While geopolitical risks mount in Israel-Gaza, upside bias exists given Fedspeak (21 speakers), 3Q23 EPS season (upside bias) and CTA potential buying.

______________________________________________________________

We discuss: We discuss how despite mounting risks from the Israel-Gaza conflict, along with other risk factors, the bias for stocks this week is positive due to a huge slate of Fedspeak, plus 3Q23 EPS season plus CTA positioning.

Please click below to view our Macro Minute (Duration: 5:18).

______________________________________________________________

As we look to the week ahead, top of mind is the widening Israel-Gaza conflict. In our view, this tragedy touches every investor personally because of the humanity and tragedy. And many because of personal knowledge of someone impacted. This personal connection also means markets will reflect this human aspect, particularly as the conflict is ongoing and threatens to become larger. It is logical to suggest equity markets are somewhat anchored by this uncertainty — to me, that makes sense.

- However, we also need to be mindful that the coming week has important macro data:

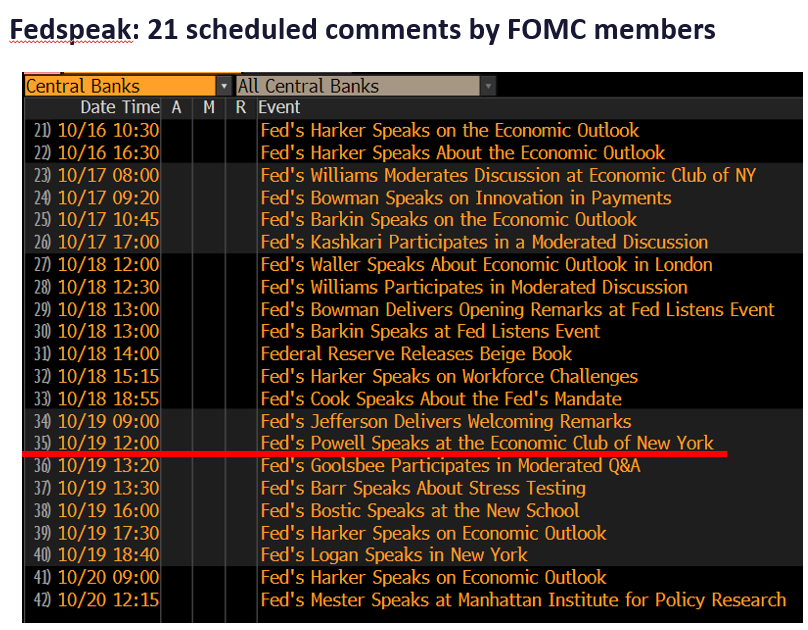

– 21 Fed speakers this week, including Fed Chair Powell

Thu 10/19 at 12pm ET at Economic Club of New York

– 3Q EPS season gets underway and we see this as “better than expected” = good

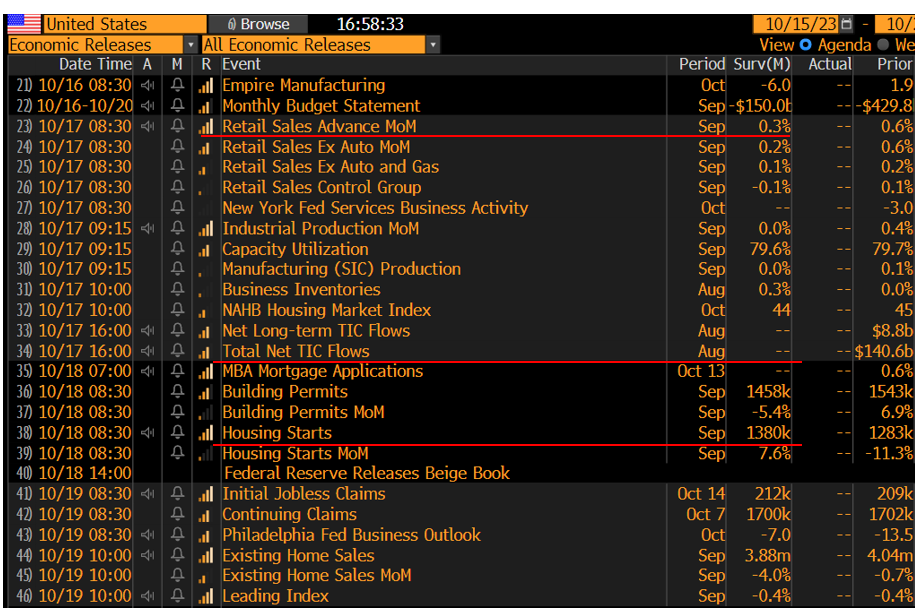

– Much economic data including Sept retail sales (10/17); Aug Treasury TIC flows (10/17);

and Sept Housing starts and Existing home sales (10/18 and 10/19)

- We realize there are real-life and meaningful issues on hand. But our focus remains on how markets likely react to incoming data and how this tracks compared to our base case. So, be mindful that X.com feeds and CNN/Fox News etc might be a distraction from some incoming data points that will impact interest rates and marginally impact Fed policy.

- One might be inclined to view equities as having downside risk because of the widening conflict in the Middle East, coupled with the ongoing Russia-Ukraine War, political circus in DC (gov’t shutdown, new House speaker) and conflicts with China. Equity markets have reacted fairly muted to the conflict so far, as evidenced by the fact equities managed to gain in the past week.

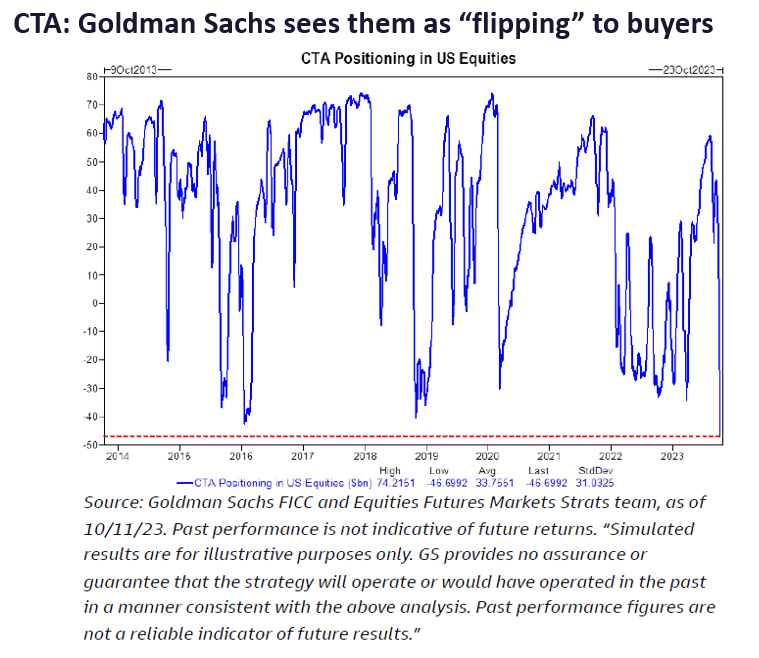

- A lot of this has to do with the fact that the cumulative building macro risks, coupled with the awful declines late-July to Sept, has driven many investors (retail and institutional) to neutral and even short positions. There are many ways to measure this and we have covered those in the past. One of the more “real-time” measures is to use tracking errors to estimate the positioning of hedge funds and CTAs (commodity trading advisors).

- Goldman Sachs Tactical Team notes that their CTA model shows

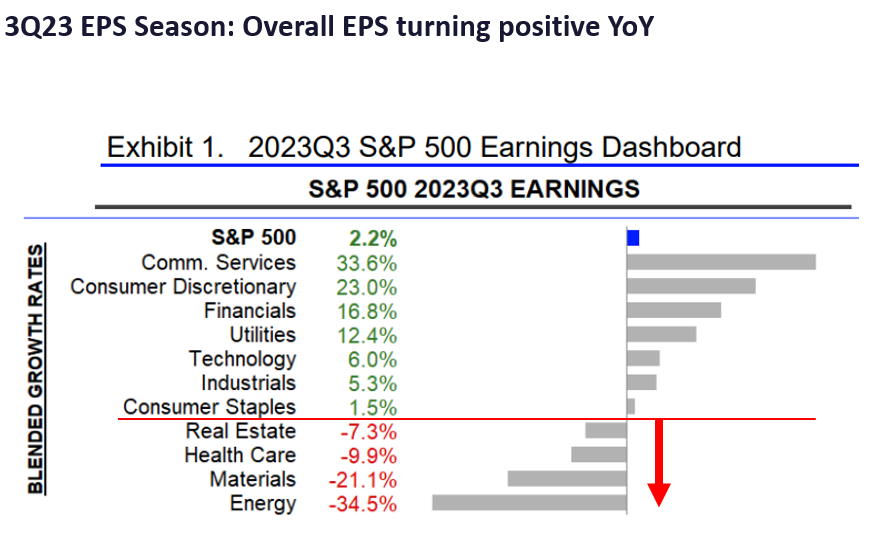

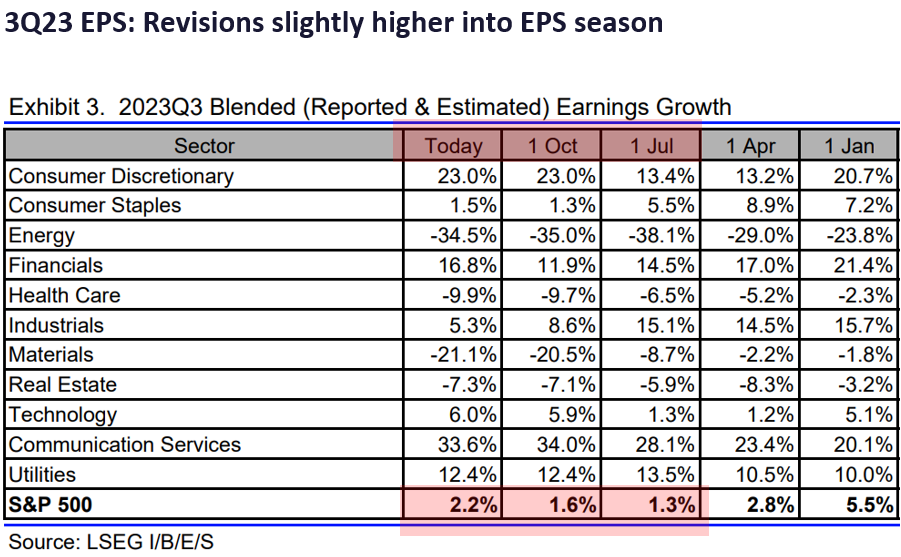

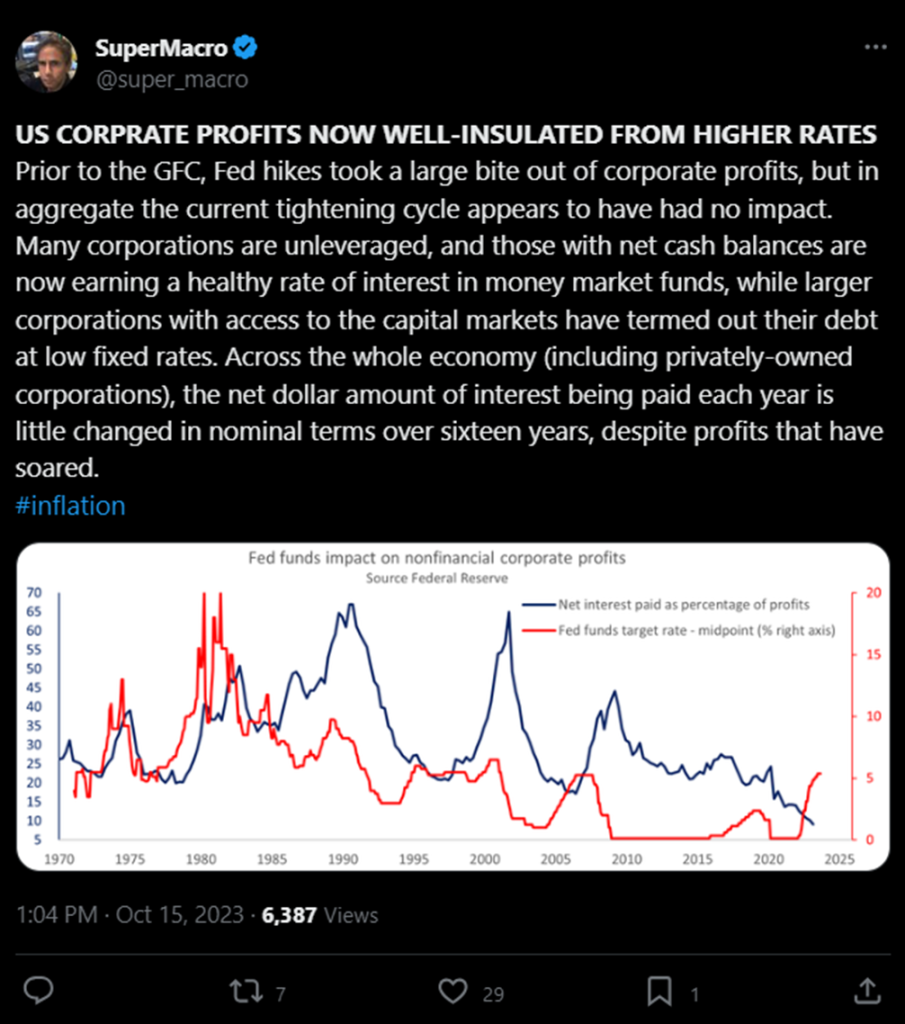

“S&P positioning is now max short as CTAs are short -$47bn in US equitiesand short-$93B globally.” According to their model, an up tape would generate $293 billion of buying of global equities. This is a sizable reversal as CTAs are estimated to have liquidated $137 billion (per GS). But an up tape is not a given, and there are multiple incoming data points on the slate. - 3Q23 earning season starts this week and estimates have been steadily increasing. For 3Q23, EPS YoY is now expected to be +2.2%, increasing steadily since early July, when 3Q23 was forecast to be +1.3%. A useful tweet by @SuperMacro shows that interest burden of corporates has not risen even as interest rates have increased. In other words, to an extent, profits are somewhat less sensitive to higher rates (via cost of debt). As we noted a few weeks ago, 7 of 11 sectors are expected to show growth YoY and the laggards are:

– Real estate -7.3%

– Healthcare -9.9%

– Materials -21.1%

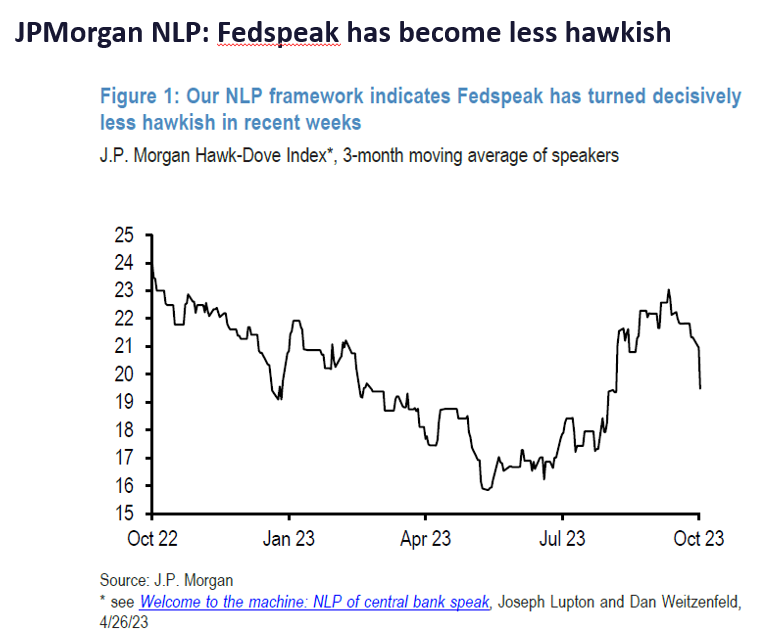

– Energy -34.5% - As for Fedspeak, JPMorgan Economists noted that their NLP (natural language processing) models show that Fed speak has turned less hawkish in the past week. There are 21 scheduled FOMC appearances this week, with the most closely watched being Fed Chair Powell on Thu 10/19 at the Economic Club of NY. The expectation is that he will hint at a pause and similar to other Fed speakers in the past few weeks, seems less hawkish than on 9/20.

Bottom line: Watch the 10-year yield, but we believe upside impulses have faded

Overall, we understand investors want to be wary given the more uncertain geopolitical environment. But we think equities will take their cues from 3 sources:

- First, the direction of yields and it seems like the US 10-year yield is drifting lower. Lower is constructive for stocks.

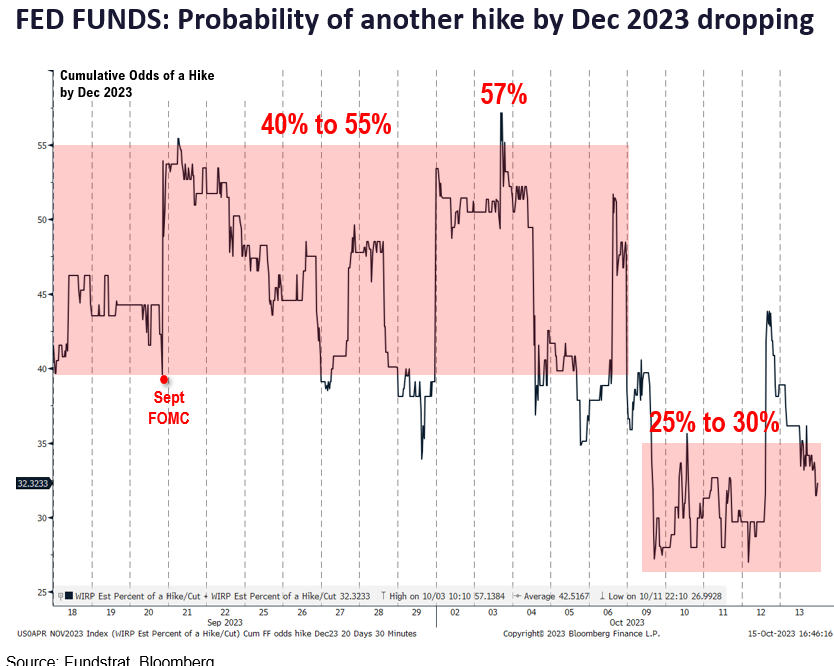

- Second, the expectations for a hike by December. Fed funds futures show this is still around 30% and we expect this to fall to zero as incoming data comes in. While many fear a resurgence of inflation, Fedspeak shows that the rise in longer term yields is accomplishing the tightening the Fed wants.

- Third, we expect positive 3Q23 EPS season to trigger upside momentum in equities via the CTA channel. As GS points out, there is an assymetry and an upside tape will bring in buyers.

Key incoming data October

-

10/2 10am ET September ISM ManufacturingTame -

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed - 10/16 8:30am ET October Empire Manufacturing Survey

- 10/17 8:30am ET October New York Fed Business Activity Survey

- 10/17 8:30am ET September Retail Sales Data

- 10/17 9am ET Manheim October Mid-Month Used Vehicle Value Index

- 10/17 10am ET October NAHB Housing Market Index

- 10/17 4pm ET August Treasury TIC Flows

- 10/18 8:30am ET September Housing Starts

- 10/18 2pm ET Fed releases Beige Book

- 10/19 8:30am ET October Philly Fed Business Outlook Survey

- 10/19 10am ET Existing Home Sales

- 10/19 12pm ET Fed (including Powell) speaking at Economic Club of New York

- 10/24 9:45am ET S&P Global PMI October Prelim

- 10/26 8:30am ET 3Q 2023 GDP Advance

- 10/27 8:30am ET September PCE

- 10/27 10am ET Oct F UMich Sentiment and Inflation expectation

- 10/30 10:30am ET Dallas Fed September Manufacturing Activity Survey

- 10/31 9am ET August S&P CoreLogic CS home price

- 10/31 10am ET October Conference Board Consumer Confidence

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decisionMarket saw Hawkish-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed - 9/22 9:45am ET S&P Global PMI September Prelim

- 9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey

- 9/26 9am ET July S&P CoreLogic CS home price

- 9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame- 9/1 8:30am ET August NFP jobs report

- 9/1 10am ET August ISM Manufacturing

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

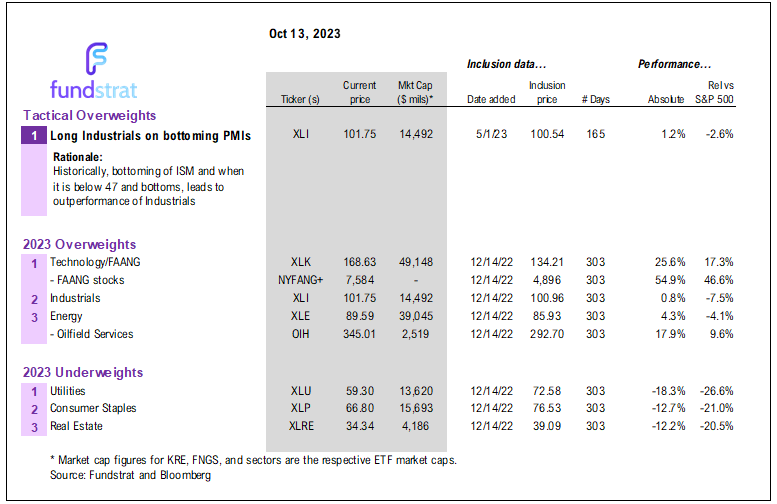

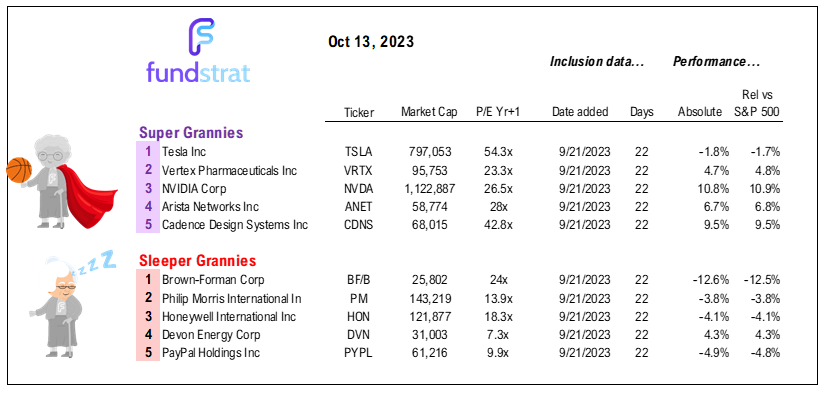

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In e2c6bd-00aef5-fe49cb-80ace4-341011

Already have an account? Sign In e2c6bd-00aef5-fe49cb-80ace4-341011