A daily market update from FS Insight — what you need to know ahead of opening bell

“You miss 100% of the shots you don’t take.” — Wayne Gretzky

Overnight

U.K. was in a technical recession in the second half of 2023. link

Japan’s top forecaster sees economy shrinking again this quarter. link

Argentina’s annual inflation rose to 254%. link

U.S. intel says Russia seeking nuclear weapons in space to destroy satellites. link

Morgan Stanley is laying off several hundred in wealth-management division. link

NYC files suit against social-media companies for mental-health effects on youths. link

Little known startup takes the AI weather-prediction crown. link

A U.S. company, Intuitive Machines, launched a moon lander from Florida, the first by a private firm. link

WhatsApp’s parent company Meta is cutting funding for fact-checking on the messaging app. link

First news

- No Chinese stocks, thanks

- Now-small tobacco has a lesson for for-now-big oil

- Monetization of football (the kind you play with your feet) is going global – with Africa leading the way, Brazil hoping to follow.

Charts of the Day

MARKET LEVELS

| Overnight |

| S&P Futures +5

point(s) (+0.1%

) overnight range: -7 to +12 point(s) |

| APAC |

| Nikkei +1.21%

Topix +0.28% China SHCOMP flat Hang Seng +0.41% Korea -0.25% Singapore +1.2% Australia +0.77% India +0.32% Taiwan +3.03% |

| Europe |

| Stoxx 50 +0.67%

Stoxx 600 +0.57% FTSE 100 -0.01% DAX +0.65% CAC 40 +0.73% Italy +0.8% IBEX -0.08% |

| FX |

| Dollar Index (DXY) -0.09%

to 104.63 EUR/USD +0.07% to 1.0735 GBP/USD -0.1% to 1.2553 USD/JPY -0.37% to 150.03 USD/CNY flat at 7.1936 USD/CNH -0.02% to 7.2227 USD/CHF -0.33% to 0.8831 USD/CAD -0.04% to 1.3539 AUD/USD +0.11% to 0.6498 |

| Crypto |

| BTC +1.11%

to 52348.83 ETH +0.71% to 2800.21 XRP +2.52% to 0.5534 Cardano +1.35% to 0.5861 Solana -0.22% to 116.89 Avalanche +2.79% to 43.29 Dogecoin -1.04% to 0.0858 Chainlink -1.25% to 20.13 |

| Commodities and Others |

| VIX -0.35%

to 14.33 WTI Crude -0.73% to 76.08 Brent Crude -0.67% to 81.05 Nat Gas +1.62% to 1.64 RBOB Gas -1.62% to 2.279 Heating Oil -0.91% to 2.784 Gold +0.24% to 1997.19 Silver +1.03% to 22.6 Copper +0.42% to 3.716 |

| US Treasuries |

| 1M -0.8bps

to 5.3494% 3M -1.4bps to 5.3641% 6M -1.1bps to 5.3081% 12M -1.1bps to 4.923% 2Y -1.4bps to 4.5634% 5Y -2.5bps to 4.2147% 7Y -2.6bps to 4.2379% 10Y -2.9bps to 4.2261% 20Y -3.7bps to 4.517% 30Y -3.3bps to 4.4019% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 0.1bps to -82.9

bps 10Y-2 Y Spread narrowed 1.5bps to -33.9 bps 30Y-10 Y Spread narrowed 0.3bps to 17.2 bps |

| Yesterday's Recap |

| SPX +0.96%

SPX Eq Wt +0.92% NASDAQ 100 +1.18% NASDAQ Comp +1.3% Russell Midcap +1.45% R2k +2.44% R1k Value +0.85% R1k Growth +1.21% R2k Value +2.11% R2k Growth +2.77% FANG+ +1.99% Semis +2.01% Software +1.98% Biotech +2.73% Regional Banks +1.86% SPX GICS1 Sorted: Indu +1.67% Comm Srvcs +1.42% Tech +1.1% Cons Disc +1.02% Fin +0.96% SPX +0.96% Healthcare +0.81% REITs +0.7% Materials +0.66% Utes +0.54% Energy -0.17% Cons Staples -0.19% |

| USD HY OaS |

| All Sectors +3.6bp

to 375bp All Sectors ex-Energy +3.5bp to 357bp Cons Disc +3.5bp to 312bp Indu +2.4bp to 283bp Tech +6.5bp to 456bp Comm Srvcs +4.4bp to 599bp Materials +5.5bp to 333bp Energy +2.2bp to 311bp Fin Snr +5.0bp to 353bp Fin Sub +3.2bp to 257bp Cons Staples +1.2bp to 309bp Healthcare -0.5bp to 445bp Utes +3.8bp to 226bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/15 | 8:30AM | Jan Import Price m/m | 0.0 | 0.0 |

| 2/15 | 8:30AM | Jan Retail Sales m/m | -0.2 | 0.6 |

| 2/15 | 10AM | Feb Homebuilder Sentiment | 46.0 | 44.0 |

| 2/15 | 4PM | Dec Net TIC Flows | n/a | 260.244 |

| 2/16 | 8:30AM | Jan PPI m/m | 0.1 | -0.2 |

| 2/16 | 8:30AM | Jan Core PPI m/m | 0.1 | -0.1 |

| 2/16 | 10AM | Feb P UMich 1yr Inf Exp | 2.9 | 2.9 |

| 2/16 | 10AM | Feb P UMich Sentiment | 80.0 | 79.0 |

| 2/21 | 2PM | Jan 31 FOMC Minutes | n/a | 0.0 |

MORNING INSIGHT

Good morning!

Today’s bounce shows 1Q24 “top” not yet in. Look for a sell-off on good news.

Our favorite sectors remain IWM 1.04% XLI 0.16% XLF -0.15% XLK 1.09% QQQ 1.55% and Bitcoin BTC.

TECHNICAL

Ralph Lauren (RL -0.27% ) is technically attractive on an intermediate-term basis following last week’s breakout of a very lengthy base. The key for technical targets normally involves the initial breakout of a lengthy base, combined with a study of the volume and acceleration which accompanied the breakout.

It’s worth pointing out that RL has been basing sideways since 2015, (nine years ago), so the high-volume breakout last week is impressive and should also put this stock on every investor’s radar.

In this case, the upside potential might be capped on a short-term basis, following a retest of all-time highs from May 2021 peaks near $193. However, at the current price, we still expect upside and feel that any decline to 150-160 would make this a very attractive technical risk reward. Bottom line: RL is an appealing stock for 2024 and is attractive to own on pullbacks, with minor upside expected in the weeks ahead, technically.

CRYPTO

The Starknet Foundation announced the Provisions (airdrop) allocations for the native token of its layer-2 ZK-rollup network, with about 1.3 million eligible wallets. The STRK token will be used for governance and to pay network fees, with later plans to enable staking within a proof-of-stake model. The total supply to be airdropped is 700 million STRK tokens, equivalent to 7% of the total supply. An additional 200 million tokens have been set aside for the Provisions plan, and the Starknet Foundation additionally plans to allocate 18% of the total supply to the community over time. The eligibility snapshot occurred in November, and the Starknet Foundation wanted to reward users who helped develop, test, and engage with the Starknet network. The largest allocation was to Starknet users, totaling 50.89% of the total distribution to over 500k eligible wallets. The second largest allocation was for ETH stakers who will receive 21.80%. The distribution will go live on February 20th, after which users will have four months to claim.

Taurus, a Swiss crypto custodian, has announced a strategic partnership with liquid staking protocol Lido to bring liquid staking access to financial institutions in Switzerland. Taurus is a highly regulated and leading digital infrastructure provider in Europe and Switzerland specifically. Over half of the Swiss banks who offer digital asset services rely on Taurus’ infrastructure. Due to increased client demand, Taurus has been working with Lido to provide its clients access to Ethereum liquid staking, allowing them to earn yield on their holdings while using stETH within DeFi. The strategic partnership serves as a bridge between traditional finance and DeFi, reducing barriers to entry and creating a new institutional on-ramp. It’s an encouraging development that we hope U.S. regulatory bodies take notice of.

FIRST NEWS

Nixing China. The Year of the Dragon may be ascendant, but it seems as if an era of the China bear has descended upon markets. As pessimism toward the world’s second-largest economy snowballs, Wall Street is going to great lengths to not be in Chinese equities. Desperate to avoid exposure to sliding Chinese markets, global money managers are using fresh investing tools at their disposal.

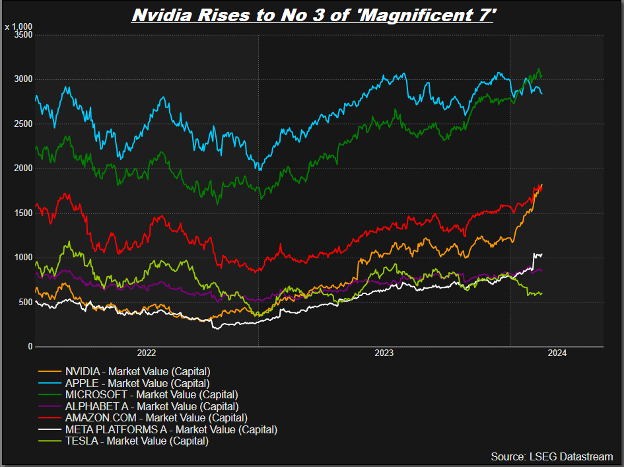

Just last week, U.S. financial-products provider Direxion launched a leveraged emerging market-focused exchange-traded fund that eschews allocations to Chinese equities entirely (or, to use industry parlance, an EM ETF ex-China). It comes as the latest Bank of America survey shows that going short Chinese stocks – which is the second-most crowded trade after being long the so-called Mag(nificent) Seven tech companies – is becoming ever-more popular. Bloomberg

Contemplating The End of Oil? Chew on Some Tobacco for Perspective. The U.S. is now the world’s largest oil producer, thanks to heavy drilling in New Mexico. Despite efforts to transition to clean energy, global demand for oil is expected to rise for at least another decade, and the companies that pump it seek to swim in as much of it as possible.

Allow us to refine that thought.

Unlike the frenzied drilling activity of the 2010s, which fueled the American energy boom yet merely drip-dropped profits, today companies are engaged in an arms race for operational scale and relevance with investors; homing in on efficiencies to make existing wells more profitable – lowering costs, returning cash, collecting data, and enlarging footprint while reducing emissions.

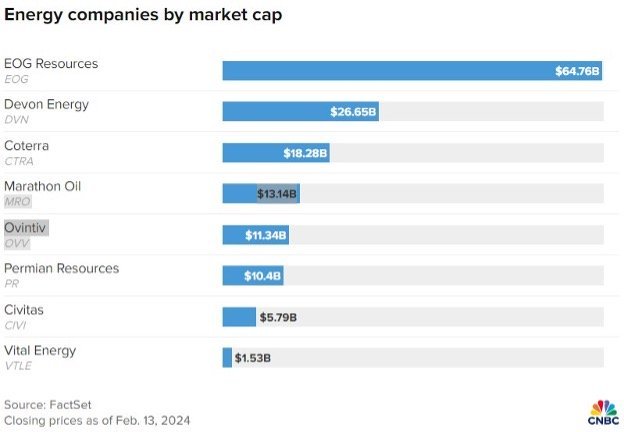

Similar dynamics are behind a spate of takeovers in the area, including Exxon buying Pioneer for ~$60 billion, Chesapeake buying Southwestern ($7.4 billion), and Occidental buying CrownRock ($12 billion), all announced in the past four months. The top six companies in the Permian Basin, the most prolific oil patch in the U.S., stretching from western Texas into southeastern New Mexico, are set to own 62% of the basin’s remaining oil reserves, per Rystad Energy.

The CEO of French giant TotalEnergies said this week that policymakers and climate protestors are naive to think oil demand will decline dramatically anytime soon and pledged that his company, the world’s fifth-largest energy firm, will keep investing in oil. As oil companies seek to maintain steady shareholder returns for as long as possible, the best way to do that is to have the biggest inventory footprint.

A comparison to stocks in another industry – tobacco – that has had to adjust to life with an expiration date, can be illustrative. By the early 2010s, investors knew cigarettes were fading but were unsure how quickly. Tobacco companies hunkered down, bulked up, and returned cash to investors. By 2020, Altria had returned $53 billion to shareholders in dividends and buybacks, more than the entire company was worth at the start of the decade, and had outperformed the S&P 500 while doing it. The idea is that the oil investor won’t necessarily mind if oil goes away in x years if they’ve gotten all their money back by then.

Despite broad global consensus, low-carbon technologies face serious challenges: an estimated $18 trillion investment shortfall, red tape, and waning political and investor support for corporate environmentalism, particularly as geopolitical turmoil makes energy security a priority. A realization that the energy transition might not be as plug-and-play as economists thought, and that oil and gas are going to be necessary for a while, is dawning on market participants.

There are two ways to prepare for the eventuality of clean energy replacing fossil fuels. One is to make major acquisitions in clean energy – the transform-the-business-to-safeguard-the-future approach, but buying a renewables company with sufficient scale to make a difference, even at current bargain prices – say, Ørsted, the offshore wind developer, whose shares are down 75% since 2021 – is not necessarily a good fit for an oil major, in terms of customer base, market cap, or balance sheet.

The other approach is to squeeze the remaining profits out of the oil business while placing smaller, in-house bets on renewables. That’s the wave of producer tie-ups we’re seeing now. Diamondback’s CEO is promising to wring $550 million out of the newly merged Diamondback-Endeavor, and investors seem to believe him: shares rose more than 11% over the last two days, which is unusual for any acquirer – especially one cutting its stock buybacks as part of the deal. Expect to see more footprint-expanding deals among producers with portfolios in the Permian and elsewhere. Semafor, CNBC

Football Is Rife with Opportunity. An effort to modernize the business side of Brazilian soccer seems to be attracting high-profile backers, including multi-club conglomerates, who view Brazil as a next frontier in the global sports industry. Also interested are Emirati royalty, who are using sports clubs the world over as vehicles for diversifying their hydrocarbon revenues and improving their reputation.

Making the Beautiful Game Pay

A lack of professional management has been blamed for a failure to realize the sport’s commercial potential in Brazil, and consequently the weak financial position of many of the country’s clubs. This has been exacerbated by the early departure of some of Brazil’s best players to European leagues, for greater pay and prestige. A study by the consultancy Convocados found total turnover in Brazil’s Serie A was about US$1.39B in 2022, which is well below the revenues earned by the top five European leagues.

In a bid to bolster income from broadcasting rights, there are proposals to use a 2021 law encouraging clubs to operate as businesses rather than hew to the traditional model of non-profit associations. The hope is that by creating a novel corporate structure that enjoys favorable tax rates, the legislation is opening the door to investors.

Brazil may well take a page from CAF, the Confederation of African Football, which will earn around $75 million in sponsorship revenue from this year’s AFCON. The Africa Cup of Nations 2023 was watched by some 2 billion people over the past month. Matches were aired in around 180 countries through deals with partner broadcasters including Sky, Canal+, beIN Sport, BBC and MultiChoice, as well as 45 Free To Air broadcasters. Some 6,000 journalists applied for media accreditation, double the number for the last AFCON in Cameroon in 2022.

CAF hired sports marketing powerhouse IMG to secure its global broadcast deals and corporate sponsorships. This year’s AFCON had 17 commercial partners, including 1xBet, Orange, Unilever, and title sponsor TotalEnergies, mentioned above. They’ve also made it easy for fans to watch AFCON anywhere in the world, and have leveraged social media, receiving boosts from major football accounts like UEFA Champions League posting about the tournament.

Ball of fire or fireball?

U.S. tech entrepreneur John Textor has agreed to a deal for Botafogo, former Brazilian soccer player Ronaldo Nazário acquired a controlling stake in his boyhood club Cruzeiro, and Miami-based investment firm 777 Partners took a majority stake in Vasco da Gama. Esporte Clube Bahia was bought by City Football Group. Some industry veterans believe Brazil’s new legal framework will provide an attractive infrastructure for investments, along with a mechanism for resolving heavy debt loads, yet past ventures into soccer by outsiders have rarely succeeded. Miami-based 777 Partners is one example of the pitfalls.

777 first made the news in November as the mystery investor binge-buying sports teams with cash from its captive insurance company. Now it’s no secret that Berkshire Hathaway uses Geico’s float to invest in outstanding businesses that multiply that float manyfold, but using policyholders’ money to buy, among other entities, a soccer team relegated to the French league’s third tier? Private-equity investors have played the insurance game before, and like many endeavors in today’s endlessly moneyballed, ruthlessly-ROI-optimized world, their actions have been scrutinized by academics. Research shows that new owners of insurers tend to shift policyholders’ funds out of stodgy investments (think government bonds) into riskier ones (think real estate). This may be a good thing, as prudish insurers can leave returns on the table out of an abundance of caution. Then again, surely a private-equity shop having its insurance arm invest in high-risk, illiquid deals so it could purge its books and book its fee is more the stuff of envelope-pushing hedge funds than of pencil-pushing insurers.

Income for life

In related news, annuities, which could see ~$700 billion in sales in the next two years, are powering the U.S. credit market rally, with the funds likely to be allocated to corporate and structured debt. An insurance product that individual consumers untutored in high finance use to help fund their retirements is selling at record levels, driving demand for corporate debt and commercial mortgage bonds. Last year, sales of annuities reached an all-time record high of $385 billion, per life-insurance trade group Limra – up 23% from the year before. The products have grown more attractive as rising interest rates translate into higher potential annual payouts from the products. FT, Semafor, Bloomberg, Semafor

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 356b74-87ca4b-8e23bf-8923f5-44a6a2

Already have an account? Sign In 356b74-87ca4b-8e23bf-8923f5-44a6a2