Market Rally Cools Off, But Cycles Point to Positive First Half

Our Views

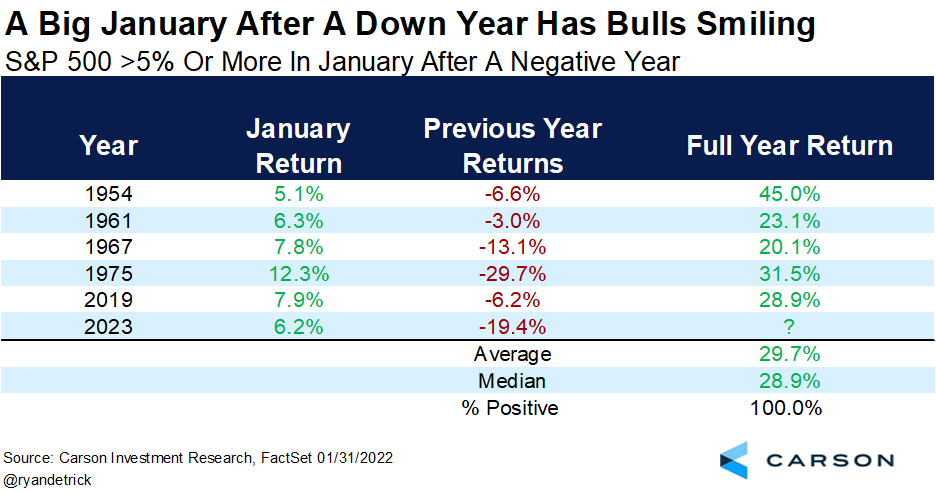

Stocks have been soft over the past week as markets debate the trajectory of inflationary pressures, particularly wages. But even as Fed/inflation narrative is debated, since the start of 2023, the S&P 500 is up >8%, something that has happened only 4 times since 1950. And there are only 17 instances (of 73 years) where YTD gains thru 25 trading days are >5%

- Of the 17 instances, markets gain from day 26 to YE 16 of 17 times

- Median full year gain is +26%, with median gains day 26 to YE of +16%

- This implies S&P 500 is ~4,800 by YE, inline with our target and far higher than Street Consensus of 4,000. In other words, it will be an “exception” if equity markets weaken

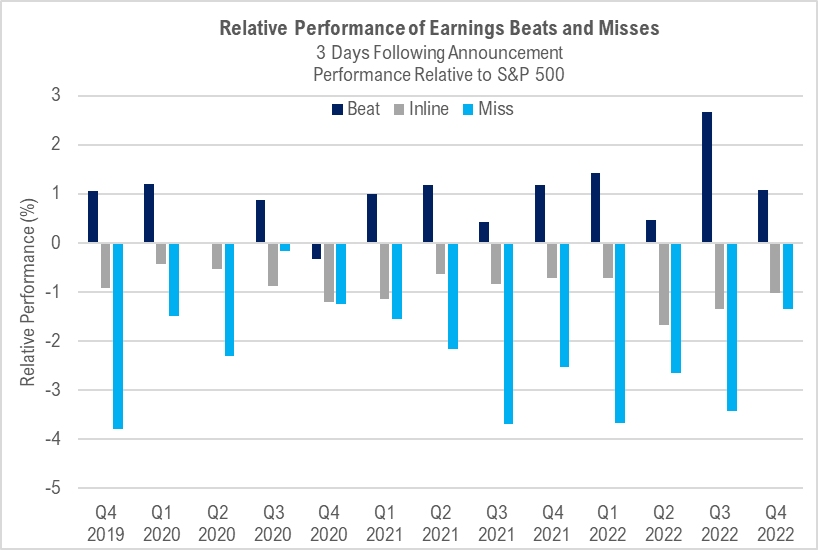

There are those who say earnings are the next “shoe to drop” but EPS estimates been falling for many months already. So, what arguably matters more is how are stocks reacting to EPS results.

- As our Quant Strategist Adam Gould notes, companies missing results in 4Q22 are falling ~1%, compared to an average decline of -2.5% to -3.0% seen 3Q21 to 3Q22. So investors are punishing misses to a far less extent.

- The two best performing sectors YTD, Comm Services (+17%) and Discretionary (+16%) have the largest negative revisions into 4Q22 results (only Financials worse). And again, highlighting a lot of the bad news of 2023 EPS is getting priced in. This doesn’t mean EPS falling is good, but this does show lots are priced in.

One of the most frequent questions investors ask us is when will the bad news on EPS get priced in?

- We know the simple answer is when EPS revisions bottom, investors will become more confident.

- We also know that there will be a crossover point where equities become less reactive to declining EPS forecasts. This happens 9 to 12 months before EPS estimates actually bottom.

- 4Q22 EPS results season so far might have presented some clues we are nearing that turning point.

Next week, the key data point will be January CPI released on 2/14 (8:30am ET), and we expect Core CPI to come in below Street consensus of +0.4% (vs +0.3% Dec). The over-arching story on inflation is that rising downside risks are as arguable as upside risks. And the “inflation risk” premium should be fading from markets and if such is the case, VIX should fall and this should support valuations.

- The SPX trend weakened this week, but declines should prove temporary and short-lived. At present, it’s right to buy dips, but it’s hard to have conviction just yet that this week’s decline has run its course.

- The energy sector is coming back with a vengeance and is a top overweight. I expect that this week’s strength marks a technical bottom in Energy which should propel this sector in the weeks and months ahead.

- Aerospace/Defense readying for a larger break out of a three-year base after two former failed attempts.

- The ongoing equity market rally appears to have run into some struggles during the back half this week as investors begin to turn their attention to the upcoming CPI data release that occurs on 2/14. Will there be a negative Valentine’s Day surprise?

- Regardless of what the data says about inflation next and the tactical implications for markets, the recent big takeaway is that despite Chair Powell continuing to communicate the view that higher for longer will be needed to fully defeat inflation he is reluctant to push back on dovish market expectations.

- This is important because it takes immediate Fed risk off the table and shifts the focus to what the data and what it points to. Furthermore, there appears to be a need to see multiple reports to possibly disprove the current dovish expectations that are priced into markets. Bottom line is that time will likely be needed to get more clarity on the main issues, which based on my work suggests a high likelihood of range-bound trade with downside risk.

- My work is still suggesting that considerable risk remains for equity investors and patience will be needed while at the same time keeping alert for opportunities that occur because of any extreme price action in either direction.

- Reddit sentiment has been very high, and this would be a short-term negative for the next week or so.

- A recent increase in high-yield prices means that although the equity risk premia have fallen, equities are becoming less expensive relative to high-yield bonds. On that basis, they are close to becoming fairly priced. So I’m still somewhat bearish for intermediate term, but I will be watching yields relative to equity risk very closely to see when that crosses over.

- Much of the kind of market action this year is typically what we’d see when you’ve hit a bottom and you have a very accommodative Fed, which is interesting because we haven’t had that kind of accommodative Fed policy. I think what is happening is the market is interpreting what the Fed has done as being accommodative.

- Kraken agreed to close its retail staking operations in a settlement with the SEC, exacerbating an ongoing drawdown in crypto prices. The regulatory implications of this will hurt consumers and centralized exchanges but will be a non-event for the underlying networks and potentially a windfall for Liquid Staking Service Providers such as Lido (LDO) and Rocket Pool (RPL).

- Despite it seeming like it was the SEC that damaged markets, crypto prices were already on uneasy footing this week following the US Labor Department’s January jobs report. We witnessed a sharp increase in the expected fed funds rate and a pick-up in premiums paid for short-term puts in the crypto market as investors manage risk ahead of a large CPI print.

- The recent regulatory crackdown on crypto-related companies in the US may discourage some business owners and slow down the inflow of new capital into the crypto economy, but it shouldn’t necessarily lead to lower token prices as there is ample precedent of regulatory actions having no effect on underlying asset prices.

- The market needed some consolidation. We think the asymmetry from here remains to the upside in 1H and that this dip is worth buying, but given the weakness displayed in the market in the latter half of this week, we think it is possible a better rebalancing opportunity awaits us next week.

- President Biden’s State of the Union address gave Republican leadership a chance to deny any intentions to cut Social Security or Medicare

- The Chinese spy balloon led to unanimous House condemnation from both parties, a rare instance of bipartisanship in the present environment.

- The Senate inquiry regarding the response by the Biden administration and U.S. military to the spy balloon has begun and should be illuminating over the next few weeks.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell 1.11% this week to close at 4,090.46. The Nasdaq shed 2.41% to close the week at 11,718.12, while Bitcoin dropped nearly 6%.

- In earnings, Disney beat on the top and bottom lines as Bob Iger issued a positive outlook in his first earnings season since his return as CEO of the entertainment giant. Meanwhile, Lyft stock plummeted 36% after an earnings “debacle.”

- We summarize market cycle trends and our updated views on the market’s strong start to 2023.

Good evening:

"Markets trend only about 15% of the time; the rest of the time they move sideways" - Paul Tudor Jones

In recent weeks, Tom Lee has noted that many clients are puzzled by the scorching market rally to kick off 2023. As inflation continues to fall, the Nasdaq posted its best start in 31 years. Rarely have markets been this resilient. Rarely has there been this much cash still on the sidelines.

“People might say, ‘Well, earnings still need to fall,’” Lee said Thursday. “Yet (the S&P 500 Index) is producing its fifth-best gain ever through day 26 … And so, we have a table here to show that if you look, through day 26, at all instances where the market went up more than five percent, the median further gain into the end of the year is 16%, and only one of the 17 instances did the market actually decline, which is 1987. So, unless you think this is 1987, the S&P is on track to end the year above 4,800.”

Lee’s research aligns with that of Mark Newton, our Head of Technical Strategy, who has relied partly on seasonal trends and cycles to forecast major market moves. Since the fall, we’ve shared the power of understanding the presidential cycle and its impact on markets. Last year was the 21st midterm election year since 1939. Newton has repeatedly noted that there has never been a negative return from the midterm election to June 30 of the following year. Six times, the returns from the midterms until June of the next year were greater than 20%.

In the four years of a presidential term, market returns are usually weakest in year two of that cycle, which was 2022. The worst quarter of the 16 quarters is year two, quarter two, so 2Q 2022 again seems to have followed the pattern. The best quarters are the fourth quarter of the second year through the second quarter of the third year. In this case, that’s Oct. 1, 2022 through June 30, 2023, generally, the sweet spot for market returns, mainly because investors look past the uncertainty around the midterm elections.

At least so far, since the mid-October lows, the market has performed true to this trend, like clockwork. While a February pullback or cool-off is likely, the subsequent few months are positive. Newton also notes that momentum and breadth have improved substantially since the fall. European and Asian markets are performing well. Plus, investor risk appetite remains low, and cash positions remain elevated, which makes Newton believe we’re in a new bull market. “This doesn’t mean we’ll go straight up,” Newton said. “We haven’t reached bullishness yet. It’s a market that respects that inflation is falling. Cyclically, we’re in a nice spot.”

Added Newton: “I have Bloomberg on in my office most of the day, and everybody is in disbelief and publicly questioning, ‘How in the world, the markets can’t rally?’ The labor market is hard to understand, but markets keep rallying, and people need to respect that…Seasonality suggests we are due to slow down, so I think the back half of the month could be choppy. But we’re on track to continue rallying, I think until March. That’s when yields and the dollar bottom, maybe we have a pullback between March and May.”

A quick glance at earnings

Adam Gould, our head of Quantitative Strategy, pointed out that this earnings season has seen the gap between the performance for earnings beats and the declines for earnings misses narrowing sharply from last quarter's. "To me, this means a lot of idiosyncratic risk is coming out of the market,” he said. “It's becoming more of a ‘rising tide lifts all boats’ kind of thing.”

Last Friday’s surprisingly strong jobs report remained on investors’ minds over the weekend, leading to a weak beginning to the first full week of trading in what is traditionally a weaker month for markets. The fear was that the Fed would see the numbers as reason to get more hawkish, but Lee was not worried. “It took the Fed three great inflation reports (below expectations) before Fed acknowledged ‘disinflation,’” he noted, so why would one strong jobs report cause the Fed to suddenly accelerate hikes?

And he was right. In his Tuesday speech, Powell kept the narrative unchanged. “The disinflationary process, the process of getting inflation down, has begun. [...] We expect 2023 to be a year of significant declines in inflation. It’s actually our job to make sure that that’s the case.”

As Lee has noted, February is particularly weak in years preceded by a negative year (like 2022). But given January’s strong performance, 2023 is expected to be a positive return year:

More AI

Amid the hubbub of ChatGPT, Microsoft rolled out an improved version of its Bing search engine. Satya Nadella told CNBC that AI-powered search is the biggest thing to happen to the company in his nine years as CEO. “I have not seen something like this since, I would say 2007-08, when the cloud was just first coming out,” Nadella said. It’s apparent that big tech’s race to capture the AI market is well underway, with no shortage of opportunity, challenge, and competition.

Not to be left behind, Alphabet announced that it planned to unveil a rival chatbot named Bard “in the coming weeks.” That proved to be at least a near-term disaster that erased as much as $100 billion from the company’s market cap on Wednesday, after Bard gave an incorrect answer to a question about NASA’s James Webb Space Telescope at a press event. The AI technology on which both companies’ tools were built has long been known to be prone to “hallucinating” false information. It can also perpetuate racial and gender biases (including hate speech) scraped from the Web.

Elsewhere

The devastation of the earthquake that struck Turkiye and Syria continues to deepen. Amidst the widening tragedy, the Turkish stock market halted trading this week. Oil prices also pushed up this week over concerns about interruptions to the flow of Azeri and Iraqi crude, which go through the Ceyhan export terminal hub that has been shut down for precautionary reasons.

The French continue to protest their president’s efforts at raising the country’s retirement age from 62 to 64, with a third day of strikes on Tuesday and fourth scheduled for Saturday.

The UK Treasury and the Bank of England began consultation on a state-backed digital pound on Tuesday, looking into a less volatile, fiat alternative to other digital currencies. No decision on the matter was expected until at least 2025.

Kazuo Ueda is reportedly slated to be named the next governor of the Bank of Japan, replacing Haruhiko Kuroda when his term expires. Dr. Ueda, an economics professor and former classmate of Ben Bernanke’s at MIT, was a surprise pick after current Deputy BOJ Governor Masayoshi Amamiya reportedly turned down the job.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: +0.4% Prev.: 0.3%

Est. 0.4% Prev. 0.3%

Est.: +0.3% Prev.: +0.1%

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+10.71%

|

+1.22%

|

+105.89%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In c8772f-63d85c-9427d3-5155e3-ca164e

Already have an account? Sign In c8772f-63d85c-9427d3-5155e3-ca164e