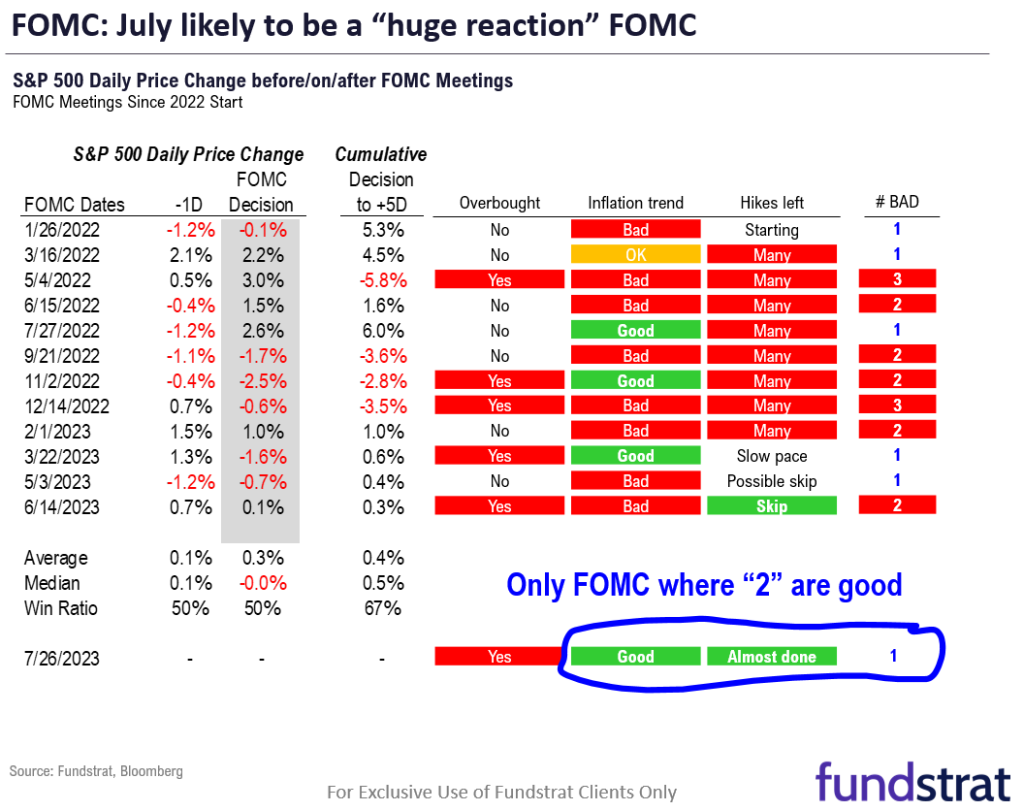

Looking at 12 recent FOMC decisions, probabilities favor a rally of 1%-2% post July FOMC

Today’s note will include a short video update. We discuss: Stocks rallied post 8 of the last 12 FOMC meetings. Using analytics, we now see probabilities favoring a 1-2% and even greater rally post-FOMC. We also highlight possible statements that trigger a selloff. (Duration: 4:49).

Today at 2pm is when the Federal Reserve FOMC releases its rate decision and Fed Chair Powell holds the press conference. A +25bp hike is largely expected but that is not what will move markets. It is the qualitative views around the Fed’s sense of progress on the inflation war that matters. Markets have wobbled into this week given selloffs around earnings and general apprehension around Wednesday. As we discuss below, the probabilities favor a 1%-2% rally post-FOMC decision.

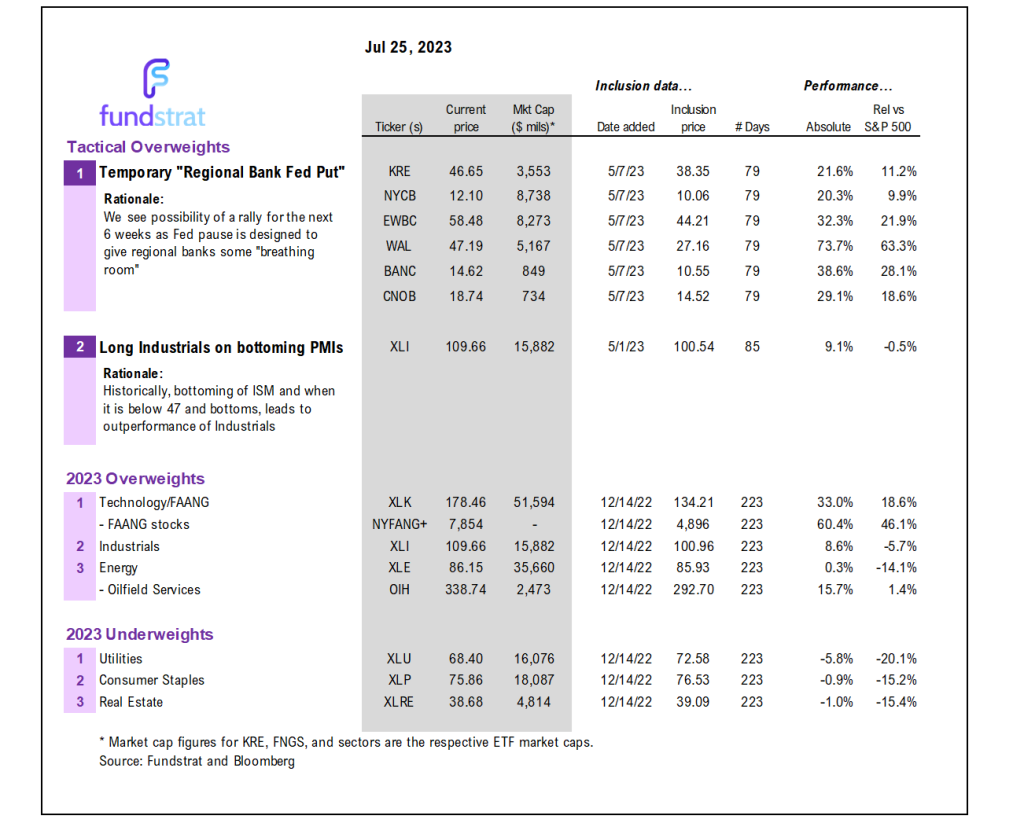

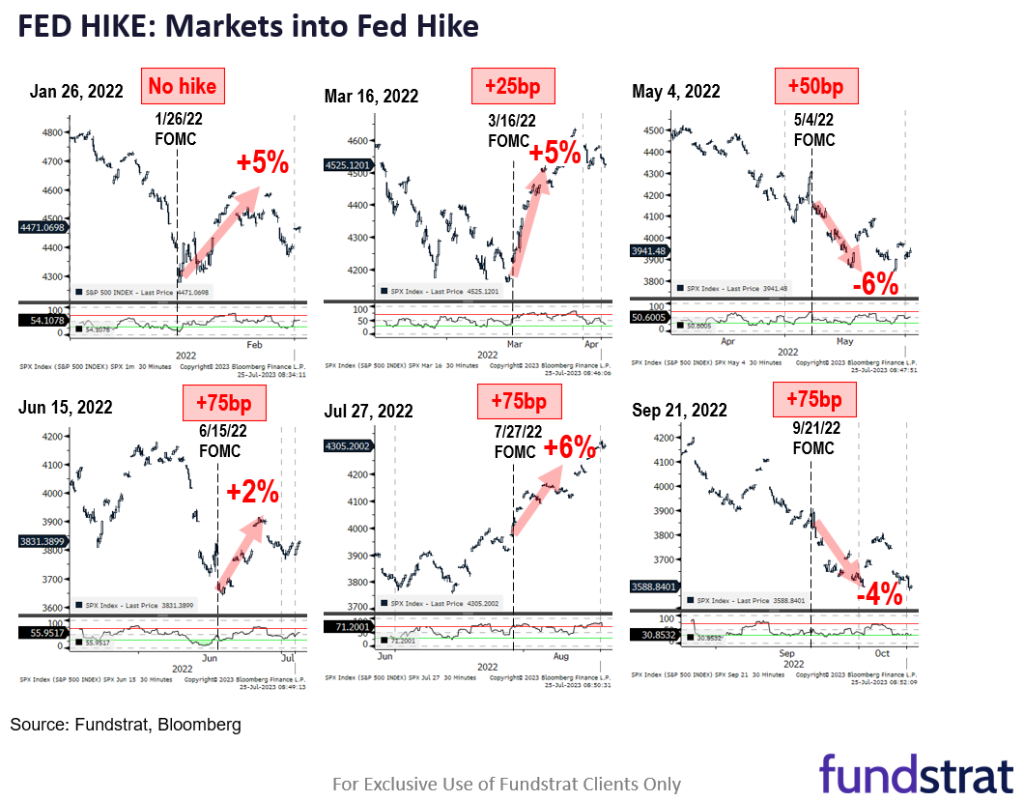

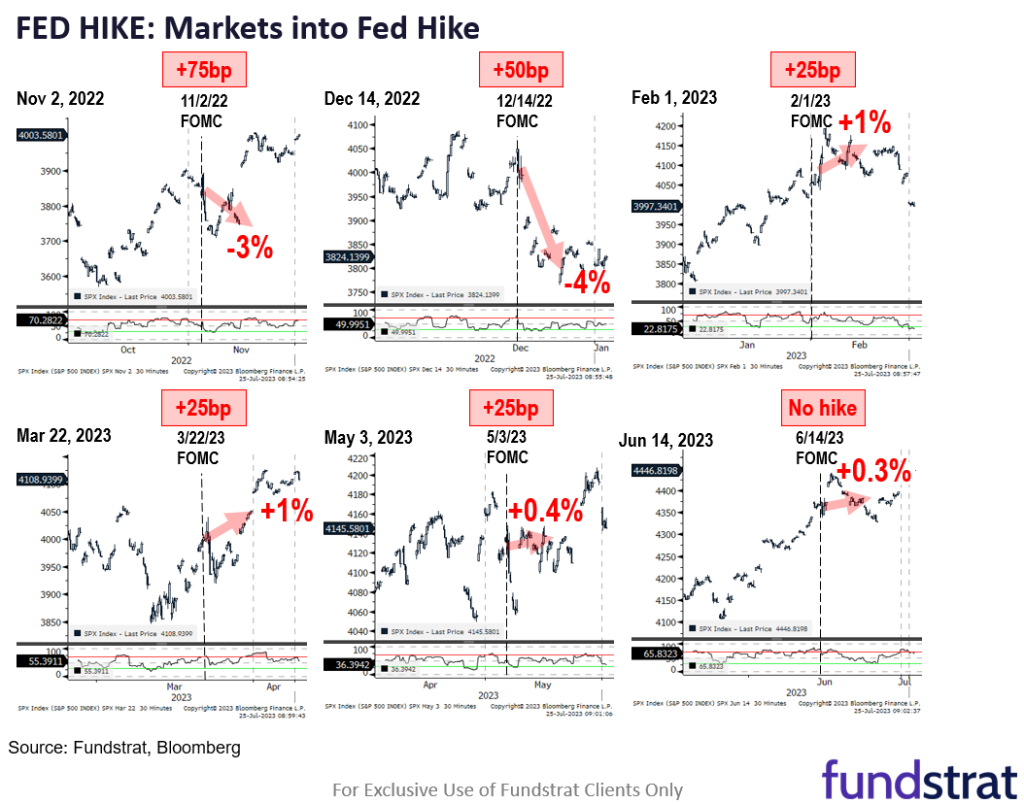

- In the last 12 FOMC since start of 2022, S&P 500 post-FOMC:

– 8 of 12, 5 day rallies 1% to 6%

– 4 of 12, 5 day declines 3% to 6% - Our data science team, led by tireless Ken, put together some analytics:

– S&P 500 RSI level: overbought or not

– preceding CPI report: Bad or good (vs consensus)

– pace of hikes ahead: Fed behind or slowing (per presser) - When bad tally was only “1” item:

– 5 instances: Jan, March, July 2022 and March, May 2023

– S&P 500 gained 5 of 5 times: 1% to 5% - When bad tally was 2 to 3 items:

– 7 instances: May, June, Sep, Nov Dec 2022 and Feb, June 2023

– stocks down 4 of 7 instances - Where do things stand into the July 2023 FOMC?

– S&P 500 overbought: Yes <– BAD

– Recent CPI report: Tame <– GOOD

– Hike pace: Fed nearly done <– GOOD - So, there is only “1” iffy item, which is markets somewhat strong into CPI report. But this is after a bad wobble last week and the calls for a correction.

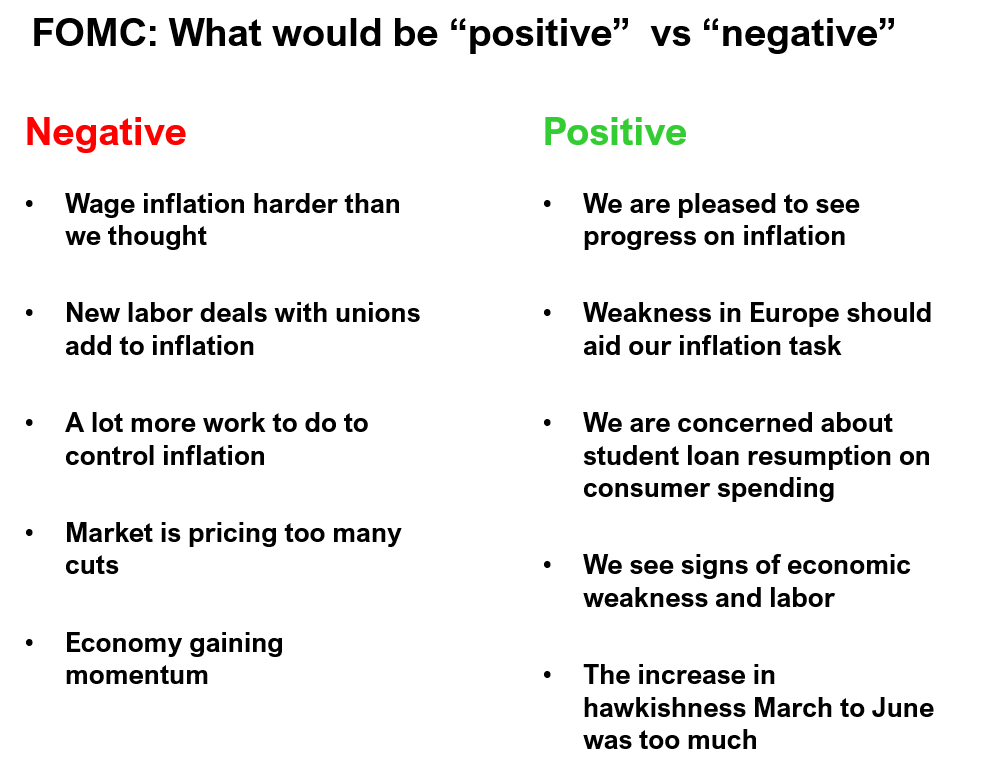

- What could the Fed say to “kill” a rally? It’s a big list:

– Wage inflation harder than we thought

– New labor deals with unions add to inflation

– A lot more work to do to control inflation

– Market is pricing too many cuts

– Economy gaining momentum - We are merely guessing. But these are the phrases that worry us.

Bottom line: We think probabilities favor an S&P 500 rally post-FOMC of >1%

We now think probabilities favor a rally. We were more nervous at the start of the week. But as the table below highlights, we see odds favor a rally.

- Moreover, many clients tell us they are preparing to short any FOMC induced rally, given the extended nature of market technicals and the fact that S&P 500 valuations are rich.

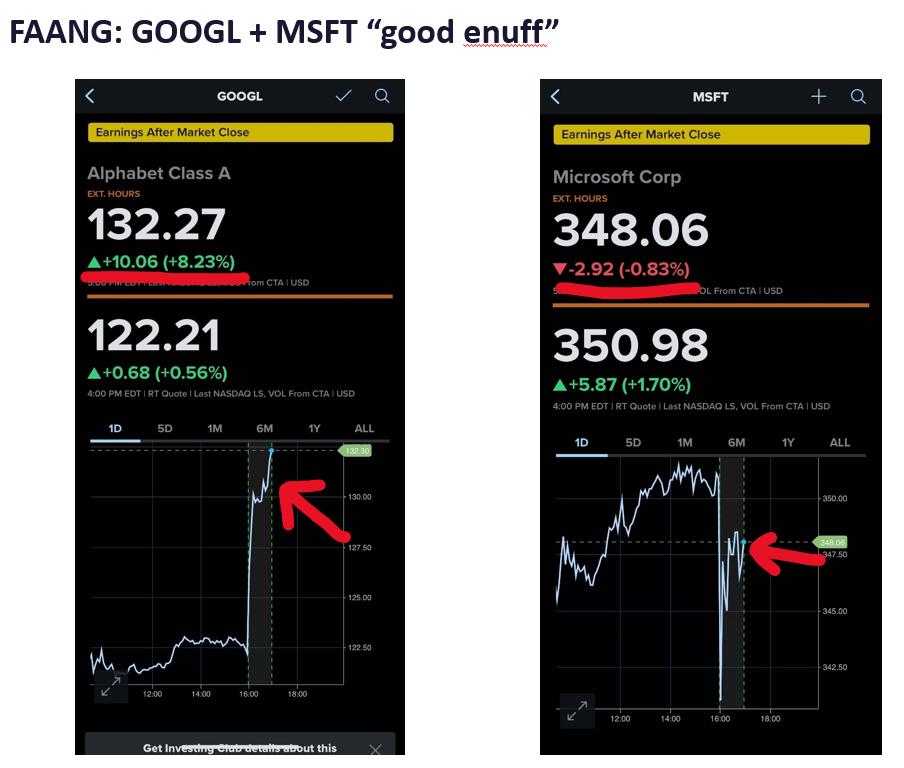

- Additionally, GOOGL 1.14% and MSFT -0.23% reports were good enough

We hope for the best Wed. But our thesis for the second half of 2023 remains constructive. And we see any pullback as shallow.

This is what could trigger markets either way.

This is the market reaction to the last 12 FOMC meetings.

Google and Microsoft good enough results to keep FAANG strong.

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame- 7/26 2pm ET July FOMC rates decision

- 7/28 8:30am ET June PCE

- 7/28 10am ET July Final U Mich 1-yr inflation

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

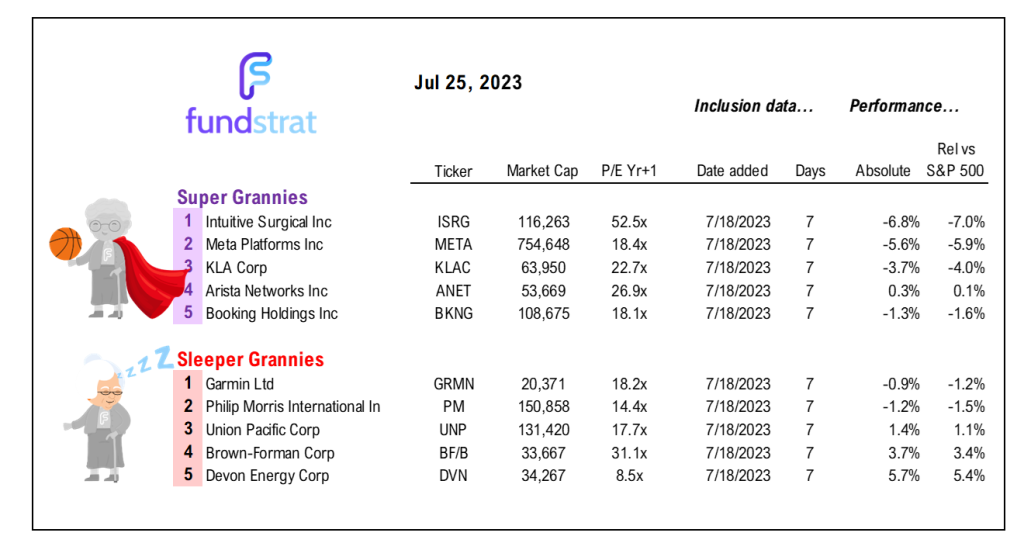

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday