AAPL selloff looks complete. Expecting sharp rally back higher

- SPX and Treasuries look to be readying for rallies which might begin Wednesday

- Cycles on both WTI and SPX look positive, but both might falter temporarily in May

- AAPL looks to hold the key for SPX and is nearing support

I continue to see the US stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time. While price action has been choppy over the last couple weeks, there remain precious little other evidence with regards to frothy speculation to excessive valuation measures that would warrant a major selloff. Rallies up to SPX-5350-5400 look likely over the next couple weeks before even minor consolidation gets underway. Treasury yields and US Dollar should have limited upside after this bounce, and both look close to rolling over.

Tuesday’s late day rally in both Treasuries and Equities helped to eliminate much of the early day weakness and by end of day, SPX had risen to multi-day highs while TNX had dropped nearly 7 bps on the day.

Most of the early Semiconductor weakness was reversed, and the Philly Semiconductor index (SOX) rose by nearly 1%. Meanwhile, sector-wise, Materials, REITS, Communication Services, Healthcare and Technology all rose by more than +0.50%

Healthcare’s weakness over the past couple weeks has certainly proven important as a minor negative for SPX performance, given that this sector is the second largest within SPX by market capitalization. However, I don’t suspect this pullback will prove long lasting, and Healthcare very well might attempt to bottom sometime in late April.

As discussed previously, until there is evidence of either Technology or Financials making a larger relative decline vs. the SPX, the recent churning in US stock indices likely can still be resolved by a push back to new highs.

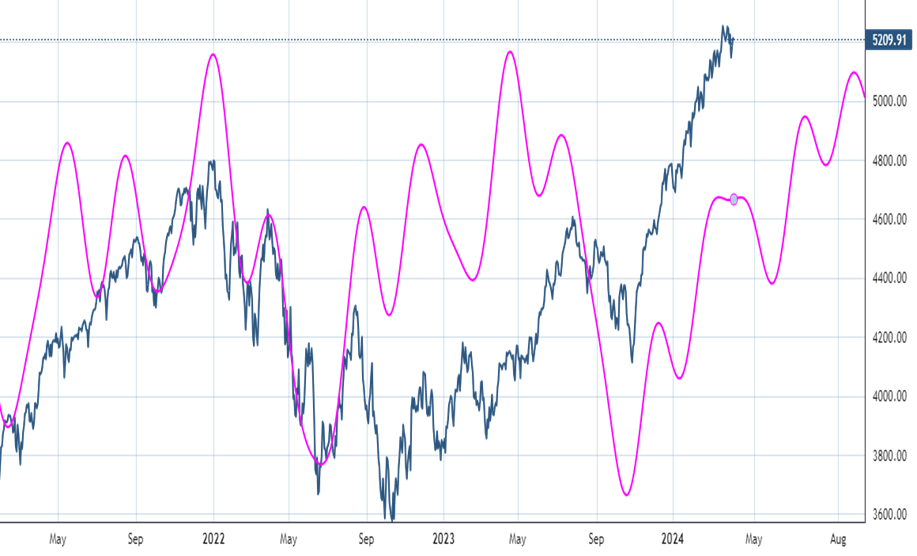

My latest daily SPX cycle composite from the Foundation of the Study of Cycles (See below) shows a possible minor bounce into 4/20 before the possibility of weakness into mid-May. Thereafter, this composite turns up in a stair stepping fashion until the month of August.

S&P 500 Cycle Composite

Overall, I don’t expect that the recent consolidation will prove too damaging to US Equity markets and very well could be complete by Wednesday’s CPI report. Stocks like AAPL are starting to show signs it might be bottoming out, and this would be an important positive for SPX and QQQ over the next couple weeks.

AAPL Selloff could be complete this week

One of the more significant stocks to always keep a close eye on given its percentage holding within SPX and QQQ is AAPL, which has steadily declined from a peak near $200 nearly four months ago. Incredibly enough, SPX managed a 10% quarterly return despite AAPL losing nearly $30 dollars from its peak.

Based on cycles, technical structure and DeMark’s counter-trend exhaustion tools, AAPL 0.04% looks quite close to bottoming.

Structurally, AAPL looks to have carved out five waves lower from January 2024 which followed an initial three-wave decline from early December 2023. Thus, from an Elliott-wave perspective, its pattern looks very much like a completed ABC decline, which should now be followed by a rally back to new highs.

DeMark indicators are finally lining up this week to show a confluence of both daily and weekly exhaustion (which following a decline, signals that AAPL could bottom and begin to turn higher).

Some minor positive momentum divergence is now present on daily charts, and the stock is nearing prominent former lows from both March as well as last October, 2023.

AAPL fits the bill of a stock that I feel is attractive technically despite its short-term downtrend still very much at hand. Much of this optimism is based on its intermediate-term structural appeal given that the stock still lies within 20% of its all-time highs after having risen more than 100% off its lows from the March 2020 bottom (The stock actually had a more prominent low back in early 2019 near $35.50)

Thus, the fact that AAPL’s minor consolidation failed to shake its intermediate-term trend, coupled with the other positives listed above, makes this quite appealing at current levels following its recent underperformance.

Movement back above $183 would add conviction to the thought that a move back to new all-time highs is underway. While a move down to $165 cannot be ruled out in AAPL, I feel with a fairly strong amount of conviction that AAPL’s decline very well might be nearing its end.

Given that Wednesday’s (4/9) CPI report (which could prove market moving) is happening near a time when AAPL has started to give off some bullish signals, makes me think that a turn back to the upside is growing closer (and might begin this week).

AAPL

Technology remains trending higher, despite the recent consolidation

One point which is crucial to continue “hammering home” revolves around Technology and its lack of trend damage despite recent underperformance.

Technology has lost ground over the last week and is one of five sectors that has shown negative performance over the past 1-month period. -1.11% in Invesco’s Equal-weighted Technology ETF (RSPT -0.26% ) vs. SPX returns of +1.68% (Performance through 4/9/24)

As can be seen below, the breakout in Technology vs. the broader market late last year carried technology to new all-time highs relative to the Equal-weighted S&P 500 (RSP 0.10% )

Yet, this consolidation since February (when eyeing RSPT relative to RSP ) has failed to result in any meaningful technical breakdown. Thus, Technology’s pullback has actually made this sector far more appealing at a time when some investors are deciding to shun the former leading sector.

Overall, I suspect that interest rates turning down should be a time that provides some ammunition to Technology and should drive money back to Growth stocks.

Bottom line, it’s wrong to abandon “Tech” without more meaningful signs of deterioration. Furthermore, if my thinking is correct about AAPL 0.04% being close to bottoming, Technology is likely to emerge and show above-average performance into the months of May and June.

RSPT / RSP

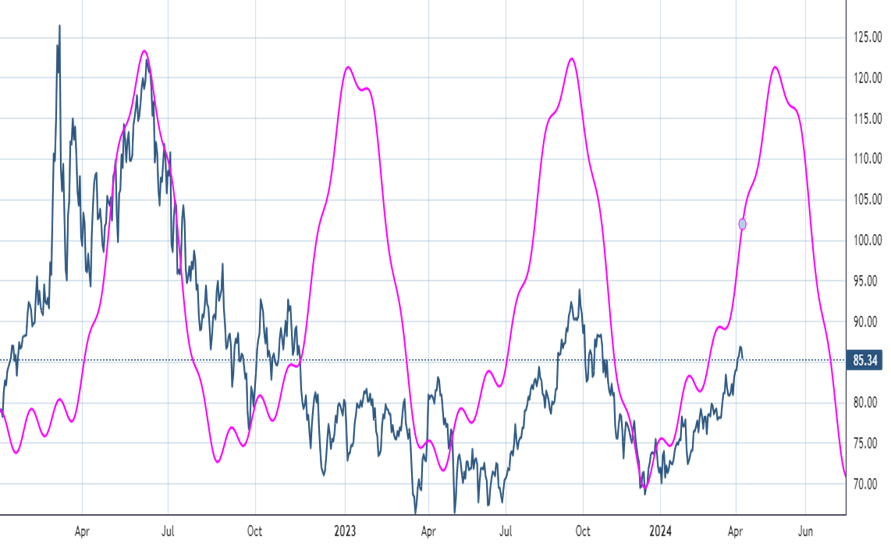

WTI Crude cycle composite chart peaks out initially in May, and then bottoms again in July

Utilizing one of the more accurate daily cycle projections on WTI Crude, which had shown heading into 2024 that the first half of the year likely could provide a steady rebound, projections now call for a possible peak in Crude during the month of May.

This gels with the seasonal tendencies for Energy to begin slowing down heading into May, and I suspect that a minor pullback might finally get underway next month following a very sharp rally since February of this year. (Recall that both daily and weekly cycle composites, when combined, suggested the possibility of a February 2024 bottom.)

While the weekly WTI Crude composite starts to turn down in August, my expectations are for an initial Crude peak in May followed by another “last ditch” rally attempt for Crude (and by extension, Energy) into this Fall before this sector starts to show some consolidation.

While I remain bullish on Energy at this time and for the price of Crude to push a bit higher, I’ll keep a close eye on this cycle composite as it’s been quite successful in lining up with former peaks in Crude back in Summer 2022 as well as Fall of 2023.

The pink line below represents amplitude, not magnitude, so this doesn’t suggest that Crude needs to give back all of this year’s gains right away. However, this does look like a potential important turn sometime in May, so I’ll be watching carefully starting in about 3-5 weeks time.

WTI Crude Composite