INTRADAY ALERT: Equities over-reacting to "hot" Jan CPI. The 1Q24 top will be when "stocks sell off on good news" -- so today is not likely the top.

THIS INTRADAY ALERT IS SENT SOLELY TO CLIENTS OF FSINSIGHT

Equites are selling off >1% today (IWM -0.83% off >3%) after Jan CPI came in “hot” vs consensus with Core CPI +0.39% (vs consensus +0.30%). Is this an over-reaction? Yes. Should investors buy this dip? Yes. We think this is still too early to “call the top” for 1Q2024. Let me explain:

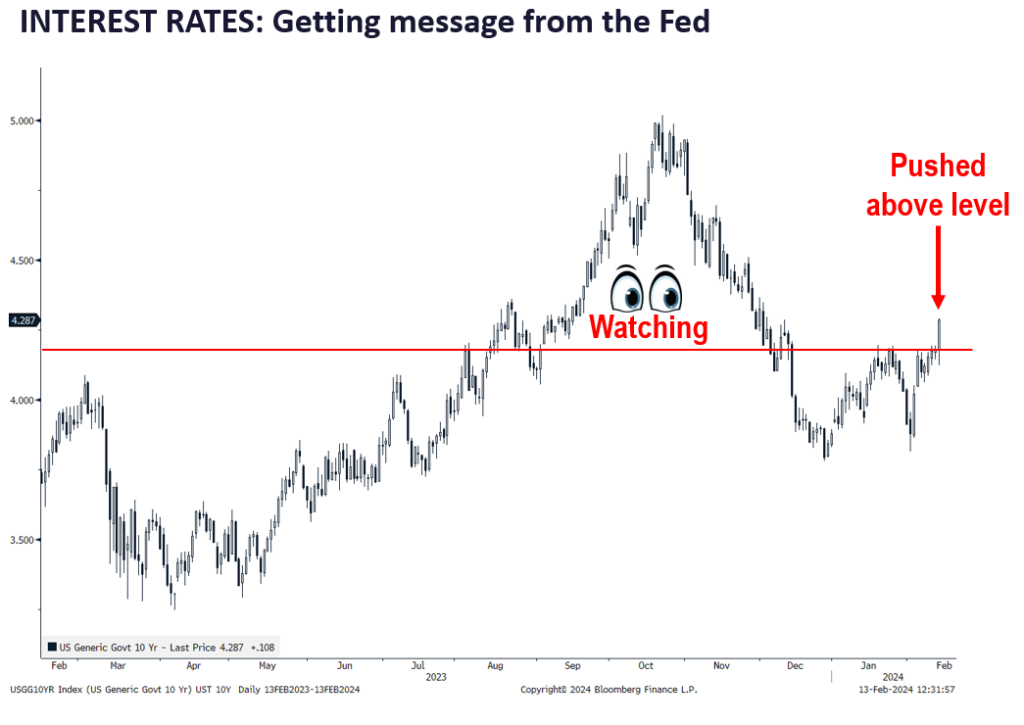

- The bond market is selling off sharply (yields up) with 10-yr yields now 4.285%, and way up from 3.865% just a week ago. And post this CPI report, we are hearing some economists/pundits suggest the Fed could even further delay rate cuts because of today’s report.

- In our view, this is an over-reaction to a singular CPI print. And the stock market reaction is also overdone as well. Why?

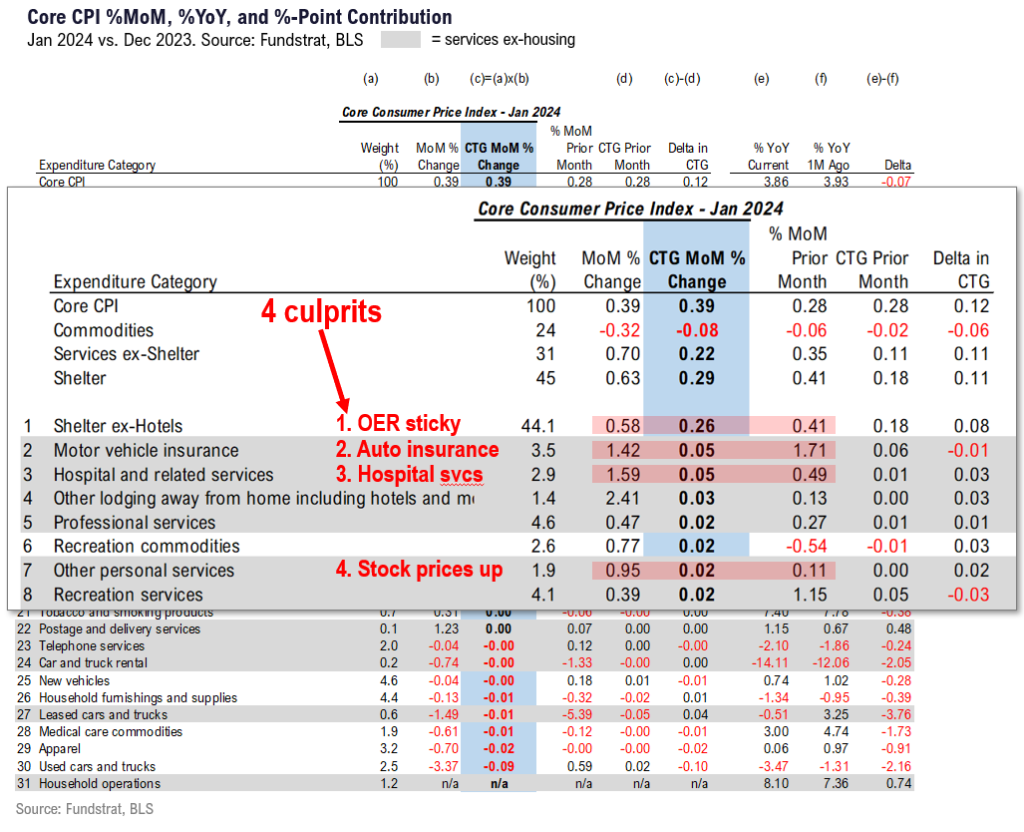

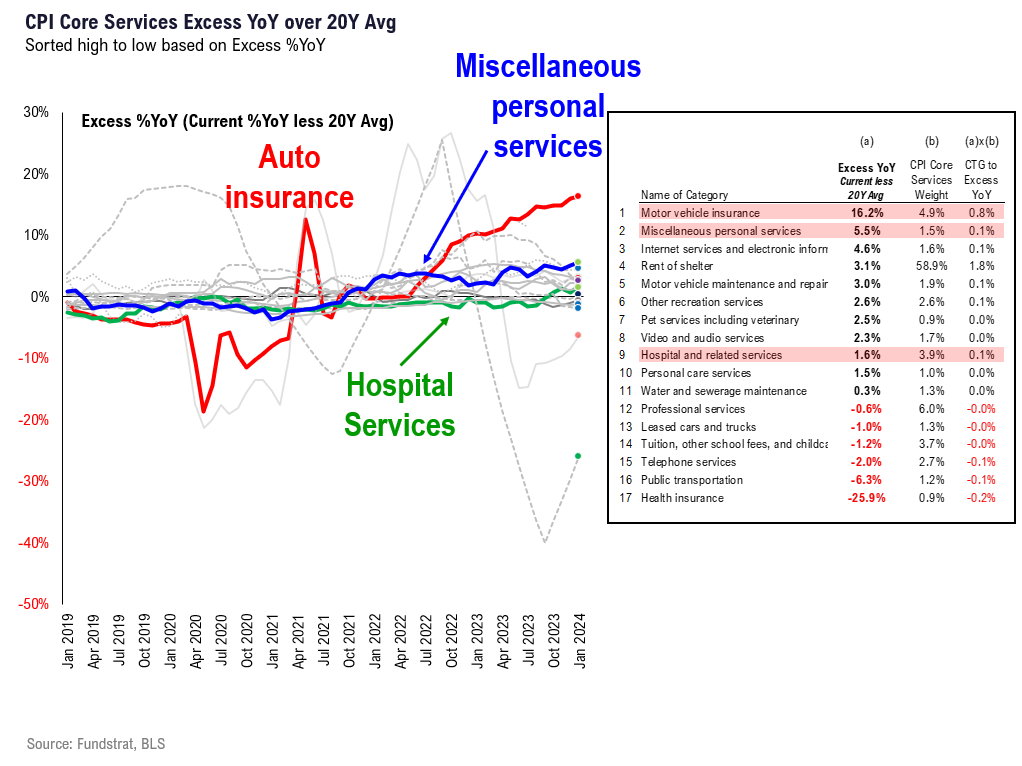

- Foremost, there are really 4 culprits behind today’s “hot” CPI:

– Shelter accelerated –> OER sticky, but not forever

– Auto insurance accelerated –> surging, but not forever

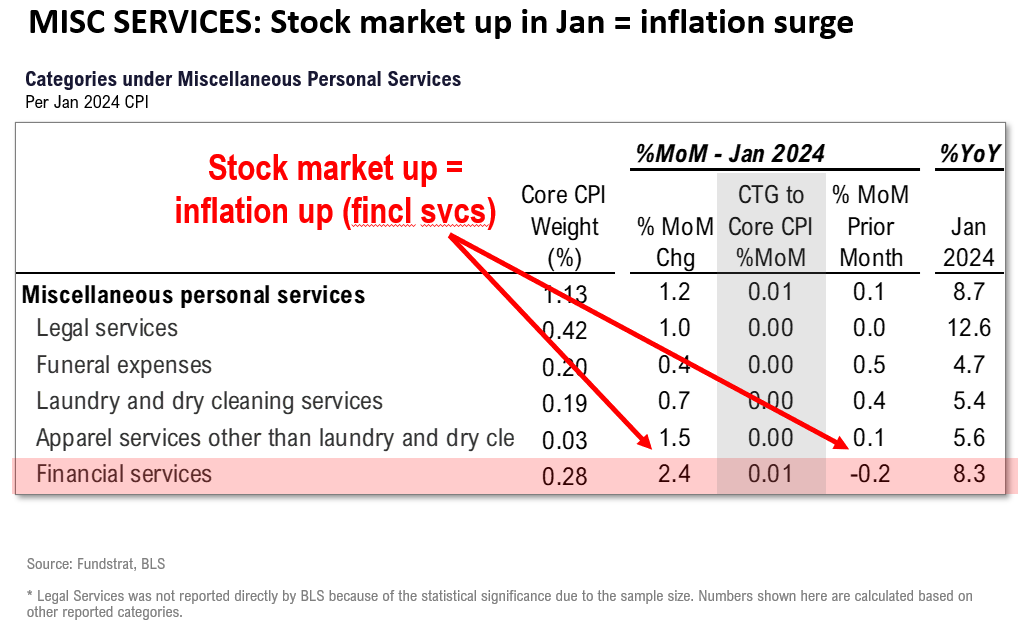

– Misc personal svcs –> stock surge = fincl svcs CPI surge, not forever

– Hospital Services surge –> we flagged, not sure what’s behind this

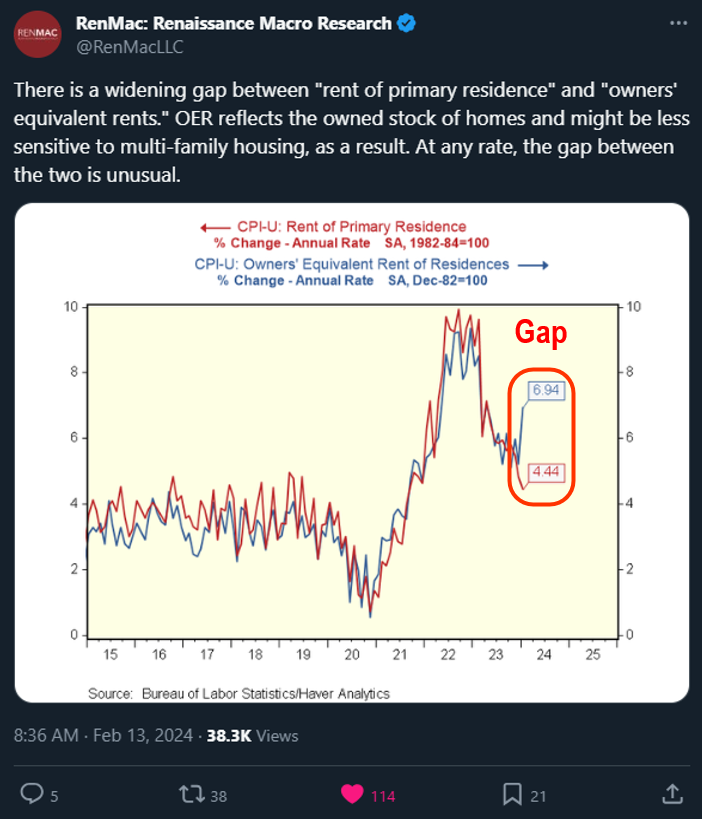

– 3 of 4 culprits not really stuff that “scares Fed now” but are lingering issues - Renaissance Macro posted an X (tweet?) highlighting that OER (owner’s equivalent rent) surged higher to 6.94% YoY while “rent of primary residence” fell to a pace of +4.44% YoY. They highlight this is an unusual divergence. Further, if supply of housing is the constraint, keeping policy tight magnifies issue.

- As for the other 3, we have talked exhaustively about this catch-up of auto insurance and the YoY growth rate continues to accelerate (now 20.6% yoy vs 20.3% last month). Financial services CPI rose because of higher stock prices.

- We do not think the downward trajectory of inflation has been halted. Core CPI is still tracking lower and there is noise in today’s report. Consider the following:

– Core CPI MoM Jan –> +0.39%

– Shelter CTG –> +0.26%

– Auto insurance CTG –> +0.05%

– Core CPI ex-both –> +0.08%, or +0.96% annualized

– CTG stands for “contribution to growth” - Just ex-those 2 items, CPI is annualizing at 1%. It is still falling like a rock.

- We also think it is too early to “call a top” in the near-term. Mark Newton, Head of Technical Strategy, noted in many recent comments that market is showing overall strength. And breadth has indeed been improving.

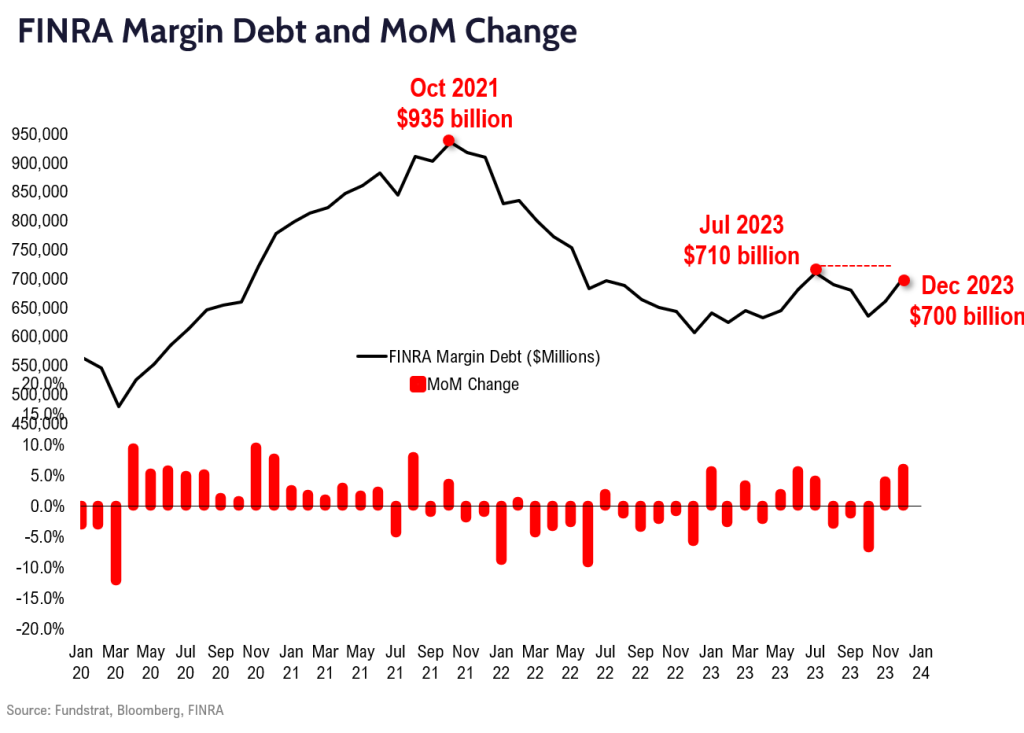

- But more telling, in our view, is the still low level of NYSE margin debt. These figures need to surge to mark a near-term top:

– current level is $700 billion (end of Dec)

– recent peak was $710 billion (Jul 2023)

– Jul peak was followed by -11% drawdown in stocks - There is just too much dry powder on the sidelines. Thus, we think this sell-off dip will be bought. The next key data points are:

– U Mich inflation expectations mid-Feb on Friday 2/16

– Nvidia reports quarterly results 2/21 (NVDA 1.17% )

Bottom line: We think it is too early to call a top for 1Q24. We are watching for a top, but this sell-off seems too consensus.

- we would look for a top to be more of a “stocks sell off on good news”

- meaning, we get a great macro data point, and stock sell off

_____________________________

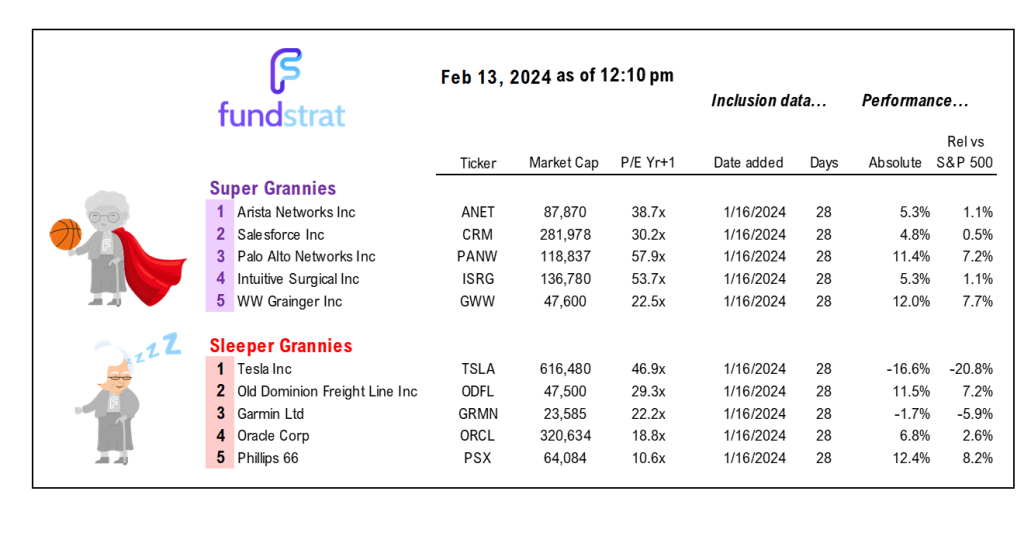

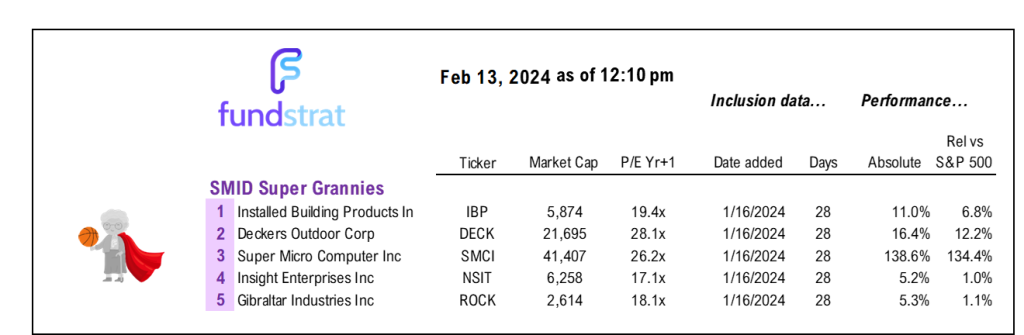

36 Granny Shot Ideas and 46 SMID Granny Shot Ideas: We performed our quarterly rebalance on 1/17. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In e553e8-0b469f-10c74b-07ed79-d77ece

Already have an account? Sign In e553e8-0b469f-10c74b-07ed79-d77ece