FL Cases May Have Peaked. Expect a “Risk-On” August Led By Cyclicals

The sell-off seen in markets Wednesday, in our view, had a capitulatory feel to it. The ostensible trigger was a combination of the soft ADP jobs report and seeming hysteria over lambda variant of COVID-19. But despite all that hysteria and broad-based selling, I was struck by a few things (anecdotes):

– dozens of inbound inquiries about lambda variant causing a new wave (see below why we think this is a nothing burger)

– US 10-year crashed to 1.126% but has since flipped higher (now 1.227%)

– several cited DeMark predictions of a 1929-style crash = more panic

– lots of angry investors = shouting at the market = ultimate capitulation signal, SERIOUSLY!!!

July/ August chop morphing into full Missouri

For those uninitiated, Missouri’s slogan is the “show me state” — so, in my days as a Technology analyst, when investors became so skeptical of a stock, we would call that stock a “show me” stock, or a Missouri.

The July/August “chop” is fanning investor anxiety about multiple scenarios that end in disaster:

– falling 10-year rates = double-dip/ disinflation coming

– weak ADP jobs report = fears US “peaked”

– media reports about lambda variant now sparks fears of another deadly wave behind the Delta variant

To us, this just shows how a thinner than usual market (July/August = revenge travel = buyers strike) and the resulting chop is fueling hysteria. While COVID-19 remains mysterious and the path remains uncertain, we think this set up is pretty ideal for a massive risk-on rally, assuming the right positive catalysts emerge.

– we discuss the 5 likely positive catalysts/signs that set stage for a full-risk on

– this likely lasts 5-6 weeks, or well into September

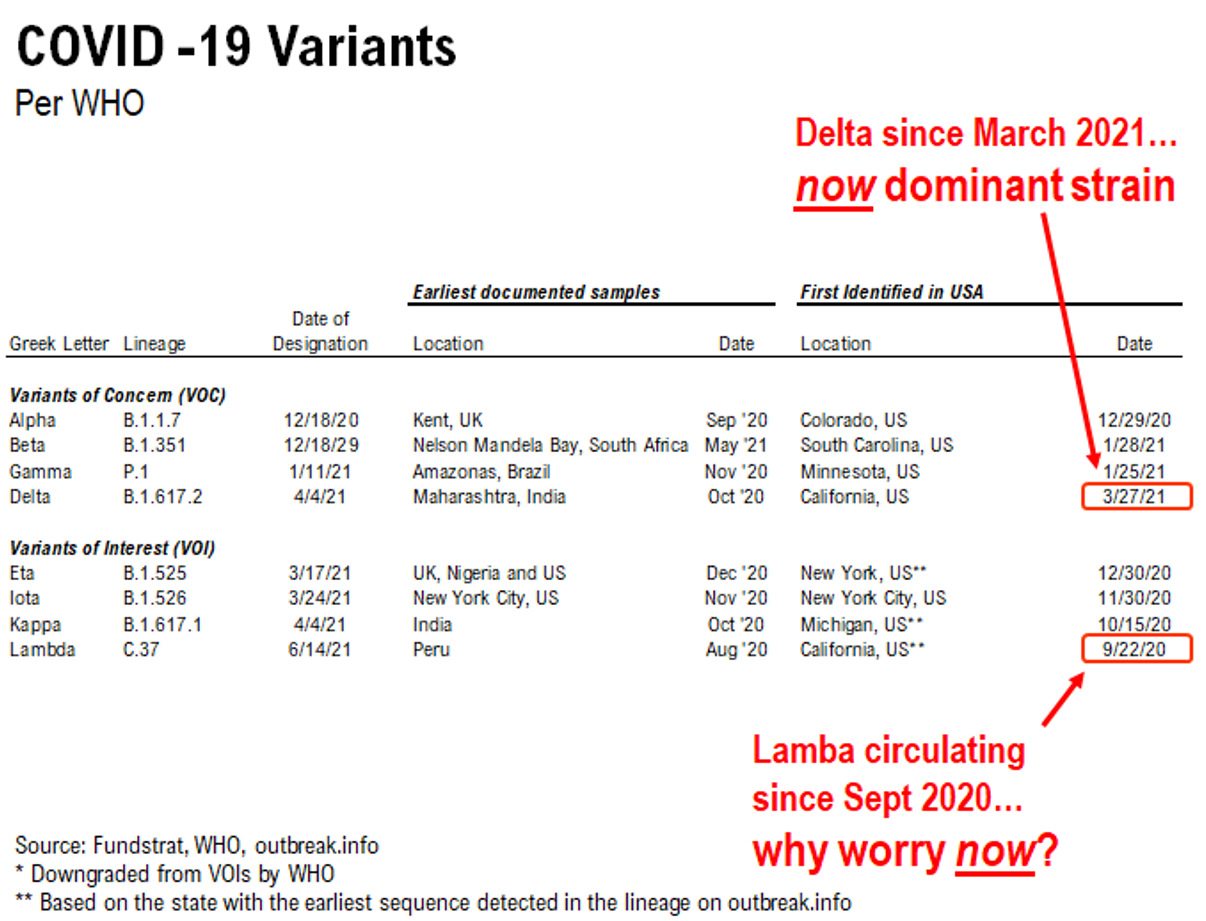

Lambda why now? Lambda variant in USA since September 2020, 6 months before Delta variant

We received multiple questions about the lambda variant, as investors are concerned this may become the next big variant sweeping across the US. We are not scientists, but we are doubtful lambda will create a new wave of infections in the US:

– Lambda was first detected in USA on 9/22/2020 in California

– Delta first detected in USA on 3/27/2021 in California

– Lambda has been circulating for 11 months, Delta for 4 months

– Why should we suddenly worry Lambda will resurge?

– Lambda was first detected in Peru and has swept through Latin America

– Investors are fearful of Lambda because it can potentially evade vaccines

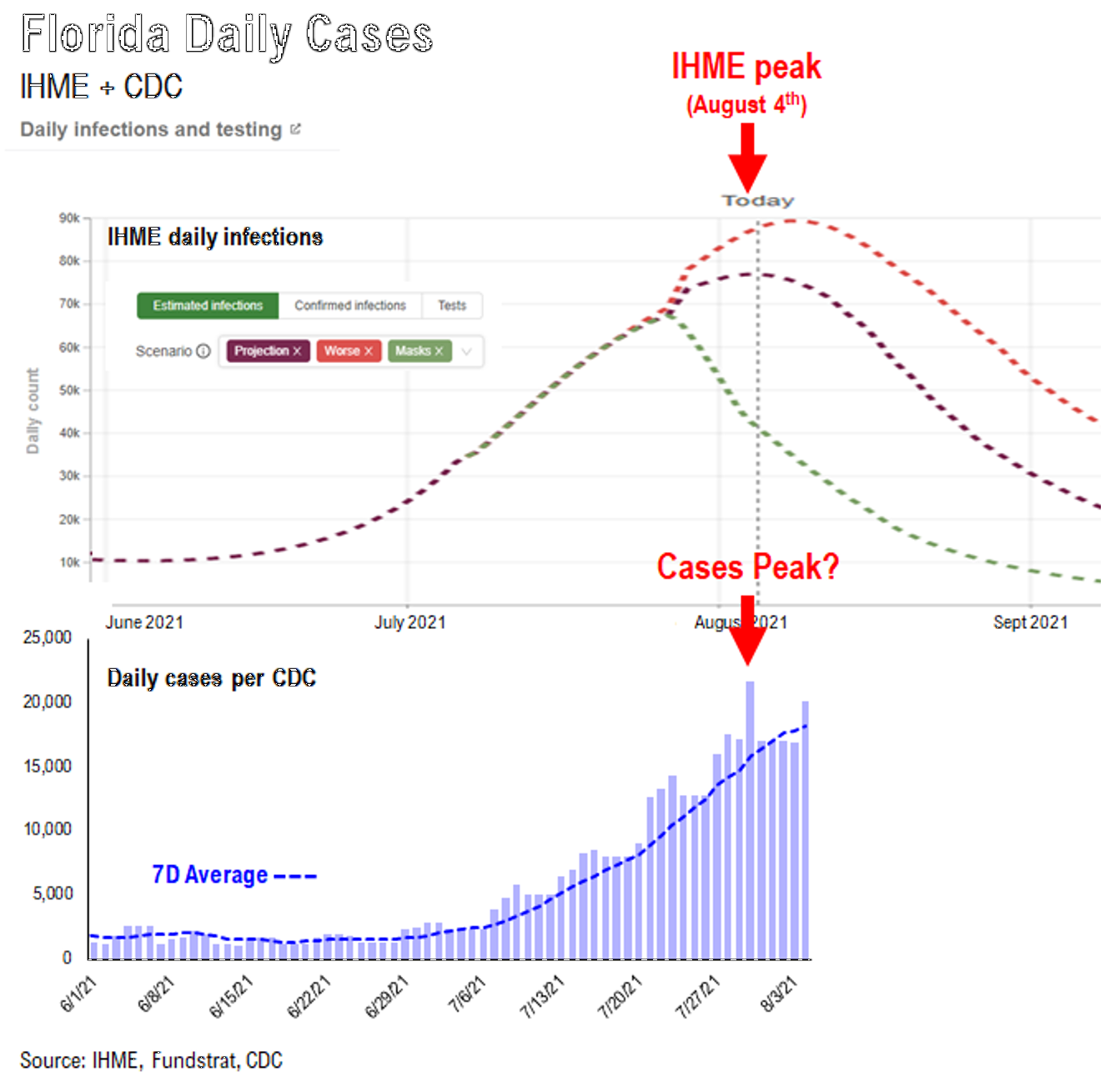

…IHME forecast on Florida might be pinpoint accurate –> have FL cases peaked?

Earlier this week, we highlighted the IHME forecast that FL infections would apex on 8/4 (Wednesday this week). And this is a key pivot. FL is seasonally seeing another COVID-19 wave and this fueled by the highly transmissible Delta variant.

– the latest CDC FL case data (lower half of chart) seems to corroborate that FL peaked?

– if FL delta variant peaked, with zero mitigation = very positive outcome

We are watching this closely, but for now, it looks like FL might have peaked. Wow.

STRATEGY: REVISED VIEW –> Full “risk on” into month-end, maybe into September

We have been progressively becoming more constructive on the prospects for equity markets into August.

– For the past 6 weeks, we have warned of July/August chop.

– But the chop is leading to mounting panic by investors

– Wednesday looked like a full on capitulation day

Thus, we are revising our view. We now expect equity markets to rally into month-end, and possibly into September. Yes, we see “chop” but this chop is likely turning into a strengthening rally into the end of the month.

– WARNING: this is very counter-seasonal

– August is normally more “chop” than July

But let me explain this rationale below.

Multiple catalysts driving “full risk on” into month-end

There are multiple positive catalysts driving a full-on risky rally into month-end (possibly into the end of September):

– US 10-yr might have seen a “double bottom” on 8/4 (vs July 20) = risk-on

– FL COVID-19 cases might be soon rolling over (might have already peaked on 8/4) = risk-on

– July jobs report might confirm US economic momentum likely stronger than recent “soft data” suggests = risk-on

– Key groups China (ETF MCHI 2.04% ), Airlines (JETS 1.55% ) and Casinos (BETZ -0.26% ) are forming important ’13 buy setup’ bottoms = risk-on

– Oilfield Services stocks (OIH 0.55% ) are finding a trifecta of key support at $179 (see below) = risk-on

EXTRA CREDIT: Multiple sell-side firms including Citi, Morgan Stanley, Stifel, among others calling for 10% correction = counter-trade

…US 10-year reversed sharply since touching 1.12% on Wed = risk-on

Earlier this week (Monday FLASH), we noted that the US 10-yr was at an important juncture on its weekly chart (touching 200-week + DeMark ’13 reversal setup’) and indeed, it looks like rates are reversing higher this week:

– possible double bottom versus July 20th

– touched 200-week moving average

– DeMark weekly combo v1b ’13 buy setup’ (meaning higher rates)

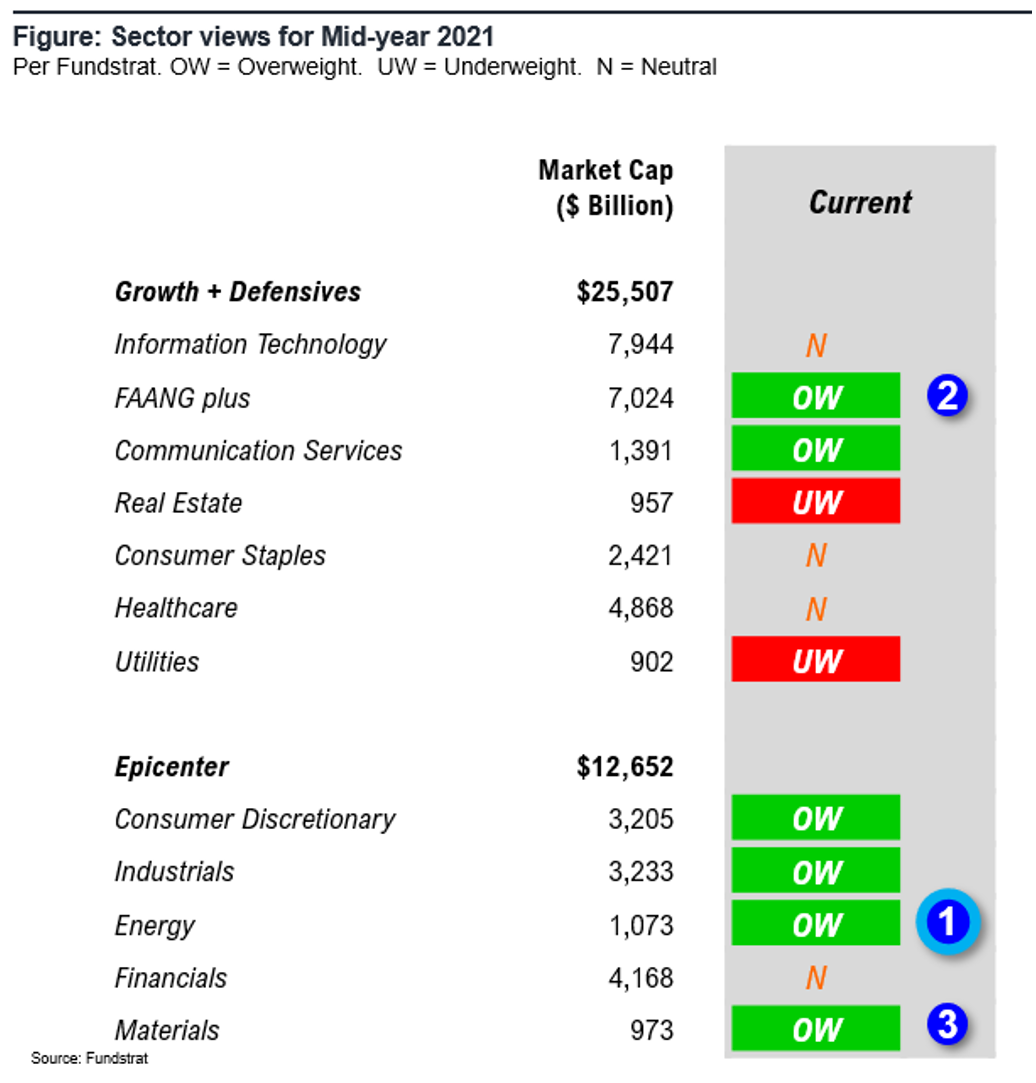

SECTORS: Oilfield Services is key to watch –> looks like a key reversal this week

If we are looking at full risk-on into month end, this is the opposite of 2020. In 2020, markets were

choppy throughout the entire month and investors needed to stock with Growth/FAANG. However, in terms of sectors, our 3 favorites into month end:

– Energy

– FAANG

– Basic Materials

So a cyclical tilt.

…Oilfield Services at a trifecta of support

We continue to believe Energy will be among the best sectors into year-end. Energy stocks naturally stall when markets become worried about the global re-opening, but we view this turbulence as temporary. This is the key question, is the July/August “chop” signaling a change in the recovery?

– Or is the “chop” seasonal and investor panic = chasing these stocks later

There are 3 reasons we think Energy/ OIH 0.55% is poised to rally hard from here:

– OIH looks like it posted a double bottom (8/4 and 7/20, identical to the US 10-yr)

– OIH is holding the 200-day moving average $182

– OIH daily RSI was oversold (see chart) and has rallied hard off this RSI reading (March 2020, Sept 2020)

…Airlines JETS 1.55% are also key to watch, and look likely to lead August rally

Another group we are watching closely is Airlines (ETF JETS 1.55% ). We discussed this DeMark ’13 buy setup’ (combo v1b daily) earlier this week. And this setup seems to be playing out:

– Airlines rallied nearly 5% on Thursday

– Airlines were massacred since Delta variant fears emerged

– logically, Delta variant apexing in USA = airline rally

…Casinos BETZ -0.26% also key and look likely to lead August rally

Another group we are watching closely is Casinos (ETF BETZ -0.26% ). We discussed this DeMark ’13 buy setup’ (combo v1b daily) earlier this week. And this setup seems to be playing out:

– Casinos rallied >4.5% on Thursday

– Casinos have been particularly hard hit because of the resurgence in cases in Asia

– If casinos continue to rally, this is a leading indicator for a broader epicenter rally

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

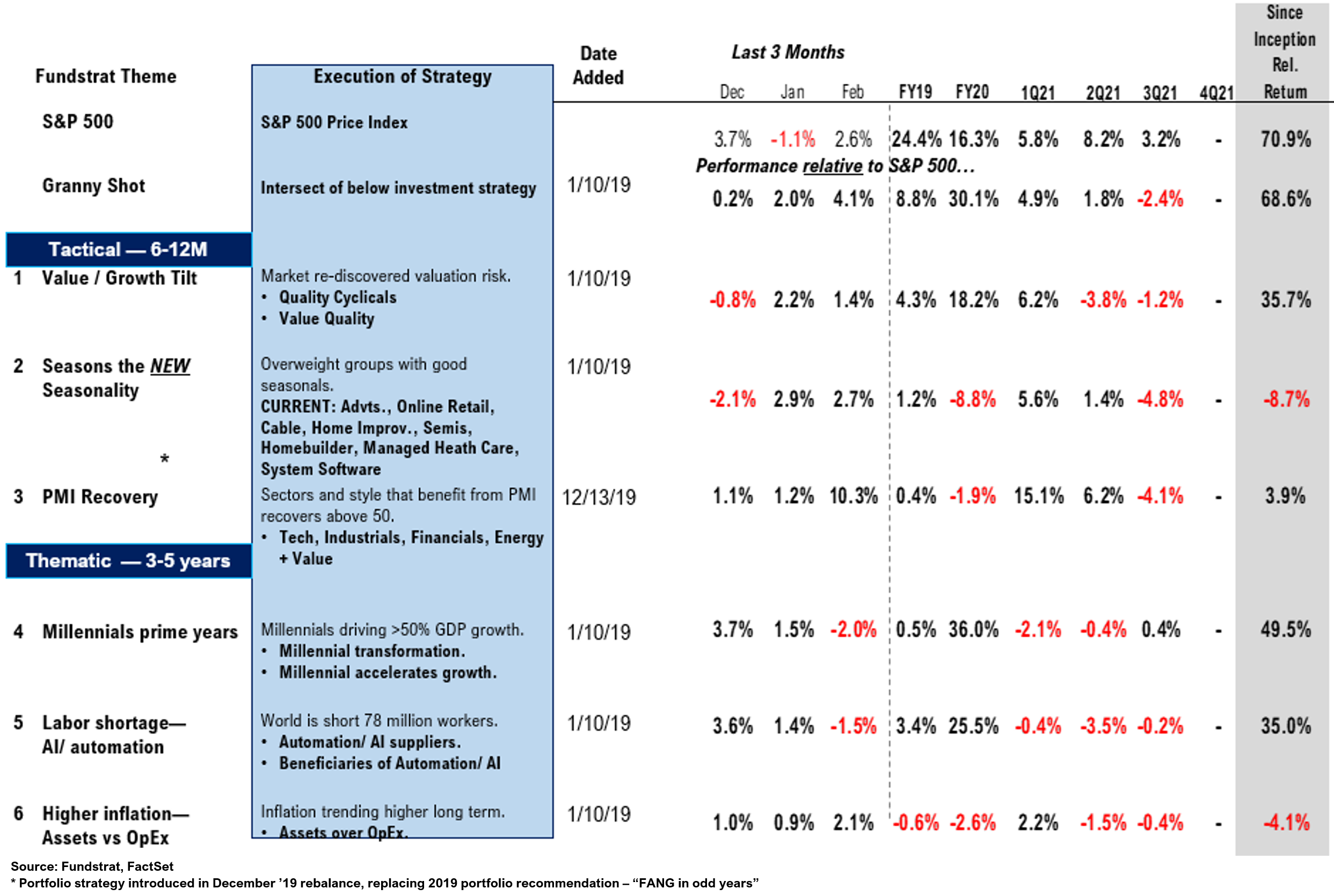

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In f8cf6c-56ed17-f97cff-be5442-1216d1

Already have an account? Sign In f8cf6c-56ed17-f97cff-be5442-1216d1