Defensives underperform sharply despite Rates, DXY weakening

- SPX likely bottoms by 4450-4485 by next Tuesday.

- US Dollar and US Treasury yields look to have made important reversals Friday

- Defensive groups like Utilities and REITS underperformed sharply in trading

US Equity indices have entered a time window where a low could take place early next week after several failed rally attempts. As discussed, rates and US Dollar have begun to retreat after sharp selloffs on Friday and I expect this continues in the weeks ahead. This should serve as a positive catalyst for why Equities can bottom. SPX should find support next Monday-Wednesday at 4450-85.

US Equity prices should be near a bottom which I expect could materialize early next week following the biggest weekly decline since mid-March. SPX has retraced 50% of the advance since late June and has now neared prior peaks from mid-June which could offer support.

Rallies back above SPX-4560 will be necessary to confirm that a low is in place. However, SPX looks to be an attractive risk/reward into early next week given the late day weakness on Friday.

US Treasury yields and the US Dollar both declined sharply on Friday, coinciding with both having hit technical resistance and turned back lower, on weak economic data.

Defensive groups like Utilities and REITS underperformed sharply, and this severe underperformance is something I view positively for risk assets in the weeks ahead.

Momentum has now begun to positively diverge on hourly charts based on indicators like RSI, just as prices have neared an important technical area of support.

Overall, I don’t suspect that August will prove to be too bearish, and prices likely should be able to stabilize and turn back up above 4600 given factors like strong positive weekly momentum, a quick retreat to recent bullishness, and last week’s selloff having alleviated recent overbought conditions for many indices.

(The hourly Bloomberg SPX chart below shows the positive momentum divergence which has started given Friday’s afternoon decline.)

Breakout? What breakout? US 10-Year Treasury yield failed to exceed 4.10% on a weekly close.

Last night’s report discussed the 5 Reasons why the Yield surge likely proves short-lived.

I believe that Friday’s severe About-face in Treasury yields across the curve happened on schedule and was strong enough to have prevented the breakout in Treasury yields, as TNX closed well below the 4.10% level.

Some minor backing and filling could be expected after this strong lift in yields earlier this week. However, cycle composites along with Exhaustion signals call for yields to turn lower and pullback throughout August.

Technically, the key floor for yields lies at 3.72%. One cannot be negative on Treasuries if yields violate this level as it should lead to a yield decline to test and possibly break May lows (which sounds impossible potentially to many market participants).

Overall, Friday’s (8/4) decline in yields looks to have happened on schedule, and I remain bullish on Treasuries for the weeks ahead, expecting yields to begin a larger decline.

US Dollar begins to retreat, and shows sharp breakdown vs. Yen

Friday’s economic data proved to be lighter than expected and directly coincided with both the Dollar and Yields starting to retreat.

Hourly patterns of USDJPY showed a very distinct breakdown from a minor Head and Shoulders pattern which has bearish technical implications.

In the short run, I believe Friday’s price action kicked off a decline back down to 137. Under that level argues for a larger selloff back to the low 120’s which I believe is likely on an intermediate-term basis.

Bottom line, our recent strength in DXY looks to have run its course, and weakness in the month of August looks probable.

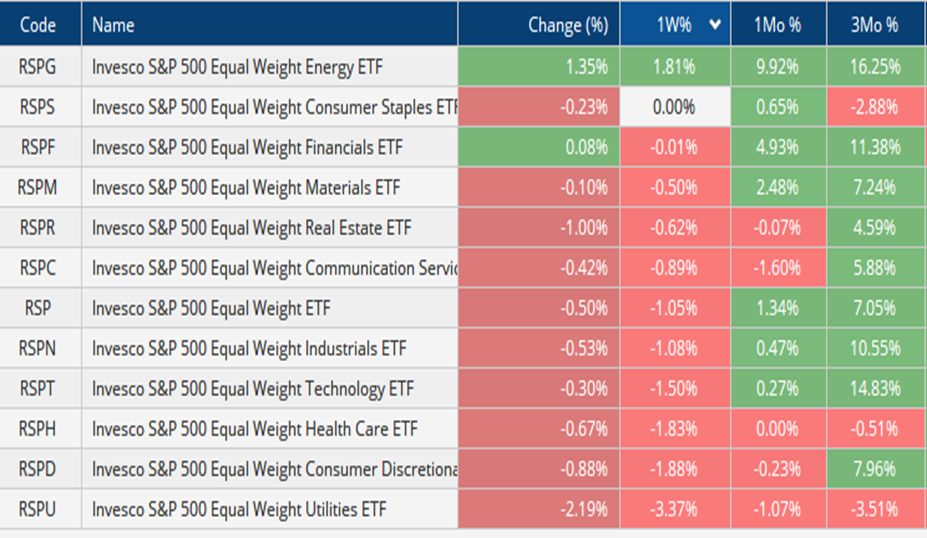

Performance data shows how Defensive sectors have underperformed sharply this past week.

One factor that argues that a stock market rally should be around the corner concerns the degree of defensive weakness markets have shown over the last week.

This can be partly explained by yield sensitive groups weakening as interest rates began to turn higher. However, my analysis shows yields likely peaking out and turning back down in the month of August.

Friday’s huge underperformance by Utilities and REITS alone was remarkable in my view, as these sectors both lagged Financials, Discretionary and Industrials by a large margin. Even Technology’s -1% decline in Equal-weighted Terms was not as severe as the selling being seen in the REITS and Utilities.

Near-term, Utilities might attempt to make a short-term low next Monday-Wednesday. However, the larger breakdown in patterns of many of these defensive groups like Utilities and REITS likely leads to more selling in these defensive groups which I view as a positive for risk assets, not a negative.