Our Views

- Despite the recent sell-off in equities, we believe the uptrend remains intact. While those bearish view stocks as in a downtrend, the uptrend is still intact. Admittedly, it has been a tough week, but we remain constructive on the market.

- The attempted capital raise by Silicon Valley Bank (SIVB) triggered massive second-order ripple effects, causing S&P 500 Financials to fall. The bank was trying to restore capital levels as losses from securities portfolios (higher rates) plus early-stage companies using cash (but raising little), ate into the company’s capital cushion.

- SIVB, the 16th largest bank in the US, is one of Tech industry’s largest lenders and media stories suggest VC and PE firms might be advising founders to move cash away from SIVB — essentially fueling a panic among Financials that continued right up until regulators shut it down.

- SIVB’s failure highlights the fact that banks collectively are sitting on sizable losses on loans due to the rise in interest rates. The FDIC reported that at the end of 2022, the total unrealized losses is $620 billion (vs ~$15b 2021), and if these banks had to liquidate their portfolios, would substantially deteriorate book value.

- But with investors and depositors rattled by the troubles at SIVB, financial conditions are tightening. This potentially reverses some of the hawkishness one would expect from the Fed, which is why March hike probabilities actually fell today to 1.557 hikes versus 1.8 hikes prior to SIVB. Basically, restricted lending by banks amplifies the impact of Fed hikes in place now, and would reduce the need for future hikes.

- Hence, while the NFP jobs report will be very important for the Fed, the SIVB-induced bank scare actually offsets the inflationary risks for the Fed to an extent. That is, even if Feb jobs is really strong, the continued second-order effects of the SIVB-issues will likely contribute to a tightening of financial conditions. This means the odds of the Fed having to accelerate its pace of hikes might be reduced.

- Overall, this has been a tough week and the turmoil in equity markets reflects this. But we remain in the view that equities are entering a positive eight-week period and expect stocks to end higher by the end of April.

- SPX should bottom out next week at support near 3850-60, or below at 3800.

- Treasury yields have rolled over sharply, and this move likely continues into April.

- Gold/Silver stocks look actionable as rates start to roll over.

- Mr. Market threw us an unexpected curveball with the shocking shuttering of SIVB this week. Many will be debating over the weekend and the weeks ahead if there will be contagion. Another important topic will be how does this impact the Fed’s ongoing inflation fight?

- Granted, I am not an expert on the inner workings of the banking system. With that being said, my initial take is there will likely be increased volatility in coming weeks, but the probability of contagion is not expected at this time.

- Although the Fed now has a more challenging debate regarding 25 or 50bps for their upcoming March FOMC meeting, the macro backdrop has not changed, and their hands are likely tied since there is still a good amount to work to be done to win the inflation fight. Thus, I remain in the Fed is higher for longer camp and now expect the terminal rate being 5.5-6.5%.

- I spent a good portion of my week doing my monthly deep dive analysis of earnings revisions at the single stock level, and there was a clear takeaway — WEAK WEAK WEAK. I am quite concerned, and my longstanding negative equity market view is only stronger now. Investors need to remain vigilant as risk remains high, and I continue to recommend higher than normal cash levels, defensive positioning with some secular growth, and staying alert for single stock opportunities.

My apologies for the delay in releasing my March Sector Allocation and Dunk List updates. I have been dealing with an unexpected personal issue, and my goal is to have all my regular reports completed next week. Thank you for your patience.

- The failure of Silicon Valley Bank, the 16th largest FDIC-insured bank in the US, due to duration mismatch issues and losses on low-yielding bonds has raised concerns about the banking system’s health, with banks sitting on $600 billion in unrealized losses.

- Counterintuitively, we do not see now as the time to sell. The recent decline in interest rates may indicate that the Federal Reserve is less likely to continue tightening monetary policy, which could be viewed positively for risk assets. The recent rebound of many cryptoassets from key technical levels, including Bitcoin, may suggest that investors see value at these levels and are interested in buying. Additionally, the reduction of incremental leverage added to the system since the beginning of the year could help mitigate the risks associated with excessive leverage in the market.

- The recent banking issues faced by SVB and Silvergate could be a significant long-term tailwind for digital assets like Bitcoin, as people may start to realize the benefits of decentralized rails in storing their capital without being beholden to the risk of bank losses. While the US financial system is comparatively sound, where it falls short, crypto excels.

- Core Strategy – The risk asymmetry in 1H is to the upside, and the ongoing calamity in the U.S. banking system will likely be resolved via orderly intervention. Rates rolling over will help to boost conditions for risk assets, and we expect the overarching disinflationary trend to continue with next week’s CPI. While we know that idiosyncratic contagion risks from the banking fallout remain present, we feel that the risk/reward here still favors being long but with increased relative exposure to the majors.

- President Biden has released his proposed budget for the 2024 fiscal year, and he is awaiting a counteroffer from House Republicans.

- Common ground will be difficult to find, but it must be found, given the need to raise the debt ceiling.

- Fed Chair Jay Powell’s semiannual testimony to Congress signaled hawkishness, but Powell made it clear that no decision had been made about rate hikes at the FOMC meeting on March 21/22.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell more than 4% this week to 3,861.59, and the Nasdaq finished at 11,138.89. Bitcoin shed 11% this week to finish at 19,943, falling below $20,000 for the first time since mid-January.

- Investors continue to be spooked by inflation, high yields, and Jerome Powell’s hawkish rhetoric.

- Silicon Valley Bank collapsed Friday in the second-biggest bank failure in U.S. history, sparking concerns about broader economic fallout.

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." Sir John Templeton

Good evening:

“How low can stocks go?”

That was the ominous headline in The Wall Street Journal 14 years ago this week as the Dow had fallen four straight weeks, while the S&P 500 was below 700 for the first time in 13 years (1996). At the time, few people not named Warren Buffett or Tom Lee were bullish on U.S. equities. Yet March 2009 turned out to be one of the best-ever times to buy quality stocks.

Today’s environment is no comparison to the Global Financial Crisis, but the consensus on Wall Street is that markets likely will re-test the fall 2022 lows. Investor confidence remains low. Not here. We bring a contrarian view, away from noise and confirmation bias, rooted in our research. Both Tom Lee and Mark Newton believe the recent pullback in stocks aligns with seasonal trends, and Jerome Powell’s hawkish rhetoric is nothing to weigh too heavily.

“A lot of people are debating the economy, and everybody seems confused as to 50 (bps) or 25 (bps), and it’s just back-and-forth banter,” Newton said. “Everyone has become an armchair economist. Even if you knew the data, you can’t correctly predict where things are going. It’s more useful to have an understanding of the stock market and where stocks are trending vs. trying to be an expert on where the economy is.”

Lee added that we’re on the verge of the best eight weeks of the year, and much of the hubbub around the Federal Reserve is noise. “You could never make an investment decision off their views because they always look at every data point and then start to think a recession or to crush it and now everybody takes their word like gospel, and I think it's made the stock market a lot more prone to panic.”

Newton said it’s important to remember that we’re still up almost 11% off the October lows and Technology is leading. The bigger pattern over the past four months outweighs any short-term pullback in the past month, Newton adds, and rates rolling over could strengthen the case for Technology. He likes semiconductors in particular.

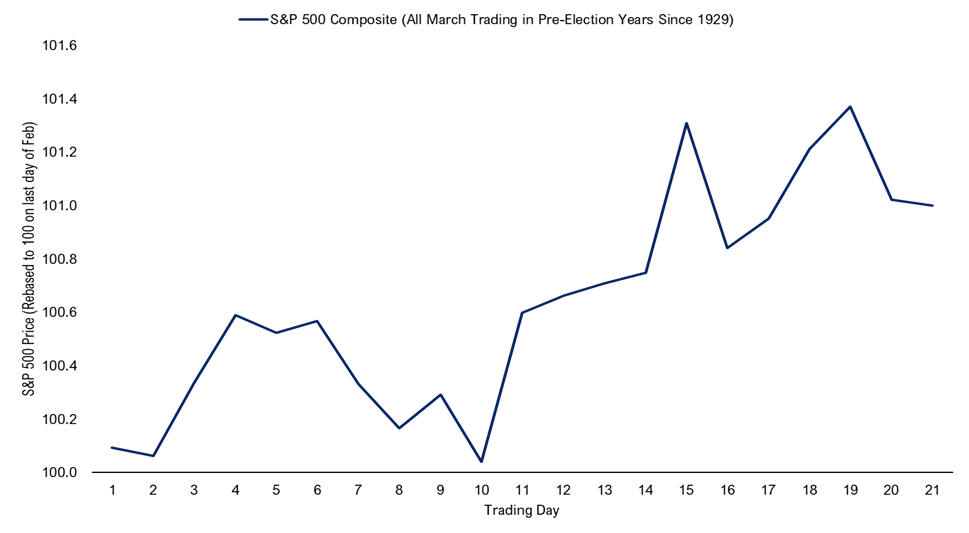

Newton also notes that stocks tend to bottom around the 10th trading day of March in a pre-election year. That is likely Tuesday or Wednesday next week.

“People have gotten dug in regards to talking about recessions and potential for economic weakness,” Newton said. “I don't disagree that eventually, these rate hikes will have an effect, I just don’t think it’s going to be this year.”

It was already a bad week for Financials before Silicon Valley Bank collapsed Friday. Newton had previously warned that the sector had violated the uptrend driving this group higher from the lows of October. After the SIVB news broke, Newton was firm in his assessment: “Financials will continue to lag and are to be avoided.”

Meanwhile, Apple (AAPL-0.41% ), roughly 7% of the S&P 500, was just upgraded by Goldman Sachs, and Newton says the stock looks good technically on heavy volume. This should bode well for the overall market given Apple’s size, and Newton expects it will coincide with a bounce upward starting in the middle of next week. “This is a great stock to own,” Newton said of Apple. “It’s always important to keep track of what the biggest components are of any index.”

For nearly a year now, Brian Rauscher, Head of Global Portfolio Strategy and Asset Allocation, has advised caution. He’s still warning that further downside risk lies ahead. He said this week that the remainder of the first half will be a challenging period for equity investors. “It is difficult based on my research to make the case for a sustainable and significant equity move higher,” Rauscher wrote this week. His bull case for the S&P 500 is trading roughly 4200-3950, and his base case is that we re-test the October 2022 low near 3500.

“Consequently, for me, that leaves either an equity trading range environment or unfinished business to the downside,” he added, “and with the 2-yr treasury and short-term yields near 5% risk-free, it sure looks like equities have some competition for investor funds.”

Rauscher added: “Strategic investors need to remain careful, cautious, and patient while being on full alert for potential opportunities that may present themselves during my expected challenging period.”

Elsewhere

U.S. employers added 311,000 jobs in February, another stronger-than-expected showing, but labor-force participation numbers crept up, suggesting more people are re-entering the workforce. This is believed to have helped nudge unemployment beyond expectations, to 3.6%

European Commission President Ursula von der Leyen met with President Biden at the White House on Friday, hoping to address EU complaints over green-energy subsidies in the Inflation Reduction Act that Biden signed into law in 2022. Negotiations are planned with Japan and the United Kingdom to address similar complaints about what U.S. allies believe unfairly benefits U.S. companies. Von der Leyen and Biden also discussed the war in Ukraine and China.

The House of Representatives voted unanimously to declassify intelligence on the origins COVID-19 pandemic. The unanimous House vote follows a unanimous Senate vote. The 18 agencies that make up the U.S. intelligence community are reportedly divided as to whether the pandemic originated from an infected animal or an accidental leak from the Wuhan Institute of Virology.

The worst drought in 60 years, along with midsummer frosts, could result in $20 billion in lost agricultural production in Argentina, a major producer of soybeans, beef, and corn.

The new High Seas Treaty will place 30% of the world’s oceans under international protection from fishing, shipping, and other commercial activities such as mining. The treaty, the result of 10 years of negotiations, aims to protect marine wildlife and acknowledges estimates that 10% of oceanic species are at risk of extinction. The treaty still requires ratification by individual countries.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 90.2 Prev.: 90.3

Est.: 5.5% Prev.: 5.6%

Prev.: -1.9% (revised)

Est.: 5.2% Prev.: 5.4%

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+8.47%

|

+1.55%

|

+104.40%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In f54990-373171-26b951-3148f0-a1404c

Already have an account? Sign In f54990-373171-26b951-3148f0-a1404c