Setup for stocks favorable for April... inflation cooling = aiding dovish Fed. Rule of 1st 5 days implies S&P 500 >4,275 by end of April.

At the start of 2023, Street consensus was bearish on equities, both sellside and investors. We have written about the unusual bearishness of Street in 2023, so we will not cover this ground again. But as we noted in our 2023 Outlook (early Dec), we wrote how probabilities favored S&P 500 gaining >20% (>4,750 by YE) with multiple factors driving this view.

- at start of April, S&P 500 up +7%, the strongest start since 2019

- S&P 500 posted two consecutive quarterly gains, which has NEVER happened in a bear market (since 1950), meaning 1Q23 gains validate a bull market started on Oct 12, 2022. S&P 500 has been rising for 6 months and investors are more bearish now than they were in October 2022.

- Bears are increasingly trapped as fundamental catalysts for stocks to decline have passed and equities have shown impressive resilience. The negative catalysts were:

– inflation was supposed to accelerate in 2023, but it is now cooling sharply

– EPS estimates were supposed to tank, but have been leveling off

– regional banking crisis was supposed to tank economy, but it is leveling off too

– Fed was supposed to become more “hawkish” but instead made a “dovish” hike

– long-term yields were supposed to soar, but have fallen consistently since Feb - In other words, bearish catalysts have come and gone and S&P 500 is up +7% YTD.

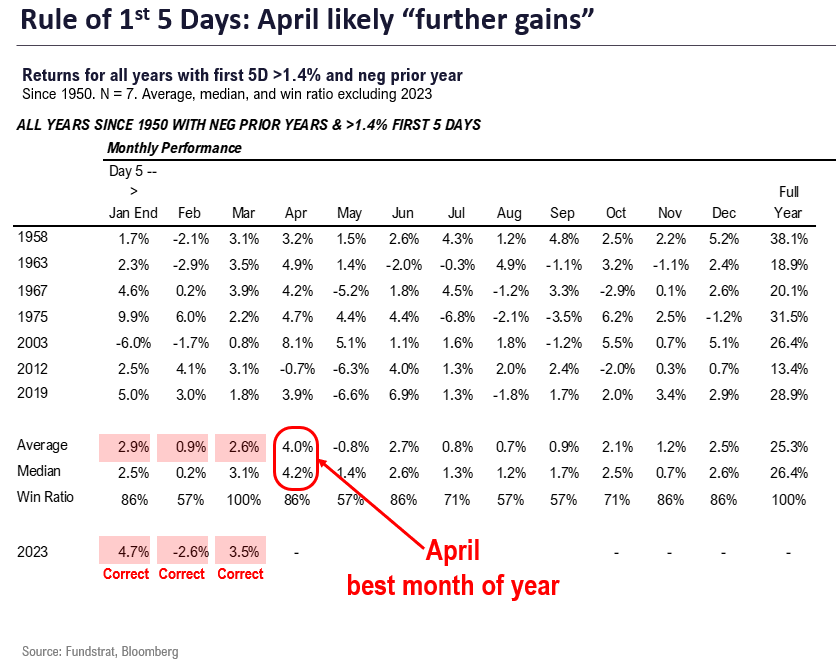

- What about April? We expect April to be the strongest month in 2023, mainly relying on the implied gains using our “Rule of 1st 5 days.” The Rule of 1st 5 days looks at years when S&P 500 gains >1.4% in 1st 5 days and is negative the prior year. This has happened 7 times since 1950: 1958, 1963, 1967, 1975, 2003, 2012 and 2019.

- Based upon those 7 years, April implied gain is +4.2% and was positive 6 of 7 times (only 2012, -0.7%). This mplies +175 points, or S&P 500 >4,275 by the end of April.

Is S&P 500 exceeding 4,275 consistent with investor positioning today? Nope.

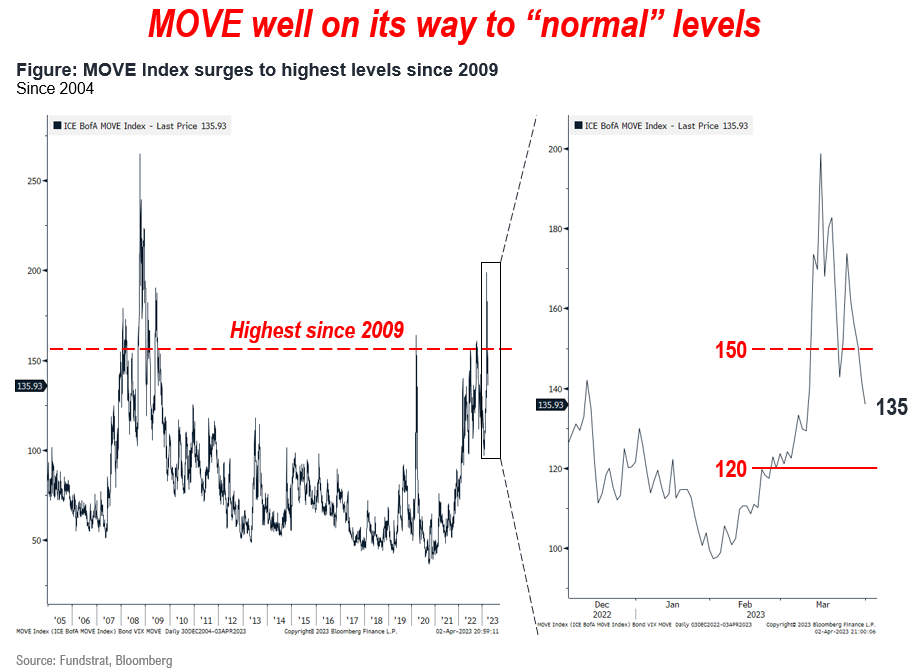

BONDS: MOVE Index finally breaking lower

As we have mentioned in multiple reports over past few weeks, we think there are 4 (more, but these are important) metrics to track the progress of this regional bank crisis. These 4 are:

- First Republic (FRC) comes to a resolution STILL FESTERING

- MOVE Index (bond volatility) below 150 (135 now) and hopefully settles below 125 DONE

- VIX Index falls below 20 DONE

- Regional bank deposits stabilize (Tables 9 and 10 of Fed’s H8). DONE

As the above shows, 3 of 4 things have recovered to levels suggesting the crisis could be ebbing.

ECONOMIC CALENDAR: Key is inflation, but data reported in March leaned to “softer” inflation

The key incoming data reported in March (Feb data) was overall dovish as it showed softer inflation.

Key incoming data starting March 19

3/7 10 am ET Powell testifies SenateHawkish3/8 10am ET Powell testifies HouseNeutral3/8 10am ET JOLTS Job Openings (Jan)Semi-strong3/8 2pm ET Fed releases Beige BookSoft3/10 8:30am ET Feb employment reportSoft3/13 Feb NY Fed survey inflation exp.Soft3/14 6am ET NFIB Feb small biz surveySoft

3/14 8:30am ET CPI FebTame3/15 8:30am ET PPI FebTame3/17 10am ET U. Mich. March prelim 1-yr inflationBIG DROP3/22 2pm ET March FOMC rate decisionDOVISH3/31 8:30am ET Core PCE deflator FebTame3/31 10am ET U Mich. March final 1-yr inflationTame

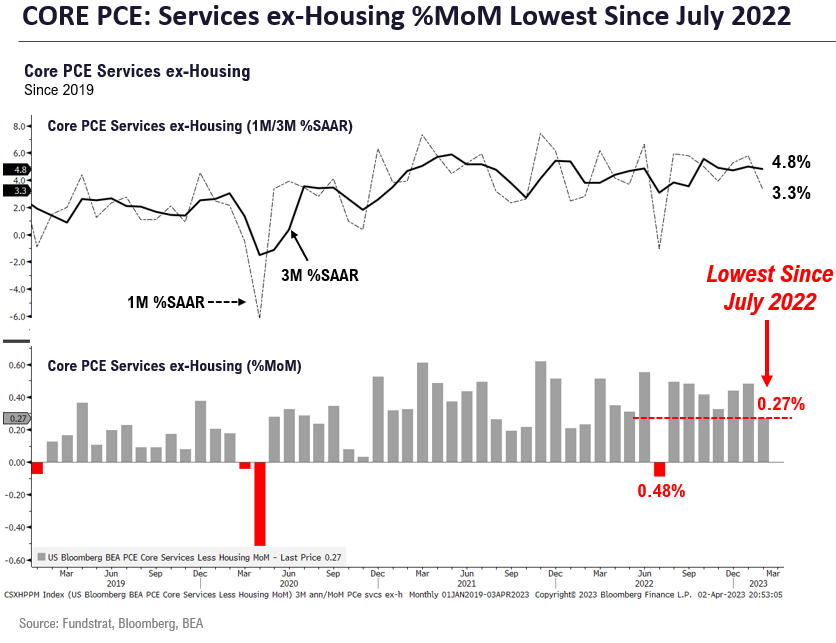

Feb PCE deflator (personal consumption expenditures) was reported Friday and this showed solid progress on inflation. Most notably:

- “super core” or core services ex-housing was only up +0.27%,

- this is the slowest since July 2022

- and is an annualized rate of 3.3% (4.8% 3M annualized)

- the trend is visibly improving for this core services ex-housing, which is the particular focus of the Fed at the moment

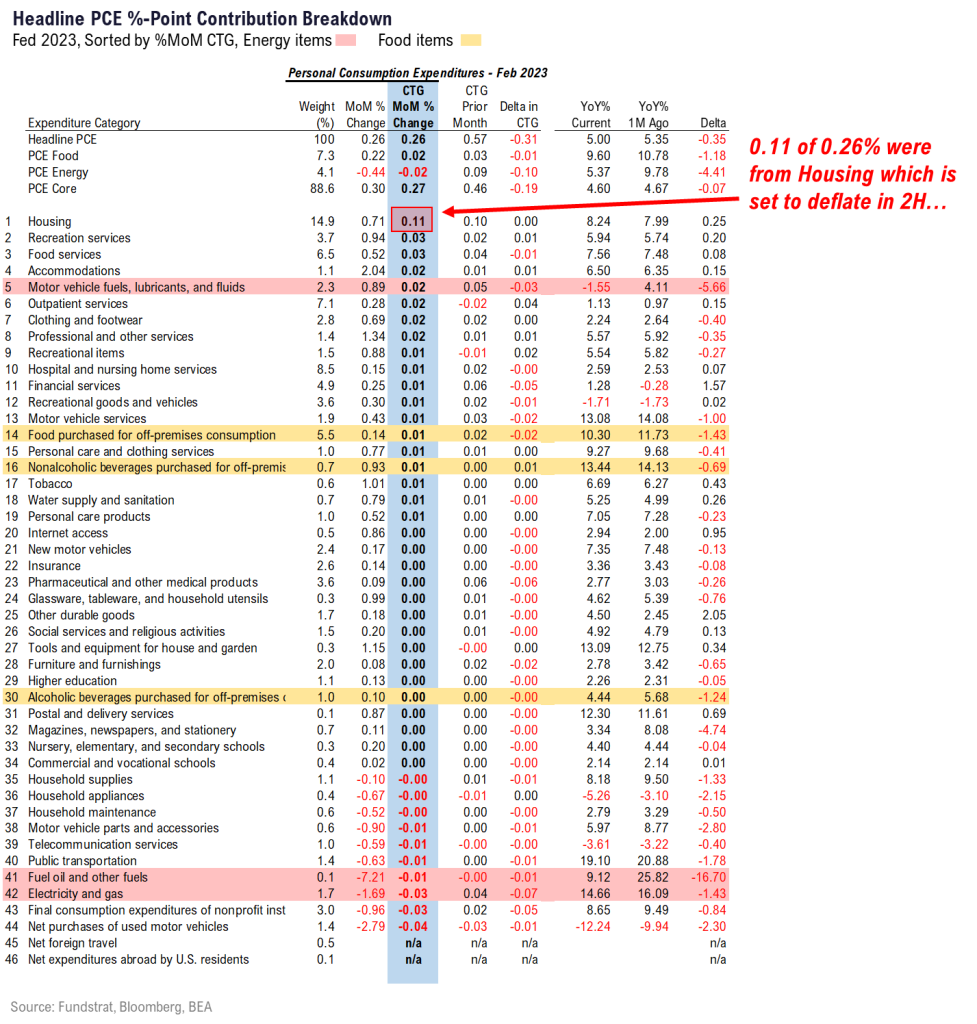

And as the data below shows, housing remains the largest contributor to PCE (personal consumption expenditures) inflation is housing. This accounted for 40% of the rise and as we noted in prior comments, this is expected to cool sharply in coming months. This is a reason we believe the incoming data supports the “dovish” March hike by Fed. Incoming inflation is cooling, making the Fed’s job easier.

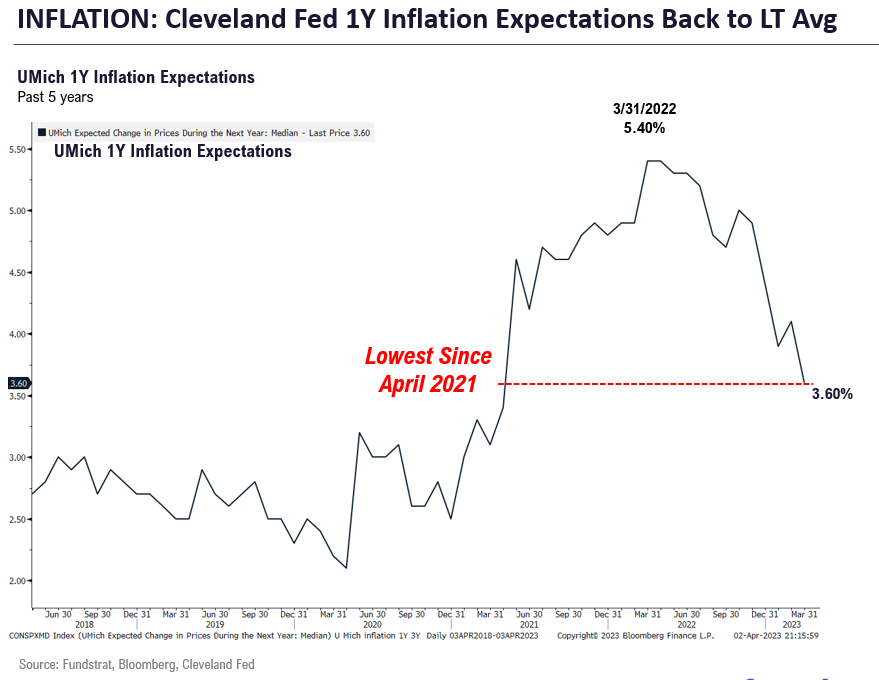

U Mich consumer inflation expectations fell again and now sits at 3.6% (year ahead), the lowest reading since April 2021. This is a sign how far inflation expectations for households have fallen. In fact, this now sits >200bp below official CPI. So, doesn’t this suggest CPI itself might be statistically lagged?

And the key data to watch in April is below. There is a lot of data this week:

- JOLTS matters

- Employment report matters

Never a dull moment.

Key incoming data April

- 4/3 10am ISM4/3 10am ISM Manufacturing Prices Paid March

- 4/4 10am ET JOLTS Job Openings (Feb)

- 4/7 8:30am ET March employment report

- 4/12 2pm ET Fed Minutes

- 4/12 8:30am ET CPI March

- 4/13 8:30am ET PPI March

- 4/14 7am ET: 1Q 2023 Earnings Season Begins

- 4/14 Atlanta Fed Wage Tracker

- 4/14 10am ET U. Mich. March prelim 1-yr inflation

- 4/19 2:30pm ET Fed releases Beige Book

- 4/28 8:30am ET PCE March

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 1/30. Full stock list here –> Click here

______________________________