A daily market update from FS Insight — what you need to know ahead of opening bell

“You can avoid reality, but you cannot avoid the consequences of avoiding reality.” — Ayn Rand

First news

- Can lack of concern with the level of national debt turn Goldilocks into Pollyanna as the spread between interest rates and inflation grows?

Overnight

- Senate on verge of passing the foreign aid package with billions in funding for Ukraine and Israel; the vote began at 5:15 a.m. this morning. link

- Nikkei and Nasdaq stalk records, CPI lurks. link

- US inflation set to slow. link

- Millions of Chinese people return home for Lunar New Year in the world’s largest annual human migration. link

- 1.5 million primary school teachers in China could have no jobs by 2035 as births in the country plummet to record lows. link

- New York state holds special election to fill George Santos’ House seat. link

- Key European Parliament committee votes on adopting the AI Act, world’s first such regulations. link

- Sony Music to buy Michael Jackson’s recording music and publishing catalogs for $600+ million”. link

- Diamondback Energy to buy privately held Endeavor Energy Partners for $26 billion in cash and stock. link

- Court orders Elon Musk to testify in SEC Twitter takeover probe. link

- Japan GDP set to confirm slip to world’s fourth-largest economy. link

Charts of the Day

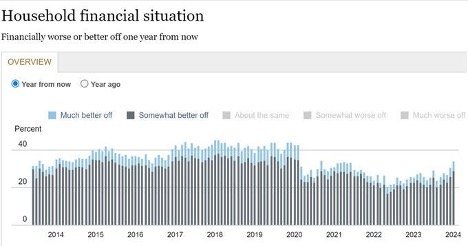

Source: NY Fed Survey of Consumer Expectations

MARKET LEVELS

| Overnight |

| S&P Futures -17

point(s) (-0.3%

) overnight range: -20 to -1 point(s) |

| APAC |

| Nikkei +2.89%

Topix +2.12% China SHCOMP flat Hang Seng flat Korea +1.12% Singapore +0.11% Australia -0.15% India +0.59% Taiwan flat |

| Europe |

| Stoxx 50 -0.77%

Stoxx 600 -0.28% FTSE 100 -0.09% DAX -0.51% CAC 40 -0.24% Italy -0.32% IBEX -0.01% |

| FX |

| Dollar Index (DXY) -0.03%

to 104.14 EUR/USD +0.02% to 1.0774 GBP/USD +0.29% to 1.2666 USD/JPY +0.11% to 149.52 USD/CNY flat at 7.1936 USD/CNH -0.02% to 7.214 USD/CHF +0.43% to 0.8795 USD/CAD -0.02% to 1.3448 AUD/USD -0.17% to 0.652 |

| Crypto |

| BTC +0.19%

to 49937.82 ETH +1.31% to 2667.0 XRP -0.51% to 0.5291 Cardano -0.43% to 0.5548 Solana +1.64% to 113.63 Avalanche +0.18% to 41.06 Dogecoin +0.73% to 0.0825 Chainlink -2.43% to 20.08 |

| Commodities and Others |

| VIX +1.08%

to 14.08 WTI Crude +1.07% to 77.74 Brent Crude +1.09% to 82.89 Nat Gas +0.34% to 1.77 RBOB Gas +0.63% to 2.382 Heating Oil +1.32% to 2.958 Gold +0.37% to 2027.46 Silver +0.89% to 22.9 Copper +0.47% to 3.741 |

| US Treasuries |

| 1M -2.4bps

to 5.356% 3M -2.4bps to 5.3605% 6M -1.8bps to 5.2767% 12M -2.2bps to 4.8478% 2Y +0.0bps to 4.474% 5Y -0.5bps to 4.1315% 7Y -1.0bps to 4.1615% 10Y -1.0bps to 4.1696% 20Y -0.8bps to 4.4783% 30Y -0.9bps to 4.3712% |

| UST Term Structure |

| 2Y-3

M Spread widened 0.1bps to -92.6

bps 10Y-2 Y Spread narrowed 0.8bps to -30.7 bps 30Y-10 Y Spread widened 0.1bps to 20.0 bps |

| Yesterday's Recap |

| SPX -0.09%

SPX Eq Wt +0.68% NASDAQ 100 -0.44% NASDAQ Comp -0.3% Russell Midcap +0.51% R2k +1.75% R1k Value +0.62% R1k Growth -0.58% R2k Value +1.94% R2k Growth +1.57% FANG+ -0.82% Semis -0.39% Software -1.04% Biotech +2.26% Regional Banks +2.15% SPX GICS1 Sorted: Utes +1.14% Energy +1.05% Materials +0.73% Cons Staples +0.63% Fin +0.42% Indu +0.12% Healthcare +0.1% SPX -0.09% Comm Srvcs -0.18% Cons Disc -0.28% REITs -0.37% Tech -0.77% |

| USD HY OaS |

| All Sectors +1.1bp

to 373bp All Sectors ex-Energy +1.3bp to 356bp Cons Disc +0.9bp to 309bp Indu +3.7bp to 282bp Tech +2.1bp to 458bp Comm Srvcs -0.4bp to 591bp Materials -1.6bp to 331bp Energy +1.2bp to 310bp Fin Snr +1.8bp to 349bp Fin Sub -1.6bp to 260bp Cons Staples +4.1bp to 308bp Healthcare +1.1bp to 446bp Utes +2.5bp to 223bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/13 | 6AM | Jan Small Biz Optimisum | 92.3 | 91.9 |

| 2/13 | 8:30AM | Jan CPI m/m | 0.2 | 0.2 |

| 2/13 | 8:30AM | Jan Core CPI m/m | 0.3 | 0.3 |

| 2/13 | 8:30AM | Jan CPI y/y | 2.9 | 3.4 |

| 2/13 | 8:30AM | Jan Core CPI y/y | 3.7 | 3.9 |

| 2/15 | 8:30AM | Jan Import Price m/m | 0.0 | 0.0 |

| 2/15 | 8:30AM | Jan Retail Sales m/m | -0.2 | 0.6 |

| 2/15 | 10AM | Feb Homebuilder Sentiment | 46.0 | 44.0 |

| 2/15 | 4PM | Dec Net TIC Flows | n/a | 260.244 |

| 2/16 | 8:30AM | Jan PPI m/m | 0.1 | -0.1 |

| 2/16 | 8:30AM | Jan Core PPI m/m | 0.1 | 0.0 |

| 2/16 | 10AM | Feb P UMich 1yr Inf Exp | 2.9 | 2.9 |

| 2/16 | 10AM | Feb P UMich Sentiment | 80.0 | 79.0 |

MORNING INSIGHT

Good morning!

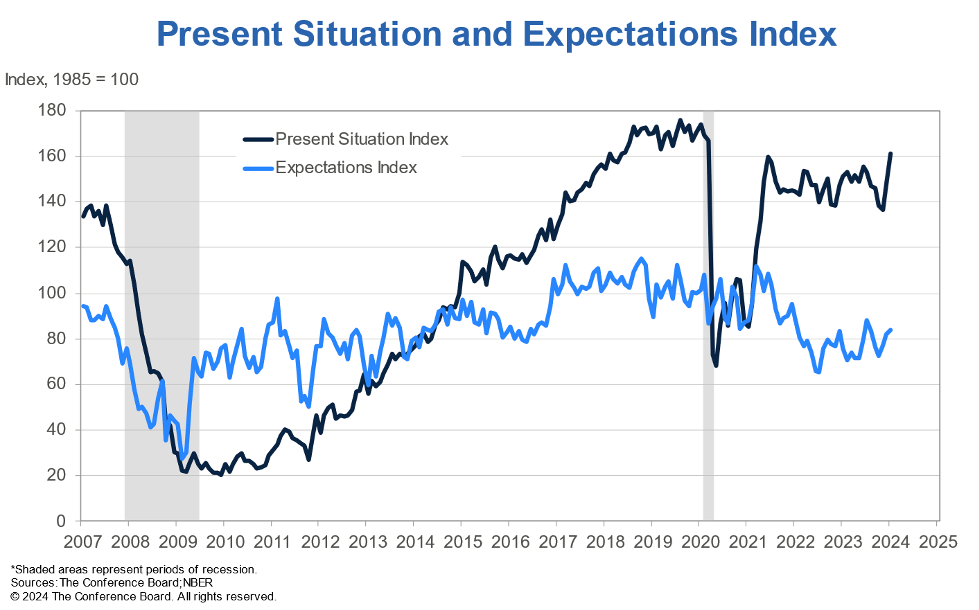

On eve of Jan. CPI, bonds have been discounting a “hot” CPI print, and stocks – to an extent. Margin debt still far lower than Nov 2021 peak.

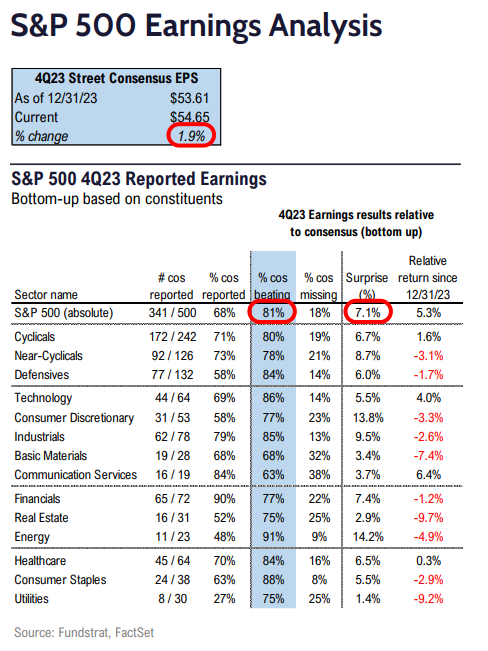

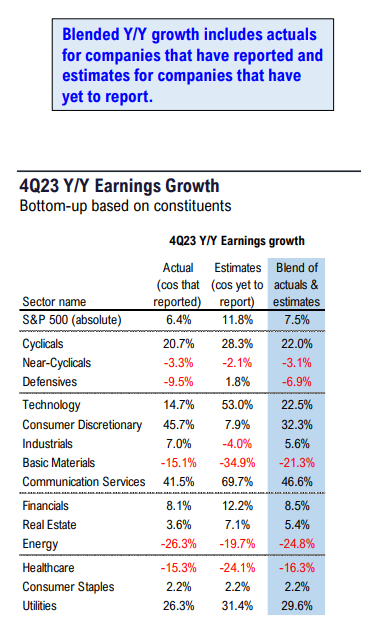

Sixty-three companies are reporting this week. Of the 341 companies that have reported so far (68% of the S&P 500):

- Overall, 81% are beating estimates, and those that “beat” are beating by a median of 7%.

- Of the 19% missing, those are missing by a median of –5%.

- On the top line, overall results are beating estimates by a median of 3% and missing by a median of –3%, and 64% of those reporting are beating estimates.

Click HERE for more.

TECHNICAL

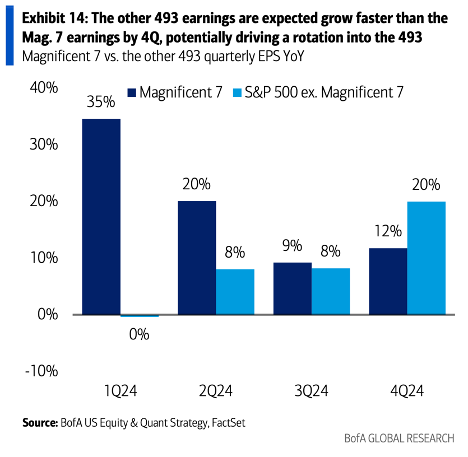

Given no evidence of trend failure, and lack of counter-trend exhaustion, we feel that SPX and QQQ 0.49% likely continue into Presidents Day weekend before any real consolidation, and NVDA 0.25% earnings on 2/21 might have importance in this regard. However, there could be some signs of mean reversion in Equal-weighted SPX vs. the cap-weighted SPX after a nearly two-month period of underperformance.

Click HERE for more.

CRYPTO

Launched on February 1st, Puffer Finance has quickly ascended to become the second-largest liquid restaking protocol on Ethereum, with a remarkable $850 million in total value locked (TVL). This platform allows users to deposit ether and obtain a liquid staking token, thereby enabling yield through ETH staking and restaking. A significant contributor to Puffer Finance’s swift increase in TVL has been a points program that increases user engagement due to the implicit promise of a future token airdrop. From a technical perspective, users have been attracted to Puffer due to their anti-slashing tool aimed at reducing the risk of slashing for validators. The growth of Puffer Finance highlights the increasing demand and burgeoning enthusiasm for restaking. This development represents one of the major potential medium-term tailwinds for Ethereum. It is expected to generate demand for ETH from those seeking to leverage Ethereum’s security to safeguard other chains and earn additional yield while doing so.

FIRST NEWS

Today’s First News story is the second in a two-part series.Part I is here.

Black Swanning, Part II. It’s not exactly that Americans aren’t paying enough taxes. Thanks in part to stepped-up enforcement on the part of the IRS, revenues are expected to average 17.8% of GDP through 2034, a hair more than the 17.3% average over the last 50 years. The problem is that spending over the next decade should average 23.5% of GDP, or ~11% more than the 50-year average (21%).

Even though the CBO may be optimistic in these debt projections, assuming there won’t be a recession, it is also likely underestimating economic growth. An assumption that GDP will rise, on average, by only 2% annually through 2034 is quite conservative, as increased productivity on the back of greater and greater penetration by AI and other technologies is likely to stimulate growth past 2%.

At the same time, discretionary spending is expected to climb by $372 billion over the next 10 years, while mandatory programs, aka entitlements, will expand by ~$2.5 trillion and may reach $6.3 trillion in 2034.

Although life expectancy in the U.S. still hasn’t hit pre-pandemic levels, it’s climbing. Longer life spans for seniors are good news, with higher entitlement spending being the inevitable result. This may mean that the Medicare and Social Security trust funds become insolvent sooner than currently forecast – 2031 for Medicare and 2034 for Social Security – forcing benefit cuts if Congress doesn’t reform the programs.

As the deficit rocketed past 130% of GDP post-pandemic, the CBO published an exhaustive litany of ways in which the deficit could theoretically be cut. Almost two years later, registered voters were asked in a survey how likely they were to sign off on a host of possible changes to a specific entitlement – Social Security – given projections warning that, unless Congress fixes Social Security, only 80% of benefits would be payable by 2035..

When asked what specific changes they were willing to weather, average Americans said: raising the Social Security payroll tax cap (overwhelming bipartisan support from respondents), with ~82% voting for it. (Increasing the level of income at which Social Security payroll taxes are reapplied to income of more than $400,000 would eliminate 61% of the shortfall.) Reducing benefits for high earners, who likely have other ways to fund their retirements, was about as popular. Gradually raising the retirement age and increasing the payroll tax by about 1% were, at ~75% of respondents, less universally popular, but still popular enough. The problem is that these last three measures, if implemented, would each only address about 13% of the shortfall, not the whole thing – and that’s only one type of entitlement.

Of course, growing deficits compound and thus increase interest payments. This fiscal year, the U.S. will spend an estimated $870 billion on servicing its debt, roughly in line with what it spends on defense. By 2034, interest payments will grow to $1.6 trillion, or 3.9% of GDP. (They are 3.73% of GDP now).

The Stanley Druckenmillers of the world have pointed out that the U.S. Treasury might have largely sidestepped the entitlement-cutting conversation and drastically cut the deficit by taking that same average American as its example, and refinancing its debt when interest rates were close to zero. In other words, it could havelocked in lower rates on its long-term debt when it had the chance, the way many American homeowners refinanced their mortgages a few years ago.

The trajectory of debt is what is critical. If interest rates stay high (as they largely have) even after inflation subsides (as it largely has) debt-service costs add to the burden on the economy without being offset by rising prices.

The talk of the town – ‘Goldilocks’ soft landing – in which inflation continues to slow, employment remains robust, and the economy expands nice and slowly, may prove Pollyannaish if the difference between interest rates and inflation remains as robust as it is now – and as it may well persist through year-end. The Hill, WSJ, Fortune, CNBC, cbo.gov