Did the Haver "ransomware" attack inadvertently impact FOMC decision for "higher for longer"? Dec 2022 "dot plots"? Explains why 2-yr see fewer Fed hikes in 2023. Surge in Earnings Yield past year supports strong gains in 2023.

Did a “ransomware” attack at Haver Analytics impact the Fed’s December FOMC forecast? Quite possibly

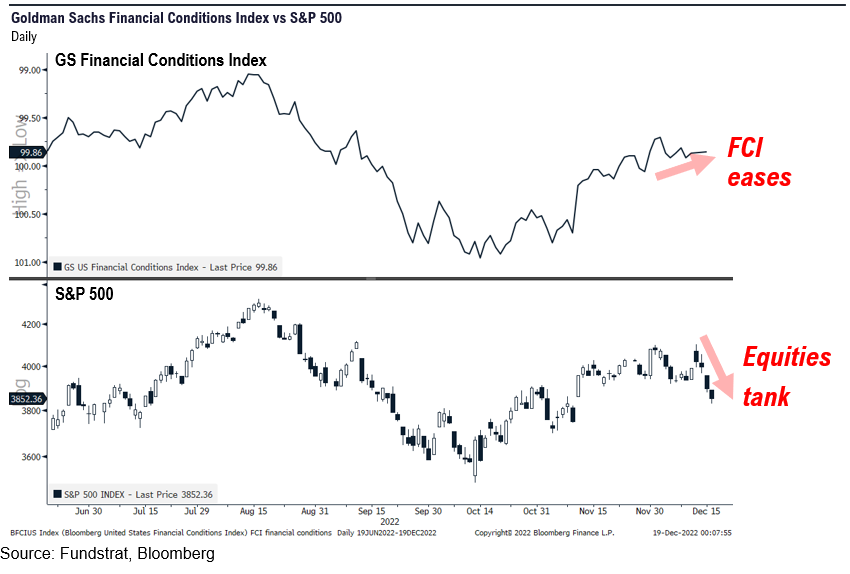

Equities sold off sharply in the days following the December FOMC. Investors told us they were disappointed:

- Despite visible progress on inflation (2 consecutive very soft inflation prints)

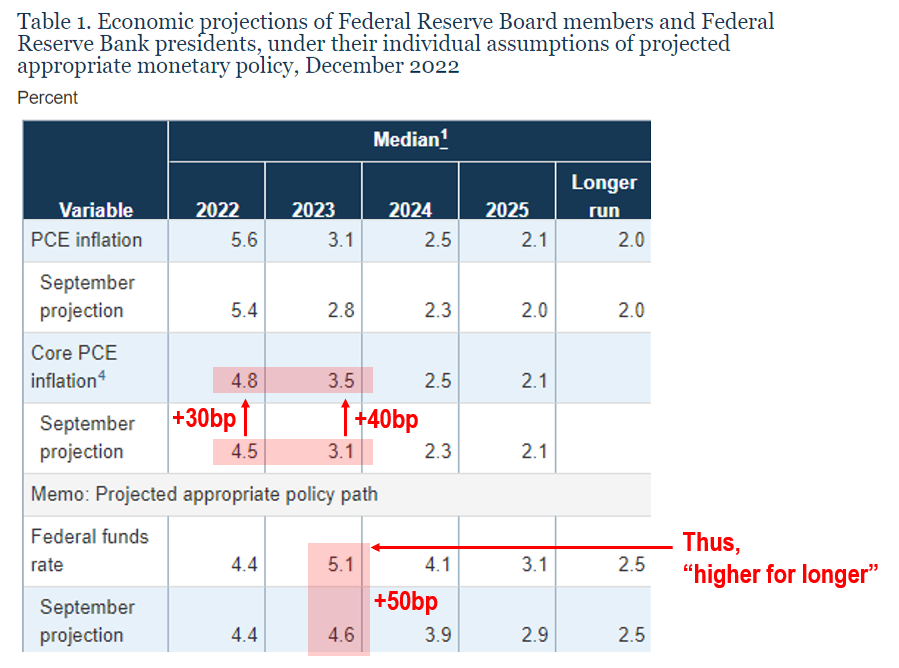

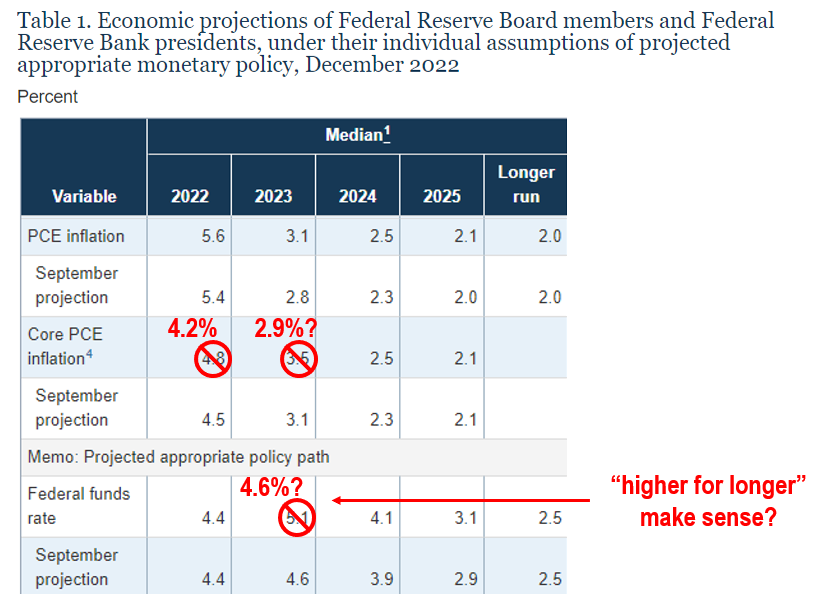

- Fed increased the inflation forecasts for 2022 and 2023 by +30bp and +40bp in their SEP (summary economic projections)

- And as a result, Fed decided to push for “higher for longer”

- In other words, despite better inflation trends, the Fed raised its inflation expectations

- Peculiarly, bond markets generally rallied as evidenced by the easing of financial conditions (FCI, see below)

- While equities went into a sharp downturn

Some investors say the Fed is shifting the inflation focus to wages which is the reason for this higher inflation forecast. But that doesn’t entirely make sense since CPI/PCE are the ultimate measure of inflation, not wages solely.

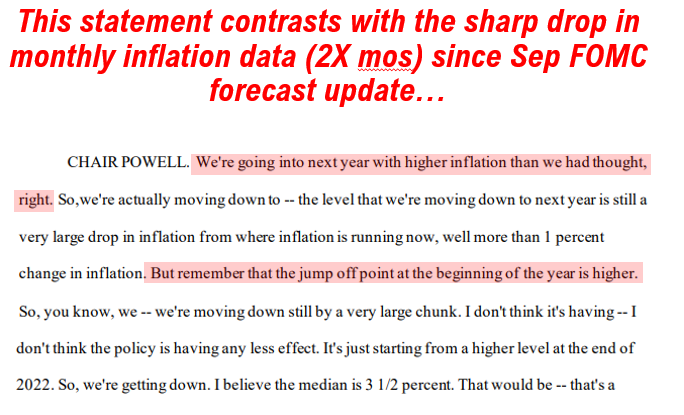

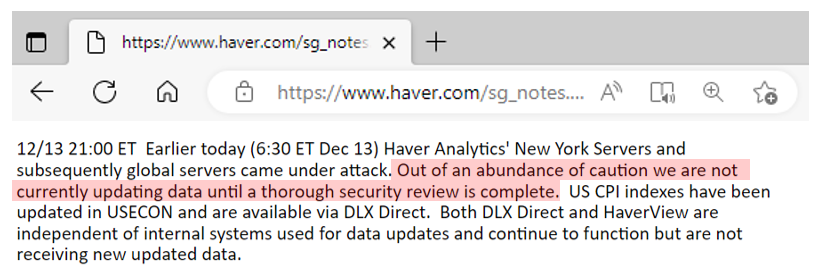

Fed made a statement that seems counter to the actual data between September SEP and December SEP

One of my most experienced and highly regarded macro clients (HA based in NYC) suggested that the Fed forecasts might have been impacted by the Haver Analytics ransomware attack. Why? Foremost, take a look at this answer given by Fed Chair Powell (in response to Victoria Guida of Politico).

- In regards to December inflation forecasts vs Sept inflation forecasts, Powell says “we’re going into next year with higher inflation than we had thought”

- “the jump-off point at the beginning of the year is higher”

- Powell is saying 2022 inflation is stronger than previously (Sept SEP) expected

- The SEP (Summary Economic Projections) indeed show this with 2022 Core PCE inflation now 4.8% as of December SEP vs 4.5% in September SEP, or +30bp higher

- But in actual trajectory (see below), 2022 Core PCE deflator is actually tracking to 4.2%, or -30bp BELOW what Fed SEP forecast

- YES. This is 60bp lower than the current FOMC SEP for 2022 inflation — 4.2% vs 4.8%

This is a lot to explain, so please understand there are a lot of tables in the explanation.

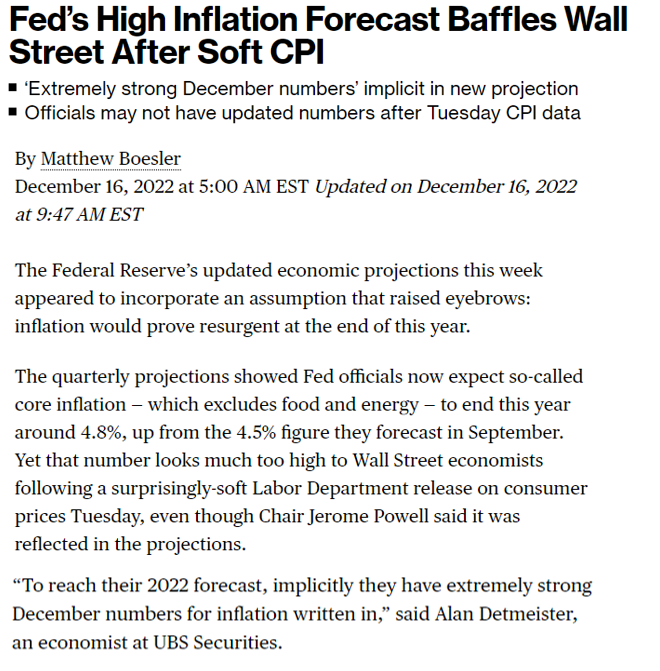

By the way, multiple economists noted this same peculiar surge in inflation.

- by the way, it is possible that November PCE could be horrifically bad (coming out 12/23)

- or it could also be the Fed SEP might have stale data due to a ransomware attack

- consider the analysis below

RANSOMWARE ATTACK: Haver Analytics has not been updating its database due to a security review

Haver Analytics is widely used by Wall Street to collect real-time economic data. We used Haver when I was at JPMorgan. At Fundstrat, we have three other data providers (not mentioned but we use 3).

- as shown below, Haver did not update data starting on 12/13

- that is the day November CPI was released

- thus, any firm using Haver data would not get the November CPI

- this is a critical data point that feeds into a forecast

DEC SEP: 2022 Core PCE inflation (deflator) raised by +30bp high and therefore 2023 raised by +40b

Recall, Powell above said 2022 inflation is higher than expected. This is reflected in the Dec SEP showing:

- 2022 Core PCE inflation now 4.8% which is +30bp higher than 4.5% in Sept SEP

- this, in our view, justified the +50bp rise in 2023 Fed Funds forecast

- the “higher for longer”

But higher 2022 Core PCE inflation mathematically makes no sense…

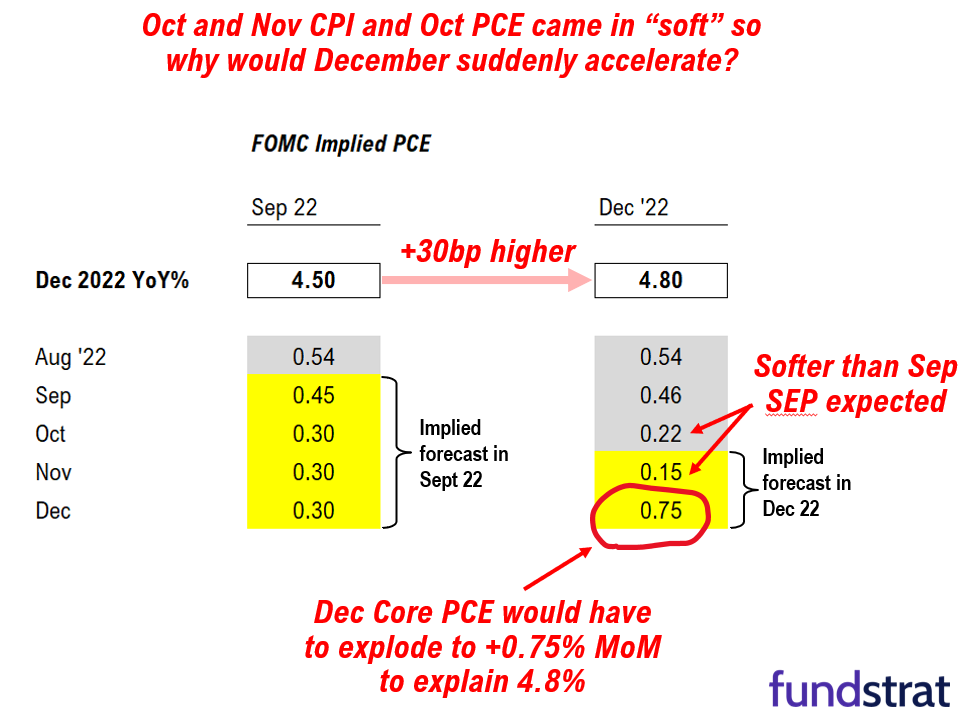

This math doesn’t make sense:

- in Sep SEP, to get to 4.5% inflation for 2022, FOMC implied +0.30bp monthly (see below)

- but Oct and Nov inflation are sharply below this level at +0.22% and +0.15% (if similar to CPI)

- but to get to 4.8% 2022 Core PCE inflation, December Core PCE has to be +0.75%, a massive jump

- Do you see what we are saying?

- The Fed’s 2022 Core PCE inflation forecast of 4.8% just seems way too high

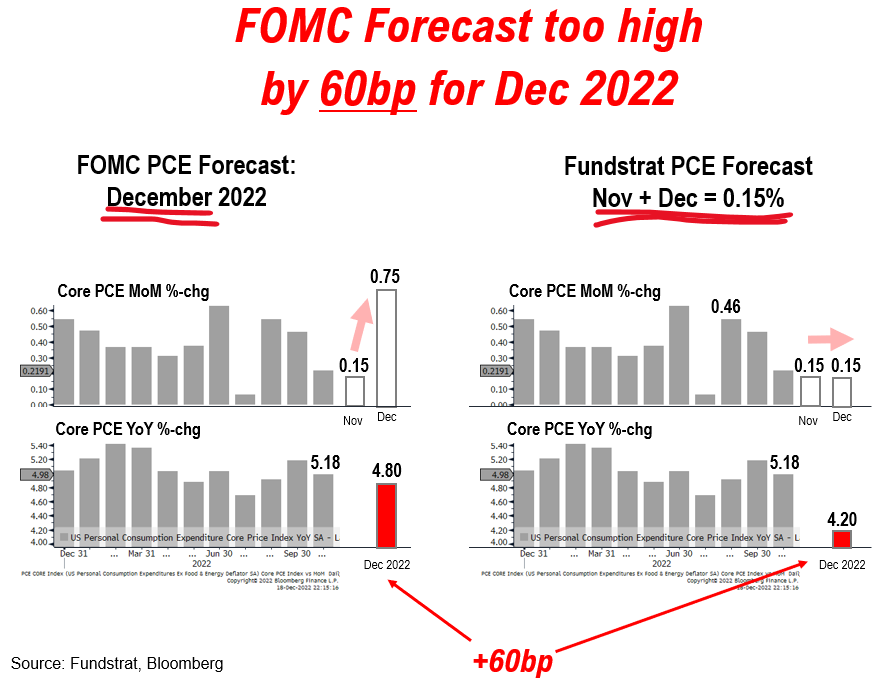

A more reasonable 2022 Core PCE inflation is likely 4.2%, or -30bp below what Sep SEP forecast

Take a look at the PCE Inflation comparison below:

- Left is the new FOMC 2022 inflation forecast of 4.8%, December Core PCE inflation needs to explode to +0.75%

- Right shows that 2022 Core PCE inflation likely to be 4.2% is Dec Core PCE inflation comes in at 0.15%

- That is -60bp below FOMC Dec SEP and -30bp lower than FOMC Sep SEP

- See what we mean?

- Why did Fed raise its 2022 inflation forecast which is the “jump-off” point for their future forecasts

PCE inflation has been -0.06% lower monthly than Core CPI… so, unlikely Fed got a “sneak” peek at a massive Nov Core PCE inflation number

Some clients might wonder if the Fed knows the Nov Core PCE (coming 12/23) might be a massive negative surprise (higher than expected):

- but since 2020, core PCE has average -0.06% monthly below Core CPI

- see the histogram on the lower chart

- Only 1 month in 2022 was Core PCE inflation higher than CPI

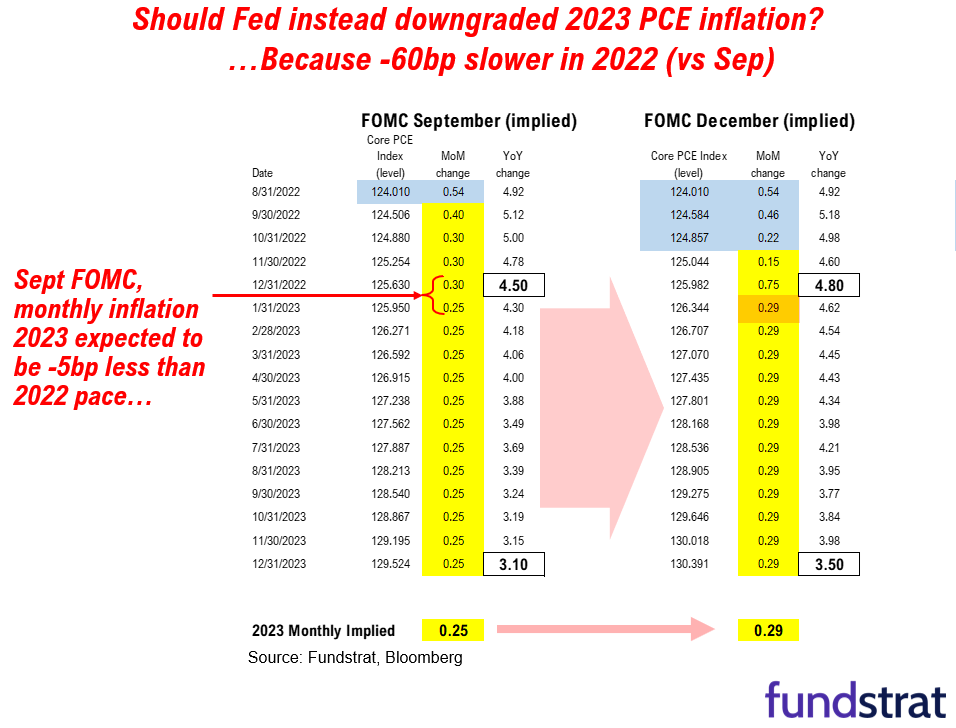

2023 Implied monthly PCE inflation actually increased, even as 2022 inflation tracking lower

As you can see below:

- Fed originally forecasted 2023 monthly inflation to be 5bp lower vs 2022

- But now has monthly inflation at 0.29% monthly

- This is 50% higher than the run-rate in the past few months, a surge coming in the Fed forecast

TAKEAWAY: Did Fed potentially get misled by the Haver attack? If so, did “higher for longer” make sense?

The Fed might have decided for “higher for longer” for reasons other than inflation forecasts:

- but this seems to be harder to understand

- if the core PCE inflation is tracking lower in 2022 than forecast

- the “jump-off” point is lower for 2023

- and if inflation run-rate is static with last 3 months, 2023 core PCE inflation would be 2.9%

- this is LOWER than forecast in Sept SEP

- Thus, should the Fed have maintained the 2023 Fed funds projection at 4.6%, not raise it 50bp?

We will not know the answer until the Jan 2023 FOMC (1/31-2/1)

But the 2-year yield says Fed will do fewer hikes than Dec SEP projects. As shown below, the 2-yr is below current Fed funds.

- and more than 60bp (2.5 hikes) below Fed “dot plot”

STRATEGY: Earnings yield (inverse of P/E) surged ~2.5% in past year, a historic move and supports view equities can rally 20% in 2023

2022 has been a year of multiple crises, from inflation to Russia-Ukraine War to China zero-COVID to FTX fraud:

- so it is possible the Fed got “dad-gummed” by a ransonware attack?

- yes

- as bizarre as it sounds

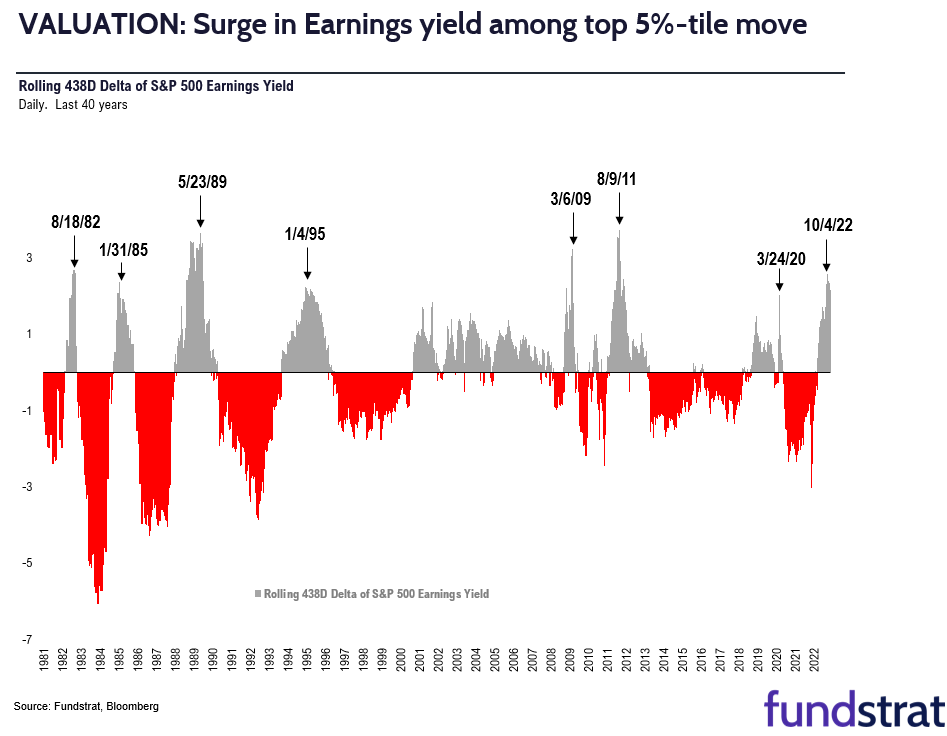

And this has contributed to a surge in the attractiveness of equity valuations. As one of our data scientists, Matt Cerminaro, points out:

- the 438 day change in earnings yield has exceeded 2.25%

- and this type of surge has not been that common in the past 40 years

- as shown below, this has happened at key times in equities

- August 82 (bottom)

- March 6, 2009 (bottom)

- March 24, 2020 (bottom)

- and other key times

- So it shows the level of decline seen in equity valuations in 2022

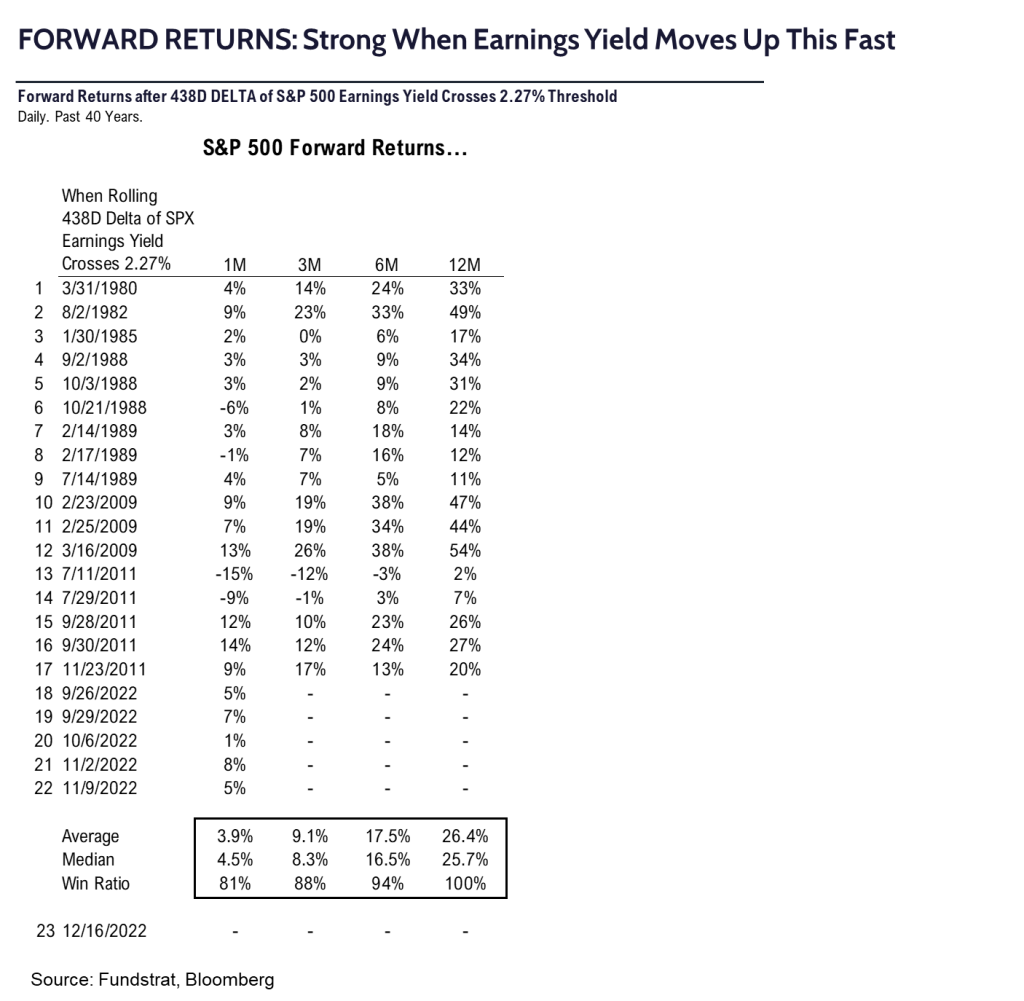

Forward returns tend to be quite solid as well.

- 12-month average return is ~26%

- 17 of 17 instances are positive 12-months later

- This lines up with our view that S&P 500 can rise 20% in 2023

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________