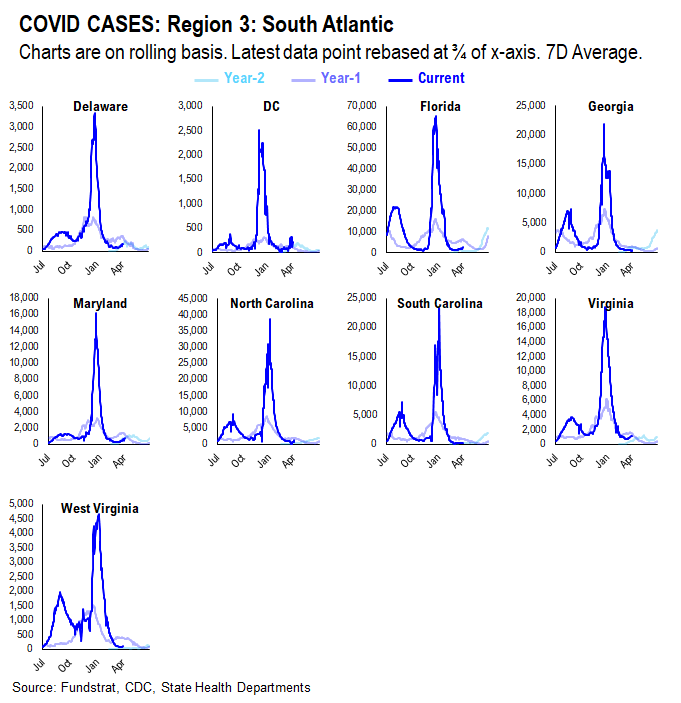

COVID-19 is retreating across all continents… if we squint, USA is curling up modestly

The regional trends in COVID-19 cases is down everywhere. This is a break in trend compared to March:

- in March, cases were rising in Europe and Asia

- But both regions case trends have turned down sharply

- and only USA might be seeing a modest uptick

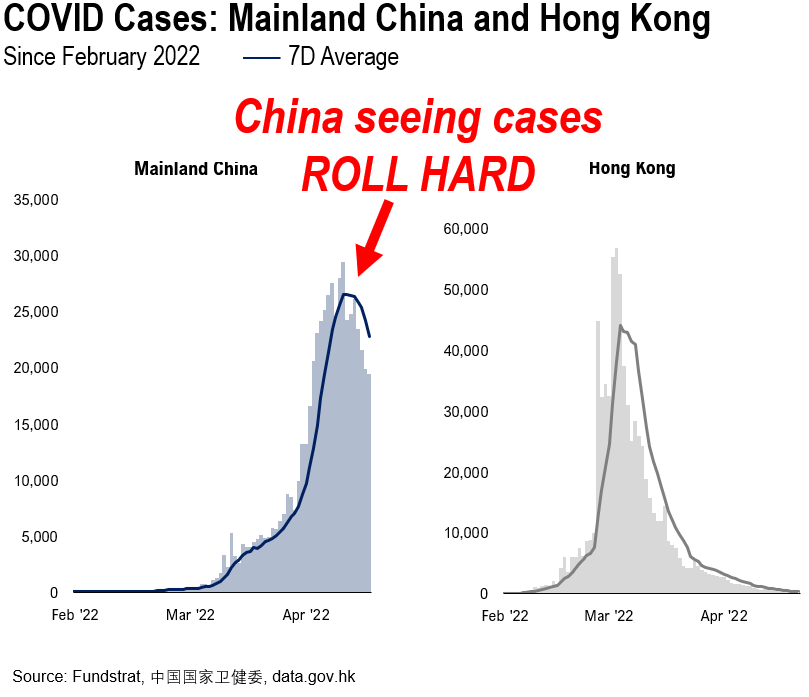

More encouragingly, China cases rolling hard finally

More encouragingly, look at China. Cases are finally rolling over hard.

- So, after fighting BA.2 and Omicron, it looks like China is finally getting ahead of COVID

- Hong Kong has seen a collapse of COVID-19 in the past few weeks

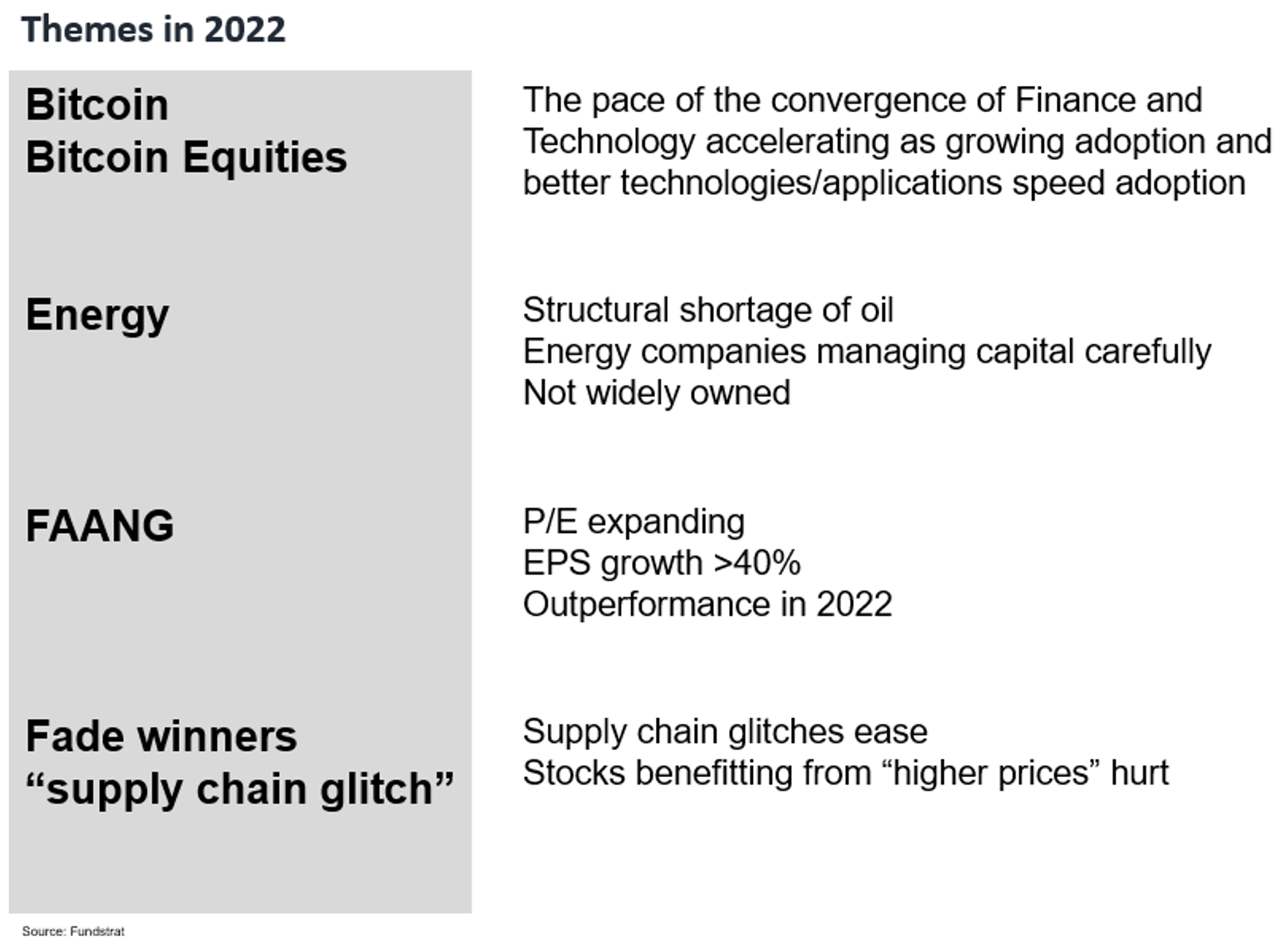

STRATEGY: We lean “bullish” into 2Q2022, but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

Stocks have continued to be treacherous in 2022. Investors are on a hair trigger.

– this is in context to a challenging 1H2022

– so jagged next 3 months

– but > 88% probability that bottom for 2022 is in

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO 4.14% GBTC 4.09% BITW 4.12%

– Energy

– FAANG FNGS 0.32% QQQ 0.20%

Combined, it can be shorted to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL 1.74% AMZN -0.44% NFLX 0.94% GOOG 0.36%

All in all, one wants to be Overweight BEEF

_____________________________

31 Granny Shot Ideas: We performed our quarterly rebalance on 4/5. Full stock list here –> Click here

_____________________________

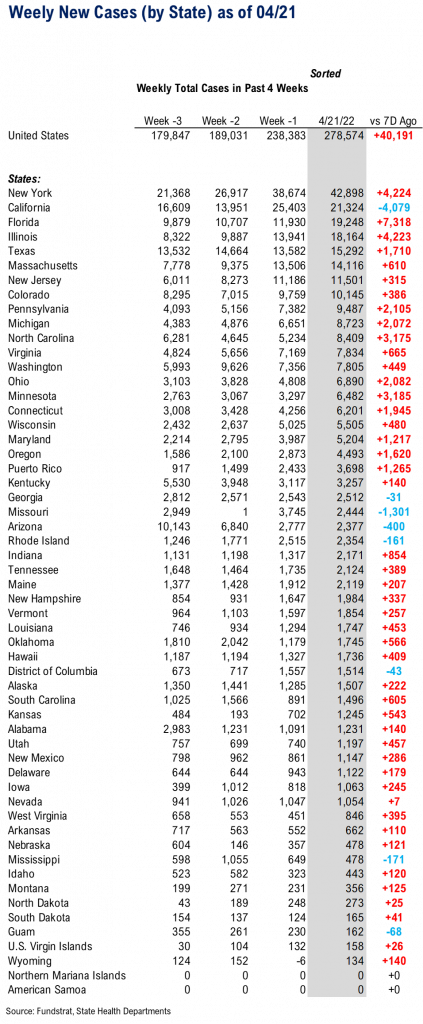

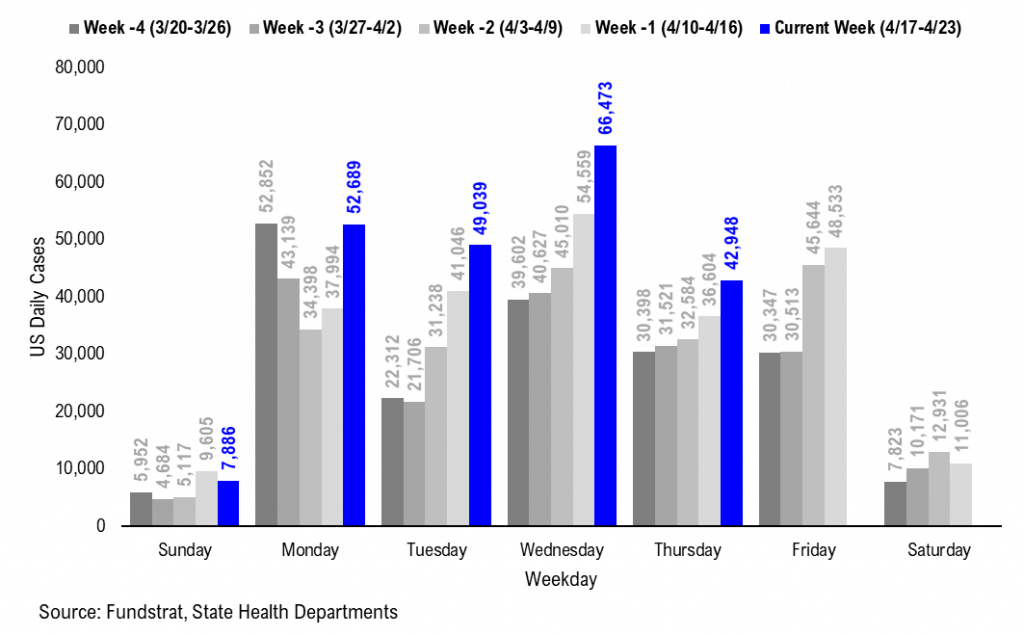

POINT 1: Total COVID-19 cases 278,574 over past 7D (avg 39,796 per day), up +40,191 (+5,742 per day) vs same period 7D ago…

_____________________________

Current Trends — COVID-19 cases (past 7 days vs. 7 days prior):

– Total new cases 278,574 vs 238,383 7D prior, up +40,191

– Avg daily cases 39,796 vs 34,055 7D prior, up +5,742

– 7D positivity rate 5.7% vs 4.7% 7D prior

– Hospitalized patients 12,142, up +5.0% vs 7D ago

– 7D Avg daily deaths 363, down -32% vs 7D ago

_____________________________

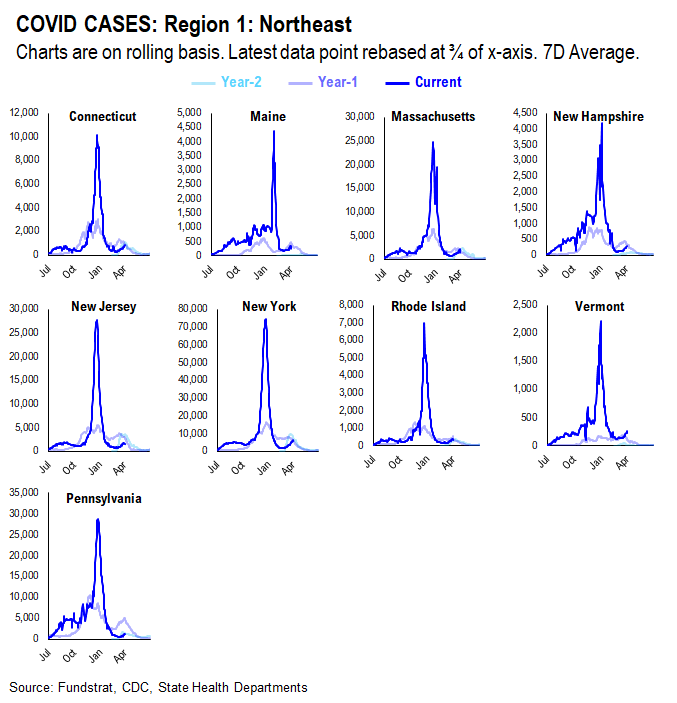

Over the past 7 days, a total of 278,574 new cases (avg 39,796 per day) were reported in the US, up +40,191 (avg up +5,742 per day) compared to the same period 7 days prior. This is not unexpected as the dominant strain, Omicron subvariant BA.2, is more transmissible. according to my sources. In fact, as shown in the chart below, 44 US states report a higher week case figure vs last week. The states where case counts rose the most are:

– NY

– IL

– FL

– NC

– other Northeastern states, i.e. PA, MA, CT, etc

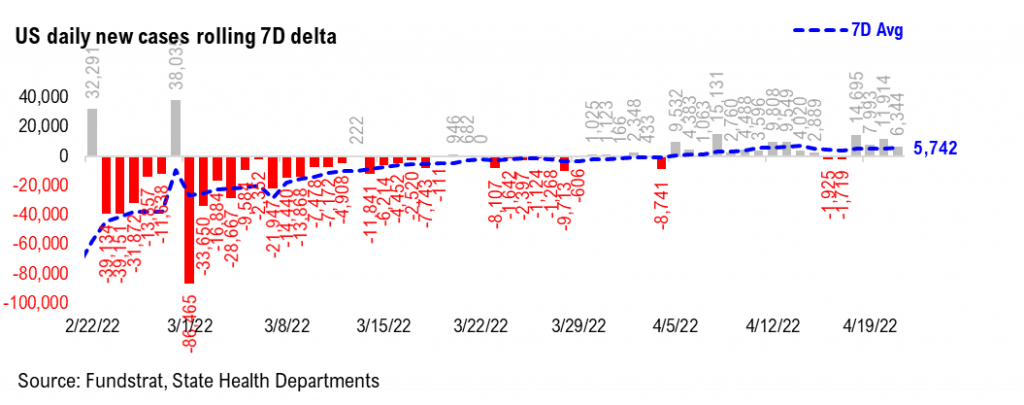

However, the case rise in the other states is very mild. This is reflected in the overall COVID case trend in the US. As you can see from the chart below, the daily cases have risen over the past 2-3 weeks, but the speed of case rise has been stable (not as parabolic as we have observed in Delta/Omicron waves).

7D delta also showed the case rise has been “linear”, not “parabolic.”

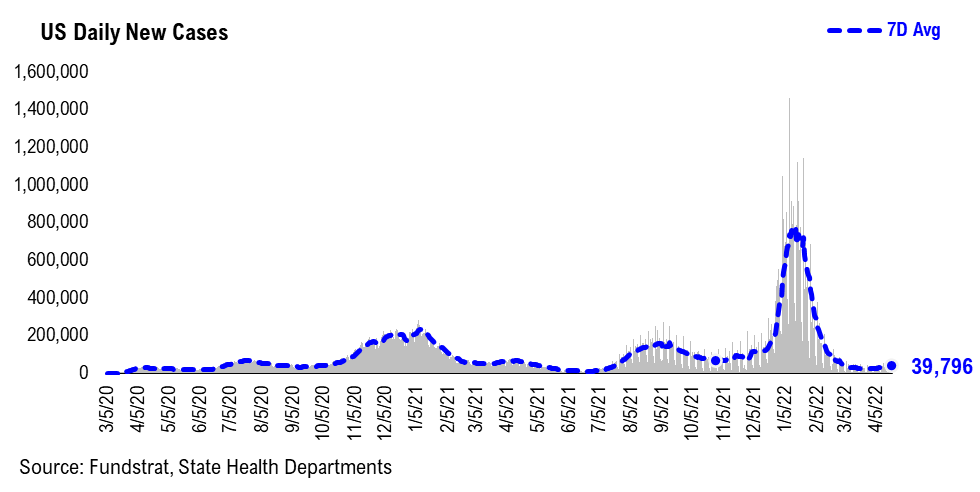

Also, in terms of the absolute number of new cases, the current level (~40,000 new cases per day) remains relatively very low compared to the new cases reported in early January.

– this might partially explain why the public and policymakers have not been panic yet

– But as we always said, COVID is so unpredictable. and the future is uncertain.

A more important question that we don’t know the answer yet is whether the “more transmissible” BA.2 will be “less lethal”? While current data suggests the subvariant does not seem to cause severe illness, it is still too early to answer it conclusively. Recall, current case counts (although ticking up recently) are still xx% off the peak earlier this year.

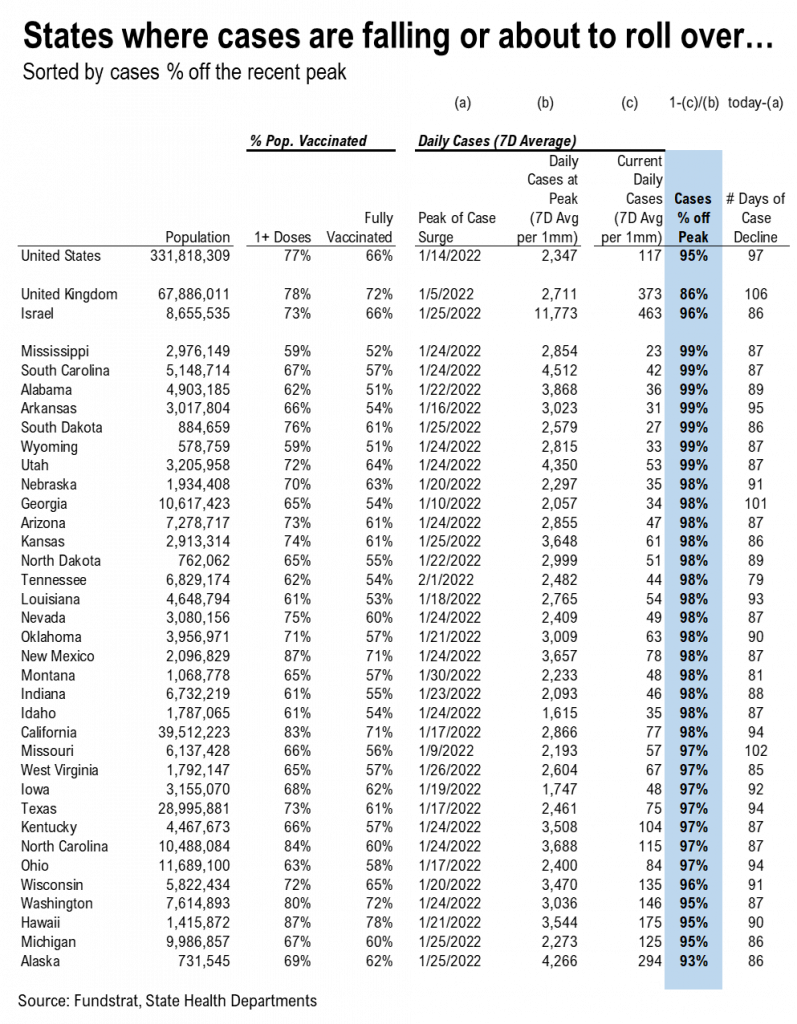

We updated our “Case Rise Tracker” – While more than half of US states are seeing a higher case count on a weekly basis, 18 states have shown clear trends of cases rising.

*** We’ve split the “Parabolic Case Tracker” into 2 tables: one where cases are falling (or about to fall), and the other where cases are rising.

In these tables, we’ve included the vaccine penetration, case peak information, and the current case trend for 50 US states + DC. The table for states where cases are declining is sorted by case % off of their recent peak, while the table for states where cases are rising is sorted by the current daily cases to pre-surge daily cases multiple.

– The states with higher ranks are the states that have seen a more significant decline / rise in daily cases

– We also calculated the number of days during the recent case surge

– The US as a whole, UK, and Israel are also shown at the top as a reference

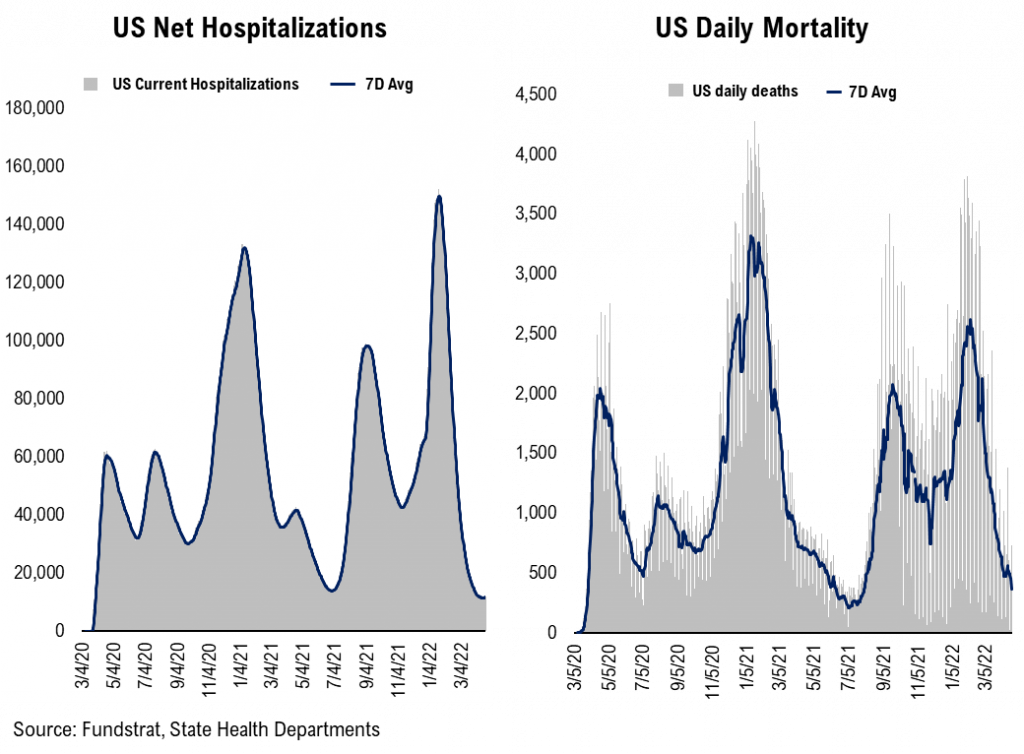

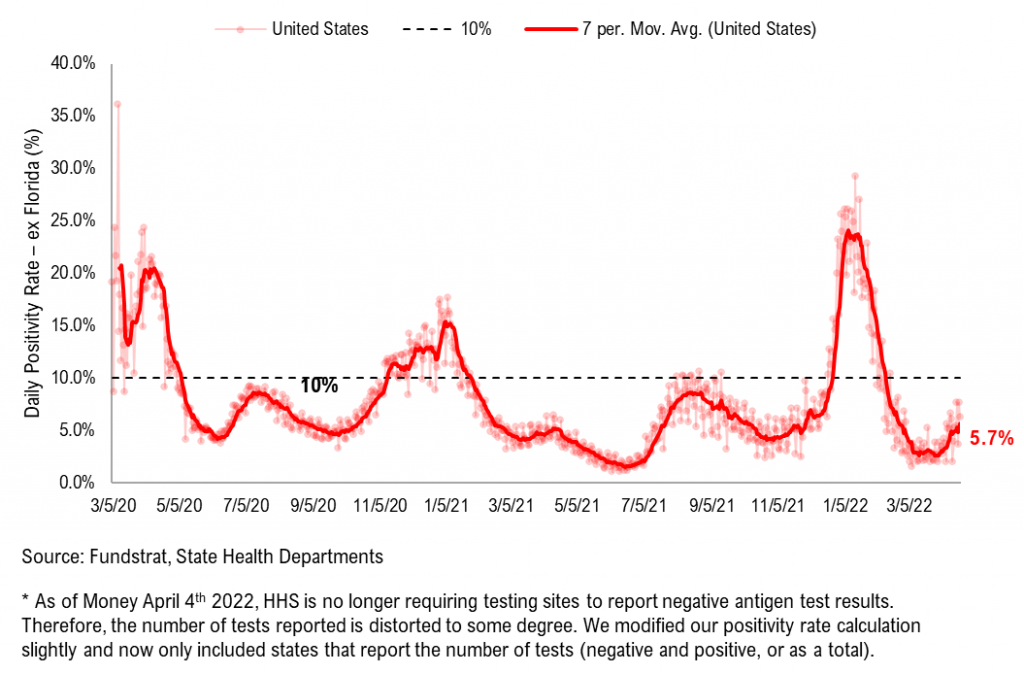

Net Hospitalization has been flat over the past week. Daily mortality is still falling. The positivity rate is now above 5%…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID

– Current hospitalization is currently at an all-time low since the pandemic. But the speed of decline has slowed and the trend has been flat-ish recently. As we noted before, unless COVID-19 100% disappears, there still should be some level of COVID-19-related hospitalizations. Hence, we are not too worried that the decline in hospitalization has slowed. And in terms of absolute numbers of hospitalization, the current level is just a fraction of the peak level at ~160,000 in Mid-January.

– Daily Mortality is still falling, rapidly. As we learned from the previous wave, the mortality trend tends to have a 3-4 week lag compared to the case trend. So, it is worth watching whether the mortality trend will start to reverse. But it seems the BA.2 sub-variant does not cause severe illness so far.

– As of Money April 4th, HHS is no longer requiring testing sites to report negative antigen test results. Therefore, the number of tests reported is distorted to some degree. We modified our positivity rate calculation slightly and now only included states that report the number of tests (negative and positive, or as a total). Based on the data we could obtain, the trend of the positivity rate is also ticking up. But the current level of 5.1% remains low.

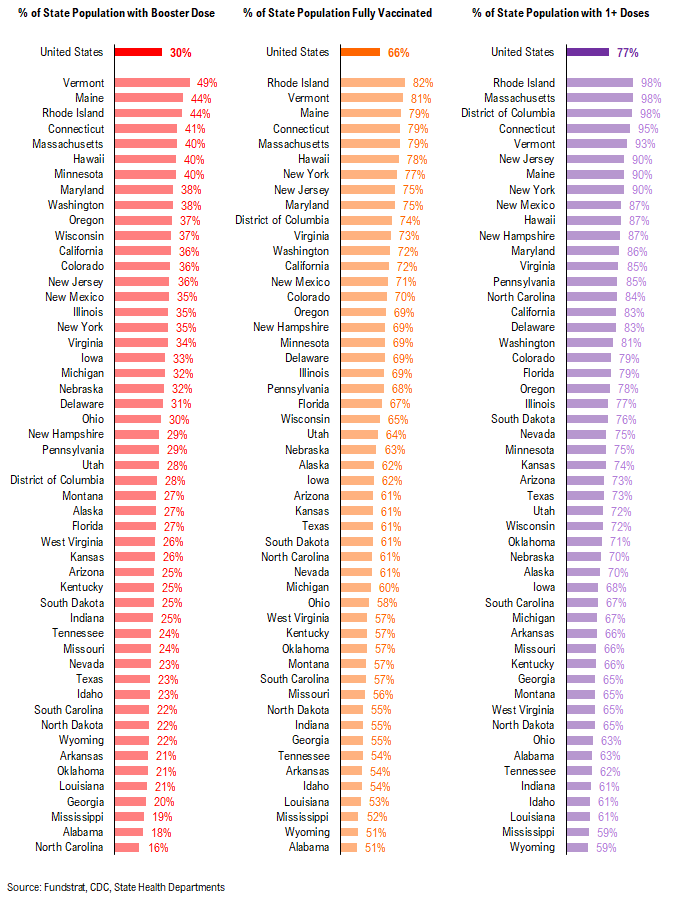

POINT 2: VACCINE: vaccination pace has slowed recently… likely due to the improvement in COVID situation

___________________________

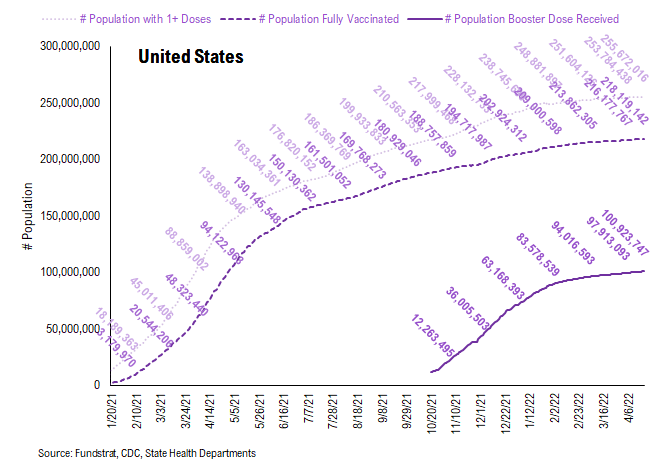

Current Trends — Vaccinations:

– avg 0.5 million this past week vs 0.5 million last week

– overall, 30.4% received booster doses, 65.7% fully vaccinated, 77.1% 1-dose+ received

_____________________________

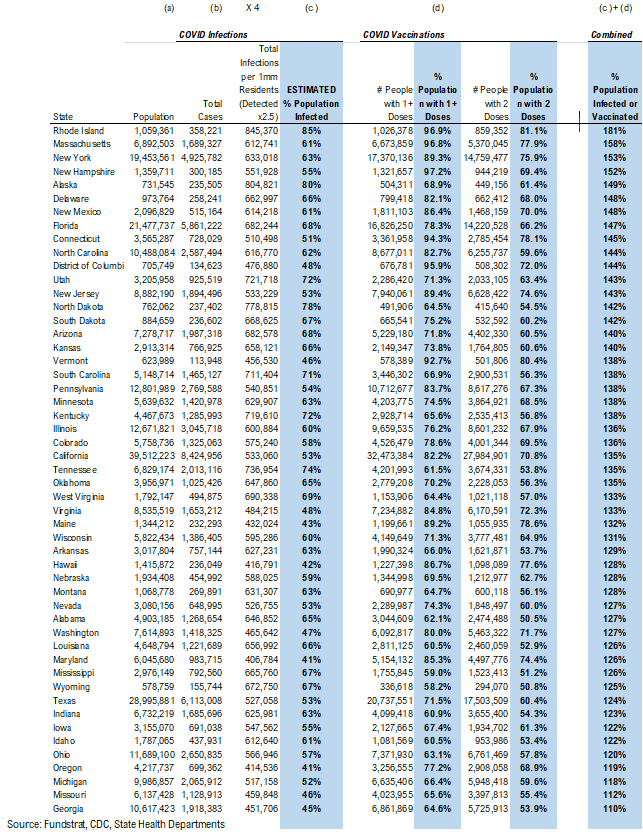

Vaccination frontier update –> all states now above 100% combined penetration (vaccines + infections)

*** We’ve updated the total detected infections multiplier from 4.0x to 2.5x. The CDC changed the estimate multiplier because testing has become much better and more prevalent.

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are above 100% combined penetration

– Again, this metric can be over 100%, as infected people could also be vaccinated, but 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated

There were a total of 373,426 doses administered, as reported on Wednesday. The vaccination pace has started to pick up over the last few weeks, but has since rolled over.

This is the state by state data below, showing information for individuals with one dose, two doses, and booster dose.

In total, 570 million vaccine doses have been administered across the country. Specifically, 256 million Americans (76% of US population) have received at least 1 dose of the vaccine. 218 million Americans (66% of US population) are fully vaccinated. And 100 million Americans (31% of US population) received their booster shot.

POINT 3: Tracking the seasonality of COVID-19

***We’ve updated the seasonality tracker to show figures from the last 9 months, from this calendar day, in each of the last two years***

As evident by trends in 2020 and 2021, seasonality appears to play an important role in the daily cases, hospitalization, and deaths trends. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.The possible explanations for the seasonality we observed are:- Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer- “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors- Opposite effects hold true in the winter

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

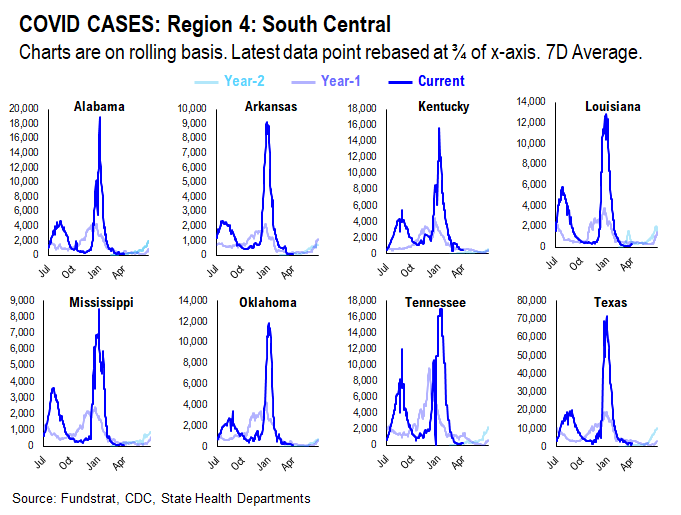

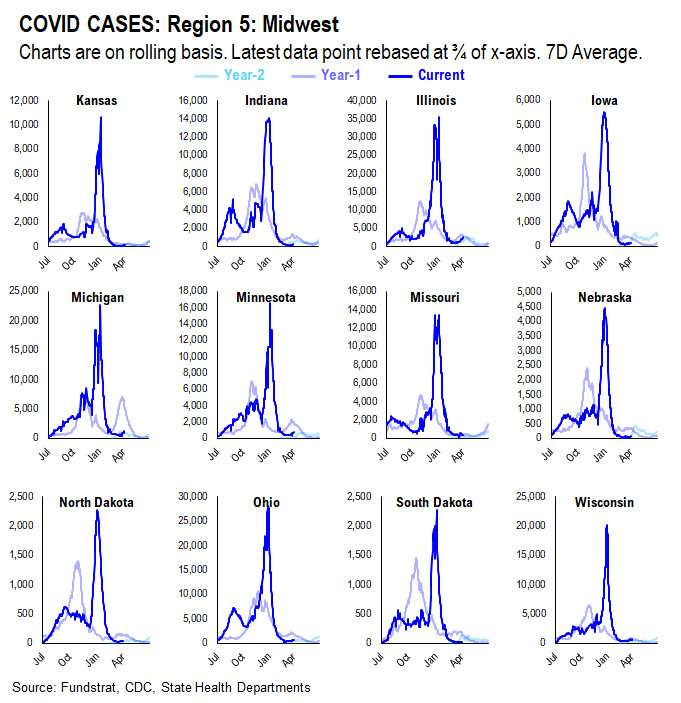

CASES

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus. Current death rates appear to be scattered compared to 2020 rates. This is likely due to varying vaccination rates in each state. States with higher vaccination rates seem to have lower death rates given the vaccine’s ability to reduce the severity of the virus; states with lower vaccination rates seem to have higher death rates.

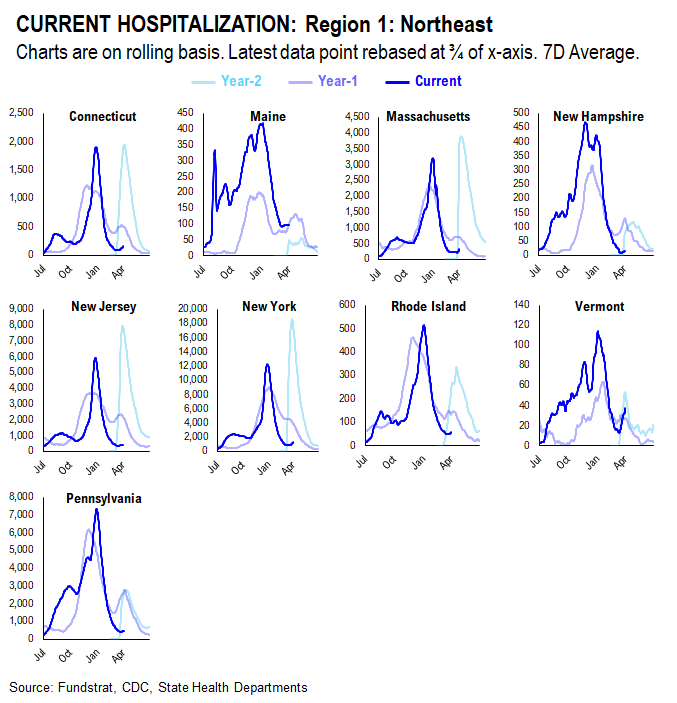

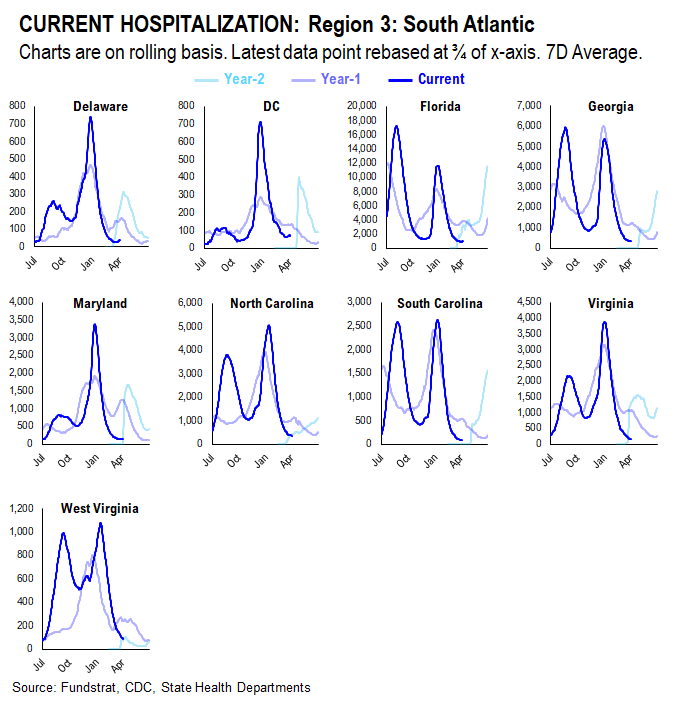

HOSPITALIZATION

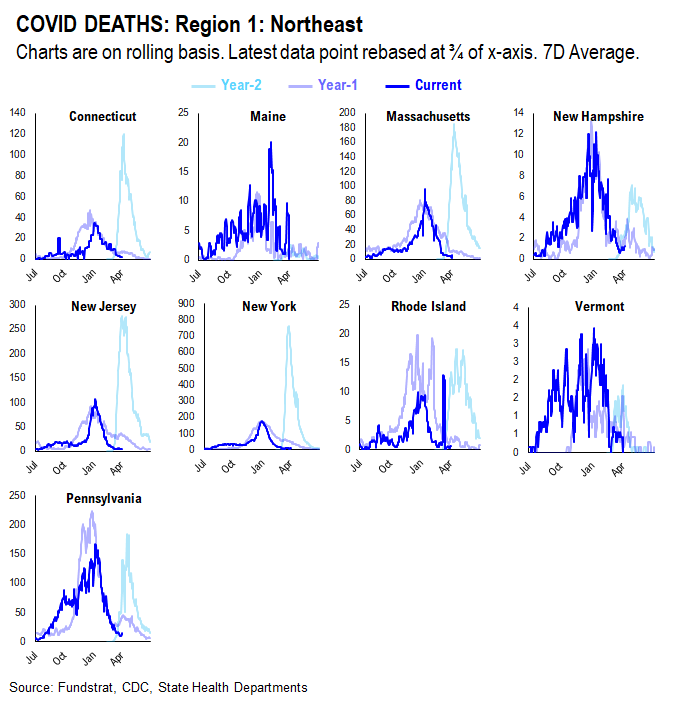

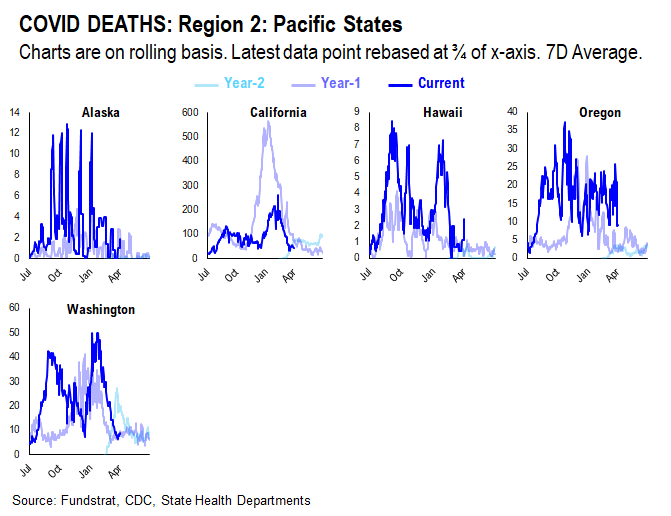

DEATHS