Growth still holding uptrends vs. Value despite Tech softness

- SPX and QQQ remain trending higher & should push up into late April before top

- Growth has shown minor pullback only & still trending up vs. Value

- Latin America could benefit further on US Dollar deterioration

This is a midday update and will serve as Thursday’s “Newton’s Law” Daily update. There won’t be a Friday report as I am traveling and will resume the normal schedule next Monday.

Minor weakness Thursday hasn’t caused much deterioration and US Market indices have bounced off early lows and remain positioned for a rally into the final week of April. It’s my thinking that despite some slowing in this uptrend (along with breadth waning) trends can still work higher into next week.

Thursday’s key technical development involved some rolling over in Treasury yields on the heels of a stronger than anticipated Jobless Claims number. This should result in yields starting to pullback to recent lows, and I’m anticipating that both Treasuries and Equities might be able to strengthen a bit more over the next week.

As discussed previously, however, Equity indices seem to be nearing a key juncture in both price and time where the “market” really has to prove itself to expect this rally can continue uninterrupted.

The slowdown in Technology has not proven too damaging thus far and Growth remains trending up vs. Value (see chart in this report) Moreover, other sectors like Financials, Discretionary, Healthcare and Energy (outside of the last few days) have come to the rescue of Tech, and have been helpful towards helping breadth slowly but surely rebound at a time that it’s very necessary to do so.

My reasons for possible concern into late April stem from the following five reasons:

First, Cycles start to turn lower from late April into mid-May. (if this doesn’t happen, then Equities would peak out by 5/20, which for now, I’m expecting should materialize as a Low.)

Second, sentiment has gotten a bit elevated in recent weeks and the Fear and Greed index along with Investors Intelligence are now approaching levels that have corresponded with peaks in Equity indices over the last year.

Third, bullish seasonality for April will start to revert to more bearish seasonality in May. Pre-election May months tend to be negative on average over the last 90 years.

Fourth, breadth has been waning lately and is far lower than February levels, despite this uptrend being intact over the last month.

Fifth, prices are up against very strong technical resistance levels and it’s thought that upside might prove limited in the weeks to come

As one sees below, the uptrend from March remains intact. However, prices are up into this strong area of resistance, and it’s expected that tactically a short-term pullback lies around the corner and likely materializes in the month of May. Note, I do not suspect this will break 3800, and should hold above mid-March lows before turning back higher.

What would nullify my concerns? A rally above 4200 initially, but above 4325 would be more meaningful, which is very broad-based and would leave no doubt for me technically that October 2022 lows were “the lows” of our 2022 bear market decline.

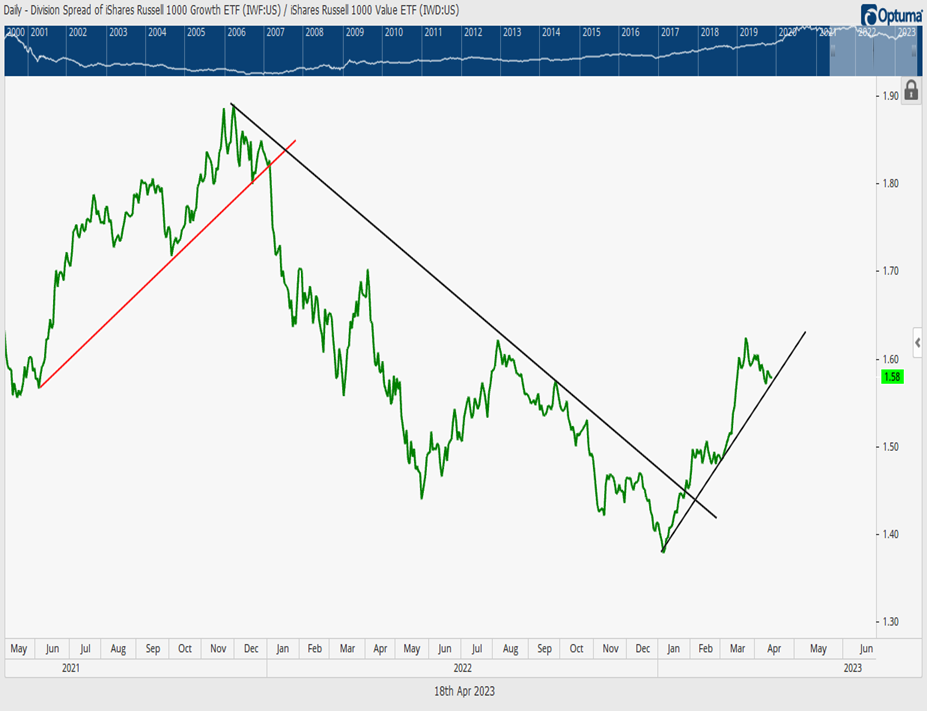

Growth still holding up vs. Value

Large-Cap Growth remains the preferred style right now, despite many clamoring to try to find a bottom in Small-cap and Mid-Cap Growth and Value, all of which look inferior in my view.

Ratio charts of the IWF 0.54% (Russell 1000 Growth ETF) vs. IWD -0.35% (Russell 1000 Value ETF) have certainly weakened a bit in recent weeks given Technology’s mild stall out.

Yet, uptrends from December 2022 remain intact at this point, and it’s still thought that a Tech rebound into late April might help this turn back higher.

Overall, this will be something to monitor closely as April comes to a close. Financials and Energy having snapped back have certainly aided Value at a time when Technology’s weakness has hurt Growth a bit. However, these are short-term minor movements only.

If/when this four-month uptrend in Growth/Value starts to give way in the weeks/months to come, I’ll discuss in this report. Until then, this minor pullback in Growth looks buyable.

Latin America has more appeal following recent breakout

As seen below, the ILF -0.07% , representing the iShares Latin America 40 ETF, has officially broken out above the five-month downtrend from last November’s highs. This is a bullish development and should help ILF -0.07% work its way higher back to the mid-to-high $20’s in the months to come.

Strength in Brazil has proven particularly promising in this regard, while Mexico remains a standout leader within the LatAm space.

Overall, unless $23.50 is broken, this looks likely to stabilize following a minor post-breakout pullback to test the area of its breakout. Movement back higher should get underway into May.

The weakness in the US Dollar is thought to be important as to why ILF -0.07% might be able to strengthen, and the success in breaking this downtrend looks like an important first step.

Breadth has contracted a bit, but might spike into month-end before any peak develops for US Equities

One interesting observation when looking across prior market peaks over the last year is the degree that breadth perks up right ahead of a peak in index prices.

As seen in this Optuma chart below, breadth has been falling since the beginning of April which is widely attributed to Technology’s underperformance.

However, prior peaks made in August 2022, along with late November 2022, along with February 2023 all coincided with an initial dip in market breadth (seen here as ratios of 10-day Advancers vs. 10-day Decliners), followed by an attempt to rally.

Given April’s bullish seasonality, it wouldn’t surprise me to see a final week push higher in indices which might give market bulls some hope on a breakout above 4200, that ends up failing as May’s FOMC meeting approaches.

Overall, while I remain optimistic on 2023, any sharp spike in breadth into late April would not necessarily be the positive development that many give it credit for, if history is any guide. Stay tuned.