INTRADAY ALERT: July jobs report not "too hot" which is supportive of stocks finding near-term bottom ahead of July CPI

The July employment report (BLS) came in slightly below Street expectations. The headline figure was +187k jobs added in July vs Street looking for 200k, and the whispers out there of a very strong figure. Recall, from a market’s perspective a “miss” to the downside more positive for stocks, as this is more consistent with what the Fed wants to see:

- The overall picture remains a strong labor market, but one that is softening

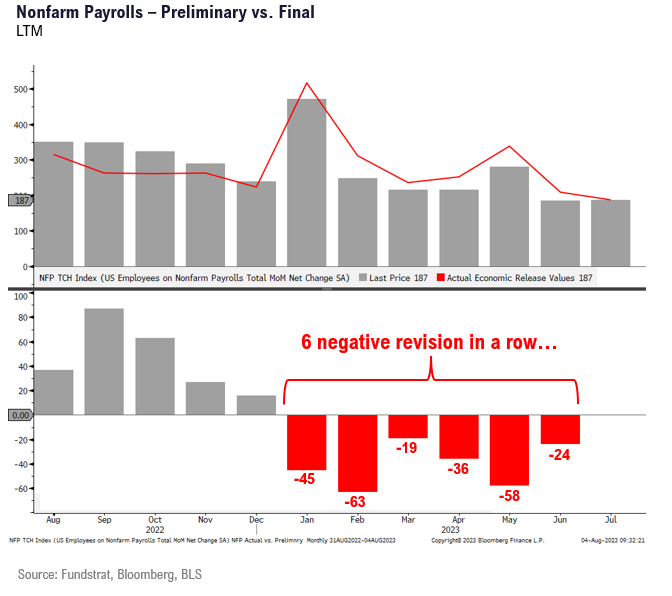

– NFP (non-farm payrolls) +187k vs Street 200k vs +209k last month (revised to 185k)

– 2 month revisions -49k <– good

– Avg hourly earnings (AHE) +0.4% vs Street +0.3% vs +0.4% last month

– Avg weekly hours 34.3 vs Street 34.4 and 34.4 last month

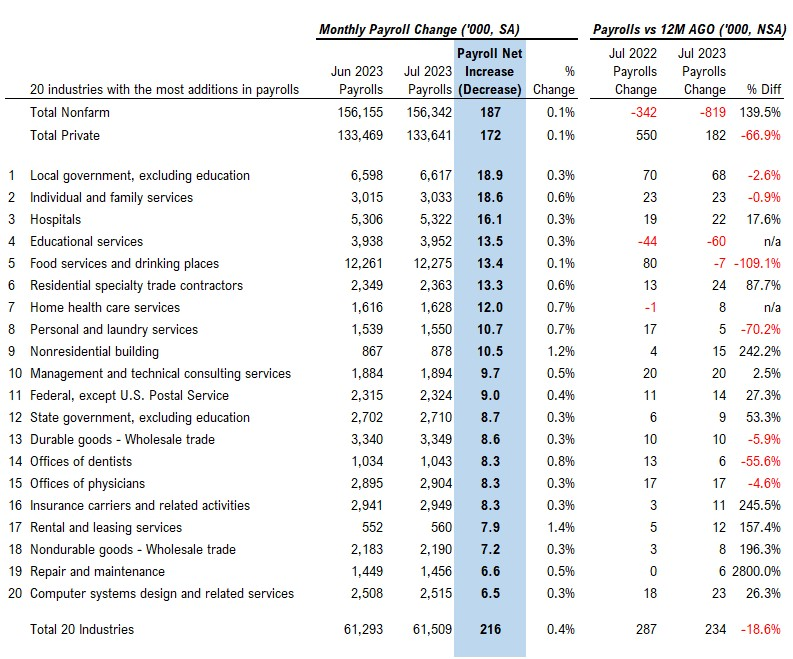

- The top 5 industries to add jobs were:

– Local govt +18.9k

– Family services +18.6k

– Hospitals +16.1k

– Education svcs +13.5k

– Food services +13.4k <– only 1 impacted by monetary policy - Of those 5 job groups above, 4 of 5 are not impacted by monetary policy. The only one being food services. In fact, historically, demand for education services goes up if the economy weakens, so it is arguably gaining from tight monetary policy (opposite what Fed intends).

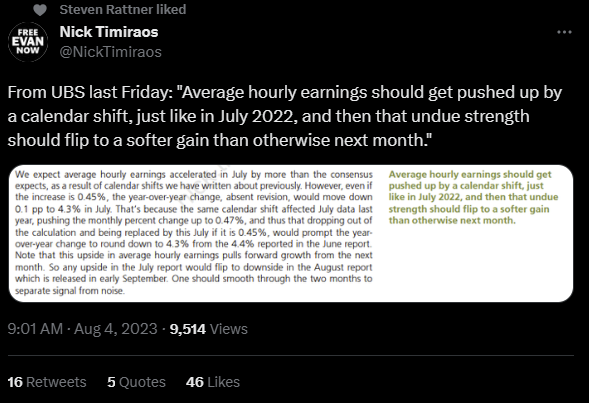

- The concerns about higher wage pressures has some offsets.

– UBS economist flagged a calendar shift as pushing up July AHE (see below)

– drop in weekly hours means total compensation (AHE * Avg hours)

– total weekly earnings /compensation rose 3.4% - Lastly, the jobs reports for the preceding 6 months have all been revised lower. This is a pretty surprising string of consecutive negative revisions. So, while the job market is strong, the strength is offset by the reduced work hours and the fact that prior months saw downward revisions.

BOTTOM LINE: July jobs good enough to support stocks finding footing ahead of July CPI next week

Bottom line, we view today’s July jobs report as good enough for stocks to find some footing ahead of next week’s July CPI. The first 3 days of August have been horrific with equities down 2%. But as we noted in our comments Fri am, this bodes well for the remainder of the month:

- 10-year yields have backed off 8bp to 4.096%. This is what we would want to see as yields initially rose.

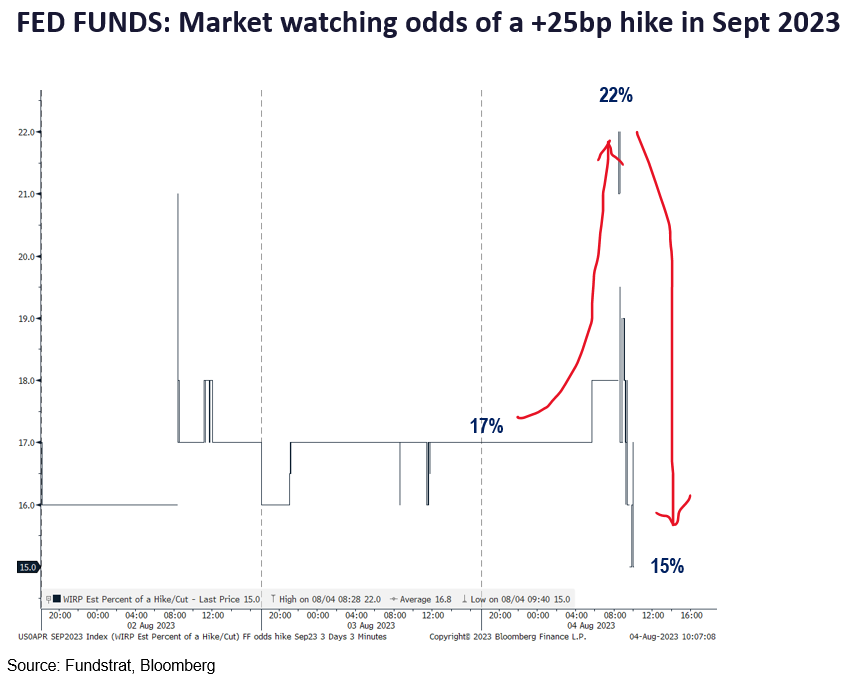

- Moreover, odds of a Fed hike in September have fallen to 15% from 17% yesterday. And this figure popped to 22% initially on the BLS report.

- VIX fell 3.6% to 15.35, after surging earlier this week. We would view VIX below 15 as a constructive sign.

- So markets are not interpreting this report as “hawkish” for the Fed.

- We are leaning towards buying the dips over the near term

- But we remain wary of August in general, so this is not a “full risk on” view

After initially popping to 22%, the odds of a September hike have fallen to 15%.

Even Fed’s Raphael Bostic suggested that Fed doesn’t need to raise rates further as the job market is visibly slowing.

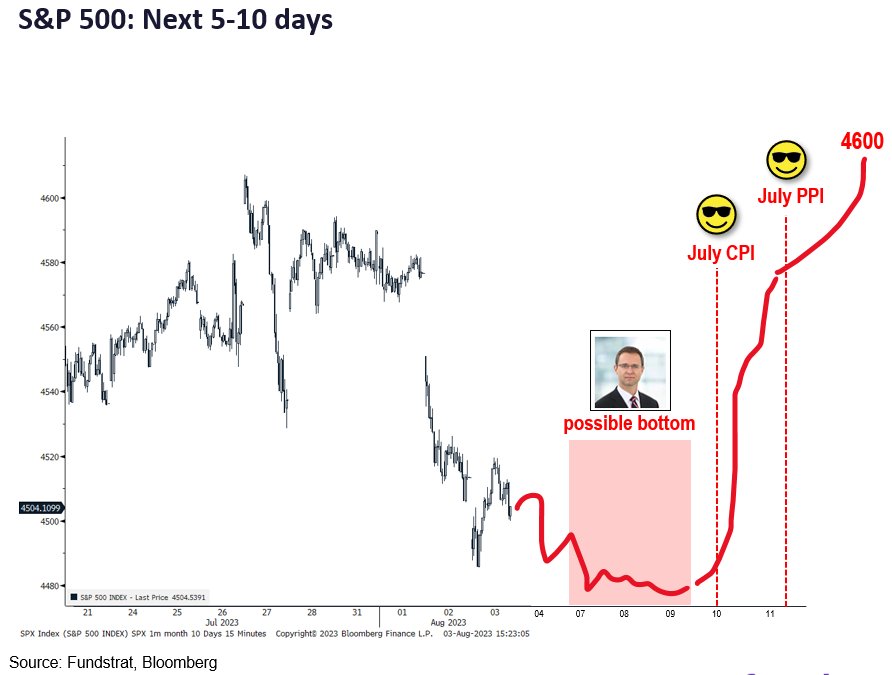

The rough roadmap for stocks near term is highlighted below and this employment report is consistent with stocks finding a bottom in the next day or so. And we believe markets will be relieved with an expected soft July CPI reading. That is released on 8/10.

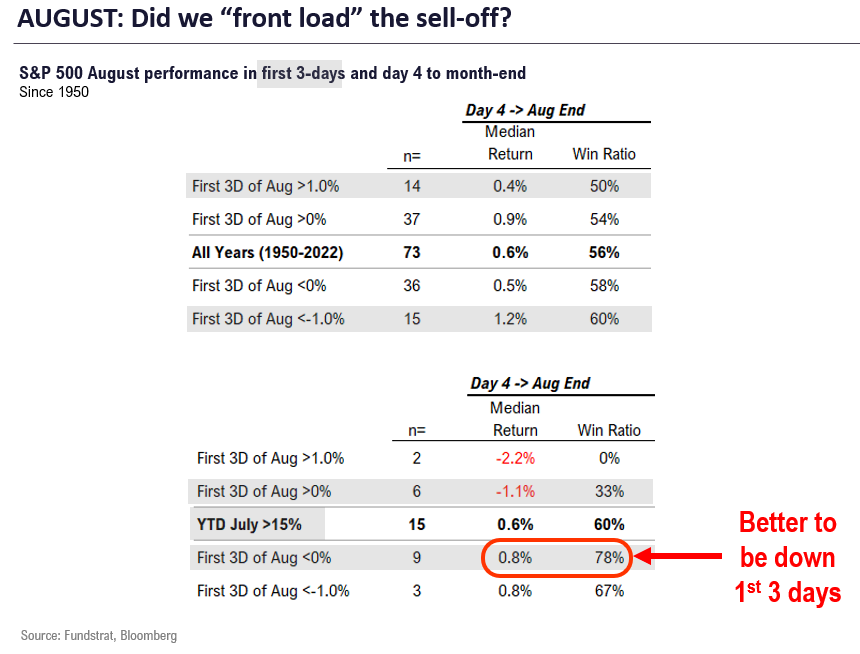

As the below table illustrates, since 1950:

- S&P 500 performs rest of August when the first 3 days are down

- If YTD >15% and first 3 days negative, day 4 to end of month +0.8% (78% win-ratio)

- if YTD >15% and first 3 days positive, day 4 to end of month -1.1% (33% win-ratio)

- Sort of seems better to be front loading the selling

The overall jobs report was better than expected.

As Nick Timiraos flagged, UBS suggested that average hourly earnings would get affected by a calendar shift.

To me what is notable is the top 5 job adders. Of those, only food services is arguably sensitive to monentary policy.

The revisions to prior monthly reports catches our eye. This does suggest that the strength of the labor market earlier has been somewhat overstated. Of course, the labor market is strong.

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame- 8/7 11am ET Manheim Used Vehicle Index July Final

- 8/10 8:30am ET July CPI

- 8/11 8:30am ET July PPI

- 8/11 10am ET U. Mich. July prelim 1-yr inflation

- 8/11 Atlanta Fed Wage Tracker July

- 8/15 8:30am ET Aug Empire Manufacturing Survey

- 8/15 10am ET Aug NAHB Housing Market Index

- 8/16 8:30am ET Aug New York Fed Business Activity Survey

- 8/16 2pm ET FOMC Minutes

- 8/17 8:30am ET Aug Philly Fed Business Outlook Survey

- 8/17 Manheim Aug Mid-Month Used Vehicle Value Index

- 8/23 9:45am ET S&P Global PMI Aug Prelim

- 8/25 10am ET Aug Final U Mich 1-yr inflation

- 8/28 10:30am ET Dallas Fed Aug Manufacturing Activity Survey

- 8/29 9am ET June S&P CoreLogic CS home price

- 8/29 10am ET Aug Conference Board Consumer Confidence

- 8/29 10 am ET Jul JOLTS

- 8/31 8:30am ET July PCE

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

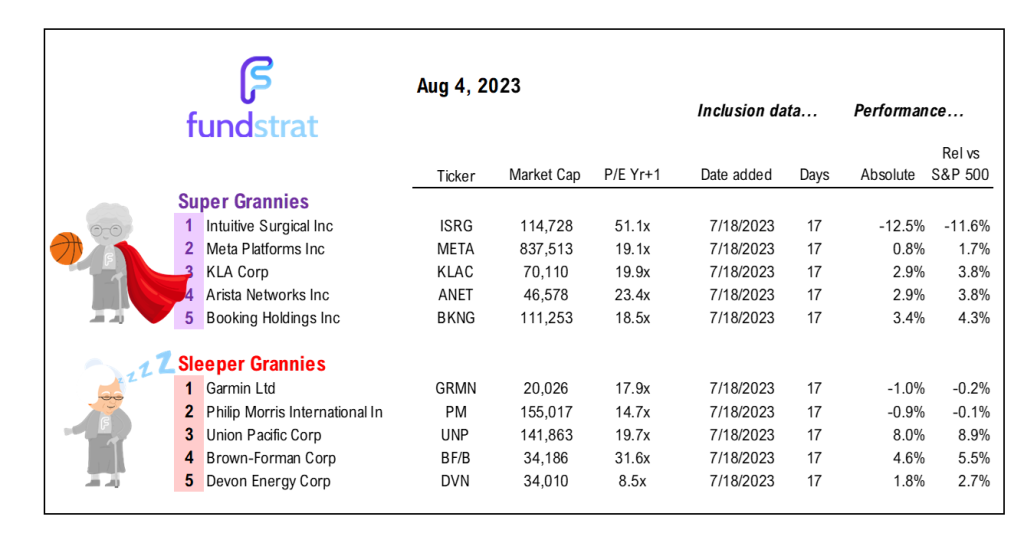

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 914d12-1b54e6-f19ee4-061d0a-65a4ea

Already have an account? Sign In 914d12-1b54e6-f19ee4-061d0a-65a4ea