Yesterday was unlikely the 1Q24 market top. Feels more like profit-taking as prices retrace gains of last 4 days. Proper yesterday is "sell off on good news" not a bad CPI report.

VIDEO: Yesterday’s 2% selloff is an over-reaction to the hot CPI print. We also think it is a touch early to call for a top in equity markets for 1Q24.

Please click below to view our macro minute (duration: 6:13).

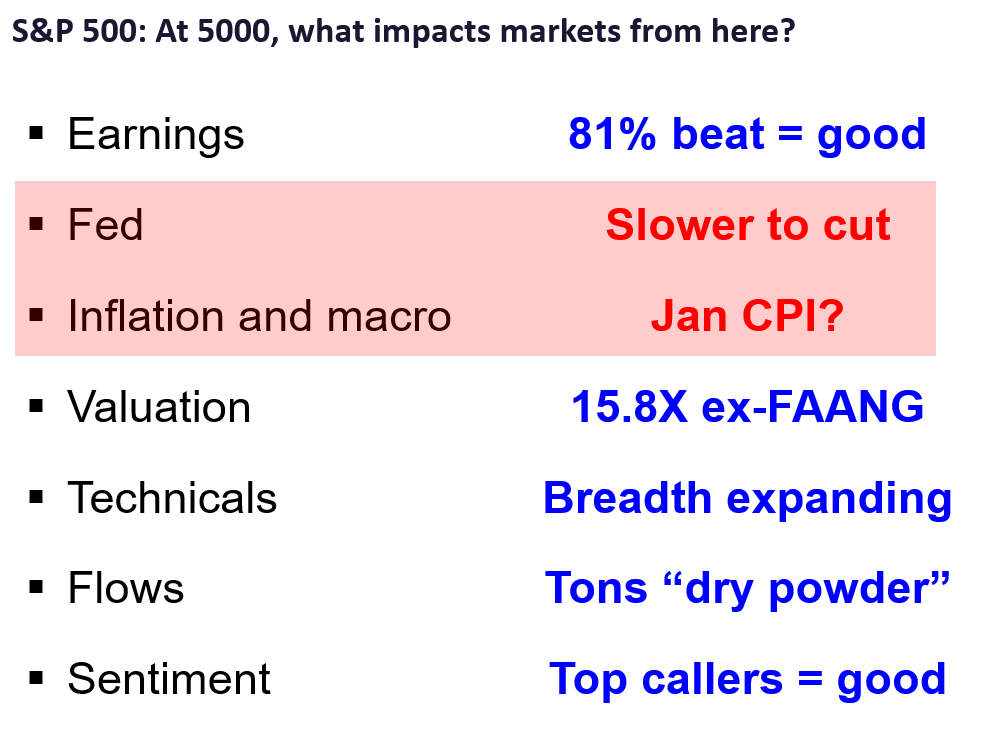

Tuesday’s selloff in equites is the largest decline of 2024 so far, after Jan CPI came in “hot” vs consensus with Core CPI +0.39% (vs consensus +0.30%). While Tuesday’s decline was indeed large, this simply takes us to prices 4 trading days ago — in other words, this is a mild retracement of recent gains:

- Is this the peak for equities in the first half of 2024? In our view, this is not likely and we think this pullback will soon get bought (aka “buy the dip”):

– first, a sure sign of a near-term peak is “a sell-off on good news”

– Tuesday was a bad data point (CPI) and a sell-off

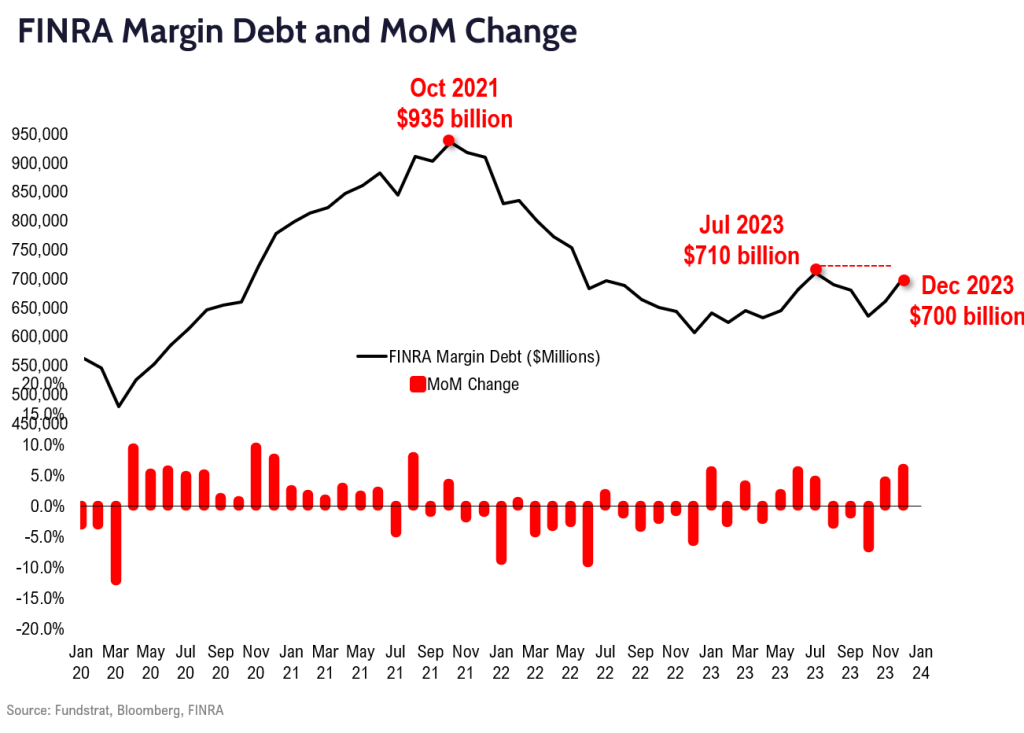

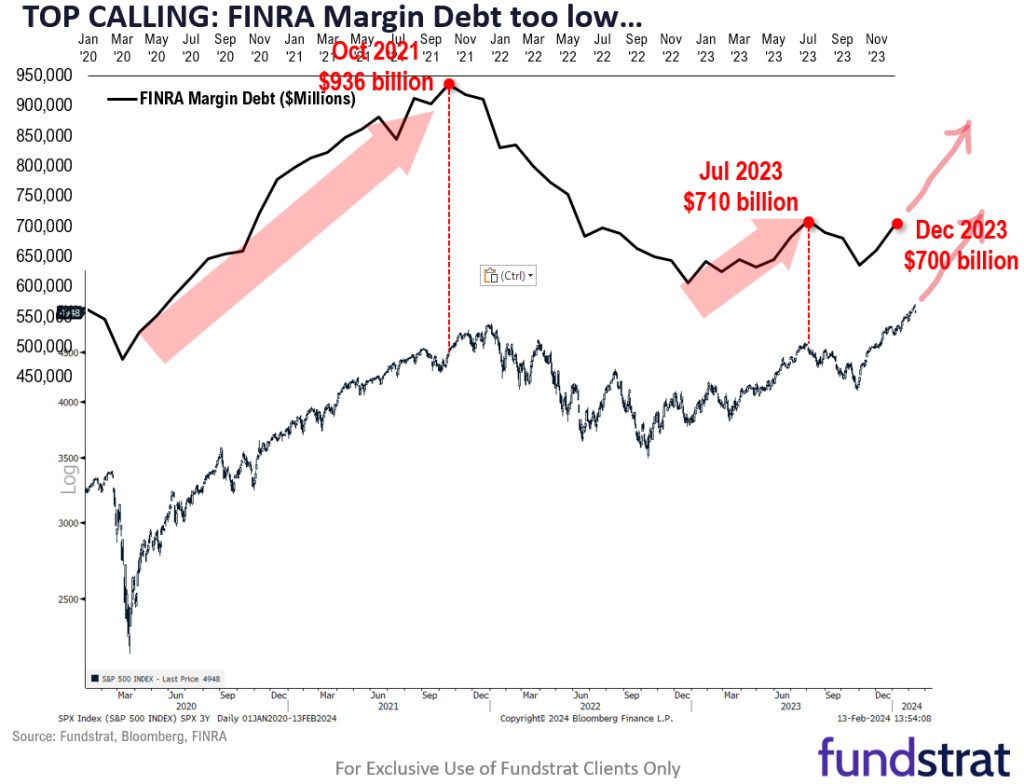

– second, there is still too much dry powder

– NYSE margin debt is still below July 2023 levels

– third, sentiment is still skeptical

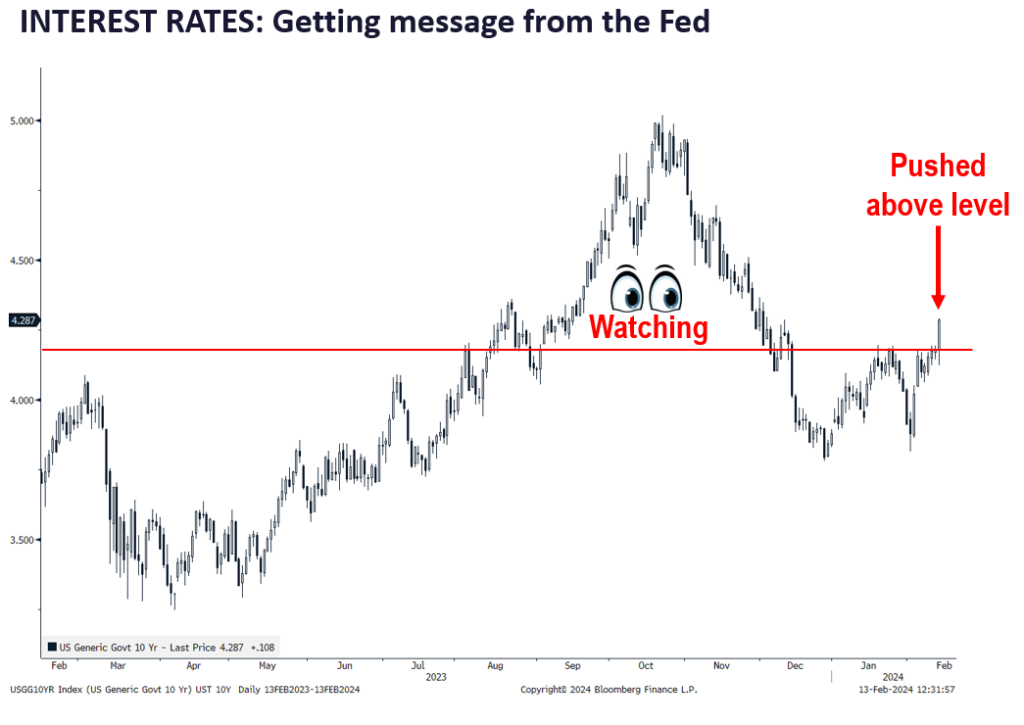

– angry bears were pounding chests in force yesterday - Of course, we are seeing some things that make us uncomfortable. The bond market is selling off sharply (yields up) with 10-yr yields now 4.285%, and way up from 3.865% just a week ago. And post this CPI report, we are hearing some economists/pundits suggest the Fed could even further delay rate cuts because of Tuesday’s report. In our view, this is an over-reaction to a singular CPI print. And the stock market reaction is also overdone as well. Why?

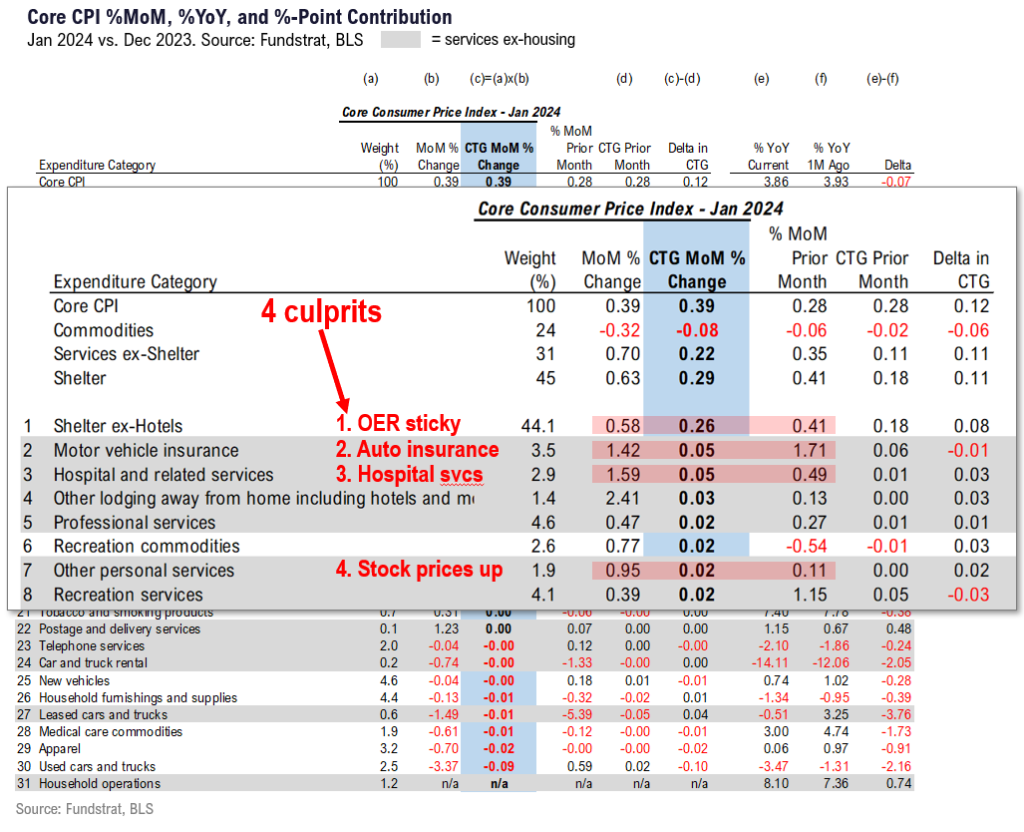

- But we think the trend in inflation is still lower. Yes, even after Tuesday’s CPI report. As we noted in our intraday alert, there are really 4 culprits behind Tuesday’s “hot” CPI:

– Shelter accelerated –> OER sticky, but not forever

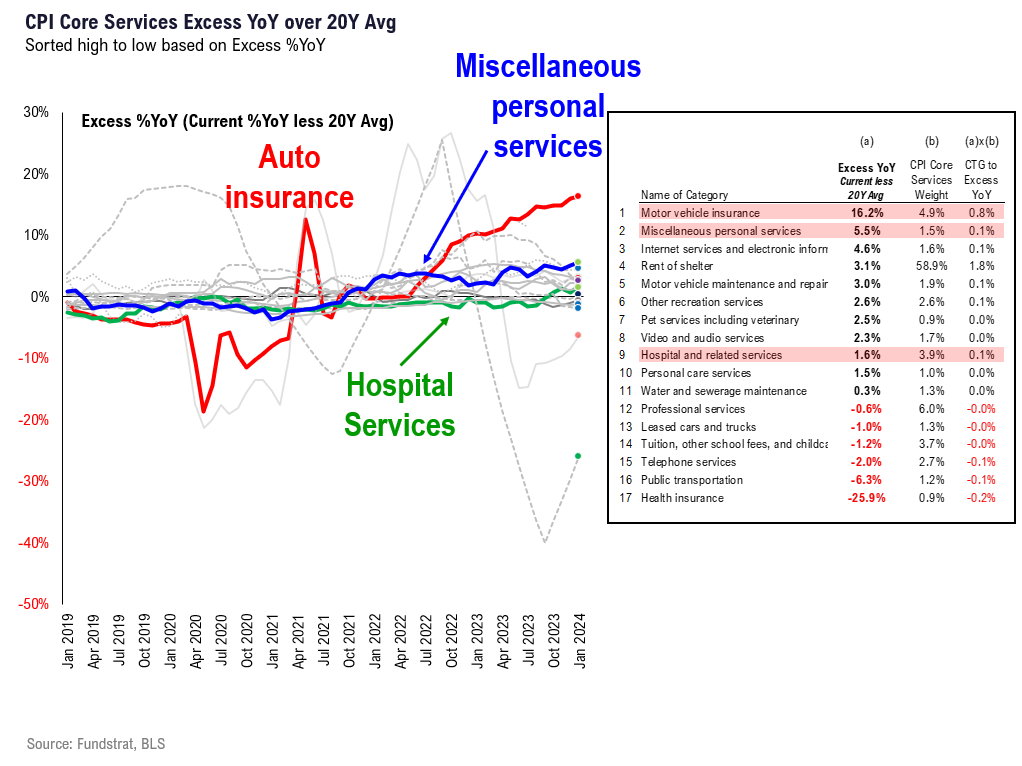

– Auto insurance accelerated –> surging, but not forever

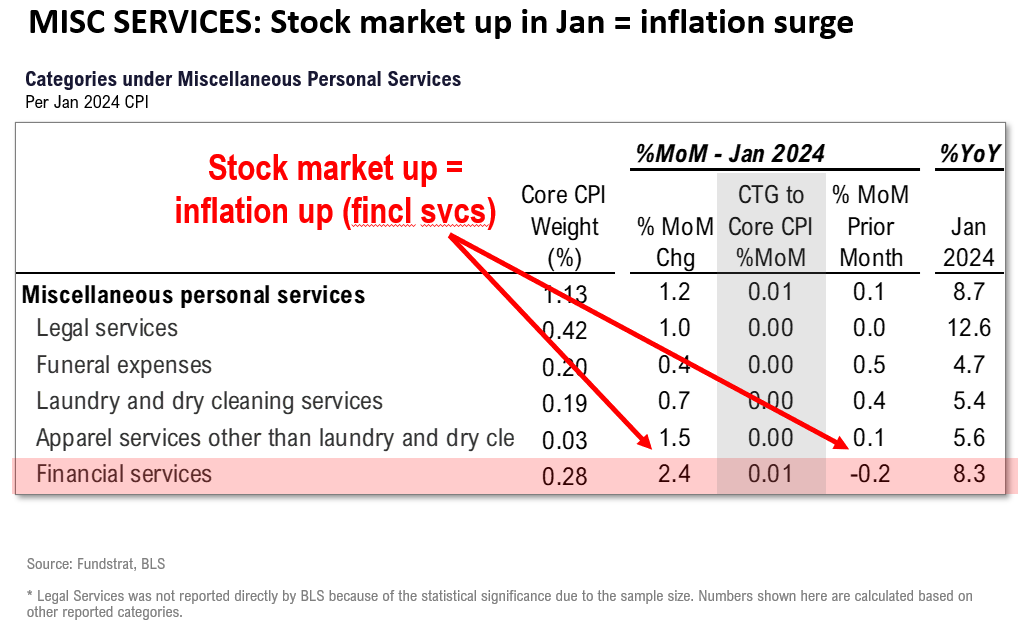

– Misc personal svcs –> stock surge = fincl svcs CPI surge, not forever

– Hospital Services surge –> we flagged, not sure what’s behind this

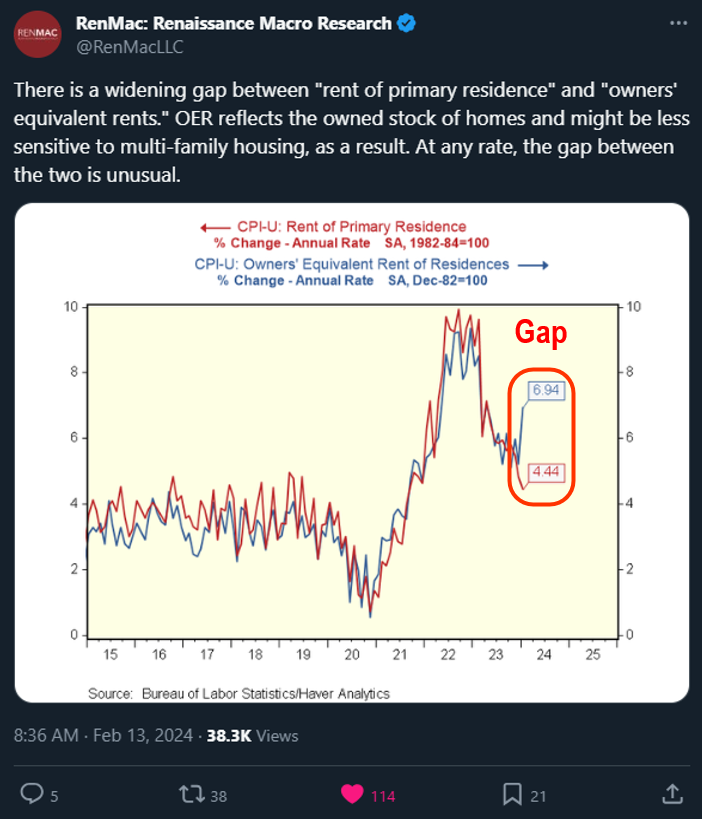

– 3 of 4 culprits not really stuff that “scares Fed now” but are lingering issues - Renaissance Macro posted an X (tweet?) highlighting that OER (owner’s equivalent rent) surged higher to 6.94% YoY while “rent of residence” fell to a pace of +4.44% YoY. They highlight this is an unusual divergence. Further, if supply of housing is the constraint, keeping policy tight magnifies issue.

- As for the other 3, we have talked exhaustively about this catch-up of auto insurance and the YoY growth rate continues to accelerate (now 20.6% yoy vs 20.3% last month). Financial services CPI rose because of higher stock prices.

- We do not think the downward trajectory of inflation has been halted. Core CPI is still tracking lower and there is noise in Tuesday’s report. Consider the following:

– Core CPI MoM Jan –> +0.39%

– Shelter CTG –> +0.26%

– Auto insurance CTG –> +0.05%

– Core CPI ex-both –> +0.08%, or +0.96% annualized

– CTG stands for “contribution to growth” - Just ex-those 2 items, CPI is annualizing at 1%. It is still falling like a rock.

- Buying power needs to be exhausted. This was behind the July 2023 top. By comparison, there is still low level of NYSE margin debt. These figures need to surge to mark a near term top:

– current level is $700 billion (end of Dec)

– recent peak was $710 billion (Jul 2023)

– Jul peak was followed by -11% drawdown in stocks - There is just too much dry powder on the sidelines. Thus, we think this sell-off dip will be bought. The next key data points are:

– U Mich inflation expectations mid-Feb on Friday 2/16

– NVidia reports quarterly results 2/21 (NVDA 6.25% ) - Similarly, sentiment is too quick to turn bearish. Skeptics of inflation, economy and stock market have were vocal yesterday. This is not what makes a near-term top. At a near-term top, we would expect investors to be adamant that this is a buyable dip:

– that is why stocks likely will peak on “good news”

– a data point that looks positive and we rollover

Bottom line: Stocks are seeing profit-taking, which is healthy but not a sign of a top in our view

We think it is too early to call at top for 1Q24. As the adage goes, we will peak when we “sell-off on good news” — We are watching for a top, but this sell-off seems too consensus.

- we would look for a top to be more of a “stocks sell off on good news”

- meaning, we get a great macro data point, and stock sell off

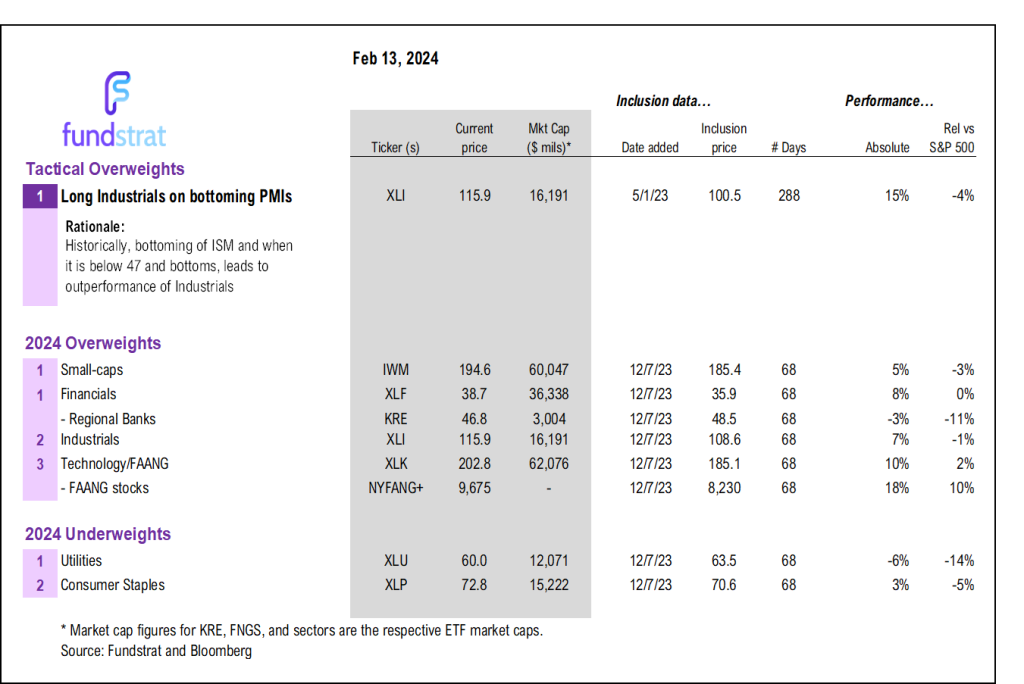

- we still favor small-caps IWM 1.04% and think this group will rebound as markets stabilize

- we also believe inflation is tracking better than suggested by yesterday’s CPI report

- we will expect stocks to be tougher in 1H24, but we do not see Tuesday as the confirmation of a top

_____________________________

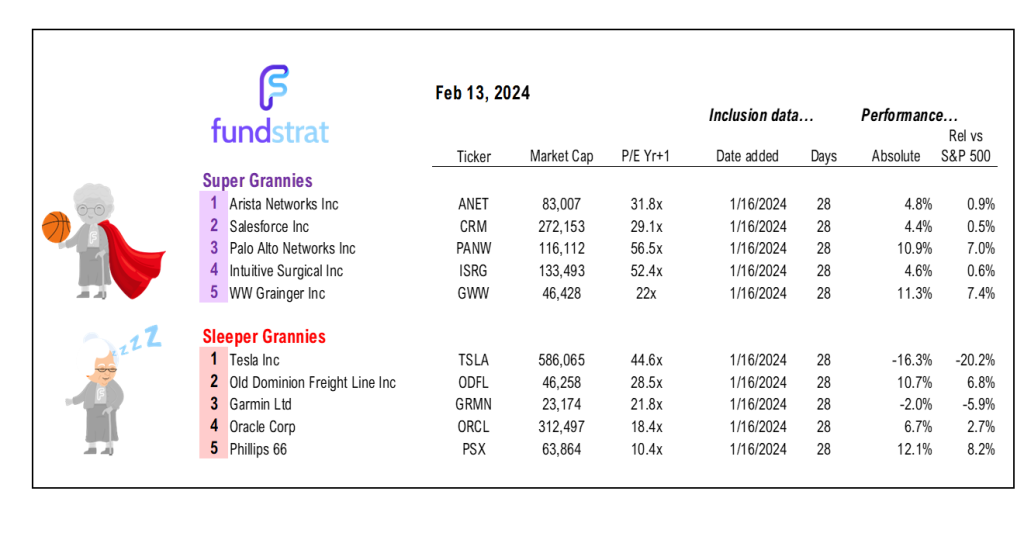

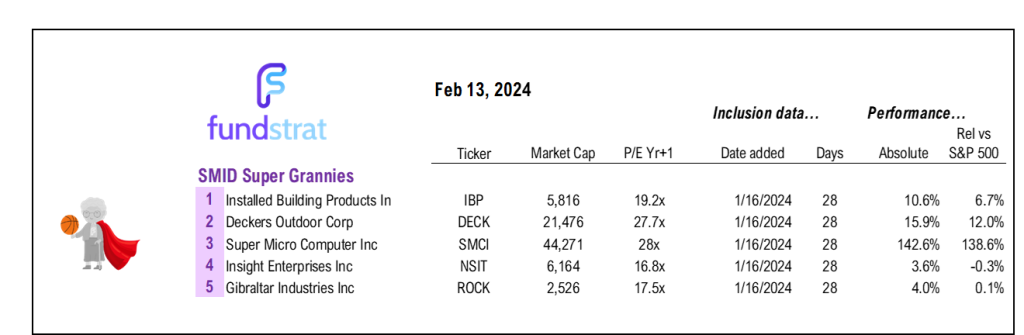

36 Granny Shot Ideas and 46 SMID Granny Shot Ideas: We performed our quarterly rebalance on 1/17. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

Key incoming data February:

2/01 8:30am ET 4QP 2023 Nonfarm ProductivityMixed2/01 9:45am ET S&P Global Manufacturing PMI January FinalTame2/01 10am ET January ISM ManufacturingMixed2/02 8:30am ET January Jobs ReportHot2/02 10am ET: U. Mich. Sentiment and Inflation Expectation January FinalTame2/05 9:45am ET S&P Global Services & Composite PMI January FinalTame2/05 10am ET January ISM ServicesTame2/07 9am ET Manheim Used Vehicle Index January FinalMixed2/09 CPI RevisionsTame2/13 8:30am ET January CPIMixed- 2/14 PPI Revisions

- 2/15 8:30am ET February Empire Manufacturing Survey

- 2/15 8:30am ET February Philly Fed Business Outlook Survey

- 2/15 8:30am ET January Retail Sales Data

- 2/15 10am EST February NAHB Housing Market Index

- 2/16 8:30am ET January PPI

- 2/16 8:30am ET February New York Fed Business Activity Survey

- 2/16 10am ET U. Mich. Sentiment and Inflation Expectation February Prelim

- 2/19 9am ET Manheim Used Vehicle Index February Mid-Month

- 2/21 2pm ET January FOMC Meeting Minutes

- 2/22 9:45am ET S&P Global PMI February Prelim

- 2/26 9:30am ET February Dallas Fed Manufacturing Activity Survey

- 2/27 9am ET February S&P CoreLogic CS home price

- 2/27 10am ET February Conference Board Consumer Confidence

- 2/28 8:30am ET 4QS 2023 GDP

- 2/29 8:30am ET January PCE

Key incoming data January:

1/02 9:45am ET S&P Global Manufacturing PMI December FinalMixed1/03 10am ET December ISM ManufacturingTame1/03 10am ET JOLTS Job Openings NovemberTame1/03 2pm ET December FOMC Meeting MinutesTame1/04 9:45am ET S&P Global Services & Composite PMI December FinalTame1/05 8:30am ET December Jobs ReportMixed1/05 10am ET December ISM ServicesTame1/08 9am ET Manheim Used Vehicle Index December FinalTame- 1/

11 8:30am ET December CPIDetails Suggest Tame 1/12 8:30am ET December PPITame1/16 8:30am ET January Empire Manufacturing SurveyTame1/17 8:30am ET January New York Fed Business Activity SurveyTame1/17 8:30am ET December Retail Sales DataStrong1/17 9am ET Manheim Used Vehicle Index January Mid-MonthTame1/17 10am EST January NAHB Housing Market IndexMixed1/18 8:30am ET January Philly Fed Business Outlook SurveyTame1/19 10am ET U. Mich. Sentiment and Inflation Expectation January PrelimTame1/24 9:45am ET S&P Global PMI January PrelimMixed1/25 8:30am ET 4QA 2023 GDPMixed1/26 8:30am ET December PCETame1/29 9:30am ET Dallas Fed January Manufacturing Activity SurveyTame1/30 9am ET January S&P CoreLogic CS home priceTame1/30 10am ET January Conference Board Consumer ConfidenceTame1/30 10am ET JOLTS Job Openings DecemberMixed1/31 2pm ET FOMC Rate DecisionTame

Key incoming data December

12/01 9:45am ET S&P Global Manufacturing PMI November FinalTame12/01 10am ET November ISM ManufacturingStrong12/05 9:45am ET S&P Global Services & Composite PMI November FinalStrong12/05 10am ET JOLTS Job Openings OctoberTame12/05 10am ET November ISM ServicesStrong12/06 8:30am ET 3QF 2023 Nonfarm ProductivityStrong12/07 9am ET Manheim Used Vehicle Index November FinalTame12/08 8:30am ET November Jobs ReportTame12/08 10am ET U. Mich. Sentiment and Inflation Expectation December PrelimTame12/12 8:30am ET November CPITame12/13 8:30am ET November PPITame12/13 2pm ET FOMC Rate DecisionDovish12/14 8:30am ET November Retail Sales DataTame12/15 8:30am ET December Empire Manufacturing SurveyTame12/15 9:45am ET S&P Global PMI December PrelimTame12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame- 12/29 9:45am ET December Chicago PMI

Key incoming data November

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame11/22 10am ET: U. Mich. November final Sentiment and Inflation ExpectationTame11/24 9:45am ET S&P Global PMI November PrelimMixed11/27 10:30am ET Dallas Fed November Manufacturing Activity SurveyTame11/28 9am ET November S&P CoreLogic CS home priceTame11/28 10am ET November Conference Board Consumer ConfidenceTame11/29 8:30am ET 3QS 2023 GDPStrong11/29 2pm ET Fed Releases Beige BookTame11/30 8:30am ET October PCETame

Key incoming data October

-

10/2 10am ET September ISM ManufacturingTame -

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decisionMarket saw Hawkish-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings