7D Delta Turns Positive, Market Chop Way Paves Way For Rally

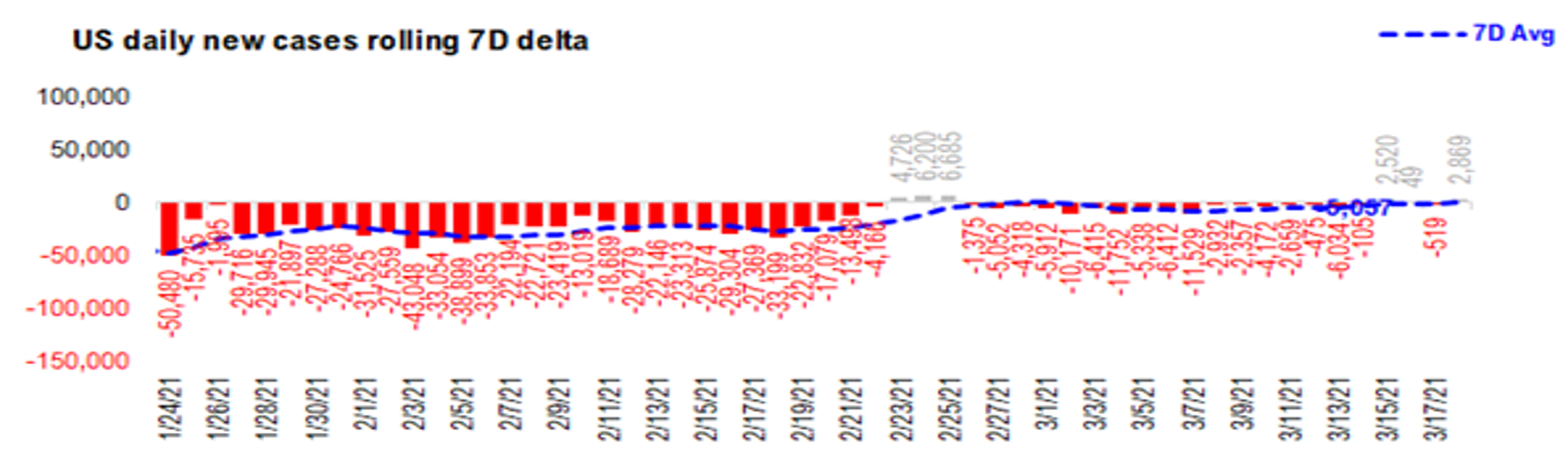

Daily cases unfortunately have returned to slightly positive coming in at 58,468 which is up 2,869 cases from a week ago. The 7D positivity rate declined to 4.4% from 4.5% 7D ago. Importantly, hospitalizations and deaths are still moving in the right direction and are down 5.1% and 7.4% from 7 days ago respectively. Dr. Fauci said on Friday that up to 30% of the new US cases are due to the variants. Luckily, despite the vaccines not being as effective against some of the newer COVID-19 variants it still appears to prevent severe illness and hospitalization to the degree that it would mean the risk for overwhelming the hospital system which we may forget after all this time is still the primary reason for lockdowns that interrupt economic activity much lower. Be sure to check out point #3 in our dailies that monitors the progress in re-opening across the United States.

The 7D delta turning positive is definitely not a good thing. However, we wanted to point out that despite the very vocal criticism of the bears about vaccination progress the White House has actually achieved its’ goal of 100 million vaccines in 100 days 42 days early. This highlights a reality that we’ve been trying to keep our subscribers apprised of; the number of previously infected (those with natural immunity) plus those vaccinated is getting to a point where the R0 will begin to drop because the virus simply will eventually run out communicable subjects to come into contact with. This doesn’t mean the numbers suddenly go to zero, it means they steadily trickle down to zero.

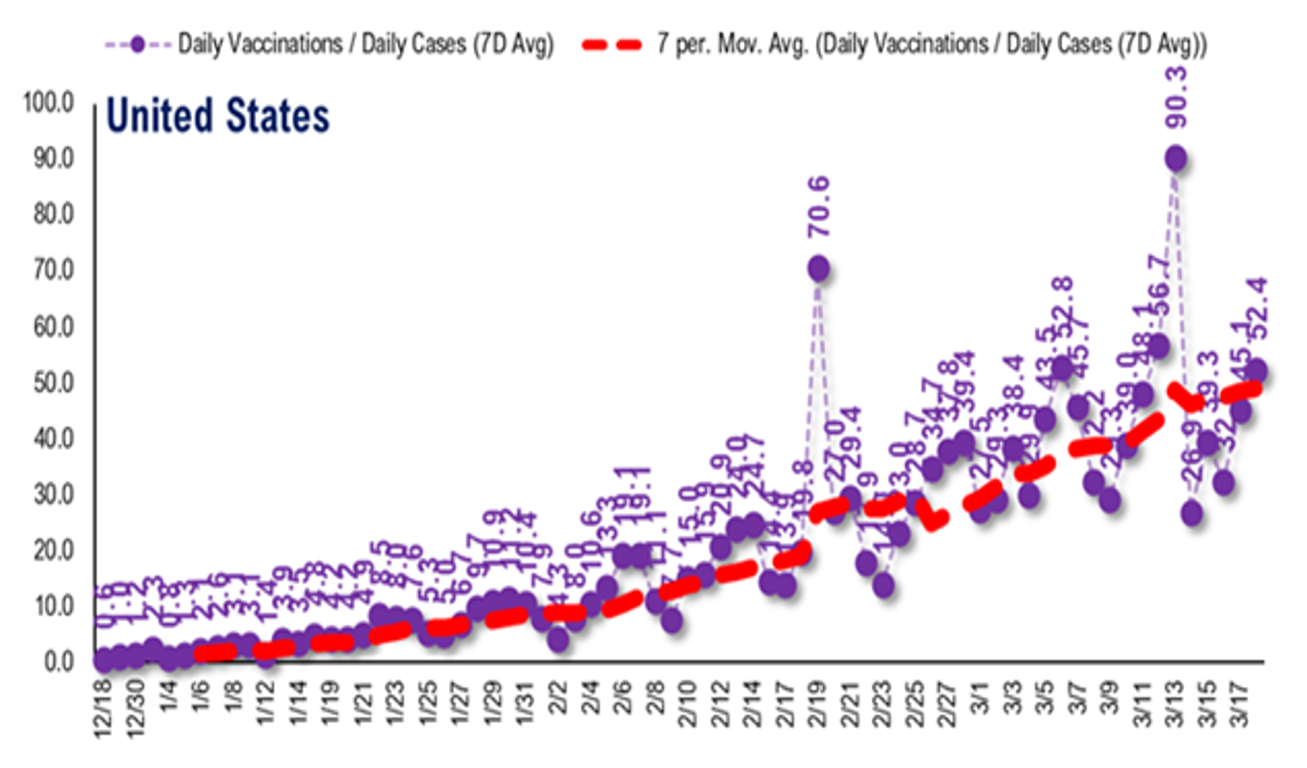

We think one of the most important numbers to remember right now is this; the 7D delta of vaccinations compared to new cases is now around 50:1. Yup. About 92% of the United States has now seen 20% 1-dose penetration. Progress is steady and further vaccine approvals and J&J rollout could speed up timeline even further.

Despite the improving fundamentals there was a major sell-off on Thursday around interest rate fears that surely wasn’t helped by Friday being a quadruple witching date. These tend to heighten short-term volatility as traders attempt to square positions in the lead-up to their contracts expiring.

STRATEGY: We think Thursday is textbook chop and probabilities favor a rally next week

Equity markets fell on Thursday. Energy was hit the worst, followed by Technology stocks. Firstly, we’d like to address that we believe the Energy sector’s pullback yesterday was a healthy consolidation and does not alter the sector’s status as having our favorite risk/reward profile for 2021. Despite the significant outperformance of the sector since November, most institutions are still way behind the ball on their exposure and are equal-weight at best. Our work on energy continues to suggest a lot of upside and we think those who used yesterday’s market weakness to buy-the-dip will be happy they did next week. Patient hands!

On Friday, the VIX dropped despite the approach to the 1.75% level by the 10 yr. Tech continued weakness on Friday although found some footing as the day progressed. Taking a step back, the question on everyone’s mind is whether the market turmoil of the week hints at a broader decline on the horizon or if this is another short-lived ‘rate-mageddon’ tantrum that will precede a market recovery. We are clearly leaning toward the second option.

Firstly, we know markets have developed inflation anxiety, given the absence of inflation risk for decades. Thus, it is understandable to see “fire, ready, aim” every time interest rates surge.

Second, while 10-YR rates surged today, the VIX hardly budged. It was >30 last time the 10-yr was above 1.6% It closed at $20.95 today. So, we aren’t seeing hedge funds seeking broader market protection, nor did Thursday trigger a lot of the de-grossing we see during periods of heightening market uncertainty. Financials were the only sector up and only slightly.

Third, the bond market, particularly credit is currently functioning in an orderly fashion despite rising rates. This is quite crucial. The Federal Reserve even felt confident enough to remove emergency bank regulation shoring up demand for Treasuries. I would be far more concerned if the 10-year was rising and we heard stories of diminishing fixed income and credit liquidity. This is part of reason VIX didn’t spike.

Fourth, Friday is a ‘quadruple witching event’ where single-stock options, futures and index options and futures all expire. These are known to cause market instability due to the gamma hedging and other activities by dealers. Moreover, given the rising popularity of call options, and the associated skew these events likely carry even more weight than usual.

Fifth, the economy is on a far stronger path of recovery than compared to any expectations at the start of 2021. In fact, stimulus checks are only starting to filter into the economy. This is going to be a known positive tailwind for multiple cohorts: retailers, recipients of spending, household confidence (get substantial liquidity) and this will ultimately have a positive spillover for stocks.

Sixth, Epicenter and cyclicals have significantly outperformed in March and on Thursday the crowded sectors Communication Services and Tech experienced acute weakness. This was an acceleration of rotation our of Growth into Epicenter.

Seventh, as we wrote last week, after markets make new highs, a pattern of chop for 7-10 days often follows. This was at play this week. Our base case is still a +10% rally to 4,300.

Bottom Line: This week’s chop will likely soon subside and we expect a rally next week. We expect Energy, Materials, Industrials, Financials and Discretionary ex. Mega-weights to lead the rally. We think Tech bottomed, but we think risk/reward is best in Epicenter.

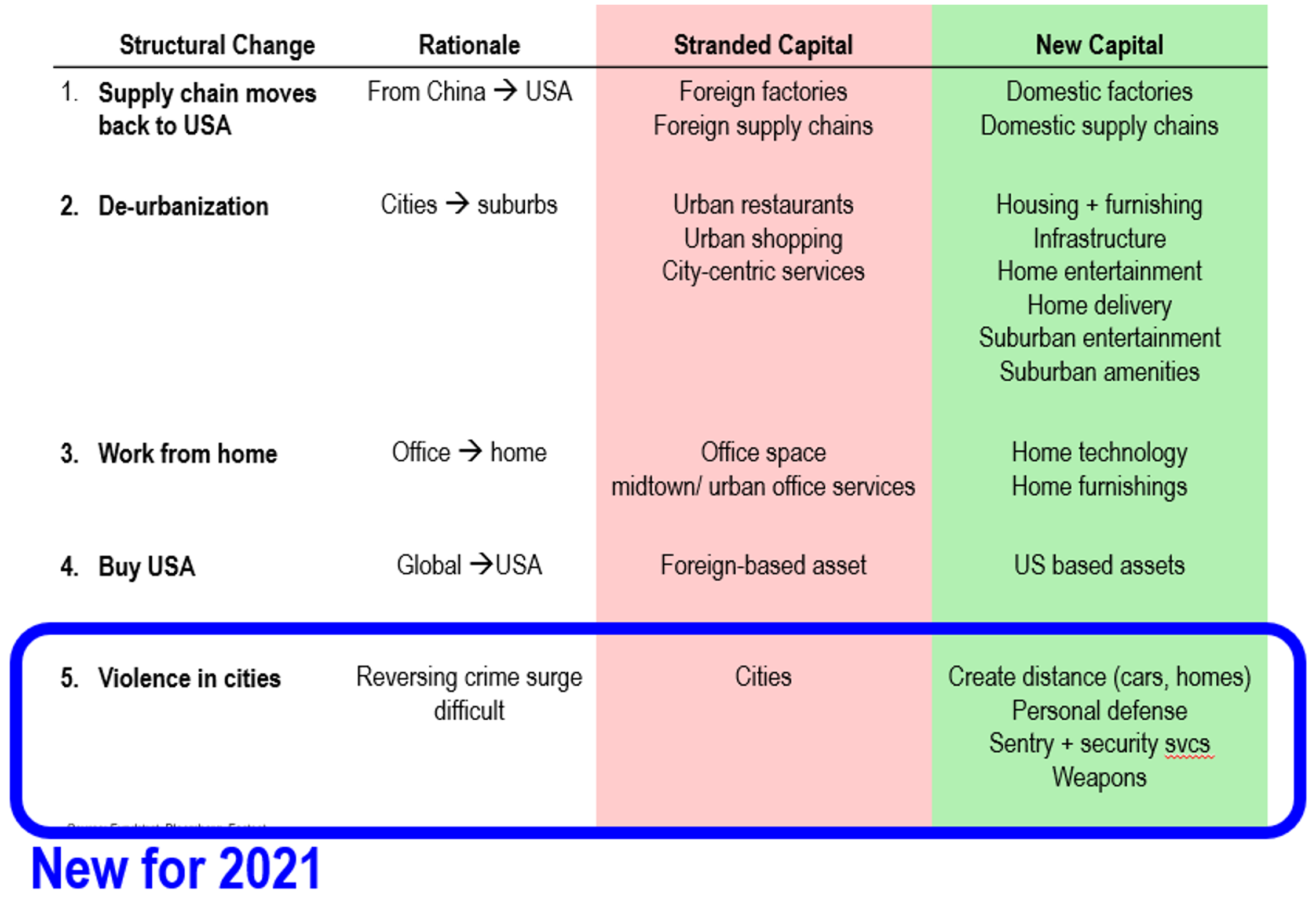

Figure: Way forward ➜ What changes after COVID-19

Per Fundstrat

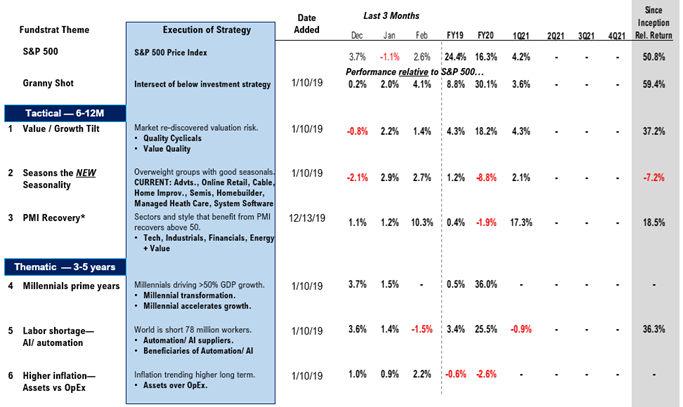

Figure: Fundstrat Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 09ecdc-a1ed36-b66650-e6348b-6e1cd8

Already have an account? Sign In 09ecdc-a1ed36-b66650-e6348b-6e1cd8