Generational Factors to Drive Inflation? Throwaway Week Paves Way for Move Higher

Summary

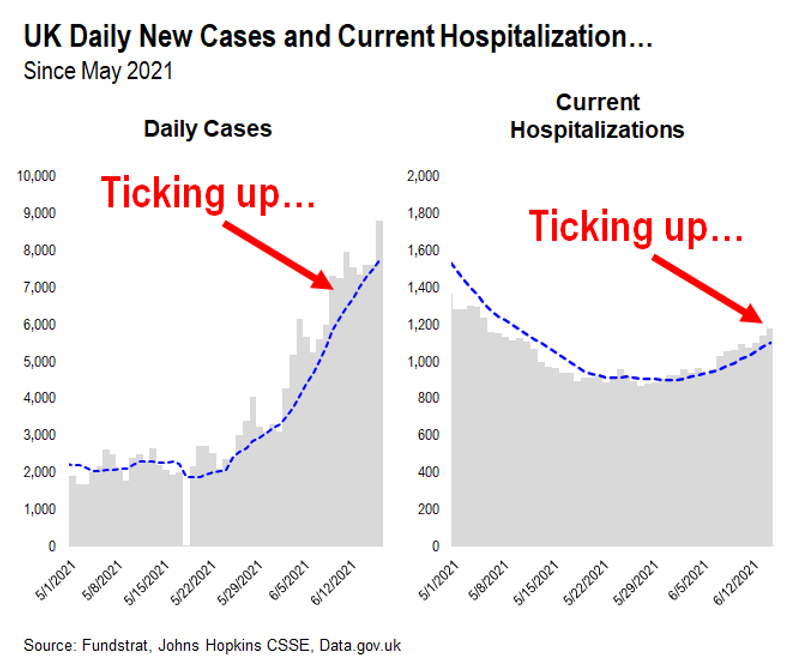

– COVID-19 case, hospitalization, death, and positivity rate trend remains positive in US, UK showing problematic developments.

– The events this week caused turmoil but ultimately they increase the level of our bullishness with regard to equities. Hyper-inflation fears receding is a good thing.

– We do believe inflation will rise and that generally the reasons and timing are being misinterpreted by the marker. We show why we think generational factors more important.

– The sell-off in Energy strikes us as a major opportunity. We’re encouraged by comments of David Tepper and other things occurring in Energy industry.

The latest COVID-19 cases are coming in a bit problematically from the United Kingdom but it is too early to sound alarm bells. Case trends, however, are not plateauing. Since daily cases ticked up a month ago, the daily cases are still surging in the UK at about 8,000 a day which has risen from 2,000 a day in May.

This is because of the highly transmissible Delta variant that we will continually monitor. Part of this surge may be due to the particular mix of vaccines being used in UK.

On this side of the pond, US vaccination trends thankfully seem to be curling upwards. In fact, there were a total of 2,035,923 doses administered newly reported by the CDC on Thursday. Although this large increase is partially due to the under-reporting on Wednesday (see table of daily vaccinations below), the overall trend of vaccination as evidenced by the 7D average. This is a good thing. The number of vaccinations is higher on a daily basis than it was a week ago. This is good news.

STRATEGY: Please ignore the markets this week, but interest rates are undershooting consensus

This was a bit of a ‘throwaway’ week given the combination of the FOMC post-mortem and the “quad witching” this Friday (which was also second largest by notional value in history falling only behind January). While the volatility and price movement have been extreme, in our view, there has been no change to the positive economic and market fundamentals supporting stocks. In other words, we see the entire week as noise. This is as opposed to signal which is useful information and not mere noise.

The Fed is acknowledging reflationary concerns, but the Fed’s central view of transitory inflation seems to have convinced markets. Regardless of the noisy drama this week the following is still true: US economy is reaching escape velocity and is fully reopen, there is substantial pent-up demand that will cause “revenge” spending, US corporates are likely to see capital spending ramp up given the strong earnings recovery and lastly stocks should be poised to surge to new highs in coming weeks.

Reflationary pressure exists, but is it being caused by secular forces and a Fed asleep at the wheel or is more about shortages of shipping containers and bottlenecks? Regardless of what the answer is, it is clear the current disruptions are causing what is likely a distorted view of the true strength of inflationary forces.

This is why we are positive on stocks and see good upside in the coming weeks. As far as sector positioning, we want to still be overweight Epicenter stocks, now minus financials which are rated neutral. A major course-correction we took last week was to upgrade the FAANG stocks which we see as a primary beneficiary of the surprise downside risk to interest rates.

More importantly, it is a good sign that Technology is strengthening. Tech and Communications Services are nearly 40% of the S&P 500 and thus their strengthening bodes quite well for the prospect of equities surging to new highs.

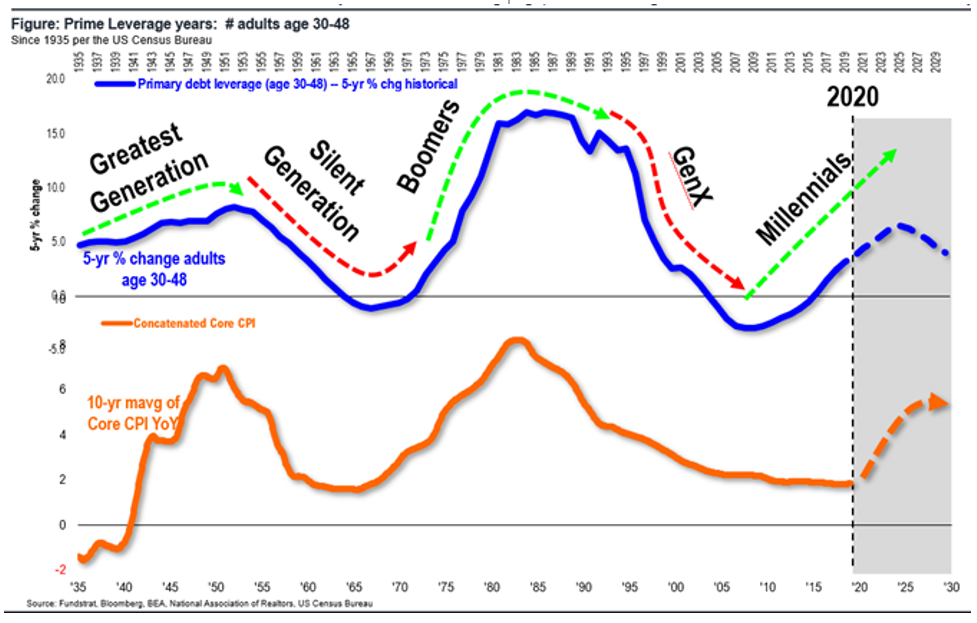

Inflation is Arguably Destiny, But I Think Consensus Has Timing wrong

I wholeheartedly agree 100% with the central view that reflationary conditions are in place and that inflation will likely rise over the next 5 years. In fact, I’d say it’s almost destiny driven by the surge in Millennial consumption and peak earning years/wealth effects. Take a look at the figure below to see what we mean.

You can see that the growth rates of adults 30-48, which is prime earning/spending/borrowing years, is associated with rise and fall of various generations. The millennial demographic surge, based on numbers, should be most similar to the unprecedented surge of Baby Boomers from 1969-1985. Core CPI seems to follow demographics and this certainly checks out from a demand perspective.

You can either forecast level, or time. If you try to do both simultaneously, you’re exponentially more likely to fail. Inflationary conditions are set to rise in the next 5-10 years. BUT. Big But. This does not have to happen in 2021 and this is primarily where we differ from the consensus view.

Markets seem to be supporting this conclusion. The 30-year bond yields all fell sharply this week. This suggest market participants are more confident the US government will meet its future debts since the Fed meeting. If inflationary forces were secular we would normally expect the 30-year bond to rise.

David Tepper made some waves this week when he said he was also bullish on Energy. At the Robinhood Conference he said that Energy stocks are the cheapest by every measure and the widespread hatred by institutions poses an opportunity. This is not an opinion-leader, this is a money-maker who takes real risks everyday on behalf of clients. This only adds to our conviction to be buyers of OIH0.33% and XLE0.48% on pullbacks.

To close, I’d like to point out that we are still extremely bullish on the Energy sector and were encouraged to see David Tepper’s comments which seemed pretty congruent with our thesis. Energy is a loathed sector that also happens to be the best performing sector YTD. Nothing has changed with regard to the bullish supply dynamics underlying our call.

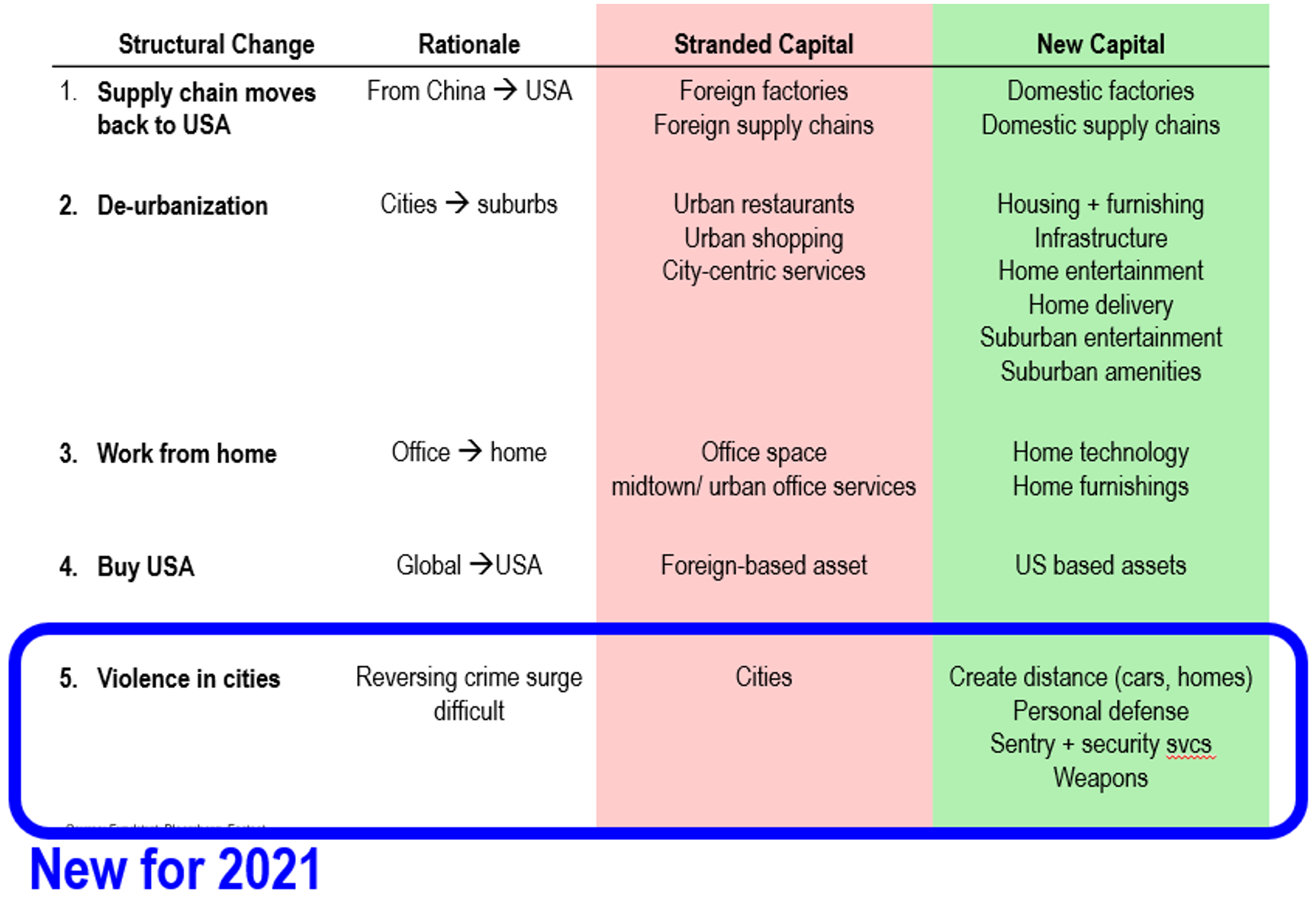

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

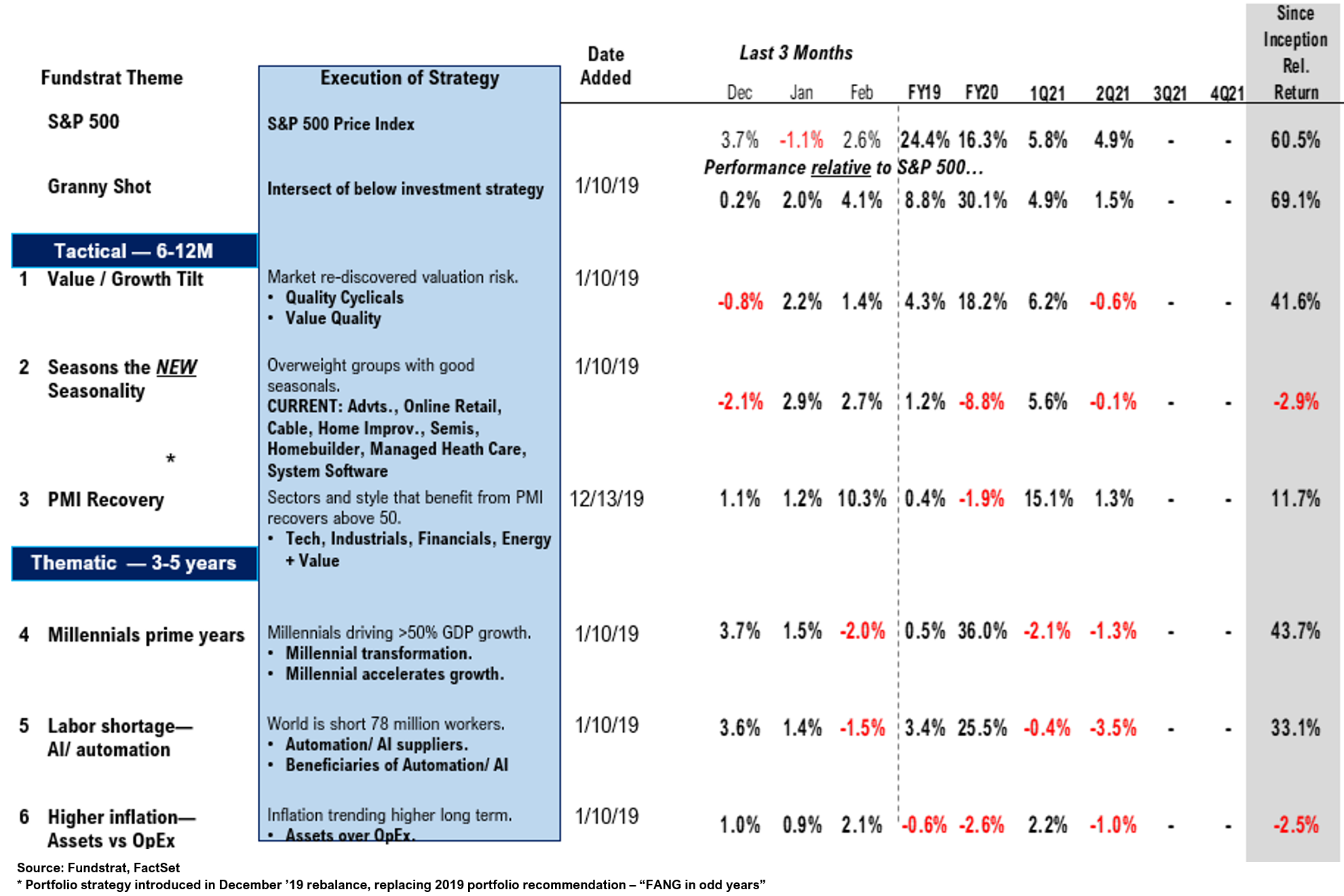

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019