INTRADAY ALERT: June jobs (NFP) soft on headline, somewhat strong on wages. But strangely wage gains in manufacturing, while services wages SLOWED to 0.30% from +0.36% = overall good. Overall, good enough to keep buying the dip ahead of June CPI.

NEW: Section (above) added identifying Key Recommendations and Super Grannies

The June jobs report was released today and overall paints a softer picture for the jobs market compared to the “hot” ADP June jobs report released the day before (7/6). Yesterday, there was a sharp reaction in the bond and volatility markets to the ADP report, leading to higher yields and a spike in VIX. While the details in this employment report are not entirely soft, we think the overall message from this particular employment report is a softening labor market. And this means, this should diminish whatever future path is ahead for Fed hikes.

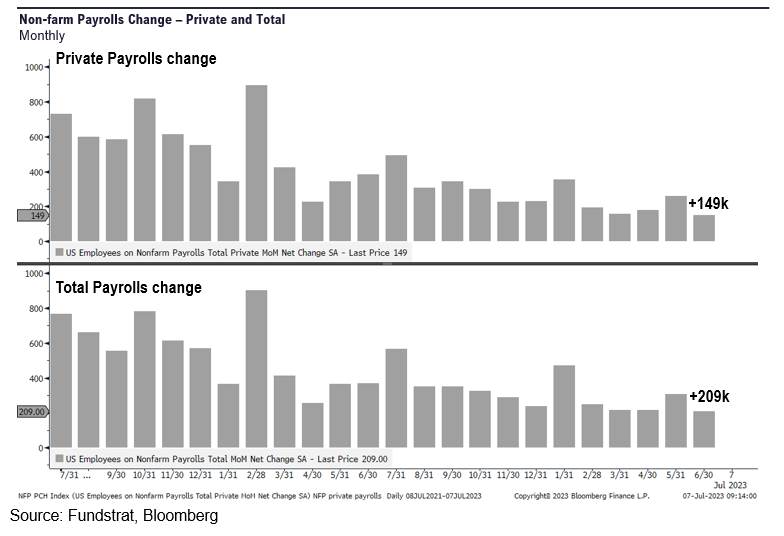

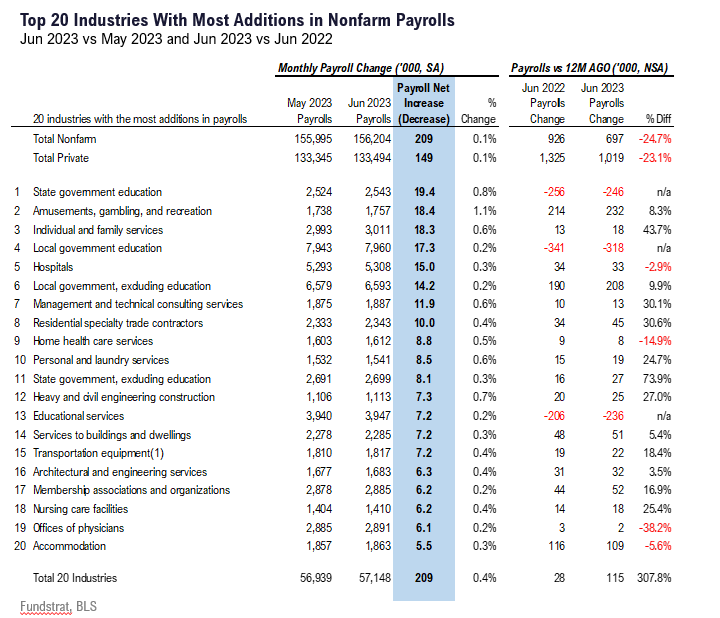

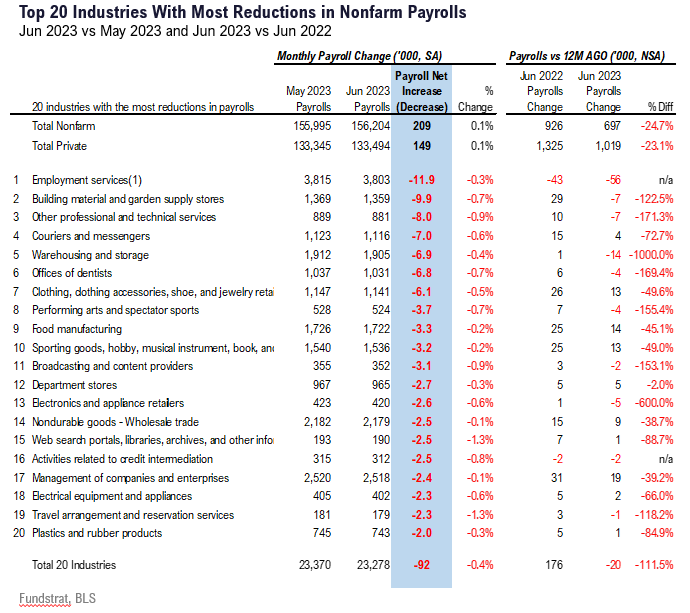

- The headline jobs figures of +209k is a miss vs consensus of +230k and a revised +306k last month. And private payrolls, ex-govt, was only +149k, a significant drop from +259k from last month.

- Tellingly, employment services (temp staffing) led the declines in employment -12k and to me, a sign that the labor market is softening since temp staffing is also falling. Other areas of declining jobs was a mix of building materials, couriers, warehouses, etc. Gains were in amusement parks, family services, hospitals, government, laundry. I don’t know, it doesn’t really scream booming services sector economy.

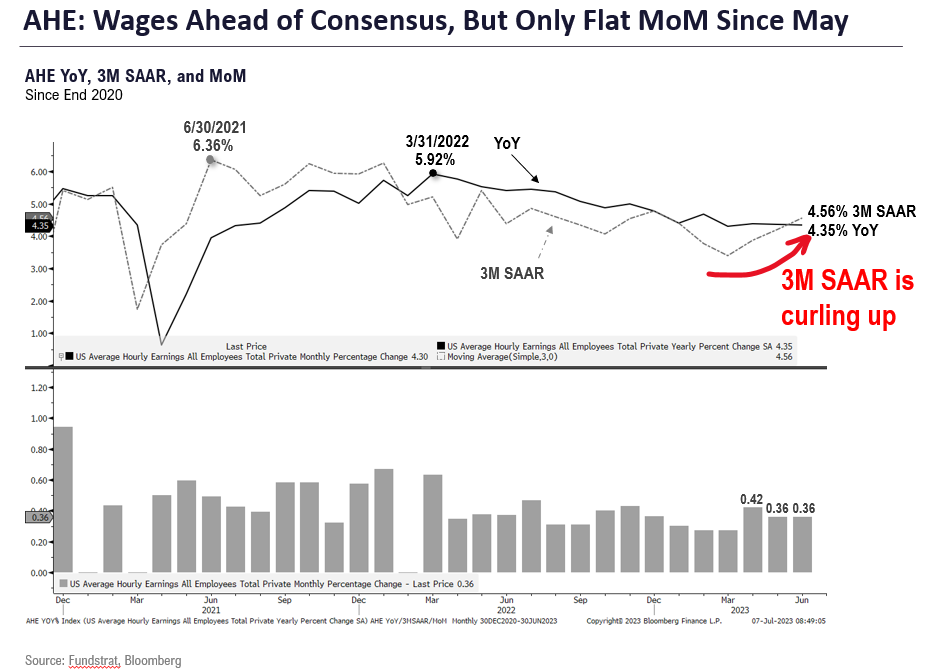

- But average hourly earnings (AHE) was a tad strong at +0.4% vs Street +0.3% and a revised +0.4% last month. This means wage growth was stronger and AHE 3M annualized is now +4.56% which is above the YoY % growth of 4.35%.

– this rise in AHE is going to be what gets investors nervous

– wage growth is what feeds into inflation

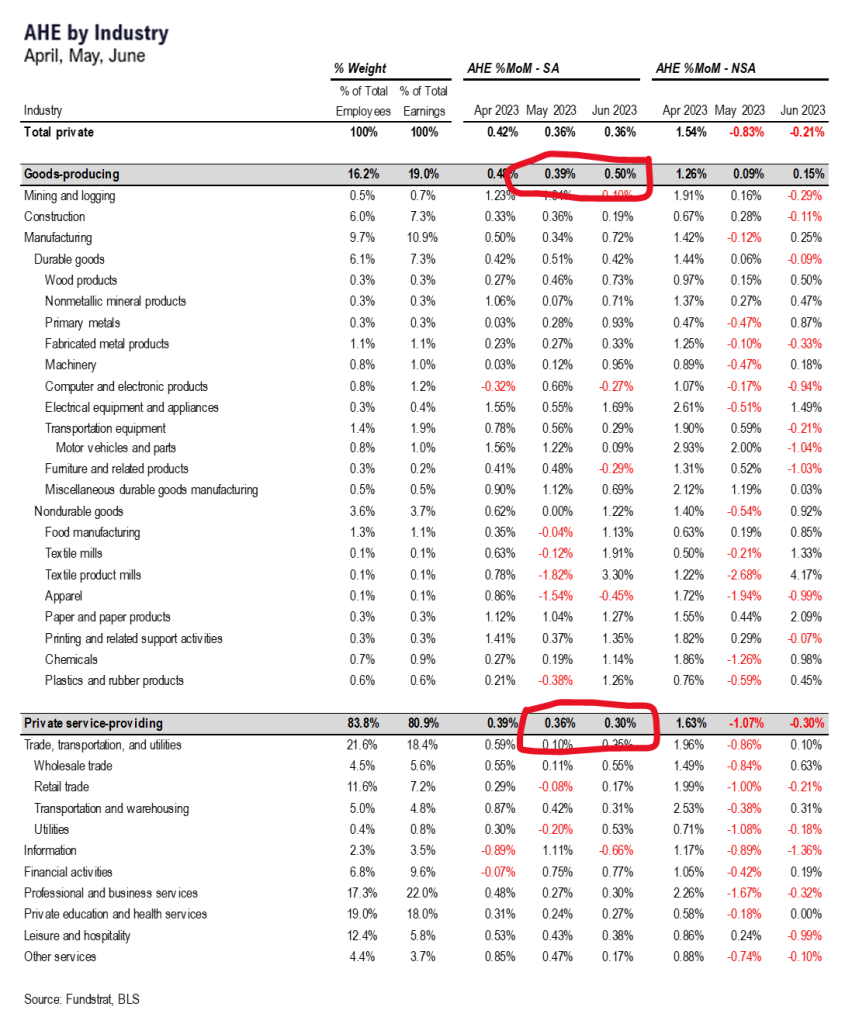

– so the jobs added was soft, but this wage growth feels somewhat strong - Looking at the report, the gains in wages came from manufacturing, while services industries saw slowing wage growth. This is a big deal. We think the AHE growth is in fact, not wage inflationary from the Fed lens:

– Manufacturing (aka Goods Producing) June +0.50% May +0.39%

– Services June +0.30% May +0.36%

– Services wages SLOWED to 3.6% annualized - See the point? The wage growth in services slowed sharply. The Fed has been focused on services inflation and the growth in wages in services. That is actually slowing.

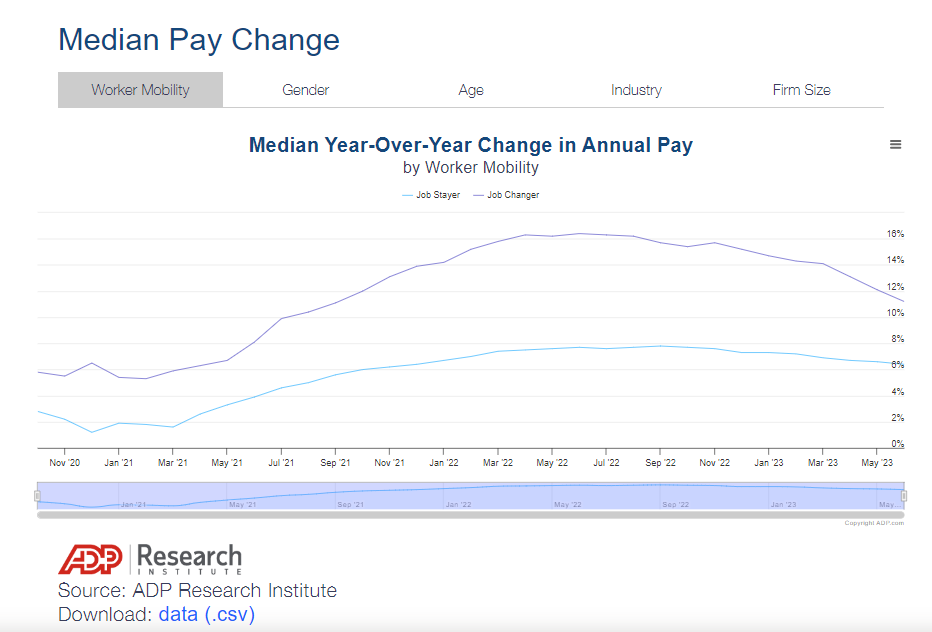

- Additionally, this AHE figure also stands in contrast to the message of wage growth seen in the ADP report yesterday. The payroll provider noted that across all segments and all job types, wage pressures are easing. Arguably, ADP wage data is far more reliable than their estimate for jobs gains.

– ADP processes payrolls for 25 million Americans

– so they have insights on wage trends - On a high level, this is a reminder that ADP employment report does not sync up with the BLS official jobs report. And the volatile market reaction yesterday was not necessarily warranted. To compare:

– ADP June jobs +497,000

– BLS June jobs report +209,000

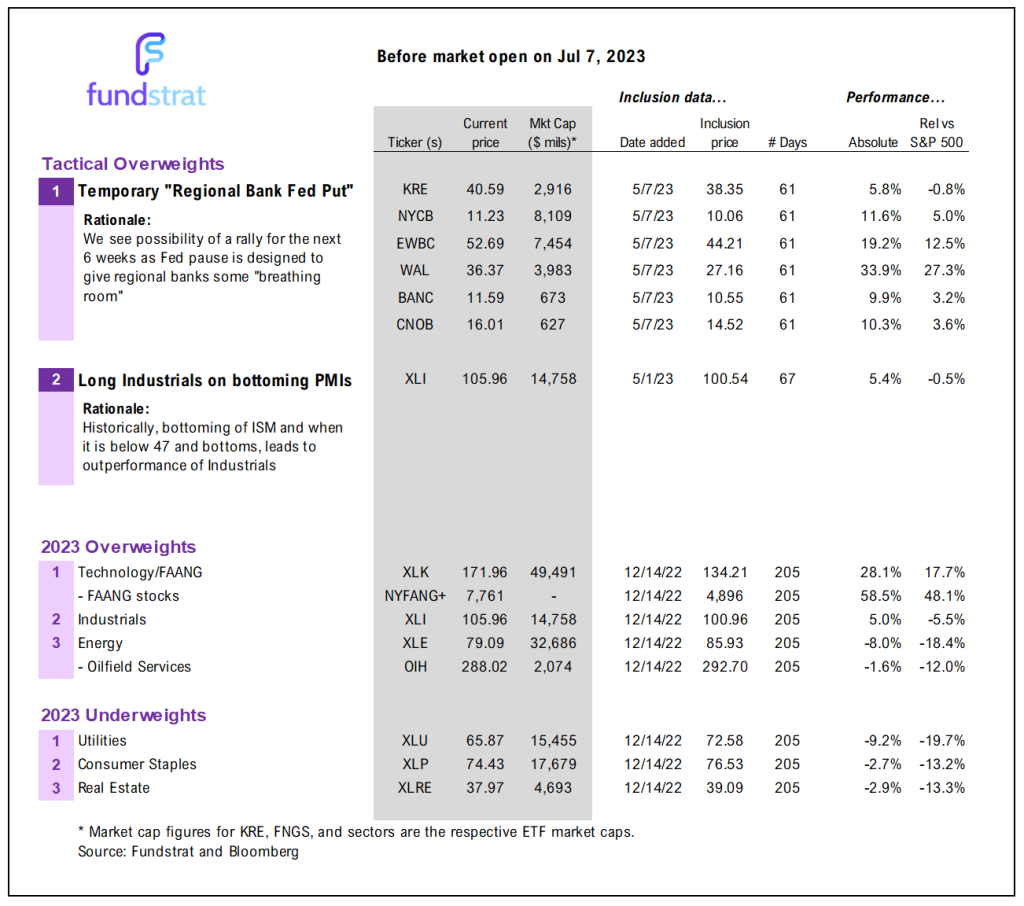

– but we see more signal in their wage conclusions for the reasons noted above. - Fed funds futures see a somewhat diminished probability of a Fed hike in Nov but higher for July. Overall, this jobs report does not really change the path of future hikes. But we think the CPI report next week (7/12) will be far more influential.

– Fed hike odds July 91% vs 88% yesterday

– Fed hike odds Nov 27% vs 30% yesterday

BOTTOM LINE: We are buying the dips, as we think the main event is the June CPI report, and ADP caused an over-reaction

Bottom line. We think the markets excessively wobbled yesterday on the heels of the ADP report. The headline figure from ADP was off vs actual jobs report. And the ADP wage story, more reliable, paints a picture of softening wage growth.

- While markets might be initially weak on this headline, we know this is because many investors are positioned cautiously. Thus, they want to point to this headline as a reason to deem the rise in markets are merely a “bear market rally” and Fed will soon come out “swinging.”

- The key, in our view, is the wage gains are manufacturing not services. Services wage pressures are easing. That is key for Fed too

- We expect good news next week on June CPI. We are still dip buyers and view this early weakness (and the dip yesterday) as buying opportunities.

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In c7f9e8-f2e40d-4051ff-4fc7d7-20be89

Already have an account? Sign In c7f9e8-f2e40d-4051ff-4fc7d7-20be89